TIDMKNB

RNS Number : 0720O

Kanabo Group PLC

29 September 2023

29 September 2023

Kanabo Group Plc

("Kanabo", the "Group" or the "Company")

UNAUDITED HALF-YEAR RESULTS FOR THE SIX MONTHSED 30 JUNE

2023

Kanabo Group plc (LSE: KNB), the patient-focused provider of

digital health services and specialist medicines, including

medicinal cannabis, announces results for the six months ended 30

June 2023 ("H1 2023").

Kanabo has evolved to be a digital health platform and is

seeking to be a key player in advancing innovative and accessible

healthcare solutions and treatments. Headquartered in the UK,

Kanabo provides patients with accessible, personalised care through

its innovative end-to-end platform across both digital primary and

secondary care clinics. Primary care services provide the first

point of contact in the healthcare system and secondary care

services is the provision of more specialist expertise and care in

respect of a particular medical problem. The Group delivers digital

primary care via The GP Service telehealth platform and the

recently launched Treat It online pain clinic provides personalised

secondary care services. Both are integrated with a supply chain

that delivers medications directly to patients and includes

Kanabo's unique metered dose inhaler products.

Through its end-to-end solution, Kanabo enables patients to

seamlessly access consultations, prescriptions, and treatments

tailored to their needs. The Company is continually identifying

additional treatments not readily available through traditional NHS

channels to add to its portfolio, responding to growing patient

demand for personalised care and medicine.

As a patient-first business, Kanabo aims to empower people with

their own healthcare choices and make the process efficient,

educational and accessible for all.

H1 2023 Key Highlights:

-- Revenue increased 88% to GBP0.45m (H1 2022: GBP0.24m),

demonstrating ongoing commercial progress.

-- Operating loss reduced 63 % to GBP 1.4 m (H1 2022: GBP3.72m),

with strategic initiatives driving improved financial

performance.

-- Cash at 30 June 2023 of GBP4.4m (31 Dec 2022: GBP3.2m) , to

support the Group's growth plans.

-- Completed a GBP2.74m fundraising by way of an oversubscribed

Placing in April 2023, reflecting investor confidence.

-- Strengthened the Board with the Appointment of Ian Mattioli

as Chair and Sharon Malka as Non-Executive Director

Post Period End and Outlook:

-- Medical inhaler completes all necessary stages for CE Mark,

certification pending - Our distinctive medical device inhaler has

successfully completed all necessary stages to become the first of

its kind to achieve CE mark certification. We anticipate formal

certification to be awarded in the coming months.

-- Major contract for Kanabo Agritec ("Agritec") - In July,

Agritec secured a landmark deal to provide consultancy services for

a cultivation and production facility in Madrid.

-- Kanabo now focused on growing two distinct but highly

complementary divisions which are founded on the team's combined

knowledge of the medicinal cannabis industry and digital health

services.

-- Positive outlook for growth - The Board remains confident in

both the short and medium-term prospects for the Company. We remain

steadfast in our commitment to increasing sales in existing markets

while exploring opportunities to expand into new geographies,

whilst simultaneously further developing our product and service

offering.

Future milestones:

Over the next six months, our key priorities include:

-- Expansion of primary care platform - launching a significant

expansion of our primary care platform, enhancing the patient

experience by facilitating direct access to treatments and

medications without a preliminary consultation. The initiative

implements cutting edge technology to streamline the process, which

in turn will expand patient capacity in our clinics.

-- Expansion of secondary care platform - leveraging our

technology and experience with launching Treat It to launch a

similar service to tackle additional areas where there is a

significant unmet medical need. We have identified the UK's mental

health sector as the first additional sector into which we will

roll out our services. The UK mental health sector is under

well-documented pressure, and our intention is to expand our

services in the coming months to that area, addressing patient

demand.

-- Partnership with UK high street pharmacies - undertake a

pilot programme that will see Kanabo collaborate with physical high

street pharmacies to trial in-pharmacy consultations via our Treat

It clinic, tapping into the pharmacies' existing patient networks

to broaden Kanabo's outreach and addressable market.

-- EU product expansion - pending receipt of CE mark for our

VapePod MD medical device inhaler, build on our UK footprint and

expand our distributor network outside of the UK across Europe to

launch into appropriate new territories, expanding our footprint

and driving geographic diversification.

Avihu Tamir, Chief Executive Officer of Kanabo, commented:

"I'm excited about the progress we made in the first half of

2023, as we build our position as a key player in primary and

secondary digital health services in the UK. With The GP Service

and 'Treat It' fully integrated, we're not just broadening our

reach but also enhancing our capabilities. We're in the final

stages of rolling out new technology that will improve patient

access to GP treatments, making healthcare more accessible than

ever.

"In addition to revolutionising secondary care with affordable,

quick, specialist consultations, we're exploring opportunities to

expand beyond pain management into other medical fields with

significant unmet demand. As we look ahead, our focus remains on

growing our patient numbers and revenue while staying committed to

personalised, accessible healthcare."

