TIDMSPSY TIDMSPSC

RNS Number : 4387N

Spectra Systems Corporation

25 September 2023

Spectra Systems Corporation

Interim Results for the Six Months Ended 30 June 2023

Spectra Systems Corporation ("Spectra Systems" or the

"Company"), a leader in machine-readable high speed banknote

authentication, brand protection technologies and gaming security

software, is pleased to announce its interim results for the six

months ended 30 June 2023.

Financial highlights:

-- Revenue of $11,621k (2022: $9,265k) up 25%

-- Adjusted EBITDA(1) up 55% at $5,903k (2022: $3,818k)

-- Adjusted PBTA(1) up 59% to $5,837k (2022: $3,669k)

-- Adjusted earnings(2) per share up 74% to US $10.8 cents (2022: US $6.2 cents)

-- Cash generated from operations of $4,418k (2022: $7,245k)

-- Strong, debt-free balance sheet, with cash(3) of $16,582k (2022: $17,961k) at 30 June 2023

(1) Before stock compensation expense and excludes

non-controlling interest

(2) Before amortization and stock compensation expense, excludes

noncontrolling interest and fewer remaining tax credits

(3) Does not include $500,000 (2022: $500,000) of restricted

cash and investments

Operational highlights:

-- Achieved key development and payment milestones for sensor

development program positioning Spectra Systems for preproduction

units in 2024 and production units in 2025

-- Completed fiscal year order at 22% higher pricing with

in-house manufacturing for supply chain mitigation with a major

central bank customer

-- Ongoing large print trial of polymer substrate with Middle Eastern central bank

-- Successful tests with new K-cup printer completed

-- Successful installation and staff training for our first

Banknote Disinfection System with an Asian central bank

-- Hired new managing director for Canadian gaming software division

Commenting on the results, Nabil Lawandy, Chief Executive

Officer, said:

"The Company's first half revenues and earnings are up

substantially from the six months ended June 30, 2022 with

increases of 25% and 59% for revenue and PBTA, respectively. Our

cash position remains strong at $16,582k with a debt free balance

sheet. The increased revenues in the first half are derived

principally from pre-production development contracts as well as

larger demand for our materials to meet increased banknote demands

of one of our existing central bank customers.

We have achieved key milestones with our sensor development

contract and are moving into the final phase of the program with

the delivery of preproduction units in Q4 of 2024. The central bank

customer expects to provide a first draft of the manufacturing

contract in H2 of this year.

Our anticipation of potential supply chain issues and proactive

implementation of a supply chain mitigation program with our

largest central bank customer has resulted in significantly

enhanced revenues in H1 as we have been able to complete that

entire fiscal year order for 2022-2023 on time.

On the optical materials front, we have significantly grown

revenue from K-cup printers and have received approval from a third

customer in Canada which we expect to place a first order in Q1 of

2024.

With regards to our suite of smartphone-based authentication

solutions, we have initiated a testing program with a UK passport

company and are awaiting approval on the use of our combined

smartphone and covert authentication holographic labels for

protection of physical versions of non-fungible token ("NFT")

artwork

Finally, our gaming software operation has gone live with the

New York State lottery, and we have appointed a new managing

director with a strong background in software management,

development and sales.

"The Board therefore believes that the Company is on track to

achieve record earnings and meet market expectations for the full

year."

Spectra Systems Corporation Tel: +1 (0)401 274 4700

Dr. Nabil Lawandy, Chief Executive Officer

WH Ireland Limited (Nominated Adviser and Tel: +44 (0)20 7220 1650

Joint Broker)

Chris Fielding/James Bavister (Corporate

Finance) Tel: +44 (0)20 3328 5665

Fraser Marshall (Corporate Broking)

Allenby Capital Limited (Joint Broker)

Nick Naylor/James Reeve (Corporate Finance)

Amrit Nahal/Guy McDougall (Sales and Corporate

Broking)

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

The person responsible for arranging the release of this

announcement on behalf of the Company is Dr. Nabil Lawandy, Chief

Executive of the Company.

Chief Executive Officer's statement

Introduction

In H1 2023, we have already achieved a PBTA level which is 73%

of the market expectations for the year. We are therefore highly

confident we will achieve market expectations for the full

year.

Revenue was up 25% at $11,621k (2022: $9,265k) for the first

half of the year. The increased revenues in the first half are

derived principally from pre-production development contracts, as

well as strong demand for our materials to meet the banknote

requirements of one of our existing central bank customers.

As a result of the increased revenue, adjusted EBITDA (before

stock compensation expense) for the half year increased 55% to

$5,903k compared to the prior year of $3,818k.

Having generated cash from operations of $4,418k (2022:

$7,245k), cash at the period end amounted to $16,582k (2022:

$17,961k), excluding $500,000 of restricted cash and investments

(2022: $500k). This is notwithstanding $5,102k paid to shareholders

during June in the form of the Company's annual dividend of

$0.115.

Review of Operations

Physical and Software Authentication Business

The Authentication Systems business generated revenue of

$10,589k (2022: $8,565k) and Adjusted EBITDA of $4,698k (2022:

$3,878k).

Authentication Systems revenues are driven by sales of covert

materials and their associated equipment and service, optical and

security phosphor materials, and the final license payments from

our licensee. The increased revenue is due to a combination of

sizable materials orders and meeting several key payment milestones

relating to sensor development funding from our long-standing

central bank customer. We continue to move forward with this

central bank towards the delivery of the preproduction sensors in

late 2024. In addition, we have executed a $1.9mm contract with a

central bank customer for Quality control equipment in H1 which

will impact our revenue and PBTA primarily in 2024-2025.

Through our strong partnership with Cartor Security Printers in

Wolverhampton we have further refined our abilities and yields of

high quality conducting and opacified polymer substrates for

evaluation by central banks, ink suppliers and printing

organizations. We have produced custom designed sheets for a Middle

Eastern central bank to be used in large scale print trials which

continue. Final decisions have been delayed as the central bank has

had to deal with local hyperinflation and has shifted temporarily

to the printing of paper substrate notes in other

denominations.

In addition, the Company has formed a close working relationship

with the largest commercial printer of polymer banknotes and is

near completion of a house note which will incorporate both our

FusionTM machine readable security as well as their newest public

security feature. The Directors anticipate that the result of this

joint development will be polymer banknotes of the highest quality

for a joint marketing effort.

During H1 and going forward, we are utilizing our increased

profitability to further support sales and marketing efforts. Since

recruiting an experienced sales director for banknote technology in

December of 2022, we have forged relationships with a number of

central banks for our polymer product as well as other related

authentication technology. With this additional recruitment, we

have been able to free up time from our existing staff to further

increase our sales efforts in brand authentication as well as

document security, with a focus on passports.

The smartphone technology has been seeded in Asia for cigarettes

and stationery for some time and while this continues to percolate,

we have opened new opportunities in the NFT art and passport data

page security areas. We now have a revised target of $1mm of

revenues for this technology by close of 2024.

Our K-cup materials business has grown significantly since a new

customer began purchasing our products in H2 2021. We have recently

successfully completed trials with a Canadian printer of K-cups and

are currently working on assessing the additional revenue with this

customer for 2024; we are hopeful we may begin filling orders in

H2.

On the software security side of the Company's business, the

Secure Transactions Group, formed around two gaming technology

acquisitions made in 2012, generated an Adjusted EBITDA of $40k

(2022:($60k)) on revenue of $840k (2022: $700k). The H1 results are

in line with expectations for this first half of the year and we

expect an increase in H2 with several lottery wins from last year

going live.

Banknote Cleaning and Disinfection Business

In 2022, we sold our first Banknote Disinfection System (BDS)

for use by an Asian central bank. During H1 2023, we have

successfully installed the BDS and trained the central bank staff.

With this first unit now installed and operational, we are able to

provide a full reference for other central banks.

Strategy

The Company's strategy for increasing revenue and earnings

continues to be focused on selling more products to existing

customers as well as opening new sales channels for the full

spectrum of our product offerings.

We have had very good success in upselling existing central bank

customers and commercially exploiting supply chain and pandemic

related issues as part of our strategy. Examples of these successes

are the expansion of sensor capabilities for exotic counterfeits,

the development and first sale of a banknote disinfection machine,

and the commencement of a program with our customer to deal with

supply chain issues now and going forward.

Our strategy for growing our newest and potentially

transformative technology for polymer banknotes is based on

validation, followed by a commemorative banknote contract and then

a full banknote denomination contract. The validation is focused on

three major stakeholders in the polymer banknote industry: the ink

manufacturers, the commercial printers, and the state printworks.

Our primary targets are central banks which are currently using

paper substrates and are contemplating a transition to polymer, as

well as central banks who have decided not to use polymer for

higher denominations due to security concerns.

With regards to our optical materials and brand authentication

products, we continue to propose to both central banks and overt

security suppliers the concept of upgrading security features to

incorporate public and machine-readable security. The strategy

behind this approach is based around partnering with suppliers who

can benefit from our technology and materials to upsell their

existing customers.

Finally, we continue to explore strategic as well as increased

sales channel-based mergers and acquisitions. The active search for

such opportunities is being accelerated as we expect to have

significant cash resources through the successful delivery of the

major central bank sensor contract.

Prospects

The Company has several new sales opportunities which mirror the

broad-spectrum of products we have developed. The inventiveness

which we have demonstrated repeatedly is a key component of our

growth strategy and drives our profit generation process strategy.

This approach has led to a high margin, intellectually driven,

patent protected suite of products from products from smartphone

authentication, to viral disinfection of banknotes to cutting-edge

covert technologies.

Opportunities within the next 24 months or less include:

-- Completion of sensor development and revenue recognition of the remaining

sensor development payments

-- Completion, delivery, and payment for a new online Quality

Control system contract received this year

-- First sensor shipments to a central bank commencing in Q2 2025

-- Sale of additional Banknote Disinfection Systems

-- Increased sales of our optical materials for K-cups and phosphor applications

-- Expansion of our gaming software business in Canada and in the online lottery market

Opportunities within the next 3-5 years:

-- TruBrandTM for use in art protection and passport data pages

-- A commemorative note series using our Fusion polymer substrate

-- Supply of upgraded sensors worth up to $50mm in hardware to a central bank customer

-- Supply of FusionTM polymer substrate and sensors to a central

bank for one or more banknote denominations

-- Significantly increased adoption of covert authentication

materials by a current or new central bank customer

The combination of these prospects, both short and long-term,

has positioned the Company to continue its revenue and earnings

growth over the coming years. We continue to develop cutting edge

technologies to remain the technology leader in the authentication

industry and to offer our shareholders growth through innovation

for both new and existing customers.

Nabil M. Lawandy

Chief Executive Officer

September 25, 2023

Consolidated statements of income

for the half year ended 30 June 2023

Half Year Half Year Full Year

to 30 Jun to 30 Jun to 31 Dec

2023 2022 2022

Unaudited Unaudited Audited

USD '000 USD '000 USD '000

Revenues

Product $ 7,242 $ 5,488 $ 11,208

Service 3,945 2,907 6,681

License and royalty 434 870 1,738

--------------------------- --------------------------- --------------------------

Total revenues 11,621 9,265 19,627

Cost of sales 3,581 3,145 7,351

--------------------------- --------------------------- --------------------------

Gross profit 8,040 6,120 12,276

Operating expenses

Research and

development 702 837 1,507

General and

administrative 1,577 1,481 3,023

Sales and marketing 415 478 753

--------------------------- --------------------------- --------------------------

Total operating

expenses 2,694 2,796 5,283

--------------------------- --------------------------- --------------------------

Operating profit 5,346 3,324 6,993

Interest and other

income 172 8 17

Loss on sale of - - -

equipment

Foreign currency

gain(loss) (35) 3 (8)

--------------------------- --------------------------- --------------------------

Profit before taxes 5,483 3,335 7,002

Income tax expense 784 707 901

--------------------------- --------------------------- --------------------------

Net income 4,699 2,628 6,101

Net income (loss)

attributable

to noncontrolling

interest 14 22 46

--------------------------- --------------------------- --------------------------

Net income

attributable

to Spectra Systems

Corporation $ 4,713 $ 2,650 $ 6,147

=========================== =========================== ==========================

Earnings per share

Basic $ 0.10 $ 0.06 $ 0.14

Diluted $ 0.10 $ 0.06 $ 0.13

Consolidated statements of comprehensive income

for the half year ended 30 June 2023

Half Year Half Year Full Year

to 30 Jun to 30 Jun to 31 Dec

2023 2022 2022

Unaudited Unaudited Audited

USD '000 USD '000 USD '000

Net income $ 4,713 $ 2,628 $ 6,101

Other comprehensive

income (loss)

Unrealized gain (loss)

on currency exchange (45) 1 (45)

Reclassification for

realized (gain) loss

in net income 35 (3) 8

------------------------ ------------------------ ------------------------

Total other comprehensive

loss (10) (2) (37)

------------------------ ------------------------ ------------------------

Comprehensive income 4,703 2,626 6,064

Net gain (loss) attributable

to noncontrolling interest 14 22 (46)

------------------------ ------------------------ ------------------------

Comprehensive income

attributable to Spectra

Systems Corporation $ 4,717 $ 2,648 $ 6,018

Consolidated balance sheets

as of 30 June 2023

As of As of As of

30 Jun 2023 30 Jun 2022 31 Dec 2022

Unaudited Unaudited Audited

USD '000 USD '000 USD '000

Current assets

Cash and cash equivalents $ 16,582 $ 17,961 $ 17,496

Trade receivables, net of allowance 3,095 1,384 3,677

Unbilled and other receivables 1,002 527 1,133

Inventory 2,368 2,192 1,599

Prepaid expenses 795 1,272 760

-----------------------

Total current assets 23,842 23,336 24,665

Non-current assets

Property, plant and equipment, net 1,910 1,617 2,102

Operating lease right of use assets,

net 1,659 828 1,217

Intangible assets, net 6,970 7,057 7,055

Restricted cash and investments 500 500 500

Deferred tax assets 1,848 530 1,881

Other assets 595 105 597

---------------------- ----------------------- ----------------------

Total non-current assets 13,482 10,637 13,352

Total assets $ 37,324 $ 33,973 $ 38,017

====================== ======================

Current liabilities

Accounts payable $ 796 $ 664 $ 929

Accrued expenses and other

liabilities 476 465 504

Operating lease liabilities, short

term 392 289 298

Taxes payable 194 49 684

Deferred revenue 4,601 1,898 4,626

---------------------- ----------------------- ----------------------

Total current liabilities 6,459 3,365 7,041

Non-current liabilities

Operating lease liabilities, long

term 1,319 595 975

Deferred revenue 1,590 4,968 1,679

---------------------- ----------------------- ----------------------

Total non-current liabilities 2,909 5,563 2,654

Total liabilities 9,368 8,928 9,695

---------------------- ----------------------- ----------------------

Stockholders' equity

Common stock 450 451 450

Additional paid in capital - common

stock 53,270 53,336 53,178

Accumulated other comprehensive loss (186) (138) (174)

Accumulated deficit (26,319) (29,224) (25,727)

-----------------------

Total Spectra Systems Corporation

stockholders' equity 27,215 24,425 27,727

Noncontrolling interest 741 620 595

---------------------- ----------------------- ----------------------

Total stockholders' equity ` 27,956 25,045 27,921

---------------------- ----------------------- ----------------------

Total liabilities and

stockholders' equity $ 37,324 $ 33,973 $ 38,017

====================== ======================

Consolidated statements of cash flows

for the half year ended 30 June 2023

Half Year Half Year Full Year

to 30 Jun to 30 Jun to 31 Dec

2023 2022 2022

Unaudited Unaudited Audited

USD '000 USD '000 USD '000

Cash flows from

operating

activities

Net income $ 4,699 $ 2,628 $ 6,101

Adjustments to

reconcile net

income to net cash

provided

by operating

activities

Depreciation and

amortization 459 418 917

Stock based

compensation

expense 92 65 142

Lease amortization

expense 89 142 287

Deferred taxes 32 550 (801)

Allowance for

doubtful accounts - - (4)

Provision for excess

and obsolete

inventory - - 694

Loss on sale of - - -

equipment

Changes in operating

assets

and liabilities

Accounts

receivables 581 861 (1,428)

Unbilled and other

receivables 131 102 (503)

Inventory (770) (248) (349)

Prepaid expenses (34) (974) (463)

Other assets - - (500)

Accounts payable (133) 175 441

Operating leases (92) (140) (285)

Accrued expenses

and other

liabilities (518) (262) 417

Deferred revenue (118) 3,928 3,374

--------------------------- --------------------------- ---------------------------

Net cash provided by

operating

activities 4,418 7,245 8,040

Cash flows from

investing

activities

Restricted cash and (3) - -

investments

Payment of patent and

trademark

costs (129) (147) (476)

Proceeds from sale of - - -

equipment

Purchases of property,

plant

and equipment (8) (338) (988)

--------------------------- --------------------------- ---------------------------

Net cash provided by

(used

in) investing

activities (140) (485) (1,464)

Cash flows from

financing

activities

Dividends paid (5,182) (5,004) (5,004)

Repurchase of shares - (570) (807)

Proceeds from exercise

of stock

options - 6 6

--------------------------- --------------------------- ---------------------------

Net cash used in

financing

activities (5,182) (5,568) (5,805)

Effect of exchange

rate on

cash and cash

equivalents (10) (6) (50)

--------------------------- --------------------------- ---------------------------

Net increase(decrease)

in

cash and cash

equivalents (914) (1,186) 721

Cash and cash

equivalents

, beginning of period 17,496 16,775 16,775

--------------------------- --------------------------- ---------------------------

Cash and cash

equivalents

, end of period $ 16,582 $ 17,961 $ 17,496

=========================== =========================== ===========================

Notes to financial information

1. Basis of preparation

This report was approved by the Directors on the 18 September

2023.

This financial information has been prepared using the

recognition and measurement principles of US Generally Accepted

Accounting Principles (GAAP). The Group has not elected to apply

IAS 34 Interim Financial Reporting.

The principal accounting policies used in preparing the interim

results are those the Company expects to apply in its financial

statements for the year ending 31 December 2023 and are unchanged

from those disclosed in the Company's Annual Report for the year

ended 31 December 2022.

The results for the half year are unaudited. The financial

information for the year ended 31 December 2022 does not constitute

the full statutory accounts for that period. The Annual Report and

financial statements for the year ended 31 December 2022 have been

filed with the Registrar of Companies. The Independent Auditors'

Report on the financial statements for the year ended 31 December

2022 was unmodified and did not draw attention to any matters by

way of emphasis.

2. Earnings per share

The calculation of basic earnings per share is based on the net

income divided by the weighted average number of common shares

outstanding. Diluted earnings per share is calculated by

considering the dilutive impact of common stock equivalents under

the treasury stock method as if they were converted into common

stock as of the beginning of the period or as of the date of grant,

if later. Excluded from the calculation of diluted earnings per

common share for the six months ended June 30, 2023, and the year

ended December 31, 2022, were 189,000 and 186,773 shares related to

stock options, respectively, because their exercise prices would

render them anti-dilutive. For the six months ended June 30,

2022,159,845 were excluded from the calculation of diluted earnings

per common share. The following table shows the calculation of

basic and diluted earnings per common share .

Half Year Half Year Full Year

to 30 Jun to 30 Jun to 31 Dec

2023 2022 2022

Numerator:

Net income $ 4,712,975 $ 2,650,000 $ 6,147,374

Denominator:

Weighted average common

shares 45,143,754 45,569,258 45,189,208

Effect of dilutive securities:

Stock Options 1,957,249 2,233,298 2,132,610

--------------------- --------------------- ---------------------

Diluted weighted average

common shares 47,101,003 47,802,556 47,321,818

===================== ===================== =====================

Earnings per common share:

Basic: $ 0.10 $ 0.06 $ 0.14

===================== ===================== =====================

Diluted: $ 0.10 $ 0.06 $ 0.13

===================== ===================== =====================

3. Investment in affiliates and other entities

During the course of business, the Company enters into various

types of investment arrangements. The Company determines whether

such investments involve variable interest entities (VIEs). If the

entity is determined to be a VIE, then management determines if the

Company is the primary beneficiary of the entity and whether or not

consolidation of the VIE is required. The primary beneficiary

consolidating the VIE must normally have both (i) the power to

direct the activities of a VIE that most significantly affect the

VIE's economic performance and (ii) the obligation to absorb losses

of the VIE or the right to receive benefits from the VIE, in either

case that could potentially be significant to the VIE. When the

Company is deemed to be the primary beneficiary, the VIE is

consolidated and the other party's equity interest in the VIE is

accounted for as a noncontrolling interest.

On December 10, 2020, the Company invested $702,000 in Solaris

BioSciences ("Solaris") and increased its equity interest from

4.79% to 48.65% on an as converted basis. A noncontrolling interest

is attributable to the 51.35% of Solaris not owned by the Company.

Prior to the investment, the Chief Executive Officer of Spectra

owned 84.54% of Solaris which declined to 46.01% after the

transaction. As part of the transaction, the Company committed to

provide $100,000 of services at cost to Solaris, of which $93,558

were provided during the six months ended June 30, 2021. In

addition, the Company will provide nominal accounting support to

Solaris and allow Solaris use of optical table space and facilities

at Spectra. In accordance with Delaware law, the transaction was

(a) unanimously approved by all three of Spectra's non-executive

Directors and (b) specially approved by a majority-in-interest of

the disinterested stockholders of Solaris. In addition, going

forward Spectra's shares in Solaris will be voted as directed by

Spectra's non-executive Directors. The Chief Executive Officer of

Solaris is also the Chief Executive Officer of Spectra.

The Company has concluded that Solaris is a VIE and the Company

is the primary beneficiary. The Company has consolidated the

accounts of Solaris as of December 10, 2020. The aggregate carrying

value of Solaris' assets and liabilities after elimination of any

intercompany transactions and balances in the consolidated balance

sheets were as follows:

As of As of As of

30 Jun 2023 30 Jun 2022 31 Dec 2022

Unaudited Unaudited Audited

USD '000 USD '000 USD '000

Assets

Cash $ 14 $ 101 $ 150

Property, plant and equipment,

net 7 7 8

Intangible assets, net 110 56 40

------------------------ ------------------------ ------------------------

Total Assets 131 164 197

Liabilities

Accounts payable 22 - 21

Accrued expenses and other - - -

liabilities

Total liabilities $ 22 $ - $ 21

4. Copies of this statement are available to the public on the

Company's website at http://www.spsy.com.

Appendix - Reconciliation of Non-GAAP measures

The Company publishes certain additional information in a

non-statutory format in order to provide readers with an increased

insight into the underlying performance of the business.

Reconciliations to the GAAP measures are shown in the following

tables:

Half Year Half Year Full Year

to 30 Jun to 30 Jun to 31 Dec

2023 2022 2022

Unaudited Unaudited Unaudited

USD '000 USD '000 USD '000

Adjusted earnings before interest, taxes,

depreciation and amortization (EBITDA)

Operating profit $ 5,346 $ 3,324 $ 6,993

Depreciation 203 159 321

Amortization 254 257 594

Stock compensation 92 65 142

Operating loss -

noncontrolling

interest 13 22 46

Stock compensation -

noncontrolling

interest (5) (10) (19)

Adjusted EBITDA $ 5,903 $ 3,817 $ 8,077

Adjusted profit before taxes and

amortization (PBTA)

Profit before taxes $ 5,483 $ 3,335 $ 7,002

Amortization 254 257 594

Stock compensation 92 65 142

Operating loss -

noncontrolling

interest 13 22 46

Stock compensation -

noncontrolling

interest (5) (10) (19)

Adjusted PBTA $ 5,837 $ 3,669 $ 7,765

Adjusted earnings per share

Adjusted PBTA $ 5,837 $ 3,669 $ 7,765

Income tax expense (784) (707) (901)

Adjusted earnings $ 5,053 $ 2,962 $ 6,864

Diluted weighted average

common

shares 47,101,003 47,802,556 47,321,818

Adjusted earnings per

share $ 0.108 $ 0.062 $ 0.145

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFFEAIISFIV

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

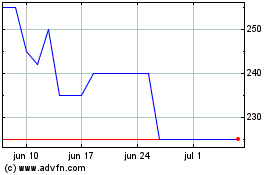

Spectra Systems (LSE:SPSY)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Spectra Systems (LSE:SPSY)

Gráfica de Acción Histórica

De May 2023 a May 2024