TIDMSTM

RNS Number : 9094N

STM Group PLC

28 September 2023

28 September 2023

STM Group Plc

("STM", "the Company" or "the Group")

Unaudited Interim Results for the six months ended 30 June

2023

STM Group Plc (AIM: STM), the multi-jurisdictional financial

services group, is pleased to announce its unaudited interim

results for the six months ended 30 June 2023.

Financial Highlights:

2023 2023 2022 2022

(reported) (underlying)** (reported) (underlying)**

Revenue GBP13.2m GBP13.2m GBP11.3m GBP11.3m

------------- ----------------- ------------- -----------------

Profit before GBP1.5m GBP1.8m GBP1.4m GBP1.7m

other items*

------------- ----------------- ------------- -----------------

Profit before GBP0.1m GBP0.4m GBP0.5m GBP0.8m

taxation ("PBT")

------------- ----------------- ------------- -----------------

Profit before

other items

margin 11% 14% 12% 15%

------------- ----------------- ------------- -----------------

Earnings per

share 0.17p N/A 0.62p N/A

------------- ----------------- ------------- -----------------

Cash at bank GBP13.8m GBP16.9m

(net of borrowings)

-------------------------------- --------------------------------

Interim dividend - 0.60p

-------------------------------- --------------------------------

* defined as revenue from continuing operations less operating

expenses i.e. profit from continuing operations before taxation,

net finance costs, depreciation, amortization, and non-operating

items such as bargain purchase gain and loss on the sale of

investments

** Underlying statistics are net of certain transactions which

are either non-recurring or exceptional and thus do not form part

of the normal course of business.

Operating Highlights:

-- Recurring revenue resilient at 95% of total revenues, similar to prior periods

-- Successful integration of Mercer SIPP and SSAS businesses

acquired in the second half of 2022

-- Completion of first part of the strategic review

-- The strategic review led in turn to a Group-wide technology

review as part of a drive to improve efficiencies and margins

-- Significant upfront work completed as part of being Consumer Duty ready

-- Appointment of new Head of Business Development, leading to

increased volumes of illustrations for our flexible annuity

products

-- Successful implementation of new client interest sharing policy

Post-period Highlights:

-- On 11 July 2023, the boards of STM, and PSF Capital GP II

Limited as general partner of PSF Capital Reserve LP ("Pension

SuperFund Capital"), announced that they had reached agreement in

principle on the key terms of a possible cash offer (the "Offer")

for the entire issued and to be issued share capital of the Company

at a price of 70 pence per share.

-- On 5 September 2023, the Company announced revised terms for

a possible cash offer at a price of 67 pence per share that would

be conditional upon the completion of a disposal of certain parts

of the Group that are non-core to the strategy of Pension SuperFund

Capital (the "Revised Possible Offer"). It was also announced that

Alan Kentish (a director and shareholder of the Company) had signed

heads of terms with STM and Pension SuperFund Capital to acquire

certain parts of the Group, comprising the UK SIPP businesses and

entities connected with the 'funder' of the Master Trust.

-- On 27 September 2023, the Company announced it had received a

revised proposal, being an offer price of up to 67 pence per share,

comprising 60 pence per share payable in cash upon completion of

the possible offer and a further 7 pence per share by way of an

unsecured loan note, repayable 12 months following the date on

which a firm intention to make an offer is announced in accordance

with Rule 2.7 of the City Code on Takeovers and Mergers (the

"Code"), with repayment contingent on certain conditions that are

being discussed between Pension SuperFund Capital and the Company.

It also announced discussions with Alan Kentish (a director and

shareholder of the Company) with respect to the acquisition of

certain parts of the Group had been revised such that it is now

proposed that Mr Kentish will only acquire the Group's UK SIPP

businesses.

-- The Company has also announced in accordance with Rule 2.6(a)

of the Code, that a further extension to the date by which Pension

SuperFund Capital is required either to announce a firm intention

to make an offer in accordance with Rule 2.7 of the Code or to

announce that it does not intend to make an offer for the Company

had been granted by the Takeover Panel, in order to allow further

time for these discussions to be completed. Consequently, Pension

SuperFund Capital is required either to announce a firm intention

to make an offer in accordance with Rule 2.7 of the Code or to

announce that it does not intend to make an offer for the Company

by not later than 5.00pm on 11 October 2023.

-- There can be no certainty that any offer will ultimately be made for the Company.

For further information, please contact:

STM Group Plc

Alan Kentish, Chief Executive Officer Via Walbrook PR

Therese Neish, Chief Financial Officer www.stmgroupplc.com

Cavendish Capital Markets Ltd (Nominated Tel: +44 (0)20 7600 1658

Adviser and Broker)

Matt Goode / Emily Watts / Abigail Kelly- https://www.cavendish.com

Corporate Finance

Tim Redfern - ECM

Walbrook PR Tel: +44 (0) 20 7933 8780

Tom Cooper / Joseph Walker Mob: +44 (0) 797 122 1972

STM@walbrookpr.com

Notes to editors:

STM is a multi-jurisdictional financial services group traded on

AIM, a market operated by the London Stock Exchange. The Group

specialises in the administration of client assets in relation to

retirement, estate and succession planning and wealth

structuring.

Today, the Group has operations in the UK, Gibraltar, Malta,

Australia and Spain. STM has developed a range of pension products

for UK nationals and internationally domiciled clients and has two

Gibraltar life assurance companies which provide life insurance

bonds - wrappers in which a variety of investments, including

investment funds, can be held.

STM's growth strategy is focused on both organic initiatives and

strategic acquisitions.

Further information on STM Group can be found at

www.stmgroupplc.com

Chief Executive's Review

Overview

I am pleased to present the results for the half year ended 30

June 2023. To say it has been a busy period would be an

understatement, firstly with the strategic review and more recently

in dealing with the possible offer by Pension SuperFund Capital for

the entire issued and to be issued share capital of the Company, as

first announced on 11 July 2023. During the recent months, the

management has been heavily focused on facilitating Pension

SuperFund Capital's due diligence workstreams. Despite the

exceptional circumstances, all colleagues and teams have worked

hard to ensure continued delivery of service to customers and value

to shareholders.

In this respect, and as previously announced, certain changes to

the policy on interest income were put into effect on 1 July 2023.

This allowed for better rate negotiations on client cash balances

with banks, and changes were made to how this was shared with

customers. Whilst the first half of the year has seen the benefits

of increased market interest rates and the income that can be

generated from funds held on behalf of clients, the second half of

the financial year is particularly expected to see the significant

benefits from the change in policy, as well as from the materially

rising interest rate environment which the Company has benefited

from during 2023. This increased interest income compensated for

income from new business generation across the Group being slower

than anticipated. With recurring operating revenue continuing to

hold up well when compared to the first half of 2022, the overall

revenue for the period was 17% higher than the prior period.

Operational expenses for the period were GBP11.7 million (2022:

GBP10.0 million), broadly in line with management expectations,

with overruns in certain expense categories, mainly legal and

professional costs, being compensated for by savings in personnel

costs. Non-operational expenses, classified as "other items" on the

income statement, increased in comparison with the prior period,

particularly in relation to finance costs (GBP302,000, 2022:

GBP99,000) and the non-cash item of amortisation of the client

portfolios (GBP672,000, 2022: GBP445,000). The increases were

expected following the acquisition of the additional SIPP and SSAS

portfolios from Mercer Ltd.

Financial review

Financial performance in the period

The Group delivered total revenue in the six months to 30 June

2023 of GBP13.2 million (2022: GBP11.3 million), of which GBP0.9

million was interest income (2022: GBP0.08 million). The current

period also saw the benefit of GBP1.4 million of income from the

Mercer portfolios which were acquired in September 2022 and which

therefore did not contribute to the revenues reported in the prior

period.

Recurring revenues at 95% of total revenues for the period

remained consistent and in line with the prior period (2022: 94%).

Recurring revenues for the current period were GBP12.6 million, as

compared to GBP10.6 million in the prior period, with GBP1.4

million being the contribution from the Mercer portfolios.

Profit before other items for the period was GBP1.5 million

(2022: GBP1.4 million), with reported profit before tax of GBP0.1

million (2022: GBP0.5 million). A number of one-off and

non-recurring costs, including legal and professional costs

associated with a strategic review of the business and other

contractual matters, were incurred during the period under review.

Adjusting for these non-recurring costs results in underlying

profit before other items of GBP1.8 million (2022: GBP1.7 million)

and underlying profit before tax of GBP0.4 million (2022: GBP0.8

million).

The reconciliation of reported measures to underlying measures

is made up of items which are either non-recurring or exceptional

and thus do not form part of the normal course of business. This

reconciliation for all three key financial measures is shown in the

table below:

RECONCILIATION OF REPORTED TO UNDERLYING MEASURES

----------------------------------------------------------------------------

REVENUE PROFIT BEFORE PROFIT BEFORE

OTHER ITEMS TAX

------------ ---------------- ----------------

2023 2022 2023 2022 2023 2022

----- ----- ------- ------- ------- -------

GBPm GBPm GBPm GBPm GBPm GBPm

----- ----- ------- ------- ------- -------

Reported measure 13.2 11.3 1.5 1.4 0.1 0.5

----- ----- ------- ------- ------- -------

Add: non-recurring costs - - 0.3 0.3 0.3 0.3

----- ----- ------- ------- ------- -------

Underlying measure 13.2 11.3 1.8 1.7 0.4 0.8

----- ----- ------- ------- ------- -------

Cashflows

Cash and cash equivalents as at 30 June 2023 were GBP18.9

million (2022: GBP18.1 million), with cash generated from operating

activities being GBP1.6 million (2022: GBP1.2 million), thus

exceeding the reported profit before tax.

During the period the Group also repaid GBP0.3 million of the

secured bank loan and the outstanding balance as at 30 June 2023

was GBP5.1 million. As a result, net cash and cash equivalents as

at 30 June 2023 amounted to GBP13.8 million (2022: GBP16.9

million).

As would be expected for a group which is regulated in several

jurisdictions , a significant proportion of the cash balances forms

part of the Group's regulatory and solvency requirements. It is not

possible to determine the exact amount of cash and cash equivalents

required for solvency purposes, as other assets can also be used to

support the regulatory solvency requirements. However, the

aggregated regulatory capital requirement across the Group as at 30

June 2023 was GBP15.7 million (2022: GBP16.9 million) largely due

to the increase in market interest rates resulting in a higher

discount rate being applied to the life assurance solvency capital

requirement.

Accrued income, in the form of work performed for clients but

not billed, as at 30 June 2023 amounted to GBP2.6 million (2022:

GBP1.6 million). This increase was largely because of the accrued

income on the Mercer portfolios acquired in September 2022, and

which would therefore not have been present at the previous period

end, and increased interest income accruals because of market rate

movements. This gives some visibility of revenue still to be billed

and subsequently collected as cash at bank.

Additionally, deferred income relating to annual fees invoiced

but not yet earned at 30 June 2023 amounted to GBP4.1 million

(2022: GBP3.9 million). This figure also gives good visibility of

revenue that is still to be earned through the Income Statement in

the coming months.

Trade receivables as at 30 June 2023 were GBP3.5 million (2022:

GBP3.4 million).

Prepayments increased by GBP0.6 million to GBP1.3 million (2022:

GBP0.7 million) as at the period end as compared to prior year

largely as a result of legal fees, claims excesses and Financial

Ombudsman Services fees incurred but recoverable from other

parties.

Other creditors and accruals increased by GBP2.0 million to

GBP6.7 million (2022 (restated): GBP4.7 million) as a result of the

Mercer portfolios acquisition and incremental movements in

operational accruals across the Group.

As more fully explained in Note 12, the comparative figures in

the Statement of Financial Position as at 30 June 2022 have been

restated to correct allocations previously made in the prior year's

interim financial statements in respect of liabilities for current

tax, trade and other receivables, and trade and other payables.

The reallocations had no impact on either the net asset position

of the Group as at 30 June 2022 or the income statement of the

Group for the six months ended on that date, both as previously

reported.

Dividend

Given the ongoing discussions with PSF in respect to a possible

offer, the Board has taken the decision not to declare an interim

dividend for the current period (2022: interim dividend of 0.6p

declared and subsequently paid).

Review of operations

Pensions

The pensions administration businesses continue to be the

cornerstone of our operations.

Pensions revenue for the period was GBP11.0 million (2022:

GBP9.1 million) representing 83% (2022: 80%) of total Group

revenues, with the Mercer portfolios accounting for GBP1.4 million

(GBP2022: GBPNil) of the GBP1.9 million of increased revenue. Total

pensions revenue arose as follows: GBP4.6 million (2022: GBP4.9

million) from QROPS, GBP3.7 million (2022: GBP1.8 million) from the

SIPP and SSAS businesses and a further GBP2.1 million (2022: GBP1.8

million) from the workplace pensions business. In addition, the

Group also achieved a revenue contribution of GBP0.6 million (2022:

GBP0.6 million) from third party administration and Group Pension

Plans.

The recurring revenue percentage for this operating segment

increased to 96% of all pensions revenues (2022: 95%), which, when

combined with the relatively low attrition rates, remains a solid

predictor of future divisional profitability.

With our new Group Head of Business Development having joined

earlier in the year and a new business development team now in

place, management believes that the pension businesses are now

better positioned to drive organic growth. The independent

strategic review commissioned in the period also identified areas

for focus in technology and processes, which the Group has

continued to explore during this period. Subject to the outcome of

the possible Offer and related management buy-out, there will be an

ongoing focus on these areas to enhance margins. Internationally,

the focus is on increasing revenue through our Malta occupational

pension schemes for international businesses.

Life Assurance

Revenue for the combined Life Assurance businesses amounted to

GBP1.9 million, which was consistent with the revenue generated in

the same period in 2022 (GBP1.9 million). In a similar manner to

the pensions operating segment, the life assurance businesses also

had high levels of recurring fees, which remained stable at 94% of

total life assurance revenues (2022: 94%).

Our flexible annuity products aimed at the UK market remain the

key focus for sustainable organic growth within our life

businesses. Conversion times for new business remain slow and

unpredictable, albeit with our new Business Development team fully

embedded the pipeline based on illustrations issued is now

considerably higher. The continuing effort to expand our

intermediary base is an important part of improving our new

business numbers.

Regulatory Developments and Consumer Duty

Consumer Duty, which is a framework set out by the Financial

Conduct Authority ("FCA") for providers and adviser firms of all

sizes providing financial products or adviser to consumers to

measure whether they are delivering good outcomes for UK consumers,

came into force on 31 July 2023. This framework puts greater focus

on firms to ensure they are actively assessing, improving and

evidencing how they are support UK consumers in making good

financial decisions about their future. Consumer duty applies to

firms operating in the UK, so it applies both to our UK SIPP

companies and to our Gibraltar companies that provide products and

service to UK residents and financial advisers.

Across the UK and Gibraltar, we implemented a Consumer Duty

working party project to oversee the implementation and review our

products and service. Various areas of our businesses, products and

services were reviewed with changes made to simplify our product

range as well as ensuring documentation, processes, procedures and

policies were all updated to reflect the regulatory changes. We are

pleased with the progress made and, whilst there are areas for

improvement, management are of the view that we are meeting our

regulatory requirements and our products and services are designed

to deliver good customer outcomes.

Outlook

Since 30 June 2023 (being the date to which STM's interim

results were drawn up), the Group has continued to demonstrate

resilience in its underlying business through the continuing high

levels of recurring revenues, supplemented by strengthening

interest income from its interest sharing model. As a result, the

Group expects to be in line with management's internal expectations

for the year ending 31 December 2023.

Possible Offer for the Company

The latest update on the possible offer was announced on 27

September 2023, when the Company updated that it had received a

revised proposal, being an offer price of up to 67 pence per share,

comprising 60 pence per share payable in cash upon completion of

the possible offer and a further 7 pence per share by way of an

unsecured loan note, repayable 12 months following the date on

which a firm intention to make an offer is announced in accordance

with Rule 2.7 of the Code, with repayment contingent on certain

conditions that being discussed between Pension SuperFund Capital

and the Company. It also announced discussions with Alan Kentish (a

director and shareholder of the Company) with respect to the

acquisition of certain parts of the Group had been revised such

that it is now proposed that Mr Kentish will only acquire the

Group's UK SIPP businesses.

The Company has also announced in accordance with Rule 2.6(a) of

the Code, that a further extension to the date by which Pension

SuperFund Capital is required either to announce a firm intention

to make an offer in accordance with Rule 2.7 of the Code or to

announce that it does not intend to make an offer for the Company

had been granted by the Takeover Panel, in order to allow further

time for these discussions to be completed. Consequently, Pension

SuperFund Capital is required either to announce a firm intention

to make an offer in accordance with Rule 2.7 of the Code or to

announce that it does not intend to make an offer for the Company

by not later than 5.00pm on 11 October 2023. The Board also notes

that there can be no certainty that any offer will ultimately be

made for the Company.

In the meantime, STM's executive management has continued to

focus on developing the underlying businesses of the Group.

Alan Kentish

Chief Executive Officer

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the period from 1 January 2023 to 30 June 2023

Unaudited Unaudited Audited

6 months 6 months Year to

to to 31 December

30 June 30 June 2022

2023 2022 GBP'000

Notes GBP'000 GBP'000

Revenue 5 13,208 11,323 24,094

Administrative expenses (11,729) (9,966) (20,773)

---------------------------------------- ------ ---------- ---------- -------------

Profit before other items 1,479 1,357 3,321

---------------------------------------- ------ ---------- ---------- -------------

OTHER ITEMS

Bargain purchase gain - - 327

(Loss)/gain on revaluation

of financial instruments (36) - 11

Loss on disposal of subsidiaries - - (162)

Finance costs (302) (99) (322)

Depreciation and amortisation (995) (778) (1,597)

---------------------------------------- ------ ---------- ---------- -------------

Profit before taxation 146 480 1,578

---------------------------------------- ------ ---------- ---------- -------------

Taxation (46) (111) (724)

---------------------------------------- ------ ---------- ---------- -------------

Profit after taxation 100 369 854

OTHER COMPREHENSIVE INCOME

Items that are or may be reclassified

to profit and loss

Foreign currency translation

differences for foreign operations (11) 13 12

---------------------------------------- ------ ---------- ---------- -------------

Total other comprehensive

(loss)/income (11) 13 12

Total comprehensive income

for the period/year 89 382 866

---------------------------------------- ------ ---------- ---------- -------------

Profit attributable to:

Owners of the Company 100 305 844

Non-controlling interests - 64 10

---------------------------------------- ------ ---------- ---------- -------------

100 369 854

---------------------------------------- ------ ---------- ---------- -------------

Total comprehensive income

attributable to:

Owners of the Company 89 318 856

Non-controlling interests - 64 10

---------------------------------------- ------ ---------- ---------- -------------

89 382 866

---------------------------------------- ------ ---------- ---------- -------------

Earnings per share basic (pence) 6 0.17 0.62 1.42

Earnings per share diluted

(pence) 6 0.17 0.62 1.42

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2023

Unaudited

Unaudited 30 June Audited

30 June 2022 31 December

2023 Restated 2022

(Note 12)

Notes GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Property and office equipment 933 1,317 1,161

Intangible assets 21,745 19,437 22,125

Financial assets 1,728 881 1,762

Deferred tax asset 51 76 58

Total non-current assets 24,457 21,711 25,106

------------------------------- ------ ---------- ----------- -------------

Current assets

Accrued income 2,576 1,550 860

Trade and other receivables 9 6,901 6,804 8,461

Receivables due from insurers 488 24,130 488

Cash and cash equivalents 8 18,931 18,118 19,234

------------------------------- ------ ---------- ----------- -------------

Total current assets 28,896 50,602 29,043

------------------------------- ------ ---------- ----------- -------------

Total assets 53,353 72,313 54,149

------------------------------- ------ ---------- ----------- -------------

EQUITY

Called up share capital 12 59 59 59

Share premium account 22,372 22,372 22,372

Retained earnings 14,482 14,734 14,382

Other reserves (2,322) (467) (1,843)

------------------------------- ------ ---------- ----------- -------------

Equity attributable to owners

of the Company 34,591 36,698 34,970

Non-controlling interests - (388) (68)

------------------------------- ------ ---------- ----------- -------------

Total equity 34,591 36,310 34,902

------------------------------- ------ ---------- ----------- -------------

LIABILITIES

Current liabilities

Liabilities for current tax 568 - 788

Trade and other payables 10 12,813 10,366 12,517

Provisions 488 24,130 488

------------------------------- ------ ---------- ----------- -------------

Total current liabilities 13,869 34,496 13,793

------------------------------- ------ ---------- ----------- -------------

Non-current liabilities

Other payables 11 4,566 1,074 5,050

Deferred tax liabilities 327 433 404

------------------------------- ------ ---------- ----------- -------------

Total non-current liabilities 4,893 1,507 5,454

------------------------------- ------ ---------- ----------- -------------

Total liabilities and equity 53,353 72,313 54,149

------------------------------- ------ ---------- ----------- -------------

STATEMENT OF CONSOLIDATED CASHFLOW

For the period from 1 January 2023 to 30 June 2023

Unaudited

Unaudited 30 June Audited

30 June 2022 31 December

2023 Restated 2022

(Note 12)

Notes GBP'000 GBP'000 GBP'000

Operating activities

Profit for the period/year before

tax 146 480 1,578

Adjustments for:

Depreciation of property and office

equipment 323 333 673

Amortisation of intangible assets 672 445 924

Loss on disposal of property and

office equipment 50 - 4

Unrealised loss/(gain) on financial

instruments at FVTPL 36 - (11)

Bargain purchase gain - - (327)

Taxation paid (337) (1,037) (619)

Decrease/(increase) in trade and

other receivables 1,560 1,150 (1,396)

Decrease in receivables due from

insurers - - 23,642

(Increase)/decrease in accrued

income (1,716) (239) 558

Increase in trade and other payables 857 116 2,428

Decrease in provisions - - (23,642)

Net cash generated from operating

activities 1,591 1,248 3,812

--------------------------------------- ------ ----------- ----------- -------------

Investing activities

Purchase of property and office

equipment (143) (13) (165)

Increase in intangible assets (292) (527) (937)

Disposal of investments - - 1,477

Purchase of financial instrument - - (1,734)

Acquisition of non-controlling

interests (400) - (120)

Consideration paid on acquisition

of subsidiaries and portfolio (220) - (3,454)

Net cash absorbed by investing

activities (1,055) (540) (4,933)

Financing activities

Proceeds from bank loan - - 4,463

Repayment of bank loan (275) (275) (550)

Interest paid on bank loan (190) (62) (162)

Lease liabilities paid (363) (473) (724)

Dividends paid 7 - - (891)

Net cash (absorbed by)/generated

from financing activities (828) (810) 2,136

--------------------------------------- ------ ----------- ----------- -------------

(Decrease)/increase in cash and

cash

equivalents (292) (102) 1,015

--------------------------------------- ------ ----------- ----------- -------------

Reconciliation of net cash flow

to movement in net funds

Analysis of cash and cash equivalents

during the period/year

(Decrease)/increase in cash and

cash equivalents (292) (102) 1,015

Effect of movements in exchange

rates on cash and cash equivalents (11) 13 12

--------------------------------------- ------ ----------- ----------- -------------

Balance at start of period/year 8 19,234 18,207 18,207

Balance at end of period/year 8 18,931 18,118 19,234

--------------------------------------- ------ ----------- ----------- -------------

STATEMENT OF CONSOLIDATED CHANGES IN EQUITY

For the period from 1 January 2023 to 30 June 2023

Foreign Share

Currency Based

Share Share Retained Treasury Translation Payments Other Non-Controlling Total

Capital Premium Earnings Shares Reserve Reserve Reserve Total Interests Equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

----------------- -------- -------- --------- --------- ------------ --------- --------- -------- ---------------- --------

Balance at 1

January 2022 59 22,372 14,429 (549) (93) 162 - 36,380 (452) 35,928

----------------- -------- -------- --------- --------- ------------ --------- --------- -------- ---------------- --------

TOTAL COMPREHENSIVE INCOME FOR THE YEAR

Profit for the

year - - 844 - - - - 844 10 854

Other comprehensive income

Foreign currency

translation

differences - - - - 12 - - 12 - 12

Transactions with owners, recorded directly in equity

Acquisition of

non-controlling

interests - - - - - - (1,375) (1,375) 374 (1,001)

Dividend paid - - (891) - - - - (891) - (891)

At 31 December

2022 and 1

January

2023 59 22,372 14,382 (549) (81) 162 (1,375) 34,970 (68) 34,902

----------------- -------- -------- --------- --------- ------------ --------- --------- -------- ---------------- --------

TOTAL COMPREHENSIVE INCOME FOR THE PERIOD

Profit for the

period - - 100 - - - - 100 - 100

Other comprehensive income

Foreign currency

translation

differences - - - - (11) - - (11) - (11)

Transactions with owners, recorded directly in equity

Acquisition of

non-controlling

interests - - - - - - (468) (468) 68 (400)

At 30 June 2023 59 22,372 14,482 (549) (92) 162 (1,843) 34,591 - 34,591

----------------- -------- -------- --------- --------- ------------ --------- --------- -------- ---------------- --------

NOTES TO THE CONSOLIDATED RESULTS

For the period from 1 January 2023 to 30 June 2023

1. Reporting entity

STM Group Plc (the "Company") is a company incorporated and

domiciled in the Isle of Man and was admitted to trading on AIM, a

market operated by London Stock Exchange plc, on 28 March 2007. The

address of the Company's registered office is 1(st) Floor, Viking

House, St Paul's Square, Ramsey, Isle of Man, IM8 1GB. The Group is

primarily involved in financial services.

2. Basis of preparation

Results for the period from 1 January 2023 to 30 June 2023 have

not been audited.

The consolidated results have been prepared in accordance with

International Financial Reporting Standards ("IFRS"),

interpretations adopted by the International Accounting Standards

Board ("IASB") and in accordance with Isle of Man law and IAS 34,

Interim Financial Reporting.

3. Significant accounting policies

The accounting policies in these consolidated results are the

same as those applied in the Group's consolidated financial

statements for the year ended 31 December 2022. No changes in

accounting policies are expected to be reflected in the Group's

consolidated financial statements for the year ended 31 December

2023.

4. Segmental information

STM Group has three reportable segments: Pensions, Life

Assurance and Other Services. Each segment is defined as a set of

business activities generating a revenue stream and offering

different services to other operating segments. The Group's

operating segments have been determined based on the management

information reviewed by the CEO and Board of Directors.

The Board assesses the performance of the operating segments

based on turnover generated. The performance of the operating

segments is not measured using costs incurred as the costs of

certain segments within the Group are predominantly centrally

controlled and therefore the allocation of these is based on

utilisation of arbitrary proportions. Management believes that this

information and consequently profitability could potentially be

misleading and would not enhance the disclosure above.

The following table presents the turnover information regarding

the Group's operating segments:

Operating Segment Unaudited Unaudited Audited

6m 2023 6m 2022 2022

GBP'000 GBP'000 GBP'000

Pensions 10,978 9,072 18,421

Life Assurance 1,937 1,910 5,001

Other Services 293 341 672

------------------- ---------- ---------- ---------

Total 13,208 11,323 24,094

------------------- ---------- ---------- ---------

Analysis of the Group's turnover information by geographical

location is detailed below:

Geographical Segment Unaudited Unaudited Audited

6m 2023 6m 2022 2022

GBP'000 GBP'000 GBP'000

Gibraltar 2,945 2,976 7,324

Malta 3,588 3,755 7,178

United Kingdom 6,425 4,251 9,110

Other 250 341 482

---------------------- ---------- ---------- ---------

Total 13,208 11,323 24,094

---------------------- ---------- ---------- ---------

5. Revenue

Unaudited Unaudited Audited

6m 2023 6m 2022 2022

GBP'000 GBP'000 GBP'000

Revenue from administration of assets 12,275 11,244 23,563

Interest and investment income 933 79 531

--------------------------------------- ---------- ---------- ---------

Total 13,208 11,323 24,094

--------------------------------------- ---------- ---------- ---------

.

6. Earnings per share

Earnings per share for the period from 1 January 2023 to 30 June

2023 is based on the profit after taxation of GBP100,000 divided by

the weighted average number of GBP0.001 ordinary shares during the

period of 59,408,088 basic.

A reconciliation of the basic and diluted number of shares used

in the period ended 30 June 2023 and 30 June 2022 is as

follows:

2023 2022

Weighted average number of shares 59,408,088 59,408,088

Share incentive plan (issued but not fully - -

allocated)

-------------------------------------------- ----------- -----------

Diluted 59,408,088 59,408,088

-------------------------------------------- ----------- -----------

7. Dividends

The following dividends were declared and paid by the Group

during the period:

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

0.0 pence (2022: 1.5 pence) per qualifying

ordinary share - - 891

----------- ----------- -------------

8. Cash and cash equivalents

Cash at bank earns interest at floating rates based on

prevailing rates. The fair value of cash and cash equivalents in

the Group is GBP18,931,000 (2022: GBP18,118,000).

9. Trade and other receivables

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'000 Restated GBP'000

GBP'000

Trade receivables 3,543 3,421 4,266

Prepayments 1,296 723 999

Other receivables 2,062 2,660 3,196

------------------- ---------- ---------- -------------

Total 6,901 6,804 8,461

------------------- ---------- ---------- -------------

10. Trade and other payables

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'000 Restated GBP'000

GBP'000

Deferred income 4,139 3,869 3,842

Trade payables 1,069 547 882

Bank loan (secured) 550 550 552

Lease liabilities 335 638 570

Contingent consideration - 56 56

Other creditors and accruals 6,720 4,706 6,615

------------------------------ ---------- ---------- -------------

Total 12,813 10,366 12,517

------------------------------ ---------- ---------- -------------

The Company signed a credit facility with Royal Bank of Scotland

(International) Ltd for GBP5.50 million in 2020, with drawn down

being completed in September 2022 to fund the acquisition of the

Mercer portfolios. The facility has a 5-year term from November

2020, with capital repayments structured over ten years and a final

instalment to settle the outstanding balance in full at the end of

the 5 years. At the period-end, the balance outstanding on this

facility was GBP5.1 million. Interest on the loan is charged at

3.5% per annum over the Sterling Relevant Reference Rate on the

outstanding balance. Prior to fully drawing down the loan, interest

was paid on the undrawn balance at a rate of 1.75% per annum over

the Sterling Relevant Reference Rate.

The facility is subject to customary cashflow to debt service

liability ratios and EBITDA (profit before other items) to debt

service liability ratio covenants tested quarterly and is secured

by a capital guarantee provided by a number of non-regulated

holding subsidiary companies within the Group and debenture over

these companies.

11. Other payables - amounts falling due in more than a year

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Lease liabilities 28 273 143

Bank loan (secured) (Note 10) 4,538 625 4,811

Other payables - 176 96

-------------------------------

Total 4,566 1,074 5,050

------------------------------- ---------- ---------- -------------

12. Reclassification - reallocation of prior year corporate tax

and payroll tax obligations

The comparative figures in the Statement of Financial Position

as at 30 June 2022 have been restated to correct allocations

previously made in the prior year's interim financial

statements.

