TIDMTHR

RNS Number : 1754U

Thor Mining PLC

29 July 2022

29 July 2022

Thor Mining PLC

("Thor" or the "Company")

Quarterly Activities Report

Highlights Outlook for September Quarter

2022

------------------------------------------------------------- ----------------------------------------------------------------

GOLD, LITHIUM, NICKEL

Ragged Range, Pilbara region,

WA Australia

* Mapping and sampling programs continuing; testing * An Airborne Magnetics Survey to commence over the

potential gold, copper-gold and eastern portion of tenure.

lithium-caesium-tantalum (LCT) targets across tenure.

Initial results from sampling highlight up to 6g/t

gold and 4.8 % copper. * RC drilling assays results.

* Electromagnetic (EM) conductor identified beneath * Potential follow up drilling of drill targets

nickel gossan from Fixed Loop Electromagnetic Survey generated from RC assay and rock chip results.

(FLEM) over the Krona Prospect.

* Full results from regional mapping and sampling

* 3,120m RC drilling program completed in early July at programs, targeting additional gold, copper and LCT

Sterling and Krona Prospects. pegmatites.

* Down Hole Electromagnetic Survey in cased Krona

drillhole.

* Interpretation of airborne magnetics and radiometrics

data.

------------------------------------------------------------- ----------------------------------------------------------------

URANIUM & VANADIUM USA

* Final authorisation for proposed drilling program at * Commence drilling program.

Wedding Bell Project received.

* Downhole radiometric logging of drillholes.

* Drilling preparations underway to test Groundhog, Rim

Rock and Section 23 at Wedding Bell Project,

Colorado.

------------------------------------------------------------- ----------------------------------------------------------------

COPPER

Alford East, SA Australia

* Government approvals received for Phase 2 diamond * Review drill targets highlighted in recent 3D

drilling program, targeting potential high-grade modelling exercise.

copper zones along strike.

* Hydrogeology quarterly water characterisation

sampling undertaken.

Kapunda, SA Australia (via 30% equity holding in EnviroCopper

Ltd)

* ISR push-pull trials underway, with tracer bromide * Copper-gold recoveries from lixiviant trials received

component completed. and integration into Scoping Study.

------------------------------------------------------------- ----------------------------------------------------------------

TUNGSTEN & MULTI COMMODITIES

Molyhil, NT Australia

Assay results from 2021 drilling * Review strategic plans for Molyhil.

identified a 46m intersection

of magnetite skarn and weakly

disseminated tungsten-molybdenum-copper

mineralisation.

------------------------------------------------------------- ----------------------------------------------------------------

CORPORATE & FINANCE

-- Mark Potter Non-Executive Chair resigned from the Board on 30

June 2022, with Alastair Clayton taking on the Non-Executive Chair

role.

Nicole Galloway Warland, Managing Director of Thor Mining,

commented:

"The June quarter has seen a flurry of on-ground activities,

with our exploration focus on advancing the Ragged Range Project

(WA), including the completion of a c. 3,000m RC program and

organising upcoming drilling for our Uranium and Vanadium Wedding

Bell Project in Colorado, USA.

"At our 100% owned Ragged Range Project, Thor is continuing to

build on and develop our geological understanding, with particular

emphasis on structural controls on mineralisation at both the

Sterling gold prospect and Kelly's copper-gold prospect. Activities

include our latest sampling programs, which have highlighted highly

encouraging high-grade gold (6/t Au) and copper values (4.8% Cu)

along newly identified structures at Sterling and Kelly's

Prospects, and the completion of the c. 3,000m RC drilling program,

which included drill testing of a FLEM Conductor at Krona

nickel-copper prospect.

"In the US, we were delighted to receive full authorisation from

federal, state and counties for the upcoming proposed drill testing

at the Wedding Bell Project, Colorado, during the period. Drilling

preparations are now underway to test the project's priority areas,

Groundhog, Rim Rock and Section 23.

"We look forward to receiving the RC drill results at Ragged

Range and being on the ground drilling at our Wedding Bell project

during the September quarter."

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Photo 1: Reverse Circulation drilling at Sterling Prospect,

Ragged Range, WA

RAGGED RANGE PROJECT

The Ragged Range Project, located in the prospective Eastern

Pilbara Craton, Western Australia (Figure 1) is 100% owned by Thor

Mining and comprises E46/1190, E46/1262, E46/1355, E46/1340, plus

the recently granted E46/1393 (Figure 1).

Since the acquisition, Thor has conducted several programs of

stream sediment and soil sampling to delineate drill targets. Thor

has also flown an airborne magnetics survey over the tenement area

to better define the structural features of the area. Thor drilled

48 RC holes totalling 3,120m at the Sterling and Krona prospects,

with drilling completed in July 2022.

Further details of the projects may be found on the Thor

website: www.thormining.com/projects/ragged-range-pilbara-project

.

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Figure 1: Ragged Range Project Location map (left) and Tenement

Map (right) showing priority prospects

Fixed Loop Electromagnetics (FLEM) Survey - Krona Prospect -

Nickel Gossan

A high-powered Fixed Loop Electromagnetics (FLEM) ground

geophysics survey was completed over the Krona Prospect in June,

covering the full extent of the nickel gossan, located in the

western portion of the tenure (Figures 1 and Figure 2) (AIM: THR 17

June 2022). This is the first ground geophysics survey on the

Ragged Range Project. The survey over the gossan was designed to

detect conductive anomalies at depth that may indicate the presence

of massive nickel-copper sulphide mineralisation to constrain

initial drill testing.

