TIDMSQZ

RNS Number : 8360M

Serica Energy PLC

19 September 2023

Serica Energy plc

("Serica" or the "Company")

Results for the six months ended 30 June 2023

London, 19 September 2023 - Serica Energy plc (AIM: SQZ), a

British independent upstream oil and gas company with operations in

the UK North Sea today announces its financial results for the six

months ended 30 June 2023. The results are included below and

copies are available at www.serica-energy.com and www.sedar.com

.

Commenting on the results, Mitch Flegg, Serica's CEO stated:

"The completion of the Tailwind acquisition in March represented

a step change in the scale and diversity of Serica, achieving a

longstanding strategic goal. We have stated consistently our

intention to continue investing in the enlarged portfolio, to add

to it in a disciplined fashion if the right opportunities arise and

to make further cash returns to shareholders. Accordingly, we look

forward to near continuous well and drilling activity across the

Bruce and Triton hubs during the next eighteen months and are

pleased to announce today an interim dividend of 9 pence per share.

This is up from 8 pence per share for the interim dividend in 2022,

following the full year dividend of 22 pence per share last

year.

Serica's current circumstances and optimism reflected in its

investment plans should not mask the fact that we share the

widespread concerns within the sector about the health of the UK's

offshore upstream industry given the current fiscal regime and

future uncertainties. We welcome the UK government's recent Call

for Evidence regarding long term fiscal policy. However, the

problems we see need to be addressed urgently in order to restore

confidence in the sector."

First Half 2023 Highlights

-- Completed acquisition of Tailwind Energy Investments Limited

on 23 March 2023 increasing 2P reserves to 130 million boe (pro

forma as at 31 December 2022).

-- Combined portfolio produced 49,350 boe per day on a pro forma

basis (1H 2022: 38,100 boe per day) balanced between gas (55%) and

oil (45%).

-- Carbon intensity (kg of CO(2) per boe) of production from

Bruce and Triton hubs lower in 1H 2023 than 1H 2022.

-- Profitability maintained with higher sales volumes largely offsetting lower gas prices.

-- Highly cash generative portfolio of assets. Cash flow from

operations of GBP266 million (1H 2022: GBP267 million) contributing

to gross cash of GBP444 million as at 30 June 2023 after tax

payments of GBP141 million, net cash outflow of GBP44 million

arising from the acquisition of Tailwind Energy and reduction of

GBP48 million in debt acquired with Tailwind.

-- Net cash of GBP234 million as at 30 June 2023.

-- Average realised gas price of 96 pence per therm (1H 2022:

136 pence per therm) and realised average oil price of US$64 per

barrel (1H 2022: US$108 per barrel).

-- Average operating cost per boe of US$17.5 (1H 2022: US$16.1 per boe).

-- Operating profit GBP159 million (1H 2022: GBP196 million).

-- Interim dividend of 9 pence per share (2022: 8 pence per

share) announced today following the full year dividend of 22 pence

per share for 2022. The interim dividend is payable on 23 November

to shareholders registered on 27 October 2023 with an ex-dividend

date of 26 October 2023.

Outlook

-- Work on multiple Bruce and Keith wells being undertaken

during remainder of 2023 and in 2024 to boost production

performance.

-- Four-well Triton hub drilling campaign sanctioned for

execution in 2024. Rig option exercised for 5(th) well in 2025.

-- Progress towards development of Belinda field with submission

of draft FDP to NSTA. Decision not to undertake further drilling on

North Eigg.

-- Production guidance for 2023 amended to 40-45,000 boe per day

due to slower than expected ramp up of production from Bruce and

Triton hubs following planned summer shutdowns. Group operating

costs expected to remain below US$20 per boe.

A meeting with sell-side analysts will be held today at 10:30am

BST. If you would like to participate, please email

serica@vigoconsulting.com .

Investor Presentation

Mitch Flegg will provide a live presentation relating to the

interim results via the Investor Meet Company platform today at

1.30pm BST.

The presentation is open to all existing and potential

shareholders.

Investors can sign up to Investor Meet Company for free and add

to meet Serica Energy plc via:

https://www.investormeetcompany.com/serica-energy-plc/register-investor

Investors who already follow Serica on the Investor Meet Company

platform will automatically be invited.

A copy of the accompanying presentation can be found on our

website: www.serica-energy.com .

Regulatory

This announcement is inside information for the purposes of

Article 7 of Regulation 596/2014.

The technical information contained in the announcement has been

reviewed and approved by Fergus Jenkins, VP Technical at Serica

Energy plc. Mr. Jenkins (MEng in Petroleum Engineering from

Heriot-Watt University, Edinburgh) is a Chartered Engineer with

over 25 years of experience in oil & gas exploration,

development and production and is a member of the Institute of

Materials, Minerals and Mining (IOM3) and the Society of Petroleum

Engineers (SPE).

Enquiries:

+44 (0)20 7390

Serica Energy plc 0230

Mitch Flegg (CEO) / Andy Bell (CFO)

+44 (0)20 7418

Peel Hunt (Nomad & Joint Broker) 8900

Richard Crichton / David McKeown

+44 (0)20 7029

Jefferies (Joint Broker) 8000

Tony White / Will Soutar

+44 (0)20 7390

VIGO Consulting 0230

Patrick d'Ancona / Finlay Thomson serica@vigoconsulting.com

NOTES TO EDITORS

Serica Energy is a British independent oil and gas exploration

and production company with a portfolio of UKCS assets.

Serica completed the acquisition of the entire issued share

capital of Tailwind Energy Investments Ltd on 23 March 2023.

Following the addition of the Tailwind assets to its portfolio,

Serica has a balance of gas and oil production. The Company is

responsible for about 5% of the natural gas produced in the UK, a

key element in the UK's energy transition.

Serica's producing assets are focused around two main hubs: the

Bruce, Keith and Rhum fields in the UK Northern North Sea, which it

operates, and a mix of operated and non-operated fields tied back

to the Triton FPSO. Serica also has operated interests in the

producing Columbus (UK Central North Sea) and Orlando (UK Northern

North Sea) fields and a non-operated interest in the producing

Erskine field in the UK Central North Sea.

Serica's portfolio of assets includes several organic investment

opportunities which are currently being pursued or are under

consideration.

Futher information on the Company can be found at

www.serica-energy.com . The Company's shares are traded on the AIM

market of the London Stock Exchange under the ticker SQZ and the

Company is a designated foreign issuer on the TSX. To receive

Company news releases via email, please subscribe via the Company

website.

INTERIM REPORT FOR THE SIX MONTH PERIODED 30 JUNE 2023

The following Interim Report of the operations and financial

results of Serica Energy plc ("Serica") and its subsidiaries

(together the "Group") contains information up to and including 18

September 2023 and should be read in conjunction with the unaudited

interim consolidated financial statements for the period ended 30

June 2023, which have been prepared by and are the responsibility

of the Company's management.

References to the "Company" include Serica and its subsidiaries

where relevant.

The results of Serica's operations detailed in the interim

financial statements are presented in accordance with International

Financial Reporting Standards ("IFRS").

The Company's shares are listed on AIM in London. Although the

Company delisted from the TSX in March 2015, the Company is a

"designated foreign issuer" as that term is defined under National

Instrument 71-102 - Continuous Disclosure and Other Exemptions

Relating to Foreign Issuers. The Company is subject to the

regulatory requirements of the AIM market of the London Stock

Exchange in the United Kingdom.

Serica is an oil and gas company with production, development

and exploration activities based in the UK.

CHIEF EXECUTIVE OFFICER'S REVIEW

The acquisition of Tailwind Energy Investments Ltd, which

completed in the first half of 2023 has provided operational

diversity and scale for Serica. This transaction is outlined in the

section following this review.

Serica's production levels in the first half of 2023 continue to

benefit from the ongoing capital investment campaign which has been

in progress for the last few years. We can also see the benefit of

the investment in the Tailwind portfolio over a similar period. As

a result of these investment projects, the net production from the

combined portfolio in the first half of 2023 was 49,350 boe/d, an

increase of 30% compared to the 38,100 boe/d from the same

portfolio in 1H 2022 and an increase of 85% compared to the Serica

net production of 26,600 boe/d in 1H 2022.

