Unaudited Half-Yearly Financial Report

FORESIGHT VCT PLCLEI:

213800GNTY699WHACF46

UNAUDITED HALF-YEARLY FINANCIAL

REPORTFOR THE PERIOD ENDED 30 JUNE

2023

Financial Highlights

- Total net assets £211.0 million

- A final dividend of 4.4p per share was paid on

30 June 2023, costing £10.7 million

- Post-period end, a special dividend of

4.0p per share was paid on 18 August 2023,

costing £9.8 million, following the

successful realisations of Mowgli Street Food Group Limited,

Datapath Group Limited and Innovation Consulting

Group Limited

- The value of the investment portfolio increased by £1.4

million, driven by £9.7 million of deployment

and an increase of £6.2 million in the value of

investments, offset by realisations of

£14.5 million

- Net Asset Value per share decreased by 1.8%

from 87.5p at 31 December 2022 to

85.9p at 30 June 2023. After adding back the

4.4p dividend paid on 30 June 2023, NAV Total

Return per share was 90.3p, which made the total

return for the half-year 3.2%

- The offer for subscription launched in January 2023 was closed

on 13 April 2023 and raised a total of £23.1

million after expenses

Chair’s Statement

I am pleased to present the Company’s unaudited Half‑Yearly

Financial Report for the period ended 30 June 2023.

Despite the challenging macroeconomic backdrop, the Company’s

Net Asset Value (“NAV”), including dividends paid during the

period, increased by 2.8p per share to 90.3p. This represents

a NAV Total Return of 3.2% for the six months to 30 June 2023.

Although the UK has managed to avoid a recession so far this

year, real GDP growth has been sluggish, with a mere 0.2% recorded

in the second quarter of this year. Inflation has remained sticky

and stubbornly high, which has led to a series of interest rate

increases. In addition, the financial markets were rocked by the

collapse of both Silicon Valley Bank and Credit Suisse in March

2023, but fortunately the turmoil was short-lived and further

contagion limited. However, heightened nervousness in the financial

markets and recent changes to banks’ capital adequacy rules are

beginning to reduce the level of funding available for smaller

businesses. Understandably, consumer and business confidence in the

UK remains fragile.

Nonetheless, the performance of the Company’s portfolio in

aggregate has remained robust in these circumstances.

The Manager has worked closely with the individual companies

and developed a good understanding of their current business

requirements.

Many of the portfolio companies successfully adapted to the new

economic landscape, with some performing extremely well while a

minority struggled as a result of a fall in consumer demand,

inflationary pressures, surging energy prices, a weak fundraising

environment and labour shortages. The overall solid performance of

the Company in the first half of 2023 demonstrates the advantages

of a well‑diversified portfolio.

StrategyThe Board and the Manager continue to

pursue a strategy for the Company which includes the following four

key objectives:

- Growth in Net Asset Value Total Return above a 5% target while

continuing to grow the Company’s assets

- Payment of annual ordinary dividends of at least 5% of the NAV

per share per annum (based on the latest announced NAV per share)

while endeavouring, at a minimum, to maintain the NAV per share on

a year‑on‑year basis

- Implementing a significant number of new and follow-on

qualifying investments every year, exceeding deployment

requirements to maintain VCT status

- Maintaining a programme of regular share buybacks at a discount

of no less than 7.5% to the prevailing NAV per share

The Board and the Manager believe that these key objectives

remain appropriate and the Company’s performance in relation to

each of them over the past six months is reviewed in more detail

below.

Net Asset Value and dividendsThe NAV of the

Company grew over the period from £191.7 million at 31

December 2022 to £211.0 million at 30 June 2023, which is in line

with the Board’s objective of growing the Company’s assets.

At the end of 2022, 89% of the Company’s assets were already

invested and the Board believed it would be in the Company’s best

interest to raise further funds to provide liquidity for its

activities in 2023 and beyond. On 20 January 2023, the Company

launched an offer for subscription to raise up to £20 million, with

an over‑allotment facility to raise up to a further £10 million,

through the issue of new shares. The offer was closed on 13 April

2023 having raised gross proceeds of £24.1 million, £23.1

million after expenses. We would like to thank those existing

shareholders who supported the offer and welcome all new

shareholders to the Company.

The final dividend for the year ended 31 December 2022 of 4.4p

per share was paid on 30 June 2023, at a total cost to the Company

of £10.7 million, including shares allotted under the dividend

reinvestment scheme.

Post-period end, the Company paid a special dividend of 4.0p per

share on 18 August 2023 following the successful sales of Mowgli

Street Food Group Limited, Datapath Group Limited and Innovation

Consulting Group Limited in the first quarter. These generated

proceeds of £14.3 million at completion. Since initial investment,

the three exits combined have returned to the Company a total of

£21.4 million, with a further £2.8 million of deferred

consideration due as at the period end. This is an exceptional

achievement from a combined initial investment of £4.2 million and

represents a cash-on-cash multiple of 5.8 times.

The Company continues to achieve its target dividend yield of 5%

of NAV, which was set in 2019 in light of the change in portfolio

towards earlier-stage, higher-risk companies, as required by the

VCT rules.

The Board and the Manager hope that this level may continue to

be exceeded in future by payment of additional “special” dividends

as and when particularly successful portfolio disposals are

achieved.

Investment performance and portfolio activityA

detailed analysis of the investment portfolio performance over the

year is given in the Manager’s Review.

In brief, during the six months under review, the Manager

completed five new investments, in a range of sectors, and five

follow-on investments costing £5.9 million and £3.8 million

respectively. The Company also disposed of three investments very

successfully, as described above.

The Board and the Manager are confident that a more significant

number of new and follow-on investments can be achieved in

2023.

After the period end, in September 2023, £1.7 million was

invested in Loopr Ltd, trading as Looper Insights, a data analytics

platform to film and TV content distributors and video-on-demand

streaming services. The Company also sold its holding in Protean

Software Limited on 14 July 2023 which generated proceeds of

£5.9 million at completion. Including cash returned to the

date of this report, the exit delivered a return multiple of

2.4 times the original investment. Furthermore, the Company

sold its holding in Fresh Relevance Limited on 12 September 2023

which generated proceeds of £10.6 million at completion. Including

cash returned to the date of this report, the exit delivered a

return multiple of 3.8 times the original investment. Further

details of these investments and realisations can be found in the

Manager’s Report.

