TIDMMAFL

RNS Number : 5256X

Mineral & Financial Invest. Limited

20 December 2023

Mineral and Financial Investments Limited

Audited Full Year Financial Results and NAV for Period ended 30

June 2023

HIGHLIGHTS

-- Fiscal Year-end Net Asset Value GBP 9.4M (FYE: 30/6/23) up

26.5%, from GBP7.5M (FYE: 30/6/22)

-- Net Asset Value Per Share ("NAVPS") fully diluted 24.27p, up

21.1%, from 20.04p (FYE: 30/6/22)

-- Net Asset Value has increased at Compound Annual Growth Rate of 29.1% since 30 June 2018

-- Investment Portfolio now totals GBP9.1m, up 18.7%, Year/Year from GBP7.7M (FY: 30/6/22).

-- NAVPS growth has exceeded that of the FTSE 350 Mining index and of the S&P GSCI since 2017

Camana Bay, Cayman Island - 20 December 2023 - Mineral &

Financial Investments (LSE-AIM: MAFL) ("M&F" or the "Company"))

is very pleased to announce its audited Net Asset value and fiscal

year results on its activities for the 12 months ended 30 June

2023.

CHAIRMAN'S COMMENTS

During the 12-month fiscal period ending 30 June 2023 your

company generated Gross Income of GBP2.394 million which translated

into an Operating Profit of GBP1.806 million. Net Profit for the

full year was GBP1.550 million or 4.35p per share basic or 4.03p

per share on a Fully Diluted ("FD") basis for the period. At the

year-end of 30 June 2023, our Net Asset Value (NAV) was GBP9.423M

an increase of 26.4% from the 30 June 2022 NAV of GBP7.454M. The

NAV per share - fully diluted (NAVPS-FD) as of 30 June 2023 was

24.27p, up 21.1% from the 30 June 2022 was 20.04p. Since 30 June

2018, our NAV FD has appreciated on average by 26.5% annually. We

continue to be effectively debt free, with working capital of

GBP9.542M.

Summary of Financial Performance (Fig. 1)

30 30 30 June June June CAGR

June June June 30 2021 30 2022 30 2023 (%)

2018 2019 2020

Net Asset Value ('000) GBP2,623 GBP5,114 GBP5,474 GBP6,438 GBP7,454 GBP9,423 29.1%

--------- --------- --------- --------- --------- --------- ------

Fully diluted NAV

per share 7.49p 14.50p 15.50p 18.22p 20.04p 24.27p 26.5%

--------- --------- --------- --------- --------- --------- ------

In a series of challenging years for the metals and mining

sector, we believe 2023 has been the most challenging year since

2013. The industry has experienced slowing total World output (Fig.

3) from a COVID recovery high of 6% in 2021 to an estimated 3% in

2023. In 2022 total World Consumer Prices (Fig. 3) peaked at an

8.7% increase for the full year 2022. We believe cost inflation

coupled with rising interest rates, mediocre metal price

performance and "peak apathy" for the sector by investment markets

has created a brutal environment for the sector and general

investment performance. The FTSE 350 Mining Index was up 5.2%

Yr/Yr. for the period ending 30 June 2023 (Fig.6). As we write this

statement the month over month performance has been down for the

major equity markets indices we follow, but the FTSE 350 Mining

Index was up 3.9% in October 2023 over September 2023. We consider

this might be a turning point. The Directors noted that US 10-year

Treasuries rose 27.2% during the Company's fiscal year, ending 30

June 2023 to 3.84%, and today stand at 4.86%. US treasuries, which

we believe is the reference point for most interest rate markets,

have guided global rates upwards. We also have observed the Western

Central Banks, to mitigate inflationary pressures, have increased

their rates up along with the US Federal Reserve. We believe a

secondary objective, of the central banks is a return to more

historically consistent levels of treasury yields ending the

prolonged period of depressed interest rates. The Directors note

that according to Yale University's Professor Schiller, long term

Interest Rates, although volatile over time, have averaged

4.49%.

The regular readers of our Annual Report to shareholders will

note that we regularly refer to the International Monetary Fund

("IMF") bi-annual economic forecasts as a yardstick for global

economic performance. Additionally, we include the IMF's economic

forecast which we believe provide a sense of what the best-informed

consensus estimates are for near term economic performance. The IMF

is forecasting slowing economic performance from the so-called

"Advanced Economies" while forecasting that "Emerging and

Developing" economies should continue to generate constant growth

through 2024.

IMF - WORLD ECONOMIC OUTLOOK [1] (Fig. 2)

October 2023 2018 2019 2020 2021 2022 2023(e) 2024(f)

World Output 3.6% 2.8% -3.1% 6.0% 3.5% 3.0% 2.9%

----- ----- ------ ----- ----- -------- --------

World Output - Advanced

Economies 2.3% 1.7% -4.5% 5.2% 2.6% 1.5% 1.4%

----- ----- ------ ----- ----- -------- --------

Emerging Markets and Developing

Economies 4.5% 3.7% -2.1% 6.6% 4.1% 4.0% 4.0%

----- ----- ------ ----- ----- -------- --------

World Consumer Prices 3.6% 3.5% 3.2% 4.7% 8.7% 6.9% 5.8%

----- ----- ------ ----- ----- -------- --------

Consumer Prices - Advanced

Economies 2.0% 1.4% 0.7% 3.1% 7.3% 4.6% 3.0%

----- ----- ------ ----- ----- -------- --------

Emerging Markets and Developing

Economies 4.9% 5.1% 5.1% 5.9% 9.8% 8.5% 7.8%

----- ----- ------ ----- ----- -------- --------

The US dollar, as measured by the DXY Index, which is a trade

weighted index of the US dollar (composed of USD vs six foreign

currencies), was up 6.0% during our fiscal year, appreciating

currencies in that index. This rise exceeds the DXY's compounded

growth rate of 3.2% (fig. 5) since 2018 -we believe that a mean

reversion will occur at some point should aid the US dollar pricing

commodities.

The US Equity market valuation, as measured by the S&P 500

P/E Index, peaked this cycle at 4,766 in December 2022. Our June 30

fiscal period saw the S&P 500 open at 3785, peak at 4,766, but

end on 30 June 2023 at 4,450, resulting in a 17.6% yr./yr. gain.

The composite measure for the European big cap stocks, the Euro

Stoxx 50, appreciated by 27.3% in the period ending 30 June 2023.

