TIDMWHR

RNS Number : 7254B

Warehouse REIT PLC

06 June 2023

6 June 2023

Warehouse REIT plc

(the "Company" or "Warehouse REIT", together with its

subsidiaries, the "Group")

Strong operational performance, successful disposal programme

and weighting towards multi-let sector provide a strong platform

for growth

Neil Kirton, Chairman of Warehouse REIT commented:

"This financial year saw a marked divergence between equity

market valuations and the continued strength of the occupier

market. Operationally, our performance has been strong; our focus

on multi-let assets in key industrial hubs where demand remains

firm but supply is constrained is paying off with like-for-like

growth in contracted rents of 5.3%. We were not immune from the

rapid rise in interest costs, which impacted both our valuation and

our earnings, but we acted decisively, with GBP90 million of

non-core disposals in line with our plan, supporting the balance

sheet and further focusing the business on its core assets.

Since year end, there are clearer signs that investors are

returning to the market, evidenced by activity across the sector

and our most recent sales, which are ahead of book. At Radway, our

flagship scheme in Crewe, we are now in advanced negotiations for a

significant pre let, a major milestone which validates our

ambitious but highly disciplined approach to development. This

opportunity, coupled with an improved financial position and our

71% weighting towards multi-let assets, the strongest part of our

market, leaves us well positioned for the future."

Maintained strong operational performance, capturing in-built

portfolio reversion and driving growth

-- GBP45.3 million contracted rent, including:

o GBP3.0 million from 40 new lettings, 29.1% ahead of previous

contracted rent

o GBP1.0 million from renewals, 15.8% ahead of previous

contracted rent

o GBP2.0 million from rent reviews, 21.5% ahead of previous

contracted rent

-- 5.3% like-for-like rental growth, with 17.6% portfolio reversion as at 31 March 2023

-- Occupancy up 3.1% from 30 September 2022 to 95.8%

-- c.99.0% of FY23 rent collected

-- In advanced negotiations for a 350,000 sq ft pre let at the first phase of Radway 16, Crewe

GBP158.5m of targeted capital activity, delivering on disposal

strategy and further focusing the business on its core assets

-- GBP59.6 million of asset disposals, crystallising an ungeared

IRR of 8.0%; further GBP29.9 million completing post period end

-- GBP64.0 million of acquisitions including Bradwell Abbey, a

multi-let industrial estate in Milton Keynes, 45.0%

reversionary

-- GBP5.0 million of capital investment or 0.5% of GAV, driving rents and values

Portfolio valuation impacted by sector-wide asset re-pricing

-- Like-for-like portfolio valuation decreased 18.5% to GBP828.8

million (2022: GBP1,012.0m); 131 bps equivalent yield expansion

partially offset by strong like-for-like growth in rental values of

6.2%, reflecting a robust occupier market

-- EPRA NTA per share 122.6p (2022: 173.9p) with total

accounting return of (25.7%) (2022: 33.2%); five year total

accounting return of 10.8%

Resilient financial performance and strengthened balance

sheet

-- Adjusted earnings of GBP19.8m (2022: GBP27.2m), primarily reflecting increased debt costs

-- Adjusted EPS of 4.7p (2022: 6.4p), with the dividend maintained at 6.4p

-- Two interest rate caps of GBP100m acquired; 75.2% of debt

hedged against interest rate volatility

-- GBP320.0 million of debt refinanced with improved covenants

-- LTV at 33.9%, with further headroom of GBP14.0 million in

available resources; pro forma LTV at 30.5% adjusting for post

balance sheet sales

Progressing our sustainability strategy

-- 60.2% of the portfolio now EPC A-C rated; advanced our pathway to Net Zero

Financial highlights

Year ended 31 March 2023 2022

Gross property income GBP47.8m GBP48.7m

------------ ------------

Operating profit before change in value GBP32.2m GBP35.4m

of investment properties

------------ ------------

IFRS (loss)/profit before tax (GBP182.8m) GBP191.2m

------------ ------------

IFRS earnings per share (43.0) 45.0p

------------ ------------

EPRA earnings per share 3.9p 6.4p

------------ ------------

Adjusted earnings per share(2) 4.7p 6.4p

------------ ------------

Dividends per share(3) 6.4p 6.4p

------------ ------------

Total accounting return(4) (25.7%) 33.2%

------------ ------------

Total cost ratio(5) 28.4% 27.1%

------------ ------------

As at 31 March 31 March

2023 2022

------------ ------------

Portfolio valuation GBP828.8m GBP1,012.0m

------------ ------------

IFRS net asset value GBP528.5m GBP739.0m

------------ ------------

IFRS net asset value per share 124.4p 173.9p

------------ ------------

EPRA net tangible assets ("NTA") per

share(6) 122.6p 173.8p

------------ ------------

Loan to value ("LTV") ratio 33.9% 25.1%

------------ ------------

Operational highlights

As at 31 March 31 March

2023 2022

Contracted rent GBP45.3m GBP44.0m

---------- ----------

Passing rent GBP41.2m GBP40.6m

---------- ----------

WAULT(7) to expiry 5.5 years 5.6 years

---------- ----------

WAULT to first break 4.5 years 4.5 years

---------- ----------

EPRA topped up yield 5.5% 4.4%

---------- ----------

Occupancy 95.8% 93.7%

---------- ----------

Meeting

A meeting for investors and analysts will be held at 9.00am on 6

June 2023 at the offices of FTI Consulting, 200 Aldersgate, London,

EC1A 4HD.

The results presentation is available in the Investor Centre

section of the Group's website. For further details, please email

FTI Consulting at warehousereit@fticonsulting.com

Enquiries

Warehouse REIT plc

via FTI Consulting

Tilstone Partners Limited

Simon Hope, Andrew Bird, Peter Greenslade, Paul Makin, Jo

Waddingham

+44 (0) 1244 470 090

G10 Capital Limited (part of the IQEQ Group, AIFM)

Maria Baldwin

+44 (0) 207 397 5450

FTI Consulting (Financial PR & IR Adviser to the

Company)

Dido Laurimore, Richard Gotla

+44 (0) 7904 122207 / WarehouseReit@fticonsulting.com

Further information on Warehouse REIT is available on its

website: http://www.warehousereit.co.uk

Notes

Warehouse REIT is a FTSE 250 UK Real Estate Investment Trust

that invests in UK warehouses, focused on multi-let assets in

industrial hubs across the UK.

We provide a range of warehouse accommodation in key locations

which meets the needs of a broad range of occupiers. Our focus on

multi-let assets means we provide occupiers with greater

flexibility so we can continue to match their requirements as their

businesses evolve, encouraging them to stay with us for longer.

We invest in our business by selectively acquiring assets with

potential and by developing opportunities we have created. Through

pro-active asset management we unlock the value inherent in our

portfolio, helping to capture rising rents and driving an increase

in capital values to deliver strong returns for our investors over

the long term.

Sustainability is embedded throughout our business, helping us

meet the expectations of our stakeholders today and futureproofing

our business for tomorrow.

The Company is an alternative investment fund ("AIF") for the

purposes of the AIFM Directive and as such is required to have an

investment manager who is duly authorised to undertake the role of

an alternative investment fund manager ("AIFM"). The AIFM and the

Investment Manager is currently G10 Capital Limited (Part of the

IQEQ Group).

Forward-looking Statements

Certain information contained in these half-year results may

constitute forward looking information. This information relates to

future events or occurrences or the Company's future performance.

All information other than information of historical fact is

forward looking information. The use of any of the words

"anticipate", "plan", "continue", "estimate", "expect", "may",

"will", "project", "should", "believe", "predict" and "potential"

and similar expressions are intended to identify forward looking

information. This information involves known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking information. No assurance can be given that this

information will prove to be correct and such forward looking

information included in this announcement should not be relied

upon. Forward-looking information speaks only as of the date of

this announcement.

