TIDMPRIM

RNS Number : 8240J

Primorus Investments PLC

18 August 2023

Primorus Investments plc

("Primorus" or the "Company")

Interim Results for the six months ended 30 June 2023

Primorus Investments plc (AIM: PRIM) is pleased to announce its

unaudited interim results for the six months ended 30 June

2023.

Overview

The last six months have been a difficult time for the capital

markets with rising interest rates causing a general slowdown in

the deployment of capital being invested. With greater

uncertainties, investors are more cautious which has had a negative

effect on the asset valuations for some of Primorus' investments.

Despite this, we remain confident in the longer-term prospects of

these investments.

Primorus has restructured the repayments due under its

Convertible Loan Note with Bushveld Minerals Limited. At the date

of this announcement, GBP307,000 has been repaid and the balance

continues to accrue interest at 10% per annum.

Alteration Earth PLC, a special purpose acquisition company in

which Primorus holds approximately 28% of the issued share capital,

announced on 1 August 2023 its intention to acquire the entire

issued share capital of Verdant Earth Resources Limited.

In addition, Primorus has exited several non-core holdings to

ensure the Company remains in a healthy position to deliver the

objectives set out within its investing policy.

Financial Results

The operating loss for the six months to 30 June 2023 was

GBP512,000 (30 June 2022: GBP847,00 loss). The net loss after tax

was GBP512,000 (30 June 2022: GBP847,000 loss).

Total assets, including cash, at 30 June 2023 amounted to

GBP7.21 million (30 June 2022: GBP8.23 million).

Outlook

The Board remains confident that significant opportunities exist

for the Company going forward. The Board is continually seeking new

investment opportunities whilst also monitoring its existing

investments.

The Board has screened several exciting opportunities within the

period and looks forward to making further investments in the near

term.

We look forward to updating shareholders as and when our

existing investments mature, and new investments present

themselves.

The Directors would like to take this opportunity to thank our

shareholders and consultants for their continued support.

Rupert Labrum Chairman

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Company's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors. While management believes that these forward-looking

statements are reasonable as and when made, there can be no

assurance that future developments affecting the Company will be

those that it anticipates.

For further information please contact:

Primorus Investments plc

Matthew Beardmore, Chief Executive

Officer +44 (0)20 8154 7907

Nominated Adviser

Cairn Financial Advisers LLP

James Caithie / Sandy Jamieson +44 (0) 20 7213 0880

Unaudited Condensed Company Statement of Comprehensive

Income

for the six months ended 30 June 2023

6 months to 6 months Year to

to

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

Not GBP'000 GBP'000 GBP'000

es

Continuing operations

Revenue

Investment income 40 52 93

Realised (loss)/gain on disposal

of financial investments (538) (300) (288)

Unrealised gain/(loss) on market

value movement of financial investments 314 (500) (542)

Total (losses)/gains on financial

investments (184) (748) (737)

-------------- --------- -----------

Share based payments - (63) (121)

-------------- --------- -----------

Operating costs (328) (36) (280)

-------------- --------- -----------

Impairment of financial investments - - (375)

-------------- --------- -----------

(Loss)/Profit before tax (512) (99) (1,513)

Taxation - - 29

-------------- --------- -----------

(Loss)/Profit for the period attributable

to equity shareholders of the company (512) (847) (1,484)

-------------- --------- -----------

- - -

Other comprehensive income

Total Comprehensive Income for

the year attributable to equity

shareholders of the company (512) (847) (1,484)

-------------- --------- -----------

Profit/(Loss) per share:

Basic profit/(loss) per share (pence) 2 (0.366) (0.605) (1.061)

Diluted profit/(loss) per share

(pence) 2 (0.366) (0.605) (1.061)

Unaudited Condensed Company Statement of Financial Position

as at 30 June 2023

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

Note s GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Financial investments 5,279 7,742 5,444

--------- --------- -----------

5,279 7,742 5,444

--------- --------- -----------

Current assets

Investments 1,843 20 2,064

Trade and other receivables 49 39 34

Cash and cash equivalents 35 427 114

--------- --------- -----------

1,927 486 2,212

--------- --------- -----------

Total assets 7,206 8,228 7,656

--------- --------- -----------

EQUITY

Equity attributable to equity holders

of the parent

Share capital 280 280 280

Share based payment reserve - 76 -

Retained earnings 6,754 7,769 7.266

--------- --------- -----------

Total equity 7,034 8,125 7.546

LIABILITIES

Current liabilities

Trade and other payables 172 70 110

Corporation tax - 33 -

Total liabilities 172 103 110

--------- --------- -----------

Total equity and liabilities 7,206 8,228 7,656

--------- --------- -----------

Unaudited Condensed Company Statement of Changes in Equity

for the six months ended 30 June 2023

Share based Total attributable

Share Share payment Retained to owners

capital premium reserve earnings of parent

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Unaudited

Balance at 31

December 2021 280 - 13 8, 616 8,909

=============== ==================== ============= ================== =====================

Loss for the

period - - - (1,484) (1,484)

--------------- -------------------- ------------- ------------------ ---------------------

