TIDMGSF

RNS Number : 8610P

Gore Street Energy Storage Fund PLC

12 October 2023

12 October 2023

Gore Street Energy Storage Fund plc

(the "Company" or "GSF")

Positive Portfolio Update and Share Price Commentary

Positive revenue trends continue, driven by the international

assets. The consolidated portfolio outperformed the GB fleet by

circa 3x during the quarter

Gore Street Energy Storage Fund plc, the internationally

diversified energy storage fund, is pleased to share an update for

FY Q2 ending 30 September 2023. This quarter again highlights the

benefits of the Company's early diversification strategy, with the

consolidated portfolio outperforming the Company's GB fleet by

c.3x, based on average revenue per MW during the period. The

portfolio build-out continues to progress following September's

energisation of 79.9 MW of additional capacity.

The Board continues to monitor the current GSF share price

volatility. The Board and the Investment Manager confirm that they

are not aware of any portfolio-specific factors that have led to

the recent sharp decline in the share price. The Board believes

that the discount to Net Asset Value at which the Company's share

price currently trades materially undervalues the Company and its

portfolio. The Board maintains confidence in the quality of the

assets across the five international energy markets, which continue

to perform strongly, underpinning the dividend.

Key FYQ2 Highlights:

-- International Diversification: The Company's non-GB portfolio

spans four uncorrelated international energy markets, including the

integrated Irish grid, Germany, Texas, and California. The

operational international fleet now accounts for over 62% of the

Company's operational capacity. This diversification insulates the

Company from the current GB market saturation, which at some stage

will ameliorate as is typical of capital-intensive industries, and

enables the pursuit of diverse revenue streams.

-- Market-Specific Strategies: Tailored system durations,

ranging from 26 minutes in Northern Ireland to two hours in Texas;

optimised revenue streams based on weather patterns, renewables

penetration, and flexibility needs. This adaptability minimises

revenue variability, ensuring stability.

-- Market Success: In August, the Company's assets in the ERCOT

market in Texas generated record revenue of approximately

GBP150/MW/hr, marking the highest monthly revenue per MW ever

achieved by the Company in a single grid. This was achieved through

strategic prequalification of new revenue streams and collaboration

with a new route-to-market partner. This achievement highlights the

advantages of having complete, in-house technical resources, from

construction to asset management and commercialisation.

Operational & Portfolio Update:

The operational fleet demonstrated strong performance,

generating an estimated weighted average revenue of GBP18.9/MW/hr

during the September-end quarter. Performance is broken down by

grid below:

-- Ireland: Unseasonably high wind penetration led to estimated

revenues of over GBP20.2/MW/hr during the three months. This is

especially pleasing for the Company given that these months have

historically been "off-season", yielding lower revenues.

-- Texas: Record-breaking monthly revenue was generated in

August following the Company's prequalification for the new ECRS

ancillary service, aligning with historical trends of high summer

revenue due to heatwaves and grid scarcity. The Portfolio generated

an estimated average of GBP65.2/MW/hr during the three months in

this market.

-- Great Britain (GB): Revenue in GB remains subdued and remains

the Company's lowest revenue market, which we believe will

continue. The estimated average revenue for the GB portfolio was

GBP6.6/MW/hr for the three months.

-- Germany: Stable revenue was maintained despite declining

ancillary service prices due to sufficient spreads that allow

energy storage to profit from energy arbitrage. The estimated

average revenue for the three-month period was GBP10.4/MW/hr.

Capital Structure:

-- The Company remains well-capitalised, with c.GBP75m in cash

or cash equivalents as of 30 September 2023 without any outstanding

debt. Of the 187 MW scheduled to come online in GB over the next 9

months, c.85% of the required capex has already been paid. The

Company currently remains undrawn on its existing GBP50m RCF. In

addition, the Company continues to progress towards securing USD

denominated project-level debt for its Big Rock asset in

California.

Construction Progress:

The Company remains on track to bring its operational portfolio

to 813.4MW by the end of 2024. A breakdown of progress is detailed

below:

-- GB: Significant strides have been made in completing assets,

with Stony (79.9 MW) energised in September 2023 and Ferrymuir

(49.9 MW) awaiting confirmation from the grid operator to bring it

to energisation with all energy storage package work complete and

ready to be energised. Enderby is still on track for and targeting

energisation in June 2024.

