TIDMMIN

RNS Number : 8523X

Minoan Group PLC

28 April 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulation (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain

28 April 2023

Minoan Group Plc

("Minoan", the "Group" or the "Company")

Results Announcement

Minoan Group Plc announces its results for the year ended 31

October 2022

Project highlights

-- Substantial financial returns whether on existing basis or amended contract.

-- New Project Masterplan and revised Business Plans.

-- Additional senior management and experienced international real estate consultants.

-- NDAs signed with first hotel group and financial partners.

-- Key milestones and timeline now clear.

Financial highlights

-- Loss before taxation of GBP1,065,000 (2020/21: GBP749,000)

due to increased loan interest charges.

-- Operating costs slightly increased to GBP541,000 (2020/21: GBP511,000).

-- Net assets increased to GBP42,689,000 (2020/21: GBP42,406,000).

George Mergos, Chairman of Loyalward Limited, said

" The period under review has seen the vision for the Project

crystallise, following significant effort to create a clear route

forward so that Shareholders are able to have a much better idea of

the very substantial value that is being established within the

Group. "

Christopher Egleton, Chairman of Minoan, said:

"The Company is now able to move forward with more certainty and

we will continue our discussions with the Foundation while focusing

on the Project commercialisation."

Minoan Group Plc's Report and Financial Statements for the year

ended 31 October 2022 can be viewed on the Company's website with

effect from 28 April 2023. A copy of the Report and Financial

statements is also being posted to shareholders today.

For further information visit www.minoangroup.com or

contact:

Minoan Group Plc

Christopher Egleton christopher.egleton@minoangroup.com

George Mergos georgios.mergos@minoangroup.com

W H Ireland Limited 020 7220 1666

Antonio Bossi / Enzo Aliaj

Peterhouse Capital Limited 020 7469 0930

Duncan Vasey

Chairman's Statement

Introduction

During the year under review, which commenced in November 2021,

as well as subsequently, your Company has been active in

progressing the Itanos Gaia Project in Crete (the "Project"). In

the period we completed the new Project Masterplan, revised

Business Plans, made additions to the senior management team and

appointed further experienced international consultants.

The continuing constructive discussions with the Public Welfare

Ecclesiastical Foundation Panagia Akrotiriani (the "Foundation")

are not impeding progress on the Project itself, as we are moving

forward based on the existing contractual documentation. On this

basis, Shareholders will be able to see from the report of George

Mergos, Chairman of Loyalward, that the key numbers relating to the

Project are very strong.

Financial Review

Operating costs for the year slightly increased to GBP541,000

compared to GBP511,000 for the year to 31 October 2022. The loss

before taxation for the year was GBP1,065,000 compared to

GBP749,000 recorded for the year to 31 October 2021 due to

increased loan interest charges .

The Company's net assets at 31 October 2022 increased to

GBP42,689,000 from GBP42,406,000. Capitalised project costs, being

costs associated with acquiring and developing the site in Crete,

planning and other design costs, increased by GBP600,000 to

GBP47,358,000.

Terms for the renewal of the DAGG loan have been received and

subject to finalising final details, the Company expects to enter

into a new agreement with DAGG in the next few days. A further

announcement will be made in due course.

The Project and Greece

The good progress, as reported in the Statement of the Chairman

of Loyalward Limited, which follows this report has enabled the

management team to move forward with certainty and to undertake and

later complete the Commercial and other negotiations that have been

in progress for some time as evidenced by the signing of the first

of a number of Non Disclosure Agreements with various interested

parties. The Commercialisation of the Project for the benefit of

shareholders is now the main focus.

During the year Savills, the Global Real Estate Advisors using

both their British and Greek teams, were appointed to work

alongside the Company's Project Team and Deloitte Financial

Consultants to review the real estate portion of the resorts at the

Project and to ensure it is positioned correctly in the

international market. The political and economic situation in

Greece has remained stable during the period under review although

a general election has been called for next month.

It is important to see Greece and the Project in the context of

the Greek and International markets, where the market for top end

resorts and villas remain buoyant with room rates having increased

significantly above inflation. Further, there are various incentive

and loan packages that are being offered by the Greek Government

combined with the EU. We will be writing to shareholders on these

and other financial matters as they affect the Project going

forward.