A single loop FLEM survey over the Krona prospect identified a

conductor at the southern end of the gossan (Figure 2 and Figure

3). The conductor was modelled as a shallow flat lying feature

approximately 100m deep (Figure 3) and is consistent with

sulphides. The shallow (100m) conductor gives Thor a clear drill

target, that was drill tested as part of RC program at the adjacent

Sterling Prospect (Figure 3).

The gossan was initially identified by the Western Australian

Geological Survey on the Split Rock 1:100K mapping explanatory

notes (Bagas et al., 2004). The gossan extends over 1km x 100m and

lies on the basal contact of the Dalton Suite ultramafics, with the

older Wyman Formation, felsic volcanics.

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Figure 2: FLEM survey showing EM conductor overlain on the 100K

GSWA Geology.

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Figure 3 : 3D modelled EM conductor

Drilling

Thor drilled 48 reverse circulation "RC" holes totalling 3,120m

at the Sterling and Krona prospects, Ragged Range Project (Figure

4), with drilling completed in July (AIM: THR 11 July 2022).

STERLING PROSPECT

11 drill traverses were completed along the Sterling Prospect

13km structural gold corridor, with drill holes generally angled

-60 degrees toward the west, near perpendicular to the structural

controls of the dominant faulted contact between the Euro Basalt

and the Dalton Suite ultramafics (Figure 4). Drill depths range

from approximately 60-170m.

This second phase of drilling tested interpreted dilational

zones (potential trap sites for mineralisation and the potential

source of the gold anomalies found in stream and soil samples).

Surface anomalism is associated with a series of faults and folds,

subparallel or at a low angle to the regional thrust faulted

contact (Norman Cairns Fault) between the Euro Basalt and the

Dalton Suite ultramafics (Figure 1 and 4). In a number of the

drillholes, fuchsite and/or sericite alteration, with pyrite and

arsenopyrite were observed, important indicators for gold

mineralisation.

KRONA PROPSECT

As part of the drilling program, one drill hole was drilled into

the FLEM conductor recently identified below the nickel gossan at

Krona Prospect, (Figure 1 and Figure 4) (AIM: THR 17 June 2022).

This hole has been cased in preparation for a future Downhole

Electromagnetic Survey ("DHEM") survey.

DJC Drilling Pty Ltd completed the drilling program. Drill

samples have been received by the Bureau Veritas laboratory in

Adelaide, with assay results anticipated in August/September.

Sampling Update- High-grade Copper and Gold found at the

Sterling and Kelly's Prospects

In parallel with the recently completed RC drilling at the

Sterling and Krona Prospects (AIM: THR 11 July 2022), three rock

chip and stream sediment sampling programs across the Ragged Range

Project area have been undertaken.

The geological mapping and sampling programs were designed

to:

-- Further develop and validate Thor's geological model by

identifying key mineralising structures and gold distribution at

the Sterling prospect.

-- Sample historic copper working at Kelly's Prospect to gain a

greater understanding of the controlling structures, the tenor of

gold mineralisation associated with the visible copper and /or

geochemical.

-- Lithological boundaries.

-- Review lithological boundaries and potential alteration

signatures using newly-acquired ASTER data.

-- Identify potential outcropping lithium-caesium-tantalum (LCT)

enriched pegmatites.

97 rock chip samples and 24 stream samples were collected in

total (of which 57 rock chips and 12 stream sample results have

been received back from the laboratory to date), highlighting

significant gold and copper mineralisation and assisting with the

structural interpretation of key controlling structures at Sterling

and Kelly's Prospects (Figure 5) (AIM: THR 25 July 2022).

No outcropping LCT-enriched pegmatites have been identified to

date; however, lithium exploration will continue with stream and

soil sampling within the 10km halo (referred to as goldilocks zone)

around the prospective Mondana Monzogranite, part of the Split Rock

Supersuite. Encouraging anomalous pathfinders in some stream

sediment samples warrant further investigation.

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Figure 4: Sterling and Krona prospects highlighting completed RC

drilling traverses

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Figure 5: Sampling Location Map showing the high-grade copper

and gold results at Sterling and Kelly's prospects

STERLING PROSPECT

The focus to date at the Sterling Prospect has been on the 13km

gold corridor defined by stream and soil samples along the

north-northwest thrust faulted contact between the Dalton Suite

ultramafics and the Euro Basalt (Norman Cairn Fault). After a

detailed geological and structural review of the complex folding

and faulting within the ultramafics and basalts by consultant

geologist Jennifer Gunter, Virga Consulting Pty Ltd, several

priority areas and potential dilutional zones were highlighted,

warranting ground- truthing, rock chip sampling, and follow up

drill testing. Close to one of these new structural target areas

(R27), a coarse stream sediment sample (ST0002) reported 0.98g/t Au

with one grain of gold noted in the pan. This target was tested

with five drillholes on two sections, while other targets were

tested as part of the recently completed RC drilling program (AIM:

THR 11 July 2022).

The 6g/t Au rock chip sample (R00053) lies within the "Kink

zone": in Central Sterling, an area of complex faulting and

significant dilation. This gold sample was collected within an

outcropping quartz breccia vein associated with an oblique fault

system to the regional Norman Cairn Fault (Figure 5).

KELLY'S PROSPECT

The Kelly's Prospect consists of a few small, high-grade

historic copper workings; these appear to be associated with shear

zones cross-cutting the northwest trending Boobina Porphyry/Euro

Basalt boundary (Figure 1 and 5).

At Kelly's Mine, historic production(1) between 1955-1970,

although small, was of very high grade - 610t of ore averaging

19.47% Cu (Figure 5 and Photo plate 2).

