TIDMFSF

RNS Number : 8678S

Foresight Sustain. Forestry Co PLC

09 November 2023

For immediate publication. This announcement contains

information that is inside information.

9 November 2023

Foresight Sustainable Forestry Company Plc

("FSF" or "the Company")

Operational Performance for the 6 months period ended 30

September 2023

and Unaudited Net Asset Value at 30 September 2023

Foresight Sustainable Forestry Company Plc, an investment

company that invests in UK forestry and afforestation assets, today

announces an update on its operational performance for the 6 month

period to 30 September 2023 and its unaudited Net Asset Value

("NAV") for its financial year ended 30 September 2023 ahead of the

release of its annual results in early December 2023.

Portfolio Performance (full year to 30 September 2023)

-- Operational performance across the portfolio is tracking within budget.

-- 18 attractive new assets acquired for a total of GBP38.4m

(inc. tax and transaction costs) with opportunistic purchasing

strategy employed during the financial year to capture favourable

pricing window.

-- Completed planting on 4 afforestation schemes, benefitting

from the associated voluntary carbon credit value creation and

bringing total number of planted schemes to 6.

-- Strong progress on development pipeline of 37 afforestation

schemes with the planting season now underway, with the expectation

remaining that many schemes will complete planting by the spring of

2024 with the remainder by spring 2025.

Investment Market (six months to 30 September 2023)

-- Increasing inflation and interest rates have led to a

weakening of the forestry and planting land investment market over

the last 6 months, characterised by a higher proportion of

distressed vendors of non-prime forestry and afforestation

properties.

-- Lower prices paid across a relatively small transaction volume.

-- The value of UK forestry assets sold in the first nine month

period of 2023 (to 30 September) represents 12% of the annual

average of the value of assets sold in 2021 and 2022.

-- Established forestry and voluntary carbon credit prices have

both been more resilient versus afforestation land values.

Valuation (six months to 30 September 2023)

-- As at 30 September 2023 the Company's unaudited NAV was

GBP169.2 million (31 March 2023: GBP186.6 million), resulting in a

NAV per Ordinary Share of 98.4 pence, equivalent to a 9.3%

reduction.

-- The independent third-party valuer has completed its

valuation in accordance with the Royal Institute of Chartered

Surveyors ("RICS") Red Book Fair Value methodology which primarily

utilises comparable market values of similar heritable title /

freehold forestry and afforestation assets from recent transactions

in the UK market.

-- The valuation methodology of the afforestation assets

excludes the development progress made.

-- During the period, the company completed four non-core asset

disposals totalling, GBP1.6m of net proceeds, made at book

value.

Company Outlook

-- Despite the challenging market conditions, the Board is

disappointed to see the share price trade at a discount to NAV.

-- The Company has a strong platform to build from and the

fundamental under-supply of land, sustainable timber and voluntary

carbon remains.

-- The Company has a GBP30m Revolving Credit Facility ("RCF")

which reaches maturity in July 2025. The RCF was drawn up to

GBP10.4m to complete three acquisitions in Scotland as announced on

13 October 2023. The current acquisition programme is now

substantially complete and servicing/repayment of the RCF will be

made through a combination of timber harvesting and the planned

disposal of non-core assets.

-- The Board and Investment Manager are focussed on protecting

the Company's existing value and exploiting the ongoing

opportunities in this market including:

o Reviewing planting and harvesting timetables to optimise cash

flow s.

o Advancing non-core asset disposals, including various

residential properties attached to existing afforestation

assets.

o Maximising allocation to afforestation and voluntary carbon

where possible.

o Positioning the Company for rapid growth when equity market

conditions improve.

A summary of the key unaudited NAV drivers from 31 March 2023 to

30 September 2023 are as follows:

Item p/share movement % change

to 31 March

2023 NAV /

cost (as applicable)

NAV at 31 March 2023 108.5 N/A

----------------- ---------------------

Acquisitions* 0.3 5.6%

----------------- ---------------------

Standing Forestry (existing at 31 March

2023) ** (3.1) (6.5%)

----------------- ---------------------

Afforestation (existing at 31 March

2023) ** (4.7) (11.2%)

----------------- ---------------------

Mixed Forestry (existing at 31 March

2023) ** (1.2) (8.4%)

----------------- ---------------------

Existing Carbon Credit valuation 0.1 8.6%

----------------- ---------------------

Fund costs including RCF expense (0.8) N/A

----------------- ---------------------

Forest operational costs and working (0.7) N/A

capital

----------------- ---------------------

NAV at 30 September 2023 98.4 N/A

----------------- ---------------------

*The change represents mark-to-market gains between the

consideration paid (inc. tax and transactions costs), and the 30

September 2023 Red Book Valuation.

** On a like-for-like basis, excluding any acquisitions,

disposals and harvesting.

Richard Davidson, Chair of Foresight Sustainable Forestry

Company Plc,

"Despite the challenging macroeconomic backdrop, we are pleased

with the Company's operational performance and the delivery of the

business plan in the year to 30 September 2023.

"Against this positive operational performance, increasing

inflation and interest rates have led to a weakening of the

investment market and consequent falls in the independent valuation

of FSF's assets, primarily driven by lower prices paid across a

much smaller volume of transactions.

"Shareholders can take comfort from our disciplined strategy of

purchasing high-quality assets, attention to cash flow and balance

sheet management and focus on delivery of the afforestation

development pipeline which positions us well to weather this period

of elevated market volatility and uncertainty."

For further information, please contact:

Foresight Sustainable Forestry Company Plc

Robert Guest

Richard Kelly

fsfc@foresightgroup.eu +44 20 3667 8100

Jefferies International Limited

Tom Yeadon

Will Soutar

Harry Randall +44 20 7029 8000

SEC Newgate

Elisabeth Cowell

fsf@secnewgate.co.uk

About the Company

Foresight Sustainable Forestry Company Plc ("the Company") is an

externally managed investment company investing in a diversified

portfolio of UK forestry and afforestation assets. Targeting a net

total return of more than CPI +5% per annum on a rolling five-year

basis, the Company provides investors with the opportunity for real

returns and capital appreciation driven by the prevailing global

imbalance between supply and demand for timber; the

inflation-protection qualities of UK land freeholds; and biological

tree growth of 3% to 4% not correlated to financial markets. It

also offers outstanding sustainability and ESG attributes and

access to carbon units related to carbon sequestration from new

afforestation planting. The Company targets value creation as the

afforestation projects successfully achieve development milestones

in the process of converting open ground into established

commercial forest and woodland areas. The Company is seeking to

make a direct contribution in the fight against climate change

through forestry and afforestation carbon sequestration initiatives

and to preserve and proactively enhance natural capital and

biodiversity across its portfolio. It is managed by Foresight Group

LLP.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVEADFPEDPDFAA

(END) Dow Jones Newswires

November 09, 2023 02:00 ET (07:00 GMT)

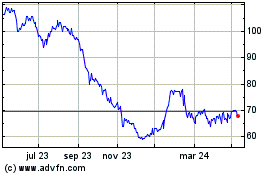

Foresight Sustainable Fo... (LSE:FSF)

Gráfica de Acción Histórica

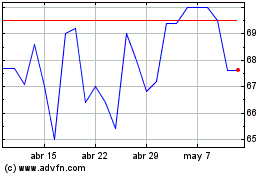

De Mar 2024 a Abr 2024

Foresight Sustainable Fo... (LSE:FSF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024