TIDMVARE

RNS Number : 9217V

Various Eateries PLC

06 December 2023

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

THE MARKET ABUSE REGULATION (EU) NO . 596/2014 AS IT FORMS PART OF

UK DOMESTIC LAW PURSUANT TO THE EUROPEAN UNION (WITHDRAWAL) ACT

2018, AS AMED. UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN.

Various Eateries plc

("Various Eateries", the "Company" or the "Group")

Result of Placing

Conditional Conversion of Debt Into Equity

PDMR Trading

Conditional New Facility Agreement

Proposed New Options

Notice of General Meeting

Various Eateries plc (AIM:VARE) confirms further to its

announcement of 7.00 a.m. (London time) on 6 December 2023 (the

"Announcement"), that it has successfully closed the Placing.

Result of Conditional Placing

Subject to the satisfaction of the conditions referred to below,

the Placing has raised, in aggregate, gross proceeds of GBP10.1

million (cGBP9.7m net proceeds) through the placing of 40,400,000

Ordinary Shares (the "Placing Shares") with certain institutional

and other investors at a price of 25 pence per share (the "Placing

Price"). The Holdings of shareholders who do not participate in the

Placing will be diluted by 50.8 per cent as a result of the

placing.

The Placing is not being underwritten and is conditional, inter

alia, upon:

a) the passing, without amendment, of the Resolutions, including

the Rule 9 Waiver Resolution at the General Meeting;

b) the execution of the Conversion documents, and the Conversion

documents not having been terminated in accordance with their terms

prior to Admission

c) Admission becoming effective by no later than 8.00 a.m. on 27

December 2023 (or such other time and/or date, being no later than

8.00 a.m. on 31 January 2024, as the Placing Agent and the Company

may agree);

d) the other conditions in the Placing Agreement being satisfied or (if applicable) waived; and

e) the Placing Agreement not having been terminated in

accordance with its terms prior to Admission.

Conversion

The Company confirms that, as set out in the announcement of

earlier today, it has, through its wholly owned subsidiary, Various

Eateries Trading Limited, now executed, conditional on completion

of the Placing and on shareholder approval at the upcoming General

Meeting, Conversion documents to convert the following

indebtedness:

-- a Deep Discounted Bond issued to Friends Provident on 15 April 2023 with a nominal value of GBP10,801,509 and maturing on 15 April 2024; which is to convert at the Placing Price. If the Conversion completes the Company will issue to Friends Provident ( which operates on an execution only basis on the sole instruction of Hugh Osmond) 43,206,036 Ordinary Shares (the "First Conversion Shares"); and

-- a Secured Loan Agreement under which there is outstanding

principal amount of GBP392,337 owed to Anella Limited, due to be

repaid on 15 April 2024, and GBP215,351 owed to TDR Capital

Limited, which is to convert at the Placing Price. If the

Conversion completes the Company will issue to Anella Limited (a

company owned and controlled by Andy Bassadone) 1,569,248 Ordinary

Shares and 861,404 Ordinary Shares to TDR Capital (a total of

2,430,752 Ordinary Shares (the "Second Conversion Shares")).

The accrued interest on the indebtedness under the Secured Loans

Agreement is intended to be settled in cash from existing cash

resources. On the Latest Practicable Date the amount of this

accrued interest was GBP9,820.06.

Use of Proceeds

As set out in the Announcement, the Company has ambitious roll

out plans over the next 18 months with plans for up to 10 new Noci

sites and up to 3 new Coppa Club sites, including Cardiff and

Farnham. The Company already has a commitment to open the Cardiff

and Farnham Coppa Club sites during calendar year 2024 and a

further site is to be identified and sourced, likely within the

south of England. The Placing Proceeds will also be utilised for

the costs of these transactions and for working capital

purposes.

The Conversion is considered, by the Independent Directors, to

be of strategic importance to the future of the Company because of

the uncertainty with regards to the Company's ability to repay the

associated debt. The indebtedness under the Deep Discounted Bond is

a material sum for the Company, and it matures in April 2024. There

is no certainty that the holder of the Deep Discount Bond would

extend the repayment terms; that the Group would have the relevant

funds to be able to repay it at the time it matures or that the

Group would be able to source a relevant debt refinancing or

fundraising of the required amount, if necessary.