Exploration to date has been sporadic, with no systematic

approach over the area. Thor's sampling program to date has

targeted areas along strike of known mineralisation, zones of

alteration, shears/faults and zones of brecciation, including

sampling along the northwest trending, 1.2km long x 25m wide ridge

between Euro Basalt and Boobina Porphyry (Photo 2). Both anomalous

gold (up to 1.46g/t) and copper (up to 4.28% Cu) have been

identified.

A Heritage Survey with the Nyamal Native Title Claimant Group

was completed over the Kelly's Prospect in early July in

preparation for drill testing.

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Photo 2: Kelly's Prospect looking southeast showing ridge

between Boobina Porphyry and Euro Basalt

(1) https://www.mindat.org/loc-122951.html

Next Steps

-- An airborne magnetic survey over the eastern portion of

tenure to commence early August.

-- Await RC drill assays, with results anticipated

August/September.

-- Preparation for follow up drilling of any anomalous

results.

-- Downhole Electromagnetic Survey (DHEM) on Krona

drillhole.

-- Continue regional exploration, focusing on both lithium

priority areas and the copper-gold historic workings in the

northeastern portion of tenure.

-- Continue to review and model historic data over the Kelly's

area in preparation for drill testing.

-- Await the full set of rock chip sample data, especially

covering the Kelly's South ridge where 1.46g/t Au was reported.

URANIUM AND VANADIUM PROJECTS

Thor holds a 100% interest in two US companies with mineral

claims in Colorado and Utah, USA. The claims host uranium and

vanadium mineralisation in an area known as the Uravan Mineral

Belt, which has a history of high-grade uranium and vanadium

production (Figure 6).

Within probable economic transport distance is a processing

plant (Energy Fuels White Mesa Mill) which may be a low hurdle

processing option for any production from these projects.

Details of the projects may be found on the Thor website:

www.thormining.com/projects/us-uranium-and-vanadium .

Following on from the San Miguel County approvals on 30 March

2022, Thor has now received the Federal Bureau of Land Management

(BLM) and Colorado Division of Reclamation, Mining and Safety

(DRMS) approvals, completing the approval process to undertake the

proposed shallow drilling program at Rim Rock, Groundhog and

Section 23, shown on Figure 7 (AIM: THR 22 June 2022).

DRILLING PROGRAM

High-grade assay results from due diligence work completed by

Thor returned up to 1.25% U(3) O(8) and 3.47% V(2) O(5) ,

confirming uranium and vanadium mineralisation within the Salt Wash

member of the Morrison Formation. This is consistent with and

typical of the historical production in the Wedding Bell, Radium

Mountain area of the Uravan mineral belt (Figure 7).

Following this work, three priority areas within the Colorado

claims were highlighted for drill testing - Section 23, Rim Rock,

and Ground Hog (Figure 7). The initial drill program comprises 15

holes drilled to an average depth of 80-100m to fully test the

prospective horizon. Final drilling preparations are now

underway.

Section 23 (Figure 7) in the southeast corner of the Wedding

Bell claims has been identified by Thor Mining and World Industrial

Minerals LLC (US Consulting team) as the highest priority drill

target in the Colorado Uranium-Vanadium Project. This area

represents the only large area in the claim block with the "Salt

Wash" Member precluded from historic prospecting, drilling and mine

production. Proposed drillholes for this area are designed to

target potential mineralisation in the third sandstone unit

estimated to be within 30-40m of surface, stratigraphically, the

mapped contact with the overlying upper Brushy Basin Member of the

Morrison Formation.

The Rim Rock Mine area (Figure 7) represents a second priority

drill target. The proposed drill holes are designed to straddle the

ESE projection of the sampled Rim Rock Mine, whose adit opening is

located immediately to the west (Photo 3). The Rim Rock Mine was

the largest uranium-vanadium producer in the project area. When the

adit area was rock chip sampled by Thor, a laterally continuous

layer of vanadium mineralisation with assays was sampled:

-- 0.89% U(3) O(8) and 1.68%V(2) O(5) - WR-004

-- 0.14 % U(3) 0(8) and 1.9% V(2) 0(5) - WR-017

-- 0.05% U(3) O(8) and 2.14% V(2) O(5) - WR-018

(AIM announcement 21 July 2020)

It is anticipated that this same layer or a stratigraphically

equivalent layer of mineralisation will be intercepted by the

proposed drill holes. Vanadium layers, such as this one, with

relatively low uranium content (by the standards of historical

uranium mining in the Uravan District), were usually ignored by the

miners.

Drilling proposed at the Groundhog Mine area (Figure 7) is

designed to test for any lateral continuation of mineralisation

parallel to the east-west mineralisation mined to the south.

Next Steps:

-- Complete drilling preparations, including engaging drilling

contractors.

-- Drilling is anticipated to start in September quarter

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Photo 3 : Uranium and Vanadium mineralisation underground at Rim

Rock Prospect

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Figure 6: Location map showing projects, infrastructure and nearby White Mesa processing plant.

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Figure 7: Map of Colorado Wedding Bell Project showing priority

areas - Section 23, Groundhog and Rim Rock.

COPPER PROJECTS

Thor holds direct and indirect interests http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

in over 400,000 tonnes of Inferred Figure 8: SA Copper projects

copper resources (Tables A, B, & C) location map.

in South Australia via its 80% farm-in

interest in the Alford East copper

project and 30% interest in EnviroCopper

Ltd.

Each of these projects are considered

by Thor directors to have significant

growth potential. Both are also advancing

towards development via low cost,

environmentally friendly In Situ Recovery

(ISR) techniques.

ALFORD EAST COPPER-GOLD PROJECT - SA

The Alford East Copper-Gold Project is located on EL6529. Thor

is earning up to 80% interest in the project from unlisted

Australian explorer Spencer Metals Pty Ltd, covering portions of

EL6255 and EL6529 (AIM: THR 23 November 2020).

