TIDMIHC

RNS Number : 4458O

Inspiration Healthcare Group PLC

03 October 2023

Inspiration Healthcare Group plc

("Inspiration Healthcare", the "Company" or the "Group")

Interim Results

Underlying growth from core neonatal and infusion businesses

Inspiration Healthcare Group plc (AIM: IHC), the global medical

technology company, announces its unaudited interim results for the

six months ended 31 July 2023.

Financial highlights

-- Revenue GBP20.4 million (H1 2023: GBP20.5 million)

o Neonatal product revenues grew 4% to GBP16.1 million driven by

sales of the SLE6000 ventilator

o Infusion product revenues were GBP4.3 million (H1 2023: GBP4.9

million) due to de-stocking (now ended) by a major customer.

Excluding this customer, Infusion revenues grew 18% versus H1

2023

-- Gross Margin improved to 48.6% (H1 2023: 45.1%), driven by

increased higher margin ventilator sales

-- Adjusted EBITDA(1) GBP1.8 million (H1 2023: GBP2.2 million)

-- Operating Profit before non-recurring items GBP0.6 million (H1 2023: GBP1.0 million)

-- Cash generated by operating activities of GBP3.5 million (H1

2023: cash outflow of GBP0.5 million)

-- Net debt(2) reduced to GBP2.1 million (31 January 2023: GBP3.8 million)

-- Interim dividend of 0.205p per share, unchanged from H1 2023

(1) Earnings before interest, tax, depreciation, share based

payments and non-recurring items

(2) Excluding IFRS16 lease liabilities

Operational highlights (including post period)

-- Launched extension of SLE6000 range for non-invasive respiratory support

-- Initiated Medical Device Single Audit Program to access

Canadian market and reduce the need for individual country

audits

-- Streamlining property portfolio to realise operational efficiencies as well as cost savings

-- Strengthened Board with appointments of Alan Olby as CFO and

Marlou Janssen as Non-Executive Director

-- Submitted SLE6000 510k application to FDA for US market - post period end

-- Launched US version of LifeStart, our stabilisation platform

for babies that have had a difficult birth - post period end

-- Launched new website for improved customer experience

Investor presentation

The Company will provide a live presentation to investors via

the Investor Meet Company platform on Friday, 6 October 2023 at

11am BST. The presentation will give an update on the Company and

an overview of the Group's interim results. To register for the

presentation, please use this link:

https://www.investormeetcompany.com/inspiration-healthcare-group-plc/register-investor

Neil Campbell, Chief Executive Officer of Inspiration Healthcare

Group plc, commented: "During the first six months we have seen

underlying growth in our core neonatal and infusion businesses,

driven by continued customer demand for our products. We also

delivered significant improvements in our gross margins and

operating cash flow placing the Group in a stronger financial

position. We have made significant progress with our US expansion

strategy, filing for FDA approval of the SLE ventilators and

launching a version of LifeStart that is aligned with US user

requirements. The headwinds seen in H1 are dissipating and with a

strong pipeline of opportunities we are confident of returning to

growth in the second half. We would like to take this opportunity

to thank our shareholders for their continued support and we look

forward to the future with optimism."

Enquiries:

Inspiration Healthcare Group plc Tel: 0330 175 0000

Neil Campbell, Chief Executive Officer

Alan Olby, Chief Financial Officer

Tel: +44(0)20 3100 2000

Nominated Adviser & Broker

Liberum

Phil Walker

Richard Lindley

Will King

Walbrook PR Ltd (Media and Investor Tel: +44(0)20 7933 8780 or inspirationhealthcare@walbrookpr.com

Relations)

Mob: +44(0) 7876 741 001

Mob: +44(0) 7796 794 663

Anna Dunphy Mob: +44(0) 7747 515 393

Stephanie Cuthbert

Louis Ashe-Jepson

About Inspiration Healthcare

Inspiration Healthcare (AIM: IHC) designs, manufactures and

markets pioneering medical technology. Based in the UK, the Company

specialises in neonatal intensive care medical devices, which are

addressing a critical need to help to save the lives and improve

the outcomes of patients, starting with the very first breaths of

life.

