TIDMJMI

RNS Number : 6506A

JPMorgan UK Smaller Cos IT PLC

23 January 2024

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT ARE NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO, THE UNITED STATES OF AMERICA

(INCLUDING ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED

STATES AND THE DISTRICT OF COLUMBIA), AUSTRALIA, CANADA, JAPAN, NEW

ZEALAND, THE REPUBLIC OF SOUTH AFRICA, IN ANY MEMBER STATE OF THE

EEA OR IN ANY OTHER JURISDICTION IN WHICH THE SAME WOULD BE

UNLAWFUL.

This announcement is not an offer to sell, or a solicitation of

an offer to acquire, securities in the United States or in any

other jurisdiction in which the same would be unlawful. Neither

this announcement nor any part of it shall form the basis of or be

relied on in connection with or act as an inducement to enter into

any contract or commitment whatsoever.

23 January 2024

JPMorgan UK Smaller Companies Investment Trust plc

Legal Entity Identifier: 549300PXALXKUMU9JM18

Proposed combination with JPMorgan Mid Cap Investment Trust

plc

Publication of Prospectus and Circular

The Board announced on 14 November 2023 that it had agreed heads

of terms for a combination of the Company with JPMorgan Mid Cap

Investment Trust plc ("JMF") (the "Transaction"), to be implemented

through a scheme of reconstruction of JMF pursuant to section 110

of the Insolvency Act 1986 (the "Scheme"). This will see the

enlarged Company continue to be managed by JPMorgan Funds Limited

(the "Manager") (which delegates the management of the Company's

Portfolio to JPMorgan Asset Management (UK) Limited (the

"Investment Manager")) and continue to operate under its existing

Investment Objective and Policy.

Subject to the successful completion of the Transaction, the

Board intends to change the name of the Company from JPMorgan UK

Smaller Companies Investment Trust plc to JPMorgan UK Small Cap

Growth & Income plc and adopt an enhanced dividend policy. The

proposals set out in this paragraph and above are collectively

referred to as the "Proposals".

As a result of the Proposals and the expected implementation of

the enhanced dividend policy following the successful completion of

the Transaction (as described further below), the Board will

announce a pre-completion interim dividend of 3.60 pence per Share

on or around 23 January 2024 (the "Pre-Completion Dividend"). The

Pre-Completion Dividend will be paid in cash only and is expected

to be paid on 27 February 2024 to Shareholders on the Register on 2

February 2024 (the "Pre-Completion Dividend Record Date"),

conditional on the passing of the JMF Resolution at the First JMF

General Meeting and the passing of the Allotment Resolution at the

General Meeting.

The Board announces that the Company has today published a

prospectus (the "Prospectus") in relation to the issue of new

ordinary shares in the capital of the Company (the "Issue")

pursuant to the Scheme together with a circular to provide the

Company's shareholders (the "JMI Shareholders") with further

details of the Transaction and to convene a general meeting of the

Company (the "General Meeting") to seek approval from JMI

Shareholders for the implementation of the Transaction (the

"Circular").

The Prospectus has been approved by the Financial Conduct

Authority and the Prospectus and Circular will shortly be available

for inspection at the National Storage Mechanism which is located

at https://data.fca.org.uk/#/nsm/nationalstoragemechanism and on

the Company's website at www.jpmsmallercompanies.co.uk .

Benefits of the Transaction

The Board believes that the Transaction has the following

benefits for Shareholders of the enlarged Company (the

"Shareholders"):

-- the enlarged Company is expected to have an unaudited Net

Asset Value of approximately GBP430 million (based on valuations as

at 18 January 2024 (the "Latest Practicable Date") ([1]) , creating

a leading investment vehicle for UK-listed or quoted smaller

companies while also improving secondary market liquidity for the

Shareholders;

-- Shareholders will benefit from the introduction of an

enhanced dividend policy, targeting a 4 per cent. yield on the NAV

per annum, calculated on the basis of 4 per cent. of audited NAV as

at the end of the preceding financial year of the Company;

-- the Company will benefit from the New Management Fee and an

enlarged asset base, reducing the blended fee rate for Shareholders

of 2 basis points, assuming that 85 per cent. of the Company's net

assets are rolled over into the Company (on the assumption that

there is full participation under the Cash Option and no Dissenting

JMF Shareholders) ;

-- Shareholders will benefit from an ongoing expense ratio

reduction of approximately 20 basis points compared to the

Company's previous accounting period ended on 31 July 2023, as a

result of the Company's fixed costs being spread over a larger

asset base and the cumulative changes to the management fee,

including the New Management Fee;

-- the Manager has agreed to make the Manager's Contribution in

respect of the Scheme, reducing the effective implementation costs

for the Company;

-- the Board believes that Eligible JMF Shareholders who elect

for the Rollover Option will benefit from the Company's broader

Investment Objective and Policy which, as at 31 December 2023, has

enabled the Company to have over 40 per cent. of its Portfolio

invested in UK-listed and quoted companies with market

capitalisations ranging from GBP1 billion to GBP3 billion; and

-- the Company's Shareholder register will become further

diversified, having introduced a number of new long-term JMF

investors to the register while also allowing a number of JMF

Shareholders and Existing Shareholders to consolidate their

holdings across the two companies.

