TIDMPEBB

RNS Number : 3462L

Pebble Group PLC (The)

05 September 2023

5 September 2023

THE PEBBLE GROUP PLC

("The Pebble Group" or the "Group")

UNAUDITED HALF YEAR RESULTS 2023

Solid performance with strategic progress

The Pebble Group (AIM: PEBB, OTCQX: PEBBF), a leading provider

of digital commerce, products and related services to the global

promotional products industry, announces its unaudited results for

the six months ended 30 June 2023 ("HY 23" or the "Period").

Having achieved solid year on year growth in HY 23, the Board

expects that for the year ending 31 December 2023 ("FY 23") the

Group's results will be in line with market expectations.

Financials

Statutory results HY 23 HY 22 Change FY 22

Revenue GBP63.3m GBP60.3m +5% GBP134.0m

Gross profit margin 42.8% 38.5% +4.3ppt 39.3%

Operating profit GBP3.3m GBP3.1m +6% GBP10.2m

Profit before tax GBP3.1m GBP2.8m +11% GBP9.7m

Basic earnings per share 1.37p 1.27p +8% 4.55p

Other financial highlights HY 23 HY 22 Change FY 22

Adjusted EBITDA(1) GBP7.5m GBP6.7m +12% GBP18.0m

Net cash / (debt)(2) GBP4.2m GBP(0.1)m +GBP4.3m GBP15.1m

Adjusted basic earnings

per share(3) 2.08p 1.88p +11% 5.78p

Financial highlights and outlook

-- Group Adjusted EBITDA up 12% following solid trading across the

Group

-- Facilisgroup: Revenue for HY 23 of GBP9.2m up 24% on HY 22 generating

GBP4.3m Adjusted EBITDA (HY22: GBP3.5m)

-- Brand Addition: Revenue for HY 23 of GBP54.2m up 2.5% on HY 22

generating GBP4.5m Adjusted EBITDA (HY 22: GBP4.4m)

-- Gross profit margins increase 4.3 percentage points to 42.8%,

driven by higher contribution from Facilisgroup and improved

margins at Brand Addition of 33.2% (HY 22: 29.9%)

-- Balance sheet strong and working capital cycle following its normal

pattern, with good profit to cash conversion resulting in a net

cash position at the full year expected to be circa GBP17m

-- The Board expects FY 23 results to deliver on market expectations

Operational highlights

-- Strong profit margins maintained in parallel with investments

into our technology, sales and marketing strategies

-- In Facilisgroup:

* New wins saw Syncore grow to 238 Partners at 4

September 2023 (31 December 2022: 225) with a strong

pipeline

* Commercio Stores, our ecommerce offering introduced

in 2022, became revenue generating with, to date,

circa 20% of Partners utilising the product

* Good progress made on the development of the Orders

product, aimed at smaller distributors, with a Beta

version launched in H2 2023

-- Brand Addition revenue growth continues to be underpinned by

its diverse and loyal client base with investments into ESG

and global capabilities further differentiating the business

with its target market

Commenting on the results, Chris Lee, Chief Executive Officer of

Pebble Group said: "Our attractive markets and blue-chip clients

have seen Facilisgroup and Brand Addition trade solidly in the

first half, as we deliver against our stated strategies. Both

businesses have strong and differentiated market positions and we

look forward to FY 23 when results are expected to be in line with

market expectations. We anticipate that Facilisgroup will become

the majority contributor to our profits as we move through 2024

."

Adjusted EBITDA means operating profit before depreciation,

(1) amortisation and share-based payments charge

Net cash/(debt) is calculated as cash and cash equivalents

(2) less borrowings (excluding lease liabilities)

Adjusted basic earnings per share ("EPS") represents Adjusted

(3) Earnings meaning profit after tax before amortisation of acquired

intangible assets and share-based payments charge divided by

a weighted average number of shares

Online analyst and investor presentation

A presentation for sell-side analysts will take place at 8:00am

today by webinar. Those wishing to attend should email

investors@thepebblegroup.com

The management team is hosting an online investor presentation

with Q&A at 12.30pm on Friday, 8 September 2023. To

participate, please register with PI World at

https://bit.ly/PEBB_H123_webinar

Enquiries:

The Pebble Group Temple Bar Advisory (Financial

Chris Lee, Chief Executive Officer PR)

Claire Thomson, Chief Financial Officer Alex Child-Villiers

+44 (0) 750 012 4121 William Barker / Sam Livingstone

+44 (0) 207 183 1190

pebble@templebaradvisory.com

Grant Thornton UK LLP (Nominated Berenberg (Corporate Broker)

Adviser) Ben Wright / Marie Moy / Yasmina

Samantha Harrison / Harrison Clarke Benchekroun

/ Ciara Donnelly +44 (0) 203 207 7800

+44 (0) 207 184 4384

About The Pebble Group

The Pebble Group is a provider of digital commerce, products and

related services to the global promotional products industry,

comprising two differentiated businesses, Facilisgroup and Brand

Addition, focused on specific areas of the promotional products

market. For further information, please visit

www.thepebblegroup.com .

CHIEF EXECUTIVE OFFICER'S REVIEW

Summary of results

We are pleased to report that both of our businesses,

Facilisgroup and Brand Addition, traded solidly throughout HY 23,

with the Group achieving Revenue of GBP63.3m (HY 22: GBP60.3m),

Adjusted EBITDA of GBP7.5m (HY 22: GBP6.7m) and Operating profit of

GBP3.3m (HY 22: GBP3.1m).

The Group's balance sheet is underpinned by Brand Addition's

blue-chip client base with Group working capital and cash

management following its usual in-year cycle. Our businesses have a

good track record of converting profit to cash, which has

continued, and the Group had Net cash at 30 June 2023 of GBP4.2m

(30 June 2022: Net debt GBP0.1m and 31 December 2022: Net cash

GBP15.1m).

Facilisgroup: providing a digital commerce platform for

promotional products businesses in North America

Revenue and profit analysis

HY 23 HY 22 FY 22

Recurring revenue GBP8.6m GBP7.0m GBP15.5m

Other revenue GBP0.6m GBP0.4m GBP1.1m

Total revenue GBP9.2m GBP7.4m GBP16.6m

Gross profit margin 100% 100% 100%

Adjusted EBITDA GBP4.3m GBP3.5m GBP9.0m

Operating profit GBP2.2m GBP1.7m GBP5.0m

Total revenue, the vast majority of which is recurring,

increased by 18.4% in USD, the business's home currency, and 24.3%

in GBP, compared to HY 22. The strong profit margins have been

maintained alongside investing in our technology , sales and

marketing strategies.

The Gross Merchandise Value ("GMV") transacted through our

technology increased by 9% to USD688m (HY 22: USD630m) and total

Partners (customers of our flagship product, Syncore) at 4

September 2023 grew to 238 (31 December 2022: 225) backed by an

increasing new business pipeline. Strong Partner retention rates

continue, demonstrating how our technology and related services are

key to their business operations.

