TIDMPOLB

RNS Number : 2280M

Poolbeg Pharma PLC

13 September 2023

Poolbeg Pharma plc

Interim results for the six months to 30 June 2023

Significant progress made and well positioned for future

growth

13 September 2023 - Poolbeg Pharma (AIM: POLB, OTCQB: POLBF,

'Poolbeg' or the 'Company'), a clinical-stage biopharmaceutical

company targeting diseases with a high unmet medical need,

announces its unaudited interim results for the six months to 30

June 2023.

Interim Results Highlights and Business Update

-- Strong cash balance of GBP14.1 million as at 30 June 2023 (31 December 2022: GBP16.2m)

-- Positive results from the POLB 001 LPS human challenge trial.

The asset has the potential to be an effective treatment for severe

influenza and potentially other acute inflammatory conditions

-- Strategic expansion of POLB 001 into oncology, including as a

potential treatment option for Cytokine Release Syndrome (CRS), a

side-effect associated with up to 95% of CAR T cell therapies

-- Further to discussions with prospective partners interested

in this area, the Company is actively exploring a potential new

indication for POLB 001 in oncology beyond CAR T

-- The Company's artificial intelligence (AI) programme with

CytoReason provided unparalleled insights into influenza infection

and successfully identified a number of novel and valuable drug

targets

-- The lab-based validation of the Respiratory Syncytial Virus

(RSV) drug targets and treatments identified from the Company's

AI-led programme is progressing and expected to complete in H2

2023

-- The Poolbeg-led Oral Vaccine consortium (EncOVac), which was

awarded EUR2.3 million in grant funding, progressed to the next

phase of development, marked by the commencement of the

encapsulation validation process

-- Continued progress on the Oral GLP-1 agonist

proof-of-technology clinical trial preparation. As a result of

adopting recommendations from a number of Key Opinion Leaders

(KOLs), the clinical trial design has been refined and the trial is

expected to commence in H1 2024

-- Industry veteran, Professor Brendan Buckley, appointed as Non-Executive Director in May 2023

Jeremy Skillington, PhD, Chief Executive Officer of Poolbeg

Pharma, commented: "During H1 2023, we made significant progress in

advancing our pipeline, bolstered by the strong clinical trial data

for POLB 001 and breakthroughs in our AI-led drug discovery

programmes, we are building towards becoming an efficient

one-stop-shop for biopharma seeking products to in-license. With a

cost-effective R&D approach, complemented by a strong balance

sheet and multiple non-dilutive funding opportunities, we are well

positioned for ongoing development and future growth with a strong

focus on our business development activities."

Investor presentation

Jeremy Skillington, PhD, Chief Executive Officer, will be

presenting at the Master Investor Sector Focus: Healthcare Webinar

on 20 September 2023.

Register to attend here .

Change of Name of Nominated Adviser and Joint Broker

The Company also announces that its Nominated Adviser and Joint

Broker has changed its name to Cavendish Capital Markets Ltd

following completion of its own corporate merger.

- Ends -

Enquiries

Poolbeg Pharma Plc

Jeremy Skillington, CEO

Ian O'Connell, CFO +44 (0) 207 183 1499

Cavendish Capital Markets Ltd (Nominated

Adviser & Joint Broker)

Geoff Nash, Charlie Beeson, Nigel

Birks, Harriet Ward (ECM) +44 (0) 207 220 0500

Singer Capital Markets (Joint Broker)

Phil Davies, Sam Butcher +44 (0) 207 496 3000

J&E Davy (Joint Broker)

Anthony Farrell, Niall Gilchrist +353 (0) 1 679 6363

Optimum Strategic Communications +44 (0) 208 078 4357

Nick Bastin, Hana Malik, Vici Rabbetts poolbeg@optimumcomms.com

About Poolbeg Pharma

Poolbeg Pharma specialises in the development of innovative

medicines to address the unmet need in infectious and other

prevalent diseases. Poolbeg Pharma has a disciplined portfolio

approach to mitigate risk, accelerate drug development, and enhance

investor returns. The Company simultaneously advances multiple

programmes in cost-effective clinical trials, rapidly generating

early human safety and efficacy data to enable early partnering /

out-licensing, with the funds generated reinvested in the pipeline.