The Shanghai and Hong Kong equity market indices were down 14.3%

and 13.5%, respectively. The Hang Seng (Hong Kong) index today is

at 17,101, down 24.6% from its 27 January 2023 peak of 22,701 -

Technically it is now in a "bear" market, while the Shanghai

exchange is down 16.3% from its January 2023, approaching bear

market territory.

Global Stock Index performance (Fig.3)

30/6/2023 30/06/2022 % Ch.

Shanghai Shenzhen CSI 300 3842 4485 -14.3%

---------- ----------- -------

Standard & Poor 500 4450 3785 17.6%

---------- ----------- -------

Euro Stoxx 50 4399 3455 27.3%

---------- ----------- -------

Hang Seng 18916 21870 -13.5%

---------- ----------- -------

FTSE 100 7532 7169 5.1%

---------- ----------- -------

Nikkei 225 33189 26393 25.7%

---------- ----------- -------

Source: Bloomberg LLP

M&FI continues to seek suitable strategic investment

opportunities that we believe will generate above average returns

while adhering to our standards of prudence while seeking above

average investment returns. We thank you for your support and we

will continue to work diligently and thoroughly to advance your

company's assets and market position.

CHIEF EXECUTIVE'S OFFICER'S REPORT

The Company generated gross income of GBP2.394M during the year,

an 84.5% improvement from the previous year's gross profit of

GBP1.297M. The operating profit for the full year, ending 30 June

2023, improved by 135.7% to GBP1.806M versus last year's operating

profit of GBP766,000.

The rise in profits is mainly due to the improved valuation of

Redcorp. Previously we used historical cost accounting to value the

investment, but since the publication of the feasibility study in

July 2023 it was resolved that the value of the investment should

be based on the estimated discounted cash flows from the

Feasibility Study of the project, applying an annual discount rate

of 20%. This has resulted in a GBP624,000 uplift in its carried

value. The improvement in M&F's profits is principally linked

to our investment portfolio performance and administrative costs

that rose by 10.6%, less than the rise in M&F's investment

performance. Per share earnings were 4.35p (basic) or 4.03p (FD),

up 71% from 2.55p (basic) and 2.35p (FD) for the 2022 fiscal year.

Foreign exchange rates negatively impacted our pre-tax income by

GBP230,000. as the British Pound rose by about 5% versus the US

dollar. The after-tax Net Income for the 2023 fiscal year was

GBP1.550,000 vs. GBP899,000 achieved during the 2022 fiscal year.

M&FI's NAVPS (FD) increased 21.1% year over year to 24.27p. The

overall cash and investment portfolios increased to GBP9.720M or by

26.8% on a year over year basis from GBP7.665M.

Summary of Financial Performance (Fig.4)

Net Asset Value Performance 30 30 30 June June June CAGR

June June June 30 30 30 (%)

2018 2019 2020 2021 2022 2023

Net Asset Value ('000) GBP2,623 GBP5,114 GBP5,474 GBP6,438 GBP7,454 GBP9,423 29.2%

--------- --------- --------- --------- --------- --------- ------

Fully diluted NAV per

share 7.49p 14.50p 15.50p 18.22p 20.04p 24.27p 26.5%

--------- --------- --------- --------- --------- --------- ------

The Directors believe the key to creating shareholder value for

Mineral & Financial Investments is attempting to achieve

positive risk adjusted investment returns while keeping operating

costs low. More specifically, operating costs which grow at a

slower rate than the accretion in the Net Asset Value. Our full

year administrative costs totalled GBP588,000, an increase of 10.6%

versus the previous year's costs of GBP531,000. General &

Administrative ("G&A") costs were up nominally but declined as

a percentage of year/year total assets (6.2% vs. 7.1%). The

increase in yr./yr. costs were principally associated with

increased share-based payments and higher operating costs for our

Swiss subsidiary M&F AG.

Price Performance of Various Commodities & Indices ( Fig.5

)

Commodity 2019 2020 2021 2022 2023 % Ch. CAGR

2023

vs. 2022

(June (June (June (June (June 2018

30) 30) 30) 30) 30) - 2023

Gold (US$/oz) 1,389 1,784 1,784 1,809 1,920 5.7% 8.4%

-------- -------- -------- -------- -------- ---------- ---------

Silver (US$/oz) 15.30 18.30 26.15 19.80 22.76 11.3% 10.4%

-------- -------- -------- -------- -------- ---------- ---------

Platinum (US$/oz) 837 828 1083 881 903 0.6% 1.9%

-------- -------- -------- -------- -------- ---------- ---------

Copper (US$/t) 5,969 6,120 9,279 7,901 8,257 (1.1%) 8.5%

-------- -------- -------- -------- -------- ---------- ---------

Nickel (US$/t) 12,670 13,240 18,172 23,229 19,869 (16.4%) 11.9%

-------- -------- -------- -------- -------- ---------- ---------

Aluminium (US$/t) 1,779 1,598 2,514 2,659 2,104 (20.3%) 4.3%

-------- -------- -------- -------- -------- ---------- ---------

Zinc (US$/t) 2,575 2,043 2,899 3,147 2,369 (27.5%) (2.1%)

-------- -------- -------- -------- -------- ---------- ---------

Lead (US$/t) 1,913 1,770 2,301 1,899 2,126 10.6% 2.7%

-------- -------- -------- -------- -------- ---------- ---------

Uranium (US$/t) 54,454 71,871 70,768 108,027 124,561 15.3% 23.0%

-------- -------- -------- -------- -------- ---------- ---------

WTI (US$/Bbl.) 60.06 40.39 75.25 107.86 70.64 6.1% 4.1%

-------- -------- -------- -------- -------- ---------- ---------

Trade Weighted

US$ (DXY) 96.56 96.68 92.66 105.09 102.91 6.0% 3.2%

-------- -------- -------- -------- -------- ---------- ---------

FTSE 350 Mining

Index 20,080 17,714 22,585 9,810 10,161 5.2% (15.7%)

-------- -------- -------- -------- -------- ---------- ---------

Global Food Price

Index [2] 100.272 97.636 129.448 144.224 136.674 (5.2%) 8.1%

-------- -------- -------- -------- -------- ---------- ---------

Source: Bloomberg LLP

During our fiscal year global commodity price performances were

mixed. Precious metals were up modestly, base metals were down with

zinc being down 27.5%, which led to reduced mine production from

several mines. We also believe that temporary mine closures are

critical, and often needed, market reactions to return markets to

more favourable supply demand balances. Lead, the standout

exception amongst base metals, was up 10.6%. Oil (WTI) prices was

up 6.1%, above its 5-year growth trend. Uranium surprised with the

creation of several physical U(3) O(8) investment funds, and or

ETF's and the growth in energy insecurity caused by the energy

shortfalls caused by the Russian/Ukrainian conflict. We admit to

not having missed the boom in the Lithium market and chose not to

chase the sector. Lithium, carbonate prices peaked late in 2022 at

US$82.00/kg and are now US$23.00/kg. It is our considered belief

that Lithium will be an important part of energy storage as we

transition away from hydrocarbon usage. However, we believed that

the market was "over exuberant" for Lithium which is the 25(th)

most abundant mineral on the planet. The US Geological Survey

estimated in 2021 that there was 88M/t of Lithium, and total global

Lithium consumption in 2023 was 134,000 tonnes (i.e. 0.15% of

currently estimated reserves). It should be noted that current

estimates are that 80% to 90% of Lithium in EV's will be recycled.

