TIDMSBTX

RNS Number : 2898V

SkinBioTherapeutics PLC

30 November 2023

SkinBioTherapeutics plc

("SkinBioTherapeutics" or "the Company")

Full year results

30 November 2023 - SkinBioTherapeutics plc (AIM: SBTX, or the

"Company"), the life science business focused on skin health,

announces the fully consolidated audited results for the 12 months

to 30 June 2023.

Operational highlights

-- The Skinbiotix(TM) partnership with Croda plc product development phase continues well:

o Successful scale-up of manufacturing

o Post financial year end, contract to extend for a further 12

months to enable exploration of potential additional claims

-- AxisBiotix-Ps(TM)

o Solid sales growth in the UK; expansion of sales distribution

into Europe during the year in Spain and post period end in Italy

and France

o Monthly retention rates of subscribers remain at 80%+

o Post year end

-- Start of recruitment of participants for the consumer study

with acne food supplement; results expected in Q1 2024

-- Launch on Amazon UK

-- Oral research and inflammation programmes continue at the University of Manchester

-- Management continuing to investigate potential accretive

inorganic opportunities that provide synergies and accelerated

routes to market; update on progress expected in the near term

Financial highlights

-- Revenues up to GBP132k (2022: GBP75k) boosted by solid increase in UK revenues.

-- Operating at loss GBP2,999k (2022: loss GBP2,982k) with

increase in sales balancing the increase in headcount costs

-- Cash and cash equivalents as at 30 June was GBP1.3m (2022:

GBP1.8m), following successful Placing and Open Offer in January

2023

o Post year end, the Company raised an additional GBP3.3m

(gross) in a Placing and Retail Offer in November 2023

-- Change to Company's auditors due to auditors' corporate reorganisation

Stuart Ashman, CEO of SkinBioTherapeutics said:

"In 2023, we introduced AxisBiotix-PS(TM) into new European

territories, beginning with Spain then moving onto France and

Italy. Launching a disruptive product into any market always takes

time to establish, and given our limited resources, we are pleased

with the loyalty and the very positive testimonials we are

receiving.

"We continue to enjoy a positive relationship with the

Croda/Sederma teams and they have provided very supportive

commentary on their views of the SkinBiotix(TM) technology. We see

their wish to extend the collaboration for a further 12 months as

very positive; it may slightly delay near-term revenue generation,

but the potential enhanced commercial opportunities could be quite

considerable. All costs for the extension and the resulting

clinical grade study are met directly by Croda."

"Next year should also see the early results from other studies,

including the consumer study around an acne product, as well as

results from our oral and inflammation programmes with Manchester

University. The acne programme is especially exciting. We saw

initial positive responses to AxisBiotix-Ps in participants of the

psoriasis study who had other skin conditions, and this has

resulted in this new development programme which could have a

significant impact on a much wider population.

"Talks with potential strategic partners continue around our

other pillars. We are also pushing ahead with our inorganic

acquisition programme, looking for opportunities that are

synergistic and complement our current programmes. We have strict

criteria for these opportunities; we will not overpay and they must

be accretive from day one."

-Ends-

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

For more information please contact:

SkinBioTherapeutics plc Tel: +44 (0) 191 495 7325

Stuart J . Ashman, CEO

Manprit Randhawa, CFO

Cavendish Capital Markets Limited Tel: +44 (0) 20 7397 8900

(Nominated Adviser & Broker)

Giles Balleny, Dan Hodkinson (Corporate Finance)

Charlie Combe (Broking)

Dale Bellis, Tamar Cranford-Smith (Sales)

Instinctif Partners (financial press) Tel: +44 (0) 20 7457 2020

Melanie Toyne-Sewell / Jack Kincade SkinBioT herapeutics@instinctif.com

Notes to Editors

About SkinBioTherapeutics plc

SkinBioTherapeutics is a life science company focused on skin

health. The Company's proprietary platform technology,

SkinBiotix(R), is based upon discoveries made by Professor

Catherine O'Neill and Professor Andrew McBain.

The Company is targeting a number of skin healthcare sectors,

the most advanced of which are cosmetic skincare and food

supplements to modulate the immune system by harnessing the

gut-skin axis. In each area SkinBioTherapeutics plans to exemplify

its technology through human studies. The Company's first product,

AxisBiotix-Ps(TM), a food supplement to address the symptoms of

mild to moderate psoriasis.

The Company listed on AIM in April 2017 and is based in

Newcastle, UK. For more information, visit:

www.skinbiotherapeutics.com and www.axisbiotix.com .

Caution regarding forward looking statements

Certain statements in this announcement, are, or may be deemed

to be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"potentially", "expect", "will" or the negative of those,

variations or comparable expressions, including references to

assumptions. These forward-looking statements are not based on

historical facts but rather on the Directors' current expectations

and assumptions regarding the Group's future growth, results of

operations, performance, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, business prospects and opportunities. Such

forward looking statements re ect the Directors' current beliefs

and assumptions and are based on information currently available to

the Directors.

Chairman and Chief Executive's Statement

Overview

The year for SkinBioTherapeutics has been dominated by growing

the sales of AxisBiotix-Ps(TM) in the UK and expanding sales and

distribution channels into Europe, starting with Spain. Beyond the

commercial operations, the Company has continued its research

programmes alongside the University of Manchester, and engaging

with partners and potential strategic partners across the other

business pillars, including SkinBiotix, and MediBiotix. Management

is also pushing its inorganic acquisition strategy forward with the

aim to generate further shareholder value in the near to medium

term.

Financial review

Reported sales for the full year were GBP132k (2022: GBP75k), in

line with management expectations, as UK sales continued to

increase slowly but steadily, and the introduction of new European

regions.

Cost of sales were GBP46k (2022: GBP29k) and gross profits were

GBP85k (2022: GBP45k). As shipping volumes have increased, the

Company is seeing a gradual improvement in the operating

margin.

Total administrative expenses were GBP3,085k (2022: GBP3,027k),

comprising research and development expenditure of GBP931k (2022:

GBP861k), which includes the ongoing cost of the inflammation

programme, and in oral health and wellbeing research programme.

Selling and distribution costs were GBP81k (FY22 GBP44k) due to an

increase in volumes of product being sold. Ongoing operating

expenses were GBP2,073k (2022: GBP2,122k).

The operating loss was GBP2,999k (2022: GBP2,982k).

The cash and cash equivalents balance as at 30 June 2023 was

GBP1.3m (2022: GBP1.8m) reflecting tight control on costs and was

boosted by the Placing and Open Offer which raised 2.6m of gross

proceeds to fund future operations. Post year end, the Company

raised an additional GBP3.3m (gross) in a Placing and Retail Offer

in November 2023.

Update on the Company's auditors

Jeffreys Henry LLP has indicated that it will resign as the

Company's Auditor as the firm will provide audit services to

clients from another company in the group, Gravita Audit Limited.