The Company and Foresight Enterprise VCT plc have the same

Manager and share similar investment policies. The Board closely

monitors the extent and nature of the pipeline of investment

opportunities and is reassured by the Manager’s confidence in being

able to deploy funds without compromising quality and to satisfy

the investment needs of both companies.

Responsible investingThe analysis of

environmental, social and governance (“ESG”) issues is embedded in

the Manager’s investment process and these factors are considered

key in determining the quality of a business and its long-term

success. Central to the Manager’s responsible investment approach

are five ESG principles that are applied to evaluate investee

companies, acquired since May 2018, throughout the lifecycle of

their investment, from their initial review and acquisition to

their final sale. Every year, the portfolio companies are assessed

and progress is measured against these principles. More detailed

information about the process can be found on pages 26 to 27 of the

Manager’s Review in the Unaudited Half-Yearly Financial Report.

BuybacksDuring the period the Company

repurchased 2,716,894 shares for cancellation at an average

discount of 7.5%, in line with its revised objective of maintaining

regular share buybacks at a discount of no less than 7.5% to the

prevailing NAV per share. The Board and the Manager consider that

the ability to offer to buy back shares at no less than 7.5% is

fair to both continuing and selling shareholders and continues to

help underpin the discount to NAV at which the shares trade.

Share buybacks are timed to avoid the Company’s closed periods.

Buybacks will generally take place, subject to demand, during the

following times of the year:

- April, after the Annual Report has been published

- June, prior to the Half-Yearly reporting date of 30 June

- September, after the Half-Yearly Report has been published

- December, prior to the end of the financial year

Management charges, co-investment and performance

incentiveThe annual management fee is an amount equal to

2.0% of net assets, excluding cash balances above £20 million,

which are charged at a reduced rate of 1.0%.

This has resulted in ongoing charges for the period ended 30

June 2023 of 2.3%, which is at the lower end of the range when

compared to competitor VCTs.

Since March 2017, co-investments made by the Manager and

individual members of the Manager’s private equity team have

totalled £1.1 million alongside the Company’s investments of £90.7

million.

The co-investment scheme requires that the individual members of

the team invest in all of the Company’s investments from that date

onwards and prohibits selective “cherry picking” of co‑investments.

If any individual team member opts out of co-investment, they

cannot invest in anything during that year. The Board believes that

the co‑investment scheme aligns the interests of the Manager’s team

with those of shareholders and has contributed to the gradual

improvement in the Company’s investment performance.

In addition to the co-investment scheme, a new performance

incentive scheme was formally approved by shareholders at a general

meeting of the Company held on 15 June 2023. The new arrangements

have superseded the previous scheme and any potential outstanding

liabilities relating to it have ended. The Manager will now be able

to earn an annual performance incentive fee as summarised

below.

A performance incentive fee will be payable in respect of each

financial year commencing on or after 1 January 2023 where the

Company achieves an average annual NAV Total Return per share, over

a rolling five-year period, in excess of an average annual hurdle

of 5% (simple not compounded). If this hurdle is met, the Manager

would be entitled to an amount equal to 20% of the excess over the

hurdle subject to a cap of 1% of the closing Net Asset Value for

the relevant financial year. No fee will become due in excess of

this cap. Where there is a negative return in the relevant

financial year, no fee shall be payable even if the five-year

average hurdle is exceeded.

However, the potential fee will be carried forward and may

become due at the end of the next financial year if the performance

hurdle described above for that next financial year is achieved and

the negative return in the preceding financial year is recovered in

that next financial year. Any such catch-up fees shall be paid

alongside any fee payable for the next financial year, but subject

to the 1% cap applying to both fees in aggregate. Any such catch-up

fees cannot be rolled further forward to subsequent financial

years. The new arrangements will be subject to continual review by

the Board to ensure continued alignment with the interests of

shareholders.

More information on the current performance incentive

arrangements can be found in note 8 of this report.

A total of £1.1 million has been accrued as an estimate of the

performance fee due in respect of this financial year, based on the

Company’s average annual performance over the last four and a half

years.

Board compositionThe Board continues to review

its own performance and undertakes succession planning to maintain

an appropriate level of independence, experience, diversity and

skills in order to be in a position to discharge its

responsibilities. 2023 has seen some planned changes to the

composition of the Board.

The Board was delighted to appoint David Ford and Dan Sandhu as

Non-Executive Directors in January 2023. After more than 16 years

as a Non-Executive Director, including nearly 12 years as Chair of

the Audit Committee, Gordon Humphries did not stand for re-election

at the AGM on 15 June 2023.

On behalf of the Company, I would once again like to thank

Gordon for his significant contribution and dedication to the

Company, which has benefited enormously from his wise counsel

during his many years of service. We will miss Gordon and we wish

him the very best for the future. Gordon has been succeeded as

Chair of the Audit Committee by Patty Dimond, who has already

served on the Board for over two years.

Shareholder communicationWe were delighted to

meet with some shareholders in person at the AGM on 15 June 2023.

We hope many of you will be available to attend our next in-person

investor forum event on 19 October 2023 at The Shard. These events

have proven very popular with our shareholders in the past and

provide the opportunity to learn first-hand about some of our

investee companies from their founders and management.

Sunset clauseAs explained in last year’s Annual

Report, a “sunset clause” applies to the current approved scheme

for EIS and VCT tax reliefs. This clause provides that income tax

relief will expire on subscriptions made for VCT shares on or after

6 April 2025, unless the legislation is amended to make the

scheme permanent, or the “sunset clause” is extended.

The UK Chancellor has reconfirmed in his Spring Budget the

government’s commitment to extend the income tax relief available

on new VCT shares beyond the tax year ending in April 2025. The

Treasury Select Committee’s report on early stage investment

published in July supported the important role played by VCTs and

called for early action on the “sunset clause”. It also noted that

the UK should be able to extend the scheme without European

Commission approval, as clarified by the new Northern Ireland

Protocol, the Windsor Framework.

Trade bodies of which the Manager is a member will continue to

lobby the government to provide greater clarity on the timing and

nature of its plans for removing this obstacle.