The Project covers the northern extension of the Alford Copper

Belt, located on the Yorke Peninsula, SA (Figure 8). The Alford

Copper Belt is a semi coherent zone of copper-gold oxide

mineralisation within a structurally controlled, north-south

corridor consisting of deeply kaolinised and oxidised troughs

within metamorphic units on the edge of the Tickera Granite, Gawler

Craton, SA (Figure 9).

Utilising historic drill hole information, Thor completed an

inferred Mineral Resource Estimate (MRE), (AIM: THR 26 January

2021), consisting of:

-- 125.6Mt @ 0.14% Cu containing 177,000t of contained

copper

-- 71, 500oz of contained gold

(AIM announcement 26 Jan 2021)

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Figure 9: Alford East Project showing the eight mineralised

domains (Plan View) (left) and Tenement & Prospect Location

Plan (right).

Phase 2 Diamond Drilling Program

Based on the new geological model, approximately 10 diamond

drill holes have been designed to test potential high-grade zones

(Figure 10):

-- Along strike and up-dip of deeply weathered zones.

-- Targeting controlling key structures including the

Netherleigh Park Fault at depth especially where there are large

gaps in existing data.

-- Targeting intersection of SMS and Liaway offset Fault.

-- Targeting intersection of Netherleigh Park Fault and Liaway

Fault.

-- Targeting subordinate splays off Netherleigh Park Fault where

there is evidence of a deep weathering trough.

In addition, hydrogeological water bores and pump testing is in

planning to determine aquifer connectivity between holes, with

initial focus in the northern area of the mineralisation.

These drill holes including pump testing have now been approved

by the South Australian Government regulators.

Concurrent to drilling, hydrometallurgical work will continue to

investigate and optimise both copper and gold metal extraction

using environmentally friendly lixiviants.

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Figure 10 : Phase two proposed drillholes, targeting potential

higher-grade zones open at depth and along strike

In conjunction with the technical assessment, Thor will continue

ongoing stakeholder and community engagement, as well as regulatory

activities.

Based on the nature of the oxide mineralisation, the deposit is

considered amenable to In Situ Recovery (ISR) techniques. For

further information on ISR please refer to Thor's website via this

link for an informative video:

www.youtube.com/watch?v=eG_1ZGD0WIw

KAPUNDA and ALFORD WEST COPPER PROJECTS - SA

Thor holds a 30% equity interest in private Australian company

EnviroCopper Limited ("ECL"). In turn, ECL has entered into an

agreement to earn, in two stages, up to 75% of the rights over

metals which may be recovered via In-Situ Recovery ("ISR")

contained in the Kapunda deposit from Australian listed company

Terramin Australia Limited ("Terramin" ASX: "TZN"), and the rights

to 75% of the Alford West copper project, comprising the northern

portion of exploration licence EL5984 held by Andromeda Metals

Limited (ASX:ADN).

Information about EnviroCopper Limited and its projects can be

found on the EnviroCopper website:

www.envirocopper.com.au

KAPUNDA

EnviroCopper Ltd ("EnviroCopper" or "ECL") has completed the

installation of test well arrays and has commenced in-situ recovery

trials ("ISR"), including tracer and push-pull test work (Figure

5). These tests are the final hydrometallurgical assessments before

ECL commences Site Environmental Lixiviant Trials (SELT).

The purpose of lixiviant trials (or "push-pull tests") is to

assess the solubility of copper mineralisation and, therefore,

copper recovery, using a specially designed solution called a

lixiviant under in-situ conditions. The trial is to be undertaken

in two stages: the first stage involves injecting and extracting a

tracer solution (Sodium Bromide - NaBr) from the same well to

demonstrate hydraulic connectivity between the observation and

environmental monitor well network. This is followed by injecting

and extracting lixiviant from the same well to test copper

solubility from the mineralisation.

Key outcomes anticipated from lixiviant trials:

-- Hydraulic connectivity between wells

-- Copper solubility and recovery

-- Establish lixiviant and time parameters for design of the

Site Environmental Lixiviant Trials (SELT).

TUNGSTEN PROJECTS

MOLYHIL TUNGSTEN / MOLYBDENUM PROJECT - NT (100% Thor)

The Molyhil tungsten-molybdenum-copper http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

deposit is 100% owned by Thor Mining Figure 11: Molyhil project location

and is located 220km north-east of map

Alice Springs (320km by road) within

the prospective polymetallic province

of the Proterozoic Eastern Arunta

Block in the Northern Territory (Figure

15).

The deposit consists of two adjacent

outcropping iron-rich skarn bodies:

the northern 'Yacht Club' lode and

the 'Southern' lode. Both lodes are

marginal to a granite intrusion; both

lodes contain scheelite (CaWO(4) )

and molybdenite (MoS(2) ) mineralisation

(Figure 10). Both the outlines of

the lodes and the banding within the

lodes strike approximately north and

dip steeply to the east.

A full background on the project is

available on the Thor Mining website:

www.thormining.com/projects .

Diamond Drilling Program

Three diamond drillholes (21MHDD001 - 21MHDD003) totalling

995.4m completed in late 2021, have successfully tested and

confirmed the newly identified 3D magnetic target located along

strike to the south of the Molyhil Critical Minerals Project. This

magnetic target represents a massive magnetite skarn hosting

disseminated tungsten-molybdenum-copper mineralisation (Figure 12)

(AIM: THR 28 July 2022).