Enquiries:

Kanabo Group plc via Vigo Consulting

Avihu Tamir, Chief Executive Officer +44 (0)20 7390 0230

Assaf Vardimon, Chief Financial Officer

Ian Mattioli, Non-Executive Chair of the Board

Peterhouse Capital Ltd (Financial Adviser)

Eran Zucker / Lucy Williams / Charles Goodfellow +44 (0)20 7469 0930

Vigo Consulting (Financial Public Relations/Investor

Relations)

Jeremy Garcia / Fiona Hetherington / Verity

Snow +44 (0)20 7390

kanabo@vigoconsulting.com 0230

About Kanabo Group plc

Kanabo Group plc (LSE:KNB) is a digital health company committed

to transforming patient care through its innovative technology

platform and specialised treatment offerings. Since its inception

in 2017, Kanabo has been focused on researching, developing, and

commercialising regulated medicinal cannabis-derived formulations

and therapeutic inhalation devices.

Kanabo's NHS-approved online telehealth platform, The GP

Service, provides patients with video consultations, online

prescriptions, and primary care services. Leveraging its telehealth

capabilities, in February 2023, Kanabo launched Treat It - an

online clinic focused on chronic pain management providing patients

with secondary care.

With its two complementary business divisions, Kanabo has

established itself as an end-to-end digital health provider,

offering telehealth consultations, prescriptions, alongside the

delivery of tailored treatments.

The Company's partially owned subsidiary, Kanabo Agritec Ltd, is

a cultivation consultancy supporting cannabis businesses in

developing new farms through infrastructural, research, and product

guidance. These farms deliver high-quality raw materials for

Kanabo's formulas and product line.

At Kanabo Group Plc, we are dedicated to providing patients with

the highest quality medical treatments and more accessible

healthcare experiences.

Visit www.kanabogroup.com for more information.

Operational Review

I am delighted to report that Kanabo has continued to make

significant progress in the first half of 2023 and continued its

strategic evolution to becoming a digital health provider, giving

patients access to a wide range of treatment pathways, including

primary and secondary care. The Group has delivered a strong

performance across both operating divisions in H1 2023, resulting

in an increase in revenues of 88% to GBP0.45m (H1 2022:

GBP0.24m).

The Group has now fully embedded The GP Service (acquired in

February 2022) into its operations, creating a balanced business

with two distinct but complementary operating divisions with

significant overlap: medicinal cannabis and digital health

services. Within the medicinal cannabis division, we have continued

to launch new products and deliver strong sales. Additionally,

Kanabo now has an established digital health services platform,

which provides customers access to online consultations with

healthcare professionals. In March of this year, we announced the

launch of Treat It, our online medicinal cannabis clinic, which

symbolised the combination of both divisions. Patients seeking

treatment plans for chronic pain management are able to access

online consultations with healthcare professionals who, in turn,

are able to prescribe medicinal cannabis products, among others, as

part of an innovative treatment pathway, which is currently

unavailable through other channels.

The Group remains focused on building an end-to-end digital

health services company that enables patients to take control of

their own healthcare pathway through providing access to

personalised medical treatments and innovative healthcare

solutions, including medicinal cannabis. Furthermore, we are

developing additional technologies for the digital health platform

that will further improve access to secondary care - seeking to

offer affordable specialist consultations at a fraction of the cost

and without the traditional waiting times. Additionally, we are

exploring opportunities to leverage our expertise with our online

chronic pain clinic and expand into complementary medical

fields.

Digital Health Services

We are delighted to report the digital health services division

continues to perform strongly following the integration of The GP

Service. We are cognisant of the platform's need to deliver a

high-quality and seamless interface for our customers and, to that

end, we have invested in the suite of technology tools, which

enables customers to benefit from video consultations, digital

prescriptions and access to primary and secondary care services.

Looking forward, we will seek to expand the breadth of our online

health services, aiming to increase our addressable market and

boost revenue through medication sales.

Since the integration of The GP Service, we have seen demand for

online consultations increase exponentially, and the platform is

now delivering more than 1,000 monthly consultations (H1 2022: 700

monthly consultations). Furthermore, the network of pharmacies

connected to our NHS-approved digital health platform has grown to

over 4,000 pharmacies.

In March 2023, we announced an exciting expansion of the online

consultation service with the launch of Treat It, Kanabo's

dedicated online medicinal cannabis clinic. The clinic - which is

regulated by the Care Quality Commission ("CQC") - aims to directly

address the issue of limited access to pain management treatments

for those suffering from chronic pain. There are estimated to be

more than 8 million chronic pain patients in the UK, and they often

face difficulties accessing medical treatment as a result of long

waiting times, bureaucracy and affordability. The Treat It clinic

enables patients to access healthcare professionals via our digital

healthcare platform, who are able to prescribe a wide range of

personalised treatments, including the prescription of medicinal

cannabis where appropriate.

As well as providing access to GP appointments for private

individuals, the Group also has a number of agreements with UK

corporations to provide services to its employees as part of a

broader benefits package. Given the continued pressures being

experienced by the National Health Service in the UK, we anticipate

further demand for our online consultations going forward.