Combination with JMF

The combination, if approved by the shareholders of each of the

Company and JMF, will be implemented through a scheme of

reconstruction under section 110 of the Insolvency Act, resulting

in the voluntary liquidation of JMF and the transfer of its assets

to the Company in exchange for the issue of new Shares ("Scheme

Shares") to Eligible JMF Shareholders and to the Liquidators of JMF

for sale in the market for the benefit of Excluded JMF Shareholders

(being Sanctions Restriction JMF Shareholders and Overseas Excluded

JMF Shareholders).

Subject to the passing of the JMF Resolutions, and the

satisfaction of the other conditions of the Issue (which are

outlined below), the Scheme will take effect on the Effective

Date.

Under the Scheme, JMF will be put into member's voluntary

liquidation and its assets split into the following three

pools:

(i) the pool of cash, undertaking and other assets to be

retained by the Liquidators to meet all known and unknown

liabilities of JMF and other contingencies (the "Liquidation

Pool");

(ii) the pool of cash, undertaking and other assets established

for distribution to participating JMF Shareholders and attributable

to JMF Reclassified B Shares (excluding any JMF Shares held by

Dissenting JMF Shareholders) (the "Cash Pool"); and

(iii) the pool of cash, undertaking and other assets

attributable to the JMF Reclassified A Shares to be established

under the Scheme and to be transferred to the Company pursuant to

the Transfer Agreement in consideration for the issuance of the

Scheme Shares to Eligible JMF Shareholders and to the Liquidators

for sale in the market for the benefit of Excluded JMF Shareholders

(the "Rollover Pool").

Details of the Issue

The number of Scheme Shares to be issued to Eligible JMF

Shareholders, and to the Liquidators appointed in respect of

Excluded JMF Shareholders, will be based on the FAV of each of the

Company and JMF and will be reviewed by an independent accountant.

The FAV per JMI Share and the FAV per JMF Share will be calculated

to six decimal places (with 0.0000005 rounded down) as at the

Calculation Date in accordance with each company's respective

normal accounting policies.

Eligible JMF Shareholders will be issued Scheme Shares

calculated by dividing the FAV per JMF Share by the FAV per JMI

Share and multiplying this ratio (which will be calculated to six

decimal places, with 0.0000005 rounded down) by the number of JMF

Shares owned as at the Record Date that will be reclassified as JMF

Reclassified A Shares.

The number of Scheme Shares which will be issued to Eligible JMF

Shareholders and the Liquidators appointed in respect of Excluded

JMF Shareholders is not known at the date of this Circular as it

will be calculated in accordance with the formula stated above at

the Calculation Date. The number of Scheme Shares to be issued will

be announced through an RIS announcement as soon as practicable

following the Calculation Date. The Issue is not being

underwritten.

JMF Revolving Credit Facilities

JMF currently has in place a revolving credit facility with

Scotiabank Europe plc ("Scotia Revolving Credit Facility") and a

second revolving credit facility with ING Bank N.V. ("ING Revolving

Credit Facility"), together the "JMF Revolving Credit Facilities").

As at the Latest Practicable Date, JMF has drawn debt amounting to

GBP23 million in aggregate under the JMF Revolving Credit

Facilities (the "JMF Outstanding Debt Amount"). As a condition to

the implementation of the Scheme, the JMF Board will arrange for

the JMF Outstanding Debt Amount to be repaid in full prior to the

Calculation Date, such repayments to be made out of available cash

and by realising assets in the JMF Portfolio.

Amendment of the Investment Management Agreement

The existing annual management fee payable by the Company to the

Manager (the "Existing Management Fee") is calculated on a tiered

basis by reference to the Net Asset Value of the Company, on the

following basis:

0.65 per cent. on the first GBP300 million of the Company's Net

Asset Value; and

0.55 per cent. on the Company's Net Asset Value in excess of

GBP300 million.

