TIDMMNTN TIDMMNTC

RNS Number : 0215M

Schiehallion Fund Limited (The)

11 September 2023

RNS Announcement

The Schiehallion Fund Limited

Legal Entity Identifier: 213800NQOLJA1JCWXQ56

Regulated Information Classification: Interim Financial

Report

The following is the unaudited Interim Financial Report for the

six months to 31 July 2023 which was approved by the Board on 8

September 2023.

Summary of Unaudited Results*

31 January

2023

Ordinary shares 31 July 2023 (audited) % change

----------------------------------- ------------- ----------- ---------

Shareholders' funds US$547.96$m US$597.61m

Net asset value per ordinary share 109.50c 119.42c (8.3%)

Share price 66.00c 92.00c (28.3%)

Discoun t (39.9%) (23.0%)

Number of shares in issue 500,430,002 500,430,002

Market capitalisation US$330.28m US$460.40m

----------------------------------- ------------- ----------- ---------

Six months Six months

to to

31 July 2023 31 July 2022

--------------------------- ------------- -------------

Revenue earnings per share (0.30c) (0.57c)

--------------------------- ------------- -------------

31 January

2023

C shares 31 July 2023 (audited) % change

---------------------------- ------------- ----------- ---------

Shareholders' funds US$557.26m US$555.57m

Net asset value per C share 79.61c 79.37c 0.3%

Share price 39.50c 49.00c (19.4%)

Discount (50.4%) (38.3%)

Number of shares in issue 700,000,000 700,000,000

Market capitalisation US$276.50m US$343.00m

---------------------------- ------------- ----------- ---------

Six months

to Six months to

31 July 2023 31 July 2022

--------------------------- ------------- --------------------

Revenue earnings per share 0.06c (0.31c)

--------------------------- ------------- --------------------

Notes

* For a definition of terms see Glossary of Terms and

Alternative Performance Measures below.

Alternative performance measure, see Glossary of Terms and

Alternative Performance Measures below.

All investment strategies have the potential for profit and

loss. Past performance is not a guide to future performance.

Periods High and Low

Six months to 31 Year to 31 January

July 2023 2023

===================================

Ordinary shares High Low High Low

=================================== ========== ========== ============ ============

Net asset value per ordinary share 117.98c 103.94c 153.18c 116.84c

=================================== ========== ========== ============ ============

Share price 87.00c 59.50c 214.00c 91.50c

=================================== ========== ========== ============ ============

(Discount)/premium (22.5%) (44.9%) 40.5% (26.9%)

=================================== ========== ========== ============ ============

Six months to 31 Year to 31 January

July 2023 2023

============================

C shares High Low High Low

============================ ========== ========== ============ ============

Net asset value per C share 79.60c 73.83c 97.20c 77.32c

============================ ========== ========== ============ ============

Share price 48.00c 39.50c 129.00c 49.00c

============================ ========== ========== ============ ============

(Discount)/premium (39.2%) (50.4%) 36.1% (41.1%)

============================ ========== ========== ============ ============

Performance since inception

Ordinary shares 31 July 27 March 2019++ % change

2023

Net asset value per ordinary share 109.50c 99.66c 9.9

Share price 66.00c 100.00c (34.0)

------------------------------------ -------- ---------------- ---------

C shares 31 July 26 April 2021# % change

2023

Net asset value per C share 79.61c 99.25c (19.8)

Share price 39.50c 124.00c (68.2)

----------------------------- -------- --------------- ---------

Notes

* For a definition of terms see Glossary of Terms and

Alternative Performance Measures below.

Alternative performance measure, see Glossary of Terms and

Alternative Performance Measures below.

++ 27 March 2019, the date the Company's ordinary shares were

admitted to trading on the Specialist Fund Segment of the Main

Market of the London Stock Exchange.

# 26 April 2021, the date the Company's C shares were admitted

to trading on the Specialist Fund Segment of the Main Market of the

London Stock Exchange.

Investment Objective

The Company's objective is to generate capital growth for

investors through making long-term minority investments in later

stage private businesses that the Company considers to have

transformational growth potential and to have the potential to

become publicly traded.

Principal risks and uncertainties

The principal and emerging risks facing the Company are:

Investment and strategic risks - liquidity of investments;

market, economic, political and environmental risks; valuation

risk; investment strategy risk; discount risk; and Environmental,

Social and Governance (ESG).

External risks - political and associated economic risk; legal

and regulatory risk.

Operational risks - performance and reliance on third party

service providers; cyber security threats; and key

professionals.

Emerging risks - geopolitical tensions, including the

Russia-Ukraine conflict and US-China tensions, high energy prices,

inflation and interest rates; cyber risk; and Environmental Social

and Governance issues (ESG).

An explanation of these risks and how they are managed is set

out on pages 7 to 10 of the Company's Annual Report and Financial

Statements for the year to 31 January 2023 which is available on

the Company's website: schiehallionfund.com.

The principal risks and uncertainties have not changed since the

date of that report.

Responsibility statement

The Directors of The Schiehallion Fund Limited confirm that to

the best of their knowledge:

a. the Interim Financial Report has been prepared in accordance

with IAS 34 Interim Financial Reporting and the Directors have

elected to prepare financial statements that comply with

International Financial Reporting Standards as issued by the

International Accounting Standards Board;

b. the Interim Management Report includes a fair review of the

information required by:

i. DTR 4.2.7R of the Disclosure Guidance and Transparency Rules,

being an indication of important events that have occurred during

the first six months of the financial year and their impact on the

condensed set of financial statements, and a description of the

principal risks and uncertainties for the remaining six months of

the financial year; and

ii. DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or the performance of

the enterprise during that period.

By Order of the Board

Linda Yueh

Chairperson

8 September 2023

Interim Management Report

The six months to 31 July 2023 saw a reduction in the asset

price volatility of 2022. The NAV Total Return was -8.3% for the

Ordinary Shares and 0.3% for the C Shares, which retained material

exposure to US Treasury Bills during the period. The share price

discounts to NAV of both the Ordinary Shares and the C Shares

widened during the period to 39.9% and 50.4% respectively.

Public markets performed relatively strongly over the period,

and the largest positive contributors to NAV performance of each of

the share classes included public holdings Wise, Affirm, Airbnb as

well as a new holding, Oddity, which is described in more detail in

the Portfolio section below. Private company valuations lagged

public markets over the period, and the largest detractors from NAV

performance of the Ordinary Shares were Scopely and Indigo

Agriculture.