The forward-looking information included in this announcement is

expressly qualified by this cautionary statement and is made as of

the date of this announcement. The Company and its Group do not

undertake any obligation to publicly update or revise any

forward-looking information except as required by applicable

securities laws.

Chairman's statement

The operational fundamentals of our business remained strong

throughout the year, but this robust performance has been

overshadowed by macro events which resulted in a step change in

interest rates, driving property yields higher and impacting

valuations across the sector.

Amid this volatility, we have maintained our focus on driving

the value of our portfolio through active asset management. The

long-term trends which have underpinned occupier demand in recent

years continue to support our leasing activity, which this year

delivered an additional GBP3.5 million in rent, bringing contracted

rent to GBP45.3 million as at 31 March 2023.

We continue to let space significantly ahead of previous rent,

demonstrating the reversionary potential of our portfolio and that

occupiers are prepared to pay higher rents for the right space in

the right locations. Our activity drove a like-for-like increase in

contracted rents of 5.3%, with the like-for-like estimated rental

value of our space up 6.2% reflecting sound underlying market

fundamentals. In addition, building on our strategic focus on

multi-let industrial space, we acquired Bradwell Abbey, a multi-let

estate near the gateway city of Milton Keynes. Multi-let assets

allow greater flexibility for occupiers because they can take

multiple or different-sized units and more easily scale up or down

according to their needs, accelerating our ability to capture

rental growth. This also means we are well placed to appeal to a

broader range of occupier as demand diversifies in new directions.

This year alone we have let space to a software provider to the

healthcare industry, an electronic bike and scooter company and an

automotive parts manufacturer. Our multi-let bias also means we can

create our own increased rental tone through targeted capex helping

to capture reversion at lease events.

Following the market correction in the second half, we

successfully executed on our strategy to reduce the level of

variable-rate debt through targeted asset disposals of non-core

properties. These totalled GBP59.6 million over the year and

crystallised an unlevered IRR of 8.0%. Encouragingly, there are

clear signs that liquidity is returning to the investment markets,

with the majority of these transactions completing towards the end

of the second half and post year end we have exchanged a further

GBP29.3 million of sales, on average 17.2% ahead of book value.

This activity further focuses the portfolio on our core assets,

enabling Tilstone Partners, our Investment Advisor, to concentrate

on opportunities which best drive value for shareholders.

Radway 16 in Crewe is the best example of this and an excellent

case study of Tilstone's expertise in site assembly. Initially, it

comprised a 250,000 sq ft multi-let estate with surplus land. It

was acquired within a portfolio purchase and has grown through

careful acquisition of adjacent sites from just 25 acres to be an

exciting development site of over 100 acres, strategically located

on Junction 16 of the M6. Inevitably, macro conditions have

impacted its valuation, but its combination of best-in-class,

sustainable space and superb connectivity make it highly attractive

to a wide range of occupiers. We are pleased that discussions for a

significant pre-let on the first phase of this scheme are well

advanced and only subject to legal documentation. We will update

stakeholders on any developments in due course.

Financial performance and returns

The dramatic increase in interest rates over the course of the

financial year to address levels of inflation not seen since the

1980s significantly reduced liquidity in investment markets.

Valuers reacted quickly, increasing yields to reflect the new

funding environment, and significantly reducing property valuations

across all commercial real estate markets. We have not been immune

and as a result of significant yield expansion, the value of the

portfolio declined by 18.5% on a like-for-like basis over the 12

months. This was partially offset by an increase in ERV of 6.2%

contributing to a fall in EPRA NTA to 122.6 pence per share at the

year end (31 March 2022: 173.8 pence) and a negative total

accounting return of (25.7%) (31 March 2022: 33.2%). However,

reflecting our very strong performance in the years following IPO

our five-year total accounting return is 10.8%.

When it became clear that interest rates would trend upwards, in

July 2022, two additional interest rate caps of GBP100.0 million

each were acquired for a total premium payable of GBP10.9 million

ahead of significant rate rises. These cap the variable SONIA rate

at 1.5% until July 2025 and July 2027 respectively. 75.2% of our

total debt of GBP306.0 million is fixed with the remaining 24.8%

subject to variable rates.

However, the increased cost of our variable rate debt had a

negative impact on earnings. While we met our target dividend of

6.4 pence per share, adjusted earnings of 4.7 pence per share meant

that for the full year, the dividend was uncovered. Following the

disposals undertaken during the period, our efforts are now focused

on continuing to capture the reversion embedded within the

portfolio and reduce the variable rate component of our debt.

As at 31 March 2023, the Group's loan to value remains within

our target range of 30% to 40%, at 33.9% as at year end, with

GBP14.0 million of headroom within our new facilities and with

additional headroom created following further asset disposals that

have exchanged, but not yet completed.

Environmental, social and governance matters

We continued to make significant progress with our ESG agenda

under the leadership of my colleague Aimée Pitman, who chairs our

Sustainability Committee. We have further strengthened how we

integrate ESG factors in everyday decisions, modelled our

climate-related risks and formulated a pathway to net zero for our

Scope 1 and 2 emissions by 2030. We continued to improve Energy

Performance Certificate ("EPC") ratings across the portfolio. We

have eradicated non-compliant F and G ratings ahead of statutory

requirements and have a capital expenditure programme aimed at

improving the ratings of all D and E rated units in England and

Wales to progress meeting expected future legislative requirements

for all commercial properties.

In July 2022 the Company transferred from AIM to the Main

Market. Given our already robust approach to corporate governance

and our comprehensive disclosure, compliance with the requirements

of the Listing Rules and related guidance has been straightforward

and we now benefit from access to a wider pool of shareholder

capital. We continue to follow and comply with the AIC Code of

Corporate Governance.

In May 2023, Tilstone Partners Limited, the Investment Advisor,

appointed Simon Hope, one of its co-founders, as Executive Chairman

and Co-Managing Director alongside Andrew Bird. This follows

Simon's move to an executive role at Tilstone.

In a separate announcement today, Martin Meech has indicated

that he will not stand for re-election at the AGM this September.

Martin has served on the Board since 2017 as the Senior Independent

Director and has been a hardworking, respected and valued colleague

having served on the Audit, Management Engagement and more recently

the Sustainability Committees. I would like to thank him for all

his efforts on our behalf and wish him well as he takes up an

executive position in the real estate industry.

As reported in elsewhere, this year the Board underwent an

externally facilitated Board evaluation. It is envisaged that the

outputs of that evaluation will be able to assist the Nomination

Committee in identifying Martin's successor. The Board have already

commenced the process using external consultants to find a

successor.

Outlook

Based on the performance of industry benchmarks and our own

experience, there are clear signs that the investment market is

stabilising and investors are returning, reflecting the very

favourable supply-demand dynamics in our markets. However, as an

industry, we are highly sensitive to the future path of interest

rates and the outlook remains uncertain, so the Board will continue

to manage the business diligently and carefully.

In this context, the ability to drive growth organically is key

to delivering returns. Occupier demand for space remains robust and

our sector continues to benefit from strong tailwinds, including

the growth of online retail and heightened focus on supply chain

resilience. In addition, our strong bias towards multi-let space in

economically relevant locations means we are well placed to capture

demand and drive rents. Selected development opportunities provide

further upside and we will commit to these as and when the time is

right.