Specialised Medications

Kanabo's research and development ("R&D") team continue to

develop and launch additional products into the Group's portfolio,

and in January announced the launch of two new medicinal cannabis

extract formulas for inhalation. These have been specifically

developed for patients suffering from severe pain and are delivered

via the Group's VapePod MD delivery device, our medical-grade

vaporiser, that ensures precise dosing. The R&D team

continually develops new formulae and products to ensure Kanabo

retains its reputation as a developer of innovative and

cutting-edge products.

Post-period end, we were informed that the Group's VapePod MD

delivery device has made further progress towards achieving CE Mark

approval. We expect the device to be the first medical

device-certified cannabis inhaler of its kind to have achieved the

CE Mark status, which will open up a wealth of opportunities for

Kanabo to expand its footprint across Europe. Upon receipt of a CE

Mark accreditation, the Group intends to progress the rollout

across certain European markets and will make further announcements

in due course.

During the first half, the Group established a strategic

partnership with the largest independent wholesaler of medications

to UK pharmacies. This, in turn, provides Kanabo with robust import

and distribution capabilities across the country. This new

partnership validates our truly end-to-end solution by solidifying

last-mile delivery and enabling future import of additional

specialised medications as we expand our online clinic

offerings.

Kanabo Agritec

Kanabo Agritec ("Agritec") - a cannabis cultivation consultancy

firm in which Kanabo has a 40% stake -delivered first contract win

in July 2023. Agritec will work alongside its Spanish partner,

Taima Growth S.L. ("Taima") to establish a cultivation centre and

will receive payment upon achieving certain milestones across the

project. Agritec is a dedicated consultancy focused on the design

build, operation and management of medicinal cannabis

facilities.

The contract with Taima is for the development of an indoor

medicinal cannabis cultivation and processing facility in Madrid,

Spain. The contract - split over two phases - will see the facility

granted a license for production and manufacturing of cannabis, and

once completed, will be capable of producing up to 3,000kg of

cannabis flowers annually.

Through our involvement with Agritec, Kanabo is not only able to

leverage its extensive knowledge and experience in establishing and

optimising medicinal cannabis facilities, but it also ensures that

the Group has a diversified supply chain through key offtake

agreements.

Directorate & Personnel Changes

Over the course of the first half, we have significantly

strengthened our Board, most notably with the appointment of Ian

Mattioli as Non-Executive Chair. As co-founder and CEO of a leading

UK pensions and wealth management consultancy, Ian brings extensive

experience in financial services, wealth management and capital

markets. Following Ian's appointment, Mr David Tsur, who has served

as Kanabo's Non-Executive Chair, moved to the role of Deputy Chair,

where we can continue to benefit from his knowledge and expertise

as we have done since the Company came to market.

Additionally, we announced the appointment of Sharon Malka, who

has gained significant experience with international healthcare and

technology companies, as Non-Executive Director.

We would like to thank both Dan Poulter and Gil Efron, who both

stepped down from the Board in the first half for their

contributions to the business. We wish Dan all the best as he

focuses on his existing commitments outside of the business and

continue to send our best wishes to Gil as he continues with

rehabilitation following his accident.

Across the period, the Group has also transitioned a number of

key roles out of Israel, where employees typically command a higher

salary, to the UK. This move has not only simplified the operating

structure of the business but has also immediately triggered a

reduction in the cost base.

Corporate activity

In May 2023, we announced a GBP2.74 million fundraising, which

received strong support from both existing and new investors, and

also saw participation from key members of the team, including Ian

Mattioli (Chair), David Tsur (Deputy Chair), Avihu Tamir (CEO) and

Suleman Sacranie (CTO and Founder of The GP Service).

Proceeds of this fundraising will enable Kanabo to pursue its

key strategic initiatives: to capitalise on the opportunity in both

digital healthcare services and the rising demand for medicinal

cannabis products and other innovative products. Proceeds have been

allocated to expand the digital health services division and to

invest in product development, technology and network growth.

The Group appointed MHA MacIntyre Hudson ("MHA") in March as the

Company's auditors, replacing Jeffreys Henry LLP ("Jeffreys

Henry"), the Company's previous auditors, following Jeffreys

Henry's decision not to register themselves with the Financial

Reporting Council as an eligible auditor to undertake Public

Interest Entity audits.

Summary & Outlook

Kanabo is a well-balanced business boasting growing primary and

secondary digital healthcare services, alongside our core cannabis

product development competencies.

Our development and launch of new products remain a cornerstone

of our business and in maintaining our market leading position. We

are recognised for having cutting edge products and solutions and,

to that end, our R&D team continues to focus on the delivery of

innovative formulae aimed at both the medical and wellness

markets.

The recently launched Treat It platform, which combines both

elements of our business, is also extremely well placed for growth.

According to Statista, the value of the medicinal cannabis market

in Europe is expected to grow from $300 million in 2019 to over

$2.5 billion in 2024 [1] .

Furthermore, there is increased demand in the UK for private

health services, as outlined previously. Over 8 million people in

the UK used online GP services last year [2] , and the digital

health market in the UK is expected to reach GBP25 billion by 2025

[3] . With our innovative end-to-end solution, Kanabo is

well-placed to benefit from this shift and demand for accessible,

personalised digital healthcare.