The Company has a broad portfolio of its own products and

complementary distributed products , for use in neonatal intensive

care designed to support even the most premature babies throughout

their hospital stay. Its own branded products range from highly

sophisticated capital equipment such as ventilators for life

support through to single-use disposables.

The Company sells its products directly to hospitals and

healthcare providers in the UK and Ireland, where it also

distributes a range of advanced medical technologies for infusion

therapy. In the rest of the world the Company has an established

network of distribution partners around the world giving access to

more than 75 countries.

The Company operates from its world-class Manufacturing and

Technology Centre in Croydon, South London and from its facility in

Hailsham, East Sussex.

Further information on Inspiration Healthcare can be found at

www.inspirationhealthcaregroup.com

Chairman's Statement

The Group has seen encouraging growth in our core products

during the first half, which has been a significant driver in

improving margins towards historic levels. Operating cash flow also

improved, reducing the level of our net debt and putting the

business in a much stronger financial position.

Overall Group revenue for the period was flat at GBP20.4

million, with growth of our core products offset by significant

regulatory delays to one of our partners' key products and

de-stocking from one of our leading Infusion customers.

Our neonatal portfolio consists of our own branded products and

complementary distributed products, enabling us to add value to our

neonatal customers by supplying a broad range of specialist

products. However, for distributed products we are reliant on our

partners' supply chain and regulatory pathways. During 2022, one of

our partners' products was discontinued. The next generation

product was expected to gain European CE marking under the Medical

Device Regulations early in 2023. However, due to ongoing

regulatory delays and the lead times for delivery and production

scheduling this product is now expected to be commercially

available during the first half of next year. On a true

like-for-like basis excluding the discontinued product, in the

period neonatal revenues grew by 11% compared to H1 2023. Sales of

our lead product range, the SLE6000 ventilator, grew strongly

driven by strong demand in Ireland and Israel and a recovery in

China.

Our Infusion business sells to a variety of customers including

'homecare providers', which look after NHS patients in the

community freeing up hospital beds and improving the quality of

life for patients. Unfortunately, one of our major customers over

stocked during the previous 12 months and began a stock reduction

exercise in H1. We have worked with the customer to get their stock

levels back to more normalised levels and the de-stocking process

is now complete and a standard run rate is expected in the second

half. Excluding this customer, Infusion revenues grew by 18%

compared to H1 2023 as we expanded use of the products into new

therapy areas, demonstrating continued underlying growth in

sales.

Our aim during the first half was to rebuild our margins and

return to cash generation. During FY23, we had a cash outflow of

approximately GBP13 million, mainly driven by the GBP6 million

investment in the new Manufacturing and Technology Centre in

Croydon and investment in working capital to ensure we had stock of

components to maintain timely delivery of our products to

customers. I am pleased that during the first half of FY24, we have

been cash positive on an operating basis, our capital expenditure

has returned to normal levels and our net borrowings have reduced

from GBP3.8 million at 31 January 2023 to GBP2.1 million at 31 July

2023. We continue to have a Revolving Credit Facility of GBP5

million and Invoice Discounting facility of up to GBP5 million

giving the Group headroom of almost GBP8 million to cover cash flow

requirements.

We have been pleased to welcome two new Board members during the

first half. I am delighted that Alan Olby has joined us as Chief

Financial Officer, bringing a great deal of experience as CFO in a

growing Life Science business in both the public and private

markets. Alan has already started to put in new systems and

processes to bring about a higher level of rigour to our

forecasting and financial management.

I am also pleased that we have further strengthened our Board

with the appointment of Marlou Janssen. Marlou brings a wealth of

Med Tech expertise to the Board and her operational experience in

Med Tech, especially in the USA, is second to none. I am sure she

will play an important role in our strategic development over the

coming years and has already proven insightful and helpful

regarding our plans for international growth.

Operational Review

In March, we launched an extension to our leading range of

specialist neonatal ventilators, which facilitate precise,

controlled ventilation for critically ill infants. We now have

three variants of the SLE6000, which have been specifically

designed to meet the different, specialist healthcare needs of the

smallest neonates across critical care, high dependency care and

non-invasive respiratory support. They all offer new 'non-invasive

modes', which allow babies who are less sick to be supported by the

ventilator, therefore accessing a large part of the market that was

previously closed to the product.