Both 21MHDD002 and 21MHDD003 intercepted disseminated

mineralisation, consisting of scheelite-molybdenite and

chalcopyrite within massive magnetite skarn. Drillhole 21MHDD002

intercepted 46m of disseminated mineralisation, whilst 21MHDD003

intercepted two zones of disseminated mineralisation over 29m of

magnetite skarn . It appears 21MHDD001 intersected the edges of the

magnetite skarn drilling over the top into a granite, with

negligible mineralisation (Table A, B and C).

21MHDD002:

-- 46m @ 0.06% WO(3) , 0.05% Mo & 0.04% Cu from 249m,

-- including 11m @ 0.05% WO(3) , 0.13% Mo & 0.06 % Cu from

272m

21MHDD003:

-- 4m @ 0.13% WO(3) , 0.08% Mo & 0.06% Cu from 255m

Visible grade estimations were significantly higher than

compared with assays, thus resulting in the samples being

resubmitted for analysis using two different analytical techniques

(Lithium Borate Fusion with ICP-MS finish and XRF Fusion), with

further follow up using the coarse reject material (Photos 4 and

5). Analytical analysis of the tungsten and molybdenum is

significantly impacted by the coarse nature of the scheelite

crystals in half core, combined with the malleable nature of the

molybdenite when pulverised; hence sample size is critical to the

representivity of assay grades (bulk sampling is optimal for

scheelite).

The Directors believe further work on the tungsten - molybdenum

- copper relationship and grade distribution is warranted.

The drilling program is co-funded by the Geophysics and Drilling

Collaborations (GDC) program as part of the 'Resourcing the

Territory' initiative, with Thor Mining granted A$110,000 (AIM: THR

03 June 2021). Full details can be found on the NTGS website:

www.resourcingtheterritory.nt.gov.au/about/gdc .

The newly discovered extension of the

tungsten-molybdenum-chalcopyrite mineralisation to the south of the

Molyhil deposit has validated the successful 3D modelling of the

geology, magnetics and mineralisation. The newly acquired data will

be used to enhance the 3D model prior to potential follow up

resource drilling.

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Photo 4: 21MHDD02- 282-283m (282.4m) - 1m @ 0.02% WO(3) , 0.23%

Mo & 0.07% Cu - coarse grained visible molybdenite in magnetite

skarn

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Photo 5: 21MHDD002: 293-294m (293.8m) - 1m @ 0.03% WO(3) , 0.04%

Mo and 0.06% Cu - significant visible molybdenite and chalcopyrite

visible throughout intercept, contrasting to assays

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Figure 12 (left): Plan view, looking down at the conceptual pit

shell (brown), with the 0.3% WO(3) isosurface in blue, 0.15% Mo

isosurface in silver, and modelled 3D magnetics in transparent red.

The yellow dashed line shows the location of the long section

(Figure 3). 21MHDD001 and 21MHDD002 completed with DD Hole C

underway.

Figure 12 (right): Long section of the Molyhil project looking

west-northwest, showing two drilled holes and a third planned hole.

Drilled holes, 21MHDD001 and 21MHDD002, were targeted into the

magnetic anomaly where it appears offset at depth by faulting. The

next planned hole, DD Hole C, is planned to intersect the

geological plunge of the mineralised intercept in 21MHDD002. The

conceptual pit shell is shown in brown, 0.3% WO(3) isosurface in

blue, 0.15% Mo isosurface in silver, and modelled 3D magnetics in

red (0.175 SI), and as a transparent red envelope (0.15 SI) and a

conceptual shape representing the down-plunge mineralised zone in

yellow.

Table A: Drill Hole Collar Summary

End of

DRILLHOLE EASTING NORTHING ELEVATION AZIMUTH DIP Hole

21MHDD001 577207 7482773 409 262 60 324.5

-------- --------- ---------- -------- ---- -------

21MHDD002 577220 7482774 409 278 60 334.2

-------- --------- ---------- -------- ---- -------

21MHDD003 577069 7482780 412 082 87 336.7

-------- --------- ---------- -------- ---- -------

Coordinates in GDA 94 Zone 53

Table B: Geology

DRILLHOLE GEOLOGY FROM (M) TO (M) DOWNHOLE INTERCEPT

(M)

21MHDD001 Calc-Silicate 159.1 255.8 96.7

----------------- --------- ------- -------------------

21MHDD002 Magnetite Skarn 249 297 48

----------------- --------- ------- -------------------

21MHDD003 Magnetite Skarn 255 259 4

----------------- --------- ------- -------------------

21MHDD003 Magnetite Skarn 274.5 283.5 9

----------------- --------- ------- -------------------

Table C: Drill Intercepts - 21MHDD002 and MHDD03

DRILLHOLE FROM TO Intercept

(M) (M) (M)

-----

Lithium Borate XRF Fusion

Fusion with ICP-AES/MS

----- ----- ----------

(LB102/ MA101/102) (XF300)

----- ----- ---------- ---------------------------- --------------------

WO(3) Mo % Cu % WO(3) Mo % Cu %

% %

----- ----- ---------- ---------- ------- ------- ------ ----- -----

21MHDD002 249 295 46 0.06 0.05 0.04 0.06 0.04 0.04

----- ----- ---------- ---------- ------- ------- ------ ----- -----

Including 272 283 11 0.05 0.13 0.06 0.05 0.12 0.05

----- ----- ---------- ---------- ------- ------- ------ ----- -----

21MHDD003 255 259 4 0.13 0.08 0.06 0.13 0.10 0.05

----- ----- ---------- ---------- ------- ------- ------ ----- -----

NEXT STEP:

The newly discovered extension of the

tungsten-molybdenum-chalcopyrite mineralisation to the south of the

Molyhil deposit, has validated the successful 3D modelling of the

geology, magnetics and mineralisation.

