TIDMNAR

RNS Number : 4562T

Northamber PLC

15 November 2023

15 November 2023

Northamber PLC

(the "Company" or the "Group")

Preliminary Results for the year ended 30 June 2023

Chairman's Statement

Results

Against a challenging backdrop, we are pleased to share that we

have continued to grow revenue year on year by GBP890k from

GBP66.26m to GBP67.15m whilst also growing gross margins from 12.8%

to 13.3%. This served to generate a continued increase in gross

margins of GBP0.43m year on year to GBP8.91m (5% increase year on

year) and reflected our continued focus on evolving our product mix

towards higher margin, more technical products through Northamber

and AVM.

As mentioned in my last statement, we expanded our Audio Visual

(AV) unit into Unified Communications and Collaborations (UC&C)

during the first half of the year with a new partnership with

Yealink who are a significant brand in the Microsoft Teams Room and

Zooms room space. This new partnership allowed us to access a

significant new UC&C market for our existing reseller customers

as well as bring existing products from our Audio Visual and

Infrastructure Solutions business units to a wider market. The

addition of ViewSonic in H2 to our Audio Visual Business Unit also

helped provide growth opportunities.

Despite sales and gross margin growth for the year, performance

in some of our focus areas remained impacted by softer demand due

to deferred purchasing decisions by some end users as they chose to

defer non essential spend in the face of inflationary pressures and

continuing economic uncertainty. Our strategy remains to focus on

building the best Proactive, Technical distribution company in our

focus technology areas of Audio Visual, Network Security &

Infrastructure, Document Management & Peripherals as we remain

confident we can deliver significant long term value and growth in

these segments for our partners and shareholders.

Inflationary pressures combined with our continued investment in

developing the team for our growth ambitions led to distribution

costs increasing from GBP5.6m to GBP5.9m. Likewise, our

administration costs increased from GBP3.4m to GBP3.5m due to

inflationary pressures. Some of these cost increases we would hope

to be non-recurring or reduced moving forward such as an

exceptional GBP110k bad debt write off for the year (up from GBP62k

prior year), GBP110k for Electricity and Gas (up from GBP66k prior

year and despite the Company installing solar panels at our Swindon

Warehouse at the start of the fiscal year) and cost of living

pressure on wages (GBP6.15m up from GBP5.67m).

It is frustrating that inflationary factors increasing

distribution and administration costs have impacted the Group

despite Gross Margin growth. The Group remains committed to

proactively working to reduce these costs as best it can.

As part of our focus on profitable scalability and efficiency

drive, after the period end, the Group implemented a new company

wide ERP system at a committed capital investment of GBP278k.

Whilst this new system will cause some initial disruption in H1

FY24 whilst it is rolled out in a phased approach across the half,

this new system will allow us to drive a stronger customer

experience and better efficiency with automation so we would hope

to see a positive impact from this in H2 FY24 and onwards.

The net effect of these results were that Earnings Before Tax

Amortisation and Depreciation but After Interest was a modest GBP3k

profit, compared with a loss of GBP54k the prior year. At an

operating level this delivered a loss before tax for the year of

GBP411k versus a loss of GBP447k last year.

We feel strongly, however, that to drive significant long term

profitable growth it is important that we continue to invest for

the future , albeit these investments are measured against the

ability to generate value.

Financial Position

We remain diligent in managing our balance sheet and were

pleased to be able to remain debt free; we are a flexible stocking

than other commodity focused distributors. Cash reserves at year

end increased to GBP5.6 million from GBP4.7 million at 30 June

2022. This focus on cash levels together with stronger interest

rates available yielded a benefit of GBP81k of interest, up from

GBP5k the prior year. We look to balance the value of cash in the

bank with the need to provide flexible stock for our partners and

consciously review this on an ongoing basis. Tied to this approach,

we disposed of an office building in Lightwater in H1 that was no

longer core to our operation for a consideration of GBP1.48 million

and moved Audio Visual Material Ltd into a new leased office

together with our Audio Visual business unit in Basingstoke.

With Net Assets at GBP23.9 million, including two unencumbered

freehold properties, the Group's overall financial position remains

very sound.

