TIDMWKOF

WEISS KOREA OPPORTUNITY FUND LTD.

LEI 213800GXKGJVWN3BF511

(Classified Regulated Information, under DTR 6 Annex 1 section 1.1)

ANNUAL REPORT AND AUDITED FINANCIAL STATEMENTS

FOR THE YEARED 31 DECEMBER 2022

Weiss Korea Opportunity Fund Ltd. (the "Company") has today, released its

Annual Financial Report for the year ended 31 December 2022. The Report will

shortly be available for inspection via the

Company's website www.weisskoreaopportunityfund.com.

For further information, please contact:

Singer Capital Markets Limited

James Maxwell/ Justin McKeegan - Nominated +44 20 7496 3000

Adviser

James Waterlow - Sales

Northern Trust International Fund

Administration Services (Guernsey) Limited

Samuel Walden +44 1481 745385

Financial Highlights

As at As at

31 December 31 December

2022 2021

£ £

Total Net Assets1 127,080,493 166,541,145

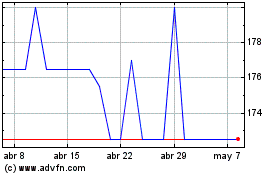

Net Asset Value ("NAV") Per 1.83 2.40

Share2

Mid-Market Share Price 1.81 2.47

As at Since inception

31 December

2022

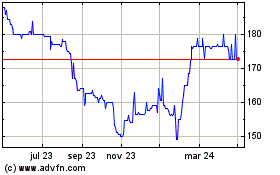

NAV Return3,4 -21.34% 123.91%5

Benchmark Return6,7 -18.22% 50.93%

As at As at

31 December 31 December

2022 2021

Portfolio Discount* 51.68% 52.16%

Share Price Premium/ -1.56% 2.79%

Discount8

Fund Dividend Yield9 3.53% 2.12%

Average Trailing 12-Month P/E Ratio of 4.0x 6.1x

Preference Shares Held10

P/B Ratio of Preference Shares 0.31 0.46

Held11

Annualised Total Expense 2.04% 1.80%

Ratio12

*Portfolio Discount

The portfolio discount represents the discount of WKOF's actual NAV to the

value of what the NAV would be if WKOF held the respective common shares of

issuers rather than preference shares on a one-to-one basis.

As at close of business on 27 April 2023, the latest published NAV per Share

was £1.87 and the Share Price was £1.84.

Company Summary

The Company

Weiss Korea Opportunity Fund Ltd. ("WKOF" or the "Company") was incorporated

with limited liability in Guernsey as a closed-ended investment company on 12

April 2013. The Company's shares were admitted to trading on the Alternative

Investment Market ("AIM") of the London Stock Exchange (the "LSE") on 14 May

2013.

The Company is managed by Weiss Asset Management LP (the "Investment Manager"

or "WAM"), a Boston-based investment management company registered with the

Securities and Exchange Commission in the United States of America.

Investment Objective and Dividend Policy

The Company's investment objective is to provide Shareholders with an

attractive return on their investment, predominantly through long-term capital

appreciation. The Company is geographically focused on South Korean ("Korean")

companies. Specifically, the Company invests primarily in listed preference

shares issued by companies incorporated in South Korea ("Korea"), which in many

cases trade at a discount to the corresponding common shares of the same

companies. Since the Company's admission to the AIM, the Investment Manager has

assembled a portfolio of Korean preference shares that it believes are

undervalued and could appreciate based on the criteria that it selects. The

Company may, in accordance with its investment policy, also invest some portion

of its assets in other securities, including exchange-traded funds, futures

contracts, options, swaps and derivatives related to Korean equities, and cash

and cash equivalents. The Company does not have any concentration limits.

The Company intends to return to Shareholders all dividends received, net of

withholding tax, on an annual basis.

Investment Policy

The Company is geographically focused on South Korean companies. Some of the

considerations that affect the Investment Manager's choice of securities to buy

and sell may include the discount at which a preference share is trading

relative to its respective common share, dividend yield and its liquidity,

among other factors. Not all of these factors will necessarily be satisfied for

particular investments.

Preference shares are selected by the Investment Manager at its sole

discretion, subject to the overall control of the Board of Directors of the

Company (the "Board").

From time to time, the Company purchases certain credit default swaps on the

sovereign debt of South Korea and put options on iShares MSCI South Korea ETF

("EWY") as general market and portfolio hedges, but generally did not hedge its

exposure to interest rates or foreign currencies during the year ended 31

December 2022 (2021: Nil). Please see additional information about the nature

of these hedges in the Investment Manager's Report.

Investment Process

The Investment Manager monitors the discounts and yields on the universe of

Korean preference shares as well as events or catalysts that could affect

preference share discounts leading to material price changes.

Multiple criteria are used to rank and calculate the returns for each

preference share, including but not limited to:

· The discount that the preference share is trading at relative to its

common share

· Expected dividend yield

· Future catalysts or events

· Management quality

· Fundamentals of the company

· Market impact from entering and exiting our position

We expect to remain close to fully invested as long as the opportunity set

remains attractive.

Why South Korea?

The future of the South Korean economy looks promising. The global success of

companies like Samsung Electronics, LG Electronics and SK Hynix stimulates

other areas of the South Korean economy both through the demand for

intermediary goods and the demand for services by the workers at these

companies. In addition, South Korea has emerged as one of the world's most

innovative countries as it:

. Ranked 1st in the Bloomberg Innovation Index for eight of the last nine

years 13

. Filed the highest number of patent applications relative to GDP in

202114

. Has an exceptionally high credit rating on its sovereign debt. South

Korea was rated higher than Japan and the U.K. by Moody's, S&P, and Fitch15.

. Ranked 7th largest exporter in the world in 202116.

. Ranked 13th largest economy by GDP in the world in 202217.

. Ranked 5th in the World Bank's Ease of Doing Business Report in 202018.

. Ranked in the top 10% in each of reading, mathematics and science

Programme for International Student Assessment (PISA) test scores in 201819.

South Korean companies are thus a key part of the value chain in some of the

world's most exciting industries, such as electric vehicles, 5G technology and

smartphones. The country also boasts a high GDP per capita, one of the lowest

government debt/GDP ratios of any country, large foreign exchange reserves, and

low levels of unemployment.

Although its population is ageing, the general education level of South Korea's

work force is increasing. South Korean students are consistently among the top

performing students in the Programme for International Student Assessment

tests, including the subtest on critical thinking. This provides a pool of

talent that can be tapped for future growth.

Index Name20 P/E Ratio P/B Ratio

Nifty Index (India) 22.4 3.0

S&P 500 (US) 19.1 3.9

Nikkei 225 (Japan) 13.9 1.6

FTSE 100 (UK) 11.6 1.6

Shanghai Composite 10.9 1.3

(China)

Hang Seng Index (HK) 10.4 1.1

TAIEX (Taiwan) 9.6 1.8

KOSPI 200 (S. Korea) 7.2 0.8

The South Korean stock market appears fundamentally cheap relative to other

equity markets. As of 31 December 2022, the KOSPI 200 trades at a 48% lower

price to earnings ratio and a 60% lower price to book ratio compared to the

average of the major indices shown in the table above. This cheap valuation can

be largely explained by the historically poor corporate governance displayed by

the major South Korean conglomerates. However, events over the last several

years indicate a trend of awareness and improvements in corporate governance.