Boards and Management

As previously noted, during the year under review the Board

welcomed George Mergos to the board of Minoan Group Plc and as

Chairman of Loyalward Limited, the Group's wholly owned subsidiary

and owner of the Project. In October we announced the team had been

further strengthened with the appointment of Marco Nijhof to work

alongside George. Marco has extensive board level experience within

the international five-star luxury hotel and retail hospitality

industry, developing, commercialising and operating world class

tourism and other businesses.

We expect to make further appointments to both the Management

and advisory teams as we progress.

Chairman's Statement (continued)

Outlook

I am pleased that the Company is able to move forward with more

certainty. We will continue our discussions with the Foundation and

will be focusing on the Project and its commercialisation. In this

context both George Mergos and I expect to be able to report

further progress shortly.

Christopher W Egleton

Chairman

28 April 2023

Statement of the Chairman of Loyalward Limited, the Project

Owner

As Shareholders are aware I joined the Boards of Loyalward and

Minoan something over a year ago. My aims were to help ensure that

the Masterplan, the Business Plan, and the discussions with the

Public Welfare Ecclesiastical Foundation Panagia Akrotiriani (the

"Foundation") were on a stable base and, in the case of the

Foundation, in a position to move forward. I am pleased to be able

to confirm that, as reported previously, those objectives have been

achieved with the Masterplan and Business Plan having been

submitted to the Foundation. In parallel, discussions with the

Foundation are progressing well and are continuing both with their

advisors as well as the Bishop of Irapetra and Sitia as Chairman of

the Foundation with a view to achieving the optimum solution for

both parties.

The discussions with the Foundation and its advisors cover the

key legal, technical and economic aspects of the Project and have

confirmed that the new law on Epifania (the equivalent of a ground

lease in English law) best serves the interests of both parties.

The current Project design relates to Complex Resorts and may be

realised on the basis of the existing legal title documentation as

well as on the basis of an amended contract with Epifania (the

equivalent of a ground lease in English law) . Shareholders will be

pleased to learn that in both cases the Project produces very

substantial returns to all parties and we can only expect them to

improve further in the future.

All of those involved in the discussions have continually

reiterated their wish to see the vision for the Itanos Gaia Project

in Crete (the "Project") realised on the ground. In this context,

in order to avoid or reduce any further unnecessary delays in

delivery, the Company is progressing all the elements of the

Project including the preparation of additional detailed Studies

necessary for the Environmental Assessment ("EA") to ensure that

everything remains in line with the Environmental rules set out in

the Presidential Decree. We expect to lodge the EA later this year.

In the meantime, we are now able to deal with the other elements of

the Project from a position of certainty which, in turn, means that

we can enter into the commercial and financing arrangements

necessary for implementation.

The EA (together with the Masterplan upon which it is based) is

the underlying document which encapsulates the vision for the

Project as it moves forward. This vision is, in part, to create one

of the most environmentally friendly resorts in the Mediterranean,

set in an unrivalled location, famed in mythology as the place

where Europa was born and where the Greek Gods went to celebrate

their victories and regenerate their spirits, whilst at the same

time allowing guests the sort of experience that is today expected

of top end resorts.

The Project will be a very high quality hotel and villa tourism

Project set in 25 square kilometres of the Cavo Sidero Peninsula in

Eastern Crete, with 28 kilometres of coastline and permitted build

space of 108,000 square metres. Current plans include four luxury

hotel and villa complexes, three of which are adjacent to the

coastline in spectacular locations with the fourth being set within

the golf area in the centre of the site. All hotel rooms and villas

will have a view of the Mediterranean and will, for the most part,

provide privacy not usually available in such locations.

The key milestones and timeline that we expect are as

follows:

Hotel Letters of Intent: 2023

Environmental Permitting: 2023/24

Financial Partnerships and Project Finance Agreements:

2023/24

Building Permits: 2024/25

Commencement of Construction: 2025

Commencement of first Hotel Operations: 2026

Overall construction period: 5-7 years.

Statement of the Chairman of Loyalward Limited, the Project

Owner

(continued)

Based on the timeline above and the Business Plan(s) prepared

with Deloitte the key numbers are:

Turnover at maturity (excluding villa disposals): EUR160m

Expected Gross Operating Profit: in excess of 30%

Equity IRR: in excess of 20%.