This is following a business reorganisation at the auditors. As

announced in the FY22 Annual Report, Gravita Audit Limited has been

appointed as the Company's auditor for the financial year ending 30

June 2023.

Jeffreys Henry LLP has confirmed to the Company that, in

accordance with Section 519 of the Companies Act 2006, there are no

circumstances in connection with its resignation which it considers

need to be brought to the attention of the Company's members or

creditors.

Current trading and outlook

Revenues of AxisBiotix-Ps(TM) have continued to increase

following the year end, with an increase in the monthly run rate

hitting GBP20k+, with revenues on course to double to cGBP250k for

the year ending 30 June 2024.

Retention rates for subscribers continue to be at least 80% with

retention rates being measured as the number of subscribers who are

remaining as a subscriber at the end of each month, compared to the

same cohort that were in existence at the start of the previous

month.

The Group also successfully completed a fundraise in November

2023, raising gross proceeds of GBP3.3m which will allow it to

continue its R&D programmes, continue marketing of

AxisBiotix-PS in the UK and Europe, and fund operating

expenditure.

Acquisition strategy

The Group is in advanced discussions to acquire two private

companies that either manufacture or sell a variety of branded

topical products for common dermatological conditions to NHS

hospitals, dispensing practices and national pharmacy chains. The

proposed targets are profitable and the Group sees a number of

synergies to improve this. However, there is no certainty of timing

or execution as the Company would need to agree additional funding

using debt and/or equity and any acquisition would be conditional

on satisfactory diligence.

In addition, the Group has a pipeline of further acquisitions

where active discussions are taking place. Any targets which the

Group is interested in purchasing will be accretive from a revenue

and earnings perspective, and thus reduce the operating cash burn,

with the goal of the Group in the next 12-18 months to becoming a

cash generating entity.

Operational review

SkinBiotix(TM) Pillar (skincare/cosmetics)

In November 2019, SkinBioTherapeutics signed a commercial and

manufacturing agreement with Croda's Consumer Care division,

Sederma, which is a specialist in bioactive ingredients for the

cosmetic industry. Croda has a global portfolio of personal care

customers which comprise many of the major international cosmetics

and FMCG brands.

During this financial year, Sederma has been focused on

developing quality formulations with their customers, which has

seen scaling-up manufacture of SkinBiotix(TM) from 600 litres to

2,000 litres which is expected to ultimately lead to the 20,000

litres vessel required to service the global market. 4 pilot

batches have been manufactured which identified significant,

unexpected technical benefits which Sederma believes may lead to a

justifiable increase in price based on clinical evidence. To this

end, the company extended its development agreement with Croda plc

to allow a clinical trial to be carried out to evidence the

additional activity. This study is fully funded by Sederma /Croda

and is expected to be completed early 2024.

Post year end, in November, Sederma extended its contract with

SkinBioTherapeutics for a further 12 months to conduct these

studies which are due to run from late 2023 into early 2024.

AxisBiotix(TM) Pillar (gut/skin axis)

The AxisBiotix pillar has challenged management time in the

year, as efforts to grow the UK market and expanding sales and

distribution channels into Europe, as well as driving the Acne

programme forward.

- AxisBiotix(TM) (Psoriasis)

Management has continued to grow the sales of the

AxisBiotix-Ps(TM) food supplement designed to alleviate the

symptoms associated with irritable skin conditions like psoriasis

in the UK and Europe.

The primary focus has been growing the UK market, whilst keeping

a strong control on costs, which has led to a reduction in

marketing expenditure with the completion of the influencer

programme. The response from customers continues to be extremely

positive with the retention rates of AxisBioTix-Ps(TM) in the UK

staying at 80% or above, which is encouraging. The retention rate

is measured as the number of subscribers who remain a subscriber at

the end of each monthly period, compared to the same cohort that

were in existence at the start of a month period. This is an

important statistic for the product, along with the increasing

number of positive testimonials from customers describing the

impact that this product has had on their lives.

This year was marked by the expansion into Europe, initially in

Spain in February 2023. Spain was management's first country target

since the market for psoriasis is similar to the UK with incidence

rates of psoriasis of between 1%-3% of the population. Post period

end, the Company opened new markets in Italy and France. The

Company also announced today that AxisBiotix-Ps(TM) will be sold on

Amazon's UK platform; the aim will be to expand this into other

countries, starting with European countries where the product

already has regulatory approval - Spain, Italy and France.

Work continues with Winclove, our formulation partner, to

investigate other delivery vehicles for SkinBiotix, for example

capsules, tablets etc which we hope to announce in 2024. These will

bring with them economic benefits to the Group.

Discussions with potential multinational partners are on-going

and are supported by our current activities. Partnering discussions

can take time and difficult to predict. Management will provide

further information as and when they are able to.

- AxisBiotix for Acne

The original consumer study with AxisBiotix-Ps(TM) involved

participants who had a mix of symptoms from psoriasis, rosacea, and

acne. The theory behind the use of a probiotic supplement was to

calm and therefore reduce the inflammatory pathways associated with

irritable skin conditions. The data showed that as well as

alleviating symptoms of psoriasis, the product had an impact on

other skin conditions; customer testimonials made reference to its

positive effect on eczema, dandruff and acne. As a result of this,

management has chosen acne as the next market to address with an

adapted form of AxisBiotix(TM).

During the year, the team has been working on a stabilised

bacterial blend from which to choose final formulations for a

consumer study in acne. The benefit of undertaking another consumer

study is the relatively short time and cost compared to a clinical

study and the classification as a food supplement rather than a

heavily regulated medical device.

Post year end, in October 2023, SkinBioTherapeutics announced

that two separate blends, formulated by Winclove Probiotics BV, had

been finalised to be studied side-by-side. A consumer volunteer

study is commencing to determine which has better efficacy. The aim

is to supply participants with the blends in powder form, just like

AxisBiotix-PS(TM).

The study involves 300 UK-based participants with acne-prone

skin, 150 randomly selected participants will receive product 1,

the other half of the group will receive product 2. Online

recruitment of participants will start via a pre-qualification

questionnaire form.

The products will be mailed to participants who are expected to

record their experience of using the product in a weekly

questionnaire over eight weeks, over which they are expected to

take the product daily. A follow-up questionnaire will be provided

one month after the participants stop taking their allocated

product. The study is expected to be completed and results reported

by the end of Q1 2024.

MediBiotix(TM) Pillar (MedTech applications e.g. woundcare)

Management is looking at using Skinbiotix(TM) technology in

medical device applications, such as woundcare since early data

showed that it encourages wound healing. In a similar way to the

AxisBiotix-Ps(TM) supplement, management is exploring how

SkinBiotix could be developed to alleviate the symptoms of eczema

via the gut-skin axis.

The advanced woundcare sector is significant but extremely

complex and heavily regulated, therefore, management believes the

optimal strategy is to seek a partner with an extensive product

portfolio and significant experience in the space to develop this

pillar further. Management continues to have advanced conversations

with global players in this sector.

