TIDMTMIP TIDMTMI

RNS Number : 4868H

Taylor Maritime Investments Limited

28 July 2023

28 July 2023

Taylor Maritime Investments Limited (the "Company")

Quarterly NAV Announcement, Trading Update and Publication of

Factsheet

Continued focus on debt reduction

Asset values firm relative to charter rates indicating positive

market outlook

Interim dividend of 2 cents per share declared

Taylor Maritime Investments Limited, the specialist dry bulk

shipping company, today announces that as at 30 June 2023 its

unaudited NAV was $1.56 per Ordinary Share compared to $1.71 per

Ordinary Share as at 31 March 2023. The Company is also pleased to

declare an interim dividend in respect of the period to 30 June

2023 of 2 cents per Ordinary Share. The NAV total return for the

quarter was -7.6%.

The first quarterly factsheet of the current financial year is

also now available on the Company's website,

www.taylormaritimeinvestments.com .

Key Highlights (to 30 June 2023)

-- TMI made further progress reducing its debt by $12 million

from net proceeds generated from the sale of a 2008 built 32k dwt

Handysize vessel, which generated an IRR of c.63% and MOIC of

c.2.0x. This resulted in a debt to gross assets ratio of 28.5% for

TMI at quarter end (27.7% as at 31 March 2023)

-- Grindrod repaid approximately $28 million of debt from

operations and proceeds from vessel sales completed during the

quarter, resulting in an estimated debt to gross assets ratio on a

'look through' [1] basis at 30 June 2023 of 37.8% (38.9% as at 31

March 2023)

-- During the period, Grindrod agreed the sale of a 2011 Chinese

built 33k dwt Handysize vessel for gross proceeds of $10.8 million,

with expected delivery by the end of August

-- The combined owned fleet comprised 47 vessels at quarter end

(TMI 22 [2] and Grindrod 25 [3] ). The Market Value of the fleet

was $880 million [4] (TMI $331 million and Grindrod $549 million

which excludes chartered-in ships without purchase options), a

decrease of approximately 5.7% on a like for like basis over the

quarter

-- The net time charter rate for the TMI fleet was $10,600 per

day at quarter end, outperforming the adjusted BHSI (Baltic

Handysize Index) Time Charter Average (net) [5] which stood at

$6,712. TMI's balanced chartering strategy continued to mitigate

the impact of softening dry bulk markets emanating from a

slower-than-expected economic recovery in China and macroeconomic

headwinds impacting demand

-- The average charter duration for the TMI fleet stands at

three months, with a large portion of the fleet positioned to

capture improvements in the charter market expected in the latter

part of 2023, and the average annualized unlevered gross cash yield

was 7.9% at quarter end

-- The blended net time charter equivalent (TCE) across the TMI

and Grindrod fleet was $12,735 per day for the quarter (including

Handysize and Supra/Ultramax vessels)

-- On 1 June 2023, Henry Strutt was appointed Non-Executive

Chair of the Company with the Interim Chair Frank Dunne remaining

as Senior Independent Director

Post-Period Trading Update (since 30 June 2023)

-- Since quarter end, TMI agreed the sale of two vessels to

Grindrod on an arm's-length basis. The transactions include a 2011

built 38.5k dwt Handysize vessel due to complete in July for $15

million net proceeds and a 40k dwt Handysize newbuild due for

delivery in Q1 of calendar year 2024 for net proceeds of $33.75

million

-- Together, these transactions achieve a balance of strategic

fleet management, improving the overall attractiveness of the fleet

profile of TMI and Grindrod and keeping an optimal number of ships

operational ahead of the expected improvement in rates to come in

the latter part of 2023, whilst also supporting TMI's de-gearing

plans

-- Since quarter end, TMI agreed one long-term charter of 20 to

24 months at a net time charter rate of $12,000 per day with a

blue-chip charterer, a rate significantly above the current index

reflecting positive forward market sentiment and the benefits of

broader chartering opportunities arising as a result of the

Grindrod investment

-- On 13 July, Grindrod announced an EGM to be held on 10 August

2023 to propose a capital reduction which would result in a total

cash distribution of up to a maximum of $45 million, of which up to

a maximum of $37 million would be payable to TMI in line with its

83.23% ownership. The surplus cash available to fund the proposed

capital reduction has been generated from recent vessel sales after

accounting for related debt repayments. Should the capital

reduction go ahead, with any initial distribution expected to be

made within financial year Q3, TMI would use proceeds to further

reduce debt

-- TMI has covered 26% of fleet days for the Financial Year

ending 31 March 2024 at a time charter equivalent rate of c.$12,100

per day

Commenting on the trading update Edward Buttery, Chief Executive

Officer, said:

"Despite current pressure on rates we continue to outperform our

benchmark index thanks to our balanced chartering strategy. Asset

values remain above historical averages and the building blocks of

an improved earnings environment for the next two years are

evident. We continue to prioritise debt reduction and delivering

synergies by integrating management of the TMI and Grindrod fleets

and making the most of opportunities given our enhanced scale so

we're in a strong position to capitalise on market improvements

when they come."

Dry bulk market outlook

After showing signs of improvement at the end of Q1 of the

calendar year, demand disappointed in Q2 as China's expected

recovery failed to materialize with the BHSI decreasing by 35% from

31 March to 30 June. Asset values, however, held up relative to

charter rates through the quarter, decreasing by 8% (Clarksons 10

year old 37k dwt Handysize vessel benchmark) reflective of more

positive forward sentiment with improving industrial trends and

re-stocking in China expected, and ample seaborne grain supply from

record harvests to meet firm demand across key importing regions.

As a result, charter rates may improve towards the latter part of

the year before the onset of the typically softer holiday period

from Christmas through to the Chinese New Year.

Overall, the combined minor bulk and grain trade is forecast to

grow by 3.0% in 2023 in tonne-mile terms according to Clarksons and

by 3.9% in 2024 when market analysts anticipate a structural

recovery in the Chinese economy driven by further policy support in

line with the Chinese Government's stated ambitions of delivering

long-term, sustainable growth.

Meanwhile, several years of limited newbuilding activity will

see Handysize fleet supply growth of 3.0% in 2023 followed by

modest 1.3% growth in 2024 as environmental regulations are

expected to lead to increased demolition of older, less efficient

tonnage. The Supra/Ultramax fleet is forecast to grow by 3.0% in

2023 and 2024. Newbuilding activity is expected to remain

constrained given shipyards are generally full until the second

half of 2026 with orders from other segments dominating and

uncertainty over future fuel choices deterring newbuild ordering.

Given this tightening supply picture and forecasts of positive

demand growth, we maintain a favourable view for 2024 and 2025 for

both charter rates and asset values.

Financing

TMI's debt balance stands at $210 million, down from $222

million at the end of March, which represents a debt to gross

assets ratio of 28.5% based on Fair Market Values as at end of June

(27.7% as at 31 March 2023).

Grindrod's estimated debt balance was $178 million with a 'look

through' debt to gross assets ratio of 37.8% based on end of June

Fair Market Values (38.9% as at 31 March 2023) (including TMI and

Grindrod debt).

After applying $15 million proceeds to repay debt from the

additional TMI vessel sale, due to complete within July 2023, TMI

debt to gross assets will reduce to 26.8% based on June Fair Market

Values.

TMI's priority is strengthening its balance sheet consistent

with its long-term commitment to a prudent capital structure. TMI

will continue to reduce its debt from agreed and planned vessel

sales as well as from proceeds from the proposed capital reduction

by Grindrod. TMI remains focused on achieving the 25% target for

TMI of debt to gross assets and this is supported by a similar

strategy at Grindrod.

ESG

During the period, a further two TMI vessels were fitted with

energy saving devices including boss-cap fins, high performance

paints, pre-swirl ducts and fuel efficiency monitoring systems. The

carbon intensity of TMI's fleet, as measured by the EEOI ("Energy

Efficiency Operational Index"), improved by 18% y-o-y over the FY22

period, primarily driven by the divestment of less-efficient

vessels, installation of energy saving devices and other efficiency

initiatives onboard.

TMI continues to work closely with its commercial and technical

managers to ensure the fleet is compliant with the new industry

decarbonisation regulations that came into force in January 2023,

designed to meet the IMO's 2030 GHG reduction targets.