Whilst these figures are themselves extremely good, they are not

set in stone and we believe they will be seen to be conservative as

the Project moves forward.

Management and Advisors

Shareholders will be aware that we have improved the Project's

management team by the addition of Marco Nijhof to the Board of

Loyalward and have appointed Savills to advise on the real estate

components. We are also in the process of recruiting other members

of both the advisory and management teams about which we will

inform you in the next few months.

Conclusion

The period under review has seen the vision for the Project

crystallise, allowed the results of the heavy workload to create a

clear route forward so that Shareholders are able to have a much

better idea of the very substantial value that is being established

within the Group. I expect to be able to inform Shareholders of

real progress in respect of both Hospitality and Financial

partnerships in the near future.

George Mergos

Chairman, Loyalward Limited

28 April 2023

Consolidated Statement of Comprehensive Income

Year ended 31 October 2022

2022 2021

GBP'000 GBP'000

--------------------------- ---------------------------

Revenue - -

Cost of sales - -

Gross profit - -

--------------------------- ---------------------------

- -

Operating expenses (541) (511)

Other operating expenses:

Corporate development costs - -

Operating loss (541) (511)

Finance costs (524) (238)

Loss before taxation (1,065) (749)

Taxation - -

--------------------------- ---------------------------

Loss after taxation (1,065) (749)

Other Comprehensive income for - -

the year

--------------------------- ---------------------------

Total Comprehensive income for

the year (1,065) (749)

Loss for year attributable to

equity holders of the Company (1,065) (749)

Loss per share attributable

to equity holders of

the Company: Basic and diluted (0.16)p (0.14)p

--------------------------- ---------------------------

Consolidated Statement of Changes in Equity

Year ended 31 October 2022

Year ended 31 October 2022

Share Share Merger Warrant Retained Total

capital premium reserve Reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- -------- --------- -------- ------------ ----------------- ----------------------

Balance at 1 November

2021 19,021 36,583 9,349 2,571 (25,118) 42,406

Loss for the year - - - - (1,065) (1,065)

Issue of ordinary shares

at a premium 1,300 - - - - 1,300

Increase in Warrant Reserve

(note 17) - - - 48 - 48

Balance at 31 October

2022 20,321 36,583 9,349 2,619 (26,183) 42,689

---------------------------- -------- --------- -------- ------------ ----------------- ----------------------

Year ended 31 October 2021

Share Share Merger Warrant Retained Total

capital premium reserve Reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- -------- --------- -------- ------------ ------------- ----------------------

Balance at 1 November

2020 17,959 36,476 9,349 2,527 (24,369) 41,942

Loss for the year - - - - (749) (749)

Issue of ordinary shares

at a premium 1,062 107 - - - 1,169

Reduction in Warrant

Reserve (note 17) - - - 44 - 44

Balance at 31 October

2021 19,021 36,583 9,349 2,571 (25,118) 42,406

--------------------------- -------- --------- -------- ------------ ------------- ----------------------

Consolidated Statement of Financial Position as at 31 October

2022

2022 2021

GBP'000 GBP'000

-------- --------

Assets

Non-current assets

Intangible assets 3,583 3,583

Property, plant and equipment 157 157

Total non-current assets 3,740 3,740

-------- --------

Current assets

Inventories 47,388 46,758

Receivables 167 162

Cash and cash equivalents 130 20

Total current assets 47,685 46,940

-------- --------

Total assets 51,425 50,680

-------- --------

Equity

Share capital 20,321 19,021

Share premium account 36,583 36,583

Merger reserve account 9,349 9,349

Warrant reserve 2,619 2,571

Retained earnings (26,183) (25,118)

-------- --------

Total equity 42,689 42,406

-------- --------

Liabilities

Current liabilities 8,736 8,274

Total equity and liabilities 51,425 50,680

-------- --------

Consolidated Cash Flow Statement

Year ended 31 October 2022

2022 2021

GBP'000 GBP'000

-------------------------- ---------------------------

Cash flows from operating

activities

Loss before taxation (1,065) (749)

Finance costs 524 238

Depreciation - -

Increase in inventories (630) (327)

(Increase) / decrease in receivables (5) 63

Increase / (decrease) in current

liabilities 370 (514)