CleanBiotix(TM) Pillar (anti-infection)

In early studies of SkinBiotix(TM), data also suggested that the

lysate prevented the most common skin pathogen, Staphylococcus

aureus, from sticking to and growing on skin surfaces. Increased

use of antibiotics has led to resistance to this infection (MRSA)

and incidences are growing more common in hospital settings.

Development of SkinBiotix as an anti-infection agent is an exciting

opportunity, but, again, management believes it would require

taking forward only as part of a wider outlicensed programme with a

bigger organisation.

Other Research Programmes

The Group has continued with its two research programmes with

the University of Manchester; an oral programme and an inflammation

study.

In August 2022, the first phase of the oral programme was

completed and results strongly supported the use of probiotic

strains or lysates in the prevention of gum (periodontal) disease.

By mixing bacteria and lysates together with oral cells, data

suggested that the cells were protected from the pathogens

connected with gum disease and reduced inflammation. By changing

the type and mix of bacteria to lysate created different levels and

elements of protection, therefore, further study is required to

optimise the mix. The research and development programme with the

University of Manchester continues to uncover novel mechanism by

which bacterially derived actives are protective in oral care

applications.

Three different actives, and a number of components have been

investigated with differentiated activities that offer a route to

oral care products with different protective actions on the hard

and soft tissues of the oral cavity. This current phase of the

programme ends in January 2024 and the company will work with the

University to publish relevant findings in H1 2024, and the

remainder of the details of the next phase programme through to

commercialisation. This lysate is different to that of

SkinBiotix.

The inflammation study is still underway. It is looking at how

the microbiome can influence and balance the body's response to

inflammation specifically related to harmful UVR (sunlight) light.

Several first-in-class findings have been made on the effects of

bacterially derived components and their ability to regulate the

cytokine mediated inflammatory response associated with exposure to

UVR. These results strongly support the use of bacterial actives in

protecting the skin from sun exposure and a breakout patent filing

has been made by the company on a lead active.

The company continues to work with the University of Manchester

in further validating these and other findings and in advancing the

technology toward human trials. The programme has delivered very

encouraging results and has been expanded and extended to allow for

the actives identified to be validated in propriety human skin

models. The programme will run until June 2025.

Conclusion

In 2023, the majority of the Company's focus has been on growing

sales of AxisBiotix-PS(TM) in the UK and starting to push into new

European territories, beginning with Spain. Launching a disruptive

product into any market always takes time to establish, and given

our limited resources, we are pleased with the loyalty and the very

positive testimonials we are receiving. The launch into new

European markets is very exciting and marks a new chapter.

We continue to enjoy a positive relationship with the

Croda/Sederma teams and they have provided very supportive

commentary on their views of the SkinBiotix(TM) technology. We see

their wish to extend the collaboration for a further 12 months as

positive overall; it may delay near-term revenue generation, but

the potential enhanced commercial opportunities could be

considerable.

Next year should also see the early results from other studies,

including the consumer study around an acne product, as well as

results from our oral and inflammation programmes with Manchester

University. The acne programme is especially exciting. We saw

initial positive responses to AxisBiotix-Ps in participants of the

psoriasis study who had other skin conditions, and this has

resulted in this new development programme which could have a

significant impact on a much wider population.

We were very pleased to complete and announce our recent

fundraise of GBP3.3m of gross proceeds in November 2023, which

allow the Group to continue to progress its R&D programmes,

namely the oral and inflammation programmes.

Talks with potential strategic partners continue around our

other pillars. We are also pushing ahead with our inorganic

acquisition programme, looking for opportunities that are

synergistic and complement our current programmes. We have strict

criteria for these opportunities; we will not overpay and they must

be accretive from day one.

Martin Hunt (Non-executive Chairman)

Stuart J. Ashman (Chief Executive Officer)

30 November 2023

Consolidated Statement of Comprehensive Income

For the Year Ended 30 June 2023

Notes 2023 2022

Continuing Operations GBP GBP

Revenue 3 132,057 74,761

Cost of Sales (46,867) (29,424)

Gross Profit 85,190 45,337

------------ ------------

Selling and distribution costs (81,294) (43,804)

Research and development (930,636) (861,383)

Operating expenses (2,072,612) (2,122,238)

------------ ------------

Total administrative expenses (3,084,542) (3,027,425)

------------ ------------

Loss from operations 4 (2,999,352) (2,982,088)

Finance costs 5 (8,886) (10,135)

------------ ------------

Loss before taxation (3,008,238) (2,992,223)

Taxation 173,089 199,622

------------ ------------

Loss for the year 7 (2,835,149) (2,792,601)

Other comprehensive income - -

Total comprehensive loss for the

year (2,835,149) (2,792,601)

============ ============

Basis and diluted loss per share

(pence) 8 (1.72) (1.78)

Consolidated Statement of Financial Position

As at 30 June 2023

Notes 2023 2022

Assets GBP GBP

Non-current assets

Property, plant and equipment 10 78,658 -

Right-of-use assets 11 94,502 126,903

Intangible assets 12 700,331 625,504

------------- ------------

Total non-current assets 873,491 752,407

------------- ------------

Current assets

Inventories 14 33,497 122,571

Trade and other receivables 15 192,885 138,150

Corporation tax receivable 15 182,545 266,916

Cash and cash equivalents 1,311,834 1,804,923

------------- ------------

Total current assets 1,720,761 2,332,560

------------- ------------

Total assets 2,594,252 3,084,967

============= ============

Equity and liabilities

Equity

Capital and reserves

Called up share capital 19 1,731,390 1,567,802

Share premium 19 10,947,874 8,758,037

Other reserves 438,589 437,316

Accumulated deficit (11,122,943) (8,287,794)

------------- ------------

Total equity 1,994,910 2,475,361

------------- ------------

Liabilities

Non-current liabilities

Lease liabilities 17 69,601 100,647

------------- ------------

Total non-current liabilities 69,601 100,647

------------- ------------

Current liabilities

Trade and other payables 16 498,696 481,742

Lease liabilities 17 31,045 27,217

------------- ------------

Total current liabilities 529,741 508,959

------------- ------------

Total liabilities 599,342 609,606

------------- ------------

Total equity and liabilities 2,594,252 3,084,967

============= ============

Consolidated Statement of Cash Flows

For the Year Ended 30 June 2023

2023 2022

GBP GBP

Cash flows from operating activities

Loss before tax for the period (3,008,238) (2,992,223)

Depreciation of property, plant and equipment 11,136 -

Right-of-use assets depreciation and interest 41,287 39,557

Amortisation of IP 656 250

Share-based payments charge 1,273 52,704

------------ ------------

(2,953,886) (2,889,712)

------------ ------------

Changes in working capital

Decrease/(increase) in inventories 89,074 (122,571)

(lncrease)/decrease in trade and other receivables (54,735) 130,796

Increase in trade and other payables 16,954 101,922

------------ ------------

Cash generated by operations 51,293 110,147

------------ ------------

Taxation received 257,458 116,534

------------ ------------

Net cash used in operating activities (2,645,135) (2,673,031)