Poolbeg Pharma also uses AI to interrogate human challenge trial

data sets to quickly identify new targets and drugs, leading to

faster development and greater commercial appeal.

The Company is targeting the growing infectious disease market.

In the wake of the COVID-19 pandemic, infectious disease has become

one of the fastest growing pharma markets and is expected to exceed

$250bn by 2025. Through opportunistic identification of assets

which complement Poolbeg Pharma's existing pipeline, the Company is

progressing programmes in oncology and metabolic syndromes; adding

disease areas with significant addressable markets.

With its initial assets from hVIVO plc , an industry leading

infectious disease and human challenge trials business, Poolbeg

Pharma has access to knowledge, experience, and clinical data from

over 20 years of human challenge trials. The Company is using these

insights to acquire new assets as well as reposition clinical stage

products, reducing spend and risk. Amongst its portfolio of

exciting assets, Poolbeg Pharma has a small molecule

immunomodulator for severe influenza and other acute inflammatory

conditions (POLB 001) which produces a highly significant reduction

in p38 MAP kinase driven cytokines in a clinical setting; a

first-in-class, intranasally administered RNA-based immunotherapy

for respiratory virus infections (POLB 002); and a vaccine

candidate for Melioidosis (POLB 003). The Company is progressing

two A rtificial I ntelligence (AI) P rogrammes to add promising new

assets to its pipeline as well as developing an Oral Vaccine

Programme and an Oral Delivery Programme focussing on metabolic

syndrome related diseases.

For more information, please go to www.poolbegpharma.com or

follow us on Twitter and LinkedIn @PoolbegPharma.

CEO Statement

I am delighted to present the unaudited interim financial

statements of Poolbeg Pharma plc ("Poolbeg" or the "Company") for

the six months to 30 June 2023. Throughout this period, we've

achieved substantial advancements across our programmes as outlined

below.

Significant progress made

POLB 001 - Severe Influenza - We reported the positive results

from our LPS human challenge trial for POLB 001 in March 2023 (see

Figure 1) and the Clinical Study Report has been finalised. These

findings demonstrated a significant reduction in both systemic and

localised inflammatory responses in a manner that suggests expected

utility in treating life-threatening infections, such as severe

influenza, and supports continued development as a treatment for

the Cytokine Release Syndrome ("CRS") associated with other acute

inflammatory conditions.

Figure 1

POLB 001 - Oncology - Expanding the potential of POLB 001 beyond

severe influenza remains a key objective for the Company to fully

unlock the potential value of the molecule and strengthen Poolbeg's

position for partnering and out-licensing. In line with this

objective, we strategically expanded POLB 001 into oncology in

January 2023 with the filing of a patent application for the use of

POLB 001 as a treatment option for the Cytokine Release Syndrome

(CRS) side-effect associated with CAR T cell therapy. CRS affects

up to 95% of cancer patients receiving CAR T cell therapy, which,

in its severe form, can be life threatening.

A potential new indication in oncology beyond CAR T is being

actively explored further to discussions with prospective partners

with interest in this area.

Clinical trial enabling activities to advance POLB 001 in

oncology are progressing.

Influenza Artificial Intelligence Programme - In June 2023, our

AI-led programme with CytoReason yielded a significant

breakthrough. The programme identified multiple novel influenza

drug targets by leveraging our unique disease progression data from

human challenge trials combined with CytoReason's curated disease

data and advanced AI platform. The insights gained offer an

unparalleled understanding of influenza infection, focusing on the

body's immune responses by identifying the drivers of disease, and

identified multiple unique drug targets that hold the potential to

block disease and aid recovery. The Company is actively exploring

the most effective way to further develop the novel drug targets in

order to generate value and is progressing towards drug target

validation which is expected to complete in 2024.

RSV Artificial Intelligence Programme - In Q4 2022, the Company

announced the successful identification of novel drug targets and

treatments by our AI partner, OneThree Biotech. This significant

breakthrough demonstrated the power of AI in accelerating drug

discovery and identification and reaffirmed our confidence in the

value of our data and our technology driven programmes. The

lab-based validation of these treatments is expected to complete in

H2 2023.

