TIDMIWG TIDMTTM

RNS Number : 5449S

IWG PLC

07 November 2023

7th November 2023

THIRD QUARTER TRADING STATEMENT

IWG plc, the largest provider of hybrid workspace globally

including its Regus and Spaces brands with an unrivalled network of

3,455 locations across more than 120 countries, issues its third

quarter trading statement for the three months ended 30th September

2023.

CONTINUING TO DELIVER AS WORLD LEADER IN HYBRID WORKSPACE

-- Quarterly system revenue of GBP830m, representing constant

currency growth of 8% year-on-year

-- Acceleration of capital-light centre growth: 200

capital-light centre signings during Q3 taking the total to 582

year to date, almost 40% more than signed during all of 2022

-- Previous signings progressing through to openings (99 in Q3

2023 vs 32 in Q3 2022). This is expected to increase further,

driving higher fee income

-- Net financial debt reduced by GBP24m during Q3 2023 to

GBP634m with revenues and continued cost discipline driving cash

generation

-- No change in Group's financial outlook from the statement at H1 results on 8th August 2023

IWG will be hosting a Capital Markets Day in New York City on

5th December 2023.

Summary financials

Constant Actual Constant Actual

currency currency currency currency

Continuing operations Q3 Q3 9m 9m

(GBPm) Q3 2023 Q3 2022 YoY YoY 9m 2023 9m 2022 YoY YoY

----------------------- -------- -------- ---------- ---------- -------- -------- ---------- ----------

System revenue(1) 830 812 +8% +2% 2,491 2,259 +11% +10%

Group revenue 736 726 +7% +1% 2,219 2,013 +11% +10%

Net financial

debt(2) 634 723 634 723

----------------------- -------- -------- ---------- ---------- -------- -------- ---------- ----------

1. System-wide revenue represents the total of all revenue made

by both non-consolidated and consolidated locations globally

2. Before the application of IFRS 16 (primarily relating to

operating leases) as defined in the Alternative performance

measures section of the 2022 Annual Report and Accounts

Momentum in quarterly revenue

System-wide revenue increased by 8% year-on-year to GBP830m in

the quarter driven by continued global demand for hybrid working

solutions. Group revenue increased by 7% to GBP736m illustrating

the benefit of network growth, pricing strength, and ancillary

services. As anticipated, FX was a headwind for the Group during Q3

2023, which has adversely affected revenue numbers on an actual FX

basis.

Continued momentum in capital-light operating model

The business continues to sign new locations on a capital-light

basis, meaning the Group will have less capital-intensive exposure

and lower operational leverage. The momentum which was evident in

H1 has continued with 200 new capital-light centres signed in Q3

and 582 signed year-to-date. This adds to an already healthy

pipeline of centres signed but not yet opened. As previously

guided, capital-light centres take on average 10 months to open and

a further 18 months to reach revenue maturity. Additionally, 212

centres which were signed up under the capital-light model have

opened during 2023 (consisting of managed, franchised and variable

rent centres).

Worka

Worka continues to perform in line with management's

expectations. To ensure Worka fully captures the value chain from

the structural growth market of hybrid working. Worka continues to

invest and develop the platform adding new services and geographies

to its operations. The company continues to generate attractive

cash flows. Worka has excellent potential for the future.

Continuing the reduction of net financial debt

Revenue growth, coupled with ongoing cost discipline, has

resulted in net financial debt reduction of GBP24m in the quarter

to GBP634m.

YoY YoY

Q3 2023 Q3 2022 change 9m 2023 9m 2022 change

-------------------------- -------- -------- -------- -------- -------- --------

Number of centres 3,455 3,323 +132 3,455 3,323 +132

Centre openings 99 32 +67 232 102 +130

Centre rationalisations (42) (44) (2) (122) (93) +29

-------------------------- -------- -------- -------- -------- -------- --------

Total new centre deals

signed 204 160 +44 604 285 +319

Of which capital light 200 147 +53 582 252 +330

-------------------------- -------- -------- -------- -------- -------- --------

Average total occupancy +20

(3) 73.5% 73.4% +10 bps 73.6% 73.4% bps

-------------------------- -------- -------- -------- -------- -------- --------

Embedded price, indexed

(4) 103 97 +6% 103 95 +8%

-------------------------- -------- -------- -------- -------- -------- --------

3. Occupancy excluding managed and franchised centres.

4. Price per square foot, Q1 2020 = 100

Capital Markets Day

To help the market better understand our business model, IWG

will be hosting a Capital Markets Day on 5th December 2023 in New

York City. Details of the event can be found using this link .

Mark Dixon, Chief Executive of IWG plc, said:

"The structural growth in hybrid working, combined with our

market position, has resulted in continued revenue momentum in the

third quarter of 2023. Our capital-light growth strategy is

continuing to deliver with around 40% more locations already signed

in 2023 than in the whole of 2022. Our revenue growth and cost

control are driving cash flow enabling us to continue to pay down

debt."

Outlook and guidance

The increasing demand for hybrid and flexible working solutions

continues to provide growth opportunities for the Group. In

particular, the market has facilitated acceleration of the growth

plans for our capital-light segment. Our active management of

costs, including those associated with supporting this accelerated

growth, has enabled us to maintain our strong financial performance

this year.

We confirm our financial outlook for 2023 and remain confident

that both EBITDA(2) and year-end net financial debt(2) will remain

in-line with management's expectations.

Further to the announcement regarding functional currency and

accounting standards consideration, IWG will report full-year 2023

results in GBP with plans to convert to USD with effect from 1st

January 2024. Adopting US GAAP remains under evaluation, with a

decision to be taken during H1 2024.

Financial Calendar

5th December 2023 - Capital Markets Day (New York City, USA)

5th March 2024 - 2023 FY Results (London, UK)

7th May 2024 - Q1 2024 Trading Update (Remote)

Details of conference call

Mark Dixon, Chief Executive Officer, and Charlie Steel, Chief

Financial Officer, will host a conference call for analysts and

investors at 9:00am GMT. To attend the conference call, please

pre-register through PC, Mac, iOS or Android, using this link .

Further information

IWG plc Brunswick Tel: + 44 (0) 20 7404

Mark Dixon, Chief Executive Officer 5959

Charlie Steel, Chief Financial Nick Cosgrove

Officer Peter Hesse

Richard Manning, Head of Investor

Relations

This trading update contains certain forward-looking statements

with respect to the operations of IWG plc. These statements and

forecasts involve risk and uncertainty because they relate to

events and depend upon circumstances that may or may not occur in

the future. There are a number of factors that could cause actual

results or developments to differ materially from those expressed

or implied by these forward-looking statements and forecasts.

Nothing in this announcement should be construed as a profit

forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTEAXFKEEDDFFA

(END) Dow Jones Newswires

November 07, 2023 02:00 ET (07:00 GMT)

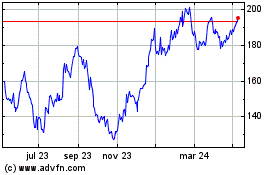

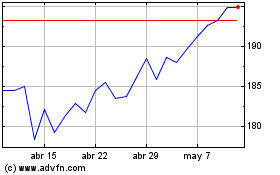

Iwg (LSE:IWG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Iwg (LSE:IWG)

Gráfica de Acción Histórica

De May 2023 a May 2024