The USA has always been an important strategic market for the

Company and we remain focused on expanding our USA presence. In

August this year, we submitted a 510K application to the FDA for

the SLE6000 ventilator. Although there is no guarantee of approval,

we hope to launch two variants of the ventilator along with

accessories and other complementary products in the second half of

2024. We believe this represents a significant potential commercial

opportunity for the Company, given existing ventilators available

in the US, size of the market, and the world wide acceptance of the

SLE6000 as a specialist neonatal ventilator.

Also in the USA, we have recently launched a new version of our

LifeStart(TM) product, which is more aligned with US user

requirements by allowing US manufactured accessories to be added to

the platform. LifeStart(TM) is a specialist unit that can be used

as a stabilisation platform for babies that have experienced a

difficult birth. The platform keeps the baby close to its

mother/family whilst the clinician determines when to clamp and cut

the umbilical cord. We are working with our distributor to build

out marketing plans as feedback from the first customers grows.

We are continuing to develop products through our R&D team

and are currently finalising a new respiratory device which

provides non-invasive respiratory support for babies that do not

need full intensive care support. The device has been developed

alongside one of our partners, who will sell a similar device in

the adult market. We expect to launch this product in the second

half. Additionally, we are now determining the next phase for

Project Wave, after the trial at Brighton and Sussex Universities

Hospital NHS Trust showed user and patient acceptance of the

product and we can start to look at wider market research to

determine pricing and how our commercial launch could be

initiated.

The Company has commenced the process to be certified under the

Medical Device Single Audit Program (MDSAP). This allows a single

MDSAP recognised auditing organisation to conduct a regulatory

audit of a medical device manufacturer on behalf of all the

regulatory authorities participating in the program. It combines

various Quality Management requirements from several regulatory

jurisdictions including the USA, Europe, Japan, Australia and

Canada. As we start to roll out our North America strategy it is

important to have the most efficient way of complying with local

regulations for the greatest number of products. Our quality

management systems have now been audited to these regulations and

we look forward to gaining certification, allowing our products to

be registered in Canada as well as reducing the need for individual

country audits.

Our Infusion division made substantial progress during the

period. We have invested in extra customer facing employees to

build our customer base and expand the use of the products into new

therapy areas, which has resulted in initial sales. This

diversification is an important part of our future growth strategy

and we will continue to launch new products from our partners in

this area of our business over the next twelve months.

As we have brought the three operating companies together we

have created a new website that gives a better user experience to

be able to access more information on Group products on one site.

This also has been built to allow future features to be added to

give a better user experience for product training along with the

potential for e-commerce.

In order to bring our teams together at our new Manufacturing

and Technology Centre in Croydon, during the first half we took the

decision to close our site in Earl Shilton, Leicestershire, where

we had an operational base for 15 years. Inevitably this impacted

some staff who could not relocate to our Croydon facility, and we

are sad to see them leave us but thank them for their hard work and

loyalty over the years and wish them well for the future. Our

Crawley facility has also now closed, and all our Head Office

functions have moved to Croydon, reducing overheads and improving

operational efficiency. While these changes resulted in some

one-off exceptional charges in the first half, we expect to realise

annual cash savings of GBP0.2 million as a result.

Financial Review

Revenue for the six months to 31 July 2023 totalled GBP20.4

million (H1 2023: GBP20.5 million). Whilst broadly flat at a

headline level, this masks an encouraging underlying performance.

The neonatal portfolio was held back by the loss of revenue from a

distributed product which contributed GBP1.0 million in H1 2023 as

explained above. On a like-for-like basis excluding this

distributed product, the neonatal portfolio grew by 11% in the

period, driven by sales of the SLE6000 ventilator.

Our infusion products delivered revenue of GBP4.3 million in the

period (H1 2023: GBP4.9 million) a decline of 14% versus last year.

However, adjusting for the customer de-stocking during the period,

underlying sales grew by 18%, continuing the growth trend seen in

FY23.

Gross margin improved to 48.6% in the period compared to 45.1%

in the same period last year. This improvement has been down to

product mix. As we commented in FY23, our margins were reduced due

to product mix and we expected them to return to historic levels as

the mix of products became more favourable, which has been the

case. Although mix can vary during the second half, we expect

margins to stabilise around their current level.