The operational performance within your portfolio remained

solid. Mean average revenue growth was 30%. By capital weighting,

22% of your portfolio comprised profitable companies, and 4% of

companies with less than a year of cash runway remaining. Of the

remaining companies, the mean average years of remaining cash

runway was over four years. In practice, we are seeing companies

across the board make strong progress towards becoming financially

self-sustaining, through a mix of cost-cutting and top-line growth

delivering operating leverage benefits.

We have continued to prospect globally for the best long-term

growth investment opportunities in the later stages of the private

markets. This has involved thematic work in supply chains, large

language models, semiconductor design and emerging sports formats.

Team members have also been spending time on the ground in

South-East and East Asia, Australia, Israel, mainland Europe,

Mexico, Brazil and of course the USA.

Following the Silicon Valley Bank crisis and Stripe's very

public 50% down-round in the first quarter of 2023, pricing

expectations among management teams have begun to normalise. This

has been uneven between geographies. The US remains the market with

the widest price expectations gap between companies and investors.

We have seen more reasonable pricing expectations in Europe, Israel

and Korea. China is its own story, with a continued forced sell-off

of the more liquid names by American investors. We are trying to

strike a balance between understanding our limited ability to

assess geopolitical black swan risks, and the increasingly

bargain-basement prices we are being offered for stakes in

remarkable businesses.

Portfolio

During the six months to 31 July, we made one new investment in

Oddity. We committed to another in Bending Spoons, which completed

shortly after the period end.

Oddity is an Israeli-American company in the skincare space.

This has been a sector that has resisted the attack of

direct-to-consumer online brands, in no small part due to the large

role try-before-you-buy plays in the shopping journey. Where

direct-to-consumer brands have emerged, they have struggled with

reliable product matching and hence have had to endure high return

rates. Advances in cameras and image recognition technology have

now begun to enable purely online channels to challenge the

department store paradigm. Oddity has additionally been developing

expertise in personalised medical skincare, with significant

current investment in custom acne creams.

Bending Spoons is an Italian company that specialises in

identifying American software-as-a-service businesses with

under-monetised products and expensive cost bases. They acquire

them, integrate them into their own technology systems, and then

work to grow them using much cheaper and higher quality Italian

software talent. Their track record of restoring slow-growing

American consumer apps to rapid and profitable growth is

remarkable.

There are some common features to these businesses. Neither was

on the venture capital ecosystem's radar. Both have capital frugal

cultures that have enabled them to create profitable businesses

without relying on regular infusions of venture capital. Both chose

to partner with Baillie Gifford as part of their planned journey to

public markets. Indeed, Oddity went public in July, with an IPO at

a higher price than our investment in private markets, making it

the largest contributor to NAV performance for the C Shares.

We have also continued to strategically reinvest in holdings. In

January 2022, we set aside a sleeve of capital to ensure we would

be able to support companies through the approaching period of

market turbulence. At the end of the reporting period, a third of

this sleeve remains. As ever, follow-on financing for portfolio

companies is not guaranteed. It is conditional on continued

operating performance and is price sensitive. There have been hard

conversations during the period. In some cases, this has led

holdings to recapitalise at much lower valuations; in other cases,

it has driven them to seek strategic options. However, where

performance has warranted, we have continued to support. During the

period, we topped up your positions in McMakler, Stripe and

Heartflow.

The period also saw the acquisition announcement for Scopely,

the American mobile games company in your portfolio. We first

invested in Scopely in October 2019 at a $1.8bn valuation. Savvy

Games agreed to acquire it for a $4.9bn valuation in April

2023.

Private Company Valuations

Whilst the Scopely sale was clearly a good investment result,

the acquisition price was beneath our NAV carrying value estimate,

making it among the largest detractors to performance from the

Ordinary Shares during the six-month period. Over the reporting

period, there were 236 revaluation events, with 41% of holdings

being revalued three or more times. The average movement at the

private company level was -10.9%.

Unlike many of our peers, who often hold investments at last

transaction value, we adjust our estimated carrying values using

live market data from public market companies deemed comparable by

an independent third party. The net effect of this is to estimate a

NAV for Schiehallion that is 18% below where it would be, if we

were recording values as-at-last-transaction.

This leads to questions of how predictive our NAV estimates are.

We look to undertake back-testing work whenever there is a real

price discovery event. When these events occur, our aim is to

achieve a balance of increases and decrease in carrying valuations,

since this would indicate unbiased estimation.

Since the start of 2022, we have had fifteen real price

discovery events across all Baillie Gifford private holdings. On

five occasions this has led to the need to mark down a valuation,

and on ten it has led to the need to increase. This suggests that

our valuation estimation process is at present marginally

conservative. The overall average movement was +10%, with the

distribution of moves being fairly evenly distributed at +/- 30%.

This is wider than the +/- 20% margin the valuations team aims for

in their estimates. (However, if one strips out the two furthest

outliers, they would have landed within the target range, despite

the last eighteen months of greatly increased market

volatility).

C Share Conversion

In August, the Board announced that the C Shares proceeds were

86.6% deployed. The calculation date for the conversion of the C

Shares into Ordinary Shares was 31 August, and the conversion ratio

of 0.7601 Ordinary Shares for each C Share was announced on 7

September. The new Ordinary Shares will be admitted to trading on

12 September.

Looking Forward

Following the conversion of the C Shares, Schiehallion will have

total net assets of approximately $1,095m, diversified across 46

companies, with cash and Treasury Bills of approximately $162m. We

believe that this leaves the Company well placed to support and

build positions in companies that are executing well and where we

see attractive valuations.

The principal risks and uncertainties facing the Company are set

out above.

Peter Singlehurst

Robert Natzler

Valuing Private Companies

We aim to hold our private company investments at 'fair value',

i.e. the price that would be paid in an open-market transaction.

Valuations are adjusted both during regular valuation cycles and on

an ad hoc basis in response to 'trigger events'. Our valuation

process ensures that private companies are valued in both a fair

and timely manner.

The valuation process is overseen by a valuations group at

Baillie Gifford, which takes advice from an independent third party

(S&P Global). The valuations group is independent from the

investment team with all voting members being from different

operational areas of the firm, and the investment managers only

receive final valuation notifications once they have been

applied.

We revalue the private holdings on a three-month rolling cycle,

with one-third of the holdings reassessed each month. During stable

market conditions, and assuming all else is equal, each investment

would be valued two times in a 6-month period. For Schiehallion and

our investment trusts, the prices are also reviewed twice per year

by the respective boards and are subject to the scrutiny of

external auditors in the annual audit process.

Beyond the regular cycle, the valuations team also monitors the

portfolio for certain 'trigger events'. These may include changes

in fundamentals, a takeover approach, an intention to carry out an

Initial Public Offering ('IPO'), company news which is identified

by the valuation team or by the portfolio managers, or meaningful

changes to the valuation of comparable public companies. Any ad hoc

change to the fair valuation of any holding is implemented swiftly

and reflected in the next published net asset value ('NAV'). There

is no delay.

