TIDMTENG

RNS Number : 1913Y

Ten Lifestyle Group PLC

03 May 2023

3 May 2023

Ten Lifestyle Group plc

("Ten", the "Company" or the "Group")

Interim results for the six months ended 28 February 2023

Ten Lifestyle Group plc (AIM: TENG), the platform driving

customer loyalty for global financial institutions and other

premium brands, is pleased to announce its unaudited Interim

Results for the six months ended 28 February 2023 ("H1").

Financial

-- Net Revenue (1) at GBP30.9m, an increase of 49%, compared to

the first half of the prior year (H1 2022: GBP20.8m); 18% higher

than the second half of the prior year (H2 2022: GBP26.1m)

o supplier revenue (2) increased 42% to GBP3.4m (H1 2022:

GBP2.4m)

o corporate revenue (3) increased 49% to GBP27.5m (H1 2022:

GBP18.4m)

o Net Corporate Revenue Retention Rate (4) of 144% (H1 2022:

105%)

-- Adjusted EBITDA (5) of GBP5.0m, an increase of GBP4.1m

compared to first half of the prior year (H1 2022: GBP0.9m) and

above the second half of the prior year (H2 2022: GBP4.0m)

-- Profit before tax of GBP0.4m, a GBP3.2m increase compared to

the first half of the prior year (H1 2022: GBP(2.8)m)

-- Cash and cash equivalents of GBP7.2m (FY 2022: GBP6.6m) and

net cash of GBP0.5m (FY 2022: GBP3.2m)

Operational

-- Record number of Active Members (6) , up 43% compared to the

first half of the prior year to 316k (H1 2022: 221k, H2 2022:

275k)

-- New mandate won in the Americas and 100% of Material

Contracts retained, a number of key contract renewals and contract

extensions signed

Maintained investment in proprietary digital platforms,

communications, and technologies to improve service quality and

efficiency, GBP7.1m (H1 2022: GBP6.5m)

-- Member satisfaction levels (7) have improved during the

period, a key indicator of repeat use and value to our corporate

clients

CURRENT TRADING AND OUTLOOK

Since the end of the first half of the financial year, member

activity remains robust in all regions. Ten continues to develop

its proposition and technology, having retained all Material

Contracts during the period and developed a healthy pipeline of

future potential launches.

The Board's expectations for the full financial year are

unchanged.

Alex Cheatle, CEO of Ten Lifestyle Group, said;

"We are pleased to report our first profit before tax since our

IPO in 2017, which provided capital to invest primarily in new

geographical markets and technology. Our digital platform is now

rolled out in over 40 countries. We reported an impressive 49% Net

Revenue growth year-on-year , meaning Ten is well positioned to

continue to drive our growth engine, even as we target sustained

cash generation."

Analyst Presentation

An online analyst presentation will be held by video link today

at 9:00am.

The Group will also be presenting an Investor Webinar for

current and prospective investors tomorrow, Thursday 4 May 2023 at

5:30pm BST .

To attend either the Analyst Presentation or the Investor

Webinar, please email investorrelations@tengroup.com .

For further information please visit www.tenlifestylegroup.com

or call:

Ten Lifestyle Group plc

Alex Cheatle, Chief Executive Officer +44 (0)20 7850

Alan Donald, Chief Financial Officer 2796

Peel Hunt LLP, Nominated Advisor and Broker

Paul Gillam +44 (0) 20 7418

James Smith 8900

(1) Net Revenue excludes the direct cost of sales relating to

certain member transactions managed by the Group.

(2) Supplier revenue is Net Revenue from Ten's supplier base,

such as hotels, airlines and event promoters which sometimes pay

commission to Ten.

(3) Corporate revenue is Net Revenue from Ten's corporate

clients, including service fees, implementation fees and fees for

the customisation of the Ten Digital Platform.

(4) Net Corporate Revenue Retention Rate is the annual

percentage change in corporate revenue, less non-recurring revenue

(i.e., non-recurring service fees, implementation fees and fees for

the customisation of the Ten Digital Platform), from corporate

client programmes operating in the previous year.