Our aim at Facilisgroup has been to extend the breadth of our

technology to offer both order workflow and ecommerce solutions to

the circa 20,000 distributors across the North American promotional

products market. We are pleased to report that by the end of 2023,

the following products will be in market:

Syncore : Order workflow, focussed on distributors with revenues

of >USD2m. This is our flagship product upon which results to

date have been principally based

Commercio Stores : Ecommerce Stores, aimed at all sizes of

distributors. Launched to market in H2 2022

Commercio Orders : Order workflow, focussed on distributors with

revenues of <USD2m. Launched in Beta stage in H2 2023

Commercio Stores, our ecommerce offering introduced in 2022, is

further developing its product features to position it as a leading

solution in the promotional products sector. Total paying customers

of this product at 4 September 2023 was 55, which includes 45

existing Partners of Syncore. The pricing strategy is based on a

monthly fee plus a fee per store which, as Commercio grows, will in

effect increase our percentage fee per USD of GMV. With the

launches of Commercio Stores and Orders now completed we expect a

decreasing trend of capital investment from circa 30% of historic

Facilisgroup revenues towards a more normalised level of 15% to

20%.

As we bring new products to market, our revenue growth is

expected to be delivered by increasing the GMV through adding new

customers and increasing the services we offer. We intend to evolve

our KPIs to reflect this, disclosing customer numbers, the GMV

transacted through our platform and the resultant "Attach Rate"

percentage derived from the amount of income earned against this

GMV.

We believe that Facilisgroup, with its strong market position,

current rate of growth and excellent profit margins, will become

the majority contributor to Group profits moving through 2024.

Brand Addition: providing promotional products and related

services under contract to many of the world's most recognisable

brands

Revenue and profit analysis

HY 23 HY 22 FY 22

Revenue GBP54.2m GBP52.9m GBP117.4m

Gross profit GBP18.0m GBP15.8m GBP36.1m

Gross profit margin 33.2% 29.9% 30.7%

Adjusted EBITDA GBP4.5m GBP4.4m GBP11.5m

Operating profit GBP2.7m GBP2.8m GBP8.0m

At Brand Addition, HY 23 revenue increased to GBP54.2m, 2.5%

ahead of HY 22 with client retention remaining high. Revenue by

client sector has broadly followed trends in the global economy,

with revenues from our Technology and Consumer sector clients being

lower in HY 23 than HY 22 whilst revenue from our Engineering and

Transport sector clients has grown in the same period. Our sector

diversity and embedded client relationships has insulated the

business through a turbulent economic cycle.

Brand Addition supports its clients through providing complex

services, ranging from the design of bespoke products and product

ranges to the hosting of web stores. Our target market clients have

promotional merchandise strategies that require creative product

solutions with a strong and consistent sustainability focus,

delivered across multiple geographies. We believe that Brand

Addition is one of the few businesses with the skills, knowledge

and experience to provide this level of service at scale. This has

afforded the business the opportunity to improve its gross margins

compared to the prior period whilst maintaining its EBITDA margins,

after investing to support our clients evolving needs.

The majority of revenue of Brand Addition is generated through

approximately 70 client contracts and with a new business

development target list of 800 companies, Brand Addition has a

large addressable market to grow into. Current new business

tendering activity remains consistent with prior years. Through

this new business development and growth within the existing client

base, we aim for high single digit year-on-year revenue growth.

Environmental, Social and Governance ("ESG")

ESG activity is a key component of our Group strategy and

continues to evolve based upon business need, best practice and

stakeholder comment. We have recently updated our ESG cornerstones

and revised our ESG Materiality Assessment based upon feedback from

a wide range of stakeholders and this development can be found

under the ESG section of our website,

https://www.thepebblegroup.com/about-us/esg/ . In Q2 2024, we will

issue our third ESG Report, reiterating our ESG priorities, actions

and progress against our targets.

Group outlook

We are continuing to deliver on our stated strategies for

Facilisgroup and Brand Addition. Both businesses have strong and

differentiated market positions and we look forward to FY 23 when

results are expected to be in line with market expectations.

Christopher Lee

Chief Executive Officer

5 September 2023

CHIEF FINANCIAL OFFICER'S REVIEW

HY 23 HY 22 FY 22

Unaudited Unaudited Audited

GBP'm GBP'm GBP'm

Revenue 63.3 60.3 134.0

Gross profit 27.1 23.2 52.7

Gross profit margin 42.8% 38.5% 39.3%

Adjusted EBITDA 7.5 6.7 18.0

Adjusted EBITDA margin 11.8% 11.1% 13.4%

Depreciation and amortisation (3.4) (3.0) (6.5)

Share-based payment charge (0.8) (0.6) (1.3)

Operating profit 3.3 3.1 10.2

Net finance costs (0.2) (0.3) (0.5)

Profit before tax 3.1 2.8 9.7

Tax (0.8) (0.7) (2.1)

Profit for the Period 2.3 2.1 7.6

Weighted average number of

shares 167,450,893 167,450,893 167,450,893

Adjusted Basic EPS 2.08p 1.88p 5.78p

Basic EPS 1.37p 1.27p 4.55p

Our results demonstrate growth in both our businesses against HY

22 as we continue to progress our stated strategy.

Revenue

Revenue for the Period to 30 June was GBP63.3m (HY 22:

GBP60.3m), an increase of GBP3.0m (5.0%) compared to the same

period in 2022. Facilisgroup total revenues increased GBP1.8m

(24.3% increase on HY 22). Annual Recurring Revenue ("ARR") growth

was 22.9% (17.4% when measured in Facilisgroup's home currency of

USD). This was achieved through increases in our Management Fees

from additional Partner numbers, implementation of a new tiered

pricing structure and growth in our Marketing Fund where we

benefited from increased Partner numbers utilising our Preferred

Suppliers. The balance of the increase relates to Brand Addition,

which grew GBP1.3m or 2.5%. Revenue by sector for Brand Addition

has broadly followed trends in the wider economy.

Gross profit

Gross profit as a percentage of revenue increased to 42.8% (HY

22: 38.5%). Of this 4.3p.p.t increase, 3.3p.p.t is an increase in

gross margins at Brand Addition as the business has maintained

strong control of its supply chain alongside being able to improve

gross margins to reflect the increasing complexity of the services

demanded by its customers. The balance of the increase reflects the

increasing proportion of Facilisgroup of the Group as a whole.

Adjusted EBITDA

Adjusted EBITDA was GBP7.5m (HY 22: GBP6.7m). The increase of

GBP0.8m is made up as follows:

- Facilisgroup GBP0.8m increase from incremental revenue net

of the costs of investment to support delivery of the medium-term

revenue aspirations;

- Brand Addition GBP0.1m increase as improvements in gross

margin have been invested in expertise to support the increasing

complexity of client services; and

- Central costs increase of GBP0.1m.

The Adjusted EBITDA margin increased to 11.8% (HY 22: 11.1%) as

a result of the increasing proportion of Facilisgroup revenue to

the Group EBITDA.