Operating expenses totalled GBP9.3 million in the period (H1

2023: GBP8.2 million) reflecting wage inflation increasing

employment costs which are the largest category within our

overheads, as well as increasing travel expenses with overseas

markets re-opening, increased regulatory fees and the impact of

exchange rate movements.

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 July 31 July 31 January

2023 2022 2023

GBP'000 GBP'000 GBP'000

---------------------------- ----------- ----------- ------------

Operating profit 150 1,049 431

----------------------------- ----------- ----------- ------------

Non-recurring items 406 - 1,158

----------------------------- ----------- ----------- ------------

Adjusted operating profit 556 1,049 1,589

----------------------------- ----------- ----------- ------------

Depreciation 653 601 1,354

Amortisation 462 466 931

Share based payment 89 87 132

----------------------------- ----------- ----------- ------------

Adjusted EBITDA 1,760 2,203 4,006

----------------------------- ----------- ----------- ------------

Adjusted EBITDA(1) amounted to GBP1.8 million, a decrease of 20%

over H1 2023 as the increased gross profit was offset by increased

in operating expenses. Operating profit for the period was GBP0.2

million after the inclusion of non-recurring charges of GBP0.4

million largely resulting from the restructure of operations with

the closure of the offices at Earl Shilton and Crawley, which is

now complete.

Finance costs increased to GBP0.3 million in the period (H1 2023

GBP0.2 million) as a result of increases in interest rates and

higher average net debt compared to the prior period.

Net Debt as at 31 July 2023 was GBP2.1 million, a net inflow of

GBP1.7 million for the first half. Net Debt has been reduced as a

result of EBITDA generation and a focus on reducing working

capital. Headroom against the Group's bank facilities (GBP5 million

RCF and GBP5 million invoice discounting facility) was GBP7.9

million at 31 July providing significant flexibility to manage

working capital flows.

Dividend

We confirm that our interim dividend payment will remain at the

same level as H2 2023 at 0.205p per share. This will be payable to

shareholders on the register on 24 November 2023 and will be paid

on 22 December 2023. The shares will go ex-dividend on 23 November

2023.

Outlook

The Company continues to execute its strategy to drive growth

through maximising sale of existing products, geographic expansion

and R&D investment to broaden its product portfolio and is well

positioned to benefit from the growth of the neonatal and infusion

markets.

With a strong pipeline of opportunities for both neonatal and

infusion products, combined with the underlying growth seen in the

first half, we are confident in returning to growth in the second

half and expect to maintain the improvement in margins for the

remainder of the year.

Mark Abrahams

Chairman

3 October 2023

(1) Earnings before interest, tax, depreciation, share based

payments and non-recurring items

Unaudited Consolidated Income Statement and Statement of Total

Comprehensive Income

For the six months ended 31 July 2023

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

31 July 31 July 31 January

2023 2022 2023

Notes GBP'000 GBP'000 GBP'000

----------------------------------------- ------- ----------- ------------------- ------------

Revenue 20,370 20,523 41,233

Cost of sales (10,472) (11,261) (23,140)

Gross profit 9,898 9,262 18,093

Operating expenses (9,342) (8,213) (16,504)

Operating profit (before non-recurring

costs) 556 1,049 1,589

Non-recurring costs 4 (406) - (1,158)

Operating profit (after non-recurring

costs) 150 1,049 431

Finance income 30 18 40

Finance cost (320) (182) (395)

(Loss) / Profit before tax (140) 885 76

Income tax 5 84 (119) 196

(Loss) / Profit attributable to

the owners of the parent company

and total comprehensive (loss)/income

for the period (56) 766 272

Earnings per share, attributable

to owners of the parent company

Basic expressed in pence per share 7 (0.08p) 1.57p 0.40p

Diluted expressed in pence per

share 7 (0.08p) 1.55p 0.39p

----------------------------------------- ------- ----------- ------------------- ------------

Unaudited Consolidated Statement of Financial Position

As at 31 July 2023

Unaudited Unaudited Audited

As at As at As at

31 July 31 July 31 January

2022

2023 Restated* 2023

Notes GBP ' 000 GBP"000 GBP ' 000

-------------------------------------------------------------------------------- ----------- ----------- -------------------