There were a record-high 47 publicly traded South Korean companies subject to

activist demands in 2022, which represented a 74% increase year-over-year

compared to 202121. The Investment Manager report sets forth some examples of

improvements in corporate governance that have taken place during the most

recent 12 months. The underlying thesis of our strategy is that improved

corporate governance will attract more investors to South Korea and the

companies in which we invest which will, over time, increase the value of the

common shares and narrow the discount of the preference shares held in WKOF's

portfolio, thus increasing the value of WKOF's holdings.

Korean Preference Shares

Many of the largest companies in the Korean market issue preference shares in

addition to their common shares. These preference shares are equity shares that

receive the same dividend per share as the voting common shares plus an

additional percentage of the preference shares' par value per share. In return

for this higher dividend, preference shares are non-voting in normal

circumstances, although they do have voting rights in certain situations. Many

of these preference shares trade at less than half the price of the

corresponding common shares despite receiving a slightly higher dividend amount

as the common shares and, therefore, provide preference shareholders with

relatively higher yields than the corresponding common shares.

The majority of Korean preference shares were issued in the mid-1990s, when the

Korean government pressured chaebols (family-owned Korean conglomerates) to

raise equity and reduce debt within their capital structures. By issuing

non-voting shares, the founders of the Korean companies were able to raise

equity capital without diluting their voting control. The additional payment as

a percentage of par value which preference shares paid out to investors, albeit

nominal today, was sufficiently large relative to the dividends in the 1990s to

attract investors. Today, there are 121 Korean preference shares outstanding

with an aggregate market capitalisation of approximately £38 billion22.

Although preference shares typically do not have voting rights, an economic or

financial model that values equity on the discounted value of future cash flows

would imply that the preference shares of these companies should be trading at

roughly the same price as the corresponding common shares. Further, preference

shares are not associated with over-priced speculative companies; rather, many

of the leading companies in the Korean economy have preference shares

outstanding today.

Continued corporate governance improvements, increased dividend payouts and

investor activism such as that experienced over the past several years could

continue to serve as catalysts for preference share discounts narrowing. The

Company invests in a portfolio of discounted Korean preference shares,

including Korean market heavyweights such as LG Chem Ltd., Hyundai Motor

Company, AmorePacific Corp., and LG Electronics Inc.

Top 10 Holdings

1. LG CHEM LTD., PFD.

15.0% OF WKOF NAVDISCOUNT TO COMMON SHARE: -54%

Korea's largest chemical company by market capitalisation, LG Chem manufactures

and sells petrochemical products and advanced materials, including plastics and

EV batteries23. Its EV battery business and subsidiary, LG Energy Solution is

the second-largest EV battery maker in the world24. In 2022, LG Chem generated

over $34bn in revenue globally25.

2. HYUNDAI MOTOR COMPANY, 2ND PFD.

12.2% OF WKOF NAV DISCOUNT TO COMMON SHARE: -51%

Hyundai Motor Company is one of Korea's leading car manufacturers by market

share, producing and selling more than 3.9 million units globally in 2022.

Hyundai plans on increasing its presence in the electric vehicle market, while

targeting to sell over 4.3 million units in 202326,27.

3. AMOREPACIFIC CORP., PFD

7.5% OF WKOF NAV DISCOUNT TO COMMON SHARE: -65%

Amorepacific Corp develops beauty and cosmetic products while operating over 30

brands, including Etude and Laneige. Amorepacific's portfolio of products

ranges from perfume to dental care, including a premium tea brand28.

4. CJ CHEILJEDANG CORP, PFD.

7.1% OF WKOF NAVDISCOUNT TO COMMON SHARE: -56%

CJ CheilJedang is a leading food company in Korea, focused on processing food

ingredients into groceries such as refined sugar, flour, and processed meats.

The company also operates a number of food brands that specialise in home meal

replacements and snacks, including names like Bibigo and Petitzel. CJ

CheilJedang also operates in the bio industry, and produces plant-based protein

and amino acids29.

5. HANWHA CORPORATION 3RD PFD.

7.0% OF WKOF NAVDISCOUNT TO COMMON SHARE: -46%

Hanwha Corporation specialises in producing and trading chemicals, aerospace &

defence products, and energy products. It also deals in the construction and

financial services industry. A Fortune Global 500 company, Hanwha Corporation's

subsidiaries include Korea's oldest life insurance company and Hanwha

Solutions, a leading domestic manufacturer of solar cell panels30.

6. LG ELECTRONICS INC., PFD.

6.7% OF WKOF NAVDISCOUNT TO COMMON SHARE: -51%

LG Electronics is a household brand in home appliances, with various product

lines including washing machines, televisions, refrigerators, and smart phones.

According to market research firm Omdia, the company ranked second globally in

terms of TV market share in 2022, capturing 16.7% of global TV sales31.

7. MIRAE ASSET DAEWOO CO., LTD., 2ND PFD.

5.7% OF WKOF NAVDISCOUNT TO COMMON SHARE: -41%

Mirae Asset Daewoo is a South Korean financial services firm offering

securities trading, equity underwriting, investment banking services, and

wealth/asset management. Mirae Asset conducts business globally, including the

United States, Canada, United Kingdom, and China32.

8. LG HOUSEHOLD AND HEALTHCARE LTD., PFD.

4.6% OF WKOF NAVDISCOUNT TO COMMON SHARE: -56%

LG Household & Health Care operates within a number of industries, spanning

from cleaning products to beauty care. Beginning with an acquisition of

Coca-Cola's Korea bottling operation in 2007, LG Household & Health Care also

established a beverage business segment, which now includes the distribution of

tea, coffee, and juices33.

9. SK CHEMICALS CO., LTD., NEW PREF

3.8% OF WKOF NAVDISCOUNT TO COMMON SHARE: -49%

SK Chemicals focuses on the production of environmentally friendly materials

and life science products. Green chemicals include bio-based material used in

the production of polyurethane, as well as amorphous resin for containers and

home appliances34. Its life science segment spans treatments for the common

cold to asthma treatments.

10. DOOSAN FUEL CELL CO., LTD., 1st PFD

3.7% OF WKOF NAV DISCOUNT TO COMMON SHARE: -68%

One of the largest fuel cell manufacturers by market capitalisation, Doosan

Fuel Cell produces and sell stationary fuel cell products globally. The company

is focused on sustainable electricity and heat generation. Its products are

targeted towards residential, commercial, and industrial use35.

Chair's Review

For the year ended 31 December 2022

We are pleased to provide the 2022 Annual Report on the Company. During the

period from 1 January 2022 to 31 December 2022 (the "Period"), the Company's

net asset value fell by 21.34% including reinvested dividends36. The Company

underperformed the reference MSCI Korea 25/50 Net Total Return Index (the

"Korea Index"), which fell by 18.22% in Pounds Sterling ("GBP"). Since the

admission of the Company to AIM in May 2013, the net asset value has increased

by 123.91% including reinvested dividends36 compared to the Korea Index returns

of 50.93%37, an annualised outperformance of the index of 7.57%.

The global economy was heavily impacted by the Russian invasion of Ukraine and

the Korean stock market was not immune, even though none of the companies in

the portfolio has direct links to Russia. The "see through" discount of the

portfolio of preference shares remains very wide and has shown little

volatility since the previous Annual Report. This has not helped returns over

the year. The Company's underperformance against the Korea Index in 2022 was

due to the widening of the discounts of the preference shares owned by the

Company and the poor performance of the common shares that the Company owns the

preference shares of, relative to those in the Index. The Korean equity market

performed poorly in 2022 due to challenging macro-economic conditions such as a

weakening currency, elevated inflation, and rising interest rates. The

performance of the Company will be explored in greater depth in the Investment

Manager's Report.