Net Assets at 87.7p per share are considerably in excess of the

average price of the ordinary shares throughout the period.

Dividend

As in previous years, your Board has had regard to the strength

of our debt free, tangible asset strong balance sheet and is

proposing the final dividend be 0.3p, at a total cost of GBP81,695.

The dividend will be paid on 19 January 2024 to shareholders on the

register as at 15 December 2023.

Staff

Our staff remain a key asset for the business and an area we

continue to invest in. The team has continued to work hard to

support our partners and each other. Our plans remain to continue

to invest in our evolving business model by continuing to invest in

building out the best team in the market to achieve our business

evolution.

We were pleased to be able to roll out a Company Share Ownership

Plan as a long term incentive for all staff in July 2023 (post year

end), and see this as a way of rewarding the team who make an

impact and drive our results

Outlook

In keeping with prior outlooks that we shared, we remain

cautiously optimistic that the investments we have made in

supporting our partners will allow us to continue to drive growth

of strategic business units. We have yet to fully benefit from

these investments, given the ongoing impact of COVID, forex

movements and supply chain issues which together with wider

economic uncertainty due to rising interest rates, inflation and

subsequent cost of living impacts, necessarily mean we must remain

cautious about the near term . We do feel strongly, however, that

our continued focus on strategic higher margin value categories

provides a solid road map for the future with profitable growth

opportunities and the ability to unlock long term value for

shareholders. The strength of our balance sheet allows us to

continue to do what is best for the business strategically and we

continue to review organic and non-organic opportunities for growth

which meet our strict criteria and add value for our

shareholders.

C.M.Thompson

Chairman

15 November 2023

Contacts:

Northamber PLC Tel: +44 (0) 208 744 8200 investor_relations@northamber.com

Colin Thompson, Chairman

Singer Capital Markets (Nominated

Adviser and Sole Broker) +44 (0) 207 496 3000

Philip Davies

NORTHAMBER PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 30 June 2023

2023 2022

Notes GBP'000 GBP'000

Revenue 2 67,149 66,260

Cost of sales (58,243) (57,791)

Gross Profit 8,906 8,469

Distribution costs (5,907) (5,556)

Administrative costs (3,491) (3,365)

Operating Loss (492) (452)

Finance income 81 5

Finance cost - -

----------- --------

Loss before tax (411) (447)

Tax expense - -

Loss for the year and total

comprehensive income attributable

to the owners (411) (447)

=========== ========

Basic and diluted Loss per ordinary (1.51)

share 3 p (1.64)p

----------- --------

The above results arise from continuing operations

CONSOLIDATED STATEMENT OF FINANCIAL POSITION At 30 June 2023

2023 2022

GBP'000 GBP'000

Non current assets

Property, plant and equipment 5,519 6,919

Intangible assets 1,251 1,309

----------- ---------------

6,770 8,228

----------- ---------------

Current assets

Inventories 11,447 10,649

Trade and other receivables 12,099 11,245

Cash and cash equivalents 5,512 4,696

29,058 26,590

----------- ---------------

Total assets 35,828 34,818

=========== ===============

Current liabilities

Trade and other payables (11,951) (10,329)

Corporation tax payable - (38)

----------- ---------------

Total liabilities (11,951) (10,367)

----------- ---------------

Net assets 23,877 24,451

=========== ===============

Equity

Share capital 272 272

Share premium account 5,734 5,734

Capital redemption reserve 1,514 1,514

Retained earnings 16,357 16,931

----------- ---------------

Equity shareholders' funds attributable

to the owners of the parent 23,877 24,451

=========== ===============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

At 30 June 2023

Share Share Capital Redemption Retained Total Equity

Capital Premium Reserve Earnings

Account

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 July 2021 272 5,734 1,514 17,569 25,089

Dividends - - - (191) (191)

Transactions with owners - - - (191) (191)

Loss and total

comprehensive income

for the year - - - (447) (447)

Balance at 30 June 2022 272 5,734 1,514 16,931 24,451

Dividends - - - (163) (163)

Transactions with owners - - - (163) (163)

Loss and total

comprehensive income

for the year - - - (411) (411)