-------------------------- ---------------------------

Net cash (outflow) from operations (806) (1,289)

Finance costs (476) (194)

Net cash used in operating

activities (1,282) (1,483)

-------------------------- ---------------------------

Cash flows from investing

activities

Purchase of property, plant - -

and equipment

Net cash used in investing

activities - -

-------------------------- ---------------------------

Cash flows from financing

activities

Net proceeds from the issue

of ordinary shares 1,300 1,169

Loans received 92 328

-------------------------- ---------------------------

Net cash generated from financing

activities 1,392 1,497

-------------------------- ---------------------------

Net increase in cash 110 14

Cash at beginning of year 20 6

-------------------------- ---------------------------

Cash at end of year 130 20

-------------------------- ---------------------------

Notes to the Financial Statements

Year ended 31 October 2022

1 General information

The financial information set out in this announcement does not

constitute statutory financial statements for the year ended 31

October 2022 or 31 October 2021. The report of the auditors on the

statutory financial statements for the year ended 31 October 2022

and 31 October 2021 was not qualified.

The report of the auditors on the statutory financial statements

for each of the years ended 31 October 2022 and 31 October 2021 did

not contain statements under section 498(2) or (3) of the Companies

Act 2006. The statutory financial statements for the year ended 31

October 2021 have been delivered to the Registrar of Companies. The

financial statements for the year ended 31 October 2022 will be

delivered to the Registrar of Companies following the Company's

Annual General Meeting.

The Company is a public limited company incorporated in England

and Wales. The Company's principal activity in the year under

review was that of a holding and management company of a Group

involved in the design, creation, development and management of

environmentally friendly luxury hotels and resorts plus the

provision of general management services.

2 Accounting policies

Basis of preparation

The financial statements are prepared under the historical cost

convention except for where financial instruments are stated at

fair value.

Adoption of new and revised Standards

The International Accounting Standards Board and IFRIC have

issued the following new and revised standards and interpretations

with an effective date after the date of these financial

statements, which have been endorsed and issued by the United

Kingdom at 31 October 2022:

Standard Details of amendment Effective

date

IAS 1 Presentation of IASB defers effective date 1 January

Financial statements of Classification of Liabilities 2023

as Current or Non-current

(Amendments to IAS 1) to

1 January 2023

IAS1 Presentation of Amended by Non-current Liabilities 1 January

Financial statements with Covenants (Amendments 2024

to IAS 1)

IAS 12 Income Taxes Amended by Deferred Tax 1 January

related to Assets and Liabilities 2023

arising from a Single Transaction

(Amendments to IAS 12)

Going concern

The directors have considered the financial and commercial

position of the Group in relation to its project in Crete (the

"Project"). In particular, the directors have reviewed the matters

referred to below.

Following the unanimous approval of a Plenum of the Greek

Council of State, the highest court in Greece, the Presidential

Decree granting land use approval for the Project was issued on 11

March 2016 and was published in the Government Gazette. The

planning rules for the Project are now enshrined in law. The

appeals lodged against the Presidential Decree have been rejected

by the Greek Supreme Court. Accordingly, the directors consider

that they will conclude further Project joint venture agreements in

the near term.

In addition to specific Project related matters as noted above,

and as has been the case in the past, the Group continues to need

to raise capital in order to meet its existing finance and working

capital requirements. While the directors consider that any

necessary funds will be raised as required, the ability of the

Company to raise these funds is, by its nature, uncertain.

Notes to the Financial Statements (continued)

Year ended 31 October 2022

2 Accounting policies (continued)

Going concern (continued)

Having taken these matters into account, the directors consider

that the going concern basis of preparation of the financial

statements is appropriate.

Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and all its subsidiaries as at 31 October

2022 using uniform accounting policies. The Group's policy is to

consolidate the result of subsidiaries acquired in the year from

the date of acquisition to the Group's next accounting reference

date. Intra-group balances are eliminated on consolidation.

Acquisitions of subsidiaries and businesses are accounted for

using the acquisition method. The consideration for each

acquisition is measured at the aggregate of the fair values of the

assets given, liabilities incurred and equity instruments issued by

the Group in exchange for control of the acquired business.

Acquisition related costs are recognised in the consolidated

statement of comprehensive income as incurred.

