Time Finance PLC New LTIP & Director/PDMR Shareholding (4213T)

22 Julio 2022 - 1:00AM

UK Regulatory

TIDMTIME

RNS Number : 4213T

Time Finance PLC

22 July 2022

22 July 2022

Time Finance plc

("Time Finance", the "Group" or the "Company")

New Long Term Incentive Plan

Director/PDMR Shareholding

Time Finance plc, the AIM listed specialist finance provider

announces the establishment of a 2022 Share Option Scheme (the

"2022 Option Scheme" or the "Scheme"). The 2022 Option Scheme has

been designed to incentivise and retain the Company's executives

and senior management to deliver sustainable growth for the

Company's shareholders and any options awarded under the 2022

Option Scheme are expected to be satisfied without further dilution

for the Group's shareholders. The Group also announces awards of

share options under the 2022 Option Scheme as set out below.

2022 Share Option Scheme

The Company has established the 2022 Option Scheme as an

unapproved (i.e. non tax-advantaged) share option scheme under

which nil-cost options over ordinary shares of 10 pence each in the

capital of the Company ("Options") may be awarded. Options awarded

under the 2022 Option Scheme will be subject to a three-year

vesting period from the date of grant, with the number of awards

which ultimately vest dependent on the grantee's continued service

and on stretching performance conditions set by the Time Finance

Remuneration Committee.

The Options today awarded under the 2022 Option Scheme, details

of which are provided below, are the only Options that will be

awarded under the Scheme. No future Option awards will be made

under the 2022 Option Scheme.

As a result, it is currently expected that the Options awarded

under the 2022 Option Scheme will be capable of being satisfied in

full from unallocated existing ordinary shares held by the

Company's Employee Benefit Trust, without any further dilutionary

effect.

The sale of ordinary shares acquired pursuant to exercises of

Options will not be permitted for a period of 12 months, save for

sales of ordinary shares to meet the income tax and both the

employee and employer National Insurance liabilities on exercise,

subject to orderly market and closed period restrictions. The sale

of ordinary shares in the ensuing period of 12 months will be

permitted subject to orderly market and close period

restrictions.

Following the implementation of the 2022 Share Option Scheme, no

further share options will be awarded under the Company's 2020

Share Option Scheme, details of which were announced by the Company

on 29 October 2020 (the "2020 Option Scheme"). 405,000 unvested

share options remain in issue under the 2020 Option Scheme.

Share Option Awards

Under the 2022 Option Scheme, the Company has today granted a

total of 1,835,000 Options (the "Awarded Options"), representing

1.98 per cent. of the Company's current undiluted issued ordinary

share capital.

The Awarded Options will vest in three equal tranches over a

three-year period subject to stretching annual performance

conditions in respect of the profitability of the Group over the

three years ended 31 May 2025 and to Remuneration Committee

discretion.

Vested Awarded Options may be exercised at nil-cost from the

date of vesting up until the date falling 5 years from the date of

vesting, provided that the recipient remains an employee of the

Group at the date that the Awarded Options are exercised.

Of the Awarded Options, 1,235,000 Awarded Options have been

granted to Ed Rimmer, the Company's Chief Executive Officer and the

remaining 600,000 Awarded Options have been granted to PDMR's of

the Group. The notifications below, provided in accordance with the

Market Abuse Regulation, provide further details.

For further information, please

contact:

Time Finance plc

Ed Rimmer, Chief Executive Officer 01225 474230

James Roberts, Chief Financial Officer 01225 474230

Cenkos Securities plc (NOMAD and

Broker)

Ben Jeynes / Max Gould (Corporate

Finance)

Julian Morse (Sales) 0207 397 8900

Walbrook PR 0207 933 8780

Paul Vann /Joseph Walker 07768 807631

Timefinance@walbrookpr.com

About Time Finance:

Time Finance's core strategy is to focus on providing or

arranging the finance UK SMEs require to fund their businesses. It

offers a multi-product range for SMEs including asset, vehicle,

loan and invoice finance. While primarily an 'own-book' lender the

Group does operates a 'hybrid' lending and broking model enabling

it to optimize business levels through market and economic

cycles.

More information is available on the Company website

www.timefinance.com .

The information below is disclosed in accordance with Article

19 of the EU Market Abuse Regulation.

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Name 1) Ed Rimmer

2) Steve Nichols

3) Sharon Bryden

-------------------------- --------------------------------------

Reason for the notification

2

------------------------------------------------------------------

a) Position/status 1) Chief Executive Officer

2) PDMR

3) PDMR

-------------------------- --------------------------------------

b) Initial notification Initial notification

/Amendment

-------------------------- --------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

------------------------------------------------------------------

a) Name Time Finance plc

-------------------------- --------------------------------------

b) LEI 213800VG3QJGBP2MKR86

-------------------------- --------------------------------------

Details of the transaction(s): section to be repeated for

4 (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------

a) Description of the Ordinary Shares of 10p each

financial instrument,

type of instrument ISIN: GB00BCDBXK43

Identification code

-------------------------- --------------------------------------

b) Nature of the transaction Award of nil-cost share options

-------------------------- --------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

1) nil 1,235,000

2) nil 300,000

3) nil 300,000

----------

-------------------------- --------------------------------------

d) Aggregated information

- Aggregated volume n/a single transactions

- Price

-------------------------- --------------------------------------

e) Date of the transaction 1) 21 July 2022

2) 21 July 2022

3) 21 July 2022

-------------------------- --------------------------------------

f) Place of the transaction Outside of a trading venue

-------------------------- --------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHSEISIEEESELW

(END) Dow Jones Newswires

July 22, 2022 02:00 ET (06:00 GMT)

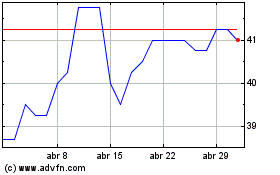

Time Finance (LSE:TIME)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Time Finance (LSE:TIME)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024