TIDMJLP

RNS Number : 0767K

Jubilee Metals Group PLC

19 December 2022

Jubilee Metals Group PLC

Registration number (4459850)

Altx share code: JBL

AIM share code: JLP

ISIN: GB0031852162

("Jubilee" or "the Company" or "the Group")

Dissemination of a Regulatory Announcement that contains inside

information according to UK Market Abuse Regulations. Not for

release, publication or distribution in whole or in part in, into

or from any jurisdiction where to do so would constitute a

violation of the relevant laws or regulations of such

jurisdiction.

Zambia Copper and Cobalt Operations Update

Corporate Update

Exercise of Warrants

Jubilee, the AIM and Altx traded metals processing company, is

pleased to announce the successful completion of the water

infrastructure upgrade at its Roan Project and continued advances

in the production of cobalt and copper from waste at its Sable

Refinery in Zambia.

As announced on 22 November 2022, the Company's new Roan copper

concentrator faced continued water supply interruptions that

severely hampered its ability to operate at design throughput

levels. The installation of the new dedicated water infrastructure

and upgraded power and feed supply infrastructure have been

completed successfully with the restart of operations back to

nameplate capacity.

Significant progress continues to be made by Jubilee's technical

and operational teams, with the development and ramp-up to

commercial level, of new extractive methods for the recovery of

copper and cobalt from historical waste, at the Company's Sable

Refinery. These developments provide unique solutions to unlocking

the value from vast copper and cobalt containing wastes.

Sable Copper Production Trial

As previously announced, the Company has been focused on a

direct leaching approach which by-passes the need for traditional

power intensive smelting of copper sulphide concentrates.

These trials have been extremely effective and not only allow

for significantly lower operating costs, but also for Sable to

produce copper from mixed materials such as copper sulphide and

copper oxide ores. Jubilee believes that this new approach to

extraction offers significant growth opportunities in the country.

As a result, the Company is examining new Run-Of-Mine material

agreements with third party producers which offer the potential to

further enhance growth for its operations at the Sable

Refinery.

Sable Cobalt Production Update

As previously announced, Jubilee is targeting the initial

production of 50 tonnes of contained cobalt metal which is the

equivalent of approximately 220 tonnes of final product, before

ramping up to the 1 200 tonnes of contained cobalt metal annual

capacity, which equates to some 5 280 tonnes of final product.

Cobalt production from waste remains in-line with management's

expectations.

Solving the technical challenges places the Company in a unique

opportunity to pursue tremendous potential growth opportunities in

the efficient recovery of cobalt from historical wastes, including

also from mixed copper cobalt materials. The Company is currently

considering to upscale the production of cobalt through the

potential acquisition of refining infrastructures to expand its

cobalt footprint in Zambia.

The additional cobalt revenue offers the Company further

opportunities to secure metal backed funding in support of the

implementation of the Northern Refining Strategy.

Corporate Update

The Company further announces that it has undertaken a

restructuring of its Executive Team in-line with its expanding

production profile, and in particular ahead of its next phase of

growth in Zambia via its Northern Refining Strategy.

As Jubilee continues to rapidly evolve and expand its

operational footprint and project portfolio, it is also required to

continuously review and where necessary expand its leadership

within its Executive Team. This review will inevitably lead to

changes in certain leadership roles as the Company upskills to meet

the demands of a growing enterprise.

In this regard the Company has expanded its commercial and

financial management teams in South Africa and Zambia to both

further strengthen its corporate governance as well as dedicate

commercial teams to Zambia in support of its project execution

team. During this restructure Mr Pedja Kovacevic, currently, Chief

Strategy Officer ("CSO") will also be assuming the role of Group

Chief Financial Officer ("CFO") with immediate effect. Pedja is a

highly experienced CFO with vast experience in the corporate

funding and international debt markets. The Company thanks the

outgoing CFO, Peet van Coller, and wishes him well in his future

endeavours.

Leon Coetzer, CEO commented: "I am very pleased to provide an

update on our copper and cobalt operations in Zambia in what has

been a truly remarkable year for Jubilee.

"We have brought the entire Southern Copper Strategy into

nameplate production and next quarter will see a new source of

revenue for Jubilee in the form of first sales for our cobalt

production.

"In Sable, we have now successfully implemented a new way of

producing copper in Zambia, which bypasses the need to smelt the

material, which is expensive and energy intensive. This new

extraction approach allows for multiple ores to be produced at

once, similar to what we have achieved at our Inyoni PGM plant in

South Africa. This is a game changer for Jubilee and opens new

opportunities beyond our existing operations in Zambia.

"As we conclude 2022, we now focus our attention on unlocking

the potential of our Northern Refining Strategy in Zambia."

Exercise of Warrants

Jubilee also announces that it has received notification from a

warrant holder to exercise 5 000 000 existing warrants in the

issued share capital of Jubilee ("the Warrant Shares") at a price

of 3.375p (ZAR71.86c) per Warrant Share. The exercise of Warrant

Shares amounts, in aggregate, to a cash value of GBP0.17 million

(ZAR3.59 million). This warrant exercise concludes all the warrants

held by the warrant holder at 3.375p.

The Warrant Shares are expected to be admitted to trading on AIM

and listed on the Altx of the JSE Limited on or about 23 December

2022 and will rank pari passu with the ordinary shares of the

Company in issue.

Total voting rights

The Company's total issued capital, after the issue of the

Warrant Shares, will be 2 694 854 150 ordinary shares. As the

Company does not hold any shares in Treasury, this figure may be

used by shareholders in the Company as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, the

share capital of the Company following Admission.

United Kingdom

19 December 2022

For further information visit www.jubileemetalsgroup.com or contact:

Jubilee Metals Group PLC

Leon Coetzer

Tel: +27 (0) 11 465 1913

Nominated Adviser - SPARK Advisory Partners Limited

Andrew Emmott/James Keeshan

Tel: +44 (0) 20 3368 3555

Joint Broker - Berenberg

Matthew Armitt/Jennifer Lee/Detlir Elezi

Tel +44 (0) 20 3207 7800

Joint Broker - WHIreland

Harry Ansell/Katy Mitchell

Tel: +44 (0) 20 7220 1670/+44 (0) 113 394 6618

JSE Sponsor - Questco Corporate Advisory Proprietary Limited

Sharon Owens

Tel: +27 (11) 011 9212

PR & IR Adviser - Tavistock

Jos Simson/ Gareth Tredway/Charles Vivian

Tel: +44 (0) 207 920 3150

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCTPBPTMTABBIT

(END) Dow Jones Newswires

December 19, 2022 02:00 ET (07:00 GMT)

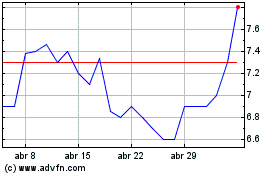

Jubilee Metals (LSE:JLP)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Jubilee Metals (LSE:JLP)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024