OutlookWe are anticipating that growth in the

UK will continue to be weak in 2023: ongoing inflationary

pressures, tight monetary policies, supply chain issues, labour

shortages and a lack of bank lending appetite may continue to

hinder economic recovery. We are conscious that such conditions

could prove particularly challenging for our investee companies

which are unquoted, small, early-growth businesses and by their

nature entail higher levels of risk and lower liquidity than larger

listed companies. On the other hand, these younger companies may

prove more agile and creative in their approach and better able to

adapt their operations swiftly and identify new products and

services in response to changing circumstances.

The Company’s current portfolio of investments is highly

diversified by number, business sector, size and stage of

development and overall has already demonstrated its relative

resilience in the face of economic and geopolitical difficulties.

We are confident that this approach will continue to provide

protection in volatile market conditions.

The Manager is continuing to see a promising pipeline of

potential investments, both new and follow-on. In addition to the

funds raised earlier in the year, we have recently announced our

intention to raise further funds in the coming months. These

combined funds will provide the necessary resources to make

selective acquisitions from the increasing number of investment

opportunities that are now emerging out of the recent disruption.

Although in the short term there may be considerable economic

headwinds, we believe the Company’s diversified portfolio is well

positioned to generate long-term value for shareholders.

Margaret LittlejohnsChair26 September 2023

Manager’s Review

The Board has appointed Foresight Group LLP (“the Manager”)

to provide investment management and administration services.

Portfolio summaryAs at 30 June 2023, the

Company’s portfolio comprised 52 investments with a total cost of

£102.6 million and a valuation of £171.2 million. The portfolio is

diversified by sector, transaction type and maturity profile.

Details of the ten largest investments by valuation, including an

update on their performance, are provided on pages 19 to 22 in the

Unaudited Half-Yearly Financial Report.

During the six months to 30 June 2023, the value of the

portfolio increased by £6.2 million and £9.7 million of new and

follow on investment was concluded. There was a strong series of

successful exits, realising £14.5 million with a further £2.8

million of deferred consideration recognised at the period end.

Overall therefore, the value of the unquoted portfolio increased by

£1.4 million in the period.

The Company’s portfolio continues to navigate the various

economic challenges, including inflation, tight labour markets and

soft financial and M&A markets. Many of the portfolio companies

are performing extremely well, while others continue to adjust.

In line with the Board’s strategic objectives, the investment

team remains focused on continuing to grow the Company’s assets

whilst paying an annual dividend to shareholders of at least 5% of

the last announced NAV per share. The Company has so far achieved

this target for the current year and this objective remains the

Manager’s focus.

New investmentsFostering strong relationships

with local deal introducers across the UK and Ireland remains

central to the private equity team’s approach. The team remains

focused on attending in-person meetings and events with both deal

introducers and prospective investee companies to generate a flow

of pipeline opportunities. The regional presence is central to this

approach and the Manager opened three offices over the last year,

in Leeds, Dublin and Newcastle. These new regional offices are

expected to support stronger relationships with local advisers and

increase deal flow from these geographies.

Five new investments were completed in the six months to 30 June

2023, totalling £5.9 million. Post-period end, in September 2023,

the Manager invested a further £1.7 million in Loopr Ltd. Further

details of each of these are provided below. Behind these, there is

a strong pipeline of opportunities that the Manager expects

to convert during the second half of 2023.

Sprintroom Limited In January 2023, £1.0

million of growth capital was invested in Sprintroom, which trades

as Sprint Electric. The business designs and manufactures drives

for controlling electric motors in light and heavy industrial

applications, as well as recovering and reusing otherwise lost

energy. The investment will be used to further develop and

commercialise novel alternating current variable speed drive

technology.

Red Flag Alert Technology Group Limited In

March 2023, the Company invested £1.7 million in Reg Flag Alert

Technology Group, a Manchester-based proprietary SaaS intelligence

platform with modular capabilities spanning compliance,

prospecting, risk management and financial health assessments.

The growth capital will be used to support continued product

development alongside an increased marketing budget which is

expected to accelerate new client acquisition with particular focus

on larger enterprise-level customers.

Firefish Software Ltd. In March 2023, the

Company invested £1.5 million in Firefish Software, a Glasgow-based

customer relationship management and marketing software platform

targeting the recruitment sector. The funding will be used to

further develop the platform in order to attract a larger

enterprise-level customer base and expand its outbound sales

team.

Five Wealth Limited In March 2023, the Company

invested £0.7 million in Five Wealth, an established boutique

financial planning business operating across the North West of

England, headquartered in Manchester. Five Wealth’s service

offering is focused on the provision of independent private client

financial advice and wealth planning. This growth capital

investment will be used to support increased marketing and

advertising to drive top-line growth and greater regulatory and

compliance costs which are forecast to increase commensurately with

AUM.

The KSL Clinic Limited In April 2023, the

Company invested £1.0 million in The KSL Clinic, a leading provider

of hair replacement treatments, with clinics in Manchester and

Kent. The investment will be used to invest in facilities, create

high-quality, sustainable jobs and to expand its geographic reach,

resulting in significant improvements in the wellbeing of

patients.

Loopr Ltd Post-period end, in September 2023,

the Company invested £1.7 million in Loopr Ltd, trading as Looper

Insights, a data analytics platform to film and TV content

distributors and video-on-demand streaming services. The investment

will be used build a sales and marketing team, expand the customer

success team and continue the development of the company’s

software.

Follow‑on investmentsThe

Manager expects to continue to deploy additional capital into both

growing portfolio companies and those that require support to trade

through more uncertain periods. Macro factors such as wage,

commodity price and energy price inflation may impact some elements

of the portfolio, but in general the Manager ensures at the time of

initial investment that investee companies are well‑capitalised to

trade through periods of lower market demand or supply challenges.

This is evidenced by the portfolio remaining relatively resilient

over the COVID-19 period, supported by the Manager’s active style,

to ensure risks are identified and mitigated early.

The Company made five follow-on investments in the period,

totalling £3.8 million, to support further growth opportunities.

Further details are provided below.

PipelineAt 30 June 2023, the Company held cash

of £36.9 million. This will be used to fund new and follow-on

investments, buybacks and running expenses, and support the

Company’s dividend objectives. The Manager has a number of

opportunities under exclusivity or in due diligence.

The Company remains well positioned to continue pursuing these

potential investment opportunities.