------------ ------------

Investing activities

Purchase of property, plant and equipment (89,794) -

Purchase of IP (75,483) (96,813)

------------ ------------

Net cash used in investing activities (165,277) (96,813)

------------ ------------

Cash flows from financing activities

Net proceeds from issue of shares 2,353,425 -

Lease payments made (36,102) (35,122)

------------ ------------

Net cash generated by/(used in) financing

activities 2,317,323 (35,122)

------------ ------------

Net decrease in cash and cash equivalents (493,089) (2,804,966)

Cash and cash equivalents at the beginning

of the period 1,804,923 4,609,889

------------ ------------

Cash and cash equivalents at the end of the

period 1,311,834 1,804,923

============ ============

Consolidated Statement of Changes in Equity

For the Year Ended 30 June 2023

Share Share Other Retained

Capital Premium reserves earnings Total

GBP GBP GBP GBP GBP

As at 1 July

2021 1,567,802 8,758,037 384,612 (5,495,193) 5,215,258

Loss for the period - - - (2,792,601) (2,792,601)

Share-based payments - - 52,704 - 52,704

As at 30 June

2022 1,567,802 8,758,037 437,316 (8,287,794) 2,475,361

---------- ----------- ---------- ------------- ------------

Loss for the period - - - (2,835,149) (2,835,149)

Issue of shares 163,588 2,453,793 - - 2,617,381

Cost of share

issue - (263,956) - - (263,956)

Share-based payments - - 1,273 - 1,273

As at 30 June

2023 1,731,390 10,947,874 438,589 (11,122,943) 1,994,910

========== =========== ========== ============= ============

Company Statement of Financial Position

As at 30 June 2023

Notes 2023 2022

Assets GBP GBP

Non-current assets

Property, plant and equipment 10 78,658 -

Right-of-use assets 11 94,502 126,903

Intangible assets 12 694,402 624,255

Investments 13 482,434 423,072

Other receivables 15 1,445,801 1,142,891

------------ ------------

Total non-current assets 2,795,797 2,317,121

------------ ------------

Current assets

Trade and other receivables 15 149,157 91,427

Corporation tax receivable 15 182,545 230,391

Cash and cash equivalents 1,124,961 1,561,402

------------ ------------

Total current assets 1,456,663 1,883,220

------------ ------------

Total assets 4,252,460 4,200,341

============ ============

Equity and liabilities

Equity

Capital and reserves

Called up share capital 19 1,731,390 1,567,802

Share premium 19 10,947,874 8,758,037

Other reserves 438,589 437,316

Accumulated deficit (9,441,596) (7,151,781)

------------ ------------

Total equity 3,676,257 3,611,374

------------ ------------

Liabilities

Non-current liabilities

Lease liabilities 17 69,601 100,647

------------ ------------

Total non-current liabilities 69,601 100,647

------------ ------------

Current liabilities

Trade and other payables 16 475,557 461,103

Lease liabilities 17 31,045 27,217

------------ ------------

Total current liabilities 506,602 488,320

------------ ------------

Total liabilities 576,203 588,967

------------ ------------

Total equity and liabilities 4,252,460 4,200,341

============ ============

Company Statement of Cash Flows

For the Year Ended 30 June 2023

2023 2022

GBP GBP

Cash flows from operating activities

Loss before tax for the period (2,471,551) (2,029,989)

Depreciation of property, plant and equipment 11,136 -

Right-of-use assets depreciation and interest 41,287 39,557

Impairment of financial assets 16,573 28,407

Share-based payments charge 1,273 52,704

------------ ------------

(2,401,282) (1,909,321)

------------ ------------

Changes in working capital

(lncrease)/decrease in trade and other receivables (57,731) (31,539)

Increase in trade and other payables 14,454 108,423

------------ ------------

Cash (used)/generated by operations (43,277) 76,884

------------ ------------

Taxation received 229,583 116,534

------------ ------------

Net cash used in operating activities (2,214,976) (1,715,903)

------------ ------------

Investing activities

Purchase of property, plant and equipment (89,794) -

Purchase of IP (70,147) (95,314)

Investment in subsidiaries (378,847) (856,949)

------------ ------------

Net cash used in investing activities (538,788) (952,263)

------------ ------------

Cash flows from financing activities

Net proceeds from issue of shares 2,353,425 -

Lease payments made (36,102) (35,122)

------------ ------------

Net cash generated by/(used in) financing

activities 2,317,323 (35,122)

------------ ------------

Net decrease in cash and cash equivalents (436,441) (2,703,288)

Cash and cash equivalents at the beginning

of the period 1,561,402 4,264,690

------------ ------------

Cash and cash equivalents at the end of the

period 1,124,961 1,561,402

============ ============

Company Statement of Changes in Equity

For the Year Ended 30 June 2023

Share Share Other Retained

Capital Premium reserves earnings Total

GBP GBP GBP GBP GBP

As at 1 July

2021 1,567,802 8,758,037 384,612 (5,284,889) 5,425,562

Loss for the period - - - (1,866,892) (1,866,892)

Share-based payments - - 52,704 - 52,704

As at 30 June

2022 1,567,802 8,758,037 437,316 (7,151,781) 3,611,374

Loss for the period - - - (2,289,815) (2,289,815)

Issue of shares 163,588 2,453,793 - - 2,617,381

Cost of share

issue - (263,956) - - (263,956)

Share-based payments - - 1,273 - 1,273

As at 30 June

2023 1,731,390 10,947,874 438,589 (9,441,596) 3,676,257

========== =========== ========== ============ ============

Notes to the Financial Statements

For the Year Ended 30 June 2023

1. General information

SkinBioTherapeutics plc ('the Company') is a public limited

company incorporated in England under the Companies Act and quoted

on the AIM market of the London Stock Exchange (AIM: SBTX).

The principal activity of the Group is the identification and

development of technology that harnesses the human microbiome to

improve health.

2. Significant accounting policies and basis of preparation

a) Statement of compliance

The consolidated and company financial statements of

SkinBioTherapeutics plc have been prepared in accordance with

UK-adopted International Accounting Standards ('IFRS') and the

Companies Act 2006 applicable to companies reporting under

IFRS.

b) Basis of preparation

The consolidated and company financial statements have been

prepared under the historical cost convention modified by the

revaluation of certain financial instruments. The accounting

policies have been applied consistently in all material

respects.