Over the next six months, our key priorities include:

-- Expansion of primary care platform - launching a significant

expansion of our primary care platform, enhancing the patient

experience by facilitating direct access to treatments and

medications without a preliminary consultation. The initiative

implements cutting edge technology to streamline the process, which

in turn will expand patient capacity in our clinics.

-- Expansion of secondary care platform - leveraging our

technology and experience with launching Treat It to launch a

similar service to tackle additional areas where there is a

significant unmet medical need. We have identified the UK's mental

health sector as the first additional sector into which we will

roll out our services. The UK mental health sector is under

well-documented pressure, and our intention is to expand our

services in the coming months to that area, addressing patient

demand.

-- Partnership with UK high street pharmacies - undertake a

pilot programme that will see Kanabo collaborate with physical high

street pharmacies to trial in-pharmacy consultations via our Treat

It clinic, tapping into the pharmacies' existing patient networks

to broaden Kanabo's outreach and addressable market.

-- EU product expansion - pending receipt of CE mark for our

VapePod MD medical device inhaler, build on our UK footprint and

expand our distributor network outside of the UK across Europe to

launch into appropriate new territories, expanding our footprint

and driving geographic diversification.

As a team, Kanabo believes there is a significant market

opportunity for the Group across both divisions. Demand for access

to healthcare professionals continues to rise, with the widely

reported pressures on national health systems resulting in

increased waiting times and frustration from patients, particularly

those suffering from chronic pain. Our medicinal cannabis products

are also gaining traction in a growing market, and we believe there

is a real opportunity to expand our sales channels to other

geographies both within and outside of Europe.

Whilst we recognise the broader socio-economic pressures that

are being felt worldwide, the Board of Kanabo believe we are well

placed to develop a scaled business addressing demand across our

sector, and in capitalising on a number of near-term growth

opportunities. We thank shareholders for their continued support

and look forward to continuing to update them on our progress.

Ian Mattioli & Avihu Tamir

Chair of the Board & Chief Executive Officer

29 September 2023

RESPONSIBILITY STATEMENT

We confirm that to the best of our knowledge:

(a) the condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting'.

(b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year; and

(c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein).

CAUTIONARY STATEMENT

This Interim Management Report (IMR) has been prepared solely to

provide additional information to shareholders to assess the

Company's strategies and the potential for those strategies to

succeed. The IMR should not be relied on by any other party or for

any other purpose.

Unaudited consolidated statement of comprehensive income for the

period ended 30 June 2023

For the

For the six months year ended

ended 30 June 31 December

---------------------- --------------

2023 2022 2022

--------- ----------- --------------

GBP 000 GBP 000 GBP 000

--------- ----------- --------------

Revenue 449 239 603

Cost of sales 372 151 404

--------- ----------- --------------

Gross profit 77 88 199

Research and development expenses 214 181 597

Sales and marketing expenses 275 511 1,190

General and administration expenses 1,270 (*) 2,045 3,804

Reverse impairment of financial assets

carried at amortised cost - - (59)

Other expenses (gains) - including

acquisition and listing costs (322) 1,067 1,448

--------- ----------- --------------

( 1,360

Operating loss ) (3,716) (6,781)

Net finance expenses (201) (57) (89)

--------- ----------- --------------

Loss before taxation from continuing (1, 561

operations ) (3,773) (6,870)

Income tax benefits - (*)- -

(1, 561

Loss for the period ) (3,773) (6,870)

========= =========== ==============

Attributable to:

(1, 557

Equity holders of the parent ) (3,778) (6,867)

Non-controlling interests (4) 5 (3)

(1, 561

) (3,773) (6,870)

========= =========== ==============

Loss (basic and diluted) per share

from continuing operations attributable

to the equity owners

Basic and diluted loss per share (0. 35

(pence per share) ) (0.92) (1.65)

========= =========== ==============

(*) A reclassification was carried out in accordance with 2022

audited annual reports .

Unaudited consolidated statement of financial position as at 30

June 2023

30 June 31 December

------------------------ ------------

2023 2022 2022

---------- ------------ ------------

Unaudited Unaudited Audited

GBP 000 GBP 000 GBP 000

---------- ------------ ------------

ASSETS

Non-current assets

Intangible assets and goodwill 9,575 (*)13,286 10,044

Property, plant, and equipment 82 100 96

Right-of-use asset 255 309 282

Long-term deposit 28 - 31

Non-current financial asset - 750 -

9,940 14,445 10,453

---------- ------------ ------------

Current assets

Inventories 77 69 81

Trade receivables 42 18 43

Other receivables 259 254 156

Current financial asset - - 491

Short-term deposits 13 51 24

Cash and cash equivalents 4,441 4,959 3,204

4,832 5,351 3,999

---------- ------------ ------------

Total assets 14,772 19,796 14,452

========== ============ ============

EQUITY AND LIABILITIES

Equity

Issued capital 14,331 10,573 10,573

Share premium account 7,169 (*) 6,850 6,850

Merger reserve 15,957 (*) 14,221 11,393

Share-based payments reserve 963 1,077 1,715

Share to be issued reserve 4,691 (*)10,476 10,476

Reverse acquisition reserve (14,968) (14,968) (14,968)