(5) Adjusted EBITDA is operating profit/(loss) before interest,

taxation, amortisation, depreciation, share-based payment expense

and exceptional items.

(6) Individuals holding an eligible product, employment, account

or card with one of Ten's corporate clients are "Eligible Members",

with access to Ten's platform, configured under the relevant

corporate client's programme, with Eligible Members who have used

the platform in the past twelve months becoming "Active

Members".

(7) Ten categorises its corporate client contracts based on the

annualised value paid, or expected to be paid, by the corporate

client for the provision of concierge and related services by Ten

as: Small contracts (below GBP0.25m); Medium contracts (between

GBP0.25m and GBP2m); Large contracts (between GBP2m and GBP5m); and

Extra Large contracts (over GBP5m). This does not include the

revenue generated from suppliers through the provision of concierge

services. Medium, Large and Extra Large contracts are collectively

Ten's "Material Contracts".

(8) Ten measures member satisfaction using the Net Promoter

Score management tool, which gauges the loyalty of a firm's

customer relationships ( https://en.wikipedia.org/wiki/Net_Promoter

).

OPERATING AND FINANCIAL REVIEW

CHIEF EXECUTIVE'S STATEMENT

The positive momentum seen in the business during 2022 has

continued, with Ten seeing increased Net Revenue and Active Members

for the fourth consecutive half-year period. Alongside this record

Net Revenue, Ten generated its first half year profit before tax

since its IPO in 2017, even whilst continuing to invest in its

proprietary technology and other innovations.

Net Revenue increased 49% to GBP30.9m (H1 2022: GBP20.8m), 39%

at constant currency, and Adjusted EBITDA increased GBP4.1m to

GBP5.0m (H1 2022: GBP0.9m), GBP3.9m at constant currency. Growth

has been achieved in all regions, with broad success in developing

existing contracts and winning new mandates with existing and new

corporate clients. This success has resulted in a 49% increase in

corporate revenue (H1: GBP27.5m; H1 2022: GBP18.4m).

Growth was especially high in the Americas following new

programme launches and good continued recovery in member activity.

Growth was slowest in APAC, where travel is still restricted in

some areas.

Throughout the period, we have focused on improving Ten's

proprietary technology, content, and service quality, further

improving our member proposition, which continued to boost the

number of Active Members.

FY 2019 FY 2020 FY 2021 H1 2022 FY 2022 H1 2023

Total Active

Members ('000) 192 226 203* 221 275 316

---------- ---------- ---------- ---------- ---------- ----------

*Impacted by COVID-19.

Member satisfaction, as measured by Net Promoter Score (NPS),

has also improved during the period. Our member engagement and

satisfaction metrics continue to be instrumental in demonstrating a

positive return on corporate client investment in the service. This

has helped us retain 100% of our Material Contracts .

We have maintained investment in technology, communications, and

content, with GBP7.1m invested in the period (H1 2022: GBP6.5m).

This includes development of the digital experience,

personalisation, automation and AI technology that drives member

engagement as well as greater efficiencies and scale. We believe

that our market-leading digital capability continues to clearly

differentiate us from our competition and that our strong client

retention and contract tender successes validate our strategy.

In addition to new contract wins and development of existing

contracts, such as the expansion of Large contracts in each of

Latin America and EMEA, we have continued to grow the penetration

of our service amongst Eligible Members, resulting in an increase

in the number of Active Members. This is enabled through a stronger

proposition, communicated even more effectively due to improved

automation and personalisation.

Our corporate clients often measure the usage of our platform as

a key metric to evaluate the Return on Investment from our service.

As we continue to expand our digital service, this will, in turn

help to reduce the cost "per interaction" to the Corporate Client

and further demonstrate the cost-effectiveness of our service.

Our proposition improvements are focused in our four service

pillars - dining, travel, live entertainment and retail - and

include improved access, better pricing (typically not available to

the public), value-add benefits and insightful editorial content.

Ten's high-quality concierge, content and support services are

delivered to our members and corporate clients from committed

experts in over 20 offices globally, led by an outstanding

management team.