The Directors declared an interim dividend of 6.3732 pence per Share, to

distribute the income received by the Company in respect of the year ended 31

December 2021. This dividend was paid to all Shareholders on 10 June 2022. The

growth in dividends per Share since the launch of the Company is in line with

the thesis that WAM has been promoting over the past several years; that Korean

companies pay out low dividends but this is improving which should attract more

global investors to the Korean stock market.

Based on the fact that the assets currently held by the Company consist mainly

of securities that are readily realisable, whilst the Directors acknowledge

that the liquidity of these assets needs to be managed, the Directors believe

that the Company has adequate financial resources to meet its liabilities as

they fall due for at least twelve months from the date of this report, and that

it is appropriate for the Financial Statements to be prepared on a going

concern basis.

The Board is authorised to repurchase up to 40% of the Company's outstanding

Ordinary Shares in issue as at 31 December 2022.38 Since admission ten years

ago, and as at the date of this document, the Company has repurchased, at a

discount to NAV, 13,190,250 Ordinary Shares of the original 105,000,000

Ordinary Shares issued at admission (12.6%). The Board also has in place

standing instructions with the Company's broker, Singer Capital Markets Limited

(the "Broker" or "Singer"), for the repurchase of the Company's Shares during

closed periods when the Board is not permitted to give individual instructions;

such closed periods typically occur around the preparation of the Annual and

Half Yearly Financial Reports. The Board intends to continue to repurchase

Shares if the Company's Shares are trading at a significant discount to net

asset value. We will also keep Shareholders informed of any share repurchases

through public announcements.

WKOF offers Shareholders the regular opportunity to elect to realise all, or a

part, of their shareholding in WKOF (the "Realisation Opportunity") once every

two years, on the anniversary of WKOF's admission date. A circular with full

details of the upcoming Realisation Opportunity was published on 13 March 2023.

If any Shareholders elect for realisation, then on the Realisation Date, WKOF's

current portfolio will be divided into two pools: a Continuation Pool and a

Realisation Pool. The Realisation Pool will be managed in accordance with an

orderly realisation with the aim of making progressive returns of cash to

holders of Realisation Shares. Given the performance of WKOF, not just recently

but over its entire life, the discount protection measures WKOF has had in

place since IPO, the potential to outperform going forward as well as many

other measures mentioned below, the Board expects demand for this feature to be

limited.

This is my last Annual Report as I have served on the Board since launch, and

it is time for a fresh perspective from new Directors. I would like to thank

Rob King for his efforts since IPO and welcome Krishna Shanmuganathan and Wendy

Dorey to the Board, as well as thank Gill Morris for her work over the past 12

months. All of your new directors are well qualified to oversee the next 10

successful years of the Company.

In last year's Chair's Review, I mentioned other initiatives that the Board

hoped to pursue in order to increase the attractiveness of WKOF's shares and

expand the shareholder register to the benefit of all Shareholders. At this

time, none of these proposals has come to fruition but will hopefully be kept

under review by the new Board and implemented in the future.

In November 2022, Krishna and I visited the Investment Manager in Boston, where

we met both the immediate team responsible for managing the Company and the

wider team as well. We were struck by how the Investment Manager is still

bullish about the opportunity. Now that travel is fully open after the Covid

pause, the team are regularly travelling to Korea and seeking ways to actively

engage with companies in the portfolio on governance issues, to help narrow the

discount of the preference shares versus the common shares. That will be the

focus of activity over the coming year rather than the other initiatives which

have, for now at least, been put to one side.

The Board is very mindful of the expenses ratio and will continue to monitor

and review all costs.

The new Chair will be selected by the other Directors and with only a few

months left on the Board, I wish my colleague the best of luck in a role I have

immensely enjoyed over the past 10 years. I am confident that WAM will continue

to manage the portfolio to the best of their ability for the next ten years, as

they have done in the past.

The Board and the Investment Manager believe that the opportunity offered by

Korean preference shares is as attractive as it has been since launch. We would

hope that the next ten years provide the same opportunities for the Company to

outperform the index.

If any of the Shareholders wish to speak with the Board, then please contact

Singers and we will be happy to answer any questions you may have.

Norman Crighton

Chair

28 April 2023

Investment Manager's Report

For the year ended 31 December 2022

In 2022, WKOF's Net Asset Value ("NAV") in pounds Sterling ("GBP") declined by

21.34%, including reinvested dividends,39 compared to the reference MSCI South

Korea 25/50 Net Total Return Index ("the Korea Index"),40 which declined by

18.22% in GBP. The NAV performance from inception through 31 December 2022,

including reinvested dividends, was 123.91%, continuing to outperform relative

to the Korea Index, which returned 50.93% over the same period.

WKOF Performance Attribution

At year-end, WKOF held a portfolio of 35 South Korean ("Korean") preference

shares. As a reminder, the economic rights of Korean preference shares are

generally the same or slightly better than the corresponding common shares, yet

the preference shares often trade at substantial discounts to the common

shares. WKOF's returns are driven by five primary factors:

the performance of the Korean equity market generally;

the performance of the common shares (which correspond to the preference

shares held by WKOF) relative to the performance of the Korean equity market;

the discounts of the preference shares it holds narrowing or widening

relative to their corresponding common shares;

excess dividend yields of the preference shares held by WKOF;

and fees, expenses and other factors.

In order to compare WKOF's relative return to the Korea Index, we report the

attribution of these aforementioned factors to WKOF's performance. The

following table provides this performance attribution for the last 12 months

and for the period since the inception of WKOF in May 2013 through 31 December

2022.

Return Component41 Last 12 Since

Months Inception

The Korea Index (18.2)% 50.9%

WKOF Common Shares vs. MSCI Index (1.7)% 21.8%

Discount Narrowing (Widening) of (1.0)% 43.6%

Preferred Shares Owned

Excess Dividend Yield of Preferred 2.4% 16.7%

Shares Owned

Fees, Expenses and Others (2.8)% (9.1)%

NAV Performance (21.3)% 123.9%

The investment thesis when WKOF was formed was based on the likelihood that the

Company would outperform the Korea Index largely due to (i) decreases in the

large discounts of the preference shares held by WKOF relative to their

corresponding common shares and (ii) the related excess dividend yields caused

by these large discounts. This has, indeed, been generally the case as these

two factors have collectively been the main contributors to WKOF's

outperformance relative to the Korea Index since inception. At present, we

remain confident in both of these theses. In September 2013, shortly after

inception, the preference shares held by WKOF traded at a 55.5% discount to

their corresponding common shares and the dividend yield was 1.7%. As of

December 2022, the discount and dividend yield were 51.7% and 3.53%,

respectively. Furthermore, over the life of the fund, the corresponding common

shares to WKOF's preference shares have also outperformed the Korea Index which

we believe demonstrates that WKOF has not had a negative selection bias with

regards to the companies in which it invests. Finally, we are focused on

returns since inception because we believe that due to high levels of

idiosyncratic volatility, any data that is gathered over one-year periods is

unlikely to be more generally applicable.

Review of the South Korean Macro Environment

The challenging South Korean macroeconomic environment discussed in the

Company's interim report issued on 12 September 2022 generally defined the

macroeconomic conditions of the year and was reflected in the performance and

trading volume of South Korean equity markets. The benchmark Korea Index

returned -18.2% in 2022, while the KOSPI 200 Index returned -26.2%.42

Concurrently, the KOSPI Index witnessed an over 40% decrease in trading volume

in 2022 compared to the prior year.43

Throughout the year, similar to other global economies, South Korea's core

inflation remained elevated. According to Statistics Korea, South Korea's

consumer price index increased over 5% on average throughout 2022 as compared

to 2021.44 This is the highest rate since 1998 and well above the Bank of

Korea's ("BoK") inflation target of 2%.45 Faced with mounting inflationary

pressure in the consumer economy, the BoK raised its policy interest rate seven

times over the year, taking the nation's policy interest rate from 1.0% as of

November 2021 to 3.25% as of November 2022 (as of the time of writing, the BoK

has decided to raise this rate to 3.5%).46 This move by BoK's Monetary Policy

Committee represents one of the most aggressive monetary tightening cycles in

South Korean history in terms of both pace and magnitude.

