TIDMSYNC

RNS Number : 4254V

Syncona Limited

09 August 2022

Syncona Limited

Achilles reports Q2 2022 Financial Results and Business

Highlights

09 August 2022

Syncona Ltd, a leading healthcare company focused on founding,

building and funding a portfolio of global leaders in life science,

notes that its portfolio company, Achilles Therapeutics Plc

(Nasdaq: ACHL) ("Achilles"), announced its financial results for

the second quarter ended June 30, 2022, and an update on recent

business highlights.

Key highlights from the announcement include:

-- Achilles expects to provide initial data from the higher dose

clinical cohorts of the Phase I/IIa clinical trials of its clonal

neoantigen-reactive T cell (cNeT) therapy in non-small cell lung

cancer (NSCLC) and melanoma in Q4 CY2022

-- The company's manufacturing facility at the Cell and Gene

Therapy Catapult has been approved by the UK Medicines and

Healthcare products Regulatory Agency to produce cNeT products to

support its ongoing Phase I/IIa clinical trials in NSCLC and

melanoma, significantly increasing Achilles' manufacturing

capacity

-- Cash balance of $202 million to support all planned

operations into Q2 CY2025, including completion of its ongoing

Phase I/IIa clinical trials

The announcement can be accessed on Achilles' website at:

https://ir.achillestx.com/ and the full text of the announcement

from Achilles is contained below.

[S]

Enquiries

Syncona Ltd

Annabel Clark / Natalie Garland-Collins / Fergus Witt

Tel: +44 (0) 20 3981 7940

FTI Consulting

Ben Atwell / Julia Bradshaw / Tim Stamper

Tel: +44 (0) 20 3727 1000

About Syncona

Syncona's purpose is to invest to extend and enhance human life.

We do this by founding and building a portfolio of global leaders

in life science to deliver transformational treatments to patients

in areas of high unmet need.

Our strategy is to found, build and fund companies around

exceptional science to create a diversified portfolio of 15-20

globally leading healthcare businesses for the benefit of all our

stakeholders. We focus on developing treatments for patients by

working in close partnership with world-class academic founders and

management teams. Our balance sheet underpins our strategy enabling

us to take a long-term view as we look to improve the lives of

patients with no or poor treatment options, build sustainable life

science companies and deliver strong risk-adjusted returns to

shareholders.

Achilles Therapeutics Reports Second Quarter 2022 Financial

Results and Recent Business Highlights

- Additional clinical data from the ongoing Phase I /IIa trials

in advanced NSCLC (CHIRON) and melanoma (THETIS) expected to be

available in Q4 2022 -

- Cell & Gene Therapy Catapult manufacturing facility

approved by MHRA for cNeT production in CHIRON and THETIS clinical

trials -

- Strong cash balance of $202 million supports all planned

operations into Q2 2025 -

London, UK 9 August 2022 - Achilles Therapeutics plc (NASDAQ:

ACHL), a clinical-stage biopharmaceutical company developing

precision T cell therapies to treat solid tumors, today announced

its financial results for the second quarter ended June 30, 2022,

and recent business highlights.

"We remain focused on advancing our lead clinical programs,

evaluating cNeT monotherapy in CHIRON for advanced non-small cell

lung cancer (NSCLC), and exploring both cNeT monotherapy and the

combination with a PD-1 checkpoint inhibitor in THETIS for

recurrent or metastatic malignant melanoma. We expect initial

activity, safety and translational science data in the fourth

quarter of this year from patients receiving higher-dose cNeT

products," said Dr Iraj Ali, Chief Executive Officer of Achilles

Therapeutics. "We are very pleased that the UK Medicines and

Healthcare products Regulatory Agency (MHRA) has now approved

Achilles' Cell and Gene Therapy Catapult Manufacturing Centre

(Catapult) site to produce cNeT products in the ongoing CHIRON and

THETIS clinical trials, significantly increasing our manufacturing

capacity for 2022 and beyond."

Business Highlights

-- On track to present additional clinical data in Q4 2022 from

the ongoing Phase I/IIa CHIRON and THETIS clinical trials in

patients with advanced NSCLC and recurrent or metastatic melanoma,

respectively.

-- Expanded global manufacturing capacity with the MHRA approval

of Achilles' Catapult facility for cNeT production in CHIRON and

THETIS and entered into a partnership agreement for clinical

manufacturing in the United States with the Center for Breakthrough

Medicines, a contract development and manufacturing organization in

King of Prussia, PA.

-- Awarded a EUR4 million ($4.2 million(1) ) research and

innovation award as part of a consortium to develop a

first-in-class smart bioprocessing manufacturing platform, with

EUR1.4 million ($1.5 million(1) ) allocated to Achilles.

-- Initiated the tumor archiving program (TAP) to study the

potential of producing cNeT from tumor material collected and

stored earlier in disease progression.

-- Strengthened the Company's leadership with the following

appointments: Bernhard Ehmer to the Board of Directors, James

Taylor as Chief Business Officer, and Cassian Yee, MD to the

Scientific Advisory Board.

-- Received the 2022 Pharmaceutical Industry Network Group

(PING) Innovation Award, acknowledging the innovation demonstrated

by the Company's work with clonal neoantigens to treat solid

tumors, including the Company's AI-powered PELEUS(TM)

bioinformatics platform and proprietary VELOS(TM) manufacturing

process.

Financial Highlights

-- Cash and cash equivalents: Cash and cash equivalents were

$201.6 million as of June 30, 2022, as compared to $266.3 million

as of December 31, 2021. The Company anticipates that its cash and

cash equivalents are sufficient to fund its planned operations into

the second quarter of 2025, including completion of the ongoing

Phase I/IIa CHIRON and THETIS clinical trials.

-- Research and development (R&D) expenses: R&D expenses

were $14.8 million for the second quarter ended June 30, 2022, as

compared to $10.8 million for the second quarter ended June 30,

2021. The increase was primarily driven by increased activity

related to our ongoing clinical trials and overall R&D.

-- General and administrative (G&A) expenses: G&A

expenses were $5.8 million for the second quarter ended June 30,

2022, as compared to $5.4 million for the second quarter ended June

30, 2021. The increase was primarily driven by an increase in

headcount and related personnel costs.

-- Net loss: Net loss for the second quarter ended June 30,

2022, was $17.3 million or $0.44 per share compared to $16.2

million, or $0.45 per share for the second quarter ended June 30,

2021.

Achilles will participate in the following investor and medical

conferences in August and September 2022. Additional details will

be available in the Events & Presentations section of the

Company's website:

-- BTIG Biotechnology Conference 2022: August 8 - 9, 2022

-- Phacilitate Advanced Therapies Europe: August 31 - September 1, 2022

-- H.C. Wainwright Annual Global Investment Conference: September 12 - 14, 2022

-- Cantor Fitzgerald's Cell & Genetic Medicines Conference: September 15, 2022

-- Immuno UK: September 29 - 30, 2022

About Achilles Therapeutics

Achilles is a clinical-stage biopharmaceutical company

developing precision T cell therapies targeting clonal neoantigens:

protein markers unique to the individual that are expressed on the

surface of every cancer cell. The Company has two ongoing Phase

I/IIa trials, the CHIRON trial in patients with advanced non-small

cell lung cancer (NSCLC) and the THETIS trial in patients with

recurrent or metastatic melanoma. Achilles uses DNA sequencing data

from each patient, together with its proprietary AI-Powered

PELEUS(TM) bioinformatics platform, to identify clonal neoantigens

specific to that patient, and then develop precision T cell-based

product candidates specifically targeting those clonal

neoantigens.

Forward-Looking Statements

This press release contains express or implied forward-looking

statements that are based on our management's belief and

assumptions and on information currently available to our

management. Although we believe that the expectations reflected in

these forward-looking statements are reasonable, these statements

relate to future events or our future operational or financial

performance, and involve known and unknown risks, uncertainties and

other factors that may cause our actual results, performance, or

achievements to be materially different from any future results,

performance or achievements expressed or implied by these

forward-looking statements. The forward-looking statements in this

press release represent our views as of the date of this press

release. We anticipate that subsequent events and developments will

cause our views to change. However, while we may elect to update

these forward-looking statements at some point in the future, we

have no current intention of doing so except to the extent required

by applicable law. You should therefore not rely on these

forward-looking statements as representing our views as of any date

subsequent to the date of this press release.

(1) June 30, 2022 exchange rate of EUR1.000 = $1.043

Investors:

Achilles Therapeutics

Lee M. Stern, VP, IR & External Communications

l.stern@achillestx.com

LifeSci Advisors

John Mullaly

jmullaly@lifesciadvisors.com

Media:

Consilium Strategic Communications

Mary-Jane Elliott, Sukaina Virji, Melissa Gardiner

+44 (0) 203 709 5000

achillestx@consilium-comms.com

ACHILLES THERAPEUTICS PLC

Condensed Consolidated Balance Sheets (Unaudited)

(in thousands, except share and per share amounts)

(expressed in U.S. Dollars, unless otherwise stated)

June 30, December 31,

2022 2021

--------- --------------

ASSETS

Current assets:

Cash and cash equivalents $ 201,595 $ 266,319

Prepaid expenses and other current assets 25,985 18,430

-------- ----------

Total current assets 227,580 284,749

-------- ----------

Non-current assets:

Property and equipment, net 17,626 17,743

Operating lease right of use assets 9,470 11,048

Deferred tax assets 26 26

Restricted cash 33 33

Other assets 2,983 3,507

-------- ----------

Total non-current assets 30,138 32,357

-------- ----------

TOTAL ASSETS $ 257,718 $ 317,106

======== ==========

LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities:

Accounts payable $ 6,651 $ 3,722

Income taxes payable 18 -

Accrued expenses and other liabilities 8,720 10,906

Operating lease liabilities-current 4,480 4,482

-------- ----------

Total current liabilities 19,869 19,110

Non-current liabilities:

Operating lease liabilities-non-current 5,640 7,777

Other long-term liability 621 691

-------- ----------

Total non-current liabilities 6,261 8,468

-------- ----------

Total liabilities 26,130 27,578

-------- ----------

Commitments and contingencies (Note 12)

Shareholders' equity:

Ordinary shares, GBP0.001 par value; 40,774,014 and 40,603,489 shares

authorized, issued and outstanding at June 30, 2022 and

December 31, 2021, respectively 54 54

Deferred shares, GBP92,451.851 par value, one share authorized, issued

and outstanding at June 30, 2022 and December 31, 2021 128 128

Additional paid in capital 405,504 401,821

Accumulated other comprehensive (loss) income (20,343) 6,636

Accumulated deficit (153,755) (119,111)

-------- ----------

Total shareholders' equity 231,588 289,528

-------- ----------

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $ 257,718 $ 317,106

======== ==========

A CHILLES THERAPEUTICS PLC

Condensed Consolidated Statements of Operations and

Comprehensive Loss (Unaudited)

(in thousands, except share and per share amounts)

Three Months Ended June 30, Six Months Ended June 30,

------------------------------- -----------------------------

2022 2021 2022 2021

---------------- ------------ --------------- -----------

OPERATING EXPENSES:

Research and development $ 14,776 $ 10,844 $ 27,790 $ 19,720

General and administrative 5,770 5,445 11,725 10,277

------------ ----------- ----------- ----------

Total operating expenses 20,546 16,289 39,515 29,997

------------ ----------- ----------- ----------

Loss from operations (20,546) (16,289) (39,515) (29,997)

OTHER INCOME, NET:

Other income 3,271 146 4,900 101

------------ ----------- ----------- ----------

Total other income, net 3,271 146 4,900 101

------------ ----------- ----------- ----------

Loss before provision for income

taxes (17,275) (16,143) (34,615) (29,896)

Provision for income taxes (14) (13) (29) (25)

------------ ----------- ----------- ----------

Net loss (17,289) (16,156) (34,644) (29,921)

------------ ----------- ----------- ----------

Other comprehensive income:

Foreign exchange translation

adjustment (19,302) (925) (26,979) 1,138

------------ ----------- ----------- ----------

Comprehensive loss $ (36,591) $ (17,081) $ (61,623) $ (28,783)

------------ ----------- ----------- ----------

Net loss per share attributable

to ordinary shareholders-basic

and diluted $ (0.44) $ (0.45) $ (0.89) $ (1.60)

============ =========== =========== ==========

Weighted average ordinary shares

outstanding-basic and diluted 39,104,375 35,683,187 38,998,686 18,756,599

============ =========== =========== ==========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UPURWRUPPUBB

(END) Dow Jones Newswires

August 09, 2022 07:05 ET (11:05 GMT)

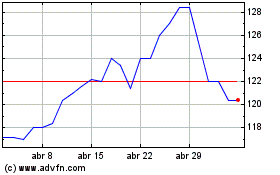

Syncona (LSE:SYNC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Syncona (LSE:SYNC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024