We believe these results further strengthen Ten's position as

the platform driving customer loyalty for global financial

institutions and other premium brands, through service delivery,

technology integration, personalisation and unique content projects

that enhance member experience and improve customer loyalty metrics

for our corporate clients.

We remain committed to building a sustainable business and are

more aware than ever of the impact our business and members have on

the world around us. That's why we continue to expand our range of

ESG partners and services across travel, dining, retail and

entertainment to deliver increased member choice. Enhancing the

visibility of these options across all channels, including our

inspirational content, and digital platform will drive sustainable

decisions amongst our members.

FINANCIAL REVIEW

Results

H1 2023 H1 2022 change

GBPm GBPm GBPm

Revenue 32.4 21.3 11.1

Net Revenue 30.9 20.8 10.1

Operating expenses and Other income (25.9) (19.9) (6.0)

Adjusted EBITDA 5.0 0.9 4.1

-------- -------- -------

Adjusted EBITDA % 16.1% 4.3%

Depreciation (1.5) (1.3) (0.2)

Amortisation (2.5) (2.2) (0.4)

Share-based payments (0.4) (0.3) (0.1)

-------- -------- -------

Operating Profit/(Loss) before interest and tax 0.6 (2.9) (0.1)

Net finance (expense)/income (0.1) 0.1 (0.2)

-------- -------- -------

Profit/(Loss) before taxation 0.4 (2.8) 3.2

Taxation expense (0.6) (0.4) (0.3)

-------- -------- -------

Loss for the period (0.2) (3.2) 3.0

Revenue

Revenue for the current period has increased significantly to

GBP32.4m, a 52% increase compared to the first half of the prior

year (H1 2022: GBP21.3m). Net Revenue has increased to GBP30.9m, a

49% increase compared to the first half of the prior year (H1 2022:

GBP20.8m), 39% at constant currency. This increase in Net Revenue

was driven by an increase in activity across the existing business

as well as new mandates won and launched. Revenue for the period is

now higher than pre-pandemic levels, with a 27% increase compared

to H1 2020 (GBP25.6m), the last undisturbed period prior to the

pandemic.

Corporate revenue for H1 2023 was GBP27.5m, a 49% increase

compared to the first half of the prior year (H1 2022: GBP18.4m)

(38% at constant currency) and now 29% above pre-COVID levels (H1

2020: GBP21.3m), with a Net Corporate Revenue Retention Rate of

144% (H1 2022: 105%), as core recurring revenue increased from

GBP16.9m to GBP24.3m. Supplier revenue (predominantly travel

related) was GBP3.4m, a 42% increase compared to the first half of

the prior year (H1 2022: GBP2.4m) and 36% higher than pre-COVID

levels (H1 2020: GBP2.5m).

Operating expenses & other income excluding depreciation,

amortisation, share-based payments and exceptional items

Operating expenses and other income for the period was GBP25.9m,

an increase of GBP6.0m (30%), compared to the first half of the

prior year (H1 2022: GBP19.9m), mainly due to an increase in

employee costs, reflecting higher headcount to support growth as

activity increased.

Adjusted EBITDA

Adjusted EBITDA, as reported, takes into account all Group

operating costs, other than the depreciation of GBP1.5m (H1 2022:

GBP1.3m), amortisation of GBP2.5m (H1 2022: GBP2.2m), and

share-based payment expenses of GBP0.4m (H1 2022: GBP0.4m). On this

basis, Adjusted EBITDA was a profit of GBP5.0m (H1 2022: GBP0.9m),

GBP3.9m at constant currency rates.

Depreciation has increased by GBP0.2m and amortisation increased

by GBP0.3m, reflecting our continued technology investment.

Share-based payment expenses increased by GBP0.1m as the number of

options granted in the period was higher than in the prior

year.

Profit before tax

Profit before tax was GBP0.4m, a GBP3.2m improvement compared to

the first half of the prior year (H1 2022: GBP(2.8)m), and our

first reported half year profit before tax since IPO in November

2017.

Regional performance

Segmental Net Revenue reporting reflects our servicing location

rather than the location of our corporate clients. This allows us

to understand and track the efficiency and profitability of our

operations around the world.

