TIDMSRB

Unaudited interim results for the three and six month periods

ended 30 June 2023

Serabi (AIM:SRB, TSX:SBI), the Brazilian focused gold mining and

development company, today releases its unaudited results for the

three and six month periods ended 30 June 2023.

A copy of the full interim statements together with commentary

can be accessed on the Company's website using the following link:

https://bit.ly/4

https://www.globenewswire.com/Tracker?data=h0OWqzKtxsqAQARLGmoVEJ_MJbLEJrgCLB9rU0HyoQDuheLfgAR8du6VUto01bDPhxjyX1BF9BxqHXYICWW4xA==

7VVUAg

https://www.globenewswire.com/Tracker?data=VOE2aplamvJVKu_aYIvSII6TailEjXWmb9VXopFZpjW0A97R69wuqdZrF2DioU64BLNyQAqrkiLwpJdvVLS1ag==

Financial Highlights

-- Gold production for the second quarter of 8,518 ounces (2022: 8418

ounces) for total production for the year to date of 16,524 ounces (2022:

15,480 ounces).

-- Cash held at 30 June 2023 of US$13.3 million (31 December 2022: US$7.2

million).

-- EBITDA for the six-month period of US$6.6 million (2022: US$5.2 million).

-- Post tax profit for the six month period of US$5.0 million (2022: US$2.1

million),

-- Profit per share of 6.58 cents compared with a profit per share of 2.74

cents for the same six month period of 2022.

-- Net cash inflow from operations for the six-month period (after mine

development expenditure of US$1.3 million) of US$7.8 million (2022:

US$1.5 million outflow).

-- Average gold price of US$1,940 per ounce received on gold sales during

the six month period (2022: US$1,869).

-- Cash Cost for the six-month period to 30 June 2023 of US$1,258 per ounce

(six months 2022 : US$1,415 per ounce) representing an 11% improvement

compared to the same period of 2022.

-- All-In Sustaining Cost for the three-month period to 20 June 2023 of

US$1,519 per ounce (six months 2022 : US$1,716 per ounce) represents a

11.5% improvement compared to the same period of 2022.

Key Financial Information

SUMMARY FINANCIAL STATISTICS

------------------------------------------------------------------------------

6 months to 6 months to 3 months to 3 months to

30 June 2023 30 June 2022 30 June 2023 30 June 2022

US$ US$ US$ US$

(unaudited) (unaudited) (unaudited) (unaudited)

------------------ ------------- ------------- ------------- -------------

Revenue 30,523,582 31,200,863 17,086,213 18,315,843

Cost of sales (21,064,434) (23,268,585) (11,297,431) (13,995,113)

Gross operating

profit 9,459,148 7,932,278 5,788,782 4,320,730

Administration and

share based

payments (2,838,267) (2,766,776) (1,483,692) (1,207,634)

EBITDA 6,620,881 5,165,502 4,305,090 3,113,096

Depreciation and

amortisation

charges (2,025,037) (2,923,245) (1,190,523) (1,751,357)

Operating profit

before finance

and tax 4,595,844 2,242,257 3,114,567 1,361,739

Profit after tax 4,979,891 2,072,939 3,512,412 343,336

Earnings per 6.58c 2.74c 4.64c 0.45c

ordinary share

(basic)

Average gold price US$1,940 US$1,845 US$1,980 US$1,846

received

(US$/oz)

------------- ------------- ------------- -------------

As at

30 June As at

2023 31 December 2022

US$ US$

(unaudited) (audited)

-------------------------- ------------ -----------------

Cash and cash equivalents 13,285,448 7,196,313

Net assets 91,291,971 81,523,603

Cash Cost and All-In

Sustaining Cost

("AISC")

--------------------

6 months to 6 months to 30 June 12 months to 31

30 June 2022 December 2022

2023

-------------------- ----------- ------------------- --------------------

Gold production for 16,524 ozs 15,480 ozs 31,819 ozs

cash cost and AISC

purposes

----------- ------------------- --------------------

Total Cash Cost of US$1,258 US$1,415 US$1,322

production (per

ounce)

----------- ------------------- --------------------

Total AISC of US$1,519 US$1,716 US$1,615

production (per

ounce)

----------- ------------------- --------------------

"The last 12 months since my appointment has been an exciting

period in the development of the Company", said Michael Lynch-Bell

, Chairman. "Operationally and financially it is pleasing to see

the Company in such a strong position after a very encouraging

quarter during which we have consistently improved our net cash

position and the Company remaining on track to meet our full year

guidance of 33,500 to 35,000 ounces.