I am confident that the business is well placed to deliver on

behalf of shareholders moving forward. Our primary focus in the

near term is continuing to optimise the portfolio earnings growth

through active asset management. It should be clear that the Board

remain very focused on total shareholder returns. As we pay down

more variable rate debt, further capture the significant

reversionary potential in the portfolio and continue the value

creation process at Radway Green, we believe we have a clear path

to further growth in our adjusted earnings per share and therefore

our dividend cover.

Neil Kirton

Chairman

5 June 2023

Objectives and strategy

We aim to create value through a top-down approach to

investment, hands-on asset management with best-in-class processes,

and an appropriate mix of financing.

Our objectives

We aim to provide shareholders with an attractive total return,

underpinned by secure income.

Total accounting return

Our target is 10% per annum, through a combination of dividends

and growth in NAV.

Outcome in 2022/23

Not achieved.

The total accounting return for the year was (25.7%), reflecting

the impact of adverse interest rates and market conditions on the

portfolio valuation, partially offset by improvements in occupancy

and interest rate caps. Our average total accounting return is on

track at 10.8%.

Plan for 2023/24

We continue to target an average return of 10% per annum.

Dividends

Our target for this year was a total dividend of at least 6.4

pence per share.

Outcome in 2022/23

Achieved.

We declared total dividends of 6.4 pence per share.

Plan for 2023/24

Our target for 2023/24 is to maintain the dividend at 6.4 pence

per share.

Sustainability

Our new environmental performance target is a 4.2% annual

reduction in our like-for-like Scope 1 and 2 emissions.

Our strategy

To achieve our objectives, we follow the strategy set out

below:

Investment strategy Risks: What we achieved: Post year end activity:

We look for: * poor performance of the Investment Advisor, Tilston * acquired one asset totalling c.335,000 sq ft in t * exchanged on a further GBP29.3m of sales

* sites close to major transport links and large e; he

conurbations, with high occupier demand and a highly attractive location of Milton Keynes; and

suitable workforce;

* poor returns on portfolio; and

* disposed of 16 assets for GBP59.6 million, genera

* buildings or land with a range of uses and long-term ting

flexibility, including the potential to change * acquisition of inappropriate assets or unrecognised an internal rate of return of 8.0%.

permitted use; and liabilities, or a breach of the investment strategy

.

* assets that match occupiers' current and future needs,

including their ESG objectives. Progress measured by:

* like-for-like valuation change;

Multi-let estates spread

risk and offer more asset * EPRA NAV;

management opportunities

than single-let assets.

Rental increases can * dividend per share; and

also be reflected across

the estate. We generally

target buildings of less * Total accounting return

than 100,000 sq ft and

have an average size

of 12,000 sq ft.

Asset management strategy Risks: During the year we: Post year end activity:

We budget to spend 0.75% * poor performance of Tilstone. * invested GBP5.0 million, or 0.5% of GAV, in capital * 8 new lettings and 3 renewals, 39.5% ahead of

of our gross asset value expenditure; prior

("GAV") on capital expenditure rents and 1.6% above March 2023 ERV; and

each year, with a target Progress measured by:

return of at least 10%. * occupancy; * completed 40 new lettings, at rents 13.0% ahead of

We also target a vacancy ERV; * 2 rent reviews, 22.5% ahead of prior rent, 19

level of 5-7%, since .5%

vacant properties allow * like-for-like rental income growth; ahead of ERV at the time of the rent review.

us to carry out asset * completed 22 lease renewals, with a 15.8% increase in

management activities. headline rents;

Improving the sustainability * rental increases agreed versus valuer's ERV;

performance of our assets,

for example by improving * completed 21 rent reviews with a 21.5% increase in

their energy efficiency, * number of energy efficient initiatives; and headline rents;

is an important part

of maintaining property

values and occupier appeal. * portfolio EPC performance * continued to progress our development project at

Radway 16, Crewe; and

* 18 EV chargers installed.

---------------------------------------------------------- ------------------------------------------------------------ ---------------------------------------------------------

Financial strategy Risks: During the year we: Post year end activity:

We fund the business * significant volatility in interest rates; * moved the Company's listing to the Premium Segment of * Refinancing with new club of lenders agreed with

through shareholders' the Main Market of the London Stock Exchange, thereby improved reporting covenants for a further 5 years

equity, bank debt and increasing the number of potential investors in the

any disposal proceeds * inability to attract investors; and Company's shares, in the UK and overseas;

we generate. We look

to raise equity at times

when we can make investments * breach of borrowing policy or loan covenants. * took out two interest rate caps of GBP100.0 million

that are accretive to each, for three and five years, capping the SONIA

shareholders. rate in the debt facilities at 1.5%;

Our strategy for debt Measured by:

financing is to maintain * LTV ratio

a prudent level of debt, * reduced leverage through the disposal programme

with an LTV range of described above; and

30 -- 40% in the longer

term. We look to hedge

the interest on a significant * maintained the LTV ratio in line with our target of

proportion of our debt, c.35%.

to provide greater certainty

over our financing costs.

---------------------------------------------------------- ------------------------------------------------------------ ---------------------------------------------------------

Key performance indicators

We use the following key performance indicators ("KPIs") to

monitor our performance and strategic progress.

Occupancy

2019: 92.0%

2020: 93.4%

2021: 95.6%

2022: 93.7%

2023: 95.8%

Description

Total open market rental value of the units leased divided by

total open market rental value, excluding development property and

land, and equivalent to one minus the EPRA vacancy rate.

Why is this important?

Shows our ability to retain occupiers at renewal and to let

vacant space, which in turn underpins our income and dividend

payments.

How we performed

Active asset management, asset disposals and the robust

occupational market helped us to increase occupancy during the year

to 95.8%.

Link to strategy

Asset management

Like-for-like rental income growth

2019: 2.1%

2020: 2.0%

2021: 2.9%

2022: 3.0%

2023: 5.3%

Description

The increase in contracted rent of units owned throughout the

period, expressed as a percentage of the contracted rent at the

start of the period, excluding development property, land and units

undergoing refurbishment.

Why is this important?

Shows our ability to identify and acquire attractive properties

and grow average rents over time.

How we performed

We delivered further good rental growth, as we continued to

capture the reversionary potential in the portfolio through active

asset management.

Link to strategy

Asset management

Rental increases agreed versus valuer's ERV

2019: 10.0%

2020: 5.1%

2021: 4.3%

2022: 6.0%

2023: 10.2%

Description

The difference between the rent achieved on new lettings and

renewals and the ERV assessed by the external valuer, expressed as

a percentage above the ERV at the start of the period.

Why is this important?

Shows our ability to achieve rental growth ahead of ERV through

asset management and the attractiveness of our assets to potential

occupiers.

How we performed

We maintained our track record of achieving rental levels ahead

of ERV.

Link to strategy

Asset management

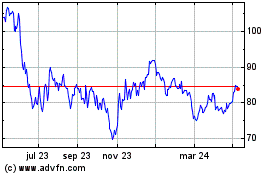

Like-for-like valuation change

2019: 4.3%

2020: 2.5%

2021: 18.8%

2022: 19.4%

2023: (18.5)%

Description

The change in the valuation of properties owned throughout the

period under review, expressed as a percentage of the valuation at

the start of the period, and net of capital expenditure.

Why is this important?

Shows our ability to acquire the right quality of assets at

attractive valuations, add value through asset management and drive

increased capital values by capturing rental growth.

How we performed

After two years of exceptionally strong valuation increases,

investment market conditions led to an 18.5% fall in the

like-for-like valuation.

Link to strategy

Investment

Asset management

Total cost ratio

2019: 29.4%

2020: 27.1%

2021: 29.5%

2022: 27.1%

2023: 28.4%

Description

EPRA cost ratio including direct vacancy costs but excluding

one-off costs. The EPRA cost ratio is the sum of property expenses

and administration expenses, as a percentage of gross rental

income.