Balance at 30 June 2023 272 5,734 1,514 16,357 23,877

============ ============ ============ ============ =============

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 30 June 2023

2023 2022

GBP'000 GBP'000

Cash flows from operating activities

Operating Loss from continuing operations (492) (452)

Depreciation of property, plant and equipment 357 336

Amortisation of intangible assets 58 56

Profit on disposal of property, plant

and equipment (74) (15)

------------- --------------

Operating loss before changes in working

capital (151) (75)

Increase in inventories (798) (2,181)

Increase in trade and other receivables (854) (492)

Increase in trade and other payables 1,622 463

Cash used in operations (181) (2,285)

Income taxes paid (38) (120)

Net cash used in operating activities (219) (2,405)

------------- --------------

Cash flows from investing activities

Interest received 81 5

Proceeds from disposal of property,

plant and equipment 1,475 60

Purchase of property, plant and

equipment (358) (222)

Net cash generated from/(used

in) investing activities 1,198 (157)

Cash flows from financing activities

Dividends paid to equity shareholders (163) (191)

Interest paid - -

Net cash used in financing activities (163) (191)

------------- --------------

Net increase/(decrease) in cash

and cash equivalents 816 (2,753)

Cash and cash equivalents at

beginning of year 4,696 7,449

Cash and cash equivalents at

end of year 5,512 4,696

------------- --------------

Notes

1. Financial information

This financial information is consistent with the consolidated

financial statements of the group for the year ended 30 June 2023.

The group's consolidated financial statements have been prepared in

accordance with international accounting standards in conformity

with the requirements of the Companies Act 2006.

The financial information set out above does not constitute the

group's statutory accounts for the years ended 30 June 2022 or 30

June 2023 but is derived from those accounts. The statutory

accounts for the year ended 30 June 2022 have been delivered to the

Registrar of Companies and those for 2023 will be delivered

following the group's annual general meeting. The auditor's report

on the 2023 accounts will be unqualified, will not include

references to any matters to which the auditors drew attention by

way of emphasis without qualifying their reports, and will not

contain statements under s.498(2) or (3) of the Companies Act 2006.

The information contained in this statement does not constitute

statutory accounts within the meaning of section 434 of the

Companies Act 2006.

2. Revenue

Although the sales of the group are predominantly to the UK

there are sales to other countries and the following table sets out

the split of the sales for the year. Revenue is attributed to

individual countries based on the location of the customer. There

are no non-current assets outside the UK.

Revenues comprise: 2023 2022

GBP'000 GBP'000

Revenue from contracts

with

customers - UK 66,489 65,602

-other 660 658

--------- ---------

67,149 66,260

--------- ---------

No customer accounted for more than 10% of the group's revenue

for the year.

3. Loss per ordinary share

The calculation of the basic and diluted earnings per share is

based on the following data:

2023 2022

GBP'000 GBP'000

Loss for the year attributable to

equity holders of the parent company (411) (447)

=========== ===========

2023 2022

Number of shares Number Number

Weighted average number of ordinary

shares for the purpose of basic and

diluted earnings per share 27,231,586 27,231,586

=========== ===========

4. Dividends

A final dividend of 0.3p per share will be paid on 19 January

2024 to those members on the register at close of business on 15

December 2023.

5. Notice of meeting

The annual report and accounts for the year ended 30 June 2023

will be posted to shareholders in due course and the Annual General

Meeting will be held on 20 December 2023.

The Company's registered office is Namber House, 23 Davis Road,

Chessington, Surrey, KT9 1HS.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR FZMMMRDMGFZM

(END) Dow Jones Newswires

November 15, 2023 02:00 ET (07:00 GMT)

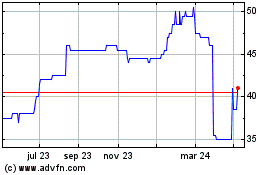

Northamber (LSE:NAR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

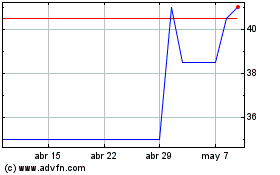

Northamber (LSE:NAR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024