This 3D modelling has identified further high priority targets

for drill testing along strike (Figure 13).

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Figure 13: 3D modelling of magnetics (transparent red)

highlights Molyhil deposit and the recently drilled southeast

plunging extension, plus drill targets along strike.

Bonya (Tungsten, Copper) and Jervois Vanadium Projects (40%

Thor)

The Bonya tungsten, copper and vanadium deposits are located

approximately 30km to the north-east of Molyhil (Figure 14). Thor,

in joint venture with Arafura, holds a 40% equity interest in the

resources.

A full background on the project is available on the Thor Mining

website: www.thormining.com/projects .

http://www.rns-pdf.londonstockexchange.com/rns/1754U_1-2022-7-28.pdf

Figure 14 : Molyhil Project location showing adjacent Bonya

tenement

CORPORATE, FINANCE, AND CASH MOVEMENTS

Mark Potter, Non-Executive Chair, resigned from the Board on 30

June 2022, with Alastair Clayton taking on the position of interim

Non-Executive Chair.

Net cash outflows from Operating and Investing activities for

the quarter were $718,000 which included expenditure of $556,000

directly related to exploration activities.

Providing an ending cash balance of $2,069,000.

In addition, Thor continues to hold 48,118,920 Power Metal

Resources plc (AIM: POW) Shares which are released from a trading

restriction at the rate of 25% each quarter, with the second

release on 31 July 2022. The market value of the POW shares

currently held is GBP445,000 (approximately $774,000) based on the

closing price of the POW Shares as traded on the London Stock

Exchange on 27 July 2022.

Cashflows for the quarter include related party payments of

$111,000 to Directors, comprising the Managing Director's salary,

and Non-Executive Directors' fees.

For further information, please contact:

Thor Mining PLC

Nicole Galloway Warland, Managing Director Tel: +61 (8) 7324

Ray Ridge, CFO / Company Secretary 1935

Tel: +61 (8) 7324

1935

WH Ireland Limited (Nominated Adviser Tel: +44 (0) 207

and Joint Broker) 220 1666

Jessica Cave / Darshan Patel / Megan Liddell

SI Capital Limited (Joint Broker) Tel: +44 (0) 1483

413 500

Nick Emerson

Yellow Jersey (Financial PR) thor@yellowjerseypr.com

Sarah Hollins / Henry Wilkinson Tel: +44 (0) 20 3004

9512

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

Competent Persons Report

The information in this report that relates to exploration

results is based on information compiled by Nicole Galloway

Warland, who holds a BSc Applied geology (HONS) and who is a Member

of The Australian Institute of Geoscientists. Ms Galloway Warland

is an employee of Thor Mining PLC. She has sufficient experience

which is relevant to the style of mineralisation and type of

deposit under consideration and to the activity which she is

undertaking to qualify as a Competent Person as defined in the 2012

Edition of the 'Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves'. Nicole Galloway

Warland consents to the inclusion in the report of the matters

based on her information in the form and context in which it

appears.

Updates on the Company's activities are regularly posted on

Thor's website www.thormining.com , which includes a facility to

register to receive these updates by email, and on the Company's

twitter page @ThorMining .

About Thor Mining PLC

Thor Mining PLC (AIM, ASX: THR; OTCQB: THORF) is a diversified

resource company quoted on the AIM Market of the London Stock

Exchange, ASX in Australia and OTCQB Market in the United

States.

The Company is advancing its diversified portfolio of precious,

base, energy and strategic metal projects across USA and Australia.

Its focus is on progressing its copper, gold, uranium and vanadium

projects, while seeking investment/JV opportunities to develop its

tungsten assets.

Thor owns 100% of the Ragged Range Project, comprising 92 km(2)

of exploration licences with highly encouraging early stage gold

and nickel results in the Pilbara region of Western Australia.

At Alford East in South Australia, Thor is earning an 80%

interest in copper deposits considered amenable to extraction via

In Situ Recovery techniques (ISR). In January 2021, Thor announced

an Inferred Mineral Resource Estimate of 177,000 tonnes contained

copper & 71,000 oz gold(1).

Thor also holds a 30% interest in Australian copper development

company EnviroCopper Limited, which in turn holds rights to earn up

to a 75% interest in the mineral rights and claims over the

resource on the portion of the historic Kapunda copper mine and the

Alford West copper project, both situated in South Australia, and

both considered amenable to recovery by way of ISR.(2)(3)

Thor holds 100% interest in two private companies with mineral

claims in the US states of Colorado and Utah with historical

high-grade uranium and vanadium drilling and production

results.

Thor holds 100% of the advanced Molyhil tungsten project,

including measured, indicated and inferred resources , in the

Northern Territory of Australia, which was awarded Major Project

Status by the Northern Territory government in July 2020.

Adjacent to Molyhil, at Bonya, Thor holds a 40% interest in

deposits of tungsten, copper, and vanadium, including Inferred

resource estimates for the Bonya copper deposit, and the White

Violet and Samarkand tungsten deposits.