The Directors understand that a little-publicized clause in the

U.S. Inflation Reduction Act ("IRA") has had US companies

scrambling to recycle electric vehicle batteries in North America,

which they also believe will put the region at the forefront of a

global race to undermine China's dominance of the field. The

Directors also understand that IRA includes a clause that

automatically qualifies EV battery materials recycled in the U.S.

as American-made for subsidies, regardless of their origin. The

Directors consider that, if this is correct, it is important

because it could potentially qualify automakers using U.S.-recycled

battery materials for EV production incentives, although there is

no guarantee that this will be the case. In summary, we take the

view that it is unlikely that we will experience a shortage of

Lithium, however, much like oil, we consider we may run out of very

cheap Lithium sometime in the future.

We have been overweight in precious metals, notably gold and to

a lesser extent silver as well as platinum group metals ("PGM"). We

remain confident that the decision was correct, and the relative

performance of precious metals to date supports this. Gold is up

5.7% yr/yr, while silver has appreciated 11.3% for the period ended

June 30, 2023. However, the share performance of the underlying

mining companies has been below our expectations due to cost

inflation exceeding metal price appreciation. We believe that this

will reverse itself and the underlying companies will outperform

metal prices. It is also our considered view that when a sector has

been out of favour, but its fundamentals are improving - the larger

cap companies will receive the first wave of investments attention,

followed by mid-caps and the small caps are last to benefit from

the markets' attention. We continue to look for that change in

trend across our portfolios.

Precious metals represent 39.2% of our asset allocation, down

from 44.9% of our assets in 2022, however, the overall value of the

investment in the sector is up 10.9% yr/yr. Base metals now

represent 39.5% of our asset allocation and, as of our YE were up

35.8% to GBP3.844M. Food, Energy and Technology increased as a

percentage of our total investable assets to 12.5% , but also on an

absolute dollar amount (+12.1%), due to increased investment into

food and fertilizer stocks, a graphite producer as well as a small

new Strategic investment in the Environmental, Social and

Governance ("ESG") auditing as well as digitizing global project

data.

Commodity Class Investment Allocation

2023-Q4 vs. 2022-Q4 (Fig. 6)

INVESTMENT COMMODITY Q4-2023 Q4-2023 Q4-2022 Q4-2022 FYE 2023/

CLASSES (GBP) (%) (GBP) (%) 2022

% Ch

---------------------- -------------- -------- ------------- -------- ----------

Cash GBP795,560 8.2% GBP481,401 6.3% 65.3%

-------------- -------- ------------- -------- ----------

Precious Metal GBP3,814,916 39.2% GBP3,441,285 44.9% 10.9%

-------------- -------- ------------- -------- ----------

Base Metals GBP3,843,664 39.5% GBP2,743,970 35.8% 40.1%

-------------- -------- ------------- -------- ----------

Food, Energy, Tech

& Misc. GBP1,212,451 12.5% GBP926,120 12.1% 30.9%

-------------- -------- ------------- -------- ----------

Diamonds GBP53,775 0.6% GBP72,163 0.9% -25.5%

-------------- -------- ------------- -------- ----------

Total investments GBP9,720,366 100.0% GBP7,664,939 100.0% 26.8%

-------------- -------- ------------- -------- ----------

For the past year we have seen and experienced mining indices

underperforming commodity indices. Equity markets have been

afflicted with a disconnect between metal prices and the

performance of the shares of the companies that explore and produce

these metals. For the first time in many years, we are seeing the

FTSE 350 mining index outperform average commodity prices. The

market is anxious about the mediocre metal price performances and

the increases in production costs, led upwards by energy costs and

soon to be followed by labour costs. We also believe that inflation

above Central banks' inflation targets will be a fact of life for a

few more years. The US dollar's out-performance is, we believe,

unlikely to continue as it did in 2023. Lastly, we continue to

maintain the view that commodity prices will have to rise, or

capacity will have to close, which will lead to metal price rises.

Although not the most robust setting for mining companies, there

is, we believe, good cause for bullishness that more broadly based

metal price rises will define 2024 and that the inflationary

pressures of 2022 will moderate, but nevertheless remain stubbornly

higher than desirable.

INVESTMENT PORTFOLIOS

We have high expectations and rarely exceed those expectations.

However, FYE 2023 has been challenging for the whole of the metals

and mining sector. Our performance in 2023 was relatively strong,

but below our expectations for the year. Our NAV rose 26.5% year

over year while NAVPS rose by 21.2%. The variance was mostly due to

the issuance of 1.44 million shares via a small capital raise at

21.0p (see announcement dated 24/5/2023). These results exceed the

performance yardsticks by which we measure our performance as can

be seen in Fig. 1.

The broader equity markets rose during our fiscal year: The Euro

Stoxx 50 was up strongly by 27.3%; The S&P 500 was up 17.6%,

the CSI 300 (Shanghai) was down 14.3%, while the FTSE 100 did

manage a gain of 5.1%. The more specific comparable measures, such

as - the S&P/TSX Global Mining Index was down 11.5% during our

fiscal period, while FTSE 350 Mining Index, was down 55.2% -

although it must be noted that we believe the FTSE 350 Mining Index

was dragged down by the Ukrainian conflict and the sanctions

imposed on Russian companies, which are part of the Index.

CASH As a percentage of Total Investments: 8.2%

Our cash as of 30 June 2023, was GBP796,000 a rise of 65.3% from

the GBP481,000 as at the end of fiscal 2022. We view Cash as an

investment. In FY 2023 we received the final US$2.5M payment from

Ascendant as part of their earn-in on the Lagoa Salgada project.