The valuations team also monitors relevant market indices on a

weekly basis and updates valuations in a manner consistent with our

external valuer's (S&P Global) most recent valuation report

where appropriate.

Continued market volatility has meant that recent pricing has

moved much more frequently than would have been the case with the

quarterly valuations cycle. The data below quantifies the

revaluations carried out during the 6 months to 31 July 2023,

however doesn't reflect the ongoing monitoring of the private

investment portfolio that hasn't resulted in a change in

valuation.

The Schiehallion Fund *

---------------------------------- ----

Instruments held 74

Percentage of portfolio revalued

up to 2 times 56%

Percentage of portfolio revalued

up to 4 times 97%

Percentage of portfolio revalued

5+ times 3%

---------------------------------- ----

* Data reflecting period 1 February 2023 to 31 July 2023 a

period of increased valuations due to ongoing market

volatility.

Year to date, most revaluations have been decreases, with a

small number of companies raising capital at an increased

valuation. The average movement in company valuations and share

prices for those are shown below.

Average movement Average movement

in company valuation in share price

--------------- ---------------------- -----------------

Schiehallion* (10.9%) (30.0%)

--------------- ---------------------- -----------------

* Data reflecting period from 1 February 2023 to 31 July

2023.

During the 6 month period ended 31 July 2023 we've written down

some of the valuations as a result of company specific

circumstances which have challenged the economic reality of the

liquidation preferences. This has contributed to the divergence in

the average movement in valuation at instrument level in comparison

to the underlying company value.

Baillie Gifford statement on stewardship

Baillie Gifford's overarching ethos is that we are 'Actual'

investors. We have a responsibility to behave as supportive and

constructively engaged long-term investors. We invest in companies

at different stages of their evolution, across many different

industries and geographies, and we focus on their unique

circumstances and opportunities. Consequently, we are wary of

prescriptive policies and rules, believing that these often run

counter to thoughtful and beneficial corporate stewardship. Our

approach favours a small number of simple principles which help

shape our interactions with companies and give appropriate latitude

to diverse processes of our different investment teams. The

following principles do not all have to be positively reflected in

each holding our teams acquire.

Our stewardship principles for public companies

Prioritisation of long-term value creation

We encourage our holdings to be ambitious, focusing on long-term

value creation and capital deployment for growth. Helping

management to resist demands from shareholders with shorter

horizons than ours can at times be an important way to achieve

better investment outcomes. We regard it as our responsibility to

encourage holdings away from destructive financial engineering and

towards activities that create genuine economic and stakeholder

value over the long run. We are happy that our value will often be

in supporting management when others don't.

A constructive and purposeful board

We believe that boards play a key role in supporting corporate

success and representing the interests of all capital providers.

There is no fixed formula, but we expect boards to have the

resources, information, cognitive and experiential diversity they

need to fulfil these responsibilities. We believe good governance

works best when there are diverse skill sets and perspectives,

paired with an inclusive culture and strong independent

representation with sufficient time to assist, advise and

constructively challenge the thinking of management.

Long-term focused remuneration with stretching targets

We look for remuneration policies that are simple, transparent

and reward superior strategic and operational endeavour. We believe

incentive schemes can be important drivers of behaviour, and

encourage policies which create genuine long-term alignment with

external capital providers. We are accepting of significant payouts

to executives if these are commensurate with outstanding long-run

value creation, but plans should not reward mediocre outcomes or

short-termism. We generally think that performance hurdles should

be skewed towards long-term results and that remuneration plans

should be subject to shareholder approval.

Fair treatment of stakeholders

We believe it is in the long-term interests of all companies to

maintain strong relationships with stakeholders - including

employees, customers, suppliers, regulators and the communities

they work within. We do not believe in one-size-fits-all policies

and recognise that operating policies, governance and ownership

structures may need to vary according to circumstance. Nonetheless,

we believe the principles of fairness, transparency and

accountability should be prioritised at all appropriate times.

Sustainable business practices

We believe an entity's long-term success is dependent on

maintaining its social licence to operate and look for holdings to

work within the spirit and not just the letter of the laws and

regulations that govern them. We expect all holdings to consider

how their actions impact society, both directly and indirectly, and

how such actions may impact their long-term success. Environmental

practices should recognise the current pace of change in

opportunities, risks and societal expectations. Climate change,

environmental impact, social inclusion, tax and fair treatment of

workers should be addressed at board level, with appropriately

ambitious policies and targets focused on the relevant material

dimensions. Boards and senior management with superior prospects

for long-term value creation should understand, regularly review

and disclose information relevant to such targets publicly,

alongside plans for ongoing improvement.

List of Investments as at July 2023 (unaudited)