Mizaic Ltd (formerly IMMJ Systems Limited)In

February 2023, £0.6 million was invested in Mizaic, a clinical

electronic document management solution supplier to the NHS. The

investment will be used to grow the leadership team and bolster the

business’s abilities to support the digitisation of records,

providing easy and efficient access to patient records for clinical

care across the NHS.

Ten Health & Fitness Limited In March 2023,

Ten Health & Fitness, a multi-site operator in the boutique

health, wellbeing and fitness market, received an additional

investment of £0.6 million. The funding enabled the company to

complete its new flagship Kings Cross site and support the

company’s transition to profitability from Q1 2023. The Kings Cross

site opened in March and is already trading well.

NorthWest EHealth Limited (“NWEH”)In March

2023, the Company invested a further £1.5 million in NWEH, which

provides software and services to the clinical trials market,

allowing pharmaceutical companies and contract research

organisations to conduct feasibility studies, recruit patients and

run trials. The investment will be used to support the delivery of

a number of new real world trials in FY23, while completing

building the company’s Connexon platform to be compatible with up

to 18 million UK healthcare data sources. Since investment, NWEH

has won a number of new customers and is considering changing its

business model to focus more on referral revenues, which will mean

a lower cost overhead in the business.

Ollie Quinn Limited In April 2023, the Company

invested £1.0 million in Ollie Quinn, a branded retailer of

prescription glasses, sunglasses and non-prescription polarised

sunglasses based in the UK and Canada. The investment will provide

the cash headroom and time for longer-term financing initiatives to

be explored.

Additive Manufacturing Technologies Ltd

(“AMT”)In April 2023, the Company invested £0.1 million in

AMT, which manufactures systems that automate the post-processing

of 3D printed parts. See the key valuation changes in the period

section on page 14 in the Unaudited Half-Yearly Financial Report

for further details.

Exits and realisationsWhilst global M&A

markets are relatively soft, the Manager has delivered some strong

realisations in the period. The Manager has witnessed

particularly strong interest from overseas buyers, particularly

those that are US funded. Certain acquirers also strategically need

to acquire a UK presence following the UK’s exit from the EU.

However, M&A activity in the broader market has been lower so

far in 2023 than recent years, suggesting the market might be

cooling slightly in the face of economic uncertainty and rising

interest rates.

Mowgli Street Food Group LimitedIn January

2023, the Company announced the successful exit of casual Indian

food chain Mowgli to TriSpan, a global private equity firm with

extensive restaurant expertise. The Manager invested in 2017, when

the business had three restaurant sites. It has since grown to 15

sites nationally. The Manager introduced Dame Karen Jones as chair,

Matt Peck as finance director and helped recruit Lucy Worth as

operations director and together with founder Nisha Katona, this

team built a market-leading hospitality brand. The business also

shared the Manager’s commitment to sustainability, creating more

than 500 jobs and ranking 16th best UK company to work for in 2022

owing to its focus on employee welfare, local charity support and

sustainable sourcing.

The exit resulted in proceeds of £5.2 million, of which

£1.6 million will be received over 12 months post the

completion of the exit, representing a return of 3.5x cost,

equivalent to an IRR of 25% since the initial investment in

2017.

Datapath Group Limited In March 2023, the

Company announced the notable exit of Datapath, a global leader in

the provision of hardware and software solutions for multiscreen

displays. The transaction generated proceeds of £5.0 million at

completion with an additional £1.2 million payable over the next 24

months. When added to £5.4 million of cash returned to date, this

implies a total cash-on-cash return of 11.6 times the original

investment, equivalent to an IRR of 38% since the initial

investment in 2007.

Since the original investment, the Manager had supported

Datapath through a period of material growth, with revenues growing

from approximately £7 million to £25 million. Datapath has

developed a market-leading hardware and software product suite for

the delivery of multiscreen displays and video walls which are sold

globally to a diverse customer base across a range of sectors.

Innovation Consulting Group Limited

(“GovGrant”) In March 2023, the Company announced the

impressive exit of GovGrant to Source Advisors, a US corporate

buyer backed by BV Investment Partners. GovGrant is one of the UK’s

leading providers of R&D tax relief, patent box relief and

other innovation services. The transaction generated proceeds of

£6.8 million at completion. When added to £0.5 million of cash

returned to date, this implies a total cash-on-cash return of

4.4 times the capital of £1.65 million invested in October

2015, equivalent to an IRR of 24%.

Since the original investment in 2015, the Manager had helped

GovGrant through a period of material growth during which it

supported the R&D activities of a growing number of customers.

GovGrant’s high levels of service and innovative products, such as

the growing patent box offering, have contributed to driving

innovation in the UK economy. The Manager had taken a proactive

approach to supporting the exceptional senior management team, all

of whom were introduced to the business during the investment

period.

Protean Software LimitedIn July 2023, the

Company achieved a successful exit of its holding in Protean

Software to Joblogic, a UK-based direct provider of Field Service

Management software to SMEs, and Protean’s direct competitor. The

Manager invested in Protean in July 2015 as one of the last buyouts

prior to the changes in VCT legislation. Over the holding period

the Manager helped Protean transition its highly featured legacy

product into a modern software product sold on a SaaS basis. The

transaction generated proceeds of £5.9 million on completion. When

added to £151,000 of cash returned to date, this implies a total

cash-on-cash return of 2.4 times the original investment,

equivalent to an IRR of 12% since the initial investment.

Fresh Relevance LimitedIn September 2023, the

Company achieved the successful exit of Fresh Relevance Limited to

Dotdigital Group plc, returning £10.6 million to the Company.

Including cash returned to date of £0.2 million, the sale implies a

3.8 times cash-on-cash return on the total investment made of £2.9

million; equivalent to an IRR of 27%.

Headquartered in Southampton, Fresh Relevance is an email

marketing and e-commerce personalisation platform. It provides

online retailers with flexible software tools to improve customer

retention and acquisition. Since the initial investment in March

2017, Fresh Relevance grew revenues nearly threefold and created

close to 40 high-quality, sustainable jobs – positively impacting

the local economy in Southampton. Many of Fresh Relevance’s

developers were recruited from the University of Southampton.