Depreciation and amortisation

The total charge for the Period was GBP3.4m (HY 22: GBP3.0m) of

which GBP2.2m (HY 22: GBP1.9m) was the amortisation of intangible

assets. In accordance with IAS 38, the Group capitalises the costs

incurred in the development of its software and the increase is a

result of continued investment in proprietary technology and

specifically the digital commerce platform at Facilisgroup.

Share-based payments

The total charge for the Period under IFRS 2 "Share-based

payments" was GBP0.8m (HY 22: GBP0.6m). This related to the awards

made to date under the 2019 Long Term Incentive Plan and the Group

Sharesave Plan (SAYE).

Operating profit

Operating profit for the Period was GBP3.3m (HY 22:

GBP3.1m).

Taxation

The tax charge for the Period to 30 June was GBP0.8m (HY 22:

GBP0.7m) and is based on the full year Group expected tax charge

for 2023. The expected rate for the year incorporates the increase

in the UK Corporation tax rate from 19% to 25% on 1 April 2023.

Basic Earnings per share

The earnings per share analysis in note 5 covers both adjusted

earnings per share (profit after tax before amortisation of

acquired intangibles, share-based payments charge and exceptional

items divided by the weighted average number of shares in issue

during the year), and statutory earnings per share (profit

attributable to equity holders divided by the weighted average

number of shares in issue during the year). Adjusted earnings were

GBP3.5m (HY 22: GBP3.2m) an increase in adjusted basic earnings per

share of 0.20 pence. Basic earnings per share was 1.37 pence per

share (HY 22: 1.27 pence per share) an increase of 0.10 pence.

Dividends

In March 2023, the Board announced a maiden dividend payment in

respect of FY 22 and in doing so stated its intention to implement

a progressive dividend policy moving in the medium-term, towards

its stated position at IPO of making dividend payments of c.30% of

profit after tax. The Board remains committed to this decision but

does not consider the introduction of an interim dividend payment

is necessary at this time. An update on the dividend payment in

respect of FY 23 will be provided at the time of the full year

announcement in March 2024.

Cashflow

The Group had a cash balance of GBP4.2m at 30 June 2023 (30 June

2022: GBP5.4m, which included GBP5.5m drawn down from its GBP10.0m

committed revolving credit facility).

Cashflow for the Period is set out below:

HY 23 HY 22 FY 22

Unaudited Unaudited Audited

GBP'm GBP'm GBP'm

Adjusted EBITDA 7.5 6.7 18.0

Movement in working capital (9.7) (14.8) (3.4)

Capital expenditure (4.0) (3.6) (8.4)

Leases (0.9) (0.9) (1.7)

---------- ---------- --------

Adjusted operating cash flow (7.1) (12.6) 4.5

Tax paid (1.5) (0.3) (1.7)

Net finance cash flows (0.3) 5.2 (0.5)

Dividend paid (1.0) - -

Exchange loss (1.0) 1.0 0.7

---------- ---------- --------

Net cash flow (10.9) (6.7) 3.0

The movement in working capital in the Period was GBP(9.7m) (HY

22: GBP(14.8m)). The outflow is in line with the normal in-year

cycle which peaks in Q3. The reduced outflow when compared with

prior period reflects the mix of sales in Brand Addition which have

been weighted towards locally sourced products where the working

capital cycle is shorter.

Capital expenditure in the Period was GBP4.0m (HY 22: GBP3.6m).

This spend relates principally to investment in the Facilisgroup

digital commerce platform which we expect to peak in 2023.

Lease payments relate to leases capitalised in accordance with

IFRS 16.

Net finance cash flows in the Period of GBP(0.3)m (HY 22:

GBP5.2m). HY 22 included GBP5.5m in respect of the utilisation of

committed facilities less GBP(0.3)m interest payments in respect of

leases capitalised in accordance with IFRS 16. At 30 June 2023 the

committed facilities had not been utilised, interest payments on

leases are consistent with HY 22.

Cash and liquidity

The Group's working capital cycle is unwinding as expected. The

high point experienced in the period from June to August 2023 is

reducing, as we progress towards the year end, with clients and

Partners continuing to pay to agreed terms. The Group had Net cash

of GBP3.1m at 4 September 2023. This includes GBP2.0m drawn down

from the GBP10.0m committed revolving credit facility. The company

continues to demonstrate an attractive profit to cash conversion

and as such we expect Net cash at the full year end, 31 December

2023 to be in line with current market expectation of circa GBP17m

(31 December 2022: GBP15.1m).

Claire Thomson

Chief Financial Officer

5 September 2023

CONSOLIDATED INCOME STATEMENT

Unaudited Unaudited Audited

Period ended Period ended Year ended

30 June 30 June 31 December

Notes 2023 2022 2022

-------------- -------------- -------------

GBP'000 GBP'000 GBP'000

Revenue 63,317 60,316 134,025

Cost of goods sold (36,188) (37,099) (81,279)

-------------- -------------- -------------

Gross profit 27,129 23,217 52,746

Operating expenses (23,810) (20,168) (42,523)

Operating profit 3,319 3,049 10,223

Analysed as:

Adjusted EBITDA(1) 6 7,480 6,698 18,042

Depreciation 8 (1,115) (1,134) (2,384)

Amortisation 7 (2,224) (1,877) (4,182)

Share-based payment charge 11 (822) (638) (1,253)

Operating profit 3,319 3,049 10,223

---------------------------- -------- -------------- --------------

Finance expense (266) (245) (520)

-------------- -------------- -------------

Profit before taxation 3,053 2,804 9,703

Income tax expense 4 (751) (673) (2,090)

-------------- -------------- -------------

Profit for the period 2,302 2,131 7,613

============== ============== =============

Basic earnings per share 5 1.37p 1.27p 4.55p

============== ============== =============

Diluted earnings per share 5 1.37p 1.27p 4.54p

============== ============== =============

Note 1: Adjusted EBITDA, which is defined as operating profit

before depreciation, amortisation, exceptional items, and

share-based payment charge is a non-GAAP metric used by management

and is not an IFRS disclosure.

