NewRiver REIT PLC First Quarter Company Update (1612H)

26 Julio 2023 - 1:00AM

UK Regulatory

TIDMNRR

RNS Number : 1612H

NewRiver REIT PLC

26 July 2023

NewRiver REIT plc

("NewRiver" or the "Company")

First Quarter Company Update

Strong operational performance, enhanced balance sheet strength

and well positioned for growth

NewRiver will hold its Annual General Meeting ("AGM") at 10:00am

today and is providing the following trading update in respect of

the first quarter ended 30 June 2023.

Allan Lockhart, Chief Executive, commented : "The excellent

operational performance that we delivered in our last financial

year has continued into our first quarter with a good leasing

performance leading to a further increase in occupancy and a

leasing retention rate of nearly 100%. We continue to see strong

occupational demand underpinned by a resilient UK consumer.

Our cash position during the quarter increased to GBP137m driven

by disciplined capital recycling and our excellent operational

performance further enhancing what we believe to be one of the

strongest balance sheets in our sector and a market leading yield

gap.

We now have significant growth opportunities available to us -

underpinned by our substantial cash holdings and through the

expansion of our capital partnerships, driven by our extensive

sector expertise. We will allocate our capital wisely as and when

attractive opportunities arise; in the meantime we are generating a

return on the majority of our cash holdings of 5% ."

Strong operational performance and growth in capital

partnerships

-- Completed 177,300 sq ft of leasing, with long-term transactions

+13.7% versus the previous rent and in-line with ERV

-- Occupancy increased to 97.1% vs 96.7% at 31 March 2023 and Retention

rate on lease expiry or break increased to 98% during Q1 FY24

(FY23: 92%) reflecting strong occupational demand

-- FY23 rent collection has now increased to 99% from 98% at the

time of full year results in June and Q1 FY24 rent collection

is tracking in-line with Q4 FY23

-- Business rates reductions of 16% across NRR portfolio, benefitting

tenants from 1 April 2023

-- Capital partnership with M&G Real Estate expanded in April with

the appointment to manage an additional shopping centre taking

total number of assets managed under this arrangement to 16 retail

parks and two shopping centres

Profitable capital recycling further enhancing balance sheet

strength

-- In June 2023, completed the disposal of Kittybrewster Retail Park

in Aberdeen and Glendoe and Telford Retail Parks in Inverness,

the final properties in the Napier Joint Venture, for GBP62.6

million (NRR share: GBP31.3 million)

-- The disposal brings the total sale receipts from Napier to GBP76.0

million, 26% higher than the price paid when NewRiver acquired

the portfolio in June 2019, and delivering an IRR since acquisition

of 16%

-- Cash & cash equivalents increased to GBP137 million from GBP111

million at 31 March 2023 and net debt reduced to GBP164 million

from GBP201 million at 31 March 2023

-- LTV as at 30 June 2023 of 29.1% (using March 2023 portfolio valuation)

reduced from 33.9% at 31 March 2023 following Napier disposal

-- Currently considering opportunities to allocate capital and in

the meantime now generating a return on the majority of cash holdings

of 5%

-- Fully unsecured balance sheet with interest rate fixed at 3.5%

on drawn debt and no maturity on drawn debt until March 2028

For further information

+44 (0)20 3328

NewRiver REIT plc 5800

Allan Lockhart (Chief Executive)

Will Hobman (Chief Financial Officer)

Lucy Mitchell (Communications

& Investor Relations)

+44 (0)20 7251

FGS Global 3801

Gordon Simpson

James Thompson

About NewRiver

NewRiver REIT plc ('NewRiver') is a leading Real Estate

Investment Trust specialising in buying, managing and developing

resilient retail assets throughout the UK.

Our GBP0.6 billion UK wide portfolio covers 7 million sq ft and

comprises 26 community shopping centres and 12 conveniently located

retail parks occupied by tenants predominately focused on essential

goods and services. Our objective is to own and manage the most

resilient retail portfolio in the UK, focused on retail parks, core

shopping centres, and regeneration opportunities in order to

deliver long-term attractive recurring income returns and capital

growth for our shareholders.

NewRiver has a Premium Listing on the Main Market of the London

Stock Exchange (ticker: NRR). Visit www.nrr.co.uk for further

information.

LEI Number: 2138004GX1VAUMH66L31

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDGZGZNVKLGFZM

(END) Dow Jones Newswires

July 26, 2023 02:00 ET (06:00 GMT)

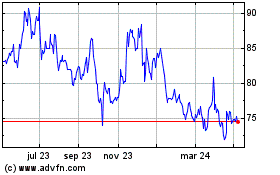

Newriver Reit (LSE:NRR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

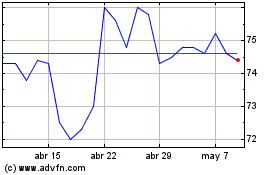

Newriver Reit (LSE:NRR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024