In the first half of 2023, 55% of the production from the

combined portfolio was gas compared to 91% of the Serica portfolio

on the first half of 2022.

Market gas prices, though still volatile, have averaged around

108p/therm in the first half of 2023 compared to over 175p per

therm in the first half of 2022. Market oil prices have averaged

around US$79/bbl in the first half of 2023 compared to around

US$107/bbl in the first half of 2022. These are before the impact

of Serica's commodity price hedging programmes.

With lower commodity prices but markedly higher production

levels, Serica's sales revenue for the six-month period to June

2023 was GBP340.6 million, broadly similar to the figure of

GBP353.5 million for the corresponding period in 2022. The profit

after taxation for the period was GBP175.5 million (1H 2022:

GBP116.7 million) but this is significantly influenced by a one-off

non-cash accounting entry related to the Tailwind acquisition.

These numbers incorporate contributions from the acquired Tailwind

assets from the completion date of 23 March 2023 rather than the

full six-month period.

The UK Energy Profits Levy (EPL) has a significant impact on

post-tax profitability for all UK oil and gas producers. However,

the substantial tax losses acquired with the Tailwind transaction

have had the effect of lowering Serica's effective rate of

taxation. The EPL is a wholly unwelcome burden that is already

leading to the delay and cancellation of longer-term investment

projects across the sector. However, allowances relating to

reinvestment in short-cycle projects offer Serica the opportunity

to mitigate its impact. Therefore, we will maintain our ongoing

short-cycle investment plans and where possible will expand and

accelerate elements of that programme.

The Company is therefore continuing with its growth strategy of

investment in projects designed to enhance and extend future

production profiles. Following the success of last year's Light

Well Intervention Vessel ("LWIV") programme on Bruce, a second

campaign has now commenced, and a third campaign is scheduled for

the first half of 2024. A significant four-well drilling campaign

in the Triton Area is expected to commence early in 2024. This will

comprise of wells on Bittern, Gannet E, Guillemot NW and

Evelyn.

The common theme amongst these capital projects is that they are

all designed to quickly add production from existing fields without

the requirement for substantial new infrastructure. These

short-cycle investments benefit from Investment Allowances under

the EPL and have the capability to add significant reserves and

production. Serica has a strong record of replacing reserves

through our ongoing investment commitment. At the end of 2022 the

Serica net 2P reserves stood at 74.9 mmboe which is a 9% increase

on the level at the time of the BKR acquisition more than four

years previously despite the production of over 30 mmboe in the

intervening period. The combined net 2P reserves for the Serica and

Tailwind portfolios at the end of 2022 were 130.4 mmboe.

We continue to focus on emissions reduction whilst maximising

production. In the first half of the year carbon intensity

(emissions divided by production) from the Bruce hub was 15.1kg

CO(2) /boe, a 9% reduction on the same period last year. On Triton,

the 1H 2023 carbon intensity was 17.7kg CO(2) /boe, a 33% reduction

on 1H 2022. As new production from Serica's forthcoming drilling

campaign will be tied back to existing offtake facilities, such

additions add reserves without adding significant carbon

emissions.

The Serica portfolio remains cash generative following the

Tailwind transaction. At the start of the year cash and deposits

totalled GBP433 million and during the first half of the year this

has risen to GBP444 million despite final 2022 tax payments of

GBP141 million, GBP62 million of cash consideration paid for the

Tailwind transaction and GBP48 million of debt repayment. The

mid-year debt level stood at GBP210 million leaving a net cash

balance of GBP234 million.

Against this background the Company is steadily increasing its

return to shareholders. Following combined dividend payments of 22

pence per share for full year 2022, the Company is today announcing

an interim dividend of 9 pence per share (2022: 8 pence per share)

which will be paid in November 2023.

Mitch Flegg

Chief Executive Officer

18 September 2023

ACQUISITION OF TAILWIND ENERGY INVESTMENTS LTD

On 23 March 2023 Serica Energy completed the acquisition of

Tailwind Energy Investments Ltd, a privately owned independent oil

and gas company with assets in the UK North Sea. As part of the

transaction, Mercuria - an investor in Tailwind - became a

strategic investor in Serica.

Tailwind was formed in 2016. Through a combination of

acquisitions, production enhancements and development of new

fields, executed by a small and expert team of oil and gas

professionals, it built a portfolio of upstream assets situated in

the UK North Sea. At the end of 2022 this portfolio had 2P reserves

of 55.5 million boe, with a rising production profile that reached

an average 23,300 boe/d in December 2022.

The assets acquired by Serica with the Tailwind transaction

comprise primarily a mix of operated and non-operated producing

fields tied-back to the Triton FPSO in the UK Central North Sea.

Tailwind's interests in producing fields also include 100% in the

Orlando field located in the UK Northern North Sea and a

non-operated 25% in the Columbus field in the UK Central North Sea

(operated by Serica).

The acquisition of Tailwind was aimed at achieving Serica's

longstanding objective to have a more diverse and broadly based

UKCS portfolio of producing fields, with material reserves and

value upside potential, coupled with a more balanced exposure to

commodity price risk. The transaction represents substantial

progress towards this objective with the number of producing fields

increased from five to eleven, mainly centred around two hubs

(Bruce and Triton), a substantial increase in 2P reserves (combined

130.4 million boe as at 31 December 2022) and a balance of gas and

oil production.

The acquisition has also added considerably to the organic

investment opportunities in Serica's portfolio. Rig slots have been

reserved in order to drill infill wells on the Bittern, Gannet E,

Guillemot North West and Evelyn fields in 2024; all of which are

existing tie-backs to the Triton FPSO. The potential developments

of the Belinda field as a tie-back to the Triton FPSO and the

Mansell field, situated in the UK Northern North Sea, are being

evaluated. All these activities will continue under the ownership

of Serica, whose team has been supplemented by the addition of

Tailwind staff.

These substantial enhancements to Serica's portfolio of upstream

assets have been achieved while maintaining the Company's financial

strength. Moreover, Serica retains a relatively low level of

decommissioning liabilities largely as a result of foundational

transactions by both Serica and Tailwind in the past involving the

sellers retaining such obligations. Serica's strong balance sheet,

allied with expected net cash inflows from the enlarged portfolio,

provides a basis for continued dividends to shareholders,

investment in the existing portfolio and further acquisitions. Very

few UKCS-focused independent oil and gas companies share this same

combination of attributes.

As described in the Annual Report and ESG Report, making a

positive contribution to the North Sea Transition Deal is a key

objective. Serica is using its operating experience to support the

infrastructure operators of the Tailwind assets to reduce

emissions. The longer-term outlook depends in part on investments

to reduce emissions from the Bruce and Triton hubs. As operator of

the Bruce hub and co-owner of the Triton FPSO, Serica is engaged in

the development and implementation of GHG Emissions Reduction

Action Plans for both facilities.

REVIEW OF OPERATIONS

UK Operations

Northern North Sea

Northern North Sea: Bruce Field - Blocks 9/8a, 9/9b and 9/9c,

Serica 98% and operator

Serica operates the Bruce field and facilities consisting of

three bridge-linked platforms, wells, pipelines and subsea

infrastructure. The platforms contain living quarters, reception,

compression, power generation, processing and export facilities and

a drilling derrick that is currently mothballed. There is also the

subsea Western Area Development (WAD) that produces from the edges

of the Bruce area.

Bruce production is predominantly gas which is rich in liquids.

Gas is exported through the Frigg pipeline to the St Fergus

terminal, where it is separated into sales gas and NGL's. Oil is

exported through the Forties Pipeline System to Grangemouth.

In the first half of the year we completed the replacement and

upgrade of the control system for the Bruce platform, increasing

the amount of data that can be captured and processed, helping us

to unlock the ability to implement AI based improvements to our

control, monitoring and maintenance activities.

We also successfully carried out the replacement of the subsea

control modules on the WAD manifold to support the Light Well

Intervention (LWI) activity in Q3 23 and Q1 24.

On the platform topsides a series of surveillance and

intervention activities were undertaken on a number of the Bruce

wells, verifying well integrity, identifying future production

options and implementing a couple of simple interventions to boost

production.

