Pensana Plc Technical Due Diligence Report on Longonjo

24 Enero 2024 - 1:00AM

UK Regulatory

TIDMPRE

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Pensana Plc ("Pensana" or the "Company")

Technical Due Diligence Report on Longonjo

Pensana (LSE:PRE) is pleased to advise that the technical due diligence report

on the Longonjo rare earth project in Angola (the Project or Longonjo) has been

reported by The Mineral Corporation (TMC) to ABSA Capital (ABSA) as the Mandated

Lead Arranger for potential debt funding of the Project.

A summary of TMC's key findings:

The Project is located approximately 320km east of the Port of Lobito and

envisages the open pit mining and processing of near surface Rare Earth Elements

(REE) bearing carbonatite ores to produce a mixed REE carbonate (MREC)

concentrate which will then be marketed commercially.

The holder of the Mineral and Mining Rights over the Longonjo mining licence

area is the Angolan registered company Ozango Minerais S.A. (Ozango), which is

84% owned by Portugal domiciled subsidiaries of Pensana. The balance of Ozango

is held by the Angolan Sovereign Wealth Fund and two Angolan partners.

Longonjo will comprise an open pit mine to recover near surface REE, which will

then be processed via concentration and downstream refining to produce a

commercially saleable Mixed Rare Earth Carbonate (MREC) concentrate for export

via the Port of Lobito to third-party offtakers for the purpose of ultimately

producing Neodymium/Praseodymium (NdPr) feed into the renewable energy and

electric vehicle markets.

A nominal plant feed of 0.8Mtpa has been specified at a TREO feed grade of 4.12%

and an NdPrO feed grade of 0.9%. The stockpiling and blending strategy critical

to achieving stable and consistent concentrator performance and product has been

identified and included in the mining and processing flowsheets. The plant

design is nominally based on a dry concentrate feed of approximately 59ktpa, to

produce a nominal MREC dry product of 19.6ktpa (15ktpa normal operating

conditions).

Whilst TMC is of the opinion that ramp-up to achieve design recoveries will be

challenging, and the ongoing operational control of the processing plants will

be critical to maintaining product quality and recovery, TMC notes no fatal

flaws in terms of the revised bankable feasibility study (BFS) review and no

material technical divergences from the level of study required for bank funding

approval.

TMC noted the capital estimate provided is extremely detailed and based on bills

of quantities and tendered prices with a capital base date of Q4 2023. An

accuracy assessment was also carried out, which confirms the level of accuracy

complies with that required by a BFS standard. TMC is of the opinion that

sustaining capital may be slightly understated however this does not present a

material risk to the Project.

Capital Cost Breakdown

+---------------------------------+--------------+

|Concentrator Plant |US$37 766 993 |

+---------------------------------+--------------+

|Plant Common Areas |US$14 687 930 |

+---------------------------------+--------------+

|TSF |US$7 157 201 |

+---------------------------------+--------------+

|Recovery Plant |US$75 472 541 |

+---------------------------------+--------------+

|Plant Infrastructure |US$15 568 988 |

+---------------------------------+--------------+

|Project Infrastructure |US$123 386 |

+---------------------------------+--------------+

|Mine Infrastructure |US$9 707 348 |

+---------------------------------+--------------+

|Environmental |US$4 538 590 |

+---------------------------------+--------------+

|Security |US$1 767 680 |

+---------------------------------+--------------+

|Site Infrastructure |US$7 001 150 |

+---------------------------------+--------------+

|Indirect Costs |US$22 640 254 |

+---------------------------------+--------------+

|Contingency |US$20 100 933 |

+---------------------------------+--------------+

|Total Project Capital Expenditure|US$216 532 994|

+---------------------------------+--------------+

The capital estimate was derived from the various currencies relating to the

goods and services costs in the country of origin and adjusted for the relevant

exchange rates: US$ South African Rand ZAR 18.5, European Euro EUR 0.9,

Australian Dollar AUD 1.5 and Angolan Kwanza AOA 830.

TMC notes the level of detail provided in the detailed capital estimate

consisting of in excess of 18,000 line items, the methodology undertaken to

produce the capital estimate and the basis of estimate being predominantly based

on bills of quantity, tendered rates and budget quotations.

Operating Cost Estimates have been updated based on the revised Project scope

and also brought to a consistent cost base date of Q4 2023. TMC has reviewed all

of the operating cost centre data and concurs that the operating cost estimates

as provided meet the accuracy levels associated with a BFS, however it is noted

that the retender for the mining contract scheduled for late 2024 will impact on

overall Project economics and in all likelihood trigger the requirement for a

revision of the mining optimisation plan.

TMC notes that the financial model as received is detailed in all modelled

inputs and results in free cash flow levels which would be likely to support a

funding decision. TMC reiterates the sensitivity of the Project economics to the

forecast rare earth oxide prices and recommends that the imminent offtake

agreements and pricing structures should be included in any funding agreement as

Conditions Precedent. Once these are available the Project financial model

should be updated, and the economics revised. The Project economics are most

sensitive to projected market dynamics and the resulting product pricing

projections, which in turn present the most material risk to Project economics.