As an export-driven economy, factors and trends in the global economy also had

an effect on South Korea and its equity markets. The South Korean won ("KRW")

had sizeable moves relative to major global currencies in 2022. During the

third quarter, the KRW depreciated 10% vs. the United States Dollar ("USD").

Adjusting for changes in relative consumer prices, the real effective exchange

rate of the KRW in September 2022 fell by over 4% compared to June 2022, making

the KRW one of the most underperforming currencies in Asia during the period.47

While South Korea also experienced record high annual export figures of over

$680 billion USD, which were mainly driven by sales of electric vehicles and

components for rechargeable batteries, the net effect on trade balances of

these factors was offset by higher raw material and energy costs.48

Valuations of Major Indices49

Index Name P/E Ratio P/B Ratio Dividend Yield

Nifty Index (India) 22.4 3.0 1.3%

S&P 500 (US) 19.1 3.9 1.8%

Nikkei 225 (Japan) 13.9 1.6 2.3%

FTSE 100 (UK) 11.6 1.6 3.7%

Shanghai Composite (China) 10.9 1.3 2.8%

Hang Seng Index (HK) 10.4 1.1 3.4%

TAIEX (Taiwan) 9.6 1.8 5.2%

KOSPI 200 (S. Korea) 7.2 0.8 2.1%

WKOF Portfolio Holdings50 4.0 0.4 3.7%

South Korean equities and the portfolio holdings of WKOF continue to offer

significant valuation discounts relative to other countries' equity markets as

represented by the price-to-earnings ratios ("P/E ratios") and price-to-book

ratios ("P/B ratios") listed above.

As previously discussed, WKOF's portfolio discount of the preference shares it

owns relative to the corresponding common shares at the end of 2022 was 51.7%.

In addition, the KOSPI 200 has depressed valuation multiples as shown above

relative to other major indices. As a result, WKOF's portfolio holdings traded

71% lower than the average P/E and 85% lower than the average P/B, as compared

to the average ratios of the selected indices above.

At year end, the two largest holdings, by issuer, of WKOF are Hyundai Motor

Company ("HMC") and LG Chem Ltd ("LGC"). These were also double-digit

percentage holdings throughout the fiscal year of 2022.

An investor owning discounted Korean preference shares receives higher annual

cash dividends compared to their corresponding common shares and also hopes to

benefit from potential capital appreciation that could arise if the discount

narrows. We began increasing WKOF's holdings of HMC starting in 2021, when

different series of HMC's preference shares traded at discounts of 55-60%

relative to the price of HMC's common shares. At the beginning of 2022, HMC was

WKOF's second largest holding by issuer. While it remains unclear when or if

the discount will narrow, the first preference shares of HMC were trading at a

larger discount than its three-year historical average discount prior to

202051. Our view was and remains that, even in the absence of the discount

tightening, the historical dividend payouts of HMC's preference shares, if

continued, are likely to generate a material yield and return for the position

based on the low trading price of the preference shares. While HMC's preference

share price declined during 2022, WKOF continues to maintain a sizable position

in HMC's preference shares as we believe the current discount level still

indicates potential for high returns.

In addition to higher dividend yields generated through owning discounted

preference shares, we believe an additional discount exists by owning

preference shares of certain holding companies. An example of such a holding

company is LG Chem, which we discussed in this year's interim report issued on

12 September 2022. Our belief is that LG Chem's shareholders, regardless of

share class, are exposed to an additional discount that exists between the

price of the common shares and the value of its assets. This is because LG

Energy Solutions ("LGES"), a publicly traded stock, represent 79% of LG Chem's

assets. We estimate that LG Chem's common shares trade at an approximately 58%

discount to the value of its assets.52 Since the assets of LG Chem are mainly

publicly traded securities, one could view LG Chem as a type of closed-end fund

- albeit one with concentrated holdings. Typically, a close-end fund trading at

a 20% discount with a low expense ratio would be considered cheap. LG Chem has

low expenses, and generally has a controlling interest in its subsidiaries.53

Accounting for both the discount of LG Chem's preference share to its common

share and the discount of LG Chem's common share to the value of its assets, we

estimate the final look-through discount of LG Chem's preference shares to be

approximately 81%. While there is no guarantee of the discounts ever

disappearing or even narrowing, we are optimistic that the sheer magnitude of

this double look-through discount may eventually be discovered by diligent

investors seeking opportunities with highly asymmetric risk and reward.

Korean Corporate Governance

Corporate governance in Korea has historically been a major subject of

criticism among investors. However, current market trends favour improvements

in corporate governance in Korea and we have observed changes in several areas

during recent years; notably, the number of share buybacks has increased even

as payout ratios have risen. For example, LG Corp announced a share buyback

this year that would be sufficient to repurchase about 4% of the stock or 6% of

float once completed, on top of its dividend.54 There have also been similar

share buybacks in recent years at companies like SK Inc. and Samsung

Electronics.55 We view buybacks and higher dividend payouts as instances of

good corporate governance as these mechanisms allow companies to provide

additional returns of cash to shareholders.

Additionally, the sharp growth in activist demands made against Korean

companies at the end of 2021 continued in 2022. This category grew by 20 cases

in 2022 (the largest increase since 2016), representing a 74% increase on

2021's total of 27.56 Importantly, the growth in such demands also corresponded

with a concomitant increase in companies acquiescing to such demands. One

noteworthy instance was a local activist campaign against a major local talent

agency producing K-pop music bands, in which the local activist fund

successfully appointed its choice of an independent auditor to the company's

board.57 While shareholder activism is still far less prevalent in Korea and

other Asian countries than in Europe or the United States, we view the growth

in activist demands in South Korea as indicating that under the right

circumstances, Korean shareholders are growing more willing to exercise

influence in favour of corporate governance improvements.

Another growing source of criticism of the current corporate governance

environment in South Korea has been from the country's top financial

regulators. From 15 September 2022 to 3 November 2022, several high-profile

public officials held at least three public policy seminars with academics,

institutional investors, and other industry participants to find solutions to

reduce the discount that Korean stocks trade at relative to global comparable

companies. The key individuals leading these seminars included the vice

chairperson of the Financial Services Commission, the governor of the Financial

Supervisory Services and chairperson of the Korea Exchange. The main themes

discussed during the series of seminars include dividend policy reform,

increasing foreign investor access to Korean equity markets and protection of

minority shareholders during mergers and acquisitions or insider trading.58 Our

view remains that improvements in corporate governance should benefit

shareholders of preference shares in many ways, including increased dividend

yields and share buybacks.

Hedging

WKOF pursues its investment strategy with a portfolio that is generally long

only. However, as further described in WKOF's Annual Report and Audited

Financial Statements for the year ended 31 December 2017 and in subsequent

Annual Reports, the Board approved a hedging strategy intended to reduce

exposure to extreme events that would be catastrophic to its Shareholders'

investments in WKOF because of political tensions in Northeast Asia. WKOF has

limited its use of hedging instruments to purchases of credit default swaps

("CDS") and put options on the MSCI Korea 25/50 Index - securities that we

believe would generate high returns if Korea experienced geopolitical disaster

without introducing material new risks into the portfolio. WKOF is actively

managing these geopolitical risks and may adjust the portfolio's hedges as

deemed appropriate. These catastrophe hedges are not expected to make money in

most states of the world. We expect that, as with any insurance policy, WKOF's

hedges will lose money most of the time. The tables below provide details about

the hedges as of 31 December 2022. Note that outside of the general market and

portfolio hedges described herein, WKOF has generally not hedged interest rates

or currencies.