Why is this important?

Shows our ability to effectively control our cost base, which in

turn supports dividend payments to shareholders.

How we performed

The total cost ratio declined further in the year due to

non-recoverable holding costs on larger vacant buildings. Excluding

vacancy costs, the EPRA cost ratio was 26.8%.

Link to strategy

Not applicable

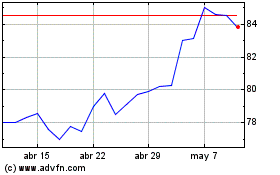

EPRA NTA

2019: 109.7p

2020: 109.5p

2021: 135.1p

2022: 173.8p

2023: 122.6p

Description

This net asset value measure assumes entities buy and sell

assets, thereby crystallising certain levels of deferred tax

liability. The measure excludes the fair value of financial

instruments that are used for hedging purposes where the Company

has the intention of keeping the hedge position until the end of

the contract duration (this is regardless of whether hedge

accounting under IFRS is applied).

Why is this important?

Shows our ability to acquire well and to increase capital values

through active asset management.

How we performed

The decline in capital values relative to the market contributed

to an 29.5% reduction in EPRA NTA per share.

Link to strategy

Investment

Asset management

Dividends per share

2019: 6.0p

2020: 6.2p

2021: 6.2p

2022: 6.4p

2023: 6.4p

Description

The total amount of dividends paid or declared in respect of the

financial year, divided by the number of shares in issue in the

period.

Why is this important?

Shows our ability to construct a portfolio that delivers a

secure and growing income, which underpins progressive dividend

payments to shareholders.

How we performed

We achieved our dividend target for the year of at least 6.4

pence per share.

Link to strategy

Investment

Loan to value ratio

2019: 39.7%

2020: 40.2%

2021: 24.6%

2022: 25.1%

2023: 33.9%

Description

Gross debt less cash, short-term deposits and liquid

investments, divided by the aggregate value of properties and

investments.

Why is this important?

Shows our ability to balance the additional portfolio

diversification and returns that come from using debt, with the

need to manage risk through prudent financing.

How we performed

The increase in the LTV primarily reflects our acquisition in

the year and the reduction in the value of the portfolio, partially

offset by proceeds from asset disposals.

Link to strategy

Financing

Investment Advisor's report

The Group performed well from an operational perspective, as we

continued to successfully implement the strategy, with a particular

focus on driving value from the portfolio through active asset

management and progressing the development opportunities, notably

at Radway 16, Crewe.

On a statutory basis, the Group's earnings per share of (43.0)

pence reflected the loss on revaluation of the investment

properties at the year end of GBP193.4 million, as a result of the

conditions in the investment market. The Group had recognised gains

on revaluation of GBP163.7 million and GBP105.0 million in the

previous two financial years.

On an adjusted basis the Group's results were affected by the

increased cost of debt in the year, as a result of rising interest

rates, and to a lesser extent by higher vacancy costs during the

year. As a result, adjusted earnings per share of 4.7 pence were

26.0% lower than the previous financial year, resulting in dividend

coverage of 73.0%.

Investment portfolio

During the year, the Group acquired two assets and disposed of a

number of other properties.

Acquisition

The Group acquired Bradwell Abbey Industrial Estate in Milton

Keynes for GBP62.0 million, excluding acquisition costs. The

multi-let industrial asset comprises 69 units across c.335,000 sq

ft and is let to occupiers including Argos, F&F Stores and

Taylor Kerr Engineering. The current rent of c.GBP7.83 per sq ft,

offers good reversionary potential compared to an ERV of GBP9.89

per sq ft. We see clear opportunities to generate upside through

strategic capital expenditure, working with the existing occupiers

and improving the estate's sustainability credentials, and we have

made good progress with our asset management plan since

purchase.

Disposals

The Group's asset management strategy includes an ongoing

programme of disposing of mature or non-core assets, so it can

redeploy the capital or use the proceeds to pay down debt. We keep

the portfolio under constant review to identify assets that are

candidates for disposal.

During the first half, the Group disposed of two assets, for

gross proceeds of GBP4.8 million. In the second half, we progressed

the Group's short-term strategy to reduce the level of

variable-rate debt with the disposal of 14 assets, for headline

consideration of GBP54.7 million, crystallising a profit on cost of

GBP3.3 million and generating an ungeared IRR of 8.9%. This brought

the aggregate proceeds for the year to GBP59.6 million. On a

statutory basis, due to the high watermark of March 2022

valuations, a GBP13.1 million loss was realised for the year ended

31 March 2023.

The sale of the assets demonstrate the liquidity of the

portfolio and include:

-- E xeter Way, Theale, a vacant 92,000 sq ft warehouse with a

high office component, sold to an owner-occupier for GBP15.0

million; and

-- Temple House, Harlow, for GBP14.5 million, sold ahead of a

potential vacancy and capital expenditure costs, following the

receipt of notice to break from the main occupier in March

2023.

The other assets disposed of included a range of smaller

properties for GBP25.2 million with a net initial yield of 6.5% and

generating an ungeared IRR of 15.4%. These are assets we had

identified as being non-core.

Asset management

Working with occupiers

The Group has a diverse base of 490 occupiers, with the top 15

occupiers accounting for 35.8% of the contracted rent roll from the

investment portfolio. The spread of the Group's occupiers across

different industries and business sizes means it is not reliant on

any one occupier or industry. This increases the Group's resilience

and helps to mitigate financial and leasing risks.

We continue to actively monitor the strength of the occupiers'

covenants using credit software such as Dun & Bradstreet,

enabling us to keep abreast of the impact of the current economic

environment on the Group's occupiers, in particular those where

energy is a high proportion of their costs. However, we have not

identified an increase in corporate failures, as reflected in the

Group's rent collection performance and bad debts (see the

financial review for more information). As at 2 June 2023, we had

collected c.99.0% of the rent due in respect of the year and we

expect this to increase as we work with occupiers to collect the

outstanding amounts.

Leasing activity

The UK occupational market remains robust and strong occupier

demand has helped us to continue to capture the inbuilt reversion

in the portfolio through lease renewals and new lettings. New

leases continue to exceed ERVs, while lease renewals and rent

reviews are achieving strong average uplifts against previous

rental levels. As a result, like-for-like contracted rent increased

by 5.3% year on year and ERVs by 6.2%, providing significant

opportunities to capture the portfolio reversion in future

periods.

New leases

The Group completed 40 new leases on 0.5 million sq ft of space

during the year, which will generate annual rent of GBP3.0 million,

29.1% ahead of previous contracted rent and 13.0% ahead of 31 March

2022 ERV. The level of incentives remains steady on all multi-let

estates.

Highlights included new leases for:

-- 3,700 sq ft at Midpoint 18, Middlewich, to a leading software

provider to the UK healthcare sector, on a ten-year lease with a

five-year break, at a rent of GBP237,000 per annum, 97.5% ahead of

previous contracted rent and inline with the 31 March 2022 ERV;

-- 138,500 sq ft at Daimler Green, Coventry, to an automotive

parts manufacturer, on a ten-year term at a rent of GBP623,000,

25.9% ahead of previous contracted rent and 16.9% above the 31

March 2022 ERV;

-- 38,600 sq ft at Swift Valley Industrial Estate, Rugby, on a

20-year lease at GBP8.60 per sq ft, 11.0% ahead of ERV;

-- 20,200 sq ft at Granby Trade Park, Milton Keynes, on a

ten-year lease with no break at GBP10.00 per sq ft;

-- 15,200 sq ft at Gateway Park, Birmingham, to an electronic

bike and scooter company, on a five-year term at a rent of GBP7.65

per sq ft, and 17.7% above the 31 March 2022 ERV; and

-- 36,100 sq ft at Carisbrooke Industrial Estate, Isle of Wight,

for a headline rent of GBP185,000 per annum for ten years with a

break at five years, equivalent to GBP5.12 per sq ft, 54.2% above

previous contracted rent and 7.7% ahead of the 31 March 2022 ERV.