Notes

(1)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20210127-maiden-copper.gold-estimate-alford-east-sa.pdf

(2)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20172018/20180222-clarification-kapunda-copper-resource-estimate.pdf

(3)

www.thormining.com/sites/thormining/media/aim-report/20190815-initial-copper-resource-estimate---moonta-project---rns---london-stock-exchange.pdf

(4)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20210408-molyhil-mineral-resource-estimate-updated.pdf

(5)

www.thormining.com/sites/thormining/media/pdf/asx-announcements/20200129-mineral-resource-estimates---bonya-tungsten--copper.pdf

TENEMENT SCHEDULE

At 30 June 2022 , the consolidated entity holds an interest in

the following Australian tenements:

Area

Project Tenement kms(2) Area ha. Holders Company Interest

Molyhil Mining Pty

Molyhil EL22349 228.10 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil EL31130 9.51 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil ML23825 95.92 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil ML24429 91.12 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil ML25721 56.2 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil AA29732 38.6 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS77 16.18 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS78 16.18 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS79 8.09 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS80 16.18 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS81 16.18 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS82 8.09 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS83 16.18 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS84 16.18 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS85 16.18 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Molyhil MLS86 8.05 Ltd 100%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Bonya EL29701 204.5 Ltd 40%

---------- ------- -------- -------------------- ----------------

Molyhil Mining Pty

Bonya EL32167 74.54 Ltd 40%

---------- ------- -------- -------------------- ----------------

Pilbara Goldfields

Panorama E46/1190 35.03 Pty Ltd 100%

---------- ------- -------- -------------------- ----------------

Pilbara Goldfields

Ragged Range E46/1262 57.3 Pty Ltd 100%

---------- ------- -------- -------------------- ----------------

Pilbara Goldfields

Corunna Downs E46/1340 48 Pty Ltd 100%

---------- ------- -------- -------------------- ----------------

Pilbara Goldfields

Bonney Downs E46/1355 38 Pty Ltd 100%

---------- ------- -------- -------------------- ----------------

Pilbara Goldfields

Hamersley Range E46/1393 11 Pty Ltd 100%

---------- ------- -------- -------------------- ----------------

At 30 June 2022 , the consolidated entity holds an interest in

the following tenements in the US State of Nevada:

Claim Group Prospect Claim Name Area Holders Company

Interest

45 blocks (611ha

Platoro Desert Scheelite NT #55 - 64 or 1,510 acres) 100%

------------ ----------------- ---------------- ------------------------------------- ---------

Garnet NT #9 - 18

Pilot Metals

Inc

------------ ----------------- ---------------- -------------------- ---------

Gunmetal NT #19 - 22,

6, 7

----------------- ----------------

Good Hope NT #1 - 5,

41 - 54

------------ ----------------- ---------------- -------------------- --------------- ---------

Black Fire 109 blocks (1,481ha BFM Resources

BFM 1 Claims BFM1 - BFM109 or 3,660 acres) Inc 100%

----------------- ---------------- -------------------- --------------- ---------

Des Scheel 22blocks (299ha BFM Resources

BFM 2 East BFM109 - BFM131 or 739Acre) Inc 100%

----------------- ---------------- -------------------- --------------- ---------

BFM Resources

Dunham Mill Dunham Mill MS1 - MS4 4 blocks Inc 100%

----------------- ---------------- -------------------- --------------- ---------

On 30 June 2022, the consolidated entity holds 100% interest in

a Uranium and Vanadium projects in US States of Colorado and Utah

as follows:

Claim Group Serial Number Claim Name Area Holders Company

Interest

Vanadium UMC445103 to 100 blocks (2,066 Cisco Minerals

King (Utah) UMC445202 VK-001 to VK-100 acres) Inc 100%

---------------- -------------- ------------------ ------------------ ------------------ ---------

Radium Mountain CMC292259 to Radium-001 99 blocks (2,045 Standard Minerals

(Colorado) CMC292357 to Radium-099 acres) Inc 100%

-------------- ------------------ ------------------ ------------------ ---------

Groundhog CMC292159 to Groundhog-001 100 blocks (2,066 Standard Minerals

(Colorado) CMC292258 to Groundhog-100 acres) Inc 100%

-------------- ------------------ ------------------ ------------------ ---------

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

Name of entity

--------------------------------------------------

THOR MINING PLC

ABN Quarter ended ("current quarter")

------------ ----------------------------------

121 117 673 30 JUNE 2022

----------------------------------

Consolidated statement of cash Current quarter Year to date

flows (12 months)

$A'000 $A'000

1. Cash flows from operating

activities

1.1 Receipts from customers

1.2 Payments for

(a) exploration & evaluation - (48)

(b) development

(c) production

(d) staff costs (43) (152)

(e) administration and corporate

costs (117) (1,017)

1.3 Dividends received (see note

3)

1.4 Interest received

Interest and other costs of

1.5 finance paid - (2)

1.6 Income taxes paid

1.7 Government grants and tax

incentives

1.8 Other 51 110

---------------- -------------

Net cash from / (used in)

1.9 operating activities (109) (1,109)

----------------- ----------------------------------- ---------------- -------------

2. Cash flows from investing

activities

2.1 Payments to acquire or for:

(a) entities

(b) tenements

(c) property, plant and equipment (88) (104)

(d) exploration & evaluation (556) (3,164)

(e) equity accounted investments

(f) other non-current assets

(bonds) (43) (43)

2.2 Proceeds from the disposal

of:

(a) entities - 246

(b) tenements

(c) property, plant and equipment

(d) investments - 102

(e) other non-current assets

2.3 Cash flows from loans to other

entities

2.4 Dividends received (see note

3)

2.5 Other (Government grants) 78 406

---------------- -------------

Net cash from / (used in)

2.6 investing activities (609) (2,557)

----------------- ----------------------------------- ---------------- -------------

3. Cash flows from financing

activities

Proceeds from issues of equity

securities (excluding convertible

3.1 debt securities) - 4,261

3.2 Proceeds from issue of convertible

debt securities

Proceeds from exercise of

3.3 options - 223

Transaction costs related

to issues of equity securities

3.4 or convertible debt securities - (120)

3.5 Proceeds from borrowings

Repayment of borrowings (lease

3.6 liability) - (19)

3.7 Transaction costs related

to loans and borrowings

3.8 Dividends paid

3.9 Other (funds received in advance

of a placement)

