TIDMPAG

RNS Number : 7956V

Paragon Banking Group PLC

06 December 2023

RNS Announcement

Paragon Banking Group PLC

6 December 2023

Strong financial performance in volatile environment

Paragon Banking Group PLC ('Paragon' or 'the Group'), the

specialist lender and banking group, today announces its full year

results for the year ended 30 September 2023

The full text of the results announcement can be accessed via

the Paragon Group website at:

https://www.paragonbankinggroup.co.uk/investors/reports-results-presentations

The results announcement will also be submitted to the National

Storage Mechanism and will shortly be available for inspection

at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

This announcement is made in accordance with DTR 6.3.5R(1A).

Nigel Terrington, Chief Executive of Paragon said:

"The Group's performance for 2023 again demonstrates the

strength of our business model, with underlying profits up 25.4%,

loan book growth of 4.7% and retail deposits increasing 24.3% to

GBP13.3 billion, outperforming the market, providing strong

liquidity and supporting growth.

The Group's diversification strategy and focus on specialist

markets across buy-to-let and our commercial divisions provides

resilience. Our digitalisation programme continues at pace,

providing better user experience for our customers and

intermediaries, along with delivering operational efficiencies.

We have today announced a further GBP50.0 million share buy-back

for the 2024 financial year. Reflecting the sustained performance

of the Group, strength of our capital ratios and liquidity level,

since 2015, the Group has returned over GBP948.5 million to

shareholders via share buybacks and dividends.

Whilst the external environment remains dynamic with high

interest rates and inflation, the Group remains well placed to

continue supporting its customers in its chosen specialist markets.

The strength of the business model and through-the-cycle experience

of the management team provides strong foundations to capitalise on

opportunities and continue to deliver strong returns for

shareholders."

Financial highlights

-- Underlying profit before fair value items increased by 25.4%

to GBP277.6 million (2022: GBP221.4 million) *

-- Reflecting the unwinding of non-cash accounting fair value

gains reported in 2022, statutory profit before tax fell by 52.2%

to GBP199.9 million (2022: GBP417.9 million including GBP4.6

million of one-off gains)

-- Underlying EPS increased 34.8% to 94.2p (2022: 69.9p) *,

reported EPS fell 46.8% to 68.7p (2022: 129.2p) reflecting fair

value unwinds

-- Underlying cost:income ratio improved further to 36.6% (2022: 39.4%)

-- Cost of risk at 12 basis points (2022: 10 basis points)

continues to reflect high quality customer base

-- Capital ratios remain strong: CET1 ratio 15.5% (2022: 16.3%)

-- Net interest margin widened by 40 basis points year-on-year to 309 basis points

-- Underlying Return on Tangible Equity increased to 20.2% (2022: 16.0%)

-- Tangible Net Asset Value per share at 30 September 2023 of GBP5.79 (2022: GBP5.33)

-- Total dividend up 30.8% to 37.4p (2022: 28.6p), in line with policy

-- GBP100.0 million share buyback programme completed in the

2023 financial year with a further GBP50.0 million announced for

the 2024 financial year

Operational highlights

-- Total new lending of GBP3.01 billion (2022: GBP3.21 billion):

o Mortgage Lending advances totalled GBP1.88 billion (2022:

GBP1.91 billion)

o Commercial Lending advances totalled GBP1.13 billion (2022:

GBP1.30 billion)

-- Enhanced customer retention of over 80 % at product maturity

and new advances support net loan book growth of 4.7% to GBP14.9

billion (2022: GBP14.2 billion)

-- Buy-to-let three-month plus arrears 0.34% (2022: 0.15%),

remaining significantly below the industry average

-- Buy-to-let portfolio loan-to-value ratio at 62.8% (2022:

57.9%), providing substantial security cover

-- Retail deposits increased 24.3% to GBP13.3 billion (2022:

GBP10.7 billion), outperforming the market, supporting growth and

providing strong liquidity

-- Further progress on delivery of digitalisation strategy, with

benefits already available to customers and intermediaries, helping

to drive operational efficiencies

-- Continuing engagement with PRA on IRB application process

* Appendix A of the results announcement

A final dividend for the year of 26.4 pence per share will be

paid on 8 March 2024 to shareholders on the register at 2 February

2024, subject to approval at the forthcoming Annual General Meeting

of the Company

For further information, please contact:

Paragon Banking Group PLC Headland Consultancy

Nigel Terrington, Chief Executive Lucy Legh / Charlie Twigg

Richard Woodman, Chief Financial

Officer

Email: paragon@headlandconsultancy.com

Tel: 0121 712 2505 Tel: 020 3805 4822

The Group will be holding a results presentation for sell-side

analysts on Wednesday 6 December 2023 at 9:30am, at UBS, 5

Broadgate, London EC2M 2QS.

This will be webcast live at:

https://secure.emincote.com/client/paragon/full-year-results-2023

The presentation material will be available on the Group's

corporate website at www.paragonbankinggroup.co.uk/investors from

7:00am on the same day, with a webcast replay available from

2:00pm.

Cautionary statement

Sections of this announcement may contain forward-looking

statements with respect to certain of the plans and current goals

and expectations relating to the future financial condition,

business performance and results of the Group. These statements can

be identified by the fact that they do not relate strictly to

historical or current facts. They use words such as 'anticipate',

'estimate', 'expect', 'intend', 'will', 'project', 'plan',

'believe', 'target' and other words and terms of similar meaning in

connection with any discussion of future operating or financial

performance but are not the exclusive means of identifying such

statements. These have been made by the directors in good faith

using information available up to the date on which they approved

this report, and the Group undertakes no obligation to update or

revise these forward-looking statements for any reason other than

in accordance with its legal or regulatory obligations (including

under the UK Market Abuse Regulation, UK Listing Rules and the

Disclosure Guidance and Transparency Rules of the Financial Conduct

Authority ('FCA')).

By their nature, all forward-looking statements involve risk and

uncertainty because they relate to future events and circumstances

that are beyond the control of the Group and depend upon

circumstances that may or may not occur in the future that could

cause actual results or events to differ materially from those

expressed or implied by the forward-looking statements. There are

also a number of factors that could cause actual future financial

conditions, business performance, results or developments to differ

materially from the plans, goals and expectations expressed or

implied by these forward-looking statements and forecasts. As a

result, you are cautioned not to place reliance on such

forward-looking statements as a prediction of actual results or

otherwise.

These factors include, but are not limited to: material impacts

related to foreign exchange fluctuations; macro-economic activity;

the impact of outbreaks, epidemics or pandemics, and the extent of

their impact on overall demand for the Group's services and

products; potential changes in dividend policy; changes in

government policy and regulation (including the monetary, interest

rate and other policies of central banks and other regulatory

authorities in the principal markets in which the Group operates)

and the consequences thereof; actions by the Group's competitors or

counterparties; third party, fraud and reputational risks inherent

in its operations; the UK's exit from the EU; unstable UK and

global economic conditions and market volatility, including

currency and interest rate fluctuations and inflation or deflation;

the risk of a global economic downturn; social unrest; acts of

terrorism and other acts of hostility or war and responses to, and

consequences of those acts; technological changes and risks to the

security of IT and operational infrastructure, systems, data and

information resulting from increased threat of cyber and other

attacks; general changes in government policy that may

significantly influence investor decisions (including, without

limitation, actions taken in support of managing and mitigating

climate change and in supporting the global transition to net zero

carbon emissions); societal shifts in customer financing and

investment needs; and other risks inherent to the industries in

which the Group operates.

Nothing in this announcement should be construed as a profit

forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSFFFEVFSLEIIV

(END) Dow Jones Newswires

December 06, 2023 02:00 ET (07:00 GMT)

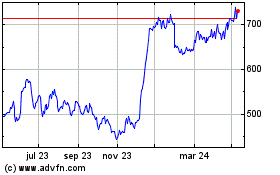

Paragon Banking (LSE:PAG)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

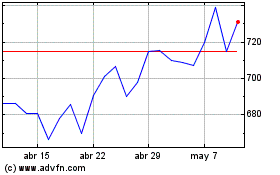

Paragon Banking (LSE:PAG)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024