The occupier is a leading manufacturing business.

Lease renewals

The Group continues to retain the majority of its occupiers,

with 59.0% remaining in occupation at lease expiry and 67.6% with a

break arising in the year, including units that were vacated and

re-let in the period, this increased the Group's effective

retention rate on lease renewals to 88.2%.

There were 22 lease renewals on 0.2 million sq ft of space

during the year, with an average uplift of 15.8% above the previous

passing rent and 2.7% above the ERV.

Highlights included:

-- 31,900 sq ft of lease renewals at Queenslie Park, Queenslie,

across nine units, securing GBP196,500 at an average of 22.8% ahead

of previous contracted rent and 10.6% ahead of 31 March 2022

ERV;

-- a five-year renewal at Cairn Court, East Kilbride. The new

lease generates total rent of GBP67,700 per annum and is 33.3%

ahead of the previous rent and 20.0% ahead of 31 March 2022

ERV;

-- a five-year renewal at Linkway Industrial Estate, Middleton.

The new lease generates total rent of GBP67,200 per annum and is

c.11.0% ahead of both the previous rent and 31 March 2022 ERV;

-- 22,000 sq ft lease renewal at Gateway Park, Birmingham,

securing GBP176,700, 22.5% ahead of previous contracted rent and

6.6% ahead of 31 March 2022 ERV.

Rent reviews

During the year 21 rent reviews were completed, generating an

additional GBP0.3 million per annum, 21.5% ahead of previous rent

and 5.2% ahead of the 31 March 2022 ERV.

Highlights included:

-- rent reviews on two leases at Air Cargo Centre, Glasgow,

which were settled at GBP440,000, 25.9% ahead of the previous

contracted rent and 11.8% ahead of the 31 March 2022 ERV;

-- settled a rent review at Tewkesbury Business Park,

Tewkesbury, for GBP330,000, 20.0% ahead of the previous contracted

rent and 9.8% ahead of the 31 March 2022 ERV;

-- settled a rent review at Austin Drive, Coventry, for

GBP275,000, 14.6% ahead of the previous contracted rent and the ERV

at the date of the rent review; and

-- rent reviews on two leases at Chittening Industrial Estate,

Bristol, which were settled at GBP210,000, 22.0% ahead of the

previous contracted rent and 4.8% ahead of the ERV at the date of

the rent review.

Development activity

Since 2017, we have assembled land for a flagship multi-let

logistics park development at Radway 16, Crewe. The Group now owns

112 acres in this premier logistics location in the North West, a

market characterised by low vacancy rates and high take up in the

region providing strong opportunities for above-average rental

growth. Radway 16 will provide state-of-the-art, sustainable

warehouse space that is suitable for a diverse range of

occupiers.

As previously reported, the Group has planning approval for more

than 1.8 million sq ft of warehousing at Radway 16, having secured

unanimous committee approval in July 2022 on phase 2 (1.02 million

sq ft), to add to previously approved consent for 0.8 million sq ft

secured in 2021. Since securing the approval on remaining scheme,

we have now satisfied the pre-commencement planning conditions of

phase 1 to enable a start on site.

In Q4 2022, we launched a marketing campaign, generating

significant occupier interest. We have also finalised the marketing

for the wider scheme, which can be configured in a number of ways

to provide a single 1 million sq ft unit or a number of smaller

units.

We continue to make progress with the Group's other development

projects, where we will only commence development once a pre-let

agreement has been signed.

Capital expenditure

We deploy carefully targeted capital expenditure to increase

rents and capital values and improve the assets' ESG performance.

On average, the Group aims to invest around 0.75% of its gross

asset value ("GAV") in capital expenditure each year. This excludes

development projects and is therefore based on GAV excluding

developments.

Total capital expenditure in the year was GBP5.0 million,

equivalent to 0.5% of GAV excluding developments. At the year end,

approximately 1.3% of the portfolio's ERV was under refurbishment

(31 March 2022: 1.6%). In line with the Group's ESG strategy, all

capital expenditure projects have long-term sustainable features

which target an improvement in the Group's overall EPC rating.

Portfolio analysis

At the year end, the Group's portfolio comprised 833 units

across 8.2 million sq ft of space (31 March 2022: 867 units across

8.5 million sq ft). The table below analyses the portfolio as at 31

March 2023:

Value Occupancy NIY NRY WAULT WAULT Average Capital

(GBPm) by ERV (%) (%) to expiry to break rent value

(%) (years) (years) (GBP (GBP

per sq per

ft) sq ft)

-------------------------------- ---------- ----- ----- ----------- ---------- -------- --------

Multi-let

more than

100k sq ft 384.0 95.2% 5.5% 6.5% 4.6 3.6 5.88 92.13

Multi-let

less than

100k sq ft 153.9 92.3% 6.4% 7.4% 5.4 4.0 6.63 89.95

Single let-

Regional distribution 131.9 100.0% 5.1% 5.8% 7.8 7.6 5.22 95.55

Single let-

last mile 83.3 100.0% 5.6% 6.9% 6.2 5.2 5.74 89.64

------------------------- ------ ---------- ----- ----- ----------- ---------- -------- --------

Total 753.1 95.8% 5.6% 6.6% 5.5 4.5 5.90 91.97

Development

land 75.7

------------------------- ------ ---------- ----- ----- ----------- ---------- -------- --------

Total portfolio 828.8

------------------------- ------ ---------- ----- ----- ----------- ---------- -------- --------

At he year end, the contracted rent roll for the investment

portfolio (excluding developments) was GBP45.3 million, with the

ERV of GBP53.3 million showing the reversionary potential in the

portfolio. Total contracted rents increased by 5.3% on a

like-for-like basis during the year.

The NIY of the investment portfolio was 5.6% at 31 March 2023,

with an equivalent yield of 6.5% and a reversionary yield of 6.6%.

The WAULT for the investment portfolio stood at 5.5 years at 31

March 2023 (31 March 2022: 5.6 years).

Occupancy improved across the investment portfolio and was 95.8%

at the year end (31 March 2022: 93.7%). Effective occupancy, which

excludes units under offer to let or undergoing refurbishment, was

98.4% at the year end (31 March 2022: 95.8%), with 1.1% of the

investment portfolio under offer to let and a further 1.5%

undergoing refurbishment at that date.

Financial review

Performance

Rental income for the year was GBP45.8 million (year ended 31

March 2022: GBP44.0 million), with the movement reflecting

like-for-like rental growth and the initial contribution from the

acquisition of Bradwell Abbey Industrial Estate, less revenue

foregone from the assets disposed of during the year. EPRA

like-for-like rental growth was 6.0%.

The Group's operating costs include its running costs (primarily

the management, audit, company secretarial, other professional and

Directors' fees), and property-related costs (including legal

expenses, void costs and repairs). Total operating costs for the

year were GBP18.9 million (year ended 31 March 2022: GBP16.0

million). The Investment Advisor fee for the year increased by

GBP0.5 million, primarily as a result of the significant net asset

growth in the second half of the previous financial year. The

reduced valuation at 31 March 2023 will result in savings for the

Group on the Investment Advisor fee in FY 2024 as this is

calculated on net assets.