CONSOLIDATED STATEMENT OF OTHER COMPREHENSIVE INCOME

Unaudited Unaudited Audited

Period ended Period ended Year ended

30 June 30 June 31 December

2023 2022 2022

-------------- --------------- ------------

GBP'000 GBP'000 GBP'000

Items that may be subsequently reclassified to profit and loss

Foreign operations - foreign currency translation differences (1,901) 2,443 2,190

-------------- --------------- ------------

Other comprehensive (expense)/income for the period/year (1,901) 2,443 2,190

Profit for the period/year 2,302 2,131 7,613

-------------- --------------- ------------

Total comprehensive income for the period/year 401 4,574 9,803

============== =============== ============

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

Unaudited Unaudited Audited

As at As at As at 31

30 June 30 June December

Notes 2023 2022 2022

---------- ---------- ----------

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Intangible assets 7 60,353 58,765 60,002

Property, plant and equipment 8 8,729 10,194 9,492

Deferred tax asset 270 395 292

Total non-current assets 69,352 69,354 69,786

---------- ---------- ----------

Current assets

Inventories 14,788 16,081 15,447

Trade and other receivables 36,901 38,587 34,693

Cash and cash equivalents 4,184 5,351 15,058

Total current assets 55,873 60,019 65,198

---------- ---------- ----------

TOTAL ASSETS 125,225 129,373 134,984

========== ========== ==========

LIABILITIES

Non-current liabilities

Lease liability 9 6,795 8,185 7,490

Deferred tax liability 2,370 3,751 2,860

Total non-current liabilities 9,165 11,936 10,350

---------- ---------- ----------

Current liabilities

Borrowings - 5,500 -

Lease liability 9 1,496 1,612 1,569

Trade and other payables 28,403 30,485 36,413

Current tax liability 397 169 1,063

Total current liabilities 30,296 37,766 39,045

---------- ---------- ----------

TOTAL LIABILITIES 39,461 49,702 49,395

========== ========== ==========

NET ASSETS 85,764 79,671 85,589

========== ========== ==========

EQUITY AND RESERVES

Share capital 1,675 1,675 1,675

Share premium 78,451 78,451 78,451

Capital reserve 125 125 125

Merger reserve (103,581) (103,581) (103,581)

Translation reserve (1,038) 1,116 863

Share-based payments reserve 2,671 1,203 1,892

Retained earnings 107,461 100,682 106,164

---------- ---------- ----------

TOTAL EQUITY 85,764 79,671 85,589

========== ========== ==========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share-based

Share Share Capital Merger Translation payments Retained Total

capital premium reserve reserve reserve reserve earnings equity

---------- -------- --------- --------- ------------- ----------- --------- -------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2022 1,675 78,451 125 (103,581) (1,327) 681 98,551 74,575

========== ======== ========= ========= ============= =========== ========= =======

Profit for the period - - - - - - 2,131 2,131

Other comprehensive

income for the period - - - - 2,443 - - 2,443

Total comprehensive

income - - - - 2,443 - 2,131 4,574

Employee share schemes

- value of employee

services - - - - - 577 - 577

Deferred tax on employee

share schemes - - - - - (55) - (55)

Total transactions

with owners recognised

in equity - - - - - 522 - 522

At 30 June 2022 1,675 78,451 125 (103,581) 1,116 1,203 100,682 79,671

---------- -------- --------- --------- ------------- ----------- --------- -------

Profit for the period - - - - - - 5,482 5,482

Other comprehensive

expense for the period - - - - (253) - - (253)

---------- -------- --------- --------- ------------- ----------- --------- -------

Total comprehensive

(expense)/income - - - - (253) - 5,482 5,229

---------- -------- --------- --------- ------------- ----------- --------- -------

Employee share schemes

- value of employee

services - - - - - 619 - 619

Deferred tax on employee

share schemes - - - - - 70 - 70

---------- -------- --------- --------- ------------- ----------- --------- -------

Total transactions

with owners recognised

in equity - - - - - 689 - 689

---------- -------- --------- --------- ------------- ----------- --------- -------

At 31 December 2022 1,675 78,451 125 (103,581) 863 1,892 106,164 85,589

---------- -------- --------- --------- ------------- ----------- --------- -------

Profit for the period - - - - - - 2,302 2,302

Other comprehensive

expense for the period - - - - (1,901) - - (1,901)

---------- -------- --------- --------- ------------- ----------- --------- -------

Total comprehensive

(expense)/income - - - - (1,901) - 2,302 401

---------- -------- --------- --------- ------------- ----------- --------- -------

Employee share schemes

- value of employee

services - - - - - 743 - 743

Deferred tax on employee

share schemes - - - - - 36 - 36

Dividend paid - - - - - - (1,005) (1,005)

Total transactions

with owners recognised

in equity - - - - - 779 (1,005) (226)

At 30 June 2023 1,675 78,451 125 (103,581) (1,038) 2,671 107,461 85,764

---------- -------- --------- --------- ------------- ----------- --------- -------

CONSOLIDATED CASH FLOW STATEMENT

Unaudited Unaudited Audited

Period Period Year ended

ended ended 31 December

30 June 30 June 2022

Notes 2023 2022

---------- ---------- -------------

GBP'000 GBP'000 GBP'000

Operating profit 3,319 3,049 10,223

Adjustments for:

* Depreciation 8 1,115 1,134 2,384

* Amortisation 7 2,224 1,877 4,182

* Share-based payments charge 11 822 638 1,253

* Loss on disposal of fixed assets 8 3 - 19

Cash flows from operating activities

before changes in working capital 7,483 6,698 18,061

* Change in inventories 659 (5,988) (5,354)

* Change in trade receivables (2,208) (9,148) (5,271)

* Change in trade payables (8,089) 321 7,263

---------- ---------- -------------

Cash flows (used in)/from operating

activities (2,155) (8,117) 14,699

* Income taxes paid (1,545) (326) (1,712)

---------- ---------- -------------

Net cash flows (used in)/from

operating activities (3,700) (8,443) 12,987

---------- ---------- -------------

Cash flows from investing activities

* Purchase of property, plant and equipment (349) (444) (945)

* Purchase of intangible assets (3,687) (3,104) (7,434)

Net cash flows used in investing

activities (4,036) (3,548) (8,379)

---------- ---------- -------------

Cash flows from financing activities

* Lease payments (919) (929) (1,737)

* Interest paid (266) (245) (520)

(1,005) - -

* Dividend paid

- 5,500 -

* Receipts from secured loan facilities

Net cash flows (used in)/from

financing activities (2,190) 4,326 (2,257)

---------- ---------- -------------

NET CASH FLOWS (9,926) (7,665) 2,351

========== ========== =============

Cash and cash equivalents at beginning

of period 15,058 12,051 12,051

Effect of exchange rate fluctuations

on cash held (948) 965 656

---------- ---------- -------------

Cash and cash equivalents at end

of period 4,184 5,351 15,058

---------- ---------- -------------

NOTES TO THE UNAUDITED CONSOLIDATED INTERIM FINANCIAL

INFORMATION

1. GENERAL INFORMATION

The principal activity of The Pebble Group plc (the "Company")

is that of a holding company and the principal activity of the

Company and its subsidiaries (the "Group") is the sale of digital

commerce, products and related services to the promotional

merchandise industry. The Group has two segments, Brand Addition

and Facilisgroup. For Brand Addition this is the sale of

promotional products internationally, to many of the world's

best-known brands, and for Facilisgroup the provision of digital

commerce, consolidated buying power and community learning and

networking events to SME promotional product distributors in North

America, its Partners, through subscription-based services.

The Company was incorporated on 27 September 2019 in the United

Kingdom and is a public company limited by shares registered in

England and Wales. The registered office of the Company is Broadway

House, Trafford Wharf Road, Trafford Park, Manchester, England M17

1DD. The Company registration number is 12231361.