"We still have challenges ahead as we continue to grow the

production base with the development of Coringa, but having spent

time with UK and Brazilian management, I am confident the solutions

being pursued will overcome these.

"Since my appointment we have strengthened the Board with the

appointment of Deborah Gudgeon who is also Chair of the Audit and

Risk Committee and in January we also welcomed Carolina Margozzini

to the Board as the representative for Fratelli Investments

Limited, one of our two major shareholders. I am pleased to be part

of such a diverse board that is working together to bring increased

value to all Serabi's stakeholders.

"We also signed an exciting copper exploration joint venture,

with Vale SA, the Brazilian mining major and drilling and other

exploration activity commenced immediately. Serabi's projects are

located in a relatively under-explored part of Brazil and the

involvement of Vale is, I believe, a further endorsement of the

mineral potential of the Tapajos region.

"We look forward to continued growth and development, and my

objective is to ensure that we achieve this in a manner that is

sustainable and in keeping with our core values, of developing gold

mining opportunities that are efficient, cost effective and

operated in a manner that brings economic, social and

infrastructure benefits to all our stakeholders, including the

local region and its communities."

Overview of the financial results

An improved level of gold production in the second quarter of

the year of 8,518 ounces, a 6% increase on the first quarter, has

resulted in total production for the year to date of 16,524 ounces

representing a 7% increase over the same period in 2022 (2022:

15,480 ounces). With continued growth anticipated for the second

half of 2023, Serabi remains on track to meet its full year

guidance of 33,500 to 35,000 ounces.

The cash balance at the end of June 2023 had increased to

US$13.3 million (Dec 2022: US$7.2 million). This does include

approximately US$0.94 million of funds held for the Vale

Exploration Alliance but nonetheless the net cash attributable to

the Group has increased by US$5.1 million during the first six

months of the year.

Cash cost for the year to date is US$1,258 per ounce which

represents a small decrease compared to the first quarter of 2023

when reported cash costs were US$1,281 per ounce and a significant

reduction compared to the same six month period of 2022 when a cash

cost of US$1,415 was reported. AISC for the year to date is

US$1,519 per ounce, which is in line with the AISC of US$1,516 per

ounce reported in the first quarter of 2023. The current AISC

compares very favourably with the same six month period of 2022

when an AISC of US$1,716 was reported, particularly given the

levels of mine development incurred in the period, particularly at

Coringa, creating the opportunity for longer term production

growth. Capitalised mine development costs were US$1.0 million

higher in the last three month period compared with the first three

months of 2023.

Gold sales for the quarter were 8,475 ounces, with inventory

levels remaining steady following the increase in gold inventory

experienced in the first quarter following the commissioning of new

tanks in the leaching circuit. Consistent with the results for the

first quarter of 2023, amortisation costs are lower in this quarter

than previously, a consequence of the reduced activity at Sao Chico

and therefore minimal amortisation costs associated with this

project. In addition, because Coringa is only in a trial mining

phase and has not attained commercial production, the project costs

are not currently subject to amortisation charges. In accordance

with accounting regulations the gold sales and related operating

costs of Coringa are being reflected in the Group's income

statement.

On 10 May 2023, the Company announced that it had entered into

an exploration alliance with Vale SA focused on the Matilda

prospect and other large regional targets in the Tapajos region of

Para, Brazil. The current exploration activity under this alliance

is being funded in its entirety by Vale up to an initial US$5

million for the Phase 1 activities. However, Serabi is the operator

and undertaking the activity either directly or using contractors

where appropriate. Vale provides funding in advance to Serabi and

at the end of the quarter, Serabi held US$0.94 million of cash that

will be used to meet the accrued and future costs of the alliance

exploration activity. The exploration costs being incurred under

the alliance are not being capitalised but are being expensed

through the Income Statement as they are incurred. Similarly, the

funds being received from Vale are also being reported through the

Income Statement as other income.

During May, the Group settled a US$5.0 million export linked

loan facility that had been advanced by Itau Bank BBA. The Group

still has a further US$5.0 million export linked facility advanced

by Santander Bank in Brazil which is due to be repaid in February

2024 and carries a fixed interest rate of 7.97%.