2023

2023 2023

2023 Ordinary C shares Total

shares value value % of

Name Business Country value US$'000 US$'000 US$'000 net assets

Designs, manufactures

and launches

Space Exploration advanced rockets

Technologies Corp and spacecraft United States 70,113 - 70,113 6.3

Online platform to send

and receive

Wise PLC - Listed money United Kingdom 45,115 14,996 60,111 5.4

Social media and news

aggregation

ByteDance Limited company China 45,561 - 45,561 4.1

Combines enzymes and

metal catalysts

to

Solugen Inc make chemicals United States - 39,947 39,947 3.6

Lithium-ion battery

Northvolt AB manufacturer Sweden 22,780 16,418 39,198 3.5

McMakler GmbH Real estate services Germany - 38,166 38,166 3.5

Online platform which

provides

Affirm Holdings point of sale consumer

Inc - Listed finance United States 17,279 20,858 38,137 3.5

Corporate credit cards

Brex Inc for startups United States 10,903 23,599 34,502 3.1

European mobility

Flix SE GmbH provider Germany 15,660 15,716 31,376 2.8

Daily Hunt Telephone voice, data,

(Ver se Innovation text messaging,

Limited) and roaming services India 30,975 - 30,975 2.8

Faire Wholesale Online wholesale

Inc marketplace United States - 29,836 29,836 2.7

Stripe Inc Online payment platform United States 24,148 1,977 26,125 2.4

Chime Financial Digital current account

Inc provider United States 6,982 18,525 25,507 2.3

Oncological records

aggregator

and diagnostic testing

Tempus Labs Inc provider United States 20,998 4,329 25,327 2.3

Direct to Consumer

Oddity - Listed Cosmetics United States - 24,810 24,810 2.2

Online platform for

checking grammar,

spelling and

improving written

Grammarly Inc communication United States - 23,804 23,804 2.2

Databricks Inc Data software solutions United States - 22,791 22,791 2.1

Kepler Computing

Inc Semiconductor company United States - 22,302 22,302 2.0

Genki Forest Technology

Group Holdings

Limited Non-alcoholic beverages China - 21,894 21,894 2.0

Epic Games Inc Video game developer United States 21,455 - 21,455 1.9

Provider of an on-demand

delivery

platform designed to

connect consumers with

Rappi, Inc local stores United States - 21,114 21,114 1.9

Online and physical

Warby Parker Inc corrective

- Listed eyewear retailer United States 19,229 - 19,229 1.7

Jobs marketplace for the

Workrise Technologies energy

Inc sector United States 15,683 - 15,683 1.4

Online security

Tanium Inc management United States 14,924 - 14,924 1.4

Silicon photonic quantum

PsiQuantum computing United States - 13,641 13,641 1.2

Loft Holdings Ltd Online property platform Brazil - 13,602 13,602 1.2

Autonomous flight

Merlin Labs Inc technology United States - 13,406 13,406 1.2

Travel and lifestyle

Away (JRSK Inc) brand United States 13,164 - 13,164 1.2

Online market place for

travel

Airbnb Inc - Listed accommodation United States 11,704 - 11,704 1.1

Developer of autonomous

delivery

Nuro Inc vehicles United States 5,056 6,524 11,580 1.1

Pet Circle (Millell

Pty Limited) Pet food and accessories Australia - 11,065 11,065 1.0

AI based software for

Wayve Technologies self-driving

Ltd cars United States - 10,667 10,667 1.0

Manufactures and

Carbon Inc Series develops 3D printers United States 9,881 - 9,881 0.9

Marketplace for truckers

Convoy Inc and shippers United States 6,455 3,094 9,549 0.9

Jiangxiaobai Holdings Producer of alcoholic

Ltd beverages China 9,321 - 9,321 0.8

Develops software for

cardiovascular

disease diagnosis

HeartFlow Inc and treatment United States 2,084 7,100 9,184 0.8

Cohesity Inc Data storage United States 8,719 - 8,719 0.8

Gene sequencing

equipment and

Illumina - Listed consumables United States 6,761 - 6,761 0.6

Oscar Health Inc Healthcare insurance

- Listed provider United States 6,174 - 6,174 0.6

Blockstream Corp Financial software

Inc developer United States - 5,300 5,300 0.5

MasterClass

(Yanka Industries Online education

Inc) platform United States 4,806 - 4,806 0.4

Sustainable

Allbirds Inc - direct-to-customer

Listed footwear brand United States 2,551 799 3,350 0.3

Graphcore Limited Computer chip developer United Kingdom 2,836 - 2,836 0.3

Honor Technology Provider of home-care

Inc services United States 944 1,225 2,169 0.2

Ginkgo Bioworks Genetic engineering for

Holdings Inc - industrial

Listed applications United States 1,404 - 1,404 0.1

Microbial seed

treatments to increase

Indigo Agriculture crop yields and grain

Inc marketplace United States 802 - 802 0.1

------------------------ ------------------------ --------------- -------------- --------- -------- ------------

Total investments 474,467 447,505 921,972 83.4

------------------------------------------------------------------- -------------- --------- -------- ------------

2023 2023 2023 2023

Ordinary C shares Total % of

shares value value value net assets

Name US$'000 US$'000 US$'000 *

----------------------------- ----------------- ---------- ---------- ------------

US Treasury Bill 18/04/2024 - 14,249 14,249 1.3

US Treasury Bill 07/09/2023 - 14,096 14,096 1.3

US Treasury Bill 02/11/2023 - 14,053 14,053 1.3

US Treasury Bill 13/06/2024 - 14,049 14,049 1.3

US Treasury Bill 22/02/2024 - 14,025 14,025 1.2

US Treasury Bill 28/12/2023 - 13,873 13,873 1.2

----------------------------- ----------------- ---------- ---------- ------------

Total US Treasury Bills - 84,345 84,345 7.6

----------------------------- ----------------- ---------- ---------- ------------

Cash 73,618 36,931 110,549 10.1

Other current assets and

liabilities (127) (11,523) (11,650) (1.1)

----------------------------- ----------------- ---------- ---------- ------------

Net current assets 73,491 25,408 98,899 9.0

----------------------------- ----------------- ---------- ---------- ------------

Total net assets 547,958 557,258 1,105,216 100.0

----------------------------- ----------------- ---------- ---------- ------------

Allocation of net assets (unaudited)

2023 2023

Ordinary C shares Total

shares Value value % of

value US$'000 US$'00 US$'00 net assets

Listed investments 110,218 61,462 171,680 15.5

Private company investments 364,249 386,043 750,292 67.9

US Treasury Bills - 84,345 84,345 7.6

Cash and cash equivalents 73,618 36,931 110,549 10.1

Net current assets (127) (11,523) (11,650) (1.1)

----------------------------- --------------- ---------- ----------- ------------

Total net assets 547,958 557,258 1,105,216 100.0

----------------------------- --------------- ---------- ----------- ------------

* See Glossary of Terms and Alternative Performance Measures

below.

The Company may hold various classes of shares in investee

companies, some of which may have a preference on winding up.

Distribution of total net assets (unaudited)

Ordinary Shares

Geographical as at 31 July

Geographical % at % at

31 July 31 January

2023 2023

-------------------- --------- ------------

United States 55.1 65.2

China 10.0 10.6

United Kingdom 8.7 6.4

India 5.7 5.4

Sweden 4.2 3.8

Germany 2.9 2.2

Net Current Assets 13.4 6.4

-------------------- --------- ------------

Sectoral as at 31 July

Sectoral % at % at

31 July 31 January

2023 2023

------------------------ --------- ------------

Industrials 20.6 19.9

Financials 20.2 15.7

Communication Services 14.8 14.9

Consumer Discretionary 12.7 11.6

Information Technology 10.6 21.0

Healthcare 5.6 5.5

Consumer Staples 1.8 4.8

Materials 0.3 0.2

Net Current Assets 13.4 6.4

------------------------ --------- ------------

C shares

Geographical as at 31 July

Geographical % at % at

31 July 31 January

2023 2023

-------------------- --------- ------------

United States 56.6 50.7

US Treasury Bills 15.1 24.7

Germany 9.7 6.8

China 3.9 5.4

United Kingdom 2.7 3.6

Sweden 2.9 2.9

Brazil 2.5 2.8

Australia 2.0 2.0

Net Current Assets 4.6 1.1

-------------------- --------- ------------

Sectoral as at 31 July

Sectoral % at % at

31 July 31 January

2023 2023

------------------------ --------- ------------

Information Technology 21.4 20.5

US Treasury Bills 15.1 24.7

Financials 14.4 12.8

Consumer Discretionary 10.4 10.4

Real Estate 9.3 7.2

Consumer Staples 8.4 5.4

Materials 7.2 8.6

Industrials 7.0 7.8

Healthcare 2.3 1.5

Net Current Assets 4.5 1.1

------------------------ --------- ------------

Income Statement (unaudited)