Major works were undertaken during the summer outage to replace

the main platform flare tip, 140 metres above the sea surface

requiring a heli-lift, along with major overhauls of the glycol

system and a booster compressor. The extensive maintenance

campaigns were all integrity and reliability focussed helping to

underpin the plans to extend Bruce production to 2035+.

The 2023 LWI work, which covers three wells and is expected to

boost production volumes, commenced in September and is ongoing.

Work on the Bruce M3 and M6 wells includes scale removal, a

reperforation and new perforation, whist work on Bruce M4 is based

on information obtained during the original work in 2022.

Bruce field production in 1H 2023 averaged circa 7,200 boe/d (1H

2022: 6,800 boe/d) of oil and gas net to Serica.

The latest independent reserves report by RISC Advisory

estimated 2P reserves of 31.8 million boe net to Serica as of 1

January 2023 (2022: 15.8 million boe). This increase reflects the

benefits from future planned well interventions and from field life

extension beyond 2030.

Northern North Sea: Keith Field - Block 9/8a, Serica 100%

Keith is an oil field produced by one subsea well tied back to

the Bruce facilities and requires very little maintenance. In

normal operation Keith produces at a relatively low rate but

provides a low-cost contribution to the oil export from Bruce. The

well has been shut-in since 2022 due to a fault in the electrical

supply.

During 2023 the Keith subsea control module was changed out to

allow the planned LWI in Q1 2024 to restore production from the

field.

The latest independent reserves report by RISC Advisory

estimated 2P reserves of 2.4 million boe net to Serica as of 1

January 2023 (2022: 0.9 million boe). These reserves are recognised

based upon the planned 2023 and 2024 programmes.

Northern North Sea: Rhum Field - Blocks 3/29a, Serica 50% and

operator

The Rhum field is a gas condensate field producing from three

subsea wells tied into the Bruce facilities through a 44km

pipeline. Rhum production is separated into gas and oil and

exported to St Fergus and Grangemouth along with Bruce and Keith

production. Rhum gas has a higher CO(2) content than Bruce gas and

so is blended with Bruce gas before leaving the offshore

facilities.

A new power umbilical was installed on the R1 well in March 2023

and further works to remove power supply vulnerabilities to Rhum

were carried out in the summer. Topsides works in the first half of

the year increased the throughput limits of the Rhum separator

creating more capacity for any future production increases.

Average Rhum field production in 1H 2023 was circa 16,300 boe/d

(1H 2022: 15,900 boe/d) of gas net to Serica.

The latest independent reserves report by RISC Advisory

estimated 2P reserves of 36.4 million boe net to Serica as of 1

January 2023 (2022: 37.2 million boe). This represents an increase

in reserves after 2022 production is taken into account which

arises from the extension of field life into the 2030s.

Northern North Sea: Orlando Field - Block 3/3b, Serica 100%

(acquired from Tailwind)

Serica is operator of Orlando which is an oil field producing

from a single subsea well tied into the Ninian Central facilities

through an 11km pipeline. Orlando production is separated into gas

and oil, with oil exported to Sullom Voe Terminal and gas used by

the Ninian operator as fuel on the platform.

Orlando has been producing steadily in 2023, following a

workover in 2022 to replace the dual Electric Submersible Pumps.

During 1H 2023, there have been some minor outages for repairs to

some topsides electrical cables.

Average Orlando field production in 1H 2023 was circa 3,500

boe/d (1H 2022: nil boe/d) net to Serica including downtime.

Average net production for the post-acquisition period from 23

March to 30 June 2023 was 3,550 boe/d.

An independent reserves report by ERCE estimated 2P reserves of

3.4 million boe net to Serica as of 1 January 2023.

Northern North Sea: Mansell - Block 3/8g, Serica 100% (acquired

from Tailwind)

The Mansell discovery is located in licence P2448 in UKCS Block

3/8g south and east of the Ninian and Columba fields. Mansell was

discovered by well 3/8b-10, drilled by BP in 1985, and following

successful appraisal was developed as a subsea tieback to the

Ninian South Platform and produced between 1992 and 1995 (Field was

then named as Staffa). The field was shut in 1995 following

waxing-up of the flowline and decommissioned. The Mansell field has

contingent resources of up to 16 mmboe. Studies are ongoing to

determine the feasibility and timing of a redevelopment.

Central North Sea

Central North Sea: Triton Area - Bittern 64.63%, Evelyn 100%,

Gannet E 100%, Guillemot West & North West 10%, Belinda 100%

(Serica share in %, acquired from Tailwind)

The Triton Area consists of eight producing oil fields developed

via common subsea infrastructure in the UK Central North Sea,

located approximately 190km east of Aberdeen in water depths of

90m. The fields currently producing oil and gas via the Triton

Floating Production Storage & Offloading (FPSO) vessel are

Evelyn, Bittern, Guillemot West and Guillemot North West, Gannet E,

Clapham, Pict and Saxon. Dana Petroleum Limited ("Dana") and

Waldorf Production UK Limited ("Waldorf") are our partners in the

Triton cluster. Dana operate the Triton FPSO along with the

Bittern, Guillemot West / North West, Clapham, Saxon, and Pict

fields. Serica is operator of the Gannet E and Evelyn fields, with

Dana as pipeline operator and Petrofac as well operator. Serica

also operates the Belinda discovery.

In February, a fourth Gannet E well was brought online bringing

combined peak production rates in Gannet E to over 13,000 boe/d.

The Evelyn field has been producing steadily since coming online in

September 2022 at circa. 6,000 boe/d. Bittern field is steady with

peak rates of circa. 7,000 boe/d (Serica net) and Guillemot West /

North West at circa. 400 boe/d (Serica net). Triton gross peak

rates have exceeded 30,000 boe/d for the first time in 10

years.

Two Guillemot West well workovers were completed in July and are

due to be brought online in September after the Triton annual

shutdown which recently completed. There is a four well program

planned for execution in 2024 as follows: Bittern sidetrack,

Guillemot North West infill well, Gannet E fifth well and Evelyn

second well. Serica is progressing the Belinda development with

plan to submit the FDP in 2H 2023 and sanction planned for

2024.

Average net (Serica share) Triton Area production in 1H 2023 was

circa 18,300 boe/d (1H 2022: 10,000 boe/d) of oil and gas. Average

net production for the post-acquisition period from 23 March to 30

June 2023 was 18,550 boe/d.

An independent report of reserves by ERCE estimated 2P reserves

of 49.2 million boe net to Serica as of 1 January 2023.

Central North Sea: Columbus Field - Blocks 23/16f and 23/21a

(part), Serica 75%

Serica Energy (UK) Limited (50%) is Operator with partners

Tailwind Mistral Limited (25%) and Waldorf Production Limited

(25%). Following the acquisition of Tailwind Mistral Limited by the

Serica group on 23 March 2023, the Serica group's net interest in

Columbus increased to 75%.

The Columbus field is located in the UK Central North Sea and

produces from a gas-condensate reservoir in the Forties Sandstone

Formation. The development consists of a single horizontal well

which runs along the central axis of the reservoir, drilled in the

spring of 2021, and production commenced in November 2021.

The Columbus well is connected to the Arran export pipeline

through which Columbus production is exported along with Arran

Field production. When production reaches the Shearwater platform,

it is separated into gas and condensate. The gas is exported to St

Fergus via the SEGAL line and the condensate to Cruden Bay via the

Forties Pipeline System.

Columbus had good initial test rates and started production in

November 2021. Flow rates then declined during the first few months

of production and average Columbus production in 2022 was around

3,800 boe/d gross.

During the first half of 2023, Columbus production has been

steady despite some short-term Shearwater offtake facility

outages.

Average net Columbus production of gas and condensate in 1H 2023

for Serica's combined 75% interest was 2,300 boe/d (1H 2022: 1,970

boe/d for a 50% interest). Average net production for the Group's

combined 75% interest in the post-acquisition period from 23 March

to 30 June 2023 was 2,250 boe/d.

The latest independent report of reserves, compiled by RISC

Advisory, estimated 2P reserves of 1.1 million boe net to Serica's

50% equity interest as at 1 January 2023 (2022: 4.9 million boe)

after allowing for production of 0.6 million boe during 2022. An

additional 25% field equity interest was acquired as part of the

Tailwind transaction in March 2023.