Credit Default Notional Total Cost Annual Price Paid as % Expiration Duration

Swaps on South Value to Cost (GBP) of Notional Date (Years)

Korean (GBP)59 Expiration Value

Sovereign Debt (GBP) (per annum)

3-year CDS 83m 593,608 183,616 0.23% 2025 3.0

Concluding Remarks

The pricing of Korean holding companies and preference shares is a direct

refutation of all the standard analyses of market efficiency. The mispricing is

large, and it is easily discovered. Historically, in countries such as Brazil

and Italy, discounts of preference shares have eventually tightened

significantly.60 Even if Korean preference share discounts never disappear or

narrow, under existing market conditions, preference shares trading at a

discount are likely to remain more economically attractive than their

corresponding common shares due to lower purchase prices and increased yields.

The dividend spread would not be sufficiently attractive on its own to justify

an investment in such shares if there was a low probability that discounts

would ever narrow; however, when coupled with our optimism that discounts will

narrow eventually, enhanced yields appear to be attractive compensation for

potential delays in such outcome.

Thank you for your trust, and we look forward to providing you with updates in

the future.

Weiss Asset Management LP

28 April 2023

Independent Auditor's Report

To the Members of Weiss Korea Opportunity Fund Ltd.

Our opinion is unmodified

We have audited the financial statements of Weiss Korea Opportunity Fund Ltd.

(the "Company"), which comprise the statement of financial position as at 31

December 2022, the statements of comprehensive income, changes in equity and

cash flows for the year then ended, and notes, comprising significant

accounting policies and other explanatory information.

In our opinion, the accompanying financial statements:

· give a true and fair view of the financial position of the Company as at

31 December 2022, and of the Company's financial performance and cash flows for

the year then ended;

· are prepared in accordance with International Financial Reporting

Standards as adopted by the EU ("IFRS"); and

· comply with the Companies (Guernsey) Law, 2008.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing

(UK) ("ISAs (UK)") and applicable law. Our responsibilities are described

below. We have fulfilled our ethical responsibilities under, and are

independent of the Company in accordance with, UK ethical requirements

including the FRC Ethical Standard as applied to listed entities. We believe

that the audit evidence we have obtained is a sufficient and appropriate basis

for our opinion.

Material uncertainty relating to going concern

The risk Our response

Going Concern Disclosure quality Our audit procedures

Refer to the Report of the The financial statements included but were not

Directors. explain how the directors limited to:

We draw attention to Note 2c have formed a judgement that

to the financial statements, it is appropriate to adopt Realisation Opportunity:

which indicates that in the going concern basis of We considered the risk that

accordance with the Company's preparation of the Company. the outcome of the

Articles of Association and That judgement is based on Realisation Opportunity

its Admission Document to the an evaluation of the could affect the Company for

Alternative Investment Market inherent risks to the at least a year from the

("AIM") of the London Stock Company's business model and date of approval of the

Exchange, the Company shall how those risks might affect financial statements (the

offer all shareholders the the Company's financial "going concern period") by

right to elect to realise resources or ability to considering outcomes of

some or all of the value of continue operations over a previous realisation

their Ordinary Shares, less period of at least a year opportunities held by the

applicable costs and from the date of approval of Company, inspecting

expenses, on or prior to the the financial statements, in summaries of meetings held

fourth anniversary of the particular in relation to by the directors, inquiring

Company's AIM admission and the Realisation Opportunity. with the investment manager

every two years thereafter, as to their assessment of

the most recent being 14 May The risk for our audit is the likelihood of uptake of

2021 and a forthcoming whether such judgements the Realisation Opportunity,

opportunity being on 13 May amounted to a material and considering key

2023 ("the Realisation uncertainty that may cast financial metrics including

Opportunity"). Subject to the significant doubt on the the performance of the

aggregate net asset value of ability of the Company to Company's share price

the continuing Ordinary continue as a going concern. against relevant market

Shares falling below the If so, that fact is required indices.

viable threshold disclosed in to be disclosed (as has been Assessing disclosures:

note 2c to the financial done) and along with a

statements, the directors may description of the We considered whether the

propose an ordinary circumstances, is a key going concern disclosure in

resolution for the winding up financial statement note 2(c) to the financial

of the Company. disclosure. statements gives full and

This condition constitutes a accurate description of the

material uncertainty that may directors' assessment of

cast significant doubt about going concern, including the

the Company's ability to identified risks and

continue as a going concern. dependencies.

Our opinion is not modified

in respect of this matter.

Other key audit matters: our assessment of the risks of material misstatement

Key audit matters are those matters that, in our professional judgment, were of

most significance in the audit of the financial statements and include the most

significant assessed risks of material misstatement (whether or not due to

fraud) identified by us, including those which had the greatest effect on: the

overall audit strategy; the allocation of resources in the audit; and directing

the efforts of the engagement team. Going concern is a significant key audit

matter and is described in the 'Material uncertainty relating to going concern'

section of our report. These matters were addressed in the context of our audit

of the financial statements as a whole, and in forming our opinion thereon, and

we do not provide a separate opinion on these matters. In arriving at our

audit opinion above, the other key audit matter was as follows (unchanged from

2021):

The risk Our response

Valuation of financial Basis: Our audit procedures

assets at fair value through As at 31 December 2022 the included but were not

profit or loss Company had invested 95% of limited to:

("Investments") its net assets in listed

£120,764,446; (2021: £ preferred shares and other Control Evaluation:

159,614,094) financial instruments issued We assessed the design,

Refer to the Audit Committee by companies incorporated and implementation and operating

Report, note 2f accounting listed in South Korea, which effectiveness of the

policy and notes 12 and 21 in certain cases may trade at relevant controls over the

disclosures a discount to the valuation of investments.

corresponding common shares

of the same companies. Valuation procedures

including use of a KPMG

The Company's listed Specialist:

investments are valued based We have used our own

on bid-market prices at the valuation specialist to

close of business of the independently price all

relevant stock exchange on investments to a third party

the reporting date obtained data source and assessed the

from third party pricing trading volumes behind such

providers. prices.

Risk: Assessing disclosures:

The valuation of the We also considered the

Company's investments, given Company's investment

they represent the majority valuation policies and their

of the Company's net assets application as described in

as at 31 December 2022, is a note 2f to the Financial

significant area of our Statements for compliance

audit. with IFRS in addition to the

adequacy of disclosures in

notes 12 and 21.

Our application of materiality and an overview of the scope of our audit

Materiality for the financial statements as a whole was set at £2,360,000,

determined with reference to a benchmark of net assets of £127,080,493 of which

it represents approximately 1.9% (2021: 2%).

In line with our audit methodology, our procedures on individual account

balances and disclosures were performed to a lower threshold, performance

materiality, so as to reduce to an acceptable level the risk that individually

immaterial misstatements in individual account balances add up to a material

amount across the financial statements as a whole. Performance materiality for

the Company was set at 75% (2021: 75%) of materiality for the financial

statements as a whole, which equates to 1,770,000 (2021: £2,497,000). We

applied this percentage in our determination of performance materiality because

we did not identify any factors indicating an elevated level of risk.