Assets

Non-current assets

Intangible assets 17,251 16,357 17,004

Property, plant and equipment 7,235 5,692 7,497

Right of use assets 5,680 7,025 5,970

Deferred tax asset 373 136 324

-----------

30,539 29,210 30,795

-------------------------------------------------------------------------------- ----------- ----------- -------------------

Current assets

Inventories 10,493 8,739 9,935

Trade and other receivables 8 10,167 10,147 11,888

Cash and cash equivalents 1,948 3,033 2,276

-------------------------------------------------------------------------------- ----------- ----------- -------------------

22,608 21,919 24,099

Total assets 53,147 51,129 54,894

-------------------------------------------------------------------------------- ----------- ----------- -------------------

Liabilities

Current liabilities

Trade and other payables 9 (6,849) (7,446) (5,812)

Lease liabilities (770) (760) (822)

Borrowings - - (2,079)

Contract liabilities (449) (319) (531)

-------------------------------------------------------------------------------- ----------- ----------- -------------------

(8,068) (8,525) (9,244)

-------------------------------------------------------------------------------- ----------- ----------- -------------------

Non-current liabilities

Lease liabilities (5,852) (6,541) (6,176)

Borrowings (4,000) - (4,000)

(9,852) (6,541) (10,176)

-------------------------------------------------------------------------------- ----------- ----------- -------------------

Total liabilities (17,920) (15,066) (19,420)

-------------------------------------------------------------------------------- ----------- ----------- -------------------

Net assets 35,227 36,063 35,474

-------------------------------------------------------------------------------- ----------- ----------- -------------------

Shareholders' equity

Called up share capital 6,823 6,812 6,813

Share premium account 18,905 18,838 18,842

Reverse acquisition reserve (16,164) (16,164) (16,164)

Share based payment reserve 421 365 405

Retained earnings 25,242 26,212 25,578

-------------------------------------------------------------------------------- ----------- ----------- -------------------

Total equity 35,227 36,063 35,474

-------------------------------------------------------------------------------- ----------- ----------- -------------------

*A prior period adjustment was made in relation to deferred tax

in the Audited Financial Statements for the year ended 31 January

2023 and consequently, adjustments to Goodwill and Deferred Tax

have been made in the Consolidated Statement of Financial Position

as at 31 July 2022. Please see note 10 for further detail.

Unaudited Consolidated Statement of Changes in Shareholders'

Equity

For the six months ended 31 July 2023

Called Reverse Share

up Share Share acquisition based payment Retained Total

Capital Premium reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 February 2022

(restated) 6,812 18,838 (16,164) 278 25,725 35,489

Profit for the period

1 February 2022 to

31 July 2022 - - - - 766 766

Total comprehensive

income for the period - - - - 766 766

-------------------------- ----------- ----------- -------------- ---------------- ----------- ---------------

Transactions with

owners in their

capacity

of owners

Dividends - -- -- -- (279) (279)

Employee share scheme

expense - - - 87 - 87

-------------------------- ----------- ----------- -------------- ---------------- ----------- ---------------

Total transactions

with owners - - - 87 (279) (192)

-------------------------- ----------- ----------- -------------- ---------------- ----------- ---------------

At 31 July 2022

(restated) 6,812 18,838 (16,164) 365 26,212 36,063

Loss for the period

1 August 2022 to 31

January 2023 - - - - (494) (494)

Total comprehensive

loss for the period - - - - (494) (494)

-------------------------- ----------- ----------- -------------- ---------------- ----------- ---------------

Transactions with

owners in their

capacity

of owners

Dividends - - - - (140) (140)

Issue of Ordinary

Shares, net of

transaction

costs and tax 1 4 - (5) - -

Employee share scheme

expense - - - 45 - 45

Total transactions

with owners 1 4 - 40 (140) (95)

-------------------------- ----------- ----------- -------------- ---------------- ----------- ---------------

At 31 January 2023 6,813 18,842 (16,164) 405 25,578 35,474

Loss for the period

1 February 2023 to

31 July 2023 - - - - (56) (56)

Total comprehensive

loss for the period - - - - (56) (56)

