PensionBee Group plc 4Q 2023 Results Announcement (8147A)

24 Enero 2024 - 10:30AM

UK Regulatory

TIDMPBEE

RNS Number : 8147A

PensionBee Group plc

24 January 2024

PensionBee Group plc

Incorporated in England and Wales

Registration Number: 13172844

LEI: 2138008663P5FHPGZV74

ISIN: GB00BNDRLN84

Wednesday 24 January 2024

PensionBee Group plc

Trading Update for the twelve months ended 31 December 2023

Successful strategy drives strong performance for 2023

Adjusted EBITDA Profitability achieved for Q4 2023

PensionBee Group plc ('PensionBee' or the 'Company'), a leading online pension provider, today

announces a trading update (unaudited) for the twelve months ended 31 December 2023.

Highlights

* Strong continued customer growth, with Invested

Customers having increased by 25% year on year to

229,000 (December 2022: 183,000).

* Assets under Administration increased by 44% year on

year to GBP4.4bn (December 2022: GBP3.0bn),

underpinned by strong Net Inflows from new and

existing customers.

* Customer Retention Rate remained >95%, driven by

customer satisfaction and continuous product

innovation.

* Revenue increased by 35% to GBP24m (2022: GBP18m),

with Annual Run Rate Revenue having increased by 44%

to GBP28m (2022: GBP20m).

* Adjusted EBITDA of GBP(8)m (2022: GBP(20)m) improved

by 57% year on year, driven by strong Revenue growth

and cost efficiencies across the business.

* Adjusted EBITDA profitability achieved in Q4 2023,

with positive Adjusted EBITDA Margin of 8% as

compared to (98)%, (50)% and (17)% in Q1, Q2 and Q3

respectively.

PensionBee delivered strong growth across all of its key performance indicators, with Assets

under Administration ('AUA') increasing by 44% to GBP4.4bn. The Company has seen excellent

momentum in the growth of its customer base, adding approximately 46,000 new Invested Customers

across the year, taking the overall Invested Customer base to 229,000. This demonstrates the

continued success of its data-led, multi-channel customer acquisition approach and highlights

the clear demand for its customer-focused proposition.

Revenue grew by 35% year on year to GBP24m as a result of strong Net Inflows from new and

existing customers, with the Annual Run Rate Revenue increasing by 44% to GBP28m(1) . The

Company's sustained high Customer Retention Rate and AUA Retention Rate, both >95%, have continued

to drive recurring Revenue.

Continued Advancement of Strategic Goals

The Company's GBP9.7m marketing investment across the year, bringing the cumulative marketing

investment since inception to GBP55m, has driven sustained brand awareness and customer acquisition.

PensionBee's brand awareness activities for the year have been centred on cost-effective channels

such as radio, television and sports sponsorship. This approach has been accompanied by continued

investment in performance channels such as search and social media, with data-led insights

driving decision-making. Cost per Invested Customer ('CPIC') has continued to demonstrate

a downward trajectory with the achievement of an In-Period CPIC for 2023 of GBP212(2) , highlighting

the Company's marketing capability and efficiency of spend.

PensionBee has continued to innovate, to meet the needs of its customers and support their

engagement. It has continued to provide customers with helpful tools they need to plan for

their retirement, such as its tax relief, state pension and inflation calculators, and the

introduction of in-app withdrawals has enabled customers at retirement age to pay themselves

a salary through retirement. The award-winning Pension Confident Podcast was also made available

within the app, making it easy for customers to directly access valuable content on the go.

The importance that the Company places on delivering outstanding customer service has been

evidenced through the achievement of a 4.6 Excellent Trustpilot rating from approximately

10,000 Trustpilot reviews, and consistently rapid response times on phones and live chat.

PensionBee has continued to invest in the scalability of its technology platform through internal

automation, efficiency, security and pension transfer improvements to support productivity,

as demonstrated by a 15% improvement in productivity.(3) The Company continued to prioritise

security and its customers' cyber safety, through its successful ISO27001 re-certification,

the onboarding of a new 24/7 security operations centre and the implementation of mandatory

two-factor authentication for all customers.

Outlook

The Board remains confident in PensionBee's potential for continued growth and profitability,

due to a combination of the strength and stability of its existing customer base, together

with its ability to attract new customers that generate growth in recurring Revenue through

its scalable technology platform.

The Company is pleased to reiterate the guidance previously provided, with an ambition to

pursue a c.2% market share target of the substantial GBP700bn UK transferable pensions market

over the next 5-10 years, translating to a Revenue ambition of approximately GBP150m.

The Company remains on track to further reduce Cost per Invested Customer, expecting to achieve

Adjusted EBITDA profitability for the full financial year of 2024, having successfully achieved

Adjusted EBITDA profitability for the fourth quarter of 2023. PensionBee expects to achieve

long-term EBITDA Margins in excess of 50%, leveraging the scalability of its technology platform

and maintaining its high quality service. This is supported by the Company's continued positive

momentum in its trading performance and growth in key indicators, such as Invested Customers

and AUA.

Romi Savova, CEO of PensionBee, commented:

"We are pleased to have substantially grown our customer base throughout the year to approximately

230,000 with GBP4.4bn of Assets under Administration, helping these customers prioritise and

engage with their retirements.

As we approach 10 years since inception, we have reached a pivotal point in our corporate

journey - the achievement of Adjusted EBITDA profitability across the fourth quarter of 2023.

Looking forward, we are confident in the continued growth of the business and the delivery

of profitability for the full year 2024, as we continue to help more and more consumers become

Pension Confident."

Analyst, Investor and Press Presentation

There will be a webcast presentation for analysts, investors and press on Wednesday 24 January

at 5:00pm UK (GMT) / 12:00pm US (EST). Please contact press@pensionbee.com if you would like

to attend.

Alternatively you can register and access the webcast with the following links:

Webcast Link: Webcast for video presentation

Conference Call Link: Conference call for Q&A

Financial Summary

As at Period End

Dec Dec Dec YoY change

2021 2022 2023

------ ------ ------ -----------

AUA (GBPm)(4) 2,587 3,025 4,350 44%

-----------

AUA Retention Rate (% of AUA)(5) >95% >95% >95% Stable

-----------

Invested Customers (thousands)(6) 117 183 229 25%

------ -----------

Customer Retention Rate (% of IC)(7) >95% >95% >95% Stable

------ -----------

Cost per Invested Customer (GBP)(8) 246 248 241 (3)%

------ ------ ------ -----------

Realised Revenue Margin (% of AUA)(9) 0.64% 0.63% 0.64% +1bp

------ ------ ------ -----------

Over the 12-month Period Ending

Dec Dec Dec YoY change

2021 2022 2023

-------- ------- ------ -----------

Revenue (GBPm)(10) 13 18 24 35%

-------- ------- ------ -----------

Cost Base (GBPm) (29) (37) (32) (13)%

-----------

Adjusted EBITDA (GBPm)(11) (16) (20) (8) 57%

-----------

Adjusted EBITDA Margin (% of Revenue)(12) (129)% (110)% (35)% 75ppt

-----------

Over the 12-month Period Ending

Dec Dec Dec YoY change

2021 2022 2023

------- ------- ------ ------------

Opening AUA (GBPm)(4) 1,358 2,587 3,025 17%

------ ------------

Gross Inflows (GBPm) 1,099 1,060 1,174 11%

------------

Gross Outflows (GBPm) (145) (197) (318) 61%

------------

Net Inflows (GBPm) 955 863 857 (1)%

------------

Market Growth and Other (GBPm) 275 (424) 464 n/m

------------

Closing AUA (GBPm)(4) 2,587 3,025 4,350 44%

------------

Over the 3-month Period Ending

Q4 Q4 Q4 YoY change

2021 2022 2023

------- ------ ------ ------------

Revenue (GBPm)(10) 4 5 7 39%

------- ------ ------ ------------

Adjusted EBITDA (GBPm)(11) (5) (1) 1 n/m

------------

Adjusted EBITDA Margin (% of Revenue)(12) (118)% (25)% 8% 33ppt

------------

Notes

* ppt is the absolute change in percentage.

1 Annual Run Rate ("ARR") Revenue is calculated using the Recurring

Revenue for the relevant month multiplied by 12.