The capitalisation of the indebtedness under the Deep Discount

Bond and the Secured Loan Agreement gives the Directors certainty

as to the Group's ability to repay this indebtedness and comfort

that the indebtedness can be repaid without a material cash

outflow.

As set out above, if the Company is unable to implement the

Placing and Conversion, the Board believes it may reduce the

Company's ability to complete its planned capital expenditure and

therefore may have a material adverse effect on the Company's

business, financial condition, results of operations and/or

prospects.

PDMR and Substantial Shareholder Participation in the Placing

and Conversion

The Company has been notified of the following participants in

the Placing and the Conversion (conditional on, amongst other

matters, shareholder approval in the upcoming General Meeting):

Name Role Ordinary Ordinary Original Total Percentage

Shares Shares holding Holding holding

Subscribed subscribed prior if the of the

for in for in to the Placing Enlarged

the Placing the Conversion Placing and the Issued

(at 25p) and the Conversion Capital

Conversion progress: if the

Placing

and Conversion

progress

Non-Executive

Hugh Osmond Director 23,500,000* 43,206,036* 41,616,859** 108,322,895 61.88%

--------------- ------------- ---------------- ------------- ------------ ----------------

Executive

Andy Bassadone Chairman 430,652*** 1,569,348*** 2,045,246*** 4,045,246 2.31%

--------------- ------------- ---------------- ------------- ------------ ----------------

Canaccord Substantial

Genuity Shareholder 12,000,000 n/a 18,505,535 30,505,535 17.43%

--------------- ------------- ---------------- ------------- ------------ ----------------

* issued to Friends Provident (which operates on an execution

only basis on the sole instruction of Hugh Osmond)

** 37,436,256 Ordinary Shares are held by Xercise2 Limited, a

company controlled by Hugh Osmond; 3,174,603 Ordinary Shares are

held by The Great House at Sonning Limited, a company controlled by

Hugh Osmond; and 1,006,000 Ordinary Shares are held by Hugh

Osmond's family members.

*** issued to Anella Limited, a company owned and controlled by

Andy Bassadone.

Participation by Hugh Osmond and his affiliated person(s)

Hugh Osmond, Xercise2 Limited, The Great House at Sonning

Limited, Lucy Potter, The Children of Hugh Osmond, Friends

Provident, Tiffany Sword and Osmond Capital Limited Connected

Persons are considered by the Panel to be acting in concert in

respect of the Company and are interested in shares which carry

47.2 per cent. of the Company's voting rights. Assuming that the

Placing and Conversion is completed, and assuming that no person

exercises any options or other rights to subscribe for Ordinary

Shares, as at Admission Hugh Osmond and members of his Concert

Party would be interested in Ordinary Shares carrying 50 per cent.

or more of the Company's voting rights. Ordinarily, the acquisition

by any member of a concert party of an interest in shares as a

result of the Rule 9 Waiver Proposal which increases the percentage

of shares carrying voting rights in which such member is interested

to 30 per cent. or more would result in the members of the concert

party having to make a mandatory offer under Rule 9 of the Takeover

Code.

Pursuant to the Placing, Friends Provident (a company that

operates on an execution only basis on the sole instruction of Hugh

Osmond) has agreed that it will subscribe for 23,500,000 Placing

Shares. Accordingly, assuming such participation in, and following

completion of, the Placing and Conversion, Hugh Osmond and members

of his Concert Party would be interested (for the purpose of the

Takeover Code) in Ordinary Shares carrying more than 30 per cent.

of the Company's voting share capital (from a shareholding of less

than 50 per cent. of the Company's voting share capital) which

would ordinarily result in Hugh Osmond and members of his Concert

Party having to make a mandatory offer under Rule 9 of the Takeover

Code.

The Panel has been consulted and has agreed, subject to the

passing of the Rule 9 Waiver Resolution by the Independent

Shareholders on a poll at the General Meeting, to waive the

obligation of Hugh Osmond and members of his Concert Party to make

a mandatory offer for the ordinary shares in the capital of the

Company not already owned by them which would otherwise arise

following completion of the Proposals. Accordingly, the Company is

proposing the Rule 9 Waiver Resolution to seek the approval of

Independent Shareholders to the Rule 9 Waiver Resolution.