Subject to the successful completion of the Transaction and with

effect from Admission, the Investment Management Agreement shall be

amended such that the Existing Management Fee shall be revised to a

tiered fee structure by reference to the Net Asset Value of the

Company on the following basis (the "New Management Fee"):

0.65 per cent. on the first GBP200 million of the Company's Net

Asset Value; and

0.55 per cent. on the Company's Net Asset Value in excess of

GBP200 million.

Costs and Expenses of the Transaction

Costs of the Company

The costs incurred by the Company prior to the Effective Date in

connection with the implementation of the Transaction (which

include legal fees, financial advisory fees, other professional

advisory fees, printing costs and other applicable expenses but

exclude, for the avoidance of doubt, any JMI Acquisition Costs (as

defined below)) will be borne by JMI Shareholders (the "JMI

Implementation Costs"). The JMI Implementation Costs are estimated

to be approximately GBP1.1 million (including irrecoverable

VAT).

In addition, the enlarged Company, and therefore all

Shareholders following implementation of the Scheme, will bear the

JMF Portfolio Realignment Costs and any stamp duty, SDRT or other

transaction tax, or investment costs it incurs in connection with

the acquisition of the assets comprised in the Rollover Pool or the

deployment of the cash therein upon receipt (the "JMI Acquisition

Costs").

The enlarged Company will also bear the London Stock Exchange

admission fees in respect of the admission of Scheme Shares.

Costs of JMF

The costs to be borne by JMF Shareholders, excluding the JMF

Portfolio Realignment Costs, are estimated to be approximately

GBP1.1 million (including irrecoverable VAT).

The costs of acquiring and disposing of investments in the

Rollover Pool transferred to the Company pursuant to the Transfer

Agreement in order to realign the Rollover Pool so that it is

consistent with the Company's Portfolio will be borne by the

enlarged Company following the implementation of the Scheme (the

"JMF Portfolio Realignment Costs"). Accordingly, the JMF Portfolio

Realignment Costs will be excluded from the costs borne by JMF for

the purposes of the FAV calculation.

Manager's Contribution

The Manager has agreed to make a contribution (the "Manager's

Contribution") to the costs of the Transaction by way of a waiver

of part of the New Management Fee payable by the Company. The

Manager's Contribution will be an amount equal to six months of the

Company's New Management Fee calculated on the value of the net

assets transferred to the Company by JMF pursuant to the Scheme

(the "Contribution Amount"). The financial value of the

Contribution Amount is estimated at approximately GBP514,554

million based on the estimated unaudited Net Asset Value of the

assets to be transferred to the Company as at the Latest

Practicable Date (assuming full participation by JMF Shareholders

under the Cash Option and no Dissenting JMF Shareholders).

Board structure

It is intended that, following the successful completion of the

Transaction, three current directors of JMF, being Richard Gubbins,

Lisa Gordon and Hannah Philp, will be appointed as non-executive

Directors of the Company (the "Prospective Directors") , such that

the Board will initially consist of seven directors, comprising

four directors from the current Board and three directors from the

board of JMF (reducing to a maximum of six directors at, or shortly

prior to, the next AGM of the Company expected to be held in

November 2024 with Andrew Impey and Richard Gubbins retiring from

the Board at, or shortly prior to, the next AGM and not standing

for re-election).

Each of the Prospective Directors is independent of the Manager

and the Investment Manager.

Change of Company Name

The Directors have resolved to change the name of the Company to

JPMorgan UK Small Cap Growth & Income plc and change the ticker

symbol of the Shares to JUGI, subject to the successful completion

of the Transaction.

The change of the name of the Company and ticker symbol will be

announced to the market by way of RIS announcement on or shortly

after the Effective Date.

New enhanced dividend policy

Subject to the successful completion of the Transaction, the

Company intends to introduce an enhanced dividend policy, targeting

a 4 per cent. yield on the NAV per annum, calculated on the basis

of 4 per cent. of audited NAV as at 31 July each year, being the

end of the preceding financial year of the Company.

Under the enhanced dividend policy, the Company will move from a

final annual dividend to equal quarterly interim dividends, to be

announced in August, November, February and May and expected to be

paid in October, January, April and July each year.

Following the successful completion of the Transaction and in

lieu of any other interim dividend for the financial year of the

Company ended 31 July 2024, the Company will announce in May 2024

an interim dividend of 2 per cent. of the unaudited NAV of the

enlarged Company as at the date of Admission which is expected to

be paid to Shareholders in July 2024.

Conditions of the Issue

The Scheme is conditional upon:

-- the passing of the JMF Resolution to be proposed at the First

JMF General Meeting and the JMF Resolution to be proposed at the

Second JMF General Meeting or any adjournment of those meetings and

such JMF Resolutions becoming unconditional in all respects;

-- approval of the Allotment Resolution by JMI Shareholders at

the General Meeting of the Company and such Resolution becoming

unconditional in all respects;

-- the approval of the FCA and the London Stock Exchange to the

Admission of the Scheme Shares to listing on the premium listing

category of the Official List and to trading on the Main Market of

the London Stock Exchange, respectively occurring before 31 March

2024, or such other date as may be mutually agreed between the

Company, JMF and the Sponsor;

-- the Sponsor Agreement not having been terminated in

accordance with its terms prior to Admission;

-- confirmation of the JMF Board that the drawn debt under the

JMF Revolving Credit Facilities has been repaid in full; and

-- the JMF Board resolving to proceed with the Scheme.

Admission and dealings

Applications will be made by the Company to the FCA for the

Scheme Shares to be admitted to the premium listing category of the

Official List and to the London Stock Exchange for the Scheme

Shares to be admitted to trading on the premium segment of the Main

Market. If the Scheme becomes effective, it is expected that the

Scheme Shares will be admitted to the Official List and the first

day of dealings in such shares on the Main Market will be 28

February 2024.

Expected Timetable

GENERAL MEETING

Posting of Circular and Forms of 23 January 2024

Proxy for the General Meeting

Latest time and date for receipt 12.00 p.m. on 8 February

of Forms of Proxy for the General 2024

Meeting

General Meeting 12.00 p.m. on 12 February

2024

Announcement of results of the General 12 February 2024

Meeting

SCHEME

Publication of Prospectus 23 January 2024

Ex-dividend date for the Pre-Completion 1 February 2024

Dividend*

Pre-Completion Dividend Record Date 2 February 2024

First JMF General Meeting 11.00 a.m. on 12 February

2024

Record Date for entitlements under 6.00 p.m. on 20 February

the Scheme 2024

JMF Shares disabled in CREST 6.00 p.m. on 20 February

2024

Calculation Date for the Scheme 5.00 p.m. on 21 February

2024

Suspension of listing of JMF Shares 7.30 a.m. on 27 February

and JMF's register closes 2024

Second JMF General Meeting 12.00 p.m. on 27 February

2024

Effective Date for implementation 27 February 2024

of the Scheme

Announcement of results of the Scheme 27 February 2024

and respective FAVs per share

Payment date for the Pre-Completion 27 February 2024

Dividend

Admission and dealings in Scheme 8.00 a.m. on 28 February

Shares commence 2024

CREST accounts credited to JMF Shareholders 8.00 a.m. on 28 February

in respect of Scheme Shares in uncertificated 2024

form

Certificates despatched by post 12 March 2024 (or as soon

in respect of Scheme Shares as practicable thereafter)

Cancellation of listing of JMF Shares as soon as practicable

after the Effective Date

References to times are to London times unless otherwise

stated. Any changes to the expected timetable set out above

will be notified to the market by the Company via an RIS

announcement.

*The Pre-Completion Dividend being the interim dividend

of 3.60 pence per Share to be announced on or around 23 January

2024 and is expected to be paid on 27 February 2024, subject

to the passing of the JMF Resolution at the First JMF General

Meeting and the passing of the Allotment Resolution at the

General Meeting.

Capitalised terms used but not defined in this announcement will

have the same meaning as set out in the Circular.

For further information please contact:

JPMorgan UK Smaller Companies Investment Contact via Company Secretary

Trust plc

Andrew Impey

JPMorgan Funds Limited

Simon Crinage

Fin Bodman +44 (0) 20 7742 4000

JPMorgan Funds Limited (Company Secretary) +44 (0) 20 7742 4000

Panmure Gordon (UK) Limited

Alex Collins +44 (0) 20 7886 2767

Ailsa Macmaster +44 (0) 20 7886 2979

Ashwin Kohli +44 (0) 20 7886 2786

[1] Based on the estimated unaudited Net Asset Value of the

Company and JMF as at the Latest Practicable Date, assuming: (i)

that there are no Dissenting JMF Shareholders; and (ii) full

participation by JMF Shareholders under the Cash Option.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFZGZMZFMGDZM

(END) Dow Jones Newswires

January 23, 2024 07:33 ET (12:33 GMT)

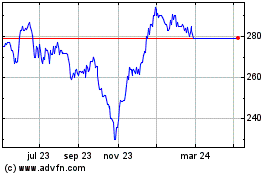

Jpmorgan Uk Smaller Comp... (LSE:JMI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Jpmorgan Uk Smaller Comp... (LSE:JMI)

Gráfica de Acción Histórica

De May 2023 a May 2024