GBPm H1 2023 H1 2022 % change

EMEA 13.3 10.0 +33%

-------- -------- ---------

Americas 13.1 6.5 +102%

-------- -------- ---------

APAC 4.5 4.3 +6%

-------- -------- ---------

Total 30.9 20.8 +49%

-------- -------- ---------

After fully allocating our indirect central costs including IT,

platform support, non-lease costs and management across the

regions, in line with headcount, the Adjusted EBITDA profitability

of each regional segment is:

GBPm H1 2023 H1 2022

EMEA 4.0 1.8

-------- --------

Americas 1.0 (1.1)

-------- --------

APAC (0.1) 0.2

-------- --------

Total 5.0 0.9

-------- --------

Adjusted EBITDA % of Net Revenue 16.1% 4.3%

-------- --------

EMEA

Net Revenue in the region during the period increased by 33%

compared to the first half of the prior year, to GBP13.3m (H1 2022:

GBP10.0m). The increase in Net Revenue was primarily driven by a

recovery of the base business, new business launched together with

higher supplier revenue due to increased member requests across

dining, entertainment, travel and events. We also improved

operational efficiency across the region. This has resulted in

Adjusted EBITDA of GBP4.0m (H1 2022: GBP1.8m), an increase of

GBP2.2m.

Americas

Net Revenue from the region during the period increased by 102%

compared to the first half of the prior year, to GBP13.1m (H1 2022:

GBP6.5m). The GBP6.6m increase in revenue in the region reflected

the recovery in base business activity and new business launched

together with an increase in supplier revenue as travel activity

returned. As the region grew it drove operational efficiencies as

we leveraged the Net Revenue growth. As a result, Adjusted EBITDA

was a profit of GBP1.0m (H1 2022 loss: GBP(1.1)m).

APAC

Net Revenue from the region during the period has increased by

6% compared to the first half of the prior year, to GBP4.5m (H1

2022: GBP4.3m). Adjusted EBITDA loss for the region was GBP(0.1)m

(H1 2022: GBP0.2m),slightly below prior year as we invested

additional resources specifically in Japan to service the post

Covid increase in activity.

Cash flow

H1 2023

GBPm

Profit before tax 0.4

Net finance expense 0.1

Working capital changes (1.4)

Non-cash items (share-based payments, depreciation and

amortisation) 4.4

--------

Operating cash flow 3.5

Capital expenditure (0.2)

Investment in intangibles (3.7)

Taxation (0.4)

--------

Cash outflow (0.8)

Cash flows from financing activities

Interest on loan paid (0.2)

Loan Receipts - Invoice financing 2.1

Loan Receipts - Loan notes 1.2

Repayment of leases and net interest (1.4)

--------

Net cash generated by financing activities 1.7

Foreign currency movements (0.3)

--------

Net increase in cash and cash equivalents 0.6

Cash and cash equivalents 7.2

--------

The pre-tax operating cash inflows of GBP3.5m reflected a profit

before tax of GBP0.4m, decreased net working capital of GBP1.4m

(due to a specific late client receipt of GBP1.0m; now received)

and add-back of non-cash items of GBP4.4m.

Additionally, during the period, we made GBP3.7m of capital

investment into our global content, internal CRM platform (TenMAID)

and the continued development of our digital platform.

Additional loan notes of GBP1.2m were issued during the period

and a new GBP2.1m invoice financing facility was entered into

during the period with the Group's bank. Repayment of leases and

net interest of GBP1.4m resulted in an increase in cash and cash

equivalents during the period of GBP0.6m.