Disposals in the period ended 30 June 2023

|

|

|

|

Accounting cost |

Exit proceeds |

|

|

|

|

Total invested1 |

at date of disposal2 |

and deferred consideration |

Total return3 |

|

Company |

Detail |

(£) |

(£) |

(£) |

(£) |

|

Innovation Consulting Group Limited |

Full disposal |

1,650,000 |

1,605,000 |

6,794,768 |

7,279,469 |

|

Mowgli Street Food Group Limited |

Full disposal |

1,526,750 |

1,526,750 |

5,183,006 |

5,294,466 |

|

Datapath Group Limited |

Full disposal |

1,000,000 |

7,563,365 |

6,216,358 |

11,601,590 |

|

200 Degrees Holdings Limited |

Loan repayment |

225,000 |

225,000 |

225,000 |

322,338 |

|

|

|

4,401,750 |

10,920,115 |

18,419,132 |

24,497,863 |

- Total invested reflects the total cash investment made by the

Company and Foresight 2 VCT plc.

- The accounting cost includes the valuation of Foresight 2 VCT

plc’s investment in Datapath at the point it was transferred to the

Company as part of the merger in December 2015. The investment cost

at the date of transfer was £73,250.

- Total return includes yield returned to the Company and

Foresight 2 VCT plc up to the date of the exit and deferred

consideration due in the future at its current holding value.

Key portfolio developmentsIn the first six

months of the year, the portfolio has demonstrated continued

resilience in the face of the economic headwinds that started

mid-way through 2022.

Material changes in valuation, defined as increasing or

decreasing by £1.0 million or more since 31 December 2022, are

detailed below. Updates on these companies are included below, or

in the Top Ten Investments section on pages 19 to 22 in the

Unaudited Half-Yearly Financial Report.

Key valuation changes in the period

|

|

Valuation |

Valuation change |

|

Company |

(£) |

(£) |

|

Callen-Lenz Associates Limited |

9,164,253 |

3,826,007 |

|

Fresh Relevance Ltd |

7,632,862 |

1,697,435 |

|

Protean Software Limited |

5,857,207 |

1,475,158 |

|

Luminet Networks Limited |

3,873,045 |

1,400,516 |

|

Aquasium Technology Limited |

4,168,765 |

1,233,488 |

|

Fourth Wall Creative Limited |

6,481,057 |

1,084,401 |

|

Ollie Quinn Limited |

3,642,983 |

(1,093,390) |

|

Additive Manufacturing Technologies Ltd |

— |

(1,814,869) |

Luminet Networks Limited Luminet is a provider

of primarily fixed wireless access (“FWA”) across c.400 sq km of

central London. It can provide connectivity to businesses via both

FWA and fibre, as well as offering secure hosting and managed

services. The company serves over 700 business customers, mostly on

contracts of 36 months.

30 June 2023 updateLuminet continues to provide a high quality

connectivity to London clients and has seen growth as businesses

return to offices following COVID. A significant contract was won

recently, which is expected to support continued revenue growth

over the financial year.

Ollie Quinn Limited Ollie Quinn is a branded

retailer of prescription glasses, sunglasses and non-prescription

polarised sunglasses based in the UK and Canada. The company

provides high-quality, branded, prescription glasses at a lower

price point than other high-end opticians in order to satisfy a gap

in the market for affordable luxury.

30 June 2023 updateThe £1.0 million follow-on investment was

completed in April and preparations for a crowdfund are close to

completion with launch expected in September 2023.

Aquasium Technology Limited Aquasium

manufactures, services and refurbishes electron beam welding

(“EBW”) equipment and vacuum furnaces (“VF”). EBW is a reliable and

efficient method of joining together a wide range of metals,

producing clean, high-integrity joints. VFs are used in hardening,

tempering and brazing applications.

30 June 2023 updateTrading has been strong for

the first half of the financial year, with revenues on budget and

materially ahead of the prior year. Both the machine sales and

spares and services divisions are trading well, with spares and

servicing also benefiting from some degree of catch up, following

the pandemic. Discussions are ongoing around the sale of the first

EBFLOW machine, with a focus on building the pipeline behind

this.

Additive Manufacturing Technologies Ltd

(“AMT”)AMT is developing machines for post-production of

3D printed parts: removal of excess polymer (“depowdering”),

surface smoothing/polishing, colouring and inspection. AMT’s goal

is to provide a fully automated end-to-end post-production system,

the “DMS”, with robots linking each stage.

30 June 2023 updateThe business is navigating

the challenging economic environment with support from the Manager,

providing expertise and guidance in line with its active management

approach.

OutlookThe global and UK markets have

experienced a volatile past six months following a strong recovery

in consumer and business demand after the COVID-19 pandemic. The

recovery has been somewhat stalled due to various economic factors

following the pandemic. Rising input prices, driven by supply chain

constraints during COVID-19 and rapidly increasing energy prices

following Russia’s invasion of Ukraine in Q1 2022, drove inflation

to a high of 11.1% in October 2022. This was initially slow to

decrease, with inflation remaining at 10.1% in March 2023 and 7.9%

in June 2023, partly driven by wage inflation resulting from a

tight labour market in the UK.

The Bank of England responded by steadily raising the base

interest rate from 0.1% in December 2021 to 5.25% in August 2023.

While this is now taking effect with inflation reducing, many

analysts predict further increases to interest rates in the short

term. The Bank of England is expected to maintain interest rates at

their current level in the medium term, with most analysts

predicting no meaningful reduction during 2024. Rising wage

inflation is limiting the impact of interest rate rises, suggesting

a further tightening of monetary policy, which would potentially

drive the UK into recession in late 2023 or 2024.

Despite this backdrop, the Company’s portfolio is reasonably

well positioned to withstand the market volatility and economic

headwinds. We have worked to balance risk, with the

portfolio exposed to a broad base of both well-established and

earlier-stage growth companies across a range of sectors. In the

period to 30 June 2023, the portfolio continued to perform well,

with the Company realising three investments in this time.

Notable examples that demonstrate our ability to capitalise on

high-quality regional opportunities in a variety of sectors are the

sale of Mowgli Street Food Group, a UK-wide casual Indian food

chain, to TriSpan, delivering a 3.5x return, the sale of Innovation

Consulting Group, a St Albans provider of R&D tax relief,

patent box relief and other innovation services, to a US corporate

buyer backed by BV Investment Partners that generated a 4.4x return

on investment, and Datapath Group, a Derbyshire-based global leader

in the provision of visual solutions, achieving an impressive

cash-on-cash return of 11.7x the original investment. The current

portfolio is well diversified with a good mix of earlier-stage and

more mature investments that will yield attractive opportunities

for the Company over time.