For the six months For the six months to For the year ended 31

to 31 July 2023 31 July 2022 January 2023

--------------- ----- ---------------------------- ------------------------------ --------------------------------

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Notes US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

--------------- ----- -------- -------- -------- -------- --------- --------- -------- ---------- ----------

Losses on

investments - (46,896) (46,896) - (209,332) (209,332) - (311,938) (311,938)

Currency losses - (9) (9) - (33) (33) - (17) (17)

Income 2 3,512 - 3,512 218 - 218 2,800 - 2,800

Investment

management fee 3 (3,937) - (3,937) (4,611) - (4,611) (8,931) - (8,931)

Other

administrative

expenses 4 (637) - (637) (595) - (595) (1,233) - (1,233)

--------------- ----- -------- -------- -------- -------- --------- --------- -------- ---------- ----------

Operating loss

before finance

costs and

taxation (1,062) (46,905) (47,967) (4,988) (209,365) (214,353) (7,364) (311,955) (319,329)

--------------- ----- -------- -------- -------- -------- --------- --------- -------- ---------- ----------

Finance cost of

borrowings - - - (9) - (9) (10) - (10)

--------------- ----- -------- -------- -------- -------- --------- --------- -------- ---------- ----------

Operating loss

before

taxation (1,062) (46,905) (47,967) (4,997) (209,365) (214,362) (7,374) (311,955) (319,329)

--------------- ----- -------- -------- -------- -------- --------- --------- -------- ---------- ----------

Tax on ordinary - - - - - - - - -

activities

--------------- ----- -------- -------- -------- -------- --------- --------- -------- ---------- ----------

Loss and total

comprehensive

loss for the

period (1,062) (46,905) (47,967) (4,997) (209,365) (214,362) (7,374) (311,955) (319,329)

--------------- ----- -------- -------- -------- -------- --------- --------- -------- ---------- ----------

For the six months For the six months For the year to 31

to 31 July 2023 to 31 July 2022 January 2023

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Notes US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

---------------- ----- -------- -------- -------- ------- --------- --------- -------- ---------- ----------

Total comprehensive

(loss)/income

for the period

analysed as follows:

Attributable to

ordinary

shareholders 5 (1,483) (48,168) (49,651) (2,835) (136,408) (139,243) (4,923) (189,131) (194,054)

Attributable to

C shareholders 5 421 1,263 1,684 (2,162) (72,957) (75,119) (2,451) (122,824) (125,275)

---------------- ----- -------- -------- -------- ------- --------- --------- -------- ---------- ----------

Loss and total

comprehensive

loss for the

period (1,062) (46,905) (47,967) (4,997) (209,365) (214,362) (7,374) (311,955) (319,329)

---------------- ----- -------- -------- -------- ------- --------- --------- -------- ---------- ----------

Earnings/(loss)

per ordinary

share 5 (0.30c) (9.62c) (9.92c) (0.57c) (27.26c) (27.83c) (0.98c) (37.79c) (38.77c)

Earnings/(loss)

per C share 5 0.06c 0.18c 0.24c (0.31c) (10.42c) (10.73c) (0.35c) (17.55c) (17.90c)

---------------- ----- -------- -------- -------- ------- --------- --------- -------- ---------- ----------

The total column of this Statement represents the Statement of

Comprehensive Income of the Company. The supplementary revenue and

capital columns are prepared under guidance published by the

Association of Investment Companies.

All revenue and capital items in this statement derive from

continuing operations.

Statement of financial position (unaudited)

At 31 At 31

July July At 31 January At 31 January

2023 2023 2023 2023

Notes US$'000 US$'000 US$'000 US$'000

------------------------------- ----- -------- ----------- ------------- -------------

Fixed assets

Investments held at fair value

through profit or loss 7 921,972 972,032

------------------------------- ----- -------- ----------- ------------- -------------

Current assets

US Treasury Bills 84,345 136,797

Cash and cash equivalents 110,549 45,799

Debtors 22,149 884

------------------------------- ----- -------- ----------- ------------- -------------

217,043 183,480

------------------------------- ----- -------- ----------- ------------- -------------

Current liabilities

Amounts falling due within one

year (33,799) (2,329)

------------------------------- ----- -------- ----------- ------------- -------------

Net current assets 183,244 181,151

------------------------------- ----- -------- ----------- ------------- -------------

Net assets 1,105,216 1,153,183

------------------------------- ----- -------- ----------- ------------- -------------

Capital and reserves

Share capital 8 1,216,503 1,216,503

Capital reserve (98,441) (51,536)

Revenue reserve (12,846) (11,784)

------------------------------- ----- -------- ----------- ------------- -------------

Shareholders' funds 1,105,216 1,153,183

------------------------------- ----- -------- ----------- ------------- -------------

Shareholders' funds - ordinary

shares 547,957 597,608

Net asset value per ordinary

share 109.50c 119.42c

Number of ordinary shares in

issue 500,430,002 500,430,002

------------------------------- ----- -------- ----------- ------------- -------------

Shareholders' funds - C shares 557,257 555,575

Net asset value per C share 79.61c 79.37c

Number of C shares in issue 700,000,000 700,000,000

------------------------------- ----- -------- ----------- ------------- -------------

Statement of changes in equity (unaudited)

Six months to 31 July 2023

Share Capital Revenue Shareholders'

capital reserve* reserve funds

US$'000 US$'000 US$'000 US$'000

Shareholders' funds at 31 January

2023 1,216,503 (51,536) (11,784) 1,153,183

Total comprehensive loss for the

period - ordinary shares - (48,168) (1,483) (49,651)

Total comprehensive income/(loss)

for the period - C shares - 1,263 421 1,684

----------------------------------- ----------- ---------- --------- --------------

Shareholders' funds at 31 July

2023 1,216,503 (98,441) (12,846) 1,105,216

----------------------------------- ----------- ---------- --------- --------------

Six months to 31 July 2022

Share Capital Revenue Shareholders'

capital reserve* reserve funds

US$'000 US$'000 US$'000 US$'000

Shareholders' funds at 31 January

2022 1,216,503 260,419 (4,410) 1,472,512

Total comprehensive loss for the

period - ordinary shares - (136,408) (2,835) (139,243)

Total comprehensive loss for the

period - C shares - (72,957) (2,162) (75,119)

----------------------------------- ---------- ---------- --------- --------------

Shareholders' funds at 31 July

2022 1,216,503 51,054 (9,407) 1,258,150

----------------------------------- ---------- ---------- --------- --------------

*Includes investment holdings loss of US$113,452,000 (31 July

2022 - gains of US$133,855,000).