Balance sheet

H1 FY

2023 2022

GBP'm GBP'm

Intangible assets 14.5 13.4

Property, plant and equipment 0.9 0.9

Right-of-use assets 1.9 2.2

Cash 7.2 6.6

Other current assets 11.7 10.1

Current lease liabilities (1.8) (1.8)

Current liabilities (17.6) (17.3)

Short term borrowings (3.6) (1.5)

Long term borrowings (3.1) (1.9)

Non-current lease liabilities (0.4) (0.9)

------- -------

Net assets 9.7 9.8

------- -------

Share capital/Share premium 30.8 30.7

Reserves (21.1) (20.9)

------- -------

Total equity 9.7 9.8

------- -------

Net assets decreased slightly to GBP9.7m at 28 February 2023

compared to GBP9.8m at 31 August 2022. This was primarily due to an

increase in long term borrowings, increasing to GBP3.1m (FY 2022:

GBP1.9m) and short-term borrowings, increasing to GBP3.6m (FY 2022:

GBP1.5m) to support the continued growth in the business.

Principal Risks and Uncertainties

The principal risks and uncertainties facing the Group remain

broadly consistent with the principal risks and uncertainties

reported in Ten's 2022 Annual Report. Regional inflation and cost

of living pressures have increased costs and led to some price

increases with corporate clients in the year. Macroeconomic changes

in each region are monitored by the Senior Leadership Team as well

as by the Board. The Group reviews its pricing in line with changes

in the macroeconomic environment and external cost pressures.

Alex Cheatle Alan Donald

Chief Executive Officer Chief Finance Officer

03 May 2023 03 May 2023

Consolidated statement of comprehensive income

Note 6 months 6 months

to 28 to 28

Feb 2023 Feb 2022

Unaudited Unaudited

GBP'000 GBP'000

Revenue 2 32,382 21,326

Cost of sales on principal member transactions (1,528) (574)

---------- ----------

Net Revenue 2 30,854 20,752

Other cost of sales (849) (638)

Gross profit 30,005 20,114

Administrative expenses (29,767) (23,139)

Other income 300 150

Operating profit before amortisation, depreciation,

interest, share based payments, exceptional items

and taxation ("Adjusted EBITDA") 4,953 886

Depreciation (1,473) (1,305)

Amortisation 3 (2,526) (2,156)

Share-based payment expense (416) (300)

Exceptional items - -

----------------------------------------------------- ----- ---------- ----------

Operating profit 538 (2,875)

Net finance (expense) / income (149) 36

---------- ----------

Profit / (loss) before taxation 389 (2,839)

Taxation expense 4 (574) (316)

---------- ----------

Loss for the period (185) (3,155)

========== ==========

Other comprehensive (expense)/income:

Foreign currency translation differences (407) (174)

Total comprehensive loss for the period (592) (3,329)

========== ==========

Basic and diluted loss per ordinary share 5 (0.2)p (3.8)p

The consolidated statement of comprehensive income has been

prepared on the basis that all operations are continuing

operations.

Consolidated statement of financial position

Note 28 Feb 2023 31 August

2022

Unaudited Audited

GBP'000 GBP'000

Non-current assets

Intangible assets 3 14,554 13,397

Property, plant and equipment 886 939

Right-of-use assets 1,880 2,274

----------

Total non-current assets 17,320 16,610

------------ ----------

Current assets

Inventories 67 118

Trade and other receivables 11,619 9,930

Cash and cash equivalents 7,158 6,584

----------

Total current assets 18,844 16,632

------------ ----------

Total assets 36,164 33,242

============ ==========

Current liabilities

Trade and other payables (16,759) (16,459)

Provisions (850) (846)

Borrowings 6 (3,591) (1,500)

Lease Liabilities (1,755) (1,834)

Total current liabilities (22,955) (20,639)

------------ ----------

Net current liabilities (4,111) (4,007)

============ ==========

Non-current liabilities

Borrowings 6 (3,086) (1,940)

Lease liabilities (441) (820)

Total non-current liabilities (3,527) (2,760)

------------ ----------

Total liabilities (26,482) (23,399)

============ ==========

Net assets 9,682 9,843

============ ==========

Equity

Called up share capital 84 84

Share premium account 30,673 30,658

Merger relief reserve 1,993 1,993

Treasury reserve 513 513

Foreign exchange reserve (954) (547)

Retained deficit (22,627) (22,858)