---------------- -------------

Net cash from / (used in)

3.10 financing activities - 4,345

----------------- ----------------------------------- ---------------- -------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 2,780 1,442

Net cash from / (used in)

operating activities (item

4.2 1.9 above) (109) (1,109)

Net cash from / (used in)

investing activities (item

4.3 2.6 above) (609) (2,557)

Net cash from / (used in)

financing activities (item

4.4 3.10 above) - 4,345

Effect of movement in exchange

4.5 rates on cash held 7 (52)

---------------- -------------

Cash and cash equivalents

4.6 at end of period 2,069 2,069

5. Reconciliation of cash and Current quarter Previous quarter

cash equivalents $A'000 $A'000

at the end of the quarter

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

5.1 Bank balances 2,069 2,780

5.2 Call deposits

5.3 Bank overdrafts

5.4 Other (provide details)

---------------- -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 2,069 2,780

----------------- ----------------------------------- ---------------- -----------------

6. Payments to related parties of the entity Current quarter

and their associates $A'000

Aggregate amount of payments to related

parties and their associates included in

6.1 item 1 111

----------------

6.2 Aggregate amount of payments to related

parties and their associates included in

item 2

----------------

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly

activity report must include a description of, and an explanation

for, such payments.

The amount at item 6.1 above represents fees paid to Non-Executive

Directors, and remuneration paid to the Managing Director.

7. Financing facilities Total facility Amount drawn

Note: the term "facility' amount at quarter at quarter end

includes all forms of financing end $A'000

arrangements available to $A'000

the entity. Add notes as necessary

for an understanding of the

sources of finance available

to the entity.

7.1 Loan facilities

------------------- ----------------

7.2 Credit standby arrangements

------------------- ----------------

7.3 Other (please specify)

------------------- ----------------

7.4 Total financing facilities

------------------- ----------------

7.5 Unused financing facilities available at

quarter end

----------------

7.6 Include in the box below a description of each facility

above, including the lender, interest rate, maturity date

and whether it is secured or unsecured. If any additional

financing facilities have been entered into or are proposed

to be entered into after quarter end, include a note providing

details of those facilities as well.

----------------- ---------------------------------------------------------------------------

8. Estimated cash available for future operating $A'000

activities

Net cash from / (used in) operating activities

8.1 (item 1.9) (109)

8.2 (Payments for exploration & evaluation classified (556)

as investing activities) (item 2.1(d))

8.3 Total relevant outgoings (item 8.1 + item (665)

8.2)

8.4 Cash and cash equivalents at quarter end 2,069

(item 4.6)

8.5 Unused finance facilities available at quarter -

end (item 7.5)

-------

8.6 Total available funding (item 8.4 + item 2,069

8.5)

-------

Estimated quarters of funding available

8.7 (item 8.6 divided by item 8.3) 3.1

-------

Note: if the entity has reported positive relevant outgoings

(ie a net cash inflow) in item 8.3, answer item 8.7 as

"N/A". Otherwise, a figure for the estimated quarters

of funding available must be included in item 8.7.

8.8 If item 8.7 is less than 2 quarters, please provide answers

to the following questions:

8.8.1 Does the entity expect that it will continue to

have the current level of net operating cash flows for

the time being and, if not, why not?

-------------------------------------------------------------------

Answer:

-------------------------------------------------------------------

8.8.2 Has the entity taken any steps, or does it propose

to take any steps, to raise further cash to fund its operations

and, if so, what are those steps and how likely does it

believe that they will be successful?

-------------------------------------------------------------------

Answer:

-------------------------------------------------------------------

8.8.3 Does the entity expect to be able to continue its

operations and to meet its business objectives and, if

so, on what basis?

-------------------------------------------------------------------

Answer:

-------------------------------------------------------------------

Note: where item 8.7 is less than 2 quarters, all of

questions 8.8.1, 8.8.2 and 8.8.3 above must be answered.

----------------- -------------------------------------------------------------------

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: ..29 July 2022...........................................................

Authorised by: .....the

Board....................................................................

(Name of body or officer authorising release - see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity

report provide a basis for informing the market about the entity's

activities for the past quarter, how they have been financed and

the effect this has had on its cash position. An entity that wishes

to disclose additional information over and above the minimum

required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in

accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 6: Exploration for and Evaluation of

Mineral Resources and AASB 107: Statement of Cash Flows apply to

this report. If this quarterly cash flow report has been prepared

in accordance with other accounting standards agreed by ASX

pursuant to Listing Rule 19.11A, the corresponding equivalent

standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market

by your board of directors, you can insert here: "By the board". If

it has been authorised for release to the market by a committee of

your board of directors, you can insert here: "By the [name of

board committee - eg Audit and Risk Committee]". If it has been

authorised for release to the market by a disclosure committee, you

can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market

by your board of directors and you wish to hold yourself out as

complying with recommendation 4.2 of the ASX Corporate Governance

Council's Corporate Governance Principles and Recommendations, the

board should have received a declaration from its CEO and CFO that,

in their opinion, the financial records of the entity have been

properly maintained, that this report complies with the appropriate

accounting standards and gives a true and fair view of the cash

flows of the entity, and that their opinion has been formed on the

basis of a sound system of risk management and internal control

which is operating effectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUWVORUAUBUUR

(END) Dow Jones Newswires

July 29, 2022 02:00 ET (06:00 GMT)

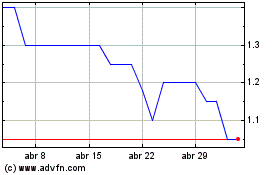

Thor Energy (LSE:THR)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Thor Energy (LSE:THR)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024