Statement of cash flows (unaudited)

Six months to 31 Six months to 31

July 2023 July 2022

US$'000 US$'000 US$'000 US$'000

------------------------------------------ ----------- ---------- ----------- ----------

Cash flows from operating activities

Operating loss before taxation (47,967) (214,362)

US Treasury Bills interest (2,236) (60)

Net losses on investments 46,896 209,332

Currency losses 9 33

Changes in debtors and creditors (592) (422)

------------------------------------------ ----------- ---------- ----------- ----------

Net cash outflow in operating activities

* (3,890) (5,479)

------------------------------------------ ----------- ---------- ----------- ----------

Cash flows from investing activities

Acquisitions of US Treasury Bills (53,111) (93,886)

Disposals of US Treasury Bills 118,826 214,739

Acquisitions of investments (45,621) (158,358)

Disposals of investments 48,555 1,848

------------------------------------------ ----------- ---------- ----------- ----------

Net cash inflow/(outflow) in investing

activities 68,649 (35,657)

------------------------------------------ ----------- ---------- ----------- ----------

Net increase/(decrease) in cash

and cash equivalents 64,759 (41,136)

Effect of exchange rate fluctuations

on cash and cash equivalents (9) (33)

Cash and cash equivalents at start

of period 45,799 86,898

------------------------------------------ ----------- ---------- ----------- ----------

Cash and cash equivalents at 31

July 110,549 45,729

------------------------------------------ ----------- ---------- ----------- ----------

* Cash from operations includes interest received of US$878,000

(2022 - US$33,000).

Notes to the financial statements (unaudited)

1. Basis of accounting

The condensed Financial Statements for the six months to 31 July

2023 comprises the statements set out above together with the

related notes below. They have been prepared in accordance with

International Financial Reporting Standards (IFRS). The Financial

Statements for the six months to 31 July 2023 have been prepared on

the basis of the same accounting policies as set out in the

Company's Annual Report and Financial Statements at 31 January

2023.

Equity investment

The ordinary shares and C shares of the Company are classified

as equity in accordance with the definition of equity instruments

under IAS 32 Financial Instruments: presentation (IAS 32). The

proceeds from the issue of shares are recognised in the Statement

of Changes in Equity net of incremental issuance costs.

Going concern

In accordance with The Financial Reporting Council's guidance on

going concern and liquidity risk, the Directors have undertaken a

rigorous review of the Company's ability to continue as a going

concern.

In undertaking this review, the Board has considered the

Company's principal risks and uncertainties, as set out on the

inside front cover, and in particular considered the impact of

heightened market volatility due to macroeconomic and geopolitical

concerns, including the Russia-Ukraine war and heightened tensions

between China and both the USA and Taiwan. Liquidity stress testing

has been carried out and having done so the Board does not believe

the Company's going concern status is affected. The Company

maintains sufficient cash balances to enable it to meet its

liabilities as they fall due.

In managing the Company's assets, the Investment Manager will

seek to ensure that the Company holds at all times a proportion of

assets that is sufficiently liquid to enable it to discharge its

payment obligations.

Accordingly, the Financial Statements have been prepared on the

going concern basis as it is the Directors' opinion, having

assessed the principal risks and uncertainties, that the Company

will continue in operational existence for a period of at least 12

months from the date of approval of these Financial Statements.

2. Income

Six months Six months Year to

to 31 July to 31 July 31 January

2023 2022 2023

US$'000 US$'000 US$'000

---------------------------- ------------ ------------ ------------

US Treasury Bills interest 2,236 60 1,618

Overseas interest 398 124 482

Deposit interest 878 34 700

---------------------------- ------------ ------------ ------------

Total income 3,512 218 2,800

---------------------------- ------------ ------------ ------------

3. Investment Management Fee

Six months Six months Year to

to 31 July to 31 July 31 January

2023 2022 2023

US$'000 US$'000 US$'000

--------------------------- ------------ ------------ ------------

Investment management fee 3,937 4,611 8,931

--------------------------- ------------ ------------ ------------

The Company has appointed Baillie Gifford & Co Limited as

its Investment Manager (the 'Investment Manager'). As the entity

appointed to be responsible for risk management and portfolio

management, the Investment Manager has also been appointed as the

Company's Alternative Investment Fund Manager ('AIFM'). Baillie

Gifford & Co Limited has delegated portfolio management

services to Baillie Gifford Overseas Limited. The Investment

Management Agreement is terminable on not less than six months'

notice.

Under the terms of the Investment Management Agreement, the

Investment Manager will be entitled to an annual fee (exclusive of

VAT, which shall be added where applicable) of: 0.9% on the net

asset value excluding cash or cash equivalent assets up to and

including US$650 million;

0.8% on the net asset value of the Company excluding cash or

cash equivalent assets exceeding US$650 million up to and including

US$1.3 billion; and 0.7% on the net asset value excluding cash or

cash equivalent assets exceeding US$1.3 billion. Management fees

are calculated and

payable quarterly.

Cash equivalents include US Treasury Bills.

4. Other administrative expenses

Six months Six months Year to

to 31 July to 31 July 31 January

2023 2022 2023

US$'000 US$'000 US$'000

------------------------ ------------ ------------ ------------

General administrative

expenses 228 202 517

Administrator's fee 28 74 86

Auditor's remuneration

for audit services 154 121 236

Directors' fees 227 198 394

------------------------ ------------ ------------ ------------

637 595 1233

------------------------ ------------ ------------ ------------

Expenses relating directly to a share class are charged directly

to that share class. Expenses pertaining to both ordinary and C

shares are split equally between the share classes.