2. BASIS OF PREPARATION

These condensed consolidated interim financial statements of the

Group are for the period ended 30 June 2023. They have been

prepared on the basis of the policies set out in the 2022 annual

financial statements and in accordance with UK adopted IAS 34.

Financial information for the period ended 30 June 2022 included

herein is derived from the condensed consolidated interim financial

statements for that period.

The condensed consolidated interim financial statements have not

been reviewed or audited, nor do they comprise statutory accounts

for the purpose of Section 434 of the Companies Act 2006, and do

not include all of the information or disclosures required in the

annual financial statements and should therefore be read in

conjunction with the Group's 2022 annual financial statements,

which were prepared in accordance with international accounting

standards in conformity with the requirements of the Companies Act

2006 and international financial reporting standards adopted

pursuant to Regulation (EC) No 1606/2002 as it applies in the

European Union.

Financial information for the year ended 31 December 2022

included herein is derived from the statutory accounts for that

year, which have been filed with the Registrar of Companies. The

auditors' report on those accounts was unqualified, did not contain

an emphasis of matter paragraph and did not contain a statement

under Section 498 of the Companies Act 2006.

The condensed consolidated interim financial statements are

presented in the Group's functional currency of Sterling and all

values are rounded to the nearest thousand (GBP'000) except when

otherwise indicated.

Accounting Policies

The accounting policies adopted in the preparation of the

condensed consolidated interim financial statements are consistent

with those followed in the preparation of the Group's annual

financial statements for the year ended 31 December 2022 as

described in the Group's Annual Report and financial statements for

that year and as available on the Group's website (

www.thepebblegroup.com ).

Taxation

Taxes on income in the interim periods are accrued using

management's best estimate of the weighted average annual tax rate

that would be applicable to expected total annual earnings.

Forward looking statements

Certain statements in these condensed consolidated interim

financial statements are forward looking with respect to the

operations, strategy, performance, financial condition, and growth

opportunities of the Group. The terms "expect", "anticipate",

"should be", "will be", "is likely to", and similar expressions,

identify forward-looking statements. Although the Board believes

that the expectations reflected in these forward-looking statements

are reasonable, by their nature these statements are based on

assumptions and are subject to a number of risks and uncertainties.

Actual events could differ materially from those expressed or

implied by these forward-looking statements. Factors which may

cause future outcomes to differ from those foreseen in

forward-looking statements include, without limitation: general

economic conditions and business conditions in the Group's markets,

customers' expectations and behaviours, supply chain developments,

technology changes, the actions of competitors, exchange rate

fluctuations, and legislative, fiscal and regulatory developments.

Information contained in these financial statements relating to the

Group should not be relied upon as a guide to future

performance.

Alternative performance measures

Throughout the condensed consolidated interim financial

statements, consistent with the Annual Report, we refer to a number

of alternative performance measures ("APMs"). APMs are used

internally by management to monitor business performance. The APMs

that are not recognised under UK-adopted international accounting

standards are:

-- Adjusted earnings;

-- Adjusted EBTIDA;

-- Adjusted operating profit; and

-- Adjusted operating cash flow.

See note 6 for the reconciliation of the APMs.

The Board considers that the above APM's provide useful

information for stakeholders on the underlying trends and

performance of the Group and facilitate meaningful year on year

comparisons.

Key risks and uncertainties

The Group has in place a structured risk management process

which identifies key risks and uncertainties along with their

associated mitigants. The key risks and uncertainties that could

affect the Group's medium-term performance, and the factors that

mitigate those risks have not substantially changed from those set

out in the Group's Annual Report which can be found on the Group's

website ( www.thepebblegroup.com ).

Going Concern statement

The Group meets its day-to-day working capital requirements

through its own cash balances and committed banking facilities. In

assessing the appropriateness of adopting the going concern basis

in the preparation of these consolidated interim financial

statements, the Directors have prepared cash flow forecasts and

projections for the up to 31 December 2024.

The forecasts and projections, which the Directors consider to

be prudent, have been further sensitised by applying reductions to

revenue growth and margin, to consider a severe but plausible

downside. Under both the base and sensitised case the Group is

expected to have headroom against covenants, which are based on

interest cover and net leverage, and a sufficient level of

financial resources available through existing facilities when the

future funding requirements of the Group are compared with the

level of committed available facilities. Based on this, the

Directors are satisfied that the Group has adequate resources to

continue in operational existence for the foreseeable future. For

this reason, they continue to adopt the going concern basis in

preparing the consolidated interim financial statements.

3. SEGMENTAL ANALYSIS

The Chief Operating Decision Maker has been identified as the

Executive Directors. The Directors have determined that the

operating segments are Brand Addition, Facilisgroup and Central

Operations.

Segment information about the above businesses is presented

below:

Income statement for the period ended 30 June 2023

Period

ended

Central 30 June

Brand Addition Facilisgroup operations 2023

--------------- ------------- ------------ ---------

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 54,153 9,164 - 63,317

Cost of goods sold (36,188) - - (36,188)

--------------- ------------- ------------ ---------

Gross profit 17,965 9,164 - 27,129

Operating expenses (15,300) (7,002) (1,508) (23,810)

Operating profit/(loss) 2,665 2,162 (1,508) 3,319

Analysed as:

Adjusted EBITDA 4,457 4,272 (1,249) 7,480

Depreciation (783) (295) (37) (1,115)

Amortisation (670) (1,554) - (2,224)

Share-based payment charge (339) (261) (222) (822)

Operating profit/(loss) 2,665 2,162 (1,508) 3,319

------------------------------- --------------- ------------- ------------

Finance expense (176) (22) (68) (266)

--------------- ------------- ------------ ---------

Profit/(loss) before taxation 2,489 2,140 (1,576) 3,053

Income tax (expense)/income (612) (526) 387 (751)

--------------- ------------- ------------ ---------

Profit/(loss) for the period 1,877 1,614 (1,189) 2,302

=============== ============= ============ =========

Due to the timing on the delivery of orders, the Brand Addition

segment of The Pebble Group Plc traditionally raises a higher

number of invoices in the period July to December which results in

The Pebble Group Plc's performance being weighted to the second

half of the year.

All the above revenues are generated from contracts with

customers.