Foreign currency translation reserve 183 (2) 14

Retained deficit (14,541) (10,491) (13,605)

---------- ------------ ------------

Equity attributable to equity holders

of the parent 13,785 17,736 12,448

Non-controlling interests (7) 5 (3)

---------- ------------ ------------

Total equity 13,778 17,741 12,445

---------- ------------ ------------

Non- current liabilities

Interest-bearing loan and borrowings 397 568 509

---------- ------------ ------------

397 568 509

---------- ------------ ------------

Current liabilities

Trade payables 88 139 153

Other payables 317 1,096 1,147

Interest-bearing loan and borrowings 192 252 198

597 1,487 1,498

---------- ------------ ------------

Total liabilities 994 2,055 2,007

---------- ------------ ------------

Total equity and liabilities 14,772 19,796 14,452

========== ============ ============

(*) A reclassification was carried out in accordance with 2022

audited annual reports .

Unaudited consolidated statement of changes in equity for the

period ended 30 June 2023

Attributable to owners of the Company

-----------------------------------------------------------------------------------------------------

Share Share Foreign

Share based to be Reverse currency

Share premium Merger payments issued acquisition translation Retained Non-controlling Total

capital account reserve reserve reserve reserve reserve deficit Total interests equity

-------- -------- -------- --------- -------- ------------ ------------ ---------- ---------- ---------------- ----------

GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000 GBP 000

-------- -------- -------- --------- -------- ------------ ------------ ---------- ---------- ---------------- ----------

As at 1

January 2022

(audited) 9,249 5,169 9,231 758 2,500 (14,968) (7) (6,748) 5,184 - 5,184

Loss for the

year - - - - - - - (6,867) (6,867) (3) (6,870)

Other

comprehensive

income - - - - - - 21 - 21 - 21

-------- -------- -------- --------- -------- ------------ ------------ ---------- ---------- ---------------- ----------

Total

comprehensive

loss - - - - - - 21 (6,867) (6,846) (3) (6,849)

Acquisition of

a subsidiary 533 - 2,162 - 7,976 - - - 10,671 - 10,671

Issue of share

capital 703 1,434 - - - - - - 2,137 - 2,137

Exercise of

options 7 5 - (10) - - - 10 12 - 12

Exercise of

warrants 81 242 - - - - - - 323 - 323

Share-based

payments - - - 967 - - - - 967 - 967

-------- -------- -------- --------- -------- ------------ ------------ ---------- ---------- ---------------- ----------

As at 31

December 2022

(audited) 10,573 6,850 11,393 1,715 10,476 (14,968) 14 (13,605) 12,448 (3) 12,445

======== ======== ======== ========= ======== ============ ============ ========== ========== ================ ==========

Loss for the

period - - - - - - - (1, 557 ) (1, 557 ) (4) (1, 561 )

Other

comprehensive

income - - - - - - 169 - 169 - 169

-------- -------- -------- --------- -------- ------------ ------------ ---------- ---------- ---------------- ----------

Total

comprehensive

loss - - - - - - 169 (1, 557 ) ( 1,388 ) (4) ( 1,392 )

Issue of share

capital 1,910 210 - - 540 - - - 2,660 - 2,660

Acquisition of

a subsidiary 1,821 - 4,564 - (6,385) - - - - - -

Debt

settlements 27 109 - - 60 - - - 196 - 196

Expiration of

options - - - ( 621 ) - - - 621 - - -

Share-based

payments - - - ( 131 ) - - - - ( 131 ) - ( 131 )

-------- -------- -------- --------- -------- ------------ ------------ ---------- ---------- ---------------- ----------

As at 30 June

2023

(unaudited) 14,331 7,169 15,957 963 4,691 (14,968) 183 (14,541) 13,785 (7) 13, 778

======== ======== ======== ========= ======== ============ ============ ========== ========== ================ ==========

Attributable to owners of the Company

---------- -----------------------------------------------------------------------------------------

Share Share to

based be Reverse Foreign

Share Share Merger payments issued acquisition exchange Retained

capital premium reserve reserve reserve reserve reserve deficit Total

---------- ---------- --------- --------- --------- ------------ --------- --------- --------

GBP '000

---------- -----------------------------------------------------------------------------------------

As at 1

January 2022 (*)

(audited) 9,249 (*)5.169 9,231 758 2,500 (14,968) (7) (6,748) 5,184

Loss for the

period - - - - - - - (3,773) (3,773)

Other

comprehensive

income - - - - - - 5 - 5

---------- ---------- --------- --------- --------- ------------ --------- --------- --------

Total

comprehensive

loss - - - - - - 5 (3773) (3,768)

Acquisition of

a subsidiary 533 - 4,990 - 7,976 - - - 13,499

Issue of share

capital 703 1,434 - - - - - - 2,137

Exercise of

options 7 5 - (10) - - - 10 12

Exercise of

warrants 81 242 - - - - - - 323

Share-based

payments - - - 329 - - - 25 354

---------- ---------- --------- --------- --------- ------------ --------- --------- --------

As at 30 June

2022

(unaudited) 10,573 6,850 14,221 1,077 10,476 (14,968) (2) (10,486) 17,741

========== ========== ========= ========= ========= ============ ========= ========= ========

(*) A reclassification was carried out in accordance with 2022

audited annual reports .