To achieve production guidance for the rest of the year and in

anticipation of increasing mine output from Coringa in 2024,

the

production plan anticipates further mine development activities. At Coringa we intersected the veins on the next level at 260mRL shortly before the end of August and this will present further development and production options. At Palito we are developing the G3 structure which in the past was a backbone of production. Re-establishing G3 as an additional production area is planned to provide further flexibility within the Palto orebody. Nonetheless, I would hope that we can maintain a broadly similar cost base for the remaining six months and continue to benefit from the continued strength of the gold price."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018.

The person who arranged for the release of this announcement on

behalf of the Company was Clive Line, Director.

Enquiries

SERABI GOLD plc

Michael Hodgson t +44 (0)20 7246 6830

Chief Executive m +44 (0)7799 473621

Clive Line t +44 (0)20 7246 6830

Finance Director m +44 (0)7710 151692

e contact@serabigold.com

https://www.globenewswire.com/Tracker?data=AwK9ll22goBuVnxMvBLgvcNhnL98IIu6YFgDL097KYibW1-WKoVCyv1JaUQRrmeD3UwTwmOi5vkv02BE2igfF-Kf3WCJqW8fzCvOHoWCWy0=

www.serabigold.com

BEAUMONT CORNISH Limited

Nominated Adviser & Financial Adviser

Roland Cornish / Michael Cornish t +44 (0)20 7628 3396

PEEL HUNT LLP

Joint UK Broker

Ross Allister t +44 (0)20 7418 9000

TAMESIS PARTNERS LLP

Joint UK Broker

Charlie Bendon/ Richard Greenfield t +44 (0)20 3882 2868

CAMARCO

Financial PR

Gordon Poole / Emily Hall t +44 (0)20 3757 4980

Copies of this announcement are available from the Company's

website at www.serabigold.com.

Forward-looking statements

Certain statements in this announcement are, or may be deemed to

be, forward looking statements. Forward looking statements are

identi ed by their use of terms and phrases such as "believe",

"could", "should" "envisage", "estimate", "intend", "may", "plan",

"will" or the negative of those, variations or comparable

expressions, including references to assumptions. These

forward-looking statements are not based on historical facts but

rather on the Directors' current expectations and assumptions

regarding the Company's future growth, results of operations,

performance, future capital and other expenditures (including the

amount, nature and sources of funding thereof), competitive

advantages, business prospects and opportunities. Such forward

looking statements re ect the Directors' current beliefs and

assumptions and are based on information currently available to the

Directors. A number of factors could cause actual results to differ

materially from the results discussed in the forward-looking

statements including risks associated with vulnerability to general

economic and business conditions, competition, environmental and

other regulatory changes, actions by governmental authorities, the

availability of capital markets, reliance on key personnel,

uninsured and underinsured losses and other factors, many of which

are beyond the control of the Company. Although any forward-looking

statements contained in this announcement are based upon what the

Directors believe to be reasonable assumptions, the Company cannot

assure investors that actual results will be consistent with such

forward looking statements.

Qualified Persons Statement

The scientific and technical information contained within this

announcement has been reviewed and approved by Michael Hodgson, a

Director of the Company. Mr Hodgson is an Economic Geologist by

training with over 35 years' experience in the mining industry. He

holds a BSc (Hons) Geology, University of London, a MSc Mining

Geology, University of Leicester and is a Fellow of the Institute

of Materials, Minerals and Mining and a Chartered Engineer of the

Engineering Council of UK, recognizing him as both a Qualified

Person for the purposes of Canadian National Instrument 43-101 and

by the AIM Guidance Note on Mining and Oil & Gas Companies

dated June 2009.

Neither the Toronto Stock Exchange, nor any other securities

regulatory authority, has approved or disapproved of the contents

of this news release.

See

https://www.globenewswire.com/Tracker?data=AwK9ll22goBuVnxMvBLgvcNhnL98IIu6YFgDL097KYgK8Z1R0doP-GuLeHYjuia95k9nNmdrv_C8cH85I0PmuxKSAVRxVZxWbJnX3mp4NHk=

www.serabigold.com for more information and follow us on twitter

@Serabi_Gold

The following information, comprising, the Income Statement, the

Group Balance Sheet, Group Statement of Changes in Shareholders'

Equity, and Group Cash Flow, is extracted from the unaudited

interim financial statements for the six months to 30 June

2023.