The consolidated and company financial statements are presented

in Sterling (GBP) as this is the predominant functional currency of

the Group and Company, and is the currency of the primary economic

environment in which it operates. Foreign transactions are

accounted in accordance with the policies set out below.

c) Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(its subsidiaries) made up to 30 June each year. Control is

achieved where the Company has the power to govern the financial

and operating policies of an investee entity so as to obtain

benefits from its activities. All intra-group transactions,

balances, income and expenses are eliminated on consolidation.

d) Going concern

These financial statements have been prepared on a going concern

basis. In considering the appropriateness of this assumption, the

Board has considered the Group's projections for the twelve months

from the date of approval of this financial information, including

cash flow forecasts. The directors are confident that based on the

Group's forecasts and the recently completed capital raise of

approximately GBP3.3 million (before costs) the Group will have

enough funds to continue in operation for at least 12 months from

the date of signing these financial statements. The Directors

believe that the Group has adequate resources to continue in

operational existence for the foreseeable future and therefore

adopt the going concern basis of accounting in preparing these

financial statements.

e) Estimates and judgements

The preparation of financial statements requires the Board to

make judgements, estimates and assumptions that may affect the

application of accounting policies and reported amounts of assets

and liabilities as at each balance sheet date and the reported

amounts of revenues and expenses during each reporting period. Any

estimates and assumptions are based on experience and any other

factors that are believed to be relevant under the circumstances

and which the Board considers to be reasonable. Actual outcomes may

differ from these estimates. Any revisions to accounting estimates

will be recognised in the period in which the estimate is revised

if the revision affects only that period. If the revision affects

both current and future periods, the change will be recognised over

those periods.

The following are the critical judgements that the Directors

have made in the process of applying the Group's accounting

policies and that have the most significant effect on the amounts

recognised in the consolidated financial statements.

Estimation of the lifetime of intangible assets

Intangible assets acquired separately from a business are

recognised at cost and are subsequently measured at cost less

accumulated amortization and accumulated impairment losses.

Intangible assets recognised are reviewed against the criteria

for capitalisation with useful life determined by reference to the

underlying product being developed. Management believes that the

assigned values and useful lives, as well as the underlying

assumptions, are reasonable, though different assumptions and

assigned lives could have a significant impact on the reported

amounts.

Useful lives are also examined on an annual basis and

adjustments, where applicable are made on a prospective basis. The

Group does not have any intangible assets with indefinite

lives.

Amortisation is calculated so as to write off the cost of an

asset, less its estimated residual value, over the useful life of

that asset as follows:

Intellectual property - 20% straight line

Capitalisation of development costs

During the year GBP75,483 (2022: GBP96,813) of development costs

were capitalised, bringing the total amount of development costs

capitalised, as intangible assets, as at 30 June 2023, to

GBP700,331 (2022: GBP625,504), net of amortisation. Management has

reviewed the balances by project, compared the carrying amount to

expected future revenues and is satisfied that no impairment exists

and that the costs capitalised will be fully recovered as the

products are launched to market. New product projects are monitored

regularly and should the technical or market feasibility of a new

product be in question, the project would be cancelled and

capitalised costs to date will be removed from the balance sheet

and charged to the statement of comprehensive income.

Inventory valuation

Inventory is carried at the lower of cost and net realisable

value, using the first in first out method. Appropriate provisions

for estimated irrecoverable amounts due to slow-moving or obsolete

inventory are recognised in the income statement where there is

objective evidence that the assets are impaired.

The provision is GBP35,386 at 30 June 2023 (2022:

GBP265,966).

Refund accruals

Accruals for sales returns are estimated on the basis of

historical returns and are recorded so as to allocate them to the

same period in which the original revenue is recorded. These

accruals are reviewed regularly and updated to reflect The Boards's

latest best estimates. The Board do not believe that the difference

between the accrual estimate and actual returns will be

material.

The accrual for net refunds totalled GBP82 at 30 June 2023

(2022: GBP267). The expected returns rate would need to differ to

actual returns by 10% to have an impact of +/- GBP1,014 on reported

revenue and on operating profit. The choice of a 10% change for the

determination of sensitivity represents an extreme variation in the

return rate.

Share-based payments

The Group measures the cost of equity-settled transactions with

employees by reference to the fair value of the equity instruments

at the date at which they are granted. The fair value is determined

by using the Black-Scholes model taking into account the terms and

conditions upon which the instruments were granted. The accounting

estimates and assumptions relating to equity-settled share-based

payments would have no impact on the carrying amounts of assets and

liabilities within the next annual reporting period but may impact

profit or loss and equity. The judgments made and the model used

are further specified in note 20.

Estimation of incremental borrowing rate in accounting for

leases under IFRS16

In recognising a lease liability and right-of-use asset under

IFRS 16 the Group has used an estimated incremental borrowing rate

of 8%. The Group does not have any borrowings, so in order to apply

IFRS 16 it was necessary to estimate the incremental borrowing rate

that would be faced by the Group. The rate of 8% was determined by

looking at a range of loans available on the market. If the

interest rate used in the calculation were higher, this would have

the effect of reducing the size of both the lease liability and

right-of-use asset, reducing the depreciation charge and increasing

the interest charge in the consolidated income statement. The

overall change to the Company Income Statement and the Company

Statement of Financial Position would be immaterial. There would be

no change to operating cash flows or lease payments as a result of

a change in the estimate of the incremental interest rate.

f) Application of new and re vised International Financial Reporting Standards (IFRSs)

The Group has adopted all of the new or amended Accounting

Standards and interpretations issued by the International

Accounting Standards Board ('IASB') or the IFRS Interpretations

Committee ('IFRIC') that are mandatory and relevant to The Group's

activities for the current reporting period.

No new standards or interpretations issued by the IASB or the

IFRIC have led to any material changes in the Group's accounting

policies or disclosures during each reporting period.

New and revised IFRSs in issue but not yet effective

There are a number of new and revised IFRSs that have been

issued but are not yet effective that the Group has decided not to

adopt early. The most significant of these are as follows:

Reference Title Summary Application

date of standard

(Periods commencing

on or after)

IFRS17 Insurance Contracts Principles for the recognition, 1 January 2023

measurement, presentation

and disclosure of insurance

contracts

1 January 2023

Amendments to address concerns

and implementation challenges

that were identified after

IFRS 17 was published

---------- -------------------- --------------------------------- ---------------------

IAS1 Presentation Amendments regarding the 1 January 2023

of Financial classification of liabilities

Statements as current or non-current

---------- -------------------- --------------------------------- ---------------------

IAS8 Accounting Amendments regarding the 1 January 2023

Policies, Changes definition of accounting

in Accounting estimates

Estimates

---------- -------------------- --------------------------------- ---------------------

IAS12 Income taxes Deferred Tax related to 1 January 2023

Assets and Liabilities arising

from a Single Transaction

---------- -------------------- --------------------------------- ---------------------

IAS37 Amendments Amendments regarding disclosure 1 January 2023

to IAS1 and of material accounting policies

IFRS Practice

Statement 2

---------- -------------------- --------------------------------- ---------------------

The adoption of these Standards and Interpretations is not

expected to have a material impact on the financial information of

the Group in the period of initial application when they come into

effect.