Central North Sea: Erskine Field - Blocks 23/26a (Area B) and

23/26b (Area B), Serica 18%

Serica holds a non-operated interest in Erskine, a gas and

condensate field located in the UK Central North Sea. Serica's

co-venturers are Ithaca Energy 50% (operator) and Harbour Energy

32%.

The Erskine field has five production wells and produces oil and

gas over the Erskine normally unattended installation, which is

transported via a multiphase pipeline and processed on the Lomond

platform which is 100% owned and operated by Harbour . Then

condensate is exported down the Forties Pipeline System via the

CATS riser platform at Everest and gas is exported via the CATS

pipeline to the CATS terminal at Teesside.

In first half of 2023 Erskine has produced steadily from the

four currently available wells.

Topsides surveillance of the W1 well is being undertaken in Q3

2023 with the intent of carrying out a MODU based intervention in

2024 to return the well to production. The regular pigging program

on the condensate export line has continued and no indications of

wax build-up have been seen.

Erskine production levels in 1H 2023 averaged 1,700 boe/d net

(1H 2022: 1,890 boe/d net).

A latest independent report of reserves by RISC Advisory

estimated 2P reserves at 3.3 million boe as of 1 January 2023

(2022: 3.4 million boe).

UK Exploration

North Eigg and South Eigg - Blocks 3/24c and 3/29c, Serica

Energy (UK) Limited 100% and Operator

In December 2019, Serica was awarded the P2501 Licence as part

of an out of round application; this comprised Blocks 3/24c and

3/29c including the North Eigg and South Eigg prospects.

The 3/24c-6B North Eigg exploration well was drilled to a depth

of 16,728 feet in the Jurassic Heather formation, completing in

early 2023. Following detailed interpretation of the North Eigg

well results, Serica has decided that there is insufficient

accessible oil to justify re-entering the suspended well and

drilling a sidetrack. After consultation with the NSTA, we have

elected to go into the second term of the P2501 Licence for the

purpose of completing the decommissioning and restoration of the

North Eigg well. Only the area immediately around the well

necessary for the abandonment has been retained with the remainder

of the block being relinquished.

Skerryvore and Ruvaal- Blocks 30/12c (part), 30/13c (split),

30/17h, 30/18c and 30/19c (part), Serica Energy (UK) Limited: 20%

working interest, operator Parkmead

The P2400 Licence was awarded in the 30(th) licence round in

2018. It is located in the Central North Sea, 60km south of the

Erskine field, and comprises blocks 30/12c, 30/13c, 30/17h and

30/18c. Current equity holders are Serica 20%, Parkmead 50%

(operator) and CalEnergy 30%. The licence is in phase C, which

expires on 30 September 2025. By the end of the current phase, we

are committed to drill a well to a depth of 3,500 metres or 200

metres into the Chalk Group, whichever is shallower. The Operator

has proposed a vertical well targeting the Mey reservoir (primary

target) and a deeper Tor chalk reservoir (secondary target). Well

planning has been awarded to Exceed. The well is expected to spud

in late 2024, with a site survey in early 2024.

In the region around Skerryvore, Harbour Energy have announced

that they are proceeding with the Talbot development, with drilling

scheduled later this year and first oil expected from Q3 2024. In a

success case, Talbot infrastructure could provide Skerryvore with

an export route via the Judy platform and the subsequent export of

produced hydrocarbons to Teeside, UK.

Licence Awards in the UK 32(nd) licensing round

The P2506 Licence was awarded to Serica 100% in the 32(nd)

Licence Round in 2020 and covers blocks in the greater Bruce / Rhum

area. Work commitments for the current phase of the licence have

now been met. A detailed prospectivity review was carried out,

which identified two prospects, the Elf Horst prospect (in the

north) and Davan discovery (in the south).

On the basis of this technical work, it has been concluded that

this opportunity does not meet Serica's investment criteria and the

decision has therefore been made not to continue the licence beyond

the end of the current phase, which ends on 30 November 2023.

Licence Awards in the UK 33(rd) licensing round

Two licences have been applied for in the 33rd Licence Round

which closed in December 2022. The applications include light

initial work commitments. Both applications are consistent with

Serica's infrastructure led exploration strategy.

F INANCIAL REVIEW

In addition to continuing strong production from its existing

assets, Serica's 1H 2023 results benefitted from inclusion of net

production and income from the Tailwind field interests from the

acquisition completion date of 23 March 2023 to the period end 30

June 2023. Net cashflows from the Tailwind assets for the period

prior to 23 March are reflected in the opening net debt position of

Tailwind. Fair value acquisition accounting, carried out under

relevant financial reporting standards as a business combination,

resulted in a one off 'gain on acquisition' of GBP139.6 million.

This was partially offset by expensed transaction costs totalling

GBP8.6 million. The group balance sheet at 30 June 2023 reflects

the full set of assets and liabilities arising from the business

combination, which include a reserve-based lending ("RBL")

facility. Further details of the accounting for the acquisition are

provided in note 11.

Although market sales prices for oil and gas were lower than for

the same period last year, this was partially offset by reduced

hedging volumes. The Tailwind acquisition has also brought a

balanced mix of oil and gas and greater production resilience

arising from a wider asset spread.

1H 2023 RESULTS

Serica generated a profit before taxation of GBP298.3 million

for 1H 2023 compared to GBP194.5 million for 1H 2022. After current

and deferred tax provisions of GBP122.8 million (1H 2022: GBP77.7

million), profit for the period was GBP175.5 million compared to

GBP116.7 million for 1H 2022 and GBP177.8 million for full year

2022.

Sales revenue

The total 1H 2023 sales revenue of GBP340.6 million (1H 2022:

GBP353.5 million) included revenues of GBP100.0 million from the

acquired Tailwind assets from the effective date of 23 March 2023

(1H 2022: GBPnil).

Total sales revenues comprised gas revenue of GBP216.6 million

(1H 2022: GBP293.6 million), oil revenue of GBP112.7 million (1H

2022: GBP41.2 million) and NGL revenue of GBP11.3 million (1H 2022:

GBP18.7 million). The fall in gas revenue was driven by lower

realised pricing compared to 1H 2022 and the increase in oil

revenue reflects new revenue streams from the largely oil based

Tailwind portfolio.

Total product sales volumes for the half year comprised

approximately 227 million therms of gas (1H 2022: 216 million

therms), 2.2 million lifted barrels of oil (1H 2022: 0.5 million

barrels) and 30,000 metric tonnes of NGLs (1H 2022: 36,800 metric

tonnes).

Average 1H 2023 sales prices net of system fees were: 96 pence

per therm (1H 2022: 136 pence per therm) for gas, US$64 per barrel

(1H 2022: US$107.7 per barrel) for oil and GBP377 per metric tonne

(1H 2022: GBP514 per metric tonne) for NGLs. Average oil and gas

sales prices reflect the mix of sales comprising volumes sold at

current spot prices and volumes sold at contracted fixed prices and

are before realised hedging costs on gas price swaps.

Gross profit

The gross profit for 1H 2023 was GBP180.1 million compared to

GBP267.1 million for 1H 2022. Overall cost of sales of GBP160.5

million compared to GBP86.3 million for 1H 2022. This comprised

GBP99.6 million of operating costs (1H 2022: GBP59.1 million) and

GBP74.7 million of non-cash depletion charges (1H 2022: GBP25.5

million).

The overall increases reflected higher production volumes for

the enlarged business. Operating costs per boe were US$17.5,

increased from US$16.1 for 1H 2022 mainly due to underlying cost

inflation and the introduction of new fields. In addition, an

increase in the overall rate of depletion charges per barrel arose

from the recognition of the Tailwind assets at fair value and an

increase in the Columbus field depletion charge per barrel from 1H

2022 due to a reduction in remaining reserves. These were partially

offset by a GBP13.8 million credit representing an increase during

the period of the liquids underlift position (1H 2022: charge of

GBP1.7 million).

Operating profit

The operating profit for 1H 2023 was GBP159.5 million compared

to GBP196.3 million for 1H 2022. This included hedging expense

related to 1H gas price swaps, of GBP13.0 million realised during

1H 2023 (1H 2022: GBP13.2 million) plus unrealised hedging gains of

GBP20.5 million (1H 2022: expense of GBP56.4 million), mainly

arising from the movement in valuation of Serica's 2022 year-end

gas swap position as it fully unwound in the period.