-------------------------- ----------- ----------- -------------- ---------------- ----------- ---------------

Transactions with

owners in their

capacity

of owners

Dividends - - - - (280) (280)

Issue of Ordinary

Shares, net of

transaction

costs and tax 10 63 - (73) - -

Employee share scheme

expense - - - 89 - 89

Total transactions

with owners 10 63 - 16 (280) (191)

-------------------------- ----------- ----------- -------------- ---------------- ----------- ---------------

At 31 July 2023 6,823 18,905 (16,164) 421 25,242 35,227

-------------------------- ----------- ----------- -------------- ---------------- ----------- ---------------

Unaudited Consolidated Statements of Cash flows

For the six months ended 31 July 2023

Unaudited Unaudited Audited

6 months 6 months Year

ended Ended ended

31 July 31 July 31 January

2023 2022 2023

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

(Loss)/Profit for the period/year (56) 766 272

Adjustments for:

Depreciation and amortisation 1,115 1,067 2,285

Employee share scheme expense 89 87 132

Loss/(profit) on disposal of tangible

assets 125 3 (26)

Loss on disposal of intangible assets - - 6

Loss on disposal of right of use assets 4 - -

Remeasurement of leases 36 - (25)

Impairment of right of use assets - - 446

Finance income (30) (18) (40)

Finance expense 320 182 395

Income tax (credit)/expense (84) 119 (196)

---------------------------------------------- -------------------- ------------------- ---------------------

1,519 2,206 3,249

Increase in inventories (558) (2,290) (3,486)

Decrease/(increase) in trade and other

receivables 1,411 (1,125) (2,501)

Increase/(decrease) in trade and other

payables 1,037 908 (740)

(Decrease)/increase in contract liabilities (82) (206) 7

---------------------------------------------- -------------------- ------------------- ---------------------

Cash flows generated from/(used in)

operations 3,327 (507) (3,471)

Taxation received 189 - -

---------------------------------------------- -------------------- ------------------- ---------------------

Net cash generated from/(used in) operating

activities 3,516 (507) (3,471)

---------------------------------------------- -------------------- ------------------- ---------------------

Cash flows from investing activities

Bank interest received 9 2 5

Interest on lease receivables 21 16 35

Purchase of property, plant and equipment (206) (4,067) (6,226)

Purchase of intangible assets (63) (54) (140)

Capitalised development costs (646) (944) (1,976)

---------------------------------------------- -------------------- ------------------- ---------------------

Net cash used in investing activities (885) (5,047) (8,302)

---------------------------------------------- -------------------- ------------------- ---------------------

Cash flows from financing activities

Principal elements of lease payments (435) (315) (697)

Principal elements of lease receipts 150 105 217

Interest on lease liabilities (140) (152) (300)

Interest paid on loans and borrowings (88) (25) (84)

Bank interest paid (87) - -

Dividends paid to the holders of the

parent (280) (279) (419)

(Repayment of)/proceeds from loans and

borrowings (2,079) - 6,079

Net cash (used in)/generated from financing

activities (2,959) (666) 4,796

---------------------------------------------- -------------------- ------------------- ---------------------

Net decrease in cash and cash equivalents (328) (6,220) (6,977)

Cash and cash equivalents at the beginning

of the period/year 2,276 9,253 9,253

Cash and cash equivalents at the end

of the period/year 1,948 3,033 2,276

---------------------------------------------- -------------------- ------------------- ---------------------

Notes to the Unaudited Interim Financial Statements

For the six months ended 31 July 2023

1. Basis of Preparation

This condensed consolidated interim financial information for

the six months ended 31 July 2023 have been prepared in accordance

with AIM rule 18 in relation to half year reports. This information

should be read in conjunction with the annual financial statements

for the year ended 31 January 2023, which have been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union.

2. Going concern basis

The Group meets its day-to-day working capital requirements

through its cash resources and borrowing facilities. At 31 July

2023 net debt of the Group was GBP2.1 million and available

facilities of up to GBP10 million provided cash headroom of up to

GBP7.9 million. Consequently, the Directors believe that the Group

has sufficient liquidity to meet its obligations as they fall due

and consider it appropriate to continue to adopt the going concern

basis in preparing its consolidated interim financial

statements.