Income statement for the period ended 30 June 2022

Period

ended

Central 30 June

Brand Addition Facilisgroup operations 2022

--------------- ------------- ------------ ---------

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 52,926 7,390 - 60,316

Cost of goods sold (37,099) - - (37,099)

--------------- ------------- ------------ ---------

Gross profit 15,827 7,390 - 23,217

Operating expenses (13,060) (5,729) (1,379) (20,168)

Operating profit/(loss) 2,767 1,661 (1,379) 3,049

Analysed as:

Adjusted EBITDA 4,377 3,515 (1,194) 6,698

Depreciation (825) (291) (18) (1,134)

Amortisation (518) (1,359) - (1,877)

Share-based payment charge (267) (204) (167) (638)

------------- ------------ ---------

Operating profit/(loss) 2,767 1,661 (1,379) 3,049

------------------------------- --------------- ------------- ------------ ---------

Finance expense (185) (9) (51) (245)

--------------- ------------- ------------ ---------

Profit/(loss) before taxation 2,582 1,652 (1,430) 2,804

Income tax (expense)/income (620) (396) 343 (673)

--------------- ------------- ------------ ---------

Profit/(loss) for the period 1,962 1,256 (1,087) 2,131

=============== ============= ============ =========

Income statement for the year ended 31 December 2022

Year ended

Central 31 December

Brand Addition Facilisgroup operations 2022

--------------- ------------- ------------ -------------

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 117,391 16,634 - 134,025

Cost of goods sold (81,279) - - (81,279)

--------------- ------------- ------------ -------------

Gross profit 36,112 16,634 - 52,746

Operating expenses (28,155) (11,624) (2,744) (42,543)

Operating profit/(loss) 7,957 5,010 (2,744) 10,223

Analysed as:

Adjusted EBITDA 11,467 9,011 (2,436) 18,042

Depreciation (1,719) (626) (39) (2,384)

Amortisation (1,232) (2,950) - (4,182)

Share-based payment charge (559) (425) (269) (1,253)

Total operating profit/(loss) 7,957 5,010 (2,744) 10,223

------------------------------- --------------- ------------- ------------

Finance expense (388) (13) (119) (520)

--------------- ------------- ------------ -------------

Profit/(loss) before taxation 7,569 4,997 (2,863) 9,703

Income tax (expense)/income (1,495) (689) 94 (2,090)

--------------- ------------- ------------ -------------

Profit/(loss) for the year 6,074 4,308 (2,769) 7,613

=============== ============= ============ =============

Statement of financial position as at 30 June 2023

As at

Central 30 June

Brand Addition Facilisgroup operations 2023

--------------- ------------- ------------ ---------

GBP'000 GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Intangible assets 38,095 22,258 - 60,353

Property, plant and equipment 5,744 2,750 235 8,729

Deferred tax asset 92 - 178 270

Total non-current assets 43,931 25,008 413 69,352

--------------- ------------- ------------ ---------

Current assets

Inventories 14,788 - - 14,788

Trade and other receivables 32,039 4,568 294 36,901

Cash and cash equivalents 2,477 1,555 152 4,184

Total current assets 49,304 6,123 446 55,873

--------------- ------------- ------------ ---------

TOTAL ASSETS 93,235 31,131 859 125,225

=============== ============= ============ =========

LIABILITIES

Non-current liabilities

Lease liability 4,618 2,177 - 6,795

Deferred tax liability - 2,370 - 2,370

Total non-current liabilities 4,618 4,547 - 9,165

--------------- ------------- ------------ ---------

Current liabilities

Lease liability 1,179 255 62 1,496

Trade and other payables 26,185 1,605 613 28,403

Current tax (asset)/liability (56) 770 (317) 397

Total current liabilities 27,308 2,630 358 30,296

--------------- ------------- ------------ ---------

TOTAL LIABILITIES 31,926 7,177 358 39,461

=============== ============= ============ =========

NET ASSETS 61,309 23,954 501 85,764

=============== ============= ============ =========

Statement of financial position as at 30 June 2022

As at

Central 30 June

Brand Addition Facilisgroup operations 2022

--------------- ------------- ------------ ---------

GBP'000 GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Intangible assets 37,840 20,925 - 58,765

Property, plant and equipment 6,903 3,231 60 10,194

Deferred tax asset 213 115 67 395

Total non-current assets 44,956 24,271 127 69,354

--------------- ------------- ------------ ---------

Current assets

Inventories 16,081 - - 16,081

Trade and other receivables 34,813 3,769 5 38,587

Cash and cash equivalents 2,905 2,219 227 5,351

Total current assets 53,799 5,988 232 60,019

TOTAL ASSETS 98,755 30,259 359 129,373

=============== ============= ============ =========

LIABILITIES

Non-current liabilities

Lease liability 5,676 2,447 62 8,185

Deferred tax liability - 3,751 - 3,751

--------------- ------------- ------------ ---------

Total non-current liabilities 5,676 6,198 62 11,936

--------------- ------------- ------------ ---------

Current liabilities

Borrowings 5,500 - - 5,500

Lease liability 1,252 339 21 1,612

Trade and other payables 27,233 2,665 587 30,485

Current tax liability 393 18 (242) 169

Total current liabilities 34,378 3,022 366 37,766

--------------- ------------- ------------ ---------

TOTAL LIABILITIES 40,054 9,220 428 49,702

=============== ============= ============ =========

NET ASSETS 58,701 21,039 (69) 79,671

=============== ============= ============ =========

Statement of financial position as at 31 December 2022

As at

Brand Central 31 December

Addition Facilisgroup operations 2022

---------- ------------- ------------ -------------

GBP'000 GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Intangible assets 37,863 22,139 - 60,002

Property, plant and equipment 6,449 3,004 39 9,492

Deferred tax asset 137 - 155 292

Total non-current assets 44,449 25,143 194 69,786

---------- ------------- ------------ -------------

Current assets

Inventories 15,447 - - 15,447

Trade and other receivables 29,989 4,648 56 34,693

Cash and cash equivalents 12,655 2,265 138 15,058

Total current assets 58,091 6,913 194 65,198

---------- ------------- ------------ -------------

TOTAL ASSETS 102,540 32,056 388 134,984

========== ============= ============ =============

LIABILITIES

Non-current liabilities

Lease liability 5,148 2,315 27 7,490

Deferred tax liability - 2,860 - 2,860

Total non-current liabilities 5,148 5,175 27 10,350

---------- ------------- ------------ -------------

Current liabilities

Lease liability 1,221 303 45 1,569

Trade and other payables 33,543 2,075 795 36,413

Current tax liability 258 805 - 1,063

Total current liabilities 35,022 3,183 840 39,045

---------- ------------- ------------ -------------

TOTAL LIABILITIES 40,170 8,358 867 49,395

========== ============= ============ =============

NET ASSETS/(LIABILITIES) 62,370 23,698 (479) 85,589

========== ============= ============ =============

4. INCOME TAX EXPENSE

The income tax expense for the period ended 30 June 2023 is

based upon management's best estimate of the weighted average

annual tax rate expected for the full year ending 31 December 2023.

The income tax expense is higher than the standard rate of 23.5%

due to higher standard income tax rates in overseas territories.

The income tax expense for the year ended 31 December 2022 was

higher than the standard rate of 19% due to higher standard income

tax rates in overseas territories.

5. EARNINGS PER SHARE

Basic earnings per share are calculated by dividing the earnings

attributable to equity shareholders by the weighted average number

of ordinary shares in issue during the period.

For diluted earnings per share, the weighted average number of

ordinary shares in issue is adjusted to assume conversion of all

potentially dilutive ordinary shares. The Company has potentially

dilutive ordinary shares arising from share options granted to

employees. Options are dilutive under the Group Sharesave Plan

(SAYE), where the exercise price together with the future IFRS 2

charge of the option is less than the average market price of the

Company's ordinary shares during the period. Options under the LTIP

schemes, as defined by IFRS 2, are contingently issuable shares and

are therefore only included within the calculation of diluted EPS

if the performance conditions are satisfied at the end of the

reporting period, irrespective of whether this is the end of the

vesting period or not.