We reported to the Audit Committee any corrected or uncorrected identified

misstatements exceeding £118,000, in addition to other identified misstatements

that warranted reporting on qualitative grounds.

Our audit of the Company was undertaken to the materiality level specified

above, which has informed our identification of significant risks of material

misstatement and the associated audit procedures performed in those areas as

detailed above.

Going concern

The directors have prepared the financial statements on the going concern basis

as they do not intend to liquidate the Company or to cease its operations, and

as they have concluded that the Company's financial position means that this is

realistic. They have concluded that there are material uncertainties that could

cast significant doubt over its ability to continue as a going concern for at

least a year from the date of approval of the financial statements (the "going

concern period").

An explanation of how we evaluated management's assessment of going concern is

set out in the 'Material uncertainty relating to going concern' section of our

report.

Our conclusions based on this work:

· we consider that the directors' use of the going concern basis of

accounting in the preparation of the financial statements is appropriate;

· we have nothing material to add or draw attention to in relation to the

directors' statement in Note 2c to the financial statements on the use of the

going concern basis of accounting, and their identification therein of a

material uncertainty over the Company's ability to continue to use that basis

for the going concern period, and we found the going concern disclosure in note

2c to be acceptable

However, as we cannot predict all future events or conditions and as subsequent

events may result in outcomes that are inconsistent with judgements that were

reasonable at the time they were made, the above conclusions are not a

guarantee that the Company will continue in operation.

Fraud and breaches of laws and regulations - ability to detect

Identifying and responding to risks of material misstatement due to fraud

To identify risks of material misstatement due to fraud ("fraud risks") we

assessed events or conditions that could indicate an incentive or pressure to

commit fraud or provide an opportunity to commit fraud. Our risk assessment

procedures included:

· enquiring of management as to the Company's policies and procedures to

prevent and detect fraud as well as enquiring whether management have knowledge

of any actual, suspected or alleged fraud;

· reading minutes of meetings of those charged with governance; and

· using analytical procedures to identify any unusual or unexpected

relationships.

As required by auditing standards, we perform procedures to address the risk of

management override of controls, in particular the risk that management may be

in a position to make inappropriate accounting entries. On this audit we do not

believe there is a fraud risk related to revenue recognition because the

Company's revenue streams are simple in nature with respect to accounting

policy choice, and are easily verifiable to external data sources or agreements

with little or no requirement for estimation from management. We did not

identify any additional fraud risks.

We performed procedures including

· Identifying journal entries and other adjustments to test based on risk

criteria and comparing any identified entries to supporting documentation; and

· incorporating an element of unpredictability in our audit procedures.

Identifying and responding to risks of material misstatement due to

non-compliance with laws and regulations

We identified areas of laws and regulations that could reasonably be expected

to have a material effect on the financial statements from our sector

experience and through discussion with management (as required by auditing

standards), and from inspection of the Company's regulatory and legal

correspondence, if any, and discussed with management the policies and

procedures regarding compliance with laws and regulations. As the Company is

regulated, our assessment of risks involved gaining an understanding of the

control environment including the entity's procedures for complying with

regulatory requirements.

The Company is subject to laws and regulations that directly affect the

financial statements including financial reporting legislation and taxation

legislation and we assessed the extent of compliance with these laws and

regulations as part of our procedures on the related financial statement items.

The Company is subject to other laws and regulations where the consequences of

non-compliance could have a material effect on amounts or disclosures in the

financial statements, for instance through the imposition of fines or

litigation or impacts on the Company's ability to operate. We identified

financial services regulation as being the area most likely to have such an

effect, recognising the regulated nature of the Company's activities and its

legal form. Auditing standards limit the required audit procedures to identify

non-compliance with these laws and regulations to enquiry of management and

inspection of regulatory and legal correspondence, if any. Therefore if a

breach of operational regulations is not disclosed to us or evident from

relevant correspondence, an audit will not detect that breach.

Context of the ability of the audit to detect fraud or breaches of law or

regulation

Owing to the inherent limitations of an audit, there is an unavoidable risk

that we may not have detected some material misstatements in the financial

statements, even though we have properly planned and performed our audit in

accordance with auditing standards. For example, the further removed

non-compliance with laws and regulations is from the events and transactions

reflected in the financial statements, the less likely the inherently limited

procedures required by auditing standards would identify it.

In addition, as with any audit, there remains a higher risk of non-detection of

fraud, as this may involve collusion, forgery, intentional omissions,

misrepresentations, or the override of internal controls. Our audit procedures

are designed to detect material misstatement. We are not responsible for

preventing non-compliance or fraud and cannot be expected to detect

non-compliance with all laws and regulations.

Other information

The directors are responsible for the other information. The other information

comprises the information included in the annual report but does not

include the financial statements and our auditor's report thereon. Our opinion

on the financial statements does not cover the other information and we do not

express an audit opinion or any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is

to read the other information and, in doing so, consider whether the other

information is materially inconsistent with the financial statements or our

knowledge obtained in the audit, or otherwise appears to be materially

misstated. If, based on the work we have performed, we conclude that there is a

material misstatement of this other information, we are required to report that

fact. We have nothing to report in this regard.

Disclosures of emerging and principal risks and longer term viability

We are required to perform procedures to identify whether there is a material

inconsistency between the directors' disclosures in respect of emerging and

principal risks and the viability statement, and the financial statements

and our audit knowledge. we have nothing material to add or draw attention to

in relation to:

· the directors' confirmation within the Viability Statement that they

have carried out a robust assessment of the emerging and principal risks facing

the Company, including those that would threaten its business model, future

performance, solvency or liquidity;

· the emerging and principal risks disclosures describing these risks and

explaining how they are being managed or mitigated;

· the directors' explanation in the Viability Statement as to how they have

assessed the prospects of the Company, over what period they have done so and

why they consider that period to be appropriate, and their statement as to

whether they have a reasonable expectation that the Company will be able to

continue in operation and meet its liabilities as they fall due over the period

of their assessment, including any related disclosures drawing attention to any

necessary qualifications or assumptions.

Corporate governance disclosures

We are required to perform procedures to identify whether there is a material

inconsistency between the directors' corporate governance disclosures and the

financial statements and our audit knowledge.

Based on those procedures, we have concluded that each of the following is

materially consistent with the financial statements and our audit knowledge:

· the directors' statement that they consider that the annual report and

financial statements taken as a whole is fair, balanced and understandable, and

provides the information necessary for shareholders to assess the Company's

position and performance, business model and strategy;

· the section of the annual report describing the work of the Audit

Committee, including the significant issues that the audit committee considered

in relation to the financial statements, and how these issues were addressed;

and

· the section of the annual report that describes the review of the

effectiveness of the Company's risk management and internal control systems.

We have nothing to report on other matters on which we are required to report

by exception

We have nothing to report in respect of the following matters where the

Companies (Guernsey) Law, 2008 requires us to report to you if, in our opinion:

· the Company has not kept proper accounting records; or

· the financial statements are not in agreement with the accounting records;

or

· we have not received all the information and explanations, which to the

best of our knowledge and belief are necessary for the purpose of our audit.

Respective responsibilities

Directors' responsibilities

As explained more fully in their statement, the directors are responsible for:

the preparation of the financial statements including being satisfied that they

give a true and fair view; such internal control as they determine is necessary

to enable the preparation of financial statements that are free from material

misstatement, whether due to fraud or error; assessing the Company's ability to

continue as a going concern, disclosing, as applicable, matters related to

going concern; and using the going concern basis of accounting unless they

either intend to liquidate the Company or to cease operations, or have no

realistic alternative but to do so.