In the event that the Rule 9 Waiver Resolution is approved, and

on the assumption that the Placing and Conversion are completed,

that Friends Provident receive the maximum amount cited above, and

that no person exercises any options or other rights to subscribe

for Ordinary Shares or New Ordinary Shares, as at Admission, Hugh

Osmond and members of his Concert Party would be interested in 62.1

per cent. of the Company's voting share capital.

In addition, Hugh Osmond and members of his Concert Party will

not be restricted from making a subsequent offer in the future for

the Company in the event that the Rule 9 Waiver Proposal is

approved by Independent Shareholders and the Transactions take

place.

Deep Discounted Bond Facility Agreement

The Company confirms that today, VEL Property Holdings Limited,

a subsidiary of the Company, has entered into a conditional DDB

Facility Agreement with Xercise 2 Limited, a company owned and

controlled by Hugh Osmond. Under the terms of the DDB Facility

Agreement, VEL Property Holdings Limited would be able to draw down

up to GBP3,018,769, at a rate of 5% above Bank of England Base rate

for a period of 15 months, for the purpose of redeeming the deep

discounted bond issued by VEL Property Holdings Limited to Friends

Provident (which operates on an execution only basis on the sole

instruction of Hugh Osmond). The details of this deep discounted

bond are set out in the Company's announcement of 18 July 2023.

This deep discounted bond has a redemption date of 14 January 2024.

In the event that the Company cannot refinance this deep discounted

bond, it is intended that the DDB Facility Agreement would provide

comfort that it can be repaid.

Issue of Options

The Directors believe that it is important for the success and

growth of the Company to employ highly motivated personnel and that

equity incentives are available to attract, retain and reward

staff.

The Company currently has outstanding options over 4,468,238

Ordinary Shares issued to its directors and management team. These

include options over 642,857 Ordinary Shares granted to Sharon

Badelek (see announcement dated 5 April 2023) and 300,000 options

granted to Tiffany Sword, respectively. Additionally, there are

joint share ownership arrangements (JSOP) in place with Andy

Bassadone and Matt Fanthorpe, which have been in place since the

Company's IPO. Following completion of the Placing and Conversion,

it is intended that all current options and JSOP arrangements will

be cancelled save for options over 1,290,262 ordinary shares, as

detailed in the table below.

Following the cancellation, the Company intends to issue new

options, also conditional on the completion of the Placing and

Conversion, in respect of 13,483,180 Ordinary Shares to certain

directors and employees of the Company on the following terms:

-- All options will vest in three tranches over three years,

with each tranche being exercisable at a 10% uplift to the previous

exercise price (the starting price being the higher of the placing

price plus 10% or market value);

-- The options are conditional on the recipient remaining an

employee of VARE at the time of exercise; and

-- Once vested, and subject to the employment condition, the

options can be exercised at any time between 3 and 10 years from

the date of grant.

The details of the new and existing options are set out in the

table below:

Name Position Held No. of existing No. of new Total options

options over options over held post-Admission

Ordinary Ordinary Shares

Shares retained granted

Andy Bassadone Executive Chairman Nil 1,428,571 1,428,571

------------------------ ----------------- ----------------- ---------------------

Chief Financial

Sharon Badelek Officer 642,857 2,857,143 3,500,000

------------------------ ----------------- ----------------- ---------------------

Tiffany Sword Non-Executive Director Nil 1,000,000 1,000,000

------------------------ ----------------- ----------------- ---------------------

An employee of

the Company and

a member of the

John Gripton Concert Party n/a 500,000 500,000

------------------------ ----------------- ----------------- ---------------------

Managing Director,

Rebecca Tooth Coppa Club n/a 2,500,000 2,500,000

------------------------ ----------------- ----------------- ---------------------

Matt Fanthorpe Culinary Director Nil 1,000,000 1,000,000

------------------------ ----------------- ----------------- ---------------------

Other employees 647,405 4,197,466 4,844,871

----------------- ----------------- ---------------------

TOTAL 1,290,262 13,483,180 14,773,442

----------------- ----------------- ---------------------

The Company intends to utilise the shares currently held by the

Company's Employee Benefit Trust, (being 6,866,173 Ordinary Shares)

to part satisfy the issue of these new options, with the balance

being issued from new equity.

