Warehouse REIT PLC Investment Advisor share purchase (6638U)

27 Noviembre 2023 - 1:00AM

UK Regulatory

TIDMWHR

RNS Number : 6638U

Warehouse REIT PLC

27 November 2023

27 November 2023

Warehouse REIT plc

(the "Company" or "Warehouse REIT", together with its

subsidiaries, the "Group")

Investment Advisor share purchase

The Board of Warehouse REIT announces that on 24 November 2023

Tilstone Partners Limited (the "Investment Advisor") acquired

592,038 ordinary shares in the share capital of the Company at a

weighted average price of 83.7 pence per share for a total cost of

GBP500,000.57.

Following the purchase, the Investment Advisor and its directors

have an interest of 27.77 million ordinary shares, representing

6.5% of the Company's issued share capital.

Simon Hope, Managing Director of Tilstone Partners Limited said:

"This purchase demonstrates our commitment to and confidence in the

quality of Warehouse REIT's assets. Given the attractive return

prospects we see in the business and with shares trading

significantly below replacement value we see this as a very

compelling investment proposition."

Enquiries

Warehouse REIT plc via FTI Consulting

Tilstone Partners Limited

Simon Hope, Peter Greenslade, Jo Waddingham +44 (0) 1244 470 090

G10 Capital Limited (part of the IQEQ

Group), AIFM

Maria Glew +44 (0) 20 7397 5450

FTI Consulting (Financial PR & IR Advisor

to the Company)

Dido Laurimore, Richard Gotla, Oliver

Parsons +44 (0) 20 3727 1000

Further information on Warehouse REIT is available on its

website: http://www.warehousereit.co.uk

Notes

Warehouse REIT is a UK Real Estate Investment Trust that invests

in UK warehouses, focused on multi-let assets in industrial hubs

across the UK.

We provide a range of warehouse accommodation in key locations

which meets the needs of a broad range of occupiers. Our focus on

multi-let assets means we provide occupiers with greater

flexibility so we can continue to match their requirements as their

businesses evolve, encouraging them to stay with us for longer.

We invest in our business by selectively acquiring assets with

potential and by delivering opportunities we have created. Through

pro-active asset management we unlock the value inherent in our

portfolio, helping to capture rising rents and driving an increase

in capital values to deliver strong returns for our investors over

the long term.

Sustainability is embedded throughout our business, helping us

meet the expectations of our stakeholders today and futureproofing

our business for tomorrow.

The Company is an alternative investment fund ("AIF") for the

purposes of the AIFM Directive and as such is required to have an

investment manager who is duly authorised to undertake the role of

an alternative investment fund manager ("AIFM"). The AIFM and the

Investment Manager is currently G10 Capital Limited (Part of the

IQEQ Group).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQUSVWROOUAUAA

(END) Dow Jones Newswires

November 27, 2023 02:00 ET (07:00 GMT)

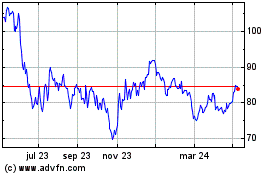

Warehouse Reit (LSE:WHR)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

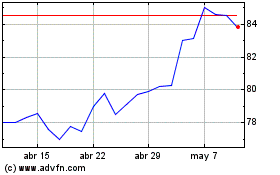

Warehouse Reit (LSE:WHR)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025