Statement of Comprehensive Income

For the six month period ended 30 June 2023

For the six months ended For the three months ended

30 June 30 June

2023 2022 2023 2022

(expressed in

US$) Notes (unaudited) (unaudited) (unaudited) (unaudited)

--------------- ----- ------------ ------------ ------------- -------------

CONTINUING

OPERATIONS

Revenue 30,523,582 31,200,863 17,086,213 18,315,843

Cost of sales (20,694,434) (23,268,585) (11,297,431) (13,995,113)

Stock

impairment

provision (370,000) -- -- --

Depreciation

and

amortisation

charges (2,025,037) (2,923,245) (1,190,523) (1,751,357)

--------------- ----- ------------ ------------ ------------- -------------

Total cost of

sales (23,089,471) (26,191,830) (12,487,954) (15,746,470)

Gross profit 7,434,111 5,009,033 4,598,259 2,569,373

Administration

expenses (2,899,894) (2,596,017) (1,449,726) (1,150,064)

Share-based

payments (85,866) (213,922) (37,799) (101,797)

Gain on asset

disposals 147,493 43,163 3,833 44,227

--------------- ----- ------------ ------------ ------------- -------------

Operating

profit 4,595,844 2,242,257 3,114,567 1,361,739

Other income --

exploration

receipts 2 1,050,535 -- 1,050,535 --

Other expenses

-- exploration

expenses 2 (1,019,911) -- (1,019,911) --

Foreign

exchange gain

/ (loss) 100,066 139,105 17,455 (37,481)

Finance expense 3 (434,748) (66,525) (273,578) (64,686)

Finance income 3 819,669 152,624 776,850 47,844

--------------- ----- ------------ ------------ ------------- -------------

Profit before

taxation 5,111,455 2,467,461 3,665,918 1,307,416

Income tax

expense 4 (131,564) (394,522) (153,506) (964,080)

--------------- ----- ------------ ------------ ------------- -------------

Profit after

taxation 4,979,891 2,072,939 3,512,412 343,336

--------------- ----- ------------ ------------ ------------- -------------

Other

comprehensive

income (net of

tax)

Exchange

differences on

translating

foreign

operations 4,703,151 1,986,773 3,708,904 (6,872,683)

--------------- ----- ------------ ------------ ------------- -------------

Total

comprehensive

profit /

(loss) for the

period(1) 9,683,042 4,059,712 7,221,316 (6,529,347)

--------------- ----- ------------ ------------ ------------- -------------

Profit per 5 6.58c 2.74c 4.64c 0.45c

ordinary share

(basic)

--------------- ----- ------------ ------------ ------------- -------------

Profit per 5 6.58c 2.68c 4.64c 0.44c

ordinary share

(diluted)

--------------- ----- ------------ ------------ ------------- -------------

(1) The Group has no non-controlling interests, and all losses are attributable to the equity holders of the parent company.

Balance Sheet as at 30 June 2023

As at As at

(expressed in As at 30 June 2022 31 December 2022

US$) Notes 30 June 2023 (unaudited) (unaudited) (audited)

-------------- ----- ------------------------- ------------- -----------------

Non-current

assets

Deferred

exploration

costs 7 20,367,929 39,608,630 18,621,180

Property,

plant and

equipment 8 51,678,058 28,254,138 48,482,519

Right of use

assets 9 5,537,628 4,801,117 5,374,042

Taxes

receivable 4,026,439 961,290 3,446,032

Deferred

taxation 1,792,206 685,650 1,545,684

-------------- ----- ------------------------- ------------- -----------------

Total

non-current

assets 83,402,260 74,310,825 77,469,457

-------------- ----- ------------------------- ------------- -----------------

Current assets

Inventories 10 9,881,514 7,724,300 8,706,351

Trade and

other

receivables 2,533,055 4,952,331 5,291,924

Derivative

financial

assets 12 649,209 -- --

Prepayments

and accrued

income 1,375,685 3,883,897 1,572,149

Cash and cash

equivalents 13,285,448 9,819,882 7,196,313

-------------- ----- ------------------------- ------------- -----------------

Total current

assets 27,724,911 26,380,410 22,766,737

-------------- ----- ------------------------- ------------- -----------------

Current

liabilities

Trade and

other

payables 6,328,124 5,626,540 5,830,872

Interest

bearing

liabilities 11 6,430,023 5,726,808 6,111,126

Derivative

financial

liabilities 12 88,755 -- --

Accruals 1,094,621 399,970 461,857

------------------------- ------------- -----------------

Total current

liabilities 13,941,523 11,753,328 12,403,855

-------------- ----- ------------------------- ------------- -----------------

Net current

assets 13,783,388 14,627,092 10,362,882

-------------- ----- ------------------------- ------------- -----------------

Total assets

less current

liabilities 97,185,648 88,937,917 87,832,339

-------------- ----- ------------------------- ------------- -----------------

Non-current

liabilities

Trade and

other

payables 4,111,078 466,292 3,800,886

Interest

bearing

liabilities 11 469,910 1,152,087 837,293

Deferred tax

liability -- 381,483 480,922

Derivative

financial

liabilities 12 -- 12,871 --

Provisions 1,312,689 2,766,049 1,190,175

Total

non-current

liabilities 5,893,677 4,778,782 6,309,276

-------------- ----- ------------------------- ------------- -----------------

Net assets 91,291,971 84,159,135 81,523,063

-------------- ----- ------------------------- ------------- -----------------

Equity

Share capital 14 11,213,618 11,213,618 11,213,618

Share premium

reserve 36,158,068 36,158,068 36,158,068

Share

incentive

reserve 14 243,002 1,289,270 1,324,558

Other reserves 15,375,463 14,472,400 14,459,255

Translation

reserve (61,573,620) (66,661,397) (66,276,771)

Retained

surplus 89,875,440 87,687,176 84,644,335

-------------- ----- ------------------------- ------------- -----------------

Equity

shareholders'

funds 91,291,971 84,159,135 81,523,063

-------------- ----- ------------------------- ------------- -----------------

.

Statements of Changes in Shareholders' Equity

For the six month period ended 30 June 2023

(expressed in US$)

Share Other

Share Share incentive reserves Translation Retained Total

(unaudited) capital premium reserve (1) reserve Earnings equity

-------------------------------------- ---------- ---------- ----------- ---------- ------------ ----------- -----------

Equity shareholders' funds at 31

December 2021 11,213,618 36,158,068 1,075,348 13,694,731 (68,648,170) 86,391,906 79,885,501

-------------------------------------- ---------- ---------- ----------- ---------- ------------ ----------- -----------

Foreign currency adjustments -- -- -- -- 1,986,773 -- 1,986,773

Profit for the period -- -- -- -- -- 2,072,939 2,072,939

-------------------------------------- ---------- ---------- ----------- ---------- ------------ ----------- -----------

Total comprehensive income for the

period -- -- -- -- 1,986,773 2,072,939 4,059,712

Transfer to taxation reserve -- -- -- 777,669 -- (777,669) --

Share incentives expense -- -- 213,922 -- -- -- 213,922

-------------------------------------- ---------- ---------- ----------- ---------- ------------ ----------- -----------

Equity shareholders' funds at 30 June

2022 11,213,618 36,158,068 1,289,270 14,472,400 (66,661,397) 87,687,176 84,159,135

-------------------------------------- ---------- ---------- ----------- ---------- ------------ ----------- -----------

Foreign currency adjustments -- -- -- -- 384,626 -- 384,626

Loss for the period -- -- -- -- -- (3,055,986) (3,055,986)

-------------------------------------- ---------- ---------- ----------- ---------- ------------ ----------- -----------

Total comprehensive income for the

period -- -- -- -- 384,626 (3,055,986) (2,671,360)

Transfer to taxation reserve -- -- -- (13,145) -- 13,145 --

Share incentives expense -- -- 35,288 -- -- -- 35,288

-------------------------------------- ---------- ---------- ----------- ---------- ------------ ----------- -----------

Equity shareholders' funds at 31

December 2022 11,213,618 36,158,068 1,324,558 14,459,255 (66,276,771) 84,644,335 81,523,063

-------------------------------------- ---------- ---------- ----------- ---------- ------------ ----------- -----------

Foreign currency adjustments -- -- -- -- 4,703,151 -- 4,703,151

Profit for the period -- -- -- -- -- 4,979,891 4,979,891

-------------------------------------- ---------- ---------- ----------- ---------- ------------ ----------- -----------

Total comprehensive income for the

period -- -- -- -- 4,703,151 4,979,891 9,683,042

Transfer to taxation reserve -- -- -- 916,208 -- (916,208) --

Share incentives expired -- -- (1,167,422) -- -- 1,167,422 --

Share incentives expense -- -- 85,866 -- -- -- 85,866

-------------------------------------- ---------- ---------- ----------- ---------- ------------ ----------- -----------

Equity shareholders' funds at 30 June

2023 11,213,618 36,158,068 243,002 15,375,463 (61,573,620) 89,875,440 91,929,971

-------------------------------------- ---------- ---------- ----------- ---------- ------------ ----------- -----------

(1) Other reserves comprise a merger reserve of US$361,461 and a taxation reserve of US$15,014,002 (31 December 2022: merger reserve of US$361,461 and a taxation reserve of US$14,097,794).