E&E asset write-offs of GBP5.7 million in 1H 2023 (1H 2022:

GBPnil) largely comprised a final charge from the North Eigg

exploration well. Administrative expenses for 1H 2023 of GBP7.9

million compared to GBP3.8 million for 1H 2022 and reflected the

growth in activities of the group arising from Tailwind completion

and subsequently.

Transaction costs of GBP8.6 million (1H 2022: GBPnil) comprise

fees and other costs associated with the acquisition of Tailwind

Energy Investments Ltd.

Profit before taxation and profit after taxation

Profit before taxation for 1H 2023 was GBP298.3 million (1H

2022: GBP194.5 million) after taking into account a gain on

acquisition of GBP139.6 million on the Tailwind transaction (1H

2022: GBPnil), a GBP1.5 million charge arising from an increase in

the fair value of the BKR financial liability (1H 2022: GBP1.9

million), GBP7.0 million of finance revenue (1H 2023: GBP0.3

million) and GBP6.3 million of finance costs (1H 2022: GBP0.3

million).

The gain on acquisition represents the difference between

provisional fair valuations of assets acquired and consideration

paid or potentially payable calculated in accordance with

applicable accounting standards. Such calculations are complex and

involve a range of projections and assumptions related to future

costs, production volumes, sales prices, discount rates and tax.

The accounting for the acquisition of the transaction assets has

been provisionally determined at this stage. The accounting

standards provide for potential further adjustments to fair value

assessments up to twelve months after completion of the

acquisition.

The 1H 2023 charge of GBP1.5 million relating to the remaining

BKR financial liabilities (1H 2022 - GBP1.9 million) arose from the

unwinding of discount on the estimated amounts of those remaining

liabilities. The fair value of the liabilities, which are described

under BKR asset acquisitions below, is re-assessed at each

financial period end.

Finance revenue of GBP7.0 million (1H 2022: GBP0.3 million)

primarily represents interest income earned on cash deposits and

has increased following the significant rises in interest rate

returns available from 1H 2023 compared to 1H 2022. Finance costs

of GBP6.3 million (1H 2022: GBP0.3 million) include interest

payable and other charges on the debt facility acquired in March

2023, the discount unwind on decommissioning provisions and other

minor finance costs.

The 1H 2023 taxation charge of GBP122.8 million (1H 2022:

GBP77.7 million) comprised current tax charges of GBP131.8 million

(1H 2022: GBP79.8 million) and a deferred tax credit of GBP9.0

million (1H 2022: credit of GBP2.1 million). The current tax charge

includes EPL charges of GBP61.1 million (1H 2022: GBPnil). The

impact upon the combined group of the increased level of taxation

applying to 1H 2023 on its current tax payable has been partially

offset through the utilisation of brought forward tax losses within

the acquired business. The gain on acquisition is a non-taxable

accounting entry.

Overall, this generated a profit after taxation of GBP175.5

million for 1H 2023 compared to a profit after taxation of GBP116.7

million for 1H 2022. This resulted in an earnings per share of

GBP0.53 (1H 2022: GBP0.43) after taking account of the weighted

average number of ordinary shares in issue.

GROUP BALANCE SHEET

Serica retains a strong balance sheet with growing cash

resources. This has allowed the Company to fund ongoing capital

investment programmes whilst delivering a progressive dividend

policy as well as seeking new acquisition and investment

opportunities. The balance sheet as at 30 June 2023 includes assets

and liabilities from the acquired Tailwind business.

Total property, plant and equipment increased from GBP265.9

million at year end 2022 to GBP888.9 million at 30 June 2023. The

main driver for the significant increase in the balance is the fair

value attributed to the Tailwind assets upon acquisition of

GBP704.0 million. The acquisition of Tailwind Energy Investments

Ltd is classified as a business combination and the calculation of

fair value is carried out in accordance with applicable accounting

standards. As described above, the valuation involves a series of

judgements and assumptions on all key components of the

calculations and are provisional until twelve months following

acquisition.

Net additions comprised capital expenditure during 1H 2023 of

GBP13.4 million across various field assets. These included

expenditure in the post-acquisition period on the GE04 and GE05

wells (Gannet E), well survey and planning work on Bittern, the

start-up of well work on the EV02 well (Evelyn), upgrades for the

Triton FPSO and other sundry asset work. These were offset by

depletion charges for 1H 2023 of GBP74.7 million (1H 2022: GBP25.5

million), other depreciation charges of GBP0.1 million (1H 2022:

GBP0.1 million) and currency translation adjustments of GBP20.1

million. Depletion charges represent the allocation of field

capital costs over the estimated producing life of each field and

comprise costs of asset acquisitions and subsequent investment

programmes.

The inventories balance of GBP9.4 million at 30 June 2023

increased from GBP4.0 million at the end of 2022. The main factor

behind the increase is the inclusion of GBP5.3 million value for

oil inventory held in the pipeline and terminal for the acquired

Orlando field. A decrease in trade and other receivables from

GBP134.6 million at the end of 2022 to GBP122.1 million at 30 June

2023 largely reflected significantly lower prices for June gas

sales compared to last December.

Hedging security advances of GBP24.3 million at 31 December 2022

were recovered during 1H 2023 as all gas swaps and the majority of

fixed forward contracts crystalised in the period.

The increase in cash balances from GBP432.5 million at 31

December 2022 to GBP444.0 million at 30 June 2023 reflected cash

flow from operations of GBP265.8 million mainly offset by GBP140.8

million of 2022 UK tax payments, capital expenditures of GBP19.0

million, net cash outflows of GBP45.3 million on the Tailwind

acquisition, and GBP47.9 million (US$60 million) on debt repayments

in the post-acquisition period.

Current trade and other payables increased to GBP80.7 million at

30 June 2023 from GBP69.9 million at the end of 2022. UK

corporation tax payable of GBP140.9 million at 30 June 2023 (31

December 2022: GBP150.0 million) reflects liabilities for

corporation tax, supplementary charge and the EPL. A significant

corporation tax payment of GBP140.8 million was made in Q1 2023 and

a further GBP80.2 million instalment payment was made in July

2023.

Derivative financial liabilities of GBP4.7 million at 30 June

2023 represent primarily the valuation of UKA ETS swaps in place at

the period end following the Tailwind acquisition. The 31 December

2022 liability of GBP24.9 million reflected Serica's gas swaps in

place at that date which unwound during 1H 2023.

The dividend payable of GBP53.7 million at 30 June 2023 (31

December 2022: GBPnil) represents the final cash dividend for 2022

of 14.0 pence per share approved at the annual general meeting on

29 June 2023 and paid in July.

Non-current financial liabilities of GBP62.3 million (31

December 2022: GBP29.4 million) comprise remaining deferred

consideration of GBP30.8 million projected to be paid under the BKR

acquisition agreements and royalty provisions of GBP31.5 million

representing amounts payable to third parties under the terms of

historic Triton asset acquisitions by Tailwind.

Non-current provisions relate to future decommissioning

obligations. These showed an increase from GBP25.2 million at 31

December 2022 to GBP99.6 million at 30 June 2023 due to GBP75.5

million arising upon the Tailwind acquisition plus the unwinding of

the discount applied to the Group's year end 2022 estimates,

partially offset by currency translation adjustments and some minor

spend in the period. The balance of provisions is in respect of

Serica's Bruce and Keith interests acquired from Marubeni, the

Columbus field and the portfolio of interests acquired in

March.

The net deferred tax liability position of GBP52.0 million at 30

June 2023 decreased from GBP153.3 million at year end 2022, mainly

following the introduction of the significant net deferred tax

asset position of GBP95.0 million upon the Tailwind acquisition.

This comprised deferred tax assets recognised on tax losses and

future relief available on decommissioning partially offset by

deferred tax liabilities arising on property, plant and equipment

balances. Deferred tax liabilities arising upon the group's

PP&E balances will be released in future periods as those

balances are depleted.