The Manager continues to leverage its regional offices to source

the highest quality growth companies where we can employ our

extensive advisory network and proactive portfolio management style

to drive growth and add value to each investee company. There

remains a strong appetite for funding from the smaller UK

businesses with growth potential, which manifested itself in a

number of exciting deals completed in the past year. Despite shifts

in the investment landscape, we continue to see excellent

opportunities to support small companies in many sub‑sectors, such

as health, technology and compliance systems, amongst others.

While the macro environment is precarious, we believe that the

Company’s portfolio is well placed to cope with a period of

uncertainty. The UK undoubtedly remains an exceptional place to

start, fund and grow a small business, and the Manager remains

committed to supporting the best UK entrepreneurs on their

journey.

James LivingstonForesight Group LLP26 September

2023

Unaudited Half-Yearly Results

and Responsibilities Statements

Principal risks and uncertaintiesThe principal

risks faced by the Company are as follows:

- Market risk

- Strategic and performance risk

- Internal and financial control risk

- Legislative and regulatory risk

- VCT qualifying status risk

- Investment valuation and liquidity risk

The Board reported on the principal risks and uncertainties

faced by the Company in the Annual Report and Accounts for the year

ended 31 December 2022. A detailed explanation can be found on

pages 47 to 49 of the Annual Report and Accounts, which is

available on the Company’s website

www.foresightvct.com or by writing to Foresight

Group at The Shard, 32 London Bridge Street, London SE1 9SG.

In the view of the Board, there have been no changes to the

fundamental nature of these risks since the previous report.

The emerging risks identified in the previous report included

those of climate change, inflationary pressures, interest rates,

supply chain issues, energy prices, the Russian invasion of Ukraine

and increased tension between the United States and China over the

future of Taiwan. These emerging risks continue to apply and be

monitored. The Board and the Manager continue to follow all

emerging risks closely with a view to identifying where changes

affect the areas of the market in which portfolio companies

operate. This enables the Manager to work closely with portfolio

companies, preparing them so far as possible to ensure they

are well positioned to endure potential volatility.

Directors’ responsibility statementThe

Disclosure and Transparency Rules (“DTR”) of the UK Listing

Authority require the Directors to confirm their responsibilities

in relation to the preparation and publication of the Half-Yearly

Financial Report.

The Directors confirm to the best of their knowledge that:

- The summarised set of financial statements has been prepared in

accordance with FRS 104

- The interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year)

- The summarised set of financial statements gives a true and

fair view of the assets, liabilities, financial position and profit

or loss of the Company as required by DTR 4.2.4R

- The interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related

parties’ transactions and changes therein)

Going concernThe Company’s business activities,

together with the factors likely to affect its future development,

performance and position, are set out in the Strategic Report of

the Annual Report. The financial position of the Company, its

cash flows, liquidity position and borrowing facilities are

described in the Chair’s Statement, Strategic Report and Notes to

the Accounts of the 31 December 2022 Annual Report. In addition,

the Annual Report includes the Company’s objectives, policies and

processes for managing its capital; its financial risk

management objectives; details of its financial instruments; and

its exposures to credit risk and liquidity risk.

The Company has considerable financial resources together with

investments and income generated therefrom across a variety of

industries and sectors. As a consequence, the Directors

believe that the Company is well placed to manage its business

risks successfully.

The Directors have reasonable expectation that the Company has

adequate resources to continue in operational existence for the

foreseeable future. Thus they continue to adopt the going

concern basis of accounting in preparing the annual financial

statements.

The Half-Yearly Financial Report has not been audited

nor reviewed by the auditors.

On behalf of the Board

Margaret LittlejohnsChair26 September 2023

Unaudited Income StatementFor the six months ended 30

June 2023

|

|

Six months ended |

Six months ended |

Year ended |

|

|

30 June 2023 |

30 June 2022 |

31 December 2022 |

|

|

|

(Unaudited) |

|

|

(Unaudited) |

|

|

(Audited) |

|

|

|

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

Realised gains on investments |

— |

3,595 |

3,595 |

— |

12,992 |

12,992 |

— |

13,207 |

13,207 |

|

Investment holding gains/(losses) |

— |

5,048 |

5,048 |

— |

(5,070) |

(5,070) |

— |

2,138 |

2,138 |

|

Income |

1,915 |

— |

1,915 |

486 |

— |

486 |

1,536 |

— |

1,536 |

|

Investment management fees |

(503) |

(2,619) |

(3,122) |

(464) |

(1,096) |

(1,560) |

(949) |

(2,550) |

(3,499) |

|

Other expenses |

(438) |

— |

(438) |

(295) |

— |

(295) |

(680) |

— |

(680) |

|

Return/(loss) on ordinary activities before

taxation |

974 |

6,024 |

6,998 |

(273) |

6,826 |

6,553 |

(93) |

12,795 |

12,702 |

|

Taxation |

(93) |

93 |

— |

— |

— |

— |

— |

— |

— |

|

Return/(loss) on ordinary activities after

taxation |

881 |

6,117 |

6,998 |

(273) |

6,826 |

6,553 |

(93) |

12,795 |

12,702 |

|

Return/(loss) per share |

0.4p |

2.6p |

3.0p |

(0.1)p |

3.1p |

3.0p |

(0.1)p |

5.9p |

5.8p |

The total columns of this statement are the profit and loss

account of the Company and the revenue and capital columns

represent supplementary information.

All revenue and capital items in the above Income Statement are

derived from continuing operations. No operations were acquired or

discontinued in the year.

The Company has no recognised gains or losses other than those

shown above, therefore no separate statement of total

recognised gains and losses has been presented.

The Company has only one class of business and one reportable

segment, the results of which are set out in the Income Statement

and Balance Sheet.

There are no potentially dilutive capital instruments in issue

and, therefore, no diluted earnings per share figures

are relevant. The basic and diluted earnings per share are,

therefore, identical.