The intention is to keep the cash somewhere between 5% and 20% of

our NAV so that we may take advantage of investment opportunities

quickly when they present themselves. Since 2017 our average cash

holding has been around 10%. Moreover, as a rule of thumb we like

to have a combined value of our cash and the Tactical portfolio to

range between 25 and 60 percent depending on our market

perspective. For the past 3 years we have been at 35% as of the end

of 2021 and ended 2022 at 35% of NAV and as at FYE 2023 we were at

31%. At the current time we believe that our greatest performance

risk is under investment to the mining sector. As the mining cycle

evolves, we would like to gradually evolve to a higher cash &

tactical holding as we monetise our strategic investments and

marshal our cash holdings to protect our overall performance

record.

M&F Portfolio Performance 2017 - 2023 (Fig.7)

2023 CAGR

vs. '18 to

(GBP,000) 2018 2019 2020 2021 2022 2023 2022 2023

Strategic GBP766.9 GBP3,655.3 GBP3,909.7 GBP4,110.3 GBP4,946.5 GBP6,721.3 35.9% 54.4%

----------- ----------- ----------- ----------- ----------- ----------- ------ --------

Tactical GBP1,319.2 GBP226.3 GBP430.4 GBP1,711.9 GBP2,237.0 GBP2,203.5 -1.5% 10.8%

----------- ----------- ----------- ----------- ----------- ----------- ------ --------

Cash GBP422.3 GBP224.4 GBP274.6 GBP854.7 GBP481.4 GBP795.6 65.3% 13.5%

----------- ----------- ----------- ----------- ----------- ----------- ------ --------

Total GBP2,508.3 GBP4,106.0 GBP4,614.8 GBP6,677.0 GBP7,664.9 GBP9,720.4 26.8% 31.1%

----------- ----------- ----------- ----------- ----------- ----------- ------ --------

TACTICAL HOLDINGS As a percentage of Total Investments:

22.7%

The Tactical portfolios declined by 1.5% to end the year at

GBP2.203M. We have seen a compression of public company valuations

which we believe is due to higher interest rates, increased

inflation, and commodity price movements largely below the rate of

inflation. As we advance through the mining cycle, we believe the

tactical portfolio should grow more quickly than the strategic

portfolio, as we monetise some of our strategic investments and

convert them into either cash or tactical investments. The tactical

portfolio now comprises 22 distinct investments of our total

portfolio of 29 investments.

STRATEGIC PORTFOLIO As a percentage of Total Investments:

69.1%

Our Strategic Portfolio are longer term holdings, that we

strongly believe will outperform given sufficient time and capital.

We believe we made these "Strategic" investments at the bottom of

the cycle. These investments were in out-of-favour assets that we

considered had high potential but were, we acknowledge, higher risk

and less liquid. We believe our competitive advantage was that we

were capable and willing to invest when others would, or could, not

invest in what we believe are good geologic assets. We believe that

the best return to risk ratio is to invest in good assets when

these are out of favour. Our Strategic Portfolio now totals

GBP6.097M and represents 67% of our Net Investable funds. The

Strategic Portfolio was up 23.3% yr./yr. in FY 2023 and has grown

by 41.9% compounded annually since 2017. The next phase of our

strategy is to gradually "harvest" these investments when and where

it makes sense and redeploy these funds into more liquid

investments that are out of favour but have strong long term

investment merits. The following are some of the most noteworthy

holdings in our Strategic Portfolio. All values are as of June 30,

2023

Redcorp Empreedimentos Mineiros Lda.: As a percentage of Total

Investments: 24.4%

Redcorp is a Portuguese company whose main asset is 85%

ownership of the Lagoa Salgada project. Our investment in Redcorp,

held through our subsidiary, represents 19.2% of our investment

portfolios. In 2018 our subsidiary entered into a sale and earn-in

option agreement with a Canadian listed company, Ascendant

Resources ("Ascendant"). Ascendant has met all its financial and

operational obligations to date. The Board consider that they have

been good partners, running the exploration program for which, we

are appreciative. On 25 May 2022, Ascendant increased its ownership

of Redcorp to 50% by completing US$9,000,000 of exploration work on

the project and making a US$1.0M payment to M&FI's subsidiary

(in accordance with the terms of the agreement between the

parties). Ascendant has now earned 80% of the overall project by

making a final US$2.5M payment to M&FI in June 2023 and

completing a Definitive Feasibility Study post year end in July

2023.

The project has advanced from an initial resource of

approximately 4.4Mt with Zinc Equivalent grade of 6.0% in 2015 to a

resource totalling 27.5Mt with a 7.5% Zinc Equivalent grade today.

On November 8, 2021 Redcorp and Ascendant announced that they have

secured a mine development licence from the Portuguese government.

As announced on 26 July 2023 Redcorp and Ascendant completed a

Feasibility Study after our year end indicating that the Lagoa

Salgada Project has, based on 100% ownership, a pre-tax NPV(@8%) of

US$188.8.M resulting in a pre-tax IRR of 47% with a 2-year pre-tax

payback based on its planned 14-year life of mine. After tax

NPV(@8%) is US$147.1M with a 39% IRR and should generate a Life of

Mine Cash Flow of US$261M.

In November 2022 Ascendant entered into a streaming agreement to

fund the completion of the feasibility study for Redcorp's Lagoa

Salgada project and for general corporate and working capital

purposes. In connection with this agreement M&FI and Ascendant

amended the terms of their shareholders agreement in respect of

Redcorp on November 28, 2022. It was agreed that M&FI should

have the right and option, but not the obligation, to exercise an

option within 6 months (plus 10 business days) of the Stage Two

Option Exercise Date (being the date when Ascendant has earned 80%

of Redcorp and being no later than 22 June 2023) to require

Ascendant to purchase all, but not less than all, of the shares in

Redcorp at a defined price. The price would be an amount in US

dollars, payable in cash, equal to 5% of the post-tax net present

value of the Project provided in the feasibility study completed

prior to the date of exercise using a 10.5% discount rate (the "Put

Option"). On 23 June 2023 M&FI and Ascendant announced that

they had agreed to an extension to the final delivery date of the

feasibility study, pursuant to the Earn-in Option Agreement for the

Lagoa Salgada project. As a result of the extension, the final

delivery date of the feasibility study would be on or before 3

August 2023. In consideration for the extension, Ascendant agreed

to grant M&FI 500,000 common share purchase warrants. Each

Warrant is exercisable into one common share in Ascendant at any

time for a period of 30 months at a price of $0.20 per share. On 26

July 2023 (after the M&FI's year end) Ascendant announced the

results of the feasibility study and with its completion Ascendant

completed the option earn-in requirements to move its ownership of

Redcorp to 80%.

