Filed Pursuant to Rule 424(b)(7)

Registration No. 333-281373

The information in this preliminary prospectus supplement is not complete and may be changed. A registration statement relating to these securities has been filed under the Securities Act of 1933, as amended, and is effective. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus Supplement dated August 8, 2024

PROSPECTUS SUPPLEMENT

(to Prospectus dated August 8, 2024)

5,000,000 Shares

Common Stock

The selling stockholders identified in this prospectus supplement are offering 5,000,000 shares of our common stock. We are not selling any shares of common stock in this offering and will not receive any of the proceeds from the shares of common stock sold by the selling stockholders.

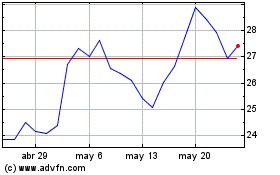

Our common stock is listed on the Nasdaq Global Select Market under the symbol “ALKT.” On August 7, 2024, the last reported sale price of shares of our common stock on the Nasdaq Global Select Market was $32.03 per share.

We are an “emerging growth company” as defined under the U.S. federal securities laws and, as such, are subject to reduced public company disclosure standards. See the section titled “Prospectus Supplement Summary—Implications of Being an Emerging Growth Company.”

Investing in our common stock involves a high degree of risk. See the section titled “Risk Factors” beginning on page S-6 of this prospectus supplement and the risk factors described in the documents that we file with the Securities and Exchange Commission that are incorporated herein by reference for a discussion of certain risks you should consider before deciding to invest in our common stock. The underwriter has agreed to purchase our common stock from the selling stockholders at a price of $ per share, which will result in $ of proceeds to the selling stockholders before expenses. The selling stockholders will receive all of the proceeds from this offering. The selling stockholders have granted the underwriter an option for a period of up to 30 days from the date of this prospectus supplement to purchase up to an additional 750,000 shares of our common stock at the same price.

The underwriter may offer the shares of common stock from time to time for sale in one or more transactions on the Nasdaq Global Select Market, in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices, subject to their right to reject any order in whole or in part. See the section titled “Underwriting” beginning on page S-21 of this prospectus supplement for a description of the compensation payable to the underwriter. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares is expected to be on or about August 12, 2024.

The date of this prospectus supplement is August 8, 2024.

TABLE OF CONTENTS

| | | | | |

| Page |

PROSPECTUS SUPPLEMENT | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus dated August 8, 2024 are part of a registration statement on Form S-3 (Registration No. 333-281373) that we filed with the Securities and Exchange Commission (the “SEC”), utilizing a “shelf” registration process on August 8, 2024.

This document contains two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and also supplements and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus, which provides more general information, some of which may not apply to this offering. This prospectus supplement may add, update, or change information contained in the accompanying prospectus. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. In addition, in this prospectus, as permitted by law, we “incorporate by reference” information from other documents that we file with the SEC. This means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus supplement and the accompanying prospectus and should be read with the same care. When we update the information contained in documents that have been incorporated by reference by making future filings with the SEC, the information included or incorporated by reference in this prospectus supplement is considered to be automatically updated and superseded. If the information contained in this prospectus supplement differs or varies from the information contained in the accompanying prospectus, you should rely on the information set forth in this prospectus supplement. If the information conflicts with any statement in a document that we have incorporated by reference, then you should consider only the statement in the more recent document. However, if any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference in this prospectus supplement or the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement as our business, financial condition, results of operations and prospects may have changed since the earlier dates.

We, the selling stockholders and the underwriter have not authorized anyone to provide you with information or to make any representation other than the information and representations contained or incorporated by reference in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, along with the information contained in any permitted free writing prospectuses we have authorized for use in connection with this offering. We, the selling stockholders and the underwriter take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

The selling stockholders are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. This prospectus supplement and the accompanying prospectus do not constitute an offer of, or an invitation to purchase, any of the common stock in any jurisdiction in which such offer or invitation is unlawful. For investors outside the United States we, the selling stockholders and the underwriter have not done anything that would permit this offering or possession or distribution of this prospectus supplement, the accompanying prospectus and any free writing prospectus that we have authorized for use in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus supplement, the accompanying prospectus and any free writing prospectus that we have authorized for use in connection with this offering must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus supplement, the accompanying prospectus and any free writing prospectus that we have authorized for use in connection with this offering outside the United States.