3. Segmental information

IFRS 8 'Operating Segments' requires operating segments to be

determined based on The Group's internal reporting to the Chief

Operating Decision Maker. The Chief Operating Decision Maker has

been determined to be The Board of Directors which receives

information on the basis of the Group's operations in key

geographical territories, based on the Group's management and

internal reporting structure. Based on this assessment the Group

consider there to be 3 operating segments. Despite there being 3

operating segments, it is not currently feasible to allocate assets

and liabilities to the operating segments. As these operating

segments grow, we expect that allocation of assets and liabilities

will be possible. Administrative expenses are not segmented for

accounting purposes as the Board do not review these by segment

currently.

Year ended 30 June 2023

UK US EU Total

GBP GBP GBP GBP

Retail sales 118,921 9,275 3,861 132,057

Cost of sales (42,205) (3,292) (1,370) (46,867)

--------- -------- -------- ---------

Gross profit 76,716 5,983 2,491 85,190

Year ended 30 June 2022

UK US EU Total

GBP GBP GBP GBP

Retail sales 57,687 17,074 - 74,761

Cost of sales (23,264) (6,160) - (29,424)

--------- -------- ---- ---------

Gross profit 34,423 10,914 - 45,337

Due to the nature of its activities, the Group is not reliant on

any individual major customers.

4. Expenses - analysis by nature

Group Group

2023 2022

GBP GBP

Other income (3,292) (1,032)

Selling and distribution costs 81,294 43,804

Depreciation of right-of-use

asset 32,401 29,422

Depreciation of plant and equipment 11,136 -

Research and development 930,636 861,383

Directors remuneration (including

share-based compensation) 778,639 624,564

Staff costs 214,606 142,342

Foreign exchange differences (51) 1,127

Auditors remuneration

* audit fees 34,450 26,250

* other services 3,000 2,260

Inventory write down 35,386 265,966

Other operating costs 966,337 1,031,339

--------------------- ---------------------

Total operating expenses 3,084,542 3,027,425

===================== =====================

5. Finance costs

Group Group

2023 2022

GBP GBP

Interest payable 8,886 10,135

----------------- ------------------

8,886 10,135

================= ==================

Interest payable represents amounts arising on leases accounted

for under IFRS 16.

6. Employees and Directors

Group and company 2023 2022

The average monthly number of employees Number Number

and senior management was:

Executive directors 2 2

Non-executive directors 3 2

Employees 7 4

-------------------- ------------------

Average total persons employed 12 8

==================== ==================

As at 30 June 2023 the Company had 11 employees (2022: 7).

Group and company 2023 2022

Staff costs in respect of these GBP GBP

employees were:

Wages and salaries 1,012,909 631,789

Social security costs 137,531 68,816

Defined contribution pensions 19,733 16,883

Share-based payments (see note

20) 1,273 52,704

----------------------- -------------------

Total remuneration 1,171,446 770,192

======================= ===================

All staff were directly employed by SkinBioTherapeutics Plc.

Some of these staff costs are included within research and

development and some in share issue costs.

All the directors above can be considered to be key management

and have the responsibility for planning, directing and

controlling, directly or indirectly, the activities of the

Company.

The remuneration of directors and key executives is determined

by the remuneration committee having regard to the performance of

individuals and market trends.

The Company operates a defined contribution pension scheme for

employees and directors. The assets of the scheme are held

separately from those of the Company in independently administered

funds. The amounts outstanding at 30 June 2023 are GBP3,326 (2022:

GBP2,633).

Group and company 2023 2022

Directors remuneration: GBP GBP

Stuart J. Ashman 382,478 368,449

Manprit Randhawa 261,480 14,951

Doug Quinn - 140,414

Martin Hunt 68,670 63,000

Dr Cathy Prescott 41,011 31,500

Danielle Bekker 25,000 6,250

------------------- -------------------

Total remuneration 778,639 624,564

=================== ===================

Which is made up of:

Remuneration 755,258 572,151

Amounts receivable under long term

incentive schemes 11,375 42,603

Company contributions to pension

schemes 12,006 9,810

------------------- -------------------

Total remuneration 778,639 624,564

=================== ===================

The number of directors to whom retirement benefits are accruing

in respect of qualifying services under defined contribution

pension schemes is 2 (2022: 2). The highest paid director received

total emoluments of GBP382,478 (2022: GBP368,449) during the

year.

7. Taxation

Income taxes recognised in profit

or loss 2023 2022

GBP GBP

Current tax

Current period - UK corporation - -

tax

R&D tax credit 182,547 173,729

R&D tax credit - prior year (8,458) 25,893

------------------- -------------------

Tax credit for the year 173,089 199,622

=================== ===================

The tax charge for each period can be reconciled to the loss per

the statement of comprehensive income as follows:

Taxable losses (3,008,238) (2,992,223)

Normal applicable rate of tax 19.00% 19.00%

Loss on ordinary activities

multiplied by normal rate of

tax (571,565) (568,522)

Effects of:

Depreciation 2,116 -

Disallowables 3,752 12,525

Capital allowances (17,061) -

R&D enhanced deductions (137,215) (128,668)

R&D tax credit (173,089) (199,622)

Losses surrendered 248,189 227,644

Unused tax losses carried forward 471,784 457,021

----------------------- -----------------------

UK tax charge/(credit) (173,089) (199,622)

======================= =======================

The Group has an unrecognised deferred tax asset of GBP1,637,470

(2022: GBP1,132,844) at the period end, which has not been

recognised in the financial statements due to uncertainty of future

profits. The Group has an estimated tax loss of GBP8,618,261 (2022:

GBP5,962,339) available to be carried forward against future

profits.

8. Loss per share

2023 2022

GBP GBP

Basic and diluted loss per

share

Total comprehensive loss for

the year (2,835,149) (2,792,601)

Weighted average number of

shares 164,713,045 156,780,236

Basic and diluted loss per

share (pence) (1.72) (1.78)

======================= =======================

As the Group and Company are reporting a loss from continuing

operations for the year then, in accordance with IAS 33, the share

options are not considered dilutive because the exercise of the

share options would have an anti-dilutive effect. The basic and

diluted earnings per share as presented on the face of the income

statement are therefore identical.

9. Company's result for the period

The Group has elected to take the exemption under section 408 of

the Companies Act 2006 not to present the Parent Company income

statement account.

The loss for the Parent Company for the period was GBP2,289,815

(2022: GBP1,866,892).