Critical accounting estimates and judgements

The preparation of the financial statements in accordance with

generally accepted financial accounting principles requires the

directors to make critical accounting estimates and judgements that

affect the amounts reported in the financial statements and

accompanying notes. The estimates and assumptions that have a

significant risk of causing material adjustments to the carrying

value of assets and liabilities within the next financial year are

discussed below:

-- in capitalising the costs directly attributable to the

Project (see inventories below), and continuing to recognise

goodwill relating to the Project, the directors are of the opinion

that the Project will be brought to fruition and that the carrying

value of inventories and goodwill is recoverable; and

-- as set out above, the directors have exercised judgement in

concluding that the Company and Group is a going concern.

Goodwill

Goodwill arising on acquisitions represents the difference

between the fair value of the net assets acquired and the

consideration paid and is recognised as an asset.

Goodwill arising on acquisition is allocated to cash-generating

units. The recoverable amount of the cash-generating unit to which

goodwill has been allocated is tested for impairment annually, or

on such other occasions that events or changes in circumstances

indicate that it might be impaired. Any impairment is recognised

immediately as an expense and is not subsequently reversed.

Property, plant and equipment

Property, plant and equipment is stated at historical cost less

accumulated depreciation and any recognised impairment loss.

Depreciation is provided in order to write off the cost of each

asset, less its estimated residual value, over its estimated useful

life on a straight line basis as follows:

Plant and equipment: 3 to 5 years

Fixtures and fittings: 3 years

Where the carrying amount of an asset is greater than its

estimated recoverable amount, it is written down immediately to its

recoverable amount.

Investments

Investments in subsidiaries are stated at cost less any

impairment deemed necessary.

Notes to the Financial Statements (continued)

Year ended 31 October 2022

2 Accounting policies (continued)

Inventories

Inventories represent the actual costs of goods and services

directly attributable to the acquisition and development of the

Project and are stated at the lower of cost and net realisable

value.

Foreign currency

A foreign currency transaction is recorded, on initial

recognition in Sterling, by applying to the foreign currency amount

the spot exchange rate between the functional currency and the

foreign currency at the date of the transaction.

At the end of the reporting period:

-- foreign currency monetary items are translated using the closing rate;

-- non-monetary items that are measured in terms of historical

cost in a foreign currency are translated using the exchange rate

at the date of the transaction; and

-- non-monetary items that are measured at fair value in a

foreign currency are translated using the exchange rates at the

date when the fair value was determined.

Exchange differences arising on the settlement of monetary items

or on translating monetary items at rates different from those at

which they were translated on initial recognition during the period

or in previous annual financial statements are recognised in profit

or loss in the period in which they arise.

When a gain or loss on a non-monetary item is recognised to

other comprehensive income and accumulated in equity, any exchange

component of that gain or loss is recognised to other comprehensive

income and accumulated in equity. When a gain or loss on a

non-monetary item is recognised in profit or loss, any exchange

component of that gain or loss is recognised in profit or loss.

Cash flows arising from transactions in a foreign currency are

recorded in Sterling by applying to the foreign currency amount the

exchange rate between the Sterling and the foreign currency at the

date of the cash flow.

Cash and cash equivalents

Cash and cash equivalents include cash in hand and short-term

deposits, with a maturity of less than three months, held with

banks.

Trade and other receivables

Trade and other receivables are recognised initially at fair

value and shown less any provision for amounts considered

irrecoverable. They are subsequently measured at an amortised cost

using the effective interest rate method, less irrecoverable

provision for receivables.

Trade and other payables

Trade and other payables are recognised initially at fair value

and subsequently measured at amortised cost using the effective

interest rate method.

Loans

Loan borrowings are recognised initially at fair value net of

transaction costs incurred. Borrowings are subsequently stated at

amortised cost and any difference between the proceeds (net of

transaction costs) and the redemption value is recognised as a

borrowing cost over the period of the borrowings using the

effective interest method.

Share-based payments

The Company has granted options and warrants to purchase

Ordinary Shares. The fair values of the options and warrants are

calculated using the Black-Scholes and Binomial option pricing

models as appropriate at the grant date. The fair value of the

options is charged to profit or loss with a corresponding entry

recognised in equity. This charge does not involve any cash payment

by the Group.