FINANCIAL STATEMENTS

Consolidated Income Statement

Year ended Year ended

30 June 30 June 2022

2023

Notes GBP'000 GBP'000

------------------------------------------ ------ ----------- --------------

Investment income 119 128

Fee revenue - -

Net gains on disposal of investments 2,108 861

Net change in fair value of investments 167 308

2,394 1,297

Operating expenses 3 (452) (439)

Share based payment expense (136) (92)

Other gains and losses 5 (230) 133

----------------------------------------- ------ ----------- --------------

Profit before taxation 1,576 899

Taxation expense 6 (26) -

Profit for the year from continuing

operations and total comprehensive

income, attributable to owners of

the Company 1,550 899

Profit per share attributable to owners

of the Company during the year from 7 Pence Pence

continuing and total operations:

Basic (pence per share) 4.4 2.5

Fully diluted (pence per share) 4.0 2.5

Consolidated Statement of Financial Position

2023 2022

Notes GBP'000 GBP'000

------------------------------------- ------ --------- ---------

CURRENT ASSETS

Financial assets held at fair value

through profit or loss 8 8,925 7,183

Trade and other receivables 10 25 18

Cash and cash equivalents 796 481

------------------------------------- ------ --------- ---------

9,746 7,682

------------------------------------- ------ --------- ---------

CURRENT LIABILITIES

Trade and other payables 11 194 125

Convertible unsecured loan notes 12 10 10

------------------------------------- ------ --------- ---------

204 135

------------------------------------- ------ --------- ---------

NET CURRENT ASSETS 9,542 7,547

------------------------------------- ------ --------- ---------

NON-CURRENT LIABILITIES

Deferred tax provision 13 (119) (93)

NET ASSETS 9,423 7,454

------------------------------------- ------ --------- ---------

EQUITY

Share capital 15 3,114 3,099

Share premium 15 6,182 5,914

Loan note equity reserve 16 6 6

Reserve for employee share schemes 17 228 92

Capital reserve 15,736 15,736

Retained earnings (15,843) (17,393)

------------------------------------- ------ --------- ---------

Equity attributable to owners of

the Company and total equity 9,423 7,454

------------------------------------- ------ --------- ---------

Consolidated Statement of Changes in Equity

Reserve for

Share Share employee Loan note Capital Accumulated Total

capital premium share schemes reserve reserve losses equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- -------- -------- -------------- --------- -------- ----------- -------

At 1 July 2021 3,096 5,892 23 6 15,736 (18,315) 6,438

Total comprehensive

income for the

year - - - - - 899 899

-------------------- -------- -------- -------------- --------- -------- ----------- -------

Share based payment

expense - - 92 - - - 92

Exercise of options 3 22 (23) - - 23 25

At 30 June 2022 3,099 5,914 92 6 15,736 (17, 393) 7,454

-------------------- -------- -------- -------------- --------- -------- ----------- -------

Total comprehensive

income for the

year - - - - - 1,550 1,550

-------------------- -------- -------- -------------- --------- -------- ----------- -------

Share based payment

expense - - 136 - - - 136

Issues of equity 15 268 - - - - 283

At 30 June 2023 3,114 6,182 228 6 15,736 (15,843) 9,423

-------------------- -------- -------- -------------- --------- -------- ----------- -------

Consolidated Statement of Cash Flows

Year ended Year ended

30 June 2023 30 June 2022

Notes GBP'000 GBP'000

-------------------------------------------- ------- -------------- --------------

OPERATING ACTIVITIES

Profit before taxation 1,576 899

Adjustments for:

Profit on disposal of trading investments (2,108) (861)

Fair value loss/(gain) on trading

investments (167) (308)

Investment income (119) (128)

Share based payment expense 136 92

Operating cash flow before working

capital changes (682) (306)

(Increase)/decrease in trade and other

receivables (7) 9

Increase/(decrease) in trade and other

payables 69 (52)

----------------------------------------------------- -------------- --------------

Net cash outflow from operating activities (620) (348)

----------------------------------------------------- -------------- --------------

INVESTING ACTIVITIES

Purchase of financial assets (3,783) (2,177)

Disposal of financial assets 4,396 2,098

Investment income 39 29

----------------------------------------------------- -------------- --------------

Net cash (outflow)/inflow from investing

activities 652 (50)

----------------------------------------------------- -------------- --------------

FINANCING ACTIVITIES

Proceeds of share issues 282 25

Net cash inflow from financing activities 282 25

----------------------------------------------------- -------------- --------------

Net (decrease)/increase in cash and

cash equivalents 315 (374)

Cash and cash equivalents as at 1

July 481 855

C ash and cash equivalents as at 30

June 796 481

----------------------------------------------------- -------------- --------------

Notes to the Financial Statements

1. Operating Profit

2023 2022

GBP'000 GBP'000

-------------------------------------------- -------- --------

Profit from operations is arrived at after

charging:

Directors fees 105 105

Other salary costs 23 20

Share based payment expense 136 92

Registrars fees 36 31

Corporate adviser and broking fees 37 39

Other professional fees 197 180

Foreign exchange differences 230 (133)

Other administrative expenses 34 44

Fees payable to the Group's auditor:

For the audit of the Group's consolidated

financial statements 20 20

-------------------------------------------- -------- --------

818 398

-------------------------------------------- -------- --------

2. Other Gains and Losses

2023 2022

GBP'000 GBP'000

--------------------------------------- --------- ---------

Foreign currency exchange differences (230) 133

--------------------------------------- --------- ---------

(230) 133

--------------------------------------- --------- ---------

3. Income Tax Expenses

2023 2022

GBP'000 GBP'000

-------------------------------------------------------- -------- -------

Deferred tax charge relating to unrealised gains

on investments 26 -

Other tax payable - -

-------------------------------------------------------- -------- -------

26 -

-------------------------------------------------------- -------- -------

The tax on the Group's profit before tax differs from the theoretical

amount that would arise using the weighted average rate applicable

to the results of the Consolidated entities as follows:

2023 2022

GBP'000 GBP'000

-------------------------------------------------------- -------- -------

Profit before tax from continuing operations 1,576 899

-------------------------------------------------------- -------- -------

Profit before tax multiplied by rate of federal

and cantonal tax in Switzerland of 14.6% (2021:

14.6%) 230 131

Less abatement in respect of long term investment

holdings (207) (118)

Unrelieved tax losses - -

Overprovided in previous period 3 (13)

Total tax 26 -

-------------------------------------------------------- -------- -------

4. Earnings Per Share

The basic and diluted earnings per share are calculated by dividing

the profit attributable to owners of the Company by the weighted

average number of ordinary shares in issue during the year.