Total equity 9,682 9,843

============ ==========

Consolidated statement of changes in equity

Share Share Merger Foreign Treasury Retained Total

capital premium relief exchange reserve deficit

account reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 September 2021

(Audited) 82 29,356 1,993 (410) 5 (19,079) 11,947

--------- --------- --------- ---------- --------- --------- --------

Loss for the year - - - - - (4,316) (4,316)

Foreign exchange - - - (137) - - (137)

Total comprehensive income

for the year - - - (137) - (4,316) (4,453)

Shares purchased by Employee

Benefit Trust (EBT) - - - - 508 - 508

Issue of share capital 2 1,302 - - - - 1,304

Equity-settled share-based

payments charge - - - - - 537 537

Balance at 31 August 2022

(Audited) 84 30,658 1,993 (547) 513 (22,858) 9,843

Loss for the period - - - - - (185) (185)

Foreign exchange - - - (407) - - (407)

Total comprehensive income

for the period - - - (407) - (185) (592)

Issue of share capital - 15 - - - - 15

Equity-settled share-based

payments charge - - - - - 416 416

Balance at 28 February 2023

(Unaudited) 84 30,673 1,993 (954) 513 (22,627) 9,682

========= ========= ========= ========== ========= ========= ========

Condensed consolidated statement of cash flows

6 months 6 months

to 28 Feb to 28 Feb

2023 2022

GBP'000 GBP'000

Cash flows from operating activities

Loss for the period, after tax (185) (3,155)

Adjustments for:

Taxation expense 574 316

Net finance expense 149 (36)

Amortisation of intangible assets 2,526 2,156

Depreciation of property, plant and equipment 254 229

Depreciation of right-of-use asset 1,219 1,076

Equity-settled share-based payment expense 416 300

Movement in working capital:

Decrease in inventories 51 28

Increase/(Decrease) in trade and other payables 205 (2,723)

(Increase)/Decrease in trade and other receivables (1,689) 3,201

Cash from/(used in) by operations 3,520 1,392

Tax paid (401) (236)

Net cash from by operating activities 3,119 1,156

----------- -----------

Cashflows from Investing activities

Purchase of intangible assets (3,683) (2,927)

Purchase of property, plant and equipment (250) (457)

Finance income 6 -

Net cash used by investing activities (3,927) (3,384)

----------- -----------

Cash flows from financing activities

Lease Liability repayments (1,280) (1,093)

Sale of treasury shares - 518

Interest paid (178) -

Loan Receipts - Invoice financing 2,084 -

Loan Receipts - Loan notes 1,185 -

Interest paid on IFRS 16 lease liabilities (81) (93)

Cash receipts from issue of share capital 15 1,302

Net cash used by financing activities 1,745 634

----------- -----------

Foreign currency movements (363) 54

Net increase /(decrease) in cash and cash

equivalents 574 (1,540)

Cash and cash equivalents at beginning

of period 6,584 6,662

Cash and cash equivalents at end of period

Cash at bank and in hand 7,158 5,122

Cash and cash equivalents 7,158 5,122

=========== ===========

Notes to the Interim Financial Information

1. Basis of preparation

These condensed consolidated financial statements have been

prepared using accounting policies based on International Financial

Reporting Standards (IFRS and IFRIC Interpretations) issued by the

International Accounting Standards Board ("IASB") as contained in

UK-adopted IFRS. They do not include all disclosures that would

otherwise be required in a complete set of financial statements and

should be read in conjunction with the 31 August 2022 Annual

Report. The financial information for the half years ended 28

February 2023 and 28 February 2022 does not constitute statutory

accounts within the meaning of Section 434 (3) of the Companies Act

2006 and both periods are unaudited.

The annual financial statements of Ten Lifestyle Group plc ('the

Group') are prepared in accordance with International standards in

conformity with the requirements of the Companies Act 2006 ('IFRS')

and with those parts of the Companies Act 2006 applicable to

companies reporting under IFRS (except as otherwise stated). The

comparative financial information for the year ended 31 August 2022

included within this report does not constitute the full statutory

Annual Report for that period. The statutory Annual Report and

Financial Statements for year ended 31 August 2022 have been filed

with the Registrar of Companies. The Independent Auditors' Report

in the Annual Report and Financial Statements for the year ended 31

August 2022 was unqualified, did not draw attention to any matters

by way of emphasis and did not contain a statement under 498(2)-(3)

of the Companies Act 2006.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its year ended 31 August 2022 annual financial statements other

than the Groups tax charge is not accounted for under the same

basis as IAS 34. The tax charge is calculated using the expected

effective tax rate at the reporting date. There are no new

standards effective yet and that would be expected to have a

material impact on the entity in the current period.