The Statement of Financial Position as at 30 June 2022 disclosed

GBP786,000 as a corporate tax liability whereas this liability was

in relation to payroll obligations due but not paid. Similarly,

other creditors and accruals previously reported as at 30 June 2022

included a recoverable of GBP255,000 in relation to a refund of

corporation tax due from the Malta authorities.

The above reallocations had no impact on either the net asset

position of the Group as at 30 June 2022 or the income statement of

the Group for the six months ended on that date, both as previously

reported. The tables below reflect the impact of this change in

presentation.

Unaudited as at 30 June 2022

As previously As

reported Reallocation restated

GBP'000 GBP'000 GBP'000

ADJUSTMENTS IN RELATION TO CURRENT ASSETS

Trade and other receivables

Other receivables 2,405 255 2,660

Trade and other receivables 6,549 255 6,804

------------------------------------------- --------------- --------------- ----------

CURRENT ASSETS 50,347 255 50,602

------------------------------------------- --------------- --------------- ----------

Unaudited as at 30 June 2022

As previously As

reported Reallocation restated

GBP'000 GBP'000 GBP'000

ADJUSTMENTS IN RELATION TO CURRENT LIABILITIES

Liabilities for current tax 786 (786) -

Trade and other payables

Other creditors and accruals 3,665 1,041 4,706

Trade and other payables 9,325 255 10,366

------------------------------------------------ -------------- --------------- ----------

TOTAL CURRENT LIABILITIES 34,241 255 34,496

------------------------------------------------ -------------- --------------- ----------

TOTAL LIABILITIES AND EQUITY 72,058 255 72,313

------------------------------------------------ -------------- --------------- ----------

13. Called up share capital

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Authorised

100,000,000 ordinary shares of GBP0.001

each 100 100 100

Called up, issued and fully paid

59,408,088 ordinary shares of GBP0.001

each 59 59 59

---------- ---------- -------------

14. Subsequent events

On 11 July 2023, the boards of STM, and Pension SuperFund

Capital", announced that they had reached agreement in principle on

the key terms of a possible cash offer (the "Offer") for the entire

issued and to be issued share capital of the Company at a price of

70 pence per share.

On 5 September 2023, the Company announced revised terms for a

possible cash offer at a price of 67 pence per share that would be

conditional upon the completion of a disposal of certain parts of

the Group that are non-core to the strategy of Pension SuperFund

Capital (the "Revised Possible Offer"). It was also announced that

Alan Kentish (a director and shareholder of the Company) had signed

heads of terms with STM and Pension SuperFund Capital to acquire

certain parts of the Group, comprising the UK SIPP businesses and

the businesses connected with and including the Master Trust.

On 27 September 2023, the Company announced it had received a

revised proposal, being an offer price of up to 67 pence per share,

comprising 60 pence per share payable in cash upon completion of

the possible offer and a further 7 pence per share by way of an

unsecured loan note, repayable 12 months following the date on

which a firm intention to make an offer is announced in accordance

with Rule 2.7 of the Code, with repayment contingent on certain

conditions that are under negotiation between Pension SuperFund

Capital and the Company. It also announced discussions with Alan

Kentish (a director and shareholder of the Company) with respect to

the acquisition of certain parts of the Group had been revised such

that it is now proposed that Mr Kentish will only acquire the

Group's UK SIPP businesses.

The Company has also announced in accordance with Rule 2.6(a) of

the Code, that a further extension to the date by which Pension

SuperFund Capital is required either to announce a firm intention

to make an offer in accordance with Rule 2.7 of the Code or to

announce that it does not intend to make an offer for the Company

had been granted by the Takeover Panel, in order to allow further

time for these discussions to be completed. Consequently, Pension

SuperFund Capital is required either to announce a firm intention

to make an offer in accordance with Rule 2.7 of the Code or to

announce that it does not intend to make an offer for the Company

by not later than 5.00pm on 11 October 2023. The Board also notes

that there can be no certainty that any offer will ultimately be

made for the Company.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUPUBUPWGBM

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

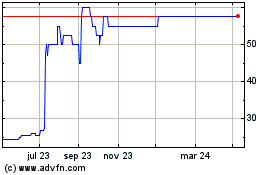

Stm (LSE:STM)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Stm (LSE:STM)

Gráfica de Acción Histórica

De May 2023 a May 2024