--------------------------------------------------------------------------

2 In-Period CPIC is defined as the marketing costs for the relevant

period divided by the number of Invested Customers for that

same period.

--------------------------------------------------------------------------

3 Invested Customers per Staff Member calculated using LTM average

for total workforce. Management information as at 30 December

2023.

--------------------------------------------------------------------------

4 Assets under Administration ('AUA') is the total invested value

of pension assets within PensionBee Invested Customers' pensions.

It measures the new inflows less the outflows and records a

change in the market value of the assets. AUA is a measurement

of the growth of the business and is the primary driver of Revenue.

--------------------------------------------------------------------------

5 AUA Retention measures the percentage of retained PensionBee

AUA from Transfer Outs over the average of the trailing twelve

months. High AUA retention provides more certainty of future

Revenue. This measure can also be used to monitor customer satisfaction.

--------------------------------------------------------------------------

6 Invested Customers ('IC') means those customers who have transferred

pension assets or made contributions into one of PensionBee's

investment plans.

--------------------------------------------------------------------------

7 Customer Retention Rate measures the percentage of retained

PensionBee Invested Customers over the average of the trailing

twelve months. High customer retention provides more certainty

of future Revenue. This measure can also be used to monitor

customer satisfaction.

--------------------------------------------------------------------------

8 Cost per Invested Customer ('CPIC') means the cumulative advertising

and marketing costs incurred since PensionBee commenced trading

up until the relevant point in time divided by the cumulative

number of Invested Customers at that point in time. This measure

monitors cost discipline of customer acquisition. PensionBee's

desired CPIC threshold is GBP200-GBP250.

--------------------------------------------------------------------------

9 Realised Revenue Margin is calculated by using the last twelve

months of Recurring Revenue over the average quarterly AUA held

in PensionBee's investment plans over the period.

--------------------------------------------------------------------------

10 Revenue means the income generated from the asset base of PensionBee's

customers, essentially annual management fees charged on the

AUA, together with a minor revenue contribution from other services.

--------------------------------------------------------------------------

11 Adjusted EBITDA is the profit or loss for the period before

taxation, finance costs, depreciation, share based compensation

and transaction costs.

--------------------------------------------------------------------------

12 Adjusted EBITDA Margin means Adjusted EBITDA as a percentage

of Revenue for the relevant period.

--------------------------------------------------------------------------

Contacts

PensionBee press@pensionbee.com

Becky O'Connor

Laura Dunn-Sims

About PensionBee

PensionBee is a leading online pension provider, making pension management easy for its customers

while they save for a happy retirement.

PensionBee helps its customers combine their old pension pots, make flexible contributions,

invest in line with their goals and values and make withdrawals from the age of 55 (increasing

to 57 in 2028). PensionBee offers a range of investment plans, including fossil fuel free

and impact investing options, from some of the world's largest asset managers.

Operating in the GBP1 trillion market of Defined Contribution pension assets, PensionBee has

grown rapidly through its direct-to-consumer marketing activities, creating a household brand

name for the mass market.

The Company has c.GBP4.4bn in Assets Under Administration and 229,000 Invested Customers as

at 31 December 2023. PensionBee has consistently maintained a Customer Retention Rate in excess

of 95% and an Excellent Trustpilot rating from more than 10,000 customers, reflecting its

commitment to outstanding customer service.

PensionBee is admitted to trading on the Premium Segment of the London Stock Exchange's Main

Market (LON:PBEE).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTPPUWPGUPCGQC

(END) Dow Jones Newswires

January 24, 2024 11:30 ET (16:30 GMT)

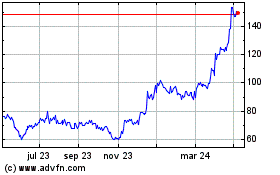

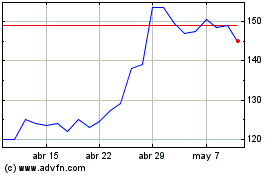

Pensionbee (LSE:PBEE)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Pensionbee (LSE:PBEE)

Gráfica de Acción Histórica

De May 2023 a May 2024