10. Property, plant and equipment

Group and Company

Plant

& Machinery

GBP

Cost

At 1 July 2021 10,200

Additions -

-------------

At 30 June 2022 10,200

Additions 89,794

At 30 June 2023 99,994

=============

Accumulated depreciation

At 1 July 2021 10,200

Charge for the -

year

-------------

At 30 June 2022 10,200

Charge for the

year 11,136

At 30 June 2023 21,336

=============

Net book value

At 1 July 2021 -

-------------

At 30 June 2022 -

-------------

At 30 June 2023 78,658

=============

11. Right-of-use assets

Group and Company

Total

GBP

Cost

At 1 July 2021 145,757

Additions 12,997

--------

At 30 June 2022 158,754

--------

At 30 June 2023 158,754

========

Accumulated amortisation

At 1 July 2021 2,429

Charge for the year 29,422

--------

At 30 June 2022 31,851

Charge for the year 32,401

At 30 June 2023 64,252

========

Net book value

At 1 July 2021 143,328

--------

At 30 June 2022 126,903

--------

At 30 June 2023 94,502

========

12. Intangible assets

Patents Patents

& trademarks & trademarks

Group Company

GBP GBP

Cost

At 1 July 2021 528,941 528,941

Additions 96,813 95,314

-------------- --------------

At 30 June 2022 625,754 624,255

Additions 75,483 70,147

At 30 June 2023 701,237 694,402

============== ==============

Accumulated amortisation

At 1 July 2021 - -

Charge for the year 250 -

-------------- --------------

At 30 June 2022 250 -

Charge for the year 656 -

At 30 June 2023 906 -

============== ==============

Net book value

At 1 July 2021 528,941 528,941

-------------- --------------

At 30 June 2022 625,504 624,255

-------------- --------------

At 30 June 2023 700,331 694,402

============== ==============

Intellectual property is to be amortised over the expected

period that the asset generates income. A small part of the IP

belonging to the active subsidiary, AxisBiotix Limited, commenced

amortisation in the year ending 30 June 2022. Other IP amortisation

is expected to commence in the year ending 30 June 2024.

13. Investments

Company: Investments in subsidiary undertakings GBP

Cost

At 1 July 2021 113,733

Additions 309,339

-------------------

At 30 June 2022 423,072

Additions 59,362

-------------------

At 30 June 2023 482,434

===================

As at 30 June 2023, the Company directly owned the following

subsidiaries:

Name of company Country of incorporation Proportion of equity

interest

SkinBiotix Limited United Kingdom 100% of ordinary

shares

AxisBiotix Limited United Kingdom 100% of ordinary

shares

MediBiotix Limited United Kingdom 100% of ordinary

shares

CleanBiotix Limited United Kingdom 100% of ordinary

shares

PharmaBiotix Limited United Kingdom 100% of ordinary

shares

14. Inventories

2023 2022

GBP GBP

Inventories 33,497 122,571

------------------ -------------------

33,497 122,571

================== ===================

The cost of inventories recognised as an expense during the year

was GBP82,252 (2022: GBP295,390).

The cost of inventories recognised as an expense includes

GBP35,386 (2022: GBP265,966) in respect of write-downs of inventory

to net realisable value.

15. Trade and other receivables

2023 2022 2023 2022

GBP GBP GBP GBP

Current

Trade debtors 816 1,800 - -

Corporation tax 182,545 266,916 182,545 230,391

Sales taxes recoverable 108,720 48,669 96,240 13,560

Other receivables 12,693 11,101 12,891 11,101

Prepayments 70,656 76,580 40,026 66,766

-------- -------- ---------- ----------

375,430 405,066 331,702 321,818

======== ======== ========== ==========

Non-current

Amounts due from group undertakings - - 1,445,801 1,142,891

-------- -------- ---------- ----------

- - 1,445,801 1,142,891

======== ======== ========== ==========

The fair values of the Company's current trade and other

receivables are considered to equate to their carrying amounts. The

maximum exposure to credit risk for trade receivables is

represented by their carrying amount. There are no financial assets

which are past due but not impaired. No current financial assets

are impaired.

The amounts owed by subsidiary undertakings include a loan to

AxisBiotix Limited for GBP1,788,549 (2022:GBP1,531,177) which was

discounted to GBP1,524,909 and then impaired by GBP16,573, in

addition to earlier years impairment of GBP62,531 to give a current

value of GBP1,445,801 (2022: GBP1,142,891) under IFRS 9, as set out

in note 2. Although the loan has no repayment terms, it is

anticipated to be repaid in 3 years from the date of these

financial statements.

16. Trade and other payables

2023 2022 2023 2022

GBP GBP GBP GBP

Current

Trade creditors 194,274 72,610 176,176 66,277

Accruals 236,837 366,784 233,839 353,534

Sales taxes payable 505 85 - -

Other taxes 62,815 31,812 61,636 31,059

Other payables 4,265 10,451 3,906 10,233

-------- -------- -------- --------

498,696 481,742 475,557 461,103

======== ======== ======== ========

Trade and other payables principally consist of amounts

outstanding for trade purchases and ongoing costs. They are

non-interest bearing and are normally settled on 30-day terms. The

directors consider that the carrying value of trade and other

payables approximates to their fair value. All trade and other

payables are denominated in Sterling. The Company has financial

risk management policies in place to ensure that all payables are

paid within the credit timeframe and no interest has been charged

by any suppliers as a result of late payment of invoices during the

period.

The fair value of trade and other payables approximates their

current book values.

17. Lease liabilities

Group and Company

2023 2022

GBP GBP

Maturity analysis

Year 1 37,770 36,102

Year 2 39,029 37,770

Year 3 35,777 39,029

Year 4 - 35,778

Year 5 - -

--------- ---------

112,576 148,679

Less future interest charges (11,930) (20,815)

--------- ---------

100,646 127,864

========= =========

Analysed as

Current 31,045 27,217

Non-current 69,601 100,647

--------- ---------

100,646 127,864

========= =========

18. Financial instruments

Maturity analysis

A summary table with maturity of financial assets and

liabilities presented below is used by management to manage

liquidity risks. The amounts disclosed in the following tables are

the contractual undiscounted cash flows. Undiscounted cash flows in

respect of balances due within 12 months generally equal their

carrying amounts in the statement of financial position, as the

impact of discounting is not material.

The maturity analysis of financial instruments at 30 June 2023

is as follows:

Group

Carrying On demand 3 to 1 to 2 to

amount and less 12 months 2 years 5 years

than 3

months

Assets

Cash and cash equivalents 1,311,834 1,311,834 - - -

Trade and other

receivables 13,509 13,509 - - -

---------- ---------- ----------- --------- ---------

1,325,343 1,325,343 - - -

========== ========== =========== ========= =========

Liabilities

Trade and other

payables 435,881 435,881 - - -

Lease liabilities 112,576 8,498 29,272 39,029 35,777

---------- ---------- ----------- --------- ---------

548,457 444,379 29,272 39,029 35,777

========== ========== =========== ========= =========

Company

Carrying On demand 3 to 1 to 2 to

amount and less 12 months 2 years 5 years

than 3

months

Assets

Cash and cash equivalents 1,124,961 1,124,961 - - -

Trade and other

receivables 12,892 12,892 - - -

---------- ---------- ----------- --------- ---------

1,137,853 1,137,853 - - -

========== ========== =========== ========= =========

Liabilities

Trade and other

payables 413,923 413,923 - - -

Lease liabilities 112,576 8,498 29,272 39,029 35,777

---------- ---------- ----------- --------- ---------

526,499 422,421 29,272 39,029 35,777

========== ========== =========== ========= =========

The maturity analysis of financial instruments at 30 June 2022

is as follows:

Group

Carrying On demand 3 to 1 to 2 to

amount and less 12 months 2 years 5 years

than 3

months

Assets

Cash and cash equivalents 1,804,923 1,804,923 - - -

Trade and other

receivables 12,901 12,901 - - -

---------- ---------- ----------- --------- ---------

1,817,824 1,817,824 - - -

========== ========== =========== ========= =========

Liabilities

Trade and other

payables 449,930 449,930 - - -

Lease liabilities 133,501 5,854 26,341 33,989 67,317

---------- ---------- ----------- --------- ---------

583,431 455,784 26,341 33,989 67,317

========== ========== =========== ========= =========

Company

Carrying On demand 3 to 1 to 2 to

amount and less 12 months 2 years 5 years

than 3

months

Assets

Cash and cash

equivalents 1,561,402 1561,402 - - -

Trade and other

receivables 1,542,278 11,101 - - 1,531,177

---------- ---------- ----------- --------- ----------

3,103,680 1,572,503 - - 1,531,177

========== ========== =========== ========= ==========

Liabilities

Trade and other

payables 430,044 430,044 - - -

Lease liabilities 133,501 5,584 26,341 33,989 67,317

---------- ---------- ----------- --------- ----------

563,545 435,898 26,341 33,989 67,317

========== ========== =========== ========= ==========

18. Share capital

Number of Share Share

shares capital premium

As at 1 July 2021 156,780,236 1,567,802 8,758,037

------------ ---------- -----------

As at 30 June 2022 156,780,236 1,567,802 8,758,037

Ordinary share issued

at 1p per share 16,358,618 163,588 2,453,793

Costs related to shares

issued - - (263,956)

------------ ---------- -----------

As at 30 June 2023 173,138,854 1,731,390 10,947,874

============ ========== ===========

On 5 January 2023 16,358,618 ordinary shares were issued by way

of a placing at a price of 16p per share to raise funding for the

Group.

Share capital is the amount subscribed for shares at nominal

value, issued and fully paid.

Share premium is the amount subscribed for share capital in

excess of nominal value.

19. Share-based payments

Share options

The Group operates share-based payment arrangements to

remunerate directors and others providing similar services in the

form of a share option scheme. The exercise price of the option is

normally equal to the market price of an ordinary share in the

Group at the date of grant. Each share option converts into one

ordinary share of the Group on exercise. No amounts are paid or

payable by the recipient on receipt of the option. The options

carry neither rights to dividends nor voting rights.

Movements in the number of share options outstanding and their

related weighted average exercise prices are as follows:

Group and company

2023 2022

Number Weighted Number Weighted

of options average of options average

exercise exercise

price price

GBP GBP

Outstanding at 1 July 17,379,343 0.12 16,729,343 0.11

Granted during the

year - - 650,000 0.38

Forfeited/cancelled

during the year (650,000) 0.38 - -

------------ ---------- ------------ ----------

Outstanding at 30 June 16,729,343 0.11 17,379,343 0.12

============ ========== ============ ==========

On 9 May 2023, 650,000 options were forfeited, which were

previously granted at an exercise price of GBP0.376 per share.

The total credit recognised for the year ended 30 June 2023 for

these share options is -GBP10,102, whereas in 2022 this was a

charge of GBP10,102.

The fair values of the share options issued in the year were

derived using the Black Scholes model. The charge recognised for

the year ended 30 June 2023 for share options is GBP11,375 (2022:

GBP52,704) amounting to a total net charge of GBP1,273 being

recognised in the profit and loss account. The following

assumptions were used in the calculations:

Deed pool 1 2 3a 3b 3c

Grant date 05/04/17 05/04/17 05/04/17 05/04/17 05/04/17

Exercise price 9p 9p 9p 9p 9p

Share price at

grant date 9p 9p 9p 9p 9p

Risk-free rate 0.24% 0.24% 0.16% 0.16% 0.16%

Volatility 60% 60% 60% 60% 60%

Expected life 3.5 years 3.5 years 2.75 years 2.75 years 2.75 years

Fair value 2.58p 1.85p 2.30p 2.30p 2.30p

Deed pool 4 5 6 7 8

Grant date 18/04/19 18/04/19 18/04/19 03/03/20 08/04/20

Exercise price 18p 18p 18p 9.5p 9p

Share price at

grant date 18p 18p 18p 9.5p 7p

Risk-free rate 0.75% 0.75% 0.75% 0.29% 0.12%

Volatility 60% 60% 60% 80% 80%

Expected life 3.5 years 3.5 years 3.5 years 0 years 2 years

Fair value 2.85p 3.99p 3.48p 9.50p 0.87p

The closing share price per share at 30 June 2023 was 12.5p (30

June 2022: 20.25p).

Expected volatility is based on a conservative estimate for an

AIM listed entity. The expected life used in the model has been

adjusted, based on management's best estimate, for the effects of

non-transferability, exercise restrictions and behavioural

considerations.

20. Related party transactions

Group and company

Key management personnel compensation 2023 2022

GBP GBP

Short-term employee benefits including

social security costs 934,467 694,844

Post-employment benefits 13,218 11,239

Share-based payments 11,375 42,603

-------- --------

959,060 748,686

======== ========

Compensation figures above include directors and key management

personnel.

Transactions with other related parties

During the period ended 30 June 2023, the Company was charged

fees of GBP55,440 (2022: GBP50,400) by Invictus Management Ltd, a

company in which Martin Hunt, a director of the Company, is also a

director. These fees relate to Martin Hunt's consultancy services

to the Company. As at 30 June 2023 GBP5,292 (2022: GBP5,040) was

outstanding.

During the period ended 30 June 2023, the Company was charged

fees of GBP28,096 (2022: GBP25,200) by Biolatris Ltd, a company in

which Dr Cathy Prescott, a director of the Company, is also a

director. These fees relate to Dr Cathy Prescott's consultancy

services to the Company. As at 30 June 2023 GBPnil (2022: GBPnil)

was outstanding.

21. Ultimate controlling party

No one shareholder has control of the Company.

22. Events after the reporting date

The Company has evaluated all events and transactions that

occurred after 30 June 2023 up to the date of signing of the

financial statements.

On 22 November 2023 the Company completed a fundraise through a

Placing and Retail Offer, raising GBP3.3m of gross proceeds.

No other material subsequent events have occurred that would

require adjustment to or disclosure in the financial

statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKKBBOBDDNDN

(END) Dow Jones Newswires

November 30, 2023 12:25 ET (17:25 GMT)

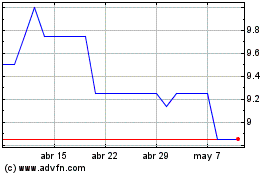

Skinbiotherapeutics (LSE:SBTX)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Skinbiotherapeutics (LSE:SBTX)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024