Oral Vaccine Programme - The Poolbeg-led Oral Vaccine consortium

(EncOVac), which was awarded EUR2.3 million in grant funding,

advanced into its next phase of development as the validation of

the encapsulation process commenced in June 2023. The research

plan, Consortium and Grant agreements have been completed and the

programme is progressing well with validation expected to complete

in H2 2023. This programme holds the potential to address a wide

range of infectious diseases, contributing positively to global

health.

Oral Delivery of Metabolic Disease Treatments - The Company

continues to make progress on the Oral GLP-1 agonist

proof-of-technology clinical trial preparation. We actively engaged

with a number of KOLs to refine the clinical trial design and, as a

result of adopting these recommendations, the trial is now expected

to commence in H1 2024. The trial aims to determine that a

Glucagon-like Peptide 1 receptor ("GLP-1") agonist can be

successfully delivered orally in humans using our licensed

technology. GLP-1 agonists such as Wegovy(R) (semaglutide) are used

to treat obesity and diabetes, and this trial has the potential to

tap into an industry that will be worth an estimated $150 billion

by 2031(1) .

Other Updates - The Company continues to review partnering

opportunities as well as actively exploring further non-dilutive

funding opportunities to progress its programmes, including POLB

002 and POLB 003. The Company has taken another proactive step in

enhancing its robust intellectual property by submitting a patent

application for POLB 003 in the first half of this year.

As announced in March 2023, we successfully strengthened the

patent portfolio of POLB 001 with another patent grant in the US,

covering the use of certain p38 MAP kinase inhibitors for the

treatment of hypercytokinaemia. Further to this, in January 2023 we

filed patent applications for the use of POLB 001 in addressing the

impact of CRS associated with CAR T cell therapy, as well as other

oncology indications beyond CAR T. It is not unusual in the

pharmaceutical industry for patents to be challenged. The

Immunomodulators I European patent was opposed by an anonymous

third party in September 2021. The European Patent Office's ("EPO")

preliminary opinion on the opposition was received in March 2023,

identifying a number of items to be discussed at a hearing set for

November 2023. Based on specialist advice received, and the fact

that the patent went through an extensive examination process prior

to being granted by the EPO, Poolbeg continues to have full

confidence in the validity and strength of the patent and will

vigorously defend its intellectual property to the extent

required.

Business Development - We continue to evaluate partnering

opportunities for a number of our programmes in line with our

operating model. With more than 50% of late-stage programmes

originating from partnering within the pharmaceutical industry,

there is significant scope to aid companies in their mission to

accelerate the development of unique medicines that address

diseases with high unmet medical need.

We have seen great progress in a number of our programmes since

the start of 2023, including the positive data from our POLB 001

LPS human challenge trial, completion of the Clinical Study Report,

the strategic expansion of POLB 001 into oncology, and the

discovery of multiple novel drug targets and treatments using AI.

We have attended several global partnering conferences so far in

2023 which have facilitated further engagement with potential

partners. With excellent relationships across the sector, and the

positive outputs to hand from a number of our programmes, we look

forward to continuing deal making discussions and providing updates

to our shareholders in due course.

Corporate & Financial

Poolbeg had a strong cash balance of GBP14.1m as at 30 June

2023. Loss for the period amounted to GBP1.8m; comprised of R&D

expenses of GBP0.9m, administrative expenses of GBP1.4m and other

income of GBP0.5m.

We welcomed Professor Brendan Buckley to the Board as

Non-Executive Director in May 2023. Brendan's significant

contributions to Poolbeg as a member of the Scientific Advisory

Board, and his extensive industry experience, greatly benefits the

Company.

Outlook

Poolbeg has continued to make significant strides in progressing

our pipeline of products and platforms during H1 2023 and we are

continuing at pace towards our aim of becoming a one-stop-shop for

pharma and biotech's seeking programmes to in-license. With strong

data from our POLB 001 clinical trial and novel drug targets and

treatments identified using our cutting-edge AI-led programmes, we

are excited by the future of Poolbeg. Our robust cash balance, cost

effective R&D approach, and multiple near term value inflection

points position Poolbeg to generate strong returns for shareholders

over the coming years.