Related Party Transactions

As Hugh Osmond is a director and, indirectly, a substantial

shareholder in the Company, the participation by Friends Provident

( which operates on an execution only basis on the sole instruction

of Hugh Osmond) in the Placing and the Conversion, constitutes a

related party transaction for the purpose of Rule 13 of the AIM

Rules of Companies. The Directors of the Company, excluding Hugh

Osmond, Sharon Badelek, Tiffany Sword and Andy Bassadone who are

not considered independent for the purposes of this opinion,

consider having consulted with WH Ireland, the Company's nominated

adviser, that the terms of the participation in the Placing and the

Conversion by Friends Provident is fair and reasonable in so far as

Shareholders are concerned.

As Hugh Osmond is a director and, indirectly, a substantial

shareholder in the Company, the execution of the DDB Facility

Agreement with Xercise2 Limited (a company owned and controlled by

Hugh Osmond) constitutes a related party transaction for the

purpose of the AIM Rules. The Directors of the Company, excluding

Hugh Osmond, Sharon Badelek, Tiffany Sword and Andy Bassadone who

are not considered independent for the purposes of this opinion,

consider having consulted with WH Ireland, the Company's nominated

adviser, that the terms of the DDB Facility Agreement are fair and

reasonable in so far as Shareholders are concerned.

As Andy Bassadone is a director of the Company, the

participation by Anella Limited (a company owned and controlled by

Andy Bassadone) in the Placing and the Conversion constitutes a

related party transaction for the purpose of the AIM Rules. The

Directors of the Company excluding Hugh Osmond, Sharon Badelek,

Tiffany Sword and Andy Bassadone who are not considered independent

for the purposes of this opinion, consider having consulted with WH

Ireland, the Company's nominated adviser, that the terms of the

participation in the Conversion and the Placing by Anella Limited

is fair and reasonable in so far as Shareholders are concerned.

As Canaccord Genuity Wealth Management is a substantial

shareholder in the Company, the allotment and issue of the Placing

Shares constitutes a related party transaction for the purpose of

the AIM Rules. The Directors of the Company, excluding Hugh Osmond,

Sharon Badelek, Tiffany Sword and Andy Bassadone who are not

considered independent for the purposes of this opinion, consider

having consulted with WH Ireland, the Company's nominated adviser,

that the terms of the participation in the Placing by Canaccord

Genuity Wealth Management is fair and reasonable in so far as

Shareholders are concerned.

The issue of options over Ordinary Shares, as set out in the

Options section above, constitutes a related party transaction for

the purpose of the AIM Rules. The Directors of the Company,

excluding Hugh Osmond, Sharon Badelek, Tiffany Sword and Andy

Bassadone who are not considered independent for the purposes of

this opinion, consider having consulted with WH Ireland, the

Company's nominated adviser, that the issue of options is fair and

reasonable in so far as Shareholders are concerned.

Irrevocable Undertakings to vote in favour of the

resolutions

Glyn Barker and Gareth Edwards, being Independent Directors, and

Compound together hold, or are able to control the voting in

respect of, 7,141,426 Ordinary Shares and, of which, Compound

holds, or is able to control the voting in respect of, 6,863,649

Ordinary Shares. Compound is considered by the Board to be an

Independent Shareholder as it is neither a member of the Concert

Party nor a Placing Participant. The 7,141,426 Ordinary Shares that

Glyn Barker, Gareth Edwards and Compound hold, or are able to

control the voting in respect of, represent approximately 31.9 per

cent. of the Ordinary Shares expected to be entitled to vote on the

Rule 9 Waiver Resolution. Glyn Barker, Gareth Edwards and Compound

have irrevocably undertaken to vote in favour of the Rule 9 Waiver

Resolution.

Shareholders which together hold, or are able to control the

voting in respect of, Ordinary Shares representing approximately

38.6 per cent. of the Ordinary Shares expected to be entitled to

vote on the Rule 9 Waiver Resolution, have irrevocably undertaken

to vote in favour of the Rule 9 Waiver Resolution.

In addition, Shareholders which together hold, or are able to

control the voting in respect of, Ordinary Shares representing

approximately 57.7 per cent. of the Existing Ordinary Shares, have

irrevocably undertaken to vote in favour of the other

Resolutions.

Recommendation

The Independent Directors, who have been so advised by WH

Ireland Limited, consider the Rule 9 Waiver Proposals to be fair

and reasonable and in the best interests of the Shareholders and

the Company as a whole. In providing advice to the Directors, WH

Ireland Limited has taken into account the Directors' commercial

assessments.

In addition, the Directors consider that all of the Resolutions

are in the best interests of the Company and its Shareholders as a

whole. Accordingly, the Directors unanimously recommend that

Shareholders vote in favour of all the Resolutions as the

Independent Directors have irrevocably undertaken to do in respect

of their entire beneficial holdings, amounting in aggregate to

277,777 Ordinary Shares, representing approximately 0.3 per cent.

of the votes the Ordinary Shares have in relation all of the

Resolutions and as the Directors (other than the Independent

Directors) have irrevocably undertaken to do in respect of their

entire beneficial holdings, amounting in aggregate to 42,717,906

Ordinary Shares, representing approximately 48.0 per cent. of the

votes the Ordinary Shares have in respect of the Resolutions (other

than the Rule 9 Waiver Resolution).

Notice of General Meeting

The Company announces that it will shortly despatch the

Shareholder Circular and Notice of General Meeting to Shareholders.

The Directors confirm they are to convene a general meeting of the

Company at 10 am on 22 December 2023 at the offices of WH Ireland

Limited, 24 Martin Lane, London, EC4R 0DR. The Shareholder Circular

and Notice of General Meeting will be available on the Company's

website https://www.variouseateries.co.uk/ from today.

Commenting, Andy Bassadone, Executive Chairman said: " We are

delighted with the support shown by new and existing shareholders

in this fundraise for the Various Eateries roll out strategy. The

landscape post Covid has presented market dynamics which we cannot

ignore, with the availability and commercials of sites being in our

favour and changes in consumer behaviour that play to our brands.

Building on this favourable landscape, we have an established

platform and team in place plus a long track record of

delivery.

The appetite for high quality food and a great experience

remains and we look forward to the expansion of our footprint, with

our successful Coppa Club and Noci brands, over the next 18 months

. "

Admission and Total Voting Rights

Subject to all resolutions being passed at the General Meeting,

application will be made to the London Stock Exchange for admission

of the Placing Shares, the First Conversion Shares and the Second

Conversion Shares (a total of 86,036,788 Ordinary Shares (the "New

Ordinary Shares") to trading on AIM. It is expected that Admission

will become effective and dealings in the New Ordinary Shares will

commence on AIM at 8.00 a.m. on or around 27 December 2023 (or such

later date as may be agreed between the Company and the Bookrunner,

but no later than 31 January 2024).

The New Ordinary Shares will be issued fully paid and will rank

pari passu in all respects with the Company's existing Ordinary

Shares.

Following Admission, the total number of Ordinary Shares in the

capital of the Company in issue will be 175,045,265 with voting

rights. This figure may be used by shareholders as the denominator

for the calculations by which they will determine if they are

required to notify their interest in, or a change to their interest

in, the Company's share capital pursuant to (i) the Company's

Articles, (ii) the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules and/or (iii) the AIM Rules for

Companies issued by the London Stock Exchange plc as amended from

time to time.

Capitalised terms used but not otherwise defined in this

announcement shall have the meanings ascribed to such terms in

Appendix II of the Announcement, unless the context requires

otherwise.

For further information, please contact:

Various Eateries Via Alma PR

plc

Andy Bassadone Executive Chairman

WH Ireland Limited Sole Broker and NOMAD Tel: +44 (0)20 7220 1666

Broking

Harry Ansell

Nominated Adviser

Katy Mitchell

Darshan Patel

Isaac Hooper

Alma PR Financial PR Tel: +44 (0)20 3405 0205

David Ison variouseateries@almapr.co.uk

Rebecca Sanders-Hewett

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Friends Provident International

-------------------------- --------------------------------------

2 Reason for the notification

------------------------------------------------------------------

a) Position/status PCA of Hugh Osmond

-------------------------- --------------------------------------

b) Initial notification Initial notification

/Amendment

-------------------------- --------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

------------------------------------------------------------------

a) Name Various Eateries plc

-------------------------- --------------------------------------

b) LEI 213800SWZ6W3RNE32B76

-------------------------- --------------------------------------

4 Details of the transaction(s): section to be repeated for (i)

each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted

------------------------------------------------------------------

a) Description Issue of Placing Shares

of the financial

instrument, ISIN: GB00BM9BZK23

type of instrument

Identification

code

-------------------------- --------------------------------------

b) Nature of the

transaction

-------------------------- --------------------------------------

c) Price(s) and Price No. of shares

volume(s) 25p 23,500,000

--------------

-------------------------- --------------------------------------

Aggregated

d) information

- Aggregated

volume

- Price 23,500,000

25p

------------------------------- --------------------------------------

e) Date of the 06 December 2023

transaction

-------------------------- --------------------------------------

f) Place of the XLON

transaction

-------------------------- --------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Friends Provident International

---------------------- --------------------------------------------

2 Reason for the notification

--------------------------------------------------------------------

a) Position/status PCA of Hugh Osmond, director of the Company

---------------------- --------------------------------------------

b) Initial notification Initial notification

/Amendment

---------------------- --------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

--------------------------------------------------------------------

a) Name Various Eateries plc

---------------------- --------------------------------------------

b) LEI 213800SWZ6W3RNE32B76

---------------------- --------------------------------------------

4 Details of the transaction(s): section to be repeated for (i)

each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted

--------------------------------------------------------------------

a) Description Conversion of Debt to Equity

of the financial

instrument, ISIN: GB00BM9BZK23

type of instrument

Identification

code

---------------------- --------------------------------------------

b) Nature of the

transaction

---------------------- --------------------------------------------

c) Price(s) and Price No. of shares

volume(s) 25p 43,206,036

--------------

---------------------- --------------------------------------------

Aggregated

d) information

- Aggregated

volume 43,206,036

- Price 25p

--------------------------- --------------------------------------------

e) Date of the 06 December 2023

transaction

---------------------- --------------------------------------------

f) Place of the Off market.

transaction

---------------------- --------------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Anella Limited

---------------------- -----------------------------------------------

2 Reason for the notification

-----------------------------------------------------------------------

a) Position/status PCA of Andy Bassadone, Director of the Company

---------------------- -----------------------------------------------

b) Initial notification Initial notification

/Amendment

---------------------- -----------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------

a) Name Various Eateries plc

---------------------- -----------------------------------------------

b) LEI 213800SWZ6W3RNE32B76

---------------------- -----------------------------------------------

4 Details of the transaction(s): section to be repeated for (i)

each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted

-----------------------------------------------------------------------

a) Description Issue of Placing Shares

of the financial

instrument, ISIN: GB00BM9BZK23

type of instrument

Identification

code

---------------------- -----------------------------------------------

b) Nature of the

transaction

---------------------- -----------------------------------------------

c) Price(s) and Price No. of shares

volume(s) 25p 430,652

--------------

---------------------- -----------------------------------------------

Aggregated

d) information

- Aggregated

volume 430,652

- Price 25p

--------------------------- -----------------------------------------------

e) Date of the 06 December 2023

transaction

---------------------- -----------------------------------------------

f) Place of the XLON

transaction

---------------------- -----------------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Anella Limited

---------------------- -----------------------------------------------

2 Reason for the notification

-----------------------------------------------------------------------

a) Position/status PCA of Andy Bassadone, Director of the Company

---------------------- -----------------------------------------------

b) Initial notification Initial notification

/Amendment

---------------------- -----------------------------------------------

3 Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

-----------------------------------------------------------------------

a) Name Various Eateries plc

---------------------- -----------------------------------------------

b) LEI 213800SWZ6W3RNE32B76

---------------------- -----------------------------------------------

4 Details of the transaction(s): section to be repeated for (i)

each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted

-----------------------------------------------------------------------

a) Description Conversion of Debt to Equity

of the financial

instrument, ISIN: GB00BM9BZK23

type of instrument

Identification

code

---------------------- -----------------------------------------------

b) Nature of the

transaction

---------------------- -----------------------------------------------

c) Price(s) and Price No. of shares

volume(s) 25p 1,569,348

--------------

---------------------- -----------------------------------------------

Aggregated

d) information

- Aggregated

volume 1,569,348

- Price 25p

--------------------------- -----------------------------------------------

e) Date of the 06 December 2023

transaction

---------------------- -----------------------------------------------

f) Place of the Off market

transaction

---------------------- -----------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIUPGPWPUPWGAQ

(END) Dow Jones Newswires

December 06, 2023 10:34 ET (15:34 GMT)

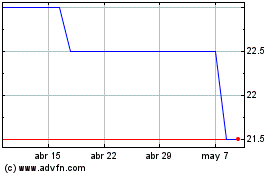

Various Eateries (LSE:VARE)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Various Eateries (LSE:VARE)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024