Going Concern

The ability of the Group to continue as a going concern is

contingent on the ongoing viability of the Group. The Group meets

its day-to-day working capital requirements through its cash

balances and wider working capital management. As at 28 February

2023, the date of the interim consolidated financial statements,

the Group had cash of GBP7.2m. The Group also has loans totalling

GBP4.6m, of which GBP1.5m is short term and due to be repaid in

June 2023 and GBP3.1m which are long term and due to be repaid in

August 2025. Additionally, GBP2.1m of debt was raised during the

period under a new invoice financing facility, which was entered

into in January 2023, to support the Group's working capital

requirements

To evaluate the Group's ability to operate as a going concern,

the Directors have reviewed the cash flow forecasts covering a

period of at least twelve months from the date of approval of the

interim consolidated financial statements. The Group's forecasts

and projections, taking account of reasonably possible changes in

trading performance for the principal risks, show that the Group

expects to be able to operate as a going concern within the level

of its current cash resources.

The Directors have considered the following scenarios when

considering forecasts to support their going concern conclusion

-- Base case cashflow forecast to 31 August 2024

-- Downside cashflow forecast to 31 August 2024 and mitigating actions available

Base Case Scenario

The Base Case forecast reviewed by the Directors is in line with

expectations for the current financial year and FY 2024. The Net

Revenue assumptions are consistent with growth trends around base

business growth, net contract wins and supplier revenue growth.

Cost assumptions reflect changes in Net Revenue as well as

continual improvements in operational efficiencies.

Downside scenario and mitigating actions

This scenario assumes a reduction of 20% in our variable Net

Revenue for the year to 31(st) August 2024. If this scenario was to

develop. The Group has a number of mitigating actions available to

it, including reducing direct operating costs to align to Net

Revenue growth rates as well as reducing indirect costs supporting

the business. Note, as per base case long term debt of GBP3.1m

(repayable in August 2025) and invoice discounting facility of

GBP2.1m remains in place with short term debt of GBP1.5m repaid in

June 2023.

Conclusion

The Directors have evaluated the Groups ability to operate as a

going concern under the above scenarios and has determined that it

has adequate resources to continue in operational existence for the

foreseeable future. The Group's cash flow forecasts show that it

expects to be able to operate as a going concern within the level

of its current cash resources. The Group has also identified cost

savings available to it should it experience a reduction in

revenue. The Group has assessed the principal risks and other

matters discussed in connection with the going concern statement

and has a reasonable expectation that it has adequate resources to

continue in operational existence for the foreseeable future.

Accordingly, the consolidated financial statements have been

prepared on a going concern basis.

The Board of Directors approved this interim report on 3 May

2023.

2. Segmental Information

The total revenue for the Group has been derived from its

principal activity; the provision of concierge services.

6 months 6 months

to 28 Feb to 28 Feb

2023 2022

(Unaudited) (Unaudited)

GBP'000 GBP'000

EMEA 13,278 10,014

Americas 13,069 6,483

APAC 4,507 4,255

------------ ------------

Net Revenue 30,854 20,752

Add back: Cost of sales on principal transactions 1,528 574

------------ ------------

Revenue 32,382 21,326

EMEA 4,036 1,830

Americas 1,007 (1,143)

APAC (90) 199

------------ ------------

Adjusted EBITDA 4,953 886

Amortisation (2,526) (2,156)

Depreciation (1,473) (1,305)

Share-based payment expense (416) (300)

------------ ------------

Operating profit / (loss) 538 (2,875)

Foreign exchange (loss)/gain 106 129

Other net finance expense (255) (93)

------------ ------------

Profit / (loss) before taxation 389 (2,839)

Taxation expense (574) (316)

------------ ------------

Loss for the period (185) (3,155)

============ ============

Net Revenue is a non-GAAP Group measure that excludes the direct

cost of sales relating to member transactions managed by the Group,

such as the cost of airline tickets sold under the Group's ATOL

licences. Net Revenue is the measure of the Group's income on which

segmental performance is measured.