The Company incurred one-off costs in the year of GBP1.1

million, in relation to its move from trading on AIM to the Main

Market of London Stock Exchange. There were no one-off costs in the

period to 31 March 2022.

The net increase in the expected credit loss allowance was

GBP0.2 million (year ended 31 March 2022: GBP0.3 million). This

modest change reflects the diversity and quality of the Group's

occupiers and our close relationships with them. The Group also

often has rent deposits, giving it additional protection from bad

debts.

The total cost ratio, which is the adjusted cost ratio including

direct vacancy costs, was 28.4% (year ended 31 March 2022: 27.1%),

with the increase driven by holding costs relating to

non-recoverable property expenses. Excluding void costs, the

adjusted cost ratio is 24.4% (year ended 31 March 2022: 24.3%). The

ongoing charges ratio, representing the costs of running the REIT

as a percentage of NAV, was 1.3% (year ended 30 March 2022:

1.2%).

The Group disposed of 16 assets in the year, resulting in a net

loss on disposal of GBP13.1 million due to the strong revaluation

uplifts since the assets were acquired. Against the assets'

purchase price, the Group recorded an internal rate of return of

8.0%. There were no disposals in the prior year.

At 31 March 2023, the Group recognised a loss of GBP193.4

million on the revaluation of its investment properties (year ended

31 March 2022: gain of GBP163.7 million).

Financing income in the year was GBP6.9 million (year ended 31

March 2022: GBP0.3 million), including GBP2.0 million interest

receipts (year ended 31 March 2022: GBPnil) from interest rate

derivatives held by the Company and GBP4.9 million change in fair

value of interest rate derivatives as at 31 March 2023 (year ended

31 March 2022: GBPnil).

Financing costs include the interest and fees on the Group's

revolving credit facility ("RCF") and term loan (see debt financing

and hedging). Total finance expenses were GBP15.5 million (year

ended 31 March 2022: GBP8.2 million). The increase reflects the

higher average debt in the year following the acquisition of

Bradwell Abbey and the higher weighted average cost of debt, which

was partly mitigated by the interest rate caps taken out in the

first half (see below). The all-in cost of debt for the year was

4.3% (year ended 31 March 2022: 2.6%). We expect interest costs to

reduce in FY 2024, as a result of the reduction in variable-rate

debt following the asset disposals in the second half of the

year.

The statutory loss before tax was GBP182.9 million (year ended

31 March 2022: GBP191.2 million profit).

The Group has continued to comply with its obligations as a REIT

and the profits and capital gains from its property investment

business are therefore exempt from corporation tax. The corporation

tax charge for the year was therefore GBPnil (year ended 31 March

2022: GBPnil).

Earnings per share ("EPS") under IFRS was (43.0) pence (year

ended 31 March 2022: 45.0 pence). EPRA EPS was 3.9 pence (year

ended 31 March 2022: 6.4 pence). Adjusted earnings per share was

4.7 pence (year ended 31 March 2022: 6.4 pence).

Dividends

The Company has declared the following interim dividends in

respect of the financial year:

Quarter to Declared Paid Amount (pence)

--------------- ----------------- ---------------- ---------------

30 June 2022 17 August 2022 3 October 2022 1.60

30 September 30 December

2022 8 November 2022 2022 1.60

31 December 28 February

2022 2023 3 April 2023 1.60

31 March 2023 6 June 2023 7 July 2023 1.60

--------------- ----------------- ---------------- ---------------

Total 6.40

---------------------------------------------------- ---------------

The total dividend of 6.40 pence per share met the Group's

target for the year and was 72.9% covered by adjusted EPS. All four

interim dividends were property income distributions. The cash cost

of the total dividend paid during the year was GBP27.6 million

(year ended 31 March 2022: GBP26.3 million).

Valuation and net asset value

The portfolio was independently valued by CBRE as at 31 March

2023, in accordance with the internationally accepted RICS

Valuation - Global Standards 2020 (incorporating the International

Valuation Standards) (the "Red Book"), and the RICS Valuation -

Global Standards 2017 - UK national supplement.

The portfolio valuation was GBP828.8 million (31 March 2022:

GBP1,012.0 million). This represented an 18.5% like-for-like

valuation decline, after taking account of capital expenditure of

GBP13.3 million, with the outward yield shift in the year being

only partly offset by rising rental values. The EPRA NIY was 5.0%

(31 March 2022: 4.0%) and the EPRA topped-up NIY was 5.5% (31 March

2022: 4.4%).

The valuation resulted in an EPRA NTA of 122.6 pence per share

at the year end (31 March 2022: 173.8 pence per share).

Debt financing and hedging

At the year end, the Group had a debt facility with a club of

four banks: HSBC, Bank of Ireland, Royal Bank of Canada and

Barclays. The facility runs until January 2025, with an option to

extend for a further two years, and comprises an RCF of GBP138.0

million and a term loan of GBP182.0 million, to give a total

facility of GBP320.0 million.

At 31 March 2023, GBP124.0 million was drawn against the RCF and

GBP182.0 million against the term loan. This gave total debt of

GBP306.0 million (31 March 2022: GBP271.0 million), with the Group

also holding cash balances of GBP25.1 million (31 March 2022:

GBP16.7 million); the Group's net debt as at 31 March 2023 is

GBP280.9 million (31 March 2022: GBP254.3 million). The LTV ratio

at 31 March 2023 was therefore 33.9% (31 March 2022: 25.1%), with

the increase reflecting the acquisition in the year and the lower

portfolio valuation, partially offset by the asset disposals.

The Group remains substantially within its covenants in the debt

facilities, which place a limit on the LTV of 55% and require

minimum interest cover of 2.0 times. Interest cover for the year

was 2.9 times.

The Group's debt facilities carry the cost of SONIA plus a

lending margin. During the first half of the year, the Group took

out two interest rate caps of GBP100.0 million each, for three and

five years respectively at a cost of GBP10.9 million payable over

the term, which cap the SONIA rate in the debt facilities at 1.5%.

The Group also has an interest rate cap of GBP30.0 million, which

expires in November 2023 and caps SONIA at 1.75%. A further

interest rate cap of GBP30.0 million expired in November 2022. The

Group had hedged approximately 75.0% of its year-end debt against

interest rate volatility.

We continue to explore opportunities to diversify the Group's

sources of debt funding, hedging requirements, extend the average

maturity of its debt and further reduce the average cost of

debt.

Post year end activity

Post-year end, the Group entered into a new five-year debt

facility totalling GBP320.0 million, replacing the existing

facility. The refinancing consists of GBP220.0 million term loan

and an RCF of GBP100.0 million, with a club of lenders consisting

of HSBC, Bank of Ireland, NatWest and Santander.

The new facility extends the tenure of the of the Group's debt

and with improved reporting covenants.

In addition, the Group has exchanged on two further disposals

for an aggregate of GBP29.3 million.

Compliance with the investment policy

The Group's investment policy is summarised below. The Group

continued to comply in full with this policy throughout the

year.

Investment policy Status Performance

The Group will only invest in warehouse ü All of the Group's

assets in the UK. assets are UK-based

urban warehouses.

------- -----------------------------

No individual warehouse will represent ü The largest individual

more than 20% of the Group's last warehouse represents

published gross asset value ("GAV"), 6.2% of GAV.

at the time it invests.

------- -----------------------------

The Group will target a portfolio ü The largest occupier

with no one occupier accounting for accounts for 6.7%

more than 20% of its gross contracted of gross contracted

rents at the time of purchase. No rents and 7.1% of

more than 20% of its gross assets gross assets.

will be exposed to the creditworthiness

of a single occupier at the time of

purchase.

------- -----------------------------

The Group will diversify the portfolio ü The portfolio is

across the UK, with a focus on areas well balanced across

with strong underlying investment the UK.

fundamentals.