Jeremy Skillington, PhD

Chief Executive Officer

12 September 2023

Consolidated Statement of Comprehensive Income

For the six months to 30 June 2023

Unaudited Unaudited Audited

Six months Six months Year ended

to to 31 December

30 June 30 June 2022 2022

2023

Note GBP'000 GBP'000 GBP'000

------------------------------------------ ----- ----------- -------------- -------------

Revenue - - -

Cost of sales - - -

------------------------------------------ ----- ----------- -------------- -------------

Gross profit - - -

------------------------------------------ ----- ----------- -------------- -------------

Administrative expenses (1,395) (1,228) (3,060)

Other operating income 177 133 278

Research and development expenses (865) (657) (2,204)

------------------------------------------ ----- ----------- -------------- -------------

Operating loss (2,083) (1,752) (4,986)

------------------------------------------ ----- ----------- -------------- -------------

Finance income 272 45 209

Loss before income taxation (1,811) (1,707) (4,777)

------------------------------------------ ----- ----------- -------------- -------------

Taxation 2 - 100 91

------------------------------------------ ----- ----------- -------------- -------------

Loss and total comprehensive loss

for the period attributable to the

equity holders of the Company (1,811) (1,607) (4,686)

------------------------------------------ ----- ----------- -------------- -------------

Loss per share:

Loss per share - basic and diluted,

attributable to ordinary equity holders

of the parent (pence) 3 (0.36) (0.32) (0.94)

Consolidated Statement of Financial Position

As at 30 June 2023

Unaudited Unaudited Audited

30 June 30 June 2022 31 December

2023 2022

Note GBP'000 GBP'000 GBP'000

------------------------------- ----- ---------- ------------- ------------

Assets

Non-current assets

Intangible assets 4 2,183 1,935 2,134

Total non-current assets 2,183 1,935 2,134

------------------------------- ----- ---------- ------------- ------------

Current assets

Trade and other receivables 5 767 1,185 962

Cash and cash equivalents 14,120 18,894 16,193

Total current assets 14,887 20,079 17,155

------------------------------- ----- ---------- ------------- ------------

Total assets 17,070 22,014 19,289

------------------------------- ----- ---------- ------------- ------------

Equity and liabilities

Equity attributable to owners

of the parent

Share capital 100 100 100

Share premium 23,100 23,100 23,100

Other reserves 2,192 1,930 2,145

Accumulated deficit (8,833) (3,943) (7,022)

------------------------------- ----- ---------- ------------- ------------

Total equity 16,559 21,187 18,323

------------------------------- ----- ---------- ------------- ------------

Current liabilities

Trade and other payables 6 511 827 966

------------------------------- ----- ---------- ------------- ------------

Total current liabilities 511 827 966

------------------------------- ----- ---------- ------------- ------------

Total liabilities 511 827 966

------------------------------- ----- ---------- ------------- ------------

Total equity and liabilities 17,070 22,014 19,289

------------------------------- ----- ---------- ------------- ------------

Consolidated Statement of Changes in Equity

For the six months to 30 June 2023

Share

Share Share based payment Merger Accumulated

capital premium reserve reserve deficit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- ---------- ---------- ---------------- ---------- -------------- --------

At 1 January

2022 100 23,100 261 1,455 (2,336) 22,580

---------------------- ---------- ---------- ---------------- ---------- -------------- --------

Loss and total

comprehensive

loss for the

period - - - - (1,607) (1,607)

Share based payments - - 214 - - 214

---------------------- ---------- ---------- ---------------- ---------- -------------- --------

Balance at 30

June 2022 100 23,100 475 1,455 (3,943) 21,187

---------------------- ---------- ---------- ---------------- ---------- -------------- --------

Loss and total

comprehensive

loss for the

period - - - - (3,079) (3,079)

Share based payments - - 215 - - 215

---------------------- ---------- ---------- ---------------- ---------- -------------- --------

Balance at 31

December 2022 100 23,100 690 1,455 (7,022) 18,323

---------------------- ---------- ---------- ---------------- ---------- -------------- --------

Loss and total

comprehensive

loss for the

period - - - - (1,811) (1,811)

Share based payments - - 47 - - 47

---------------------- ---------- ---------- ---------------- ---------- -------------- --------

Balance at 30

June 2023 100 23,100 737 1,455 (8,833) 16,559

---------------------- ---------- ---------- ---------------- ---------- -------------- --------