Adjusted EBITDA is a non-GAAP Company specific measure excluding

interest, taxation, amortisation, depreciation, share-based

payment, and exceptional costs. Adjusted EBITDA is the main measure

of performance used by the Board, who are considered to be the

chief operating decision makers. Adjusted EBITDA is the principal

operating metric for a segment.

The statement of financial position is not analysed between

reporting segments. Management and the chief operating

decision-maker consider the statement of financial position at a

Group level.

3. Intangible Assets

The Group capitalised GBP3.7m (H1 2022: GBP2.9m, FY 2022:

GBP6.6m) of costs representing the development of Ten's global

digital platform, TenMAID (Ten's proprietary customer relationship

management system) resulting in a net book value of GBP14.6m (H1

2022: GBP12.3m, FY 2022: GBP13.4m) after an amortisation charge of

GBP2.5m (H1 2022: GBP2.2m, FY 2022: GBP4.6m).

4. Taxation

The income tax expense has been recognised based on the best

estimate of the weighted average annual effective Group tax rate

expected for the full financial year. The income tax expense of

GBP0.6m (H1 2022: GBP0.4m) includes foreign taxes recognised by

overseas Group companies on a territory-by-territory basis using

the expected effective tax rate for the full year.

5. Earnings Per Share

6 months to 28 Feb 2023 6 months to 28 Feb 2022

GBP'000 GBP'000

Loss attributable to equity shareholders of the parent (185) (3,155)

------------------------ ------------------------

Weighted average number of ordinary shares in issue (net of

treasury) 83,808,935 83,195,255

Basic loss per share (pence) (0.2)p (3.8)p

------------------------ ------------------------

Where the Group has incurred a loss in the six-month period to

28 February 2023, the diluted earnings per share is the same as the

basic loss per share as the loss has an anti-dilutive effect.

6. Borrowings

In addition to the Group's GBP4.6m of loans (FY 2022: GBP3.4m),

on the 25(th) of January 2023 the Group entered an invoice

financing facility available up to a maximum of GBP2.1m, of which

the full facility of GBP2.1m has been utilised at 28 February 2023.

The Group has invoice financing facilities in place relating to

trade receivables due from large corporate clients of Ten Lifestyle

Management Ltd that are denominated in USD$ and GBPGBP. The trade

receivables guaranteed under the arrangement totalled GBP3.3m (PY:

GBPnil). The Group retains the credit risk associated to these

trade receivables and therefore presents these trade receivables

gross within the reported current assets. The liability arising

from the invoice financing is presented as borrowings within

current liabilities. The invoice financing facility is guaranteed

to the value of the debts advanced and accrues interest at a rate

of 2% over the base rate.

8. Cautionary Statement

This document contains certain forward-looking statements

relating to Ten Lifestyle Group plc. The Company considers any

statements that are not historical facts as "forward-looking

statements". They relate to events and trends that are subject to

risk and uncertainty that may cause actual results and the

financial performance of the Company to differ materially from

those contained in any forward-looking statement. These statements

are made by the Directors in good faith based on information

available to them and such statements should be treated with

caution due to the inherent uncertainties, including both economic

and business risk factors, underlying any such forward-looking

information.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAFSAEEDDEAA

(END) Dow Jones Newswires

May 03, 2023 02:00 ET (06:00 GMT)

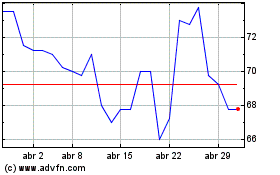

Ten Lifestyle (LSE:TENG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Ten Lifestyle (LSE:TENG)

Gráfica de Acción Histórica

De May 2023 a May 2024