The impact on basic earnings per share of the potentially

dilutive share options issued under The Pebble Group Plc Long Term

Incentive Plan on 21 December 2020, 8 June 2021, 29 March 2022 and

28 March 2023 and Group Sharesave Plan (SAYE) on 6 October 2021 and

25 April 2023 is GBPnil for the periods ended 30 June 2023 and 30

June 2022.

The calculation of basic earnings per share is based on the

following data:

Statutory EPS

Unaudited Unaudited Audited

Period Period Year ended

ended ended 31 December

30 June 30 June 2022

2023 2022

Earnings (GBP'000)

Earnings for the purposes of basic and

diluted earnings per share

being profit for the period attributable

to equity shareholders 2,302 2,131 7,613

------------ ------------ -------------

Number of shares

Weighted average number of shares for

the purposes of basic earnings per share 167,450,893 167,450,893 167,450,893

Weighted average dilutive effects of

conditional share awards 600,871 - 185,624

Weighted average number of shares for

the purposes of diluted earnings per

share 168,051,764 167,450,893 167,636,517

------------ ------------ -------------

Earnings per ordinary share (pence)

Basic earnings per ordinary share (pence) 1.37 1.27 4.55

Diluted earnings per ordinary share (pence) 1.37 1.27 4.54

------------ ------------ -------------

Adjusted EPS

The calculation of adjusted earnings per share is based on the

after-tax adjusted profit after adding back certain costs as

detailed in the table in note 6. Adjusted earnings per share

figures are given to exclude the effects of amortisation of

acquired intangible assets, share-based payment charge and

exceptional items, all net of taxation, and are considered to show

the underlying performance of the Group.

Unaudited Unaudited Audited

Period Period Year ended

ended ended 31 December

30 June 30 June 2022

2023 2022

------------ ------------ -------------

Earnings (GBP'000)

Earnings for the purposes of basic and

diluted earnings per share being adjusted

earnings 3,479 3,153 9,675

------------ ------------ -------------

Number of shares

Weighted average number of shares for

the purposes of adjusted earnings per

share 167,450,893 167,450,893 167,450,893

Weighted average dilutive effects of conditional

share awards 600,871 - 185,624

Weighted average number of shares for

the purposes of diluted earnings per share 168,051,764 167,450,893 167,636,517

------------ ------------ -------------

Adjusted earnings per ordinary share

(pence)

Basic adjusted earnings per ordinary share

(pence) 2.08 1.88 5.78

Diluted adjusted earnings per ordinary

share (pence) 2.07 1.88 5.77

------------ ------------ -------------

See note 6 for the reconciliation of adjusted earnings.

6. ALTERNATIVE PERFORMANCE MEASURES (APMs)

Throughout the consolidated interim financial statements, we

refer to a number of APMs. A reconciliation of the APMs used are

shown below:

Unaudited Unaudited Audited

Period Period Year ended

ended ended 31 December

30 June 30 June 2022

Adjusted earnings: 2023 2022

------------- ------------- -------------

GBP'000 GBP'000 GBP'000

Profit for the period 2,302 2,131 7,613

Add back/(deduct):

Amortisation charge on acquired intangible

assets 709 677 1,420

Share-based payment charge 822 638 1,253

Tax effect of the above (354) (293) (611)

------------- ------------- -------------

Adjusted earnings 3,479 3,153 9,675

============= ============= =============

Unaudited Unaudited Audited

Period Period Year ended

ended ended 31 December

30 June 30 June 2022

Adjusted EBTIDA: 2023 2022

------------- ------------- -------------

GBP'000 GBP'000 GBP'000

Operating profit 3,319 3,049 10,223

Add back:

Depreciation 1,115 1,134 2,384

Amortisation 2,224 1,877 4,182

Share-based payment charge 822 638 1,253

------------- ------------- -------------

Adjusted EBITDA 7,480 6,698 18,042

============= ============= =============

Unaudited Unaudited Audited

Period Period Year ended

ended ended 31 December

30 June 30 June 2022

Adjusted operating profit: 2023 2022

------------- ------------- -------------

GBP'000 GBP'000 GBP'000

Operating profit 3,319 3,049 10,223

Add back:

Amortisation charge on acquired intangible

assets 709 677 1,420

Share-based payment charge 822 638 1,253

------------- ------------- -------------

Adjusted operating profit 4,850 4,364 12,896

============= ============= =============

Unaudited Unaudited Audited

Period Period Year ended

ended ended 31 December

30 June 30 June 2022

Adjusted operating cash flow: 2023 2022

------------- ------------- -------------

GBP'000 GBP'000 GBP'000

Adjusted EBITDA 7,480 6,698 18,042

Deduct:

Movement in working capital (9,638) (14,815) (3,362)

Capital expenditure (4,036) (3,548) (8,379)

Leases (919) (929) (1,737)

------------- ------------- -------------

Adjusted operating cash flow (7,113) (12,594) 4,564

============= ============= =============

7. INTANGIBLE ASSETS

Software

Customer and Development Work in

Goodwill relationships costs progress Total

--------- --------------- ----------------- ---------- --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

Balance at 31 December

2021 35,805 10,241 21,321 423 67,790

--------- --------------- ----------------- ---------- --------

FX difference on translation 312 1,014 1,207 38 2,571

Additions - - 2,189 827 3,016

Disposals - - (15) - (15)

Balance at 30 June

2022 36,117 11,255 24,702 1,288 73,362

--------- --------------- ----------------- ---------- --------

FX difference on translation 22 67 436 1 526

Additions - - 158 3,288 3,446

Disposals - - (911) - (911)

Reclassifications - - 492 (492) -

--------- --------------- ----------------- ---------- --------

Balance at 31 December

2022 36,139 11,322 24,877 4,085 76,423

--------- --------------- ----------------- ---------- --------

FX difference on translation (168) (530) (655) (188) (1,541)

Additions - - 401 3,286 3,687

Reclassifications - - 3,644 (3,644) -

Balance at 30 June

2023 35,971 10,792 28,267 3,539 78,569

--------- --------------- ----------------- ---------- --------

Accumulated amortisation

Balance at 31 December

2021 - 1,647 10,469 - 12,116

--------- --------------- ----------------- ---------- --------

FX difference on translation - 166 453 - 619

Charge for the period - 265 1,612 - 1,877

Disposals - - (15) - (15)

Balance at 30 June

2022 - 2,078 12,519 - 14,597

--------- --------------- ----------------- ---------- --------

FX difference on translation - 5 425 - 430

Charge for the period - 289 2,016 - 2,305

Disposals - - (911) - (911)

--------- --------------- ----------------- ---------- --------

Balance at 31 December

2022 - 2,372 14,049 - 16,421

--------- --------------- ----------------- ---------- --------

FX difference on translation - (113) (316) - (429)

Charge for the period - 277 1,947 - 2,224

Balance at 30 June

2023 - 2,536 15,680 - 18,216

--------- --------------- ----------------- ---------- --------

Net book value

--------- --------------- ----------------- ---------- --------

At 31 December 2021 35,805 8,594 10,852 423 55,674

--------- --------------- ----------------- ---------- --------

At 30 June 2022 36,117 9,177 12,183 1,288 58,765

--------- --------------- ----------------- ---------- --------

At 31 December 2022 36,139 8,950 10,828 4,085 60,002

--------- --------------- ----------------- ---------- --------

At 30 June 2023 35,971 8,256 12,587 3,539 60,353

========= =============== ================= ========== ========

The Group tests annually for impairment, or more frequently if

there are indicators that goodwill might be impaired.