Condensed Consolidated Cash Flow Statement

For the three month period ended 30 June 2023

For the six months For the three months

ended ended

30 June 30 June

2023 2022 2023 2022

(expressed in US$) (unaudited) (unaudited) (unaudited) (unaudited)

------------------------------------------------------ ----------- ----------- ----------- -----------

Operating activities

Post tax (loss) / profit for period 4,979,891 2,072,939 3,512,412 343,336

Depreciation -- plant, equipment and mining properties 2,025,037 2,923,245 1,190,523 1,751,357

Stock impairment provision 370,000 -- -- --

Net financial expense (484,987) (225,204) (520,727) 54,323

Provision for taxation 131,564 394,522 153,506 964,080

Gain / (loss) on disposals (147,493) (43,163) (3,833) (44,227)

Share-based payments 85,866 213,922 37,799 101,797

Taxation paid (395,890) (131,462) (109,153) (3,813)

Interest paid (385,814) (51,838) (359,404) (31,612)

Foreign exchange (loss) / gain (72,071) (211,323) 18,350 (71,395)

Changes in working capital

(Increase)/decrease in inventories (781) (394,806) 348,963 1,504,893

Decrease/(increase) in receivables, prepayments and

accrued income 2,765,042 (3,912,322) 883,597 (2,164,981)

(Decrease)/increase in payables, accruals and

provisions 247,961 (339,994) 934,445 (657,737)

----------------------------------------------------- ----------- ----------- -----------

Net cash inflow from operations 9,118,325 294,516 6,086,478 1,746,021

------------------------------------------------------ ----------- ----------- ----------- -----------

Investing activities

Purchase of property, plant and equipment and assets

in construction (980,086) (2,490,502) (238,179) (1,521,615)

Mine development expenditure (1,339,090) (1,849,462) (966,690) (783,577)

Geological exploration expenditure (357,424) (692,980) (357,424) (223,730)

Pre-operational project costs -- (2,266,252) 206,546 (1,124,670)

Proceeds from sale of assets 191,515 64,762 33,044 51,605

Interest Received 79,799 -- 36,980 --

Net cash outflow on investing activities (2,405,286) (7,234,434) (1,285,723) (3,601,987)

------------------------------------------------------ ----------- ----------- ----------- -----------

Financing activities

Receipt of short-term loan 5,000,000 4,923,586 -- 4,923,586

Repayment of short-term loan (5,096,397) -- (5,096,397) --

Payment of finance lease liabilities (610,982) (502,225) (307,841) (314,908)

Net cash (outflow)/inflow from financing activities (707,379) 4,421,361 (5,404,238) 4,608,678

------------------------------------------------------ ----------- ----------- ----------- -----------

Net increase/(decrease) in cash and cash equivalents 6,005,660 (2,518,557) (603,483) 2,752,712

Cash and cash equivalents at beginning of period 7,196,313 12,217,751 13,920,999 6,932,625

Exchange difference on cash 83,475 120,688 (32,068) 134,545

------------------------------------------------------ ----------- ----------- ----------- -----------

Cash and cash equivalents at end of period 13,285,448 9,819,882 13,285,448 9,819,882

------------------------------------------------------ ----------- ----------- ----------- -----------

Notes

1. Basis of preparation

These interim condensed consolidated financial statements are

for the three and six month periods ended 30 June 2023. Comparative

information has been provided for the unaudited three and six month

periods ended 30 June 2022 and, where applicable, the audited

twelve month period from 1 January 2022 to 31 December 2022. These

condensed consolidated financial statements do not include all the

disclosures that would otherwise be required in a complete set of

financial statements and should be read in conjunction with the

2022 annual report.

The condensed consolidated financial statements for the periods

have been prepared in accordance with International Accounting

Standard 34 "Interim Financial Reporting" and the accounting

policies are consistent with those of the annual financial

statements for the year ended 31 December 2022 and those envisaged

for the financial statements for the year ending 31 December

2023.

The Directors have reviewed the principal risks and

uncertainties facing the Group and have concluded that those facing

the Group for the remaining six months of the current financial

year are unchanged from the risks set out in the 2022 Annual Report

and Accounts. In reaching this conclusion, the Directors considered

changes in the internal and external environment during the

intervening period which could threaten the Group's business model,

future performance, liquidity, solvency or reputation. Details of

these principal risks and how they are being managed are set out on

pages 25 to 32 of the 2022 Annual Report and Accounts.

The interim financial information has not been audited and does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. Whilst the financial information included in

this announcement has been compiled in accordance with

International Financial Reporting Standards ("IFRS") this

announcement itself does not contain sufficient financial

information to comply with IFRS. The Group statutory accounts for

the year ended 31 December 2022 prepared in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006 have been filed with the

Registrar of Companies. The auditor's report on these accounts was

unqualified. The auditor's report did not contain a statement under

Section 498 (2) or 498 (3) of the Companies Act 2006

Accounting standards, amendments and interpretations effective

in 2023

The Group has not adopted any standards or interpretations in

advance of the required implementation dates.

The following Accounting standards came into effect as of 1

January 2023

IFRS 17 Insurance Contracts, including Amendments 1 January 2023

to IFRS 17

Classification of Liabilities as Current or Non-current 1 January 2023

(Amendments to IAS 1) and Classification of Liabilities

as Current or Non-current -- Deferral of Effective

Date

There is no material impact on the financial statements from the

adoption of these new accounting standards or amendments to

accounting standards,

Certain new accounting standards and interpretations have been

published that are not mandatory for the current period and have

not been early adopted. These standards are not expected to have a

material impact on the Company's current or future reporting

periods.

These financial statements do not constitute statutory accounts

as defined in Section 434 of the Companies Act 2006.

(i) Going concern

At 30 June 2023 the Group held cash of US$13.29 million which

represents an increase of US$6.09 million compared to 31 December

2022. This increase includes the receipt of a US$5.0 million loan,

from Santander Bank in Brazil, on 22 February 2023. The proceeds

raised from the loan will be used for working capital and provided

the Group with adequate liquidity to repay a similar arrangement

which was repaid on 12 May 2023.

Management prepares, for Board review, regular updates of its

operational plans and cash flow forecasts based on their best

judgement of the expected operational performance of the Group and

using economic assumptions that the Directors consider are

reasonable in the current global economic climate. The most recent

plans assume that during 2023 the Group will continue gold

production from its Palito Complex operation as well as increase

production from the Coringa mine and will be able to increase gold

production to exceed the levels of 2022.

The Directors will, however, continue to limit the Group's

discretionary expenditures including the continued development of

Coringa which, on a longer term basis, may require additional

external sources of finance to be secured.

The Directors have concluded that, based on the current

operational projections, it remains appropriate to adopt the going

concern basis of accounting in the preparation of these interim

unaudited financial statements. The Directors acknowledge that the

Group remains subject to operational and economic risks and any

unplanned interruption or reduction in gold production or

unforeseen changes in economic assumptions may adversely affect the

level of free cash flow that the Group can generate on a monthly

basis and its ability to secure further finance as and when

required The Directors consider that the Group will be able to

secure the necessary external finance for the development of its

Coringa project but that the timing of this may be dependent on the

receipt of further permits and licences. The Directors believe that

all the necessary permits and licenses will be awarded when all

current information requests of the relevant authorities have been

met.

2. Other Income and Expenses

Under its copper exploration alliance with Vale announced on 10

May 2023, the related exploration activities being undertaken by

the Group under the management of a working committee (comprising

representatives from Vale and Serabi), are being funded in their

entirety by Vale up to a value of US$5 million during Phase 1 of

the programme. The Group at this time has no certainty that the

exploration for copper deposits will result in a project that is

commercially viable recognising that exploration and development of

copper deposits is not the core activity of the Group, there is a

significant cost involved in developing new copper deposits and it

is unlikely that without the financial support of Vale that the

Group would independently seek to develop a copper project in

preference to any of its existing gold projects and

discoveries.

As a result, it is recognising both the funding received from

Vale and the related exploration expenditures through its income

statement. As this is not the principal business activity of the

Group these receipts and expenditures are classified as other

income and other expenses.

3. Finance Costs

6 months ended 3 months ended

30 June 2023 6 months ended 30 June 2023 2021 3 months ended

(unaudited) 30 June 2022 (unaudited) (unaudited) 30 June 2022 (unaudited)

US$ US$ US$ US$

Loss on

revaluations

of hedging

derivatives (88,755) -- (88,755) --

Interest

expense on

short term

loan (243,318) (53,859) (131,608) (53,859)

Interest

expense on

trade

finance (41,891) (12,666) (25,056) (10,827)

Interest

expense on

finance

leases (60,784) -- (28,159) --

Total

Financial

expense (434,748) (66,525) (273,578) (64,686)

Interest

Income 79,799 -- 36,980 --

Gain on

revaluation

of warrants -- 152,624 -- 47,844

Gain on

revaluation

of hedging

derivatives 570,863 -- 570,863 --

Realised gain

on hedging

derivatives 169,007 -- 169,007 --

-------------- ------------------------- ------------------ -------------------------

Total

Financial

expense 819,669 152,624 776,850 47,844

-------------- ------------------------- ------------------ -------------------------

Net finance

income /

(expense) 384,921 86,099 503,272 (16,842)

-------------- ------------------------- ------------------ -------------------------

4. Taxation

The Group has recognised a deferred tax asset to the extent that

the Group has reasonable certainty as to the level and timing of

future profits that might be generated and against which the asset

may be recovered. The deferred tax liability arising on unrealised

exchange gains has been eliminated in the six-month period to 30

June 2023 reflecting the stronger Brazilian Real exchange rate at

the end of the period and resulting in deferred tax income of

US$607,223 (six months to 30 June 2022 -- benefit of

US$199,222).

The Group has also incurred a tax charge in Brazil for the six

month period of US$738,787 (six months to 30 June 2022 -

US$593,744).

5. Earnings per share

6 months ended 30 June 2023 6 months ended 30 June 2022 3 months ended 30 June 2023 3 months ended 30 June 2022

(unaudited) (unaudited) (unaudited) (unaudited)

------------- --------------------------- --------------------------- --------------------------- ---------------------------

Profit

attributable

to ordinary

shareholders

(US$) 4,979,891 2,072,939 3,512,412 343,336

------------- --------------------------- --------------------------- --------------------------- ---------------------------

Weighted

average

ordinary

shares in

issue 75,734,551 75,734,551 75,734,551 75,734,551

Basic profit

per share (US

cents) 6.58c 2.74c 4.64c 0.45c

------------- --------------------------- --------------------------- --------------------------- ---------------------------

Diluted

ordinary

shares in

issue (1) 75,734,551 77,484,551 75,734,551 77,484,551

Diluted 6.58c 2.68c 4.64c 0.44c

profit per

share (US

cents)

------------- --------------------------- --------------------------- --------------------------- ---------------------------

(1) There were no share options outstanding at 30 June 2023 (30

June 2022: 1,750,000 options vested and exercisable as at 30 June

2022). At 30 June 2023 and 30 June 2022, there were 864,500

Conditional Share Awards in issue under the Serabi 2020 Restricted

Share Plan (the "2020 Plan") (see Note 13(c)). The underlying

shares to be issued pursuant to these Conditional Share Awards can

only be issued if certain performance conditions have been met and

at the end of the stipulated vesting period. Subsequent to the end

of the period the Company announced that 404,700 Conditional Share

Awards had lapsed as the performance conditions had not been

achieved. The vesting period for the remaining 459,800 Conditional

Share Awards has not yet been completed. Accordingly, none of the

Conditional Share Awards that may be issued in the future have been

included in the calculation of diluted earnings per share.

5. Post balance sheet events

Subsequent to the end of the period, there has been no item,

transaction or event of a material or unusual nature likely, in the

opinion of the Directors of the Company to affect significantly the

continuing operation of the entity, the results of these

operations, or the state of affairs of the entity in future

financial periods.

Attachment

-- Q2 2023 Financial Report

https://ml-eu.globenewswire.com/Resource/Download/c6e29d29-5644-4f9c-9493-ba8c39f8c4a5

(END) Dow Jones Newswires

August 31, 2023 02:00 ET (06:00 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

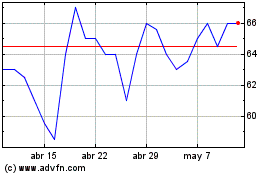

Serabi Gold (LSE:SRB)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Serabi Gold (LSE:SRB)

Gráfica de Acción Histórica

De May 2023 a May 2024