Unaudited consolidated statement of cash flows for the period

ended 30 June 2023

For the six months ended 30 June For the year ended 31 December

------------------------------------ --------------------------------

2023 2022 2022

------------------ ----------------

GBP 000 GBP 000 GBP 000

------------------ ---------------- --------------------------------

Operating activities

Loss before tax (1, 561 ) (3,773) (6,870)

Adjustments to reconcile profit before tax

to net cash flows:

Net reverse losses on financial assets - - (59)

Share-based payment expense ( 131 ) 354 967

Depreciation of property, plant and

equipment and right-of-use assets 38 27 69

Amortisation of intangible assets and

impairment of goodwill 678 559 976

Provision for bad debts 1 - 3

Loss on current financial asset 158 - 259

Net finance expenses 27 30 56

Working capital changes:

Change in trade receivable - 5 (3)

Change in other receivable (103) 60 155

Change in inventories 4 (6) (18)

Change in trade payables (65) 78 92

Change in other payables (634) 646 677

Change in long term deposit 3 (31) (31)

------------------ ---------------- --------------------------------

(1,585) (2,051) (3,727)

Interest paid (27) (19) (52)

------------------ ---------------- --------------------------------

Net cash flows used in operating activities (1,612) (2,070) (3,779)

------------------ ---------------- --------------------------------

Investing activities

Purchase of property, plant, and equipment (3) (58) (68)

Proceeds from sale financial asset 333 - -

Acquisition of a subsidiary, net of cash

acquired - 235 235

Investment in short term deposits 11 - (4)

Development expenditures (209) (86) (86)

Net cash flows from investing activities 132 91 77

------------------ ---------------- --------------------------------

Financing activities

Share issue net of issuing cost 2,660 2,137 2,137

Proceeds from exercise of warrants - 323 323

Proceeds from exercise of share options - 12 12

Receipts of short and long-term loans - 9 68

Repayment of lease liability (22) (14) (37)

Repayment of borrowings (67) (17) (100)

Net cash flows from financing activities 2,571 2,450 2,403

------------------ ---------------- --------------------------------

Net increase (decrease) in cash and cash

equivalents 1,091 471 (1,299)

Net foreign exchange difference 146 11 26

Cash and cash equivalents at 1 January 3,204 4,477 4,477

Cash and cash equivalents at end of the

period 4,441 4,959 3,204

================== ================ ================================

Notes to the consolidated financial statements

1. Corporate information

The interim condensed consolidated financial statements of

Kanabo Group Plc. and its subsidiaries (collectively, the Group)

for the six months ended 30 June 2023 were authorized for issue in

accordance with a resolution of the directors on 27 September

2023.

Kanabo Group Plc. (the Company) is a limited company,

incorporated and domiciled in England and Wales, whose shares are

publicly traded on the London Stock Exchange in the standard

segment.

The registered office is located at Churchill House, 137-139

Brent Street, London, NW4 4DJ.

The Group principal activities are the distribution and

development of cannabis derived medical and wellness products.

2. Basis of preparation and changes to the Group's accounting policies

a. Basis of preparation

The interim condensed consolidated financial statements for the

six months ended 30 June 2023 have been prepared in accordance with

IAS 34 Interim Financial Reporting. The Group has prepared the

financial statements on the basis that it will continue to operate

as a going concern. The Directors consider that there are no

material uncertainties that may cast significant doubt over this

assumption. They have formed a judgement that there is a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future, and not less than

12 months from the end of the reporting period. The interim

condensed consolidated financial statements do not include all the

information and disclosures required in the annual financial

statements, and should be read in conjunction with the Group's

annual consolidated financial statements as at 31 December

2022.

b. New standards, interpretations and amendments adopted by the Group

The accounting policies adopted in the preparation of the

interim condensed consolidated financial statements are consistent

with those followed in the preparation of the Group's annual

consolidated financial statements for the year ended 31 December

2022, except for the adoption of new standards effective as of 1

January 2023. The Group has not early adopted any standard,

interpretation or amendment that has been issued but is not yet

effective. Several amendments apply for the first time in 2023, but

do not have an impact on the interim condensed consolidated

financial statements of the Group.

3. Estimates and Judgements

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expense.

Actual results may differ from these estimates. In preparing

these condensed consolidated interim financial statements, the

significant judgements made by management in applying the Group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the financial statements for

the year ended 31 December 2022.

4. Financial risk management

The Group's activities expose it to a variety of financial

risks, including - market risk (including currency risk and

interest rate risk), credit risk and liquidity risk. The condensed

consolidated interim financial statements do not include all

financial risk management information and disclosures required in

the annual financial statements; they should be read in conjunction

with the Group's annual financial statements as at 31 December

2022. There have been no changes in any risk management policies

since the year end or as disclosed in the prospectus.