------- -----------------------------

The Group can invest no more than ü The Group held no

10% of gross assets in other listed investments in other

closed-ended investment funds. funds during the

year.

------- -----------------------------

The Group will consider where appropriate ü Other than refurbishing

an element of speculative development, vacant units, the

provided the exposure to these assets, Group did not undertake

assessed on a cost basis, shall not any speculative development

exceed 10% of the gross assets of in the period.

the Company.

------- -----------------------------

The Group may invest directly, or ü The Group's exposure

through forward funding agreements to developments at

or forward commitments (provided within the year end was

the overall exposure limited stated 9.1% of GAV.

above), in developments (including

pre-developed land), where:

* the structure provides us with investment risk rather

than development risk;

* the development is at least partially pre-let, sold

or de-risked in a similar way; and

* we intend to hold the completed development as an

investment asset.

------- -----------------------------

The Group views an LTV of between ü The LTV at 31 March

30% and 40% as optimal over the longer 2023 was 33.9%.

term but can temporarily increase

gearing up to a maximum of LTV of

50% at the time of an arrangement,

to finance value enhancing opportunities.

------- -----------------------------

Investment Manager

The Company is an alternative investment fund for the purposes

of the Alternative Investment Fund Managers Directive ("AIFMD")

and, as such, is required to have an Investment Manager who is duly

authorised to undertake that role. G10 Capital Limited ("G10") is

the Company's AIFM and Investment Manager and is authorised and

regulated by the Financial Conduct Authority.

Investment Advisor

Tilstone Partners Limited is Investment Advisor to the Company

and the Investment Manager.

Tilstone Partners Limited

5 June 2023

Principal risks and uncertainties

PRINCIPAL RISKS AND UNCERTAINTIES

Our ability to identify, understand and manage our risks and

uncertainties is key to delivering our strategy and generating

returns for investors.

Our approach and culture

Our understanding of the potential risks associated with our

business activities, and our ability to implement robust management

arrangements linked to our risk appetite are essential for a

successful business. Our risk management activities enable us to

identify and manage risks arising internally - from our

decision-making and strategy; and from external risks - which arise

when we are impacted by changes in the external market and

environment.

Our culture of practical, pragmatic risk awareness and

management has been particularly important during the economic

challenges of the last financial year, which include increasing

interest rates, rising inflation, and significant increases in

energy and utility costs. These financial challenges in particular

had an impact on our occupiers and the population of potential

occupiers, leading to some changes in our risk profile and risk

mitigation plans.

Risk management framework

Our strong culture is underpinned by a structured approach to

the understanding and management of risk, with a risk management

framework which is reviewed and approved by the Board, via the

Audit and Risk Committee, each year.

The framework is clear and focused, setting out the Board's risk

appetite, with defined responsibilities; processes for the regular

review of risk and consideration of emerging risk; and reporting

arrangements. This clarity is designed to enable the Group's

Investment Advisor to take advantage of opportunities and make

effective business decisions, whilst staying within an agreed set

of parameters.

During the year, the risk framework and risk appetite were

enhanced to reflect our growing focus on ESG and climate-related

risks. We also took the decision to review our risk evaluation

matrix, to reflect the increasing size of the business, and our

move from AIM to the Main Market.

Risk appetite

Risk management is embedded in our decision-making processes,

supported by robust systems, policies, leadership and governance.

Our business uses an outsourced model, and we rely on our service

providers to make decisions and take risks within agreed parameters

in the delivery of our objectives. Those parameters are summarised

in our stated risk appetite.

The level of risk considered appropriate to accept in achieving

business objectives is determined by the Board:

-- The Group has no appetite for risk in areas relating to

regulatory compliance, and the health, safety and welfare of our

occupiers, stakeholders, and the wider community in which we

work

-- Appetite for risk relating to climate change is low, and the

Group is actively focusing on the identification and mitigation of

physical and transitional risks for its portfolio

-- We have a moderate appetite for risk in relation to

activities which are directed towards driving revenues and

increased financial returns for its investors

The Board

The Board has overall responsibility for the Group's approach to

risk management and internal control, including:

-- The design and implementation of risk management and internal

control systems which identify the risks facing the business and

enable the Board to make an assessment of principal risks

-- Determining the nature and extent of the principal risks

faced, and those risks which the Group is willing to take

-- Agreeing how principal risks are managed or mitigated to reduce their likelihood or impact

-- Ensuring that there is sufficient relevant, reliable and

valid assurance about the mitigation of risk

The Audit and Risk Committee

The majority of the operations of the Group are outsourced, and

the Audit and Risk Committee relies on risk information from its

service providers, primarily the Investment Advisor.

To fulfil its responsibilities the Audit and Risk Committee:

-- Monitors key risks and changes in risk throughout the year

-- Seeks to identify and consider potential emerging risks to

the Group, arising both externally and internally

-- Considers each of the principal risks, the business's

mitigation strategies, and assurances from both management and

independent sources

-- Undertakes an annual review of the effectiveness of the risk management process, including:

o The operation of risk management and control systems

o Integration of risk management and internal control with strategy and business planning

o Changes in the nature, likelihood and impact of principal risks

o The quality of risk reporting

o Any issues dealt with in reports reviewed during the year, in

particular the incidence of significant control failings or

weaknesses that have been identified, and the extent of the impact

which they had or could have had

o The effectiveness of the Company's public reporting processes

-- Takes advice from the Sustainability Committee with respect

to updating climate-related risks and mitigations.

The Sustainability Committee

The Sustainability Committee has oversight of the Group's

approach to the management of climate related risks. It provides

the Audit and Risk Committee and Board with updates and information

in relation to climate risk generally, and progress with the

strategy agreed for the Group to manage risks in this area.

The Investment Advisor

The Investment Advisor supports the Audit and Risk Committee and

Board, and is responsible for risk identification, documentation

and evaluation, including both current and emerging risks; for the

implementation of appropriate controls; and for meaningful

reporting to the Audit and Risk Committee.

Documentation and reporting

The corporate risk register is the core of the risk management

process. It contains an assessment of the risks faced by the Group

together with the controls established to reduce those risks to an

acceptable level. It is maintained and reviewed regularly by the

Investment Advisor, and formally reviewed at each meeting of the

Audit and Risk Committee.

A standard evaluation matrix is used to assess the exposure to

risks, and that is reviewed and approved as part of the risk

management framework at least annually.

Risks are categorised into:

-- Business risk - the risk of making poor business decisions,

implementing decisions ineffectively, or being unable to adapt to

changes in its environment. In particular this includes our

property investment risk, and our acquisition, disposal and tenancy

decision making processes.

-- Compliance risk - the risk of legal or regulatory sanctions,

financial loss, or loss to reputation a regulated business may

suffer as a result of its failure to comply with all applicable

laws, regulations, codes of conduct and standards of good

practice.

-- Climate-related-risk - risks to the business from the impact

of climate change. This includes direct physical impacts such as

flooding, or excessive indoor temperatures during periods of

extreme heat; and transitional risks such as changes in demand from

occupiers, or the cost of complying with changes in building

standards.

-- Financial risk - the risk of financial loss resulting from

risks such as market, credit and liquidity risks:

-- Market risk - economic losses resulting from price changes in the capital markets.

-- Credit risk - change in the financial situation of a

counterparty, such as an issuer of securities or other debtor with

liabilities or arising out of investments and payment transactions

with investors.

-- Liquidity risk - not meeting the criteria of the borrowing

policy and payment obligations at all times.

-- Operational risk - the risk of a loss resulting from

inadequate processes, technical failure, human error or external

events.