Notes to the Financial Statements (continued)

Year ended 31 October 2022

2 Accounting policies (continued)

Share-based payments (continued)

Where warrants are issued in conjunction with a loan instrument,

the fair value of the warrants forms part of the total finance cost

associated with that instrument and is released to profit or loss

through finance costs over the term of that instrument using the

effective interest method.

Taxation

Current taxes, where applicable, are based on the results shown

in the financial statements and are calculated according to local

tax rules using tax rates enacted, or substantially enacted, by the

statement of financial position date and taking into account

deferred taxation. Deferred tax is computed using the liability

method. Under this method, deferred tax assets and liabilities are

determined based on temporary differences between the financial

reporting and tax bases of assets and liabilities and are measured

using enacted rates and laws that will be in effect when the

differences are expected to reverse. Deferred tax is not accounted

for if it arises from initial recognition of an asset or liability

in a transaction that at the time of the transaction affects

neither accounting, nor taxable profit or loss. Deferred tax assets

are recognised to the extent that it is probable that future

taxable profits will arise against which the temporary differences

will be utilised.

Deferred tax is provided on temporary differences arising on

investments in subsidiaries except where the timing of the reversal

of the temporary difference is controlled by the Group and it is

probable that the temporary difference will not reverse in the

foreseeable future. Deferred tax assets and liabilities arising in

the same tax jurisdiction are offset.

The Group is entitled to a tax deduction for amounts treated as

compensation on exercise of certain employee share options. As

explained under "Share-based payments" above, a compensation

expense is recorded in the Group's statement of comprehensive

income over the period from the grant date to the vesting date of

the relevant options. As there is a temporary difference between

the accounting and tax bases a deferred tax asset is recorded. The

deferred tax asset arising is calculated by comparing the estimated

amount of tax deduction to be obtained in the future (based on the

Company's share price at the statement of financial position date)

with the cumulative amount of the compensation expense recorded in

the statement of comprehensive income. If the amount of estimated

future tax deduction exceeds the cumulative amount of the

remuneration expense at the statutory rate, the excess is recorded

directly in equity against retained earnings.

3 Information regarding directors and employees

Directors' and key management remuneration

Costs taken

Costs taken to

to profit or

inventories loss Total

GBP'000 GBP'000 GBP'000

------------- ------------ --------

Year ended 31 October

2022

Fees 65 90 155

Sums charged by third parties

for

directors' and key management

services - 85 85

Share-based payments - - -

65 175 240

------------- ------------ --------

Year ended 31 October 2021

Fees 35 115 150

Sums charged by third parties

for

directors' and key management

services 2 100 112

Share-based payments - - -

37 225 262

------------- ------------ --------

Notes to the Financial Statements (continued)

Year ended 31 October 2022

3 Information regarding directors and employees (continued)

The total directors' and key management remuneration shown above

includes the following amounts in respect of the directors of the

Company. No director has a service agreement with a notice period

that exceeds twelve months.

2022 2021

Fees/Sums Fees/Sums

charged by Share-based charged by Share-based

third parties payments third parties payments

GBP'000 GBP'000 GBP'000 GBP'000

-------------- ----------- -------------- -----------

C W Egleton (Chairman) 40 - 40 -

B D Bartman (Retired

15/2/22) 10 - 35 -

G D Cook 35 - 35 -

T R C Hill 35 - 35 -

G Mergos 30 - - -

-------------- ----------- -------------- -----------

150 - 145 -

-------------- ----------- -------------- -----------

2022 2021

No. No.

------------------------------ ------------------------------

Group monthly average number of persons

employed

Directors 9 7

Management, administration and sales - -

------------------------------ ------------------------------

4 Loss before taxation

The loss before taxation is stated after charging:

2022 2021

GBP'000 GBP'000

Depreciation - -

Auditor's remuneration 23 17

Foreign exchange variances - -

------------------------------ ------------------------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR GUGDSRUDDGXI

(END) Dow Jones Newswires

April 28, 2023 02:04 ET (06:04 GMT)

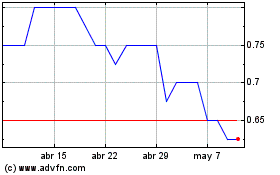

Minoan (LSE:MIN)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Minoan (LSE:MIN)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024