-- California: The Big Rock asset (200.0 MW) construction is

proceeding well, with key equipment procured and on-site works

scheduled to commence this year. The project remains within budget

and on track to meet its energisation date in 2024.

-- Texas: Contracts for advanced engineering and procurement of

HV equipment for Dogfish (75.0 MW) have been signed, with further

agreements in progress. The project remains on track for its

energisation in 2024.

-- Ireland: Engineering and procurement for Porterstown Phase II

(60.0 MW) are underway and are on track for energisation in October

2024.

Alex O'Cinneide, CEO of Gore Street Capital, the Investment

Manager of the Company, commented :

"I wish to address fellow shareholders directly regarding the

recent performance of the Company's share price, which has been

disappointing, particularly considering the Company's continued

impressive operating performance. In light of this, the Investment

Manager, Gore Street Capital has purchased shares, as announced on

3 October.

Energy storage faces the same challenges as the rest of

renewable infrastructure in a high-interest environment. It is

important to recognise, however, that despite these difficulties,

our commitment to the Company's objectives remains unchanged. We

are successfully executing against the strategy laid out to

investors and delivering on the commitments made, including those

regarding dividend distributions to our Shareholders. Our dividend

coverage is the highest amongst peers and will continue to increase

and be underpinned as significant new capacity comes on stream over

the next 12 months.

In terms of operational progress, we have achieved significant

milestones. Stony has been energised, and we remain confident of

reaching our goal of 813.4 MW operational capacity by the close of

2024.

In our sector, there have been higher assumptions over future

revenue opportunities than we foresaw, and those assumptions have

had to be unwound. This has given the impression that volatility

over energy storage revenues is higher, and therefore, investors

are placing a higher risk premium on funds like ours. What that

view fails to consider is the difference in strategy enacted by

those funds.

The Company's unique diversification strategy, which has seen

the deployment of operational assets across four uncorrelated

markets, has reduced revenue volatility by c.50%. The Company's

balance sheet reflects prudent management, with the lowest debt

levels amongst our peers.

While markets remain turbulent, our team is more determined than

ever to navigate these challenges successfully. We remain focused

on our objectives and are fully committed to delivering value for

shareholders."

Pat Cox, Chair of the Company, commented:

"The Board notes the recent weakness in share price, which, in

our view, significantly underrates the best-in-class performance of

our portfolio.

Our operational assets have consistently met and often exceeded

expectations, especially in our international markets, where recent

revenue generation has surpassed projections.

It is important to emphasise that our operating portfolio

demonstrates strong performance on the international stage and

reinforces our confidence in the strategic choices we have

made.

We would like to reassure shareholders that despite the recent

market conditions, the Company's balance sheet remains strong, it

continues to perform particularly well operationally, and we remain

committed to delivering value for our Shareholders."

For further information:

Gore Street Capital Limited

Alex O'Cinneide / Paula Travesso Tel: +44 (0) 20 3826 0290

Shore Capital (Joint Corporate Broker)

Anita Ghanekar / Rose Ramsden / Iain Sexton (Corporate Advisory) Tel: +44 (0) 20 7408 4090

Fiona Conroy (Corporate Broking)

J.P. Morgan Cazenove (Joint Corporate Broker) Tel: +44 203 493

8000

William Simmonds / Jérémie Birnbaum (Corporate Finance) Tel: +44

(0) 20 3493 8000

Buchanan (Media Enquiries)

Charles Ryland / Henry Wilson / George Beale Tel: +44 (0) 20

7466 5000

Email: gorestreet@buchanan.uk.com

Notes to Editors

About Gore Street Energy Storage Fund plc

Gore Street is London's first listed and internationally

diversified energy storage fund dedicated to the low-carbon

transition. It seeks to provide Shareholders with sustainable

returns from their investment in a diversified portfolio of

utility-scale energy storage projects. In addition to growth

through increasing operational capacity and a considerable

pipeline, the Company aims to deliver consistent and robust

dividend yield as income distributions to its Shareholders.

https://www.gsenergystoragefund.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUFFFEFIALLLIV

(END) Dow Jones Newswires

October 12, 2023 02:00 ET (06:00 GMT)

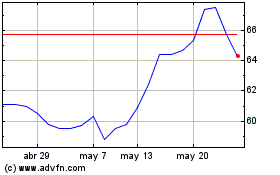

Gore Street Energy Storage (LSE:GSF)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Gore Street Energy Storage (LSE:GSF)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025