8. PROPERTY, PLANT AND EQUIPMENT

Fixtures Computer Right-of-use

and fittings hardware Assets Total

-------------- ---------- ------------- --------

GBP'000 GBP'000 GBP'000 GBP'000

Cost

Balance at 31 December

2021 3,892 3,226 12,784 19,902

-------------- ---------- ------------- --------

Impact of foreign exchange

translation 208 101 758 1,067

Additions 114 330 2,388 2,832

Disposals - (69) (1,713) (1,782)

Balance at 30 June 2022 4,214 3,588 14,217 22,019

-------------- ---------- ------------- --------

Impact of foreign exchange

translation 8 45 25 78

Additions 213 288 83 584

Disposals (880) (1,250) (527) (2,657)

Balance at 31 December

2022 3,555 2,671 13,798 20,024

-------------- ---------- ------------- --------

Impact of foreign exchange

translation (115) (77) (624) (816)

Additions 194 145 472 811

Disposals - (7) (345) (352)

-------------- ---------- ------------- --------

Balance at 30 June 2023 3,634 2,732 13,301 19,667

-------------- ---------- ------------- --------

Accumulated depreciation

Balance at 31 December

2021 3,133 2,323 6,519 11,975

-------------- ---------- ------------- --------

Impact of foreign exchange

translation 148 31 319 498

Charge for the period 107 216 811 1,134

Disposals - (69) (1,713) (1,782)

-------------- ---------- ------------- --------

Balance at 30 June 2022 3,388 2,501 5,936 11,825

-------------- ---------- ------------- --------

Impact of foreign exchange

translation 6 67 20 93

Charge for the period 126 235 889 1,250

Disposals (880) (1,231) (525) (2,636)

-------------- ---------- ------------- --------

Balance at 31 December

2022 2,640 1,572 6,320 10,532

-------------- ---------- ------------- --------

Impact of foreign exchange

translation (92) (48) (220) (360)

Charge for the period 245 205 665 1,115

Disposals - (4) (345) (349)

-------------- ---------- ------------- --------

Balance at 30 June 2023 2,793 1,725 6,420 10,938

-------------- ---------- ------------- --------

Net book value

-------------- ---------- ------------- --------

Balance at 31 December

2021 759 903 6,265 7,927

-------------- ---------- ------------- --------

Balance at 30 June 2022 826 1,087 8,281 10,194

-------------- ---------- ------------- --------

Balance at 31 December

2022 915 1,099 7,478 9,492

-------------- ---------- ------------- --------

Balance at 30 June 2023 841 1,007 6,881 8,729

============== ========== ============= ========

Right-of-use Assets - net book Unaudited Unaudited Audited

value Period Period Year ended

ended ended 31 December

30 June 30 June 2022

2023 2022

---------- ---------- -------------

GBP'000 GBP'000 GBP'000

Leasehold property 6,655 8,118 7,362

Fixtures and fittings 43 127 87

Computer hardware 183 36 29

---------- ---------- -------------

6,881 8,281 7,478

========== ========== =============

9. LEASES

Amounts recognised in the consolidated statement of financial

position

In addition to the right-of-use assets included within note 8,

the consolidated statement of financial position shows the

following amounts relating to leases:

Unaudited Unaudited Audited

Period Period Year ended

ended ended 31 December

30 June 30 June 2022

Lease liabilities 2023 2022

---------- ---------- -------------

GBP'000 GBP'000 GBP'000

Maturity analysis - contractual undiscounted

cash flows:

Less than one year 1,912 2,063 1,897

More than one year, less than two years 1,688 1,873 1,726

More than two years, less than three

years 1,684 1,633 1,627

More than three years, less than four

years 1,465 1,637 1,624

More than four years, less than five

years 1,019 1,418 1,091

More than five years 1,611 2,685 2,207

---------- ---------- -------------

Total undiscounted lease liabilities

at period end 9,379 11,309 10,172

Finance costs (1,088) (1,512) (1,113)

---------- ---------- -------------

Total discounted lease liabilities

at period end 8,291 9,797 9,059

---------- ---------- -------------

Lease liabilities included in the

statement of financial position:

Current 1,496 1,612 1,569

Non-current 6,795 8,185 7,490

---------- ---------- -------------

8,291 9,797 9,059

---------- ---------- -------------

Amounts recognised in the consolidated income statement

The consolidated income statement shows the following amounts

relating to leases:

Unaudited Unaudited Audited

Period Period Year ended

ended ended 31 December

30 June 30 June 2022

2023 2022

---------- ---------- -------------

GBP'000 GBP'000 GBP'000

Depreciation charge - fixtures and fittings 644 788 1,655

Depreciation charge - computer hardware 21 23 45

---------- ---------- -------------

665 811 1,700

========== ========== =============

Interest expense (within finance expense) 199 213 374

========== ========== =============

10. FINANCIAL INSTRUMENTS

The fair values of all financial instruments included in the

consolidated statement of financial position are a reasonable

approximation of their carrying values.

11. SHARE-BASED PAYMENTS

The Group operates equity-settled share-based payment plans for

certain employees of the Group under The Pebble Group Plc Long-Term

Incentive Plan (the 'LTIP') and The Pebble Group Plc Group

Sharesave Plan (the 'SAYE').

On 28(th) March 2023, under the LTIP, the Group made awards of

1,655,496 conditional shares to certain Directors and employees. On

25(th) April 2023, under the SAYE, the Group granted awards of

417,932 conditional shares.

The Group recognised total expenses of GBP822,000 (period ending

30 June 2022: GBP638,000) in respect of equity-settled share-based

payment transactions for the period ended 30 June 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKQBPDBKBNCK

(END) Dow Jones Newswires

September 05, 2023 02:00 ET (06:00 GMT)

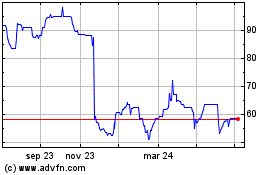

The Pebble (LSE:PEBB)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

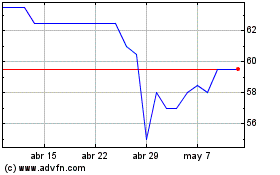

The Pebble (LSE:PEBB)

Gráfica de Acción Histórica

De May 2023 a May 2024