5. Earnings per share

Six months to Six months to Year to 31

31 July 2023 31 July 2022 January 2023

Ordinary shares US$'000 c US$'000 c US$'000 c

------------------------------ --------- -------- ---------- -------- ---------- --------

Revenue return on ordinary

activities after taxation (1,483) (0.30c) (2,835) (0.57) (4,923) (0.98)

Capital return on ordinary

activities after taxation (48,168) (9.62c) (136,408) (27.26) (189,131) (37.79)

------------------------------ --------- -------- ---------- -------- ---------- --------

Loss and total comprehensive

loss for the period (49,651) (9.92c) (139,243) (27.83) (194,054) (38.77)

------------------------------ --------- -------- ---------- -------- ---------- --------

Weighted average number of

ordinary shares in issue 500,430,002 500,430,002 500,430,002

------------------------------ ------------------- -------------------- --------------------

Six months Six months Year to

to to 31 January

31 July 31 July 2022 2023

2023

Ordinary shares US$'000 c US$'000 c US$'000 c

--------------------------------------- ---------- ------- ----------- -------- ---------- --------

Revenue return on ordinary activities

after taxation 421 0.06c (2,162) (0.31) (2,451) (0.35)

Capital return on ordinary activities

after taxation 1,263 0.18c (72,957) (10.42) (122,824) (17.55)

--------------------------------------- ---------- ------- ----------- -------- ---------- --------

Profit/(loss) and total comprehensive

(loss) for the period 1,684 0.24c (75,119) (10.73) (125,275) (17.90)

--------------------------------------- ---------- ------- ----------- -------- ---------- --------

Weighted average number of C

shares in issue 700,000,000 700,000,000 700,000,000

--------------------------------------- ------------------- --------------------- --------------------

Net return per share is based on the above totals of revenue and

capital and the weighted average number of shares in issue during

each period. There are no dilutive or potentially dilutive shares

in issue.

6. Ordinary dividends

There were no dividends paid or proposed in respect of the six

months for either the ordinary shares or for the C shares (2022 -

nil).

7. Financial Instruments

Fair value hierarchy

The fair value hierarchy used to analyse the fair values of

financial assets is described below. The levels are determined by

the lowest (that is the least reliable or least independently

observable) level of input that is significant to the fair value

measurement for the individual investment in its entirety as

follows:

Level 1 - using unadjusted quoted prices for identical

instruments in an active market;

Level 2 - using inputs, other than quoted prices included within

Level 1, that are directly or indirectly observable (based on

market data); and

Level 3 - using inputs that are unobservable (for which market

data is unavailable).

Level Level Level 3 Total

As at 31 July 2023 1 US$'000 2 US$'000 US$'000 US$'000

--------------------------------------- ----------- ----------- --------- ---------

Listed equities 171,680 - - 171,680

--------------------------------------- ----------- ----------- --------- ---------

Unlisted ordinary shares - - 102,223 102.223

--------------------------------------- ----------- ----------- --------- ---------

Unlisted preference shares* - - 635,916 635,916

--------------------------------------- ----------- ----------- --------- ---------

Unlisted convertible promissory notes - - 12,143 12,143

--------------------------------------- ----------- ----------- --------- ---------

Total financial asset investments 171,680 - 750,292 921,972

--------------------------------------- ----------- ----------- --------- ---------

Level Level Level 3 Total US$'000

As at 31 January 2023 1 US$'000 2 US$'000 US$'000

--------------------------------------- ----------- ----------- --------- --------------

Listed equities 119,018 - - 119,018

--------------------------------------- ----------- ----------- --------- --------------

Unlisted ordinary shares - - 131,977 131,977

--------------------------------------- ----------- ----------- --------- --------------

Unlisted preference shares* - - 708,914 708,914

--------------------------------------- ----------- ----------- --------- --------------

Unlisted convertible promissory notes - - 12,123 12,123

--------------------------------------- ----------- ----------- --------- --------------

Total financial asset investments 119,018 - 853,014 972,032

--------------------------------------- ----------- ----------- --------- --------------

* The investments in preference shares are not classified as

equity holdings as they include liquidation preference rights that

determine the repayment (or multiple thereof) of the original

investment in the event of a liquidation event such as a

take-over.

During the six months to 31 July 2023, the investment in Oddity

was transferred from Level 3 to Level 1 on becoming listed. During

the year ended 31 January 2023, no investments were transferred

from Level 3 to Level 1 on becoming listed.

The valuation techniques used by the Company are explained in

the accounting policies on page 49 of the Company's Annual Report

and Financial Statements for the year to 31 January 2023. Listed

investments are categorised as Level 1 if they are valued using

unadjusted quoted prices for identical instruments in an active

market and as Level 2 if they do not meet all these criteria but

are, nonetheless, valued using market data. The Company's holdings

in unlisted investments are categorised as Level 3 unobservable

data is a significant input to their fair value measurements.

8. Share Capital

31 July 31 July 31 January 31 January

2023 2023 2023 2023

Number US$'000 Number US$'000

--------------------------------------------- ------------ --------- ------------ -----------

Alloted, called up and fully paid ordinary

shares of US$1 each 500,430,002 521,701 500,430,002 521,701

Allotted, called up and fully paid C shares

of US$1 each 700,000,000 694,802 700,000,000 694,802

--------------------------------------------- ------------ --------- ------------ -----------

By way of a special resolution dated 15 March 2019 the Directors

have a general authority to allot up to 720,000,000 ordinary shares

or C shares, such figure to include the ordinary shares issued at

the initial placing. 477,250,000 ordinary shares were issued at the

Company's initial placing, with a further 23,180,002 ordinary

shares subsequently issued, the Company has the ability to issue a

further 219,569,998 shares under this existing authority which

expires at the end of the period concluding immediately prior to

the Annual General Meeting of the Company to be held in 2024 (or,

if earlier, five years from the date of the resolution).

By way of a special resolution dated 18 March 2021 the Directors

have a general authority to allot up to 700,000,000 C shares. On 26

April 2021, the Company issued 700,000,000 C shares of US$1 each

and raised gross proceeds of US$700,000,000. The issue costs in

respect of the C share issue were US$5,198,000. These costs

consisted of mainly broker commission (US$4,066,000), legal fees

(US$601,000) and listing fees (US$396,000).

During the six months to 31 July 2023 the Company did not issue

any ordinary shares or C shares. In the period from 1 August 2023

to 7 September 2023 the Company issued no ordinary shares or C

shares.

By way of ordinary resolutions passed on 12 May 2023 the

Directors of the Company have general authority to make market

purchases of up to 75,014,457 ordinary shares and 104,930,000 C

shares, being 14.99% of the ordinary and C shares in issue as at 24

March 2023, being the latest practicable date prior to the

publication of the Company's Annual Report and Financial Statements

for the year ended 31 January 2023. These authorities will expire

at the conclusion of the Annual General Meeting of the Company to

be held in respect of the year ending 31 January 2024. No ordinary

shares or C shares have been bought back during the six months

ended 31 July 2023 (31 July 2022 - nil) hence the authorities

remain at 75,014,457 ordinary shares and 104,930,000 C shares. In

the period from 1 August 2023 to 7 September 2023 no ordinary

shares or C shares were bought back.

Holders of ordinary shares have the right to receive income and

capital from assets attributable to such share class. Ordinary

shareholders have the right to receive notice of general meetings

of the Company and have the right to attend and vote at all general

meetings.