3. Interim financial information

The interim financial information for the period ended 31 July

2023 is unaudited and does not constitute statutory accounts within

the meaning of Section 434 of the Companies Act 2006. The interim

financial information for the period ended 31 July 2022 is also

unaudited. The audited accounts for the year ended 31 January 2023

for Inspiration Healthcare Group plc were approved by its Board of

Directors on 11 May 2023 and have been delivered to the Registrar

of Companies with an unqualified audit report.

The Company's annual report and financial statements for the

year ended 31 January 2023 were prepared under International

Financial Reporting Standards (IFRS) as adopted by the European

Union, International Financial Reporting Interpretations Committee

(IFRIC) interpretations and with those parts of the Companies Act

2006 applicable to companies reporting under IFRS. The standards

used are those published by the International Accounting Standards

Board (IASB) and endorsed by the EU at the time of preparing those

statements.

4. Non-recurring items

Non-recurring items are items which, given their nature,

management believes should be disclosed separately for the purposes

of presenting the results of the Group and the earnings per share

figures. During the six months ending 31 July 2023, the Group

recognised the following non-recurring items:

Unaudited Unaudited Audited

6 months 6 months Year

Ended Ended Ended

31 July 31 July 31 January

2023 2022 2023

GBP'000 GBP'000 GBP'000

----------------------------------- ----------- ----------- ------------

Impairments of leased properties - - 446

Restructuring costs 266 - -

Aborted acquisition costs - - 467

Other 140 - 245

Total 406 - 1,158

----------------------------------- ----------- ----------- ------------

Restructuring costs include asset impairments, severance and

related costs following the Group's decision to close the Earl

Shilton and Crawley offices to consolidate the property portfolio

and centralise the business in Croydon.

Other includes project consultancy costs and legal fees relating

to a contract dispute.

Notes to the Unaudited Interim Financial Statements

(continued)

For the six months ended 31 July 2023

5. Taxation

Unaudited Unaudited Audited

6 months 6 months Year

Ended Ended Ended

31 July 31 July 31 January

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------------------------------- ----------- ----------- ------------

UK corporation tax (credit)/charge

in the period (35) 168 42

Deferred tax credit in the period (49) (49) (238)

Tax on (loss)/profit on ordinary

activities (84) 119 (196)

------------------------------------- ----------- ----------- ------------

6. Dividends

The final dividend for the year ended 31 January 2023 of 0.41

per share (2022: 0.41p per share) was paid to shareholders on 28

July 2023.

The Board has declared an interim dividend of 0.205p per share

(H1 2023: 0.205p per share) to be paid on 22 December 2023.

7. Earnings per ordinary share

Basic earnings per share for the period is calculated by

dividing the profit attributable to ordinary shareholders for the

year after tax by the weighted average number of shares in

issue.

Basic diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares in issue to assume

conversion of all potential dilutive ordinary shares.

Unaudited Unaudited Audited

6 months 6 months Year

Ended Ended Ended

31 July 31 July 31 January

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------------------------------------------- ----------- ----------- ------------

(Loss)/Profit attributable to equity

holders of the Company (56) 766 272

Add back non-recurring items 406 - 1,158

Add back amortisation of intangible

assets acquired through business combinations 302 302 605

Numerator for underlying earnings

per share calculation 652 1,068 2,035

------------------------------------------------- ----------- ----------- ------------

Notes to the Unaudited Interim Financial Statements

(continued)

For the six months ended 31 July 2023

The weighted average number of shares in issue and the diluted

weighted average number of shares in issue were as follows:

Unaudited Unaudited Audited

6 months 6 months Year

Ended Ended Ended

31 July 31 July 31 January

2023 2022 2023

------------------------------------------ ------------ ------------ ------------

Number of Ordinary Shares in issue

at the beginning of the period/year 68,130,606 68,121,447 68,121,447

Weighted average number of shares

issued during the period/year 67,727 - 5,771

------------------------------------------ ------------ ------------ ------------

Weighted average number of ordinary

shares in issue during the period/year

for the purposes of basic earnings

per share 68,198,333 68,121,447 68,127,218

Dilutive effect of potential Ordinary

shares:

Share options 1,121,012 866,052 691,392

------------------------------------------ ------------ ------------ ------------