Interest bearing loans of GBP210.1 million at 30 June 2023 (31

December 2022: GBPnil) comprise the RBL facility assumed upon the

Tailwind acquisition completion on 23 March 2023. Amounts drawn

under the facility at 30 June 2023 were US$270 million which are

disclosed net of unamortised fees. The facility was drawn by US$330

million at the date of acquisition with repayments of US$60 million

made in the post-acquisition period to 30 June 2023. The

redetermined total amount available for drawdown under the facility

at 30 June 2023 was US$377 million.

Overall, net assets have increased from GBP408.7 million at year

end 2022 to GBP754.8 million at 30 June 2023.

The increase in share capital from GBP183.2 million to GBP192.4

million arose from shares issued following the exercise of share

options, shares issued under employee share schemes and the nominal

value of shares issued for the Tailwind acquisition, whilst the

increase in other reserves from GBP25.6 million to GBP28.0 million

arose from share-based payments related to share option awards. The

merger reserve of GBP225.4 million in the consolidated group

accounts arose in connection with the shares issued for the

Tailwind acquisition.

CASH BALANCES AND FUTURE COMMITMENTS

Current net cash position and price hedging

At 30 June 2023 the Group held net cash of GBP230.8 million

which consisted of cash and cash equivalents of GBP444.0 million

(31 December 2022: GBP432.5 million) net of the RBL drawings of

GBP213.2 million (31 December 2022: GBPnil) adjusted for

unamortised fees of GBP3.1 million (31 December 2022: GBPnil).

Cash hedging security advances of GBP24.3 million that had been

lodged with hedge counterparties at 31 December 2022 as security

against settlement of future gas hedge instruments were fully

recovered during the 1H 2023 period. Of total cash and cash

equivalents, GBP18.1 million was held in restricted accounts

against letters of credit issued in respect of certain

decommissioning liabilities as at 30 June 2023 (31 December 2022:

GBP18.1 million).

As at 31 August 2023, the Company held cash and cash equivalents

of GBP333.2 million, after settlement of the 2022 final dividend

and an initial 2023 tax instalment in July 2023.

Hedging

Serica carries out hedging activity to manage commodity price

risk and to ensure there is sufficient funding for future

investments. At 30 June 2023 Serica held the following

instruments:

Gas - fixed pricing under gas sales agreements (equivalent to

gas price swaps) for the Q3 2023 period of 50,000 therms per day at

an average price of 41 pence per therm.

Oil - fixed pricing under oil sales agreements (equivalent to

oil price swaps): for the 2H 2023 period approximately 11,000

barrels per day at an average price of US$61 per barrel, for the 1H

2024 period approximately 5,000 barrels per day at an average price

of US$70 per barrel, and for the 2H 2024 period approximately 2,700

barrels per day at an average price of US$80 per barrel.

UKA ETS - fixed price swaps for UKA ETS products for 2023

consisting of 66,000 MT at GBP77.12/MT for 2023 and 231,000 MT at

GBP79.39/MT for 2024.

Field and other capital commitments

Serica's planned 2023/24 investment programme includes two Light

Well Intervention Vessel campaigns (Q3 2023 & 1H 2024) on the

Bruce and Keith fields and a four-well drilling campaign in the

Triton Area (Bittern B1z, Gannet GE-05, Evelyn Phase 2 (EV02) and a

Guillemot NW infill well). Potential further programmes to enhance

current production profiles and extend field life are under

consideration.

At 30 June 2023, the Group had commitments for future capital

expenditure relating to its oil and gas properties amounting to

GBP134.5 million which relate primarily to the GE05 well, EV02

well, Bruce LWIV and Triton FPSO/Bittern capex projects.

The Group's only significant exploration commitment is the

drilling of a commitment well on Licence P2400 (Skerryvore - Serica

20%) to be drilled before October 2025.

Cash projections are run periodically to examine the potential

impact of extended low oil and gas prices as well as possible

production interruptions. Serica currently has substantial net cash

resources and relatively low operating costs per boe which means

that the Company is well placed to withstand such risks and its

capital commitments can be funded from existing cash resources.

OTHER

Asset values and impairment

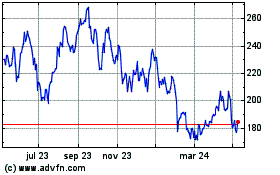

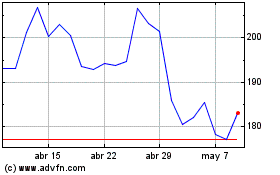

At 30 June 2023, Serica's market capitalisation stood at

GBP806.3 million, based upon a share price of 210.4 pence, which

exceeded the net asset value of GBP761.4 million. A review was

performed for any indication that the value of the Group's oil and

gas assets may be impaired at the balance sheet date of 30 June

2023 and no impairment triggers were noted. By 15 September the

Company's market capitalisation has risen to GBP1,033.0

million.

Additional Information

Additional information relating to Serica, can be found on the

Company's website at www.serica-energy.com and on SEDAR at

www.sedar.com

Approved on behalf of the Board

Mitch Flegg

Chief Executive Officer

18 September 2023

Forward Looking Statements

This disclosure contains certain forward looking statements that

involve substantial known and unknown risks and uncertainties, some

of which are beyond Serica Energy plc's control, including: the

impact of general economic conditions where Serica Energy plc

operates, industry conditions, changes in laws and regulations

including the adoption of new environmental laws and regulations

and changes in how they are interpreted and enforced, increased

competition, the lack of availability of qualified personnel or

management, fluctuations in foreign exchange or interest rates,

stock market volatility and market valuations of companies with

respect to announced transactions and the final valuations thereof,

and obtaining required approvals of regulatory authorities. Serica

Energy plc's actual results, performance or achievement could

differ materially from those expressed in, or implied by, these

forward looking statements and, accordingly, no assurances can be

given that any of the events anticipated by the forward looking

statements will transpire or occur, or if any of them do so, what

benefits, including the amount of proceeds, that Serica Energy plc

will derive therefrom.

Serica Energy plc

Group Income Statement

Six Six

months months Year

ended ended ended

30 June 30 June 31 Dec

Notes 2023 2022 2022

Continuing operations GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Sales revenue 4 340,620 353,472 812,423

Cost of sales 5 (160,486) (86,346) (218,155)

Gross profit 180,134 267,126 594,268

Unrealised hedging income/(expense) 6 20,460 (56,390) 20,877

Realised hedging expense 6 (12,961) (13,203) (45,384)

Exploration expense and new ventures (665) (185) (185)

E&E asset write-offs (5,732) - (82,749)

Administrative expenses (7,911) (3,839) (9,225)

Transaction costs 11 (8,550) - (1,785)

Foreign exchange (loss)/gain (2,856) 3,653 3,903

Share-based payments 13 (2,432) (823) (3,510)

Operating profit 159,487 196,339 476,210

Gain on acquisition 11 139,559 - -

Change in fair value of BKR financial liability (1,469) (1,899) 8,407

Finance revenue 7,028 345 4,499

Finance costs (6,342) (310) (938)

Profit before taxation 298,263 194,475 488,178

Taxation charge for the period 10 (122,791) (77,746) (310,382)

Profit after taxation and 175,472 116,729 177,796

profit for the period

Earnings per ordinary share (EPS)

Basic EPS on profit for the period (GBP) 0.53 0.43 0.65

Diluted EPS on profit for the period (GBP) 0.51 0.41 0.62

Serica Energy plc

Condensed Group Statement of Comprehensive Income

Six Six

months months Year

ended ended ended

30 June 30 June 31 Dec

2023 2022 2022

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Profit for the period 175,472 116,729 177,796

Other comprehensive loss

Exchange differences on translation (12,821) - -

------------ ------------ ----------

Other comprehensive loss for the period (12,821) - -

------------ ------------ ----------

Total comprehensive profit for the period 162,651 116,729 177,796

Total comprehensive profit attributable to:

Equity owners of the company 162,651 116,729 177,796

------------ ------------ ----------

Serica Energy plc

Group Balance Sheet

30 June 31 Dec 30 June

2023 2022 2022

GBP000 GBP000 GBP000

Notes (Unaudited) (Audited) (Unaudited)