Emerging risk

The regular risk reviews undertaken by the Investment Advisor

specifically include review of emerging risks, and this is also

part of the review by and discussions with the Audit and Risk

Committee. The assessment considers internal changes, and external

changes trends, and incidents, and considers:

-- Is this risk relevant to the Group's business activities?

-- What is the potential impact, if the risk crystallises?

-- What are our potential strategies for the management and mitigation of the risk?

-- How could we get assurance that these strategies are effective in practice?

-- Is this a risk that we should continue to pro-actively monitor?

During the year, we have made some changes to the risks on the

register, enhancing risk definitions and the evaluation of some

risks, to reflect the challenges being presented by the current

cost of financing, and more difficult economic and market

conditions.

One new principal risk was agreed during the year, relating to

the Group's ability to raise funding - be that equity, loan

financing or through asset disposals.

Environmental, social and governance ("ESG") risk

We have continued to invest in and develop our knowledge and

plans to manage risk exposure around our sustainable ambitions and

climate-related risks. The associated risks are integrated in the

Group's risk management process and corporate risk register, and we

have also developed an additional, more granular ESG risk register.

C limate change risk remains one of the Group's principal

risks.

Our governance framework has been enhanced with a Sustainability

Committee (a sub-committee of the Board/Investment Advisor), having

regular oversight of the Group's responsible business agenda,

sustainability strategy and external ESG reporting plus being

provided with regular updates on regulatory requirements and

general market expectations. Following the climate risk scenario

modelling undertaken this year, the Sustainability Committee will

review the Group's climate related risks and mitigation strategies

in detail via the focused ESG risk register and recommend any

required updates to the Audit and Risk Committee.

Climate-related risks, particularly physical risks, are

incorporated in our decision-making protocols for portfolio changes

and capital developments. Costs associated with the Group's

sustainability and climate-related ambitions e.g. minimum energy

efficiency standards ahead of legislative requirements for

properties and net zero carbon pathway, are included in our

financial modelling and budgeting. Capital project planning also

includes a focus on energy usage reduction and implementing

building efficiency measures such as building management systems,

replacement of high emission fittings, reduction of water usage and

support of sustainable transport initiatives. A climate risk

scenario modelling has been completed, to enable us to assess the

exposure of our portfolio to physical climate-related risks across

certain climate scenarios. The assessment provided a clear overview

of the impact likelihood that modelled hazards pose to the

portfolio, enabling us to make strategic decisions on where to

focus mitigation actions and harness opportunities. We are

introducing targeted surveys of occupiers to understand their

challenges and requirements, to enable us to work together to

reduce risk and further understand our energy consumption

baseline.

Principal risks

Principal risks are those which are considered material to the

Group's development, performance, position or future prospects. The

principal risks are captured in the corporate risk register and are

reviewed by the Board and Audit and Risk Committee, who

consider:

-- any substantial changes to principal risks;

-- material changes to control frameworks in place;

-- changes in risk scores; and

-- any significant risk incidents arising.

Changes in principal risks during the year

One new principal risk was agreed during the year, relating to

the Group's ability to raise funding - be that equity, loan

financing or through asset disposals. Previously, risks covering

this area were included in the risk register, but were not

considered to be significant principal risks. However, the

combination of a hardening market for asset disposals, market

uncertainties impacting on our share price, the timing of our

refinancing, and the increasing cost of capital have all combined

to result in an increased exposure.

In some cases the evaluation of principal risks has changed

during the year, and the detailed risks section on the following

pages shows those changes, with additional information setting out

the reasons for changes and risk mitigation plans.

Risk Risk mitigation Change and Category

commentary

A Interest rate ó Financial

changes Increases in Interest rates

Changes in interest interest have increased

rates could directly rates are not significantly

impact on our cost within our over the last

of capital, and control, and our 12 months,

indirectly may focus and there is

impact on market is therefore still the risk

stability. primarily of further

Interest rates on mitigation of increases.

continued to increase the impact.

during 2022/23. Interest rate However, during

caps are the year we

in place, and we have reduced

are revising our exposure,

and by increasing

renegotiating hedging and

our reducing debt

funding levels, and

arrangements. our plans and

forecasts have

The Investment taken the current

Advisor high interest

maintains rates into

detailed records account.

of the property

portfolio, Overall, we

and financial consider that

scenario the level of

testing is risk is therefore

undertaken unchanged from

to assess the previous years.

potential

impact of

changes in

financing

costs.

Whilst we remain

comfortable

that appropriate

new funding

arrangements

will be put

in place,

changes in

interest

rates could have

an impact

on returns and

profitability.

------------------------------------------------------------ ------------------ ------------------ ------------

B Unable to raise The downturn in New Financial

funding through the economy

equity, debt or during the year This is the

asset disposals has had first year

sufficient to raise an impact on each this has been

capital and finance of these considered

the Group's activities. potential risk a principal

There are three areas. risk, and this

areas of potential We have a decision has

risk: framework of been driven

* Inability to attract additional equity investment mitigations in by the

place, combination

designed to of pressures

* Difficulty in securing new loan funding for the address the on each of

business, at an affordable rate risks, but the three areas.

recognise that

market conditions

* Our ability to raise funds through the disposal of are

assets could be impacted by a hardening market if the more challenging.

economic outlook deteriorates further

We have regular

investor

communications

and performance

reporting against

our

strategy, and

have the

benefit of an

enlarged

investor base

following

previous

fundraises.

The Investment

Advisor

completed the

refinance

of the Group's

financing

arrangements.

The Investment

Advisor

maintains close

contact

with agents to

ensure

that disposal

proceeds

and the timing of

sales

are optimised.

The monitoring

of financial

covenants

also enables

efficient

disposal

planning.

------------------------------------------------------------ ------------------ ------------------ ------------

C Poor portfolio ñ Business

returns The investment The external

strategy economic

There is a risk is set by the environment

that the returns Board, and has increased

generated by the performance the potential

portfolio may not against key for occupier

be in line with targets and KPIs defaults and

our plans and forecasts. is reviewed liquidations,

There are many and reported to which in turn

factors that could the Board may impact

drive this, including on an ongoing both rental

: basis. income and

* Inappropriate investment strategy set by the Board Significant portfolio

decisions, valuations.

relating to

* Poor delivery of the strategy by the Investment assets or

Advisor occupiers follow

established

protocols,

* Poor yields from the property portfolio because of ensuring there

reduced capital valuations or rental income is proper

assessment,

at the right

levels.

This would have

an impact on the

financial performance

of the REIT, and

returns for our

investors.

------------------------------------------------------------ ------------------ ------------------ ------------

D Impact of climate ó Business

change on our portfolio

Climate change We have a

is likely to have Sustainability

an increasing impact Committee, which

across the business, challenges,

which could include: approves and

- Extreme weather monitors

events impacting our

on properties sustainability

- Increasing costs strategy

of suppliers/disruption and progress.

to supplies for The committee

maintenance and members have

development received

- Properties not training on

meeting regulatory/occupier climate related

requirements relating risks from MEES,

to energy efficiency, and this

building standards, training will be

or location for rolled

logistics out to the

- Increasing costs Investment

of compliance as Advisor.

requirements around During the year

energy efficient we have

solutions and building obtained support

standards continue from

to strengthen. external

There is also a specialists to

potentially significant assist us with

resource requirement defining

for the collection our ambitions,

and maintenance including

of the different our

data required for decarbonisation

reporting (eg. pathway,

carbon emissions), climate-related

because of the governance

size and make up and the

of the portfolio resulting TCFD

- A reduction in reporting.

property values An environmental

and achievable specialist

rents, if assets completed a

are not developed/maintained climate risk

to appropriate scenario