Consolidated Statement of Cash Flows

For the six months to 30 June 2023

Unaudited Unaudited Audited

Six months Six months Year ended

to to 31 December

30 June 30 June 2022 2022

2023

Note GBP'000 GBP'000 GBP'000

------------------------------------------ ----- ------------ -------------- -------------

Cash flows from operating activities

Loss on ordinary activities

before taxation (1,811) (1,707) (4,777)

Adjustments for:

Finance income (272) (45) (209)

Amortisation 4 13 13 26

Share based payment expense 47 214 429

SME R&D tax credit 2 - - 91

Movements in working capital

and other adjustments:

Change in trade and other receivables 5 195 (579) (456)

Change in trade and other payables 6 (455) 389 528

Net cash flow used in operating

activities (2,283) (1,715) (4,368)

------------------------------------------ ----- ------------ -------------- -------------

Cash flow from investing activities

Payments for intangible assets 4 (62) (385) (597)

Interest received from bank 272 45 209

Net cash flow generated/(used)

in investing activities 210 (340) (388)

------------------------------------------ ----- ------------ -------------- -------------

Net cash flow from financing - - -

activities

------------------------------------------ ----- ------------ -------------- -------------

Net change in cash and cash

equivalents (2,073) (2,055) (4,756)

Cash and cash equivalents at

beginning of period 16,193 20,949 20,949

------------------------------------------ ----- ------------ -------------- -------------

Cash and cash equivalents at

end of period 14,120 18,894 16,193

------------------------------------------ ----- ------------ -------------- -------------

Notes to the Interim Results

1. General information

Poolbeg Pharma plc ("Poolbeg" or the "Company") is a public

limited company incorporated in England and Wales with company

number 13279507. The Company is quoted on the AIM market of the

London Stock Exchange (ticker: POLB.L, ISIN: GB00BKPG7Z60) and

traded on the OTCQB Venture Market ("OTCQB") in the United States

under the ticker POLBF.

Poolbeg specialises in the development of innovative medicines

to address the unmet need in infectious and other prevalent

diseases. Poolbeg has a disciplined portfolio approach to mitigate

risk, accelerate drug development and enhance investor returns.

2. Basis of preparation

The Interim Results of the Company for the six months to 30 June

2023 comprise those of the Company and its subsidiaries (together

the "Group"). The Interim Results have been prepared on the going

concern basis under the historical cost convention in accordance

with the recognition and measurement requirements of United Kingdom

adopted International Financial Reporting Standards ("IFRS") and

their interpretations issued by the International Accounting

Standards Board ("IASB"), and in accordance with those parts of the

Companies Act 2006 applicable to companies reporting under IFRS. As

is permitted by the AIM rules, the Directors have not adopted the

requirements of IAS 34 "Interim Financial Reporting" in preparing

the financial statements. Accordingly, the financial statements are

not in full compliance with IFRS and have neither been audited nor

reviewed pursuant to guidance issued by the Auditing Practices

Board.

The financial information for the six months to 30 June 2023 and

30 June 2022 is unaudited. The information for the year ended 31

December 2022 has been extracted from the Company's audited

accounts on which the auditors issued an unqualified audit opinion.

The information presented for that period does not constitute full

accounts for that period. The 31 December 2022 audited accounts

have been delivered to the Companies House.

The financial information is presented in GBP which is the

functional and presentational currency of the Company. Balances are

rounded to the nearest thousand (GBP'000) except where otherwise

indicated.

The Interim Results were approved by the Board of Directors on

12 September 2023.

The accounting policies used in the preparation of the Interim

Results are consistent with those used in the Company's audited

financial statements for the year to 31 December 2022. The

application of the accounting policies can involve significant

estimation, uncertainty and critical judgement. The most

significant judgement made in relation to the Interim Results

is:

Research and development ("R&D") tax credits: R&D tax

claims can be complex and require management to make significant

assumptions in building the methodology for the claim, interpreting

research and development tax legislation to the Group's specific

circumstances, and agreeing the basis of the tax computations with

HM Revenue & Customs or other tax authorities. As the Group has

not yet built up a track record of R&D tax credit receipts, an

estimation of the potential R&D tax credit receivable for the

current period and prior year has not been recognised in the Income

Statement. R&D tax claims in relation to the 2022 tax year have

been submitted by the Group and rebates in relation to that period

are anticipated.