Non-current assets

Exploration & evaluation assets 8 869 1,001 10,254

Property, plant and equipment 9 888,871 265,907 316,920

889,740 266,908 327,174

------------ ---------- ------------

Current assets

Inventories 9,417 3,998 4,528

Trade and other receivables 122,128 134,627 81,864

Hedging security advances - 24,320 160,380

Cash and cash equivalents 444,007 432,529 258,318

------------ ---------- ------------

575,552 595,474 505,090

------------ ---------- ------------

TOTAL ASSETS 1,465,292 862,382 832,264

------------ ---------- ------------

Current liabilities

Trade and other payables 80,739 69,887 45,924

Corporate tax payable 140,924 149,998 95,639

Derivative financial liability 4,664 24,914 102,181

Gas contract liabilities 162 987 10,807

Financial liabilities 6,273 - -

Dividend payable 7 53,652 - 24,467

Non-current liabilities

Gas contract liabilities - - 162

Financial liabilities 62,317 29,378 39,685

Provisions 99,576 25,199 28,371

Deferred tax liability 10 52,037 153,295 118,519

Interest bearing loans 11 210,143 - -

------------ ---------- ------------

TOTAL LIABILITIES 710,487 453,658 465,755

------------ ---------- ------------

NET ASSETS 754,805 408,724 366,509

============ ========== ============

Share capital 12 192,381 183,177 182,889

Merger reserve 12 225,446 - -

Other reserves 13 28,008 25,576 22,889

Currency translation reserve (12,821) - -

Accumulated funds 321,791 199,971 160,731

TOTAL EQUITY 754,805 408,724 366,509

============ ========== ============

Serica Energy plc

Group Statement of Changes in Equity

Group

Merger Currency

and Other translation Accumulated

Share capital reserves reserve funds Total

GBP000 GBP000 GBP'000 GBP000 GBP000

At 1 January 2022 (audited) 181,993 22,066 - 68,469 272,528

Profit for the year - - - 177,796 177,796

-------------- ----------- -------------- ------------ ---------

Total comprehensive income - - - 177,796 177,796

Issue of shares 1,184 - - - 1,184

Share-based payments - 3,510 - - 3,510

Dividend payable - - - (46,294) (46,294)

At 31 December 2022 (audited) 183,177 25,576 - 199,971 408,724

Profit for the period - - - 175,472 175,472

Other comprehensive income - - (12,821) - (12,821)

Total comprehensive income - - (12,821) 175,472 162,651

Issue of shares 9,204 225,446 - - 234,650

Share-based payments - 2,432 - - 2,432

Dividend payable - - - (53,652) (53,652)

At 30 June 2023 (unaudited) 192,381 253,454 (12,821) 321,791 754,805

============== =========== ============== ============ =========

Serica Energy plc

Group Cash Flow Statement

Six Six

months months Year

ended ended ended

30 June 30 June 31 Dec

2023 2022 2022

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Operating activities:

Profit for the period 175,472 116,729 177,796

Adjustments to reconcile profit for the period

to net cash flow from operating activities:

Taxation charge 122,791 77,746 310,382

Change in fair value of BKR financial liability 1,469 1,899 (8,407)

Gain on acquisition (139,559) - -

Net finance (income)/costs (686) (35) (3,870)

Depletion 74,697 25,529 76,887

Oil and NGL over/underlift movement (13,770) 1,700 20,270

E&E asset write-offs 5,732 - 82,749

Unrealised hedging (gains)/losses (20,460) 56,390 (20,877)

Contract revenue (825) (27,523) (37,505)

Share-based payments 2,432 823 3,510

Other non-cash movements 3,182 (2,042) (1,503)

Hedging security advances 24,320 (44,990) 91,070

Decrease/(increase) in receivables 65,646 48,787 (8,571)

(Increase)/decrease in inventories (134) (475) 55

(Decrease)/increase in payables (33,475) 12,423 22,872

Cash inflow from operations 265,832 266,961 704,858

Taxation paid (140,826) - (143,500)

Decommissioning spend (28) - (1,218)

Net cash inflow from operating activities 124,978 266,961 560,140

Investing activities:

Interest received 7,028 345 4,499

Purchase of E&E assets (5,604) (7,305) (80,801)

Purchase of property, plant & equipment (13,396) (13,614) (16,298)

Cash outflow from business combinations - (93,870) (93,871)

Acquisition of subsidiary, net of cash acquired (44,036) - -

Net cash outflow from investing activities (56,008) (114,444) (186,471)

------------ ------------ ------------

Financing activities:

Issue of ordinary shares 374 896 1,184

Transaction costs on issue of shares (1,249) - -

Repayment of borrowings (47,940) - -

Payments of lease liabilities (296) (87) (132)

Dividends paid - - (46,294)

Finance costs paid (5,520) (34) (385)

Net cash (out)/inflow from financing activities (54,631) 775 (45,627)

------------ ------------ ------------

Cash and cash equivalents

Net increase in period 14,339 153,292 328,042

Effect of exchange rates on cash and cash equivalents (2,861) 2,042 1,503

Amount at start of period 432,529 102,984 102,984

Amount at end of period 444,007 258,318 432,529

============ ============ ============

Serica Energy plc

Notes to the Unaudited Consolidated Financial Statements

1. Corporate information

The interim condensed consolidated financial statements of the

Group for the six months ended 30 June 2023 were authorised for

issue in accordance with a resolution of the directors on 18

September 2023.

Serica Energy plc (the "Company") is a public limited company

incorporated and domiciled in England & Wales. The Company's

ordinary shares are traded on AIM in London. The principal activity

of the Company is to identify, acquire and exploit oil and gas

reserves.

2. Basis of preparation and accounting policies

Basis of Preparation

The interim condensed consolidated financial statements for the

six months ended 30 June 2023 have been prepared in accordance with

International Accounting Standard 34 "Interim Financial

Reporting".

These unaudited interim consolidated financial statements of the

Group have been prepared following the same accounting policies and

methods of computation as the consolidated financial statements for

the year ended 31 December 2022. These unaudited interim

consolidated financial statements do not include all the

information and footnotes required by generally accepted accounting

principles for annual financial statements and therefore should be

read in conjunction with the consolidated financial statements and

the notes thereto in the Serica Energy plc annual report for the

year ended 31 December 2022. A number of amendments to existing

standards and interpretations were effective from 1 January 2023,

as was IFRS 17 Insurance Contracts , but there was no impact on the

1H 2023 condensed consolidated financial statements. The Group has

not early adopted any standard, interpretation or amendment that

has been issued but is not yet effective.

The financial information contained in this announcement does

not constitute statutory financial statements within the meaning of

section 435 of the Companies Act 2006.

Consolidated statutory accounts for the year ended 31 December

2022, on which the auditors gave an unqualified audit report, have

been filed with the registrar of Companies. The report of the

auditors included in that 2022 Annual Report was unqualified and

did not contain a statement under either Section 498(2) or Section

498(3) of the Companies Act 2006.

Going Concern

The Directors are required to consider the availability of

resources to meet the Group's liabilities for the period ending 31

December 2024, the 'going concern period'. The financial position

of the Group, its cash flows and capital commitments are described

in the Financial Review above.

Following completion of Serica's acquisition of Tailwind Energy

Investments Ltd on 23 March 2023 the Serica Group's going concern

considerations now include a US$377 million assumed RBL facility.

See note 11 for further details of the RBL facility. The

acquisition of Tailwind gives the Group increased production and

operating cash flows, a balance in product mix between gas and oil,

and two main operating hubs which reduces the potential impact of

production interruptions. Serica currently has competitive

operating costs per boe and its capital commitments can be funded

from existing cash resources.

The Group regularly monitors its cash, funding and liquidity

position, including available facilities and compliance with

facility covenants. Near term cash projections are revised and

underlying assumptions reviewed, generally monthly, and longer-term

projections are also updated regularly. Downside price and other

risking scenarios are considered. In addition to commodity sales

prices the Group is exposed to potential production interruptions

and these are also considered under such scenarios. In recent

years, management has given priority to building a strong cash

reserve which can respond to different types of risk.

As at 30 June 2023 the Group held cash and term deposits of

GBP444.0 million including GBP18.1 million of restricted funds,

with separate RBL liquidity headroom of US$107 million (US$270

million drawn versus US$377 million available).

For the purposes of the Group's going concern assessment we have

reviewed two cash projections for the going concern period. These

projections cover a base case forecast and an extreme stress test

scenario for the combined operations of the Group, including both

legacy Tailwind and Serica assets. RBL repayments have been assumed

based on the current redetermination and no covenant compliance

matters noted.