Diluted weighted number of shares

in issue for the purpose of diluted

earnings per share 69,319,345 68,987,499 68,818,610

------------------------------------------ ------------ ------------ ------------

The basic and diluted earnings per share are as follows:

Unaudited Unaudited Audited

6 months 6 months Year

Ended Ended Ended

31 July 31 July 31 January

2023 2022 2023

pence pence pence

--------------------------------------------- ----------- ----------- ------------

Basic earnings per share (0.08) 1.57 0.40

Adjust for:

Non-recurring items 0.60 - 1.70

Amortisation of intangible assets acquired

through business combinations 0.44 0.44 0.89

Adjusted basic earnings per share 0.96 2.01 2.99

--------------------------------------------- ----------- ----------- ------------

Diluted earnings per share (0.08) 1.55 0.39

--------------------------------------------- ----------- ----------- ------------

Adjusted for:

Non-recurring items 0.59 - 1.68

Amortisation of intangible assets acquired

through business combinations 0.44 0.44 0.88

Adjusted diluted earnings per share 0.95 1.99 2.95

--------------------------------------------- ----------- ----------- ------------

Notes to the Unaudited Interim Financial Statements

(continued)

For the six months ended 31 July 2023

8. Trade and Other Receivables

Audited

Unaudited Unaudited 31 January

31 July 31 July 2023

2023 2022 GBP'000

GBP'000 GBP'000

---------------------------------- ------------- ------------- -------------

Trade receivables 8,802 9,019 10,393

Loss allowance (321) (230) (266)

Net trade receivables 8,481 8,789 10,127

UK corporation tax receivable - - 143

Other taxes and social security - - 304

Net investment in leases 620 436 616

Other receivables 350 117 183

Prepayments and accrued income 716 805 515

Total 10,167 10,147 11,888

---------------------------------- ------------- ------------- -------------

9. Trade and Other Payables

Audited

Unaudited Unaudited 31 January

31 July 31 July 2023

2023 2022 GBP'000

GBP'000 GBP'000

---------------------------------- ------------- ------------- -------------

Trade payables 4,841 4,852 4,081

Other taxes and social security 686 212 257

Other payables 523 289 434

Accrued expenses 799 2,093 1,040

Total 6,849 7,446 5,812

---------------------------------- ------------- ------------- -------------

10. Prior year adjustment

A Prior period adjustment has been made in respect of the

Group's deferred tax. In FY2021, the Group recognised a deferred

tax liability relating to taxable temporary differences that arose

from the recognition of intangibles on the acquisition of SLE

Limited in July 2020. At the time of the acquisition, a deferred

tax asset was not recognised. However, accounting standards require

a deferred tax asset to be recognised to the extent of the existing

deferred tax liability and therefore a deferred tax asset should

have been recognised in FY2021.

This was corrected by restating each of the affected financial

statement line items for prior periods at the time of the audited

financial statements for the year ended 31 January 2023 and as a

result, the 31 July 2022 interim results presented herein have also

been restated accordingly.

Further information on the financial impact of the prior period

adjustment can be found in the Group's audited accounts for the

year ended 31 January 2023.

11. Related party transactions

Lease of Leicestershire facility

The Leicestershire facility at Earl Shilton is rented on an arms

length basis from a self-invested pension plan controlled by Neil

Campbell and others. In April 2023, the Directors made the decision

to close the Earl Shilton office, in order to further consolidate

the Group's properties, reduce overheads and bring teams together

at our new Manufacturing and Technology Centre in Croydon. All

affected employees have been notified of this decision and the

office closed at the end of September 2023.

Employment of related parties

Several close family members of the Directors are employed by

the Group, and they are remunerated at a fair market rate which is

commensurate with their roles.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFSAIRLFIIV

(END) Dow Jones Newswires

October 03, 2023 02:00 ET (06:00 GMT)

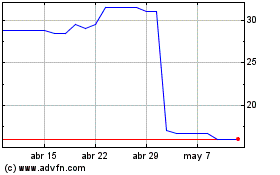

Inspiration Healthcare (LSE:IHC)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Inspiration Healthcare (LSE:IHC)

Gráfica de Acción Histórica

De May 2023 a May 2024