S

For further information, please contact:

Taylor Maritime Investments IR@tminvestments.com

Limited

Edward Buttery

Camilla Pierrepont

Jefferies International Limited

Stuart Klein

Gaudi Le Roux +44 20 7029 8000

Montfort Communications TMI@montfort.london

Alison Allfrey

George Morris Seers

Sanne Fund Services (Guernsey)

Limited

Matt Falla +44 1481 737600

Notes to Editors

About the Company

Taylor Maritime Investments Limited is an internally managed

investment company listed on the Premium Segment of the Official

List, its shares trading on the Main Market of the London Stock

Exchange since May 2021. The Company specializes in the acquisition

and chartering of vessels in the Handysize and Supramax bulk

carrier segments of the global shipping sector. The Company invests

in a diversified portfolio of vessels which are primarily

second-hand. TMI's fleet portfolio currently numbers 22 vessels in

the geared dry bulk segment. The ships are employed utilising a

variety of employment/charter strategies.

On 20 December, the Company announced it acquired a controlling

majority interest in Grindrod Shipping Holdings Ltd ("Grindrod")

(NASDAQ:GRIN, JSE:GSH), a Singapore incorporated, dual listed

company on NASDAQ and the Johannesburg Stock Exchange. Grindrod

currently owns 21 geared dry bulk vessels complementary to the

Company's fleet. They are mostly Japanese built, including 13

Handysize vessels and 8 Supra/Ultramax vessels. Grindrod has seven

vessels in its chartered in fleet with purchase options on

four.

The combined TMI and Grindrod fleet numbers 47 vessels

(excluding three long term chartered in vessels without purchase

options).

The Company's target dividend policy is 8 cents p.a. paid on a

quarterly basis, with a targeted total NAV return of 10-12% per

annum over the medium to long-term.

The Company has the benefit of an experienced Executive Team led

by Edward Buttery and who previously worked closely together at the

Commercial Manager, Taylor Maritime. Established in 2014, Taylor

Maritime is a privately owned ship-owning and management business

with a seasoned team that includes the founders of dry bulk

shipping company Pacific Basin Shipping (listed in Hong Kong

2343.HK) and gas shipping company BW Epic Kosan (formerly Epic

Shipping) (listed in Oslo BWEK:NO). Taylor Maritime's team of

industry professionals are based in Hong Kong, Singapore and

London.

For more information, please visit

www.taylormaritimeinvestments.com .

About Geared Vessels

Geared vessels are characterised by their own loading equipment.

The Handysize and Supra/Ultramax market segments are particularly

attractive, given the flexibility, versatility and port

accessibility of these vessels which carry necessity goods -

principally food and products related to infrastructure building -

ensuring broad diversification of fleet activity and stability of

earnings through the cycle.

IMPORTANT NOTICE

The information in this announcement may include forward-looking

statements, which are based on the current expectations and

projections about future events and in certain cases can be

identified by the use of terms such as "may", "will", "should",

"expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "believe" (or the negatives thereon) or other

variations thereon or comparable terminology. These forward-looking

statements are subject to risks, uncertainties and assumptions

about the Company, including, among other things, the development

of its business, trends in its operating industry, and future

capital expenditures and acquisitions. In light of these risks,

uncertainties and assumptions, the events in the forward-looking

statements may not occur.

References to target dividend yields and returns are targets

only and not profit forecasts and there can be no assurance that

these will be achieved.

[1] Including Grindrod debt

[2] Excluding the newbuild vessel due to be delivered in the

first quarter of calendar year 2024

[3] Including one vessel held for sale, 4 chartered in ships

with purchase options including one which has been exercised, but

excluding 3 chartered in ships without purchase options

[4] Including one Grindrod asset held for sale

[5] BHSI index is basis a 38k dwt type (since Jan 2020),

therefore the Company uses adjusted BHSI figures weighted according

to average dwt of the Company's fleet

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVDBGDRRDDDGXR

(END) Dow Jones Newswires

July 28, 2023 02:00 ET (06:00 GMT)

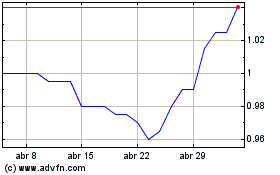

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Taylor Maritime Investme... (LSE:TMI)

Gráfica de Acción Histórica

De May 2023 a May 2024