The base case assumptions include commodity pricing of

GBP1/therm for gas and US$70/bbl for oil throughout the going

concern period. Production, opex, capex and tax assumptions are

those currently included in standard management forecasting. The

forward looking price assumptions are considered as reasonable in

light of recent commodity forward pricing and a consensus of

published forecasts from the industry, brokers and other

analysts.

The stress test assumptions assume commodity pricing of

GBP1/therm for gas and US$70/bbl for oil for Q4 2023, a full

six-month shut-in of all production for 1H 2024, followed by a

return to base case production in 2H 2024 to the end of the going

concern period at 31 December 2024. Lower commodity pricing of 75

pence/therm and US$50/bbl oil are assumed for the 2H 2024 period in

this scenario which are significantly below the range of current

market expectations for the going concern period. Under this

scenario, which would result in lower cash inflows and repayments

of the RBL facility as redetermined, the Group was able to maintain

sufficient cash to meet its obligations and maintain covenant

compliance. A number of mitigating factors and mitigating actions

that are under management control are available to management in

the stress test event. These would mitigate the reduced operating

cash outflows experienced and are not included in the

projection.

After making enquiries and having taken into consideration the

above factors, the Directors considered it appropriate that the

Group has adequate resources to continue in operational existence

for the going concern period. Accordingly, they continue to adopt

the going concern basis in preparing the financial statements.

Significant accounting policies

A number of new standards, amendments to existing standards and

interpretations were applicable from 1 January 2023. The adoption

of these amendments did not have a material impact on the Group's

interim condensed consolidated financial statements for the period

ended 30 June 2023.

The accounting policies adopted in the preparation of the

interim condensed consolidated financial statements are consistent

with those followed in the preparation of the Group's annual

financial statements for the year ended 31 December 2022. The

impact of seasonality or cyclicality on operations is not

considered significant on the interim consolidated financial

statements.

The Group financial statements are presented in GBP and all

values are rounded to the nearest thousand pounds (GBP000) except

when otherwise indicated.

Basis of Consolidation

The consolidated financial statements include the accounts of

the Company and its wholly-owned subsidiaries Serica Holdings UK

Limited, Serica Energy Holdings BV, Serica Energy Corporation, Asia

Petroleum Development Limited, Petroleum Development Associates

(Asia) Limited, Serica Energy (UK) Limited, PDA Lematang Limited,

Serica Glagah Kambuna BV, Tailwind Energy Investments Ltd, NSV

Energy Limited, Tailwind Energy Ltd, Tailwind Mistral Ltd, Tailwind

Energy Sirocco Ltd, Tailwind Energy Chinook Ltd and Tailwind Energy

Bora Ltd. Together, these comprise the "Group".

The results and financial position of all of the Group entities

that have a functional currency different from the presentation

currency are translated into the presentation currency as

follows:

-- Assets and liabilities for each balance sheet presented are

translated at the closing rate at the date of that balance

sheet;

-- Income and expenses for each income statement are translated

at average exchange rates (unless this average is not a reasonable

approximation of the rates prevailing on the transaction dates, in

which case income and expenses are translated at the rate on the

dates of each transaction);

-- The exchange differences arising on translation for

consolidation are recognised in other comprehensive income; and

-- Any fair value adjustments to the carrying amounts of assets

and liabilities arising on the acquisition are treated as assets

and liabilities of the acquired entity and are translated at the

spot rate of exchange at the reporting date.

All inter-company balances and transactions have been eliminated

upon consolidation.

3. Segmental Information

For the purposes of segmental reporting, the Group currently

operates a single class of business being oil and gas exploration,

development and production and related activities in a single

geographical area, being presently the UK North Sea.

4. Sales Revenue

Six months Six months Year

ended ended ended

30 June 30 June 31 Dec

2023 2022 2022

GBP000 GBP000 GBP000

Gas sales 215,782 266,089 652,680

Gas supply contract revenue 825 27,523 37,505

Total gas sales 216,607 293,612 690,185

Oil sales 112,729 41,185 88,048

NGL sales 11,284 18,675 34,190

Total revenue 340,620 353,472 812,423

----------- ----------- -----------

Gas supply contract revenue in 2022 and 1H 2023 arose from the

unwind of gas contract liabilities initially recognised upon the

restructuring of certain gas swaps to other fixed price instruments

under a gas sales contract in August 2021.

5. Cost of sales

Six months Six months Year

ended ended ended

30 June 30 June 31 Dec

2023 2022 2022

GBP000 GBP000 GBP000

Operating costs 99,559 59,117 120,998

Movement in liquids overlift/underlift (13,770) 1,700 20,270

Depletion (note 9) 74,697 25,529 76,887

160,486 86,346 218,155

----------- -----------

6. Group Operating Profit

Six months Six months Year

ended ended ended

30 June 30 June 31 Dec

2023 2022 2022

GBP000 GBP000 GBP000

Realised hedging losses (12,961) (13,203) (45,384)

----------- ----------- ---------

Unrealised hedging gains/(losses) 20,460 (56,390) 20,877

----------- ----------- ---------

Derivative financial instruments

The Group enters into derivative financial instruments with

various counterparties. Other derivative financial instruments held

at 31 December 2022 comprised gas swaps which were valued by

counterparties, with the valuations reviewed internally and

corroborated with readily available market data of forward gas

pricing (level 2). No gas swap derivative financial instruments

were held at 30 June 2023.

Details of the Group's derivative financial instruments held as

at 30 June 2023 are provided in the financial review above.

Realised hedging losses comprise losses realised on 1H 2023 gas

price swaps.

Unrealised hedging gains comprise gains on gas swaps partially

offset by unrealised losses on the UKA ETS swap instruments held.

Unrealised hedging gains on gas and other swaps comprise unrealised

charges on the movement during 1H 2023 in the calculated fair value

liability of outstanding gas price or other derivative contracts

measured at the respective Balance Sheet dates.

7. Dividends payable

A final cash dividend for 2022 of 14.0 pence per share was

proposed in April 2023 and approved at the annual general meeting

on 29 June 2023. Following the approval in the 1H 2023 period, the

dividend payable of GBP53.7 million is recognised as a liability in

the Balance Sheet at 30 June 2023. The dividend was paid in July

2023.

Dividends on ordinary shares paid in 2022

A final cash dividend for 2021 of 9.0 pence per share was

proposed in April 2022 and approved at the annual general meeting

on 30 June 2022. Following the approval in the 1H 2022 period, the

dividend payable of GBP24.5 million was recognised as a liability

in the Balance Sheet at 30 June 2022. The dividend was paid in July

2022.

An interim cash dividend for 2022 of 8.0 pence per share was

announced in September 2022 and was paid in November 2022.

8 . Exploration and Evaluation Assets

Total

GBP000

Cost:

At 1 January 2022 2,949

Additions 80,801

Asset write-offs (82,749)

At 31 December 2022 1,001

Acquisitions -

Additions 5,604

Asset write-offs (5,732)

Currency translation adjustment (4)

At 30 June 2023 869

=================

Net Book Amount:

30 June 2023 869

=================

31 December 2022 1,001

=================

1 January 2022 2,949

=================

The E&E asset write-offs for 1H 2023 of GBP5.7 million

(2022: GBP82.7 million) primarily comprised drilling costs from the

North Eigg exploration well and minor costs associated with the

P2506 licence. The well encountered hydrocarbons but not of

commercial quantities as the reservoir sands were thinner than

prognosed.

9. Property, Plant and Equipment

Oil and Fixtures

gas properties and fittings Right-of-use

assets Total

GBP000 GBP000 GBP000 GBP000

Cost:

At 1 January 2022 466,554 212 516 467,282

Additions 15,953 - 345 16,298

Decommissioning asset (2,231) - - (2,231)

At 31 December 2022 480,276 212 861 481,349

Acquisitions (note 11) 703,963 - - 703,963

Additions 13,396 - - 13,396

Currency translation adjustment (20,074) - - (20,074)

At 30 June 2023 1,177,561 212 861 1,178,634

---------------- --------------

Depreciation and depletion:

At 1 January 2022 137,698 167 473 138,338