Total

comprehensive

income for

the

period - - - (1,484) (1,484)

Share based

payment expense - - 121 - 121

Reclassification

upon cancellation

of share options - - (134) 134 -

--------------- -------------------- ------------- ------------------ ---------------------

Balance at 31

December 2022 280 - - 7,266 7,546

=============== ==================== ============= ================== =====================

Loss for the

period - - - (512) (512)

--------------- -------------------- ------------- ------------------ ---------------------

Total

comprehensive

income for

the period - - - (512) (512)

Balance at 30 June

2023 280 - - 6,754 7,034

=============== ==================== ============= ================== =====================

Unaudited Condensed Company Statement of Cash Flows

for the six months ended 30 June 2023

6 months 6 months Year

to to to

30-Jun-23 30-Jun-22 31-Dec-22

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Operating Profit/(Loss) (512) (847) (1,484)

Adjustments for:

(Profit)/Loss on disposal of financial

investments 538 300 288

Fair value movement on listed investments (314) 500 542

Impairment provision on unlisted

investments - - 375

Decrease/(increase) in trade and

other receivables (15) (34) -

Increase/(decrease) in trade and

other payables 62 26 66

Foreign exchange loss/(gain) 166 (132) (112)

Interest income on investments (40) (52) (93)

Share based payment - 63 121

Income tax (credit) - - (29)

---------- ---------- ----------

(115) (176) (326)

Income taxes paid - (4) (36)

---------- ---------- ----------

Net cash used in operating activities (115) (180) (362)

Cash flows from investing activities

Disposal proceed from sale of financial

investments 36 3,026 1,937

Payment for financial investments - (3,360) (2,402)

---------- ---------- ----------

Net cash from/(used in) investing

activities 36 (334) (465)

---------- ---------- ----------

Net change in cash and cash equivalents (79) (514) (827)

========== ========== ==========

Cash and cash equivalents at beginning

of period 114 941 941

---------- ---------- ----------

Cash and cash equivalents at end

of period 35 427 114

========== ========== ==========

Notes to the condensed unaudited interim financial

statements

1. General Information

The condensed interim financial information for the 6 months to

30 June 2023 does not constitute statutory accounts for the

purposes of Section 434 of the Companies Act 2006 and has not been

audited or reviewed. No statutory accounts for the period have been

delivered to the Registrar of Companies.

The condensed interim financial information in respect of the

year ended 31 December 2022 has been produced using extracts from

the statutory accounts for that period. Consequently, this does not

constitute the statutory information (as defined in section 434 of

the Companies Act 2006) for the year ended 31 December 2022, which

was audited. The statutory accounts for this period have been filed

with the Registrar of Companies. The auditors' report was

unqualified and did not contain a statement under Sections 498 (2)

or 498 (3) of the Companies Act 2006.

The auditor's report was approved by the Directors on 15 June

2023 and is available on the Company's website at

www.primorusinvestments.com .

2. Basis of preparation and accounting

The financial information has been prepared on the historical

cost basis. The Company's business activities, together with the

factors likely to affect its future development, performance and

position are set out in the Chairman's Statement. This statement

also includes a summary of the Company's financial position and its

cash flows.

The financial statements have been prepared in accordance with

the Companies Act 2006 and UK-adopted international accounting

standards (UK-adopted IAS) and related interpretations. As

permitted, this does not include IAS 34 "Interim Financial

Reporting". This condensed set of financial statements has been

prepared applying the accounting policies that were applied in the

preparation of the Company's published financial statements for the

year ended 31(st) December 2022. As these interim financial

statements do not include all of the information or disclosures

required in the annual financial statements they should be read in

conjunction with the Company's 2022 annual financial

statements.

3. Earnings per share

Earnings per ordinary share has been calculated using the

weighted average number of shares in issue during the period. The

weighted average number of equity shares in issue was 139,830,968.

IAS 33 requires presentation of diluted EPS when a company could be

called upon to issue shares that would decrease earnings per share

or increase the loss per share.

Six months Six months Year ended

to to

30 June 30 June 31 December

2023 2022 2022

(Unaudited) (Unaudited) (Audited)

restated

(GBP'000) (GBP'000) (GBP'000)

Net profit/(loss) attributable to equity

holders of

the company (512) (847) (1,484)

Weighted average number of shares 139,830,968 139,830,968 139,830,968

Weighted average number of diluted

shares 139,830,968 139,830,968 139,830,968

Basic (loss)/profit per share (pence) (0.366) (0.605) (1.061)

Diluted (loss)/profit per share (pence) (0.366) (0.605) (1.061)

4. Events after the reporting date

There are no events after the end of the reporting date to

disclose that have not already been the subject of an announcement

by the Company.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BSGDIGBBDGXI

(END) Dow Jones Newswires

August 18, 2023 10:12 ET (14:12 GMT)

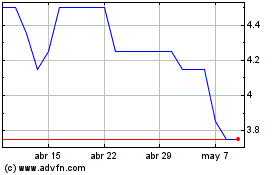

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Primorus Investments (LSE:PRIM)

Gráfica de Acción Histórica

De May 2023 a May 2024