Unaudited Reconciliation of Movements in Shareholders’

FundsFor the six months ended 30 June 2023

|

|

Called-up |

Share |

Capital |

|

|

|

|

|

|

share |

premium |

redemption |

Distributable |

Capital |

Revaluation |

|

|

|

capital |

account |

reserve |

reserve¹ |

reserve¹ |

reserve |

Total |

|

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

|

As at 1 January 2023 |

2,192 |

56,380 |

1,195 |

47,701 |

16,602 |

67,659 |

191,729 |

|

Share issues in the period |

290 |

25,936 |

— |

— |

— |

— |

26,226 |

|

Expenses in relation to share issues |

— |

(1,019) |

— |

— |

— |

— |

(1,019) |

|

Repurchase of shares |

(27) |

— |

27 |

(2,219) |

— |

— |

(2,219) |

|

Realised gains on disposal of investments |

— |

— |

— |

— |

3,595 |

— |

3,595 |

|

Investment holding gains |

— |

— |

— |

— |

— |

5,048 |

5,048 |

|

Dividends paid |

— |

— |

— |

(10,711) |

— |

— |

(10,711) |

|

Management fees charged to capital |

— |

— |

— |

— |

(2,619) |

— |

(2,619) |

|

Revenue return for the period before taxation |

— |

— |

— |

974 |

— |

— |

974 |

|

Taxation for the period |

— |

— |

— |

(93) |

93 |

— |

— |

|

As at 30 June 2023 |

2,455 |

81,297 |

1,222 |

35,652 |

17,671 |

72,707 |

211,004 |

- Reserve is available for distribution; total distributable

reserves at 30 June 2023 total £53,323,000 (31 December 2022:

£64,303,000).

Unaudited Balance SheetAt 30 June 2023

Registered number: 03421340

|

|

As at |

As at |

As at |

|

|

30 June |

30 June |

31 December |

|

|

2023 |

2022 |

2022 |

|

|

(Unaudited) |

(Unaudited) |

(Audited) |

|

|

£’000 |

£’000 |

£’000 |

|

Fixed assets |

|

As at |

As at |

|

Investments held at fair value through profit or loss |

171,153 |

157,171 |

169,775 |

|

Current assets |

|

|

|

|

Debtors |

4,545 |

12,309 |

3,037 |

|

Cash and cash equivalents |

36,938 |

28,565 |

19,525 |

|

Total current assets |

41,483 |

40,874 |

22,562 |

|

Creditors |

|

|

|

|

Amounts falling due within one year |

(1,632) |

(156) |

(608) |

|

Net current assets |

39,851 |

40,718 |

21,954 |

|

Net assets |

211,004 |

197,889 |

191,729 |

|

Capital and reserves |

|

|

|

|

Called-up share capital |

2,455 |

2,237 |

2,192 |

|

Share premium account |

81,297 |

54,692 |

56,380 |

|

Capital redemption reserve |

1,222 |

1,129 |

1,195 |

|

Distributable reserve |

35,652 |

61,539 |

47,701 |

|

Capital reserve |

17,671 |

17,841 |

16,602 |

|

Revaluation reserve |

72,707 |

60,451 |

67,659 |

|

Equity shareholders’ funds |

211,004 |

197,889 |

191,729 |

|

Net Asset Value per share |

85.9p |

88.5p |

87.5p |

Unaudited Cash Flow StatementFor the six months ended 30

June 2023

|

|

Six months ended |

Six months ended |

Year ended |

|

|

30 June |

30 June |

31 December |

|

|

2023 |

2022 |

2022 |

|

|

(Unaudited) |

(Unaudited) |

(Audited) |

|

|

£’000 |

£’000 |

£’000 |

|

Cash flow from operating activities |

|

|

|

|

Loan interest received from investments |

850 |

311 |

1,249 |

|

Dividends received from investments |

580 |

96 |

132 |

|

Deposit and similar interest received |

487 |

27 |

220 |

|

Investment management fees paid |

(2,011) |

(1,843) |

(3,789) |

|

Secretarial fees paid |

(65) |

(65) |

(130) |

|

Other cash payments |

(340) |

(168) |

(457) |

|

Net cash outflow from operating activities |

(499) |

(1,642) |

(2,775) |

|

Cash flow from investing activities |

|

|

|

|

Purchase of investments |

(8,721) |

(3,170) |

(11,051) |

|

Net proceeds on sale of investments |

14,515 |

10,272 |

21,922 |

|

Net proceeds on deferred consideration |

— |

51 |

266 |

|

Net cash inflow from investing activities |

5,794 |

7,153 |

11,137 |

|

Cash flow from financing activities |

|

|

|

|

Proceeds of fundraising |

23,692 |

18,531 |

18,531 |

|

Expenses of fundraising |

(589) |

(455) |

(473) |

|

Repurchase of own shares |

(2,313) |

(4,468) |

(9,234) |

|

Equity dividends paid |

(8,672) |

(8,075) |

(15,182) |

|

Net cash inflow/(outflow) from financing

activities |

12,118 |

5,533 |

(6,358) |

|

Net inflow of cash in the period |

17,413 |

11,044 |

2,004 |

|

Reconciliation of net cash flow to movement in net

funds |

|

|

|

|

Increase in cash and cash equivalents for the period |

17,413 |

11,044 |

2,004 |

|

Net cash and cash equivalents at start of period |

19,525 |

17,521 |

17,521 |

|

Net cash and cash equivalents at end of

period |

36,938 |

28,565 |

19,525 |

Analysis of changes in net debt

|

|

At 1 January 2023 |

Cash flow |

At 30 June 2023 |

|

|

£’000 |

£’000 |

£’000 |

|

Cash and cash equivalents |

19,525 |

17,413 |

36,938 |

Notes to the Unaudited Half-Yearly ResultsFor the six

months ended 30 June 2023

1 The Unaudited Half-Yearly Financial Report

has been prepared on the basis of the accounting policies set out

in the statutory accounts of the Company for the year ended 31

December 2022. Unquoted investments have been valued

in accordance with IPEV Valuation Guidelines.

2These are not statutory accounts in accordance

with S436 of the Companies Act 2006 and the financial information

for the six months ended 30 June 2023 and 30 June 2022 has been

neither audited nor formally reviewed. Statutory accounts in

respect of the year ended 31 December 2022 have been audited and

reported on by the Company’s auditors and delivered to the

Registrar of Companies and included the report of the auditors

which was unqualified and did not contain a statement under S498(2)

or S498(3) of the Companies Act 2006. No statutory accounts in

respect of any period after 31 December 2022 have been reported on

by the Company’s auditors or delivered to the Registrar

of Companies.