3. Loss per share - basic and diluted

The Group presents basic and diluted loss per share ("LPS") data

for its ordinary shares. Basic LPS is calculated by dividing the

loss attributable to ordinary shareholders of the Company by the

weighted average number of ordinary shares outstanding during the

period. Diluted LPS is determined by adjusting the loss

attributable to ordinary shareholders and the weighted average

number of ordinary shares outstanding for the effects of all

dilutive potential ordinary shares, which comprise warrants and

share options granted by the Company.

The calculation of loss per share is based on the following:

Unaudited Unaudited Audited

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2022 2022

2023

------------------------------------------ ------------- --------------- --------------

Loss after tax attributable to equity

holders of the Company (GBP'000) (1,811) (1,607) (4,686)

Weighted average number of ordinary

shares in issue 500,000,000 500,000,000 500,000,000

Fully diluted average number of ordinary

shares in issue 500,000,000 500,000,000 500,000,000

------------------------------------------ ------------- --------------- --------------

Basic and diluted loss per share

(pence) (0.36) (0.32) (0.94)

------------------------------------------ ------------- --------------- --------------

Under IAS 33.43 "Earnings per Share", the calculation of loss

per share does not assume conversion, exercise, or other issue of

potential shares that would have an antidilutive effect on LPS. For

the current and comparative periods, the effect of options would be

to reduce the loss per share and as such the basic and diluted LPS

are the same. There were 36,829,181 share options and warrants

outstanding as at 30 June 2023 (30 June 2022 and 31 December 2022:

36,829,181) and these are potentially dilutive.

4. Intangible assets

Acquired Patents

Licences & Trademarks Total

& Data

GBP'000 GBP'000 GBP'000

-------------------------------- ----------- --------------- --------

Cost

At 31 December 2021 1,500 81 1,581

Additions 435 162 597

-------------------------------- ----------- --------------- --------

At 31 December 2022 1,935 243 2,178

-------------------------------- ----------- --------------- --------

Additions - 62 62

-------------------------------- ----------- --------------- --------

At 30 June 2023 1,935 305 2,240

-------------------------------- ----------- --------------- --------

Accumulated amortisation

At 31 December 2021 18 - 18

Amortisation charge 25 1 26

-------------------------------- ----------- --------------- --------

At 31 December 2022 43 1 44

-------------------------------- ----------- --------------- --------

Amortisation charge 13 - 13

-------------------------------- ----------- --------------- --------

At 30 June 2023 56 1 57

-------------------------------- ----------- --------------- --------

Net book value

-------------------------------- ----------- --------------- --------

Net book value at 30 June 2023 1,879 304 2,183

-------------------------------- ----------- --------------- --------

Net book value at 31 December

2022 1,892 242 2,134

-------------------------------- ----------- --------------- --------

Additions in the period relate to patent applications. Patents

are measured initially at purchase cost and are amortised on a

straight-line basis over their life from the date that they are

available for use.

5 Trade and other receivables

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------------- ------------ ------------ --------------

Trade receivables 6 - -

Prepayments and accrued income 718 990 878

VAT and corporation tax receivables 43 195 84

Trade and other receivables 767 1,185 962

------------------------------------- ------------ ------------ --------------

6 Trade and other payables

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

--------------------------------------- ------------ ------------ --------------

Trade payables 124 295 293

Accrued expenses 321 489 623

Other payables 11 9 4

Social security costs and other taxes 55 34 46

Trade and other payables 511 827 966

--------------------------------------- ------------ ------------ --------------

7. Events after the reporting period

None to report.

8. Copy of the interim results

A copy of the Company's Interim Results for the six months to 30

June 2023 is available on the Company's website,

www.poolbegpharma.com/investors/documents/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPUWABUPWGMP

(END) Dow Jones Newswires

September 13, 2023 02:00 ET (06:00 GMT)

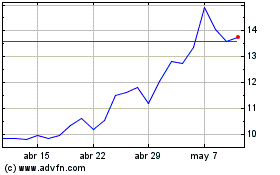

Poolbeg Pharma (LSE:POLB)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Poolbeg Pharma (LSE:POLB)

Gráfica de Acción Histórica

De May 2023 a May 2024