Earthworks and civils contractors established site in November 2022. Servitude

bush clearing and pylon installations to the borehole pumps, contractors camp,

main camp and water treatment plant were in progress at the time of the site

visit at the end of February 2023. Overall, the level of detail design of the

infrastructure is commensurate with the requirements of the BFS and TMC is of

the opinion that the infrastructure design is appropriate and fit for purpose to

support the mining and processing operations.

TMC is of the opinion that the level of work undertaken for the project schedule

and plan of execution is commensurate with the requirements of a BFS and the

work undertaken is comprehensive and will be the basis for a potential

successful project execution.

Extensive work has been undertaken in the areas of social and community

engagement. TMC supports the programmes and costs which have been allocated to

the various social initiatives, however notes that the Relocation Action Plan

still requires careful monitoring and management to ensure successful

implementation, minimising community grievances. Ozango's engagements and

initiatives now comply with the expectations associated with a BFS level of

study and in some instances exceed expected levels.

TMC notes that all legislative aspects of Human Resources management have been

addressed adequately, however it does recommend that remuneration levels are

reviewed prior to the commencement of recruitment, as the budgeted levels may

mitigate against the procurement of top level individuals, particularly in the

senior technical expatriate roles. The BFS meets expected levels of detail in

terms of all HR, operational readiness and occupational health and safety

aspects. It is noted that specific operational readiness planning is only

expected at the next stage of the Project.

Tim George CEO commented: "We are very grateful to Russel Heins and the team at

The Mineral Corporation team for the diligent and extremely thorough review of

all aspects of the Longonjo project undertaken in their role as lead Technical

Advisor to ABSA as the Mandated Lead Arranger and we are pleased with the

positive recommendations.

The review was based on the re-engineered, reduced capital cost of the project

for financing purposes following our review in Q2 of 2023. A huge amount of work

has gone into the capital cost estimate which as noted by Russell and the team

is based on very detailed estimates and we are pleased that despite the current

inflationary and cost pressures the estimate has been confirmed around US$217

million, which includes US$20 million in contingency.

As previously announced, once the Longonjo operations are operational and fully

commissioned it is our intention to expand production to around 40,000 tonnes of

MREC per annum which will require an additional capital cost of around US$100

million which is expected to be incurred around year three of the initial

operations.

Whilst this technical review has been underway, we have been working closely

with our financiers ABSA, FSDEA and others and we expect to be in a position to

announce the financing arrangements shortly."

About The Mineral Corporation

The Mineral Corporation (TMC) was established in Johannesburg, South Africa in

1997 and is home to a well-informed, globally-focused corporate and technical

advisory team of mining sector professionals. TMC have expertise in mineral

exploration, geology, mining engineering and development, mineral processing,

mining infrastructure, ESG, statutory compliance, mineral asset valuation and

techno-economic modelling.

TMC understand that exploration and mining can be high risk industries and are

confident that their skills can be applied to identify, resolve and minimise

their clients exposure to such risk, thereby creating or preserving value.

TMC cover all minerals, including precious metals, base metals, noble and

refractory metals, energy minerals (coal and uranium), mineral sands, precious

and semi-precious stones, rare earth elements and industrial minerals.

Since inception, TMC has created or preserved many billions in various

currencies (including rand, dollar, pounds) on behalf of clients. Their business

model is founded on the qualification and quantification of mineral investment

opportunities. TMC assemble teams of expert multi-disciplinary consultants who

collectively craft an integrated business model to evaluate clients'

enterprises. TMC's group of professionals offers knowledge from six continents

but enjoys a particular passion for Africa. In many circumstances, TMC's

imaginative, but always realistic, examination of mineral projects offers

distinctive solutions to the complex alternatives that challenge investors.

TMC also provide bespoke institutional research on the mining industry.

The information contained within this announcement is considered by the Company

to constitute inside information as stipulated under the Market Abuse

Regulations (EU) No.596/2014. Upon the publication of this announcement via a

Regulatory Information Service, this inside information will be considered to be

in the public domain. The person responsible for arranging for the release of

this announcement on behalf of the Company is Paul Atherley, Chairman.

- ENDS -

For further information, please contact:

Shareholder/analyst enquiries:

Pensana Plc

Paul Atherley, ChairmanIR@pensana.co.uk

Tim George, Chief Executive Officer

Rob Kaplan, Chief Financial Officer

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

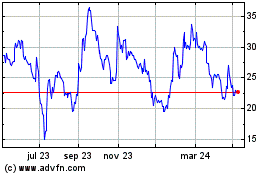

Pensana (LSE:PRE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

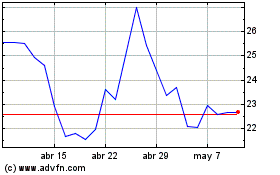

Pensana (LSE:PRE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024