3 Copies of the Unaudited Half-Yearly Financial

Report will be sent to shareholders via their chosen method and

will be available for inspection at the Registered Office

of the Company at The Shard, 32 London Bridge Street, London

SE1 9SG.

4 Net Asset Value per shareThe Net Asset Value

per share is based on net assets at the end of the period and on

the number of shares in issue at the date.

|

|

Net assets |

Number of |

|

|

|

shares in issue |

|

30 June 2023 |

£211,004,000 |

245,495,673 |

|

30 June 2022 |

£197,889,000 |

223,678,255 |

|

31 December 2022 |

£191,729,000 |

219,151,944 |

5 Return per shareThe weighted average number

of shares used to calculate the respective returns are shown in the

table below.

|

|

Shares |

|

Six months ended 30 June 2023 |

232,668,471 |

|

Six months ended 30 June 2022 |

215,848,355 |

|

Year ended 31 December 2022 |

218,519,391 |

Earnings for the period should not be taken as a guide to the

results for the full year.

6 Income

|

|

Six months |

Six months |

Year ended |

|

|

ended |

ended |

31 December |

|

|

30 June |

30 June |

2022 |

|

|

2023 |

2022 |

£’000 |

|

Loan stock interest |

848 |

337 |

1,184 |

|

Dividends receivable |

580 |

122 |

132 |

|

Deposit and similar interest received |

487 |

27 |

220 |

|

|

1,915 |

486 |

1,536 |

7 Investments at fair value through profit or

loss

|

|

£’000 |

|

Book cost as at 1 January 2023 |

103,766 |

|

Investment holding gains |

66,009 |

|

Valuation at 1 January 2023 |

169,775 |

|

Movements in the period: |

|

|

Purchases |

9,711 |

|

Disposal proceeds1 |

(14,515) |

|

Realised gains |

3,595 |

|

Investment holding gains2 |

2,587 |

|

Valuation at 30 June 2023 |

171,153 |

|

Book cost at 30 June 2023 |

102,557 |

|

Investment holding gains |

68,596 |

|

Valuation at 30 June 2023 |

171,153 |

- The Company received £14,515,000 from the disposal of

investments during the period. The book cost of these investments

when they were purchased was £10,920,000. These investments have

been revalued over time and until they were sold any unrealised

gains or losses were included in the fair value of the

investments.

- Investment holding gains in the Income Statement include the

deferred consideration debtor increase of £2,461,000. The debtor

movement reflects the recognition of amounts receivable in respect

of Mowgli Street Food Group Limited (£1,647,000) and Datapath Group

Limited (£1,167,000), offset by an FX movement in respect of

Codeplay Software Limited (£42,000) and provisions made against

balances in respect of Mologic Ltd. (£241,000) and FFX Group

Limited (£70,000). Post-period end, £824,000 of deferred

consideration was received in relation to Mowgli Street Food Group

Limited.

8 Performance incentive feeIn order to

incentivise the Manager to generate enhanced returns for

shareholders, the Manager will potentially be entitled to

performance incentive payments in respect of each financial year

commencing on or after 1 January 2023 where the Company achieves an

average annual NAV Total Return per share, over a rolling five-year

period, in excess of an average annual hurdle of 5% (simple not

compounded). If the hurdle is met, the Manager would be entitled to

an amount equal to 20% of the excess over the hurdle subject to a

cap of 1% of the closing Net Asset Value for the relevant financial

year (and no fee will be due in excess of this cap).

Where there is a negative return in the relevant financial year,

no fee shall be payable even if the hurdle is exceeded. However,

the potential fee will be carried forward and will become due at

the end of the next financial year if the performance hurdle

described above for that next financial year is achieved and the

negative return in the preceding financial year is recovered in

that next financial year. Any such catch-up fees shall be paid

alongside any fee payable for the next financial year subject to

the 1% cap applying to both fees in aggregate. Any such catch-up

fees cannot be rolled further forward to subsequent financial

years.

The new performance incentive scheme, as described above, in the

Chair’s Statement of the Company’s 31 December 2022

Annual Report and Accounts and the Circular dated

18 May 2023, was formally approved by shareholders at

the General Meeting held on 15 June 2023.

Estimation of the financial effectAs at 30 June

2023, the NAV Total Return since 31 December 2018 was

33.2p (being the aggregation of NAV per share as at 30 June 2023,

before any performance incentive provision, of 86.4p and dividends

paid per share in the period totalling 24.9p less the NAV per share

as at 31 December 2018 of 78.1p) giving an average annual NAV Total

Return per share of 6.6p. This compares to the average annual

hurdle of 3.9p based on the opening NAV per share of 78.1p as at

31 December 2018 and therefore an excess of 2.7p over

the hurdle.

If NAV Total Return for the year ending 31 December 2023, the

Net Asset Value of the Company as at 31 December 2023 and the

weighted average number of shares in issue over the five‑year

period to 31 December 2023 remained unchanged from their positions

as at 30 June 2023, the Manager would be entitled to a performance

incentive payment of £1.1 million, which has been provided for

in the financial statements.

9 Related party transactionsNo Director has an

interest in any contract to which the Company is a party other than

their appointment and payment as Directors.

10 Transactions with the ManagerForesight Group

LLP was appointed as Manager on 27 January 2020 and earned fees of

£2,011,000 up to 30 June 2023 (30 June 2022: £1,857,000,

31 December 2022: £3,499,000). Performance incentive fees of

£1.1 million have been accrued as at 30 June 2023 (30 June 2022:

£nil, 31 December 2022: £nil).

Foresight Group LLP is the Company Secretary (appointed in

November 2017) and received, directly and indirectly,

for accounting and company secretarial services, fees of

£65,000 during the period (30 June 2022: £65,000, 31 December

2022: £130,000).

At the balance sheet date there was £nil due to Foresight Group

LLP (30 June 2022: £7,000, 31 December 2022: £nil).

END

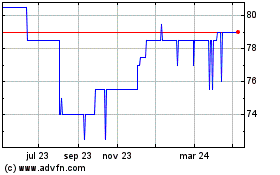

Foresight Vct (LSE:FTV)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

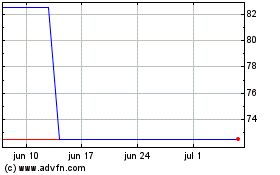

Foresight Vct (LSE:FTV)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025