2023 2022

GBP'000 GBP'000

----------------------------------------------- ----------- -----------

Profit attributable to owners of the Company

- Continuing and total operations 1,550 899

------------------------------------------------ ----------- -----------

2023 2022

----------------------------------------------- ----------- -----------

Weighted average number of shares for

calculating basic earnings per share 35,611,416 35,271,011

Weighted average number of shares for

calculating fully diluted earnings per

share 38,511,416 35,271,011

------------------------------------------------ ----------- -----------

Earnings per share from continuing and

total operations

- Basic (pence per share) 4.4 2.5

- Fully diluted (pence per share) 4.0 2.5

------------------------------------------------ ----------- -----------

5. Investments Held at Fair Value Through Profit or Loss

2023 2022

GBP'000 GBP'000

--------------------------------------------------- ----------- -----------

1 July - Investments at fair value 7,183 5,822

Cost of investment purchases 3,783 2,177

Proceeds of investment disposals (4,396) (2,098)

Profit on disposal of investments 2,108 861

Fair value adjustment 167 308

Accrued interest on loan notes 80 113

--------------------------------------------------- ----------- -----------

30 June - Investments at fair value 8,925 7,183

--------------------------------------------------- ----------- -----------

Categorised as:

Level 1 - Quoted investments 3,835 2,237

Level 3 - Unquoted investments 5,090 4,946

--------------------------------------------------- ----------- -----------

8,925 7,183

--------------------------------------------------- ----------- -----------

The Group has adopted fair value measurements using the IFRS 7

fair value hierarchy

Categorisation within the hierarchy has been determined on the

basis of the lowest level of input that is significant to the fair

value measurement of the relevant asset as follows:

Level 1 - valued using quoted prices in active markets for identical

assets

Level 2 - valued by reference to valuation techniques using observable

inputs other than quoted prices included in Level 1.

Level 3 - valued by reference to valuation techniques using inputs

that are not based on observable market criteria.

LEVEL 3 investments

Reconciliation of Level 3 fair value measurement of investments

2023 2022

GBP'000 GBP'000

--------------------------------------------------- ----------- -----------

Brought forward 4,946 4,110

Purchases 307 152

Proceeds of investment disposals (238) -

Profit on disposal of investments 90 -

Fair value adjustment (639) 684

--------------------------------------------------- ----------- -----------

Carried forward 4,466 4,946

--------------------------------------------------- ----------- -----------

Level 3, unquoted investments are valued on the basis of the last

fund raise, except for Redcorp where the value has been based on

the net present value of the cash flows from the project.

The Group's largest Level 3 investment is Redcorp Empreendimentos

Mineiros LDA ("Redcorp").

REDCORP EMPREIMENTOS MINEIROS LDA

Redcorp is a Portuguese exploration development and mining company

whose main asset is the Polymetallic) Lagoa Salgada Volcanogenic

Massive Sulphide (VMS) Project, which has resources of zinc, lead,

copper, gold, silver, tin and indium.

In June 2018, TH Crestgate entered into an agreement with Ascendant

Resources Inc ("Ascendant") under which Ascendant initially acquired

25% of the equity in Redcorp for a consideration of US$2.45 million,

composed of US$1.65 million in Ascendant shares and US$800,000

in cash.

The second part of the Agreement was an Earn-in Option under which

Ascendant had the right to earn a further effective 25% interest

via staged payments amounting to US$3.5 million. In addition Ascendant

was required to spend a minimum of US$9.0 million directly on the

Lagoa Salgada Project within 48 months of the closing date, to

fund exploration drilling, metallurgical test work, economic studies

and other customary activities for exploration and development.

Under the last part of the agreement Ascendant was able to acquire

an additional 30% taking its total interest to 80% by the payment

of US$2,500,000 on or before 22 Dec 2022 This date was amended

so that the cash payment had to be received on/or before 22 June

2023. In addition a feasibility study was to be delivered by 22

August 2023.

To date the payments due from Ascendant under the agreement have

all been fulfilled. The Group's investment in Redcorp has been

valued on a discounted cash flow basis using a 20% discount rate

from the from the Feasibility Study completed in July 2023. As

at 30 June 2023, Mineral and Financial Investments AG owned 50%

of Redcorp (2022: 50%).

Redcorp currently owns 85% of the Lagoa Salgada project. M&F agreed

in June 2017 with Empresa Desenvolvimento Mineiro SA (EDM), a Portuguese

State-owned company, to re-acquire EDM's 15% rights on the project

resulting in Redcorp holding a 100% ownership of the project. The

2017 agreement was subject to the Portuguese Secretary of State's

approval which was not received. Redcorp and M&F continue to explore

ways and means to complete the purchase. EDM's right is an option,

if exercised, to receive a 15% working interest ("WI") in the Lagoa

Salgada Project ("LSP"). This 15% WI is subject to a Right of First

Refusal ("ROFR") if EDM exercises the Option and choses to sell

its interest. The WI is subject to standard dilution features if

financial obligations are unsatisfied. This option expires 120

days after the delivery of a Feasibility Study. M&F has granted

Ascendant conditional options that would, if exercised, result

in Ascendant owning (net) 80% interest in the Project if M&F is

unsuccessful in re-acquiring EDM's rights/interest. Within 6 months

& 10 days after the delivery of the Feasibility Study. If EDM opt

to not exercise its Option, M&F would retain its 20% Carried Interest

and the adjusting call options held by Ascendant would be nullified.

If EDM exercises its option to the 15% WI then M&F would retain

a (net) 5% CI. M&F has the right to sell its (net) 5% CI to Ascendant

at a price representing M&F's 5% share of the NPV of the LSP as

estimated in the Feasibility Study (using a 10.5% Discount Rate).

We currently estimate that this value would be significantly higher

than the year end value.

6. Subsidiary companies

The Group's subsidiary companies are as follows:

Proportion of ownership

Country of incorporation interest and voting

Principal and principal rights

Name activity place of business held by the Group

Mineral & Financial

Investments AG Investment Steinengraben 18 100%

company 4051 Basel, Switzerland

5 Bath Road, London,

M&FI Services United Kingdom,

Ltd Service company W4 1LL 100%

All intergroup transactions and balances are eliminated on

consolidation.