Holders of C shares have the right to receive income and capital

from assets attributable to such share class. C shareholders have

the right to receive notice of general meetings of the Company and

have the right to attend and vote at all general meetings.

9. Transaction Costs

During the period the Company incurred transaction costs on

purchases of investments of US$nil (31 July 2022 - US$57,000; 31

January 2023 - US$57,000) and transaction costs on sales of US$nil

(31 July 2022- US$nil; 31 January 2023 - US$nil).

10. Transactions with related parties and the investment manager and administrator

There have been no transactions with related parties during the

first six months of the current financial year that have materially

affected the financial position or the performance of the Company

during that period and there have been no changes in the related

party transactions described in the last Annual Report and

Financial Statements that could have such an effect on the Company

during that period.

None of the views expressed in this document should be construed

as advice to buy or sell a particular investment.

Glossary of terms and alternative performance measures

('APM')

Shareholders' funds and Net Asset Value

Shareholders' Funds is the value of all assets held less all

liabilities, with borrowings deducted at book cost. Net Asset Value

(NAV) is the value of all assets held less all liabilities, with

borrowings deducted at either fair value or par value. Per share

amounts are calculated by dividing the relevant figure by the

number of ordinary shares in issue.

Net current assets

Net current assets comprise current assets less current

liabilities (excluding borrowings).

(Discount)/premium (APM)

As stock markets and share prices vary, an investment company's

share price is rarely the same as its NAV. When the share price is

lower than the NAV per share it is said to be trading at a

discount. The size of the discount is calculated by subtracting the

share price from the NAV per share and is usually expressed as a

percentage of the NAV per share. If the share price is higher than

the NAV per share, it is said to be trading at a premium.

31 July 31 January

Ordinary shares 2023 2023

--------------------------------------------- ------- ----------

Closing NAV per share (a) 109.50c 119.42c

----------------------------------- -------- ------- ----------

Closing share price (b) 66.00c 92.00c

----------------------------------- -------- ------- ----------

(b - a)

÷

Discount expressed as a percentage a (39.9%) (23.0%)

----------------------------------- -------- ------- ----------

31 July 31 January

C shares 2023 2023

--------------------------------------------- ------- ----------

Closing NAV per share (a) 79.61c 79.37c

----------------------------------- -------- ------- ----------

Closing share price (b) 39.50c 49.00c

----------------------------------- -------- ------- ----------

(b - a)

÷

Discount expressed as a percentage a (50.4%) (38.3%)

----------------------------------- -------- ------- ----------

Other shareholder information

Automatic Exchange of Information

In order to fulfil its legal obligations under the Guernsey

Common Reporting Standard Legislation relating to the Automatic

Exchange of Information, the Company is required to collect and

report certain information about certain shareholders.

The legislation will require investment companies to provide

personal information to the Guernsey authorities on certain

investors who purchase shares in investment funds. As an affected

company, The Schiehallion Fund Limited will have to provide

information annually to the local authority on the tax residencies

of non-UK based certificated shareholders and corporate

entities.

Foreign Account Tax Compliance Act

Pursuant to the reciprocal information sharing

inter-governmental agreement entered into by the States of Guernsey

and the US Treasury, and for the purposes of the US Foreign Account

Tax Compliance Act ('FATCA') of the Company registered with the

Internal Revenue Service ('IRS') as a Foreign Financial Institution

('FFI') and received a Global Intermediary Identification Number

(R2NXXB.9999.SL.831). The Company can be located on the

IRS FFI list.

Sustainable finance disclosure regulation ('SFDR')

The EU Sustainable Finance Disclosure Regulation ('SFDR') does

not have a direct impact in the UK due to Brexit, however, it

applies to third-country products marketed in the EU. As The

Schiehallion Fund Limited is marketed in the EU by the AIFM, BG

& Co Limited, via the National Private Placement Regime (NPPR)

the following disclosures have been provided to comply with the

high-level requirements of SFDR.

The AIFM has adopted Baillie Gifford & Co's ESG Principles

and Guidelines as its policy on integration of sustainability risks

in investment decisions.

Baillie Gifford & Co's approach to investment is based on

identifying and holding high quality growth businesses that enjoy

sustainable competitive advantages in their marketplace. To do this

it looks beyond current financial performance, undertaking

proprietary research to build an in-depth knowledge of an

individual company and a view on its long-term prospects. This

includes the consideration of sustainability factors

(environmental, social and/or governance matters) which it believes

will positively or negatively influence the financial returns of an

investment.

More detail on the Managers' approach to sustainability can be

found in the Governance and Sustainability Principles and

Guidelines document, available publicly on the Baillie Gifford

website bailliegifford.com

The underlying investments established under the EU Taxonomy

Regulation do not take into account the EU criteria for

environmentally sustainable economic activities.

None of the views expressed in this document should be construed

as advice to buy or sell a particular investment.

You can find up to date performance information about The

Schiehallion Fund on the Schiehallion Fund page of the Managers'

website at schiehallionfund.com++

The Schiehallion Fund Limited is managed by Baillie Gifford, the

Edinburgh based fund management group with around GBP226 billion

under management and advice in active equity and bond portfolios

for clients in the UK and throughout the world (as at 5 September

2023). The Administrator, Secretary and Designated Manager is Alter

Domus (Guernsey) Limited.

++ Neither the contents of the Managers' website nor the

contents of any website accessible from hyperlinks on the Managers'

website (or any other website) is incorporated into, or forms part

of, this announcement.

Past performance is not a guide to future performance. The value

of an investment and any income from it is not guaranteed and may

go down as well as up and investors may not get back the amount

invested. This is because the share price is determined by the

changing conditions in the relevant stock markets in which the

Company invests and by the supply and demand for the Company's

shares.

8 September 2023

For further information please contact:

Alex Blake, Baillie Gifford & Co

Tel: 0131 275 2859 or 07773 246035

Jonathan Atkins, Four Communications

Tel: 0203 920 0555 or 07872 495396

- ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFESUFEDSEEU

(END) Dow Jones Newswires

September 11, 2023 05:25 ET (09:25 GMT)

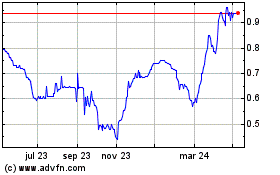

The Schiehallion (LSE:MNTN)

Gráfica de Acción Histórica

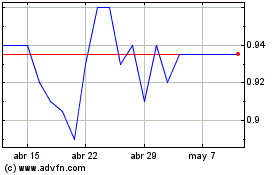

De Abr 2024 a May 2024

The Schiehallion (LSE:MNTN)

Gráfica de Acción Histórica

De May 2023 a May 2024