Auditor's responsibilities

Our objectives are to obtain reasonable assurance about whether the financial

statements as a whole are free from material misstatement, whether due to fraud

or error, and to issue our opinion in an auditor's report. Reasonable assurance

is a high level of assurance, but does not guarantee that an audit conducted in

accordance with ISAs (UK) will always detect a material misstatement when it

exists. Misstatements can arise from fraud or error and are considered material

if, individually or in aggregate, they could reasonably be expected to

influence the economic decisions of users taken on the basis of the financial

statements.

A fuller description of our responsibilities is provided on the FRC's website

at www.frc.org.uk/auditorsresponsibilities.

The purpose of this report and restrictions on its use by persons other than

the Company's members as a body

This report is made solely to the Company's members, as a body, in accordance

with section 262 of the Companies (Guernsey) Law, 2008. Our audit work has

been undertaken so that we might state to the Company's members those matters

we are required to state to them in an auditor's report and for no other

purpose. To the fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the Company and the Company's members, as a

body, for our audit work, for this report, or for the opinions we have formed.

KPMG Channel Islands Limited

Chartered Accountants

Guernsey

28 April 2023

Statement of Financial Position

As at 31 December 2022

As at As at

31 December 31 December

2022 2021

Notes £ £

Assets

Financial assets at fair value through 12,21 120,764,446 159,614,094

profit or loss

Derivative financial assets 13,21 - 221,639

Other receivables 14 4,598,722 4,976,005

Due from broker - 696

Margin account 15 1,327,313 1,381,413

Cash and cash equivalents 16 2,890,620 3,091,245

Total assets 129,581,101 169,285,092

Liabilities

Derivative financial 13,21 1,145,453 984,227

liabilities

Due to broker - 263,091

Other payables 17 1,355,155 1,496,629

Total liabilities 2,500,608 2,743,947

Net assets 127,080,493 166,541,145

Represented by:

Shareholders' equity and

reserves

Share capital 18 33,986,846 33,986,846

Other reserves 93,093,647 132,554,299

Total shareholders' equity 127,080,493 166,541,145

Net Assets Value per Ordinary Share 6 1.8336 2.4029

The Notes form an integral part of these Financial Statements.

The Financial Statements were approved and authorised for issue by the Board of

Directors on 28 April 2023.

Norman Crighton Gill

Morris

Chair

Director

Statement of Comprehensive Income

For the year ended 31 December 2022

For the year For the year

ended ended

31 December 31 December

2022 2021

Notes £ £

Income

Net changes in fair value of financial 7 (37,206,667) 2,349,820

assets

at fair value through profit or loss

Net changes in fair value of derivative 8 1,253,397 403,489

financial

instruments through profit or loss

Net foreign currency gains/(losses) 2n 632,948 (424,970)

Dividend income 9 5,088,748 5,586,806

Bank interest 9 4,488 -

income

Total (loss)/ (30,227,086) 7,915,145

income

Expenses

Operating expenses 10 (3,696,545) (4,891,244)

Total operating expenses (3,696,545) (4,891,244)

(Loss)/profit for the year before dividend (33,923,631) 3,023,901

withholding tax

Dividend withholding tax 2u (1,119,942) (1,232,396)

(Loss)/profit for the year after dividend (35,043,573) 1,791,505

withholding tax

(Loss)/profit and total comprehensive (35,043,573) 1,791,505

(loss)/income for the year

Basic and diluted (loss)/earnings per 5 (0.5056) 0.0244

Share

All items derive from continuing activities.

Following review of the AIC SORP and its impact on the Statement of

Comprehensive Income the Board has decided not to follow the recommended income

and capital split. This is due to the fact that the Company's dividend policy

is not influenced by its expense policy. See Investment Objective and Dividend

Policy for details of the Company's dividend policy.

The Notes form an integral part of these Financial Statements.

Statement of Changes in Equity

For the year ended 31 December 2022

Share Other

capital reserves Total

Notes £ £ £

Balance as at 1 January 2022 33,986,846 132,554,299 166,541,145

Total comprehensive loss for the year - (35,043,573) (35,043,573)

Transactions with Shareholders,

recorded directly in equity

Distributions paid 3 - (4,417,079) (4,417,079)

Balance as at 31 December 33,986,846 93,093,647 127,080,493

2022

Share Other

capital reserves Total

For the year ended 31 Notes £ £ £

December 2021

Balance as at 1 January 2021 68,124,035 135,000,918 203,124,953

Total comprehensive income for the year - 1,791,505 1,791,505

Transactions with Shareholders,

recorded directly in equity

Purchase of own Shares for 18 (1,719,433) - (1,719,433)

cancellation

Purchase of Realisation 18 (32,417,756) - (32,417,756)

Shares

Distributions paid 3 - (4,238,124) (4,238,124)

Balance as at 31 December 33,986,846 132,554,299 166,541,145

2021

The Notes form an integral part of these Financial Statements.

Statement of Cash Flows

For the year ended 31 December 2022

For the year For the year

ended 31 December ended 31

2022 December 2021

Notes £ £

Cash flows from operating activities

(Loss)/profit for the year (35,043,573) 1,791,505

Adjustments for:

Net change in fair value of financial 7 37,206,667 (2,349,820)

assets held at fair value through profit

or loss

Exchange (gains)/losses on cash and cash (523,108) 424,970

equivalents

Net change in fair value of derivative 8 (1,253,397) (403,489)

financial instruments held at fair value

through profit or loss

Increase in receivables excluding (3,314) (620)

dividends

Decrease in other payables excluding 17 (57,744) (210,895)

withholding tax

Dividend income (3,968,807) (4,354,411)

Dividend received 4,265,673 4,330,946

Purchase of financial assets at fair value (10,431,005) (104,226,201)

through profit or loss

Proceeds from the sale of financial assets 11,811,591 140,561,400

at fair value through profit or loss

Net cash generated from operating 2,002,983 35,563,385

activities

Cash flows from investing activities

Opening of derivative financial 1,799,480 724,897

instruments

Closure of derivative financial (163,217) (1,084,182)

instruments

Decrease in margin account 54,100 714,561

Net cash generated from investing 1,690,363 355,276

activities

Cash flows from financing activities

Purchase of own shares for cancellation 18 - (1,719,433)

Repurchase of realisation Shares - (32,417,756)

Distributions paid 3 (4,417,079) (4,238,124)

Net cash used in financing activities (4,417,079) (38,375,313)

Net decrease in cash and cash equivalents (723,733) (2,456,652)

Exchange gains/(losses) on cash and cash 523,108 (424,970)

equivalents

Cash and cash equivalents at the beginning 3,091,245 5,972,867

of the year

Cash and cash equivalents at the end of 2,890,620 3,091,245

the year

The Notes form an integral part of these Financial Statements.

Notes to the Financial Statements

For the year ended 31 December 2022

1. General information

Weiss Korea Opportunity Fund Ltd. ("WKOF" or the "Company") was incorporated

with limited liability in Guernsey, as a closed-ended investment company on 12

April 2013. The Company's Shares were admitted to trading on AIM of the LSE on

14 May 2013.

The Investment Manager of the Company is Weiss Asset Management LP.

At the AGM held on 27 July 2016, the Board approved the adoption of the new

Articles of Incorporation in accordance with Section 42(1) of the Companies

(Guernsey) Law, 2008 (the "Law").