7. Trade and other receivables

2023 2022

GBP'000 GBP'000

------------------------------------ --------------- ---------------

Other receivables 10 12

Prepayments 15 6

Total 25 18

The fair value of trade and other receivables is considered

by the Directors not to be materially different to the carrying

amounts.

At the balance sheet date in 2023 and 2022 there were no trade

and other receivables past due

1

8. Trade and other payables

2023 2022

GBP'000 GBP'000

----------------------------------- ----------------- ----------------

Trade payables 12 50

Other payables 114 21

Accrued charges 68 54

Total 194 125

The fair value of trade and other payables is considered by

the Directors not to be materially different to carrying amounts.

9. Convertible unsecured loan notes

The outstanding convertible loan notes are zero coupon, unsecured

and unless previously purchased or converted they are redeemable

at their principal amount at any time on or after 31 December

2014.

The net proceeds from the issue of the loan notes have been

split between the liability element and an equity component,

representing the fair value of the embedded option to convert

the liability into equity of the Company as follows:

2023 2022

GBP'000 GBP'000

------------------------------------------------- --------- ---------

Liability component at beginning and end

of period 10 10

------------------------------------------------- --------- ---------

The Directors estimate the fair value of the liability component

of the loan notes at 30 June 2023 to be approximately GBP10,000

(2022: GBP10,000)

10. Deferred taxation provision

2023 2022

GBP'000 GBP'000

---------------------------------------- -------- --------

As at 1 July 93 93

Provision relating to unrealised gains

on investments 26 -

---------------------------------------- -------- --------

As at 30 June 119 93

---------------------------------------- -------- --------

11. Employee share schemes

SHARE OPTIONS

On 10 June 2022 the Company granted 2,350,000 options to directors,

advisers and consultants, exercisable at 13.5p per share, representing

a 15% premium to the closing mid-market price on 9 June 2022. The

options vest in three tranches, one third on the date of grant,

one third on the anniversary of the date of grant, and one third

on the second anniversary of the date of grant. The options can

be exercised at any time from the date of vesting for a period of

5 years whilst the recipient is employed or engaged by the Company.

The fair value of the options granted during the year was determined

using the Black-Scholes pricing model. The significant inputs to

the model in respect of the options were as follows:

Date of grant 10 June 2022

Share price at date

of grant 11.75p

Exercise price per

share 13.50p

No. of options 2,350,000

Risk free rate 1.0%

Expected volatility 50%

Life of option 5 years

Calculated fair value

per share 4.6797p

The share-based payment charge for the year was GBP52,000 (2022:

GBP41,000).

The share options movements and their weighted average exercise

price are as follows:

2023 2022

Weighted average Weighted average

exercise price exercise price

Number (pence) Number (pence)

---------------------- --------- ---------------- --------- ----------------

Outstanding at 1 July 2,350,000 13.50 330,000 7.50

Granted - - 2,350,000 13.50

Exercised - - (330,000) 7.50

Lapsed - - - -

Outstanding at 30

June 2,350,000 13.50 2,350,000 13.50

---------------------- --------- ---------------- --------- ----------------

RESTRICTED SHARE UNITS ("RSUs")

On 10 June 2022 the Company granted 1,150,000 RSUs to directors.

The RSUs vest in three tranches, one third on the date of grant,

one third on the anniversary of the date of grant, and one third

on the second anniversary of the date of grant. They can be exercised

at any time from the date of vesting for a period of 5 years whilst

the recipient is employed or engaged by the Company, with a reference

price of 11.75p being the closing mid-market price on 9 June 2022.

The fair value of the RSUs granted during the year was determined

to be the reference price of 11.75p per share, and the share-based

payment charge for the year in respect of the RSUs was GBP84,000

(2022: GBP51,000).

The RSU movements and their weighted average reference price are

as follows:

2023 2022

Weighted average Weighted average

Reference price Reference price

Number (pence) Number (pence)

----------------- ---------- ------------------ --------- -----------------

Outstanding at

1 July 1,150,000 11.75 - -

Granted - - 1,150,000 11.75

Exercised - - - -

Lapsed - - - -

Outstanding at

30 June 1,150,000 11.75 1,150,000 11.75

----------------- ---------- ------------------ --------- -----------------

12. Share capital

Number of Nominal Share

shares Value premium

GBP'000 GBP'000

------------------------------------ ------------ -------- ---------

AUTHORISED

At 30 June 2022 and 30 June 2023

Ordinary shares of 1p each 160,000,000 1,600

Deferred shares of 24p each 35,000,000 8,400

------------------------------------ ------------ -------- ---------

10,000

------------------------------------ ------------ -------- ---------

ISSUED AND FULLY PAID

At 30 June 2022

Ordinary shares of 1p each 35,465,395 354

Deferred shares of 24p each 11,435,062 2,745

------------------------------------ ------------ -------- ---------

3,099 5,914

Ordinary shares issued in year

to 30 June 2023 1,440,476 15 268

------------------------------------ ------------ -------- ---------

At 30 June 2023

Ordinary shares of 1p each 36,905,871 369

Deferred shares of 24p each 11,435,062 2,745

------------------------------------ ------------ -------- ---------

3,114 6,182

------------------------------------ ------------ -------- ---------

The ordinary shares carry no rights to fixed income but entitle

the holders to participate in dividends and vote at Annual

and General meetings of the Company.

The restricted rights of the deferred shares are such that

they have no economic value.

13. Loan note equity reserve

2023 2022

GBP'000 GBP'000

-------------------------------------------- -------- --------

Equity component of convertible loan notes

at 1 July 6 6

Equity component of convertible loan notes

at 30 June 6 6

-------------------------------------------- -------- --------

14. Reserve for employee share schemes

2023 2022

GBP'000 GBP'000

------------------------------------------- -------- --------

Brought forward at 1 July 92 23

Transfer to retained earnings on exercise

of options - (23)

Share based payment charge 136 92

------------------------------------------- -------- --------

Carried forward at 30 June 228 92

------------------------------------------- -------- --------

15. Risk management objectives and policies

The Company is exposed to a variety of financial risks which

result from both its operating and investing activities. The

Company's risk management is coordinated by the board of directors

and focuses on actively securing the Company's short to medium

term cash flows by minimising the exposure to financial markets.

MARKET PRICE RISK

The Company's exposure to market price risk mainly arises from

potential movements in the fair value of its investments. The

Company manages this price risk within its long-term investment

strategy to manage a diversified exposure to the market. If

each of the Company's equity investments were to experience

a rise or fall of 10% in their fair value, this would result

in the Company's net asset value and statement of comprehensive

income increasing or decreasing by GBP893,000 (2022: GBP718,000).

FOREIGN CURRENCY RISK

The Group holds investments and cash balances denominated in

foreign currencies and investments quoted on overseas exchanges;

consequently, exposures to exchange rate fluctuations arise.

The Group does not hedge its foreign currency exposure and its

liabilities in foreign currencies are limited to the trade payables

of Mineral & Financial Investments AG which are not material.

The carrying amounts of the Group's foreign currency denominated

monetary assets at the reporting date are as follows:

2023 2022

GBP'000 GBP'000

----------------------------------------------------- ---------- ----------

US Dollar 5,740 5,913

Canadian Dollar 3,142 1,402

Swiss franc 201 28

Euro 115 -

Australian Dollar - 208

FOREIGN CURRENCY SENSITIVITY ANALYSIS

The Group is mainly exposed to the US Dollar and the Canadian

Dollar in respect of investments which are either denominated

in or valued in terms of those currencies. The following table

details the Group's sensitivity to a 5 per cent increase and

decrease in pounds sterling against the US Dollar, Canadian

Dollar and Swiss franc. The Group's exposure to the Australian

Dollar and the Euro are not considered material.

2023 2022

GBP'000 GBP'000

----------------------------------------------------- ---------- ----------

5% increase in exchange rate

US Dollar against GBP 287 296

5% decrease in exchange rate

against GBP (287) (296)

Canadian 5% increase in exchange rate

Dollar against GBP 157 70

5% decrease in exchange rate

against GBP (157) (70)

Swiss 5% increase in exchange rate

franc against GBP 10 1

5% decrease in exchange rate

against GBP (10) (1)

Euro 5% increase in exchange rate 6 -

against GBP

5% decrease in exchange rate (6) -

against GBP

Australian 5% increase in exchange rate

Dollar against GBP - 10

5% decrease in exchange rate

against GBP - (10)

---------------------------------------------------- ---------- ----------

CREDIT RISK

The Company's financial instruments, which are exposed to credit

risk, are considered to be mainly cash and cash equivalents

and the Company's receivables are not material. The credit risk

for cash and cash equivalents is not considered material since

the counterparties are reputable banks.

The Company's exposure to credit risk is limited to the carrying

amount of the financial assets recognised at the balance sheet

date, as summarised below:

15. Risk management and objectives

2023 2022

GBP'000 GBP'000

--------------------------------------------- --------------- --------------

Cash and cash equivalents 796 481

Other receivables 10 12

--------------------------------------------- --------------- --------------

806 493

--------------------------------------------- --------------- --------------

No impairment provision was required against other receivables

which are not past due.

LIQUIDITY RISK

Liquidity risk is managed by means of ensuring sufficient cash

and cash equivalents are held to meet the Company's payment obligations

arising from administrative expenses.

CAPITAL RISK MANAGEMENT

The Company's objectives when managing capital are:

* to safeguard the Company's ability to continue as a

going concern, so that it continues to provide

returns and benefits for shareholders;

* to support the Company's growth; and

* to provide capital for the purpose of strengthening

the Company's risk management capability.

The Company actively and regularly reviews and manages its capital

structure to ensure an optimal capital structure and equity holder

returns, taking into consideration the future capital requirements

of the Company and capital efficiency, prevailing and projected

profitability, projected operating cash flows, projected capital

expenditures and projected strategic investment opportunities.

Management regards total equity as capital and reserves, for capital

management purposes.

16. Financial instruments

FINANCIAL ASSETS BY CATEGORY

The IFRS 9 categories of financial assets included in the balance

sheet and the headings in which they are included are as follows:

2023 2022

GBP'000 GBP'000

-------------------------------------------------- ----------- ----------

Financial assets:

Cash and cash equivalents 796 481

Loans and receivables 10 12

Investments held at fair value

through profit and loss 8,925 7,183

9,731 7,675

-------------------------------------------------- ----------- ----------

FINANCIAL LIABILITIES BY CATEGORY

The IFRS 9 categories of financial liability included in the balance

sheet and the headings in which they are included are as follows:

2023 2022

GBP'000 GBP'000

-------------------------------------------------- ----------- ----------

Financial liabilities at amortised

cost:

Convertible unsecured loan notes 10 10

Trade and other payables 126 71

--------------------------------------------------- ----------- ----------

136 81

-------------------------------------------------- ----------- ----------

17. Contingent liabilities and capital commitments

There were no contingent liabilities or capital commitments

at 30 June 2023 or 30 June 2022.

18. Post year end events

On 26 July 2023 the Company announced that Ascendant had completed

the feasibility study for the Lagoa Salgada project and thus

had completed its earn in to 80% of Redcorp.

19. Related party transactions

Key management personnel, as defined by IAS 24 'Related Party

Disclosures' have been identified as the Board of Directors,

as the controls operated by the Group ensure that all key decisions

are reserved for the Board of Directors. Details of the directors'

remuneration and the options and RSUs granted to directors are

disclosed in the remuneration report.

20. Ultimate controlling party

The Directors do not consider there to be a single ultimate

controlling party.

FOR MORE INFORMATION:

Jacques Vaillancourt, Mineral & Financial Investments Ltd. +44 780 226 8247

Katy Mitchell and Sarah Mather , WH Ireland Limited +44 207 220 1666

Jon Belliss, Novum Securities Limited +44 207 382 8300

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 (MAR) as in force in

the United Kingdom pursuant to the European Union (Withdrawal) Act

2018. Upon the publication of this announcement via Regulatory

Information Service (RIS), this inside information is now

considered to be in the public domain.

[1] International Monetary Fund, "World Economic Outlook:

Recovery - Navigating Global Divergences" - October, 2023

[2] International Monetary Fund / Monthly / 2016 = 100 / Not

seasonally adjusted

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKKBBOBDDBBB

(END) Dow Jones Newswires

December 20, 2023 12:25 ET (17:25 GMT)

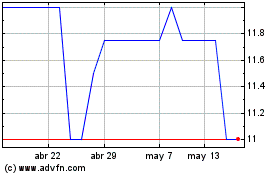

Mineral & Financial Inve... (LSE:MAFL)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Mineral & Financial Inve... (LSE:MAFL)

Gráfica de Acción Histórica

De May 2023 a May 2024