5. Going concern

The preparation of the financial statements requires an

assessment on the validity of the going concern assumption.

The Directors are required to satisfy themselves that it is

reasonable for them to conclude whether it is appropriate to

prepare the financial statements on a going concern basis, and as

part of that process, they have followed the Financial Reporting

Council's guidelines ("Guidance on the Going Concern Basis of

Accounting and Reporting on Solvency and Liquidity Risk" issued

April 2016).

As at 30 June 2023, the Group's cash position was GBP4,441

thousand and it was in a strong net current asset position. Based

on the above, the Group's current cash reserves and detailed cash

forecasts produced, the Directors are confident that the Group will

be able to meet its obligations as they fall due over the course of

the next 12 months. Whilst the Group may seek to raise further

funds in the next 12 months, the Directors are confident that the

Group would be able to meet their obligations as they fall due in

the event of no further funding being obtained due to the low level

of committed expenditure relative to the forecasted discretionary

expenditure, which could be reduced or deferred.

The impact of the risk factors such as high-interest rates and

high inflation, declining consumer power, Russia's invasion of

Ukraine, and supply chain disruptions had little effect on the

business of the Group during 2022 and the first half of 2023,

following that the Directors do not believe that these risks will

have a significantly adverse impact on the Group in the foreseeable

future.

6. Segment information

Following the acquisition of GP Service (UK) Limited ("GPS"),

for management purposes, the Group is organized into business units

based on its products and services and has two reportable segments,

as follows:

- Primary case segment - the tele pharma services provided by

GPS.

- Secondary case segment - distribution and development of

cannabis derived medical and wellness products.

No operating segments have been aggregated to form the above

reportable operating segments.

The following tables present revenue and loss information for

the Group's operating segments for the six months ended 30 June

2023:

For the six months ended 30 June 2023:

Primary Secondary Adjustments

care care Total segments and eliminations Consolidated

--------- ---------- --------------- ------------------ -------------

GBP '000

-------------------------------------------------------------------------

Revenue

External customer 395 54 449 - 449

Inter-segment - - - - -

Total revenue 395 54 449 - 449

========= ========== =============== ================== =============

Results

( 1, 009 ( 552 (1, 561 (1, 561

Segment loss ) ) ) - )

========= ========== =============== ================== =============

For the six months ended 30 June 2022:

Primary Secondary Adjustments

care care Total segments and eliminations Consolidated

-------- ---------- --------------- ------------------ -------------

GBP '000

------------------------------------------------------------------------

Revenue

External customer 208 31 239 - 239

Inter-segment - - - - -

Total revenue 208 31 239 - 239

======== ========== =============== ================== =============

Results

Segment loss (932) (2,841) (3,773) - (3,773)

======== ========== =============== ================== =============

The following table presents assets and liabilities information

for the Group's operating segments.

As at 30 June 2023:

Primary Secondary Adjustments

care care Total segments and eliminations Consolidated

-------- ---------- --------------- ------------------ -------------

GBP '000

------------------------------------------------------------------------

Assets 10,051 6,472 16,523 (1,751) 14,772

======== ========== =============== ================== =============

Liabilities 2,211 534 2,745 (1,751) 994

======== ========== =============== ================== =============

As at 30 June 2022:

Primary Secondary Adjustments

care care Total segments and eliminations Consolidated

------------- ---------- --------------- ------------------ -------------

GBP '000

-----------------------------------------------------------------------------

Assets (*) 13,841 6,445 20,286 (490) 19,796

============= ========== =============== ================== =============

Liabilities (*) 1,114 1,431 2,545 (490) 2,055

============= ========== =============== ================== =============

(*) A reclassification was carried out in accordance with 2022

audited annual reports .

7. Share-based payments

During the reporting period, 25,050,00 share options were

granted to employees and senior executives under the options plans

.

The total share-based payment charge in the period was GBP 131

thousand (gain). The share-based payment charge was calculated

using the Black-Scholes model. All granted options have an exercise

period between two and three years from the date of issue. The

total of the share-based payment charge has been simultaneously

credited to retained earnings.

During the reporting period, 34,722,222 warrants were granted to

investors. After the reporting period addition 12,847,221 warrants

were granted see note 11.a. The warrants were not issued for goods

or services provided and therefore fall outside the scope of IFRS 2

and do not require fair valuing.

As of 30 June 2023, none of the options or warrants have been

converted into shares.

Share-based payments charge for the reporting period:

For the six months ended For the year

30 June ended 31 December

--------------------------- -------------------

2023 2022 2022

---------------- --------- -------------------

GBP '000

------------------------------------------------

Cost of sales 8 - 13

Research and development 20 17 68

Sales and marketing ( 75 ) 129 349

General and administration ( 84 ) 208 537

---------------- --------- -------------------

Total ( 131 ) 354 967

================ ========= ===================

8. General and administration

For the six months For the year

ended 30 June ended 31 December

--------------------- -------------------

2023 2022 2022

----------- -------- -------------------

GBP '000

------------------------------------------

Salaries and related expenses 240 431 778

Share-based payment expense ( 84 ) 208 537

Insurance 49 35 82

Professional services 209 610 1,005

Rent and related expenses 34 40 81

Depreciation 38 27 69

Amortization 678 680 976

IT Development and licenses 28 45 45

Travel and accommodation 53 70 128

Other 25 20 103

----------- -------- -------------------

Total 1, 270 2,166 3,804

=========== ======== ===================

9. Other expenses

For the six months ended For the year

30 June ended 31 December

--------------------------- -------------------

2023 2022 2022

------------- ------------ -------------------

GBP '000

------------------------------------------------

Acquisition and listing

costs 158 395 514

Loss on current financial

asset 158 - 259

Expense (reverse) provision

for brokerage fees (524) 675 675

Research and development

tax credit (114) - -

Total (322) 1,067 1,448

============= ============ ===================

10. Loss per share

The basic earnings per share is calculated by dividing the loss

attributable to the ordinary shareholders of the Company by the

weighted average number of Ordinary shares in issue during the

period, excluding Ordinary shares purchased by the Company and held

as treasury shares.

For the six months For the year

ended 30 June ended 31 December

-------------------------- -------------------

2023 2022 2022

------------ ------------ -------------------

Unaudited Audited

-------------------------- -------------------

Loss attributable to equity

holders of the Company (1, 561

(GBP'000) ) (3,773) (6,870)

Weighted average number

of shares in issue 445,982,665 408,018,768 415,187,814

------------ ------------ -------------------

(0. 35

Loss per share pence ) (0.92) (1.65)

------------ ------------ -------------------

Due to the loss incurred in the period under review, the

dilutive securities have no effect on 30 June 2023.

11. Events during the reporting period

a. On 9 May 2023 and 10 May 2023 ("admission dates"), the

Company raised GBP2,740 thousand (before costs) by the issue of

95,138,889 ordinary shares of 2.5 pence each. The Group

additionally granted a half warrant to the noteholders to subscribe

for an additional half a new ordinary share at an exercise price of

5.76 pence for 24 months following the Admission Dates.

Participants in the fundraising include a new institutional

investor as well as the Group's Directors and Senior Officers of

the Company. The issue of the shares to the Directors and Senior

Officers of the Company in the fundraise was conditional upon the

approval by the Company's shareholders of certain resolutions to be

proposed at the annual general meeting of the Group (the

"AGM").

On 30 June 2023, the AGM approved the issue of the shares as a

result, after the reporting period additional 18,749,999 ordinary

shares of 2.5 pence each out of the 95,138,889 have been

issued.

The total warrants issued sum to 47,569,443 (see also note

7).

b. On 13 June 2023, the Company published a prospectus (the

"Prospectus") in relation to the proposed issue of 38,461,492

Ordinary Shares ("2020 Deferred Consideration Shares") in

connection with the acquisition of Kanabo Research Limited for 6.5

pence and proposed issue of 72,831,186 Ordinary Shares

("Outstanding Consideration Shares") in connection with the

acquisition of The GP Service (UK) Ltd at for 12.65 pence.

On 28 June 2023 the " Outstanding Consideration Shares " were

issued.

On 10 July 2023 the " The 2020 Deferred Consideration Shares "

were issued.

c. On 23 May 2023 the Company signed a settlement agreement with

one of its previous service providers. According to the agreement,

the Company will issue 5,000,000 new ordinary shares in exchange

for removing all mutual claims.

The shares will be issued for the provision of brokerage

services in relation to the acquisition of The GP Service ("GPS").

4LLC will receive their shares in two tranches, with 3,000,000

shares ("First Tranche") and the remaining 2,000,000 shares

("Second Tranche") to be received within three months.

Of the First Tranche, 337,192 new ordinary shares ("4LLC

Shares") were issued by the Company. The remaining 2,662,808

ordinary shares of the First Tranche will be transferred from the

shares previously held by Mr. Atul Devani, Co-founder of GPS.,

Based on the compromise agreement signed with Mr. Devani, on his

leaving the Company he returned 25% of the shares received as

consideration for the acquisition of GPS. As such, in the

settlement of the First Tranche, the Company issued only 337,192

new ordinary shares.

After the reporting period, the shares agreed on the Second

Tranche have been issued.

Following the settlement agreement, the company reversed the

previous booked provision and as a result, recorded income of

GBP524 thousand booked under " Other expenses " .

***

[1]

https://www.statista.com/statistics/1096946/legal-cannabis-market-in-europe-forecast/

[2]

https://digital.nhs.uk/data-and-information/publications/statistical/patients-registered-at-a-gp-practice

[3]

https://www.statista.com/outlook/dmo/digital-health/united-kingdom

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEUFWAEDSESU

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

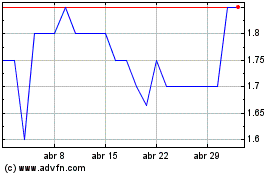

Kanabo (LSE:KNB)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Kanabo (LSE:KNB)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024