Just Group PLC Business update for the six months to 30 June 2023 (2926G)

18 Julio 2023 - 1:00AM

UK Regulatory

TIDMJUST

RNS Number : 2926G

Just Group PLC

18 July 2023

NEWS RELEASE www.justgroupplc.co.uk

18 July 2023

JUST GROUP plc

STRONG MOMENTUM CONTINUES

Just Group plc ("Just", the "Group") announces a business update

for the six months ended 30 June 2023.

Highlights

* Retirement Income sales have more than doubled to

GBP1.9bn .

* DB sales are up 149% to GBP1.4bn . We completed 35

transactions during the period (H1 22: 14

transactions). The DB market has been consistently

busy this year, and w e expect this momentum to

continue.

* Retail sales are up 54% to GBP0.5bn. The retail

annuity market is buoyant, as higher interest rates

have increased the guaranteed returns from annuities,

and made them significantly more attractive to

financial advisers and customers .

* Given the strong new business growth in the first

half of 2023, we are highly confident of achieving

our financial ambitions for the full year. O ur

delivery so far in 2023 and positive ongoing momentum

further supports our confidence in Just's ability to

deliver 15% growth in underlying operating profit per

annum, on average over the medium term.

Retirement Income sales for H1 23 up 116% to GBP1.9bn

6 months to 6 months to

Just Group new business(1) 30/06/23 30/06/22 Change

GBPm GBPm %

Defined Benefit De-risking

("DB") 1,429 574 149

Guaranteed Income for Life

("GIfL)(2) 470 305 54

------------ ------------ -------

Retirement Income sales 1,899 879 116

------------ ------------ -------

The rise in interest rates during 2022 and 2023 has a positive

effect on both the DB and GIfL markets.

In DB, LCP(3) estimate that c.1,000 DB pension schemes (or

one-in-five of the total) are already fully funded on an insurer

buyout basis. In 2022, there were 201 DB transactions, of which

Just completed 56. 2023 industry volumes are expected to

significantly exceed the record GBP44bn written in 2019.

DB business highlights during the first six months of the year

include:

* Writing our largest (GBP513m) and smallest (GBP0.6m)

deals to date.

* Completed 35 transactions of which 22 were less than

GBP10m.

* The bulk quotation service now has over 200 schemes

from 19 EBCs.

The GIfL market has had its busiest six month period since

Pensions Freedoms in 2014. The open market, where Just competes,

has achieved particularly strong growth. Higher interest rates have

stimulated both customer and adviser demand. The introduction of

the FCA's Consumer Duty, and the findings from the FCA's thematic

review into retirement income advice, are likely to increase the

use of guaranteed solutions to help customers achieve their

objectives.

David Richardson, Group Chief Executive, said:

"Following three years of delivering 18% average sales growth

per annum, we have further demonstrated the strength of our new

business model with sales in the first six months more than

doubling year on year.

Our DB business is going from strength to strength. During the

last six months, we have announced our largest transaction to date

at over GBP500m, and have a record pipeline of new business

opportunities for the second half. Our bulk quotation service is

growing in popularity and providing a steady source of completions

as EBCs and trustees are increasingly seeing the benefits of price

monitoring. We welcome the Chancellor's confirmation, in his recent

speech, of the important role played by insurers offering

buyouts.

I am delighted that the GIfL market has returned to strong

growth, and providing increased opportunity to utilise our medical

underwriting expertise to risk select. The combination of higher

interest rates and new FCA rules should further encourage advisers

to re-examine the attractiveness of guaranteed solutions,

especially for older clients.

I am once again very grateful for the achievements of our

colleagues, which enables us to help more people achieve a better

later life. We are exceptionally well positioned to continue

benefiting from the unstoppable trends and positive developments in

both our markets. Our ability to take advantage of these trends and

execute have further increased our confidence in Just's ability to

deliver 15% growth in underlying operating profit per annum, on

average over the medium term. "

FINANCIAL CALENDAR DATE

Interim results for the six months 15 August 2023

ended 30 June 2023

===============

Note 1: Numbers in table subject to rounding

Note 2: Care Plan sales are now reported within the GIfL figure.

This figure now includes UK GIfL, South Africa GIfL and Care

Note 3: LCP, an employee benefit consultant

Note 4: All the figures are unaudited

Enquiries

Investors / Analysts Media

Alistair Smith, Investor Relations Stephen Lowe, Group Communications

Telephone: +44 (0) 1737 232 792 Director

alistair.smith@wearejust.co.uk Telephone: +44 (0) 1737 827 301

press.office@wearejust.co.uk

Paul Kelly, Investor Relations

Telephone: +44 (0) 20 7444 8127 Temple Bar Advisory

paul.kelly@wearejust.co.uk Alex Child-Villiers

William Barker

Telephone: +44 (0) 20 7183 1190

A copy of this announcement will be available on the Group's

website www.justgroupplc.co.uk

JUST GROUP PLC

GROUP COMMUNICATIONS

Enterprise House

Bancroft Road

Reigate

Surrey RH2 7RP

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFFADFIDLIV

(END) Dow Jones Newswires

July 18, 2023 02:00 ET (06:00 GMT)

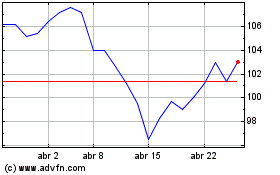

Just (LSE:JUST)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

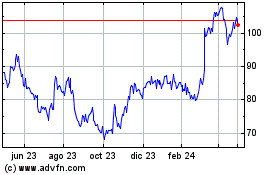

Just (LSE:JUST)

Gráfica de Acción Histórica

De May 2023 a May 2024