2. Significant accounting policies

a) Statement of compliance

The Financial Statements of the Company for the year ended 31 December 2022

have been prepared in accordance with IFRS adopted by the European Union and

the AIM Rules of the London Stock Exchange. They give a true and fair view and

are in compliance with the Law. Unless disclosed elsewhere within these

financial statements, the Board has adopted the AIC Statement of Recommended

Practice ("SORP") where this is consistent with the requirements of IFRS, in

compliance with the Companies (Guernsey) Law, 2008 and appropriate for the

Company's policies.

b) Basis of preparation

The Financial Statements are prepared in Pounds Sterling (£), which is the

Company's functional and presentational currency. They are prepared on a

historical cost basis modified to include financial assets and liabilities at

fair value through profit or loss.

c) Going concern

In accordance with the Company's Articles of Incorporation and its Admission

Document, the Company shall offer all Shareholders the right to elect to

realise some or all of the value of their Ordinary Shares (the "Realisation

Opportunity"), less applicable costs and expenses, on or prior to the fourth

anniversary of the Company's admission to AIM and, unless it has already been

determined that the Company be wound-up, every two years thereafter, the next

such opportunity being 12 May 2023 (the "Realisation Date").

On 13 March 2023, the Company announced that pursuant to the Realisation

Opportunity, Shareholders who are on the register as at the record date may

elect, during the Election Period, to redesignate all or part (provided that

such part be rounded up to the nearest whole Ordinary Share) of their Ordinary

Shares as Realisation Shares. The Election Period commenced on 12 April 2023

and closes at 1pm, 5 May 2023.

Subject to the aggregate NAV of the continuing Ordinary Shares at the close of

business on the last business day before the Realisation Date being not less

than £50 million, the Ordinary Shares held by the Shareholders who have elected

for realisation will be redesignated as Realisation Shares and the Portfolio

will be split into two separate and distinct Pools, namely the Continuation

Pool (comprising the assets attributable to the continuing Ordinary Shares) and

the Realisation Pool (comprising the assets attributable to the Realisation

Shares). If one or more Realisation Elections are duly made and the NAV of the

continuing Ordinary Shares at the close of business on the last business day

before the Reorganisation Date is less than £50 million, the Directors may

propose an ordinary resolution for the winding up of the Company and may pursue

a liquidation of the Company instead of splitting the Portfolio into the

Continuation Pool and the Realisation Pool.

Currently, the Board does not know the number of Shareholders (or related

Shares) who will take up the Realisation Opportunity. Based on the uncertainty

of the uptake of the offer, there is a material uncertainty over the going

concern of the entity. As the assets of the Company consist mainly of

securities that are readily realisable, whilst the Directors acknowledge that

the liquidity of these assets needs to be managed, the Directors believe that

the Company has adequate financial resources to meet its liabilities as they

fall due in the foreseeable future and for at least twelve months from the date

of this Report, and that it is appropriate for the Financial Statements to be

prepared on a going concern basis, given that the Board believes the Company

will continue in existence post the Realisation Opportunity.

d) Standards, amendments and interpretations not yet effective

A number of new standards, amendments to standards and interpretations are

effective for annual periods beginning on/after 1 January 2023, and have not

been early adopted in preparing these financial statements. None of these is

expected to have a material effect on the financial statements of the Company.

· IFRS 17 Insurance Contracts (Effective 1 January 2023)

· Definition of Accounting Estimates (Amendments to IAS 8) (Effective 1

January 2023)

· Disclosure of Accounting Policies (Amendments to IAS 1 and IFRS Practice

Statement 2)

(Effective 1 January 2023)

· Amendments to IAS 12 Income Taxes - Deferred Tax related to Assets and

Liabilities arising from a Single Transaction (effective from 1 January 2023)

· Amendments to IAS 1 Presentation of Financial Statements - Classification

of liabilities (effective from 1 January 2024)

e) Standards, amendments and interpretations effective during the year

A number of new standards, amendments to standards and interpretations are

effective for annual periods beginning on 1 January 2022, and have been adopted

in preparing these financial statements where relevant.

· Amendments to IFRS 3 Business Combinations - Reference to the Conceptual

Framework

· Amendments to IAS 37 Provisions, Contingent Liabilities and Contingent

Assets - Onerous Contracts - Cost of Fulfilling a Contract

· Amendments to IFRS 1 First-time Adoption of International Financial

Reporting Standards - Subsidiary as a First-Time Adopter

· Amendments to IFRS 9 Financial Instruments - Fees in the '10 per cent'

test for derecognition of financial liabilities

The adoption of these standards has not had a material impact on the financial

statements of the Company.

f) Financial instruments

i) Classification

Financial assets are classified into the following categories: financial assets

at fair value through profit or loss and amortised cost.

The classification depends on the business model in which a financial asset is

managed and its contractual cash flows.

Financial liabilities are classified as either financial liabilities at fair

value through profit or loss or other financial liabilities at amortised cost.

Financial assets at fair value through profit or loss ("investments")

Financial assets and derivatives are recognised in the Company's Statement of

Financial Position when the Company becomes a party to the contractual

provisions of the instrument.

Purchases and sales of investments are recognised on the trade date (the date

on which the Company commits to purchase or sell the investment). Investments

purchased are initially recorded at fair value, being the consideration given

and excluding transaction or other dealing costs associated with the

investment.

Subsequent to initial recognition, investments are measured at fair value.

Gains and losses arising from changes in the fair value of investments and

gains and losses on investments that are sold are recognised through profit

or loss in the Statement of Comprehensive Income within net changes in fair

value of financial assets at fair value through profit or loss.

ii) Recognition and measurement

Financial assets at fair value through profit or loss ("derivatives: credit

default swaps and options")

Subsequent to initial recognition at fair value, credit default swaps and

options are measured at fair value through profit and loss.

The fair values of the credit default swaps and options are based on traded

prices. The valuation of the credit default swaps and options fair values means

fluctuations will be reflected in the net changes in fair value of derivative

instruments through profit or loss.

Derivatives are presented in the Statement of Financial Position as financial

assets when their fair value is positive and as financial liabilities when

their fair value is negative.

Other financial instruments

For other financial instruments, including other receivables and other

payables, the carrying amounts as shown in the Statement of Financial Position

approximate the fair values due to the short term nature of these financial

instruments.

iii) Fair Value Measurement

Fair value is the price that would be received to sell an asset or paid to

transfer a liability in an orderly transaction between market participants at

the measurement date. Investments traded in active markets are valued at the

latest available bid prices ruling at midnight, Greenwich Mean Time ("GMT"), on

the reporting date. The Directors are of the opinion that the bid-market prices

are the best estimate of fair value. Gains and losses arising from changes in

the fair value of financial assets and financial liabilities at fair value

through profit and loss are shown as net changes in fair value of financial

assets through profit or loss in Note 12 and are recognised in the Statement of

Comprehensive Income in the period in which they arise. Gains and losses

arising from changes in the fair value of derivative financial instruments are

shown as net changes in fair value of derivative financial instruments through

profit or loss in Note 13 and are recognised in the Statement of Comprehensive

Income in the period in which they arise.

iv) Derecognition of financial instruments

A financial asset is derecognised when: (a) the rights to receive cash flows

from the asset have expired; (b) the Company retains the right to receive cash

flows from the asset, but has assumed an obligation to pay them in full without

material delay to a third party under a "pass through arrangement"; or (c) the

Company has transferred substantially all the risks and rewards of the asset,

or has neither transferred nor retained substantially all the risks and rewards

of the asset, but has transferred control of the asset.

On derecognition of a financial asset, the difference between the carrying

amount of the asset using the average cost method and the consideration

received (including any new asset obtained, less any new liability assumed) is

recognised in profit or loss.

A financial liability is derecognised when the obligation under the liability

is discharged, cancelled, or expired.