The information contained in this prospectus supplement and the accompanying prospectus is accurate only as of the date of this prospectus supplement or the date of the accompanying prospectus, as applicable, and the information in the documents incorporated by reference in this prospectus supplement and the accompanying prospectus is accurate only as of the date of those respective documents, regardless of the time of delivery of this prospectus supplement and the accompanying prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since those dates. We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference in this prospectus supplement or the accompanying prospectus were made solely

for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties and covenants were accurate only as of the date when made; therefore, such representations, warranties and covenants should not be relied on as accurate representations of the current state of our affairs. It is important for you to read and consider all information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus in making your investment decision. You should read this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, any free writing prospectus that we have authorized for use in connection with this offering and the additional information described under the sections titled “Where You Can Find More Information; Incorporation by Reference” in this prospectus supplement and in the accompanying prospectus, before investing in our common stock.

Unless otherwise indicated or the context otherwise requires, references in this prospectus supplement and the accompanying prospectus to “Alkami,” “we,” “our,” “us,” and the “Company” refer to Alkami Technology, Inc.

TRADEMARKS, SERVICE MARKS AND TRADENAMES

We have proprietary rights to trademarks, trade names and service marks appearing in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein that are important to our business. Solely for convenience, the trademarks, trade names and service marks may appear in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein without the ® and TM symbols, but any such references are not intended to indicate, in any way, that we forgo or will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, trade names and service marks. All trademarks, trade names and service marks appearing in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein are the property of their respective owners.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information appearing elsewhere in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus. This summary is not complete and does not contain all of the information that you should consider in making your investment decision and is qualified in its entirety by the more detailed information appearing elsewhere, or incorporated by reference, in this prospectus supplement or the accompanying prospectus. Before investing in our common stock, you should carefully read the entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, including the information presented under “Risk Factors,” “Management’s Discussion and Analysis of Our Financial Condition and Results of Operations” and our financial statements and related notes incorporated by reference in this prospectus supplement and the accompanying prospectus.

Business Description

Alkami is a cloud-based digital banking solutions provider. We inspire and empower community, regional and super-regional financial institutions (“FIs”) to compete with large, technologically advanced and well-resourced banks in the United States. Our solution, the Alkami Digital Banking Platform, allows FIs to onboard and engage new users, accelerate revenues and meaningfully improve operational efficiency, all with the support of a proprietary, true cloud-based, multi-tenant architecture. We cultivate deep relationships with our clients through long-term, subscription based contractual arrangements, aligning our growth with our clients’ success and generating an attractive unit economic model.

Alkami was founded to help level the playing field for FIs. Since then, our vision has been to create a platform that combines premium technology and fintech solutions in one integrated ecosystem, delivered as a software-as-a-service solution and providing our clients’ customers with a single point of access to all things digital. We have invested significant resources to build a technology stack that prioritized innovation velocity and speed-to-market given the importance of product depth and functionality in winning and retaining clients. In fiscal 2020, we acquired ACH Alert, LLC to pursue adjacent product opportunities, such as fraud prevention and to expand our addressable market. In addition, in September 2021, we acquired MK Decisioning Systems, LLC, a technology platform for digital account opening, credit card and loan origination solutions. In April 2022, we acquired Segmint, a leading cloud-based financial data analytics and transaction data cleansing provider.

Our domain expertise in retail and business banking has enabled us to develop a suite of products tailored to address key challenges faced by FIs. Due to our architecture, adding products through our single code base is fast, simple and cost-effective. The key differentiators of the Alkami Digital Banking Platform include:

•User experience: Personalized and seamless digital experience across user interaction points, including desktop, mobile, chat and SMS, establishing durable connections between FIs and their customers.

•Integrations: Scalability and extensibility driven by more than 300 real-time integrations to back-office systems and third-party fintech solutions as of June 30, 2024, including core systems, payment cards, mortgages, bill pay, electronic documents, money movement, personal financial management and account opening.

•Deep data capabilities: Data synchronized and stored from back-office systems and third-party fintech solutions and synthesized into meaningful insights, targeted content, and other areas of monetization.

The Alkami Digital Banking Platform offers an end-to-end set of software products.

Corporate Information

We were incorporated under the laws of the State of Delaware on August 18, 2011. Our principal executive offices are located at 5601 Granite Parkway, Suite 120, Plano, Texas 75024, and our telephone number is (877) 725-5264. Our corporate website address is www.alkami.com. Information contained on, or accessible through, our website shall not be deemed incorporated into and is not a part of this prospectus supplement. We have included our website in this prospectus supplement solely as an inactive textual reference.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, as amended (the “JOBS Act”). As an “emerging growth company,” we may take advantage of reduced reporting requirements that are otherwise not applicable to public companies. These include, but are not limited to:

•not being required to comply with the auditor attestation requirements of the Sarbanes-Oxley Act of 2002, as amended (the “Sarbanes-Oxley Act”);

•reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements, and registration statements; and

•exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved.

We will remain an emerging growth company until the earliest of (i) the last day of the year in which we have total annual gross revenues of $1.235 billion or more; (ii) December 31, 2026; (iii) the date on which we have issued more than $1.0 billion in non-convertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC.

Based on the market value of our common stock held by non-affiliates as of June 30, 2024, we will cease to qualify as an emerging growth company as of December 31, 2024.

THE OFFERING

| | | | | |

Common stock offered by the selling stockholders | 5,000,000 shares. |

| |

Option to purchase additional shares of common stock. | The selling stockholders have granted the underwriter an option to purchase up to 750,000 additional shares of common stock. This option is exercisable, in whole or in part, for a period of 30 days following the date of this prospectus supplement. |

| |

Common stock outstanding after this offering | 98,985,370 shares. |

| |

Use of proceeds | The selling stockholders will receive all of the net proceeds from the sale of shares of common stock in this offering. See the section titled “Use of Proceeds.” |

| |

Risk factors | Investing in our common stock involves significant risks. See the sections titled “Risk Factors” beginning on page S-6 of this prospectus supplement and the accompanying prospectus and the documents incorporated by reference herein and therein for a discussion of the risks you should carefully consider prior to investing in shares of our common stock. |

| |

Nasdaq symbol | “ALKT” |

The number of shares of common stock outstanding prior to and after this offering is based on 98,985,370 shares of common stock outstanding as of June 30, 2024 and excludes:

•2,860,009 shares of our common stock issuable upon the exercise of stock options outstanding as of June 30, 2024, at a weighted average exercise price of $9.02 per share;

•7,347,640 shares of our common stock issuable upon the vesting and settlement of restricted stock units (“RSUs”) outstanding as of June 30, 2024;

•296,785 shares of our common stock issuable upon the vesting and settlement of RSUs granted after June 30, 2024; and

•19,207,207 shares of our common stock reserved for future issuance under our 2021 Incentive Award Plan and 2021 Employee Stock Purchase Plan as of June 30, 2024.

In addition, except as otherwise indicated, all information in this prospectus supplement assumes the following:

•no exercise of outstanding options or vesting and settlement of RSUs subsequent to June 30, 2024; and

•no exercise by the underwriter of their option to purchase additional shares of common stock.

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before investing in our common stock, you should carefully consider each of the following risk factors, together with the other information contained in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, including “Management’s Discussion and Analysis of Financial Condition and Results of Operations” as well as the other information set forth under “Risk Factors” contained in our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 29, 2024 (the “Annual Report”) and our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2024, filed with the SEC on May 2, 2024 and for the quarter ended June 30, 2024, filed with the SEC on August 1, 2024 (the “Quarterly Reports”), and our consolidated financial statements and related notes contained in our Annual Report and our Quarterly Reports, as well as any amendment or update thereto reflected in our subsequent filings with the SEC. The occurrence of any of the risks described below and under the sections titled “Risk Factors” in our Annual Report and our Quarterly Reports could materially and adversely affect our business, prospects, financial condition, operating results and cash flow, in which case the trading price of our common stock could decline and you could lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business, prospects, financial condition, results of operations and cash flow. See the section titled “Special Note Regarding Forward-Looking Statements.”

Risks Related to the Offering

Our stock price may be volatile or may decline regardless of our operating performance, resulting in substantial losses for investors purchasing shares in this offering.

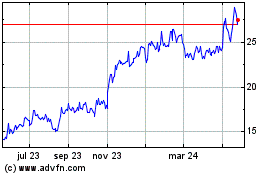

The market price of our common stock has in the past fluctuated and may in the future fluctuate significantly as a result of a number of factors, some of which are beyond our control. For example, the closing price per share of our common stock on the Nasdaq Global Select Market ranged from a low of $15.07 to a high of $28.87 during the twelve months ended June 30, 2024. In the event of a drop in the market price of our common stock, you could lose a substantial part or all of your investment in our common stock. The following factors could affect our stock price:

•our actual operating and financial condition, and our prospects;

•variations in our quarterly or annual results of operations;

•the public reaction to our press releases, our other public announcements and our filings with the SEC;

•strategic actions by our competitors;

•changes in the stock market valuations and operating performance of other technology companies generally, or of those in the financial technology sector in particular;

•general market conditions, price and volume fluctuations in the overall stock market, including as a result of trends in the economy as a whole;

•overall conditions in our industry and the markets in which we operate;

•general economic conditions in the United States;

•lawsuits threatened or filed against us;

•our failure to meet revenue or earnings estimates made by research analysts or other investors;

•changes in revenue or earnings estimates, or changes in recommendations or withdrawal of research coverage, by equity research analysts;

•changes in our capital structure, such as future issuances of debt or equity securities;

•speculation in the press or investment community;

•issuance of new or updated research or reports by securities analysts;

•changes in accounting principles, policies, guidance, interpretations, or standards;

•changes in our board of directors or management, or any action by our directors or management that damages the reputation of our company or the image of our brand;

•actions by our stockholders;

•anticipated or actual changes in laws, regulations or government policies applicable to our business or the industry we operate in;

•announcement by us or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments;

•security breaches impacting us or other companies in the industry we operate in;

•sales of large blocks of our common stock, including sales by our founders, principal stockholders or our executive officers and directors, or the perception that such sales may occur;

•short sales, hedging and other derivative transactions involving our capital stock; and

•the other factors described in the sections of this prospectus supplement and the accompanying prospectus titled “Risk Factors” and “Special Note Regarding Forward-Looking Statements” as well as the other information set forth under the sections titled “Risk Factors” contained in our Annual Report and our Quarterly Reports, including any amendment or update thereto reflected in our subsequent filings with the SEC.

The stock markets in general have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of our common stock. Securities class action litigation has often been instituted against companies following periods of volatility in the overall market and in the market price of a company’s securities. Such litigation, if instituted against us, could result in very substantial costs, divert our management’s attention and resources and harm our business, financial condition, and results of operations.

We are an “emerging growth company” and the reduced disclosure requirements applicable to emerging growth companies may make our common stock less attractive to investors.

We are an “emerging growth company” as defined in the JOBS Act. Under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected to use this extended transition period for complying with new or revised accounting standards that have different effective dates for public and private companies until the earlier of the date we (i) are no longer an emerging growth company or (ii) affirmatively and irrevocably opt out of the extended transition period provided in the JOBS Act. As a result, our consolidated financial statements may not be comparable to companies that comply with new or revised accounting pronouncements as of public company effective dates.

For as long as we continue to be an emerging growth company, we also intend to take advantage of certain other exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we will rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock, and our stock price may be more volatile.

We will remain an emerging growth company until the earliest of (i) the last day of the year in which we have total annual gross revenues of $1.235 billion or more; (ii) December 31, 2026; (iii) the date on which we have issued more than $1.0 billion in non-convertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the SEC. See also the section titled “Prospectus Supplement Summary–Implications of Being an Emerging Growth Company.”

If we fail to maintain proper and effective internal control over financial reporting, our ability to produce accurate and timely financial statements could be impaired, investors may lose confidence in our financial reporting and the trading price of our common stock may decline.

Pursuant to Section 404 of the Sarbanes-Oxley Act, our management is required to report upon the effectiveness of our internal control over financial reporting. When we lose our status as an “emerging growth company,” our independent registered public accounting firm will be required to attest to the effectiveness of our internal control over financial reporting. The rules governing the standards that must be met for our management to assess our internal control over financial reporting are complex and require significant documentation, testing and possible remediation. We may need to upgrade our information technology systems; implement additional financial and management controls, reporting systems and procedures; and hire additional accounting and finance staff. If we or our independent registered public accounting firm are unable to conclude that our internal control over financial reporting is effective, investors may lose confidence in our financial reporting and the trading price of our common stock may decline.

We cannot assure you that there will not be material weaknesses or significant deficiencies in our internal control over financial reporting in the future. Any failure to maintain internal control over financial reporting could severely inhibit our ability to accurately report our financial condition, results of operations or cash flows. If we are unable to conclude that our internal control over financial reporting is effective, or if our independent registered public accounting firm determines we have a material weakness or significant deficiency in our internal control over financial reporting once that firm begins its Section 404 reviews, investors may lose confidence in the accuracy and completeness of our financial reports, the market price of our common stock could decline, and we could be subject to sanctions or investigations by Nasdaq, the SEC or other regulatory authorities. Failure to remedy any material weakness in our internal control over financial reporting, or to implement or maintain other effective control systems required of public companies, could also restrict our future access to the capital markets.

If industry or securities analysts publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

The trading market for our common stock is influenced by the research and reports that industry or securities analysts publish about us or our business. If one or more analysts ceases coverage of our company or fails to publish reports on us regularly, we could lose visibility in the financial markets, which in turn could cause our stock price or trading volume to decline. Moreover, if our results of operations do not meet the expectations of the investor community, or one or more of the analysts who cover our company downgrade our stock, our stock price could decline. As a result, you may not be able to sell shares of our common stock at prices equal to or greater than the price of common stock sold in this offering.

The principal stockholders of Alkami will continue to have significant influence over the election of our board of directors and approval of any significant corporate actions.

Our directors, officers and other principal stockholders, in the aggregate, beneficially owned approximately 53% of the outstanding shares of Alkami as of June 30, 2024. These stockholders currently have, and likely will continue to have, significant influence with respect to the election of our board of directors and approval or disapproval of all significant corporