Jadestone Energy PLC Montara Restart Plan and Operations Update (9527K)

31 Agosto 2023 - 3:27AM

UK Regulatory

TIDMJSE

RNS Number : 9527K

Jadestone Energy PLC

31 August 2023

Montara Restart Plan and Operations Update

31 August 2023 - Singapore: Jadestone Energy plc ("Jadestone",

or the "Company") an independent oil and gas production company

focused on the Asia-Pacific region, provides the following

operational update.

Montara

The Company is pleased to announce that, following an

investigation and assurance review into the 4S/5C tank defect, it

intends to restart production at Montara on 1 September 2023.

Production will be restarted from one well at an expected rate

of c.1,000 bbls/d to recommission the FPSO's oil production system,

followed by gas compression, allowing further wells to be brought

back online within several days. At this point, production is

expected to increase to c.6,000 bbls/d, the rate prior to the

shutdown at the end of July 2023.

The Company will continue to utilise a shuttle tanker to provide

additional storage during this period of constrained FPSO storage

capacity.

Further to the announcement on 23 August 2023, FPSO tank

inspection and repair work has continued to make progress, with the

following activities taking place:

-- Repairs in ballast water tank 4P are almost complete, after

which it will be returned to service.

-- Inspections and preparations for repair work are now underway

in tank 5C and ballast water tank 4S.

The defects encountered pose no safety or structural risk, nor

any risk of a hydrocarbon leak to sea.

The National Offshore Petroleum Safety and Environmental

Management Authority has been kept regularly updated on progress at

Montara.

Further updates on Montara will be provided as activity

progresses.

Akatara

The Akatara development continues to make good progress, and

remains on budget and schedule for first gas in H1 2024. The

project is currently c.55% complete (from c.42% in mid-July 2023)

with c.2.5 million man hours worked without a lost-time

incident.

Malaysia

On 15 August 2023, the Naga-2 rig was taken on contract for the

East Belumut field drilling campaign on the PM329 PSC. Drilling

operations on the first of the four wells has commenced. The four

wells are expected to deliver incremental gross peak oil production

of 2-2,500 bbls/d with a projected IRR of c.90%.

-ends-

For further information, please contact:

Jadestone Energy plc

Paul Blakeley, President and CEO +65 6324 0359 (Singapore)

Bert-Jaap Dijkstra, CFO

Phil Corbett, Investor Relations Manager +44 (0) 7713 687467 (UK)

ir@jadestone-energy.com

Stifel Nicolaus Europe Limited (Nomad, +44 (0) 20 7710 7600 (UK)

Joint Broker)

Callum Stewart

Jason Grossman

Ashton Clanfield

Jefferies International Limited (Joint +44 (0) 20 7029 8000 (UK)

Broker)

Tony White

Will Soutar

Camarco (Public Relations Advisor) +44 (0) 203 757 4980 (UK)

Billy Clegg jse@camarco.co.uk

Georgia Edmonds

Elfie Kent

About Jadestone Energy

Jadestone Energy plc is an independent oil and gas company

focused on the Asia-Pacific region. It has a balanced and

increasingly diversified portfolio of production and development

assets in Australia, Malaysia, Indonesia, Thailand and Vietnam, all

stable jurisdictions with a positive upstream investment

climate.

Led by an experienced management team with a track record of

delivery, who were core to the successful growth of Talisman

Energy's business in Asia-Pacific, the Company is pursuing a

strategy to grow and diversify the Company's production base both

organically, through developments such at Akatara in Indonesia and

Nam Du/U Minh in Vietnam, as well as through acquisitions that fit

within Jadestone's financial framework and play to the Company's

strengths in managing maturing oil assets. Jadestone delivers value

in its acquisition strategy by enhancing returns through operating

efficiencies, cost reductions and increased production through

further investment.

Jadestone is a responsible operator and well positioned for the

energy transition through its increasing gas production, by

maximising recovery from existing brownfield developments and

through its Net Zero pledge on Scope 1 & 2 GHG emissions from

operated assets by 2040. This strategy is aligned with the IEA Net

Zero by 2050 scenario, which stresses the necessity of continued

investment in existing upstream assets to avoid an energy crisis

and meet demand for oil and gas through the energy transition.

Jadestone Energy plc (LEI: 21380076GWJ8XDYKVQ37) is listed on

the AIM market of the London Stock Exchange (AIM: JSE). The Company

is headquartered in Singapore. For further information on the

Company please visit www.jadestone-energy.com .

The information contained within this announcement is considered

to be inside information prior to its release, as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 which is part

of UK law by virtue of the European Union (Withdrawal) Act

2018.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSDISAFEDSEEA

(END) Dow Jones Newswires

August 31, 2023 04:27 ET (08:27 GMT)

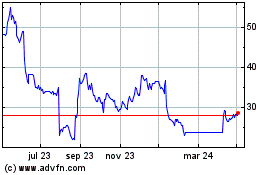

Jadestone Energy (LSE:JSE)

Gráfica de Acción Histórica

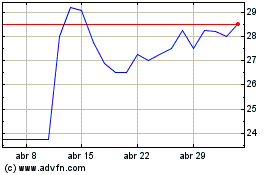

De Mar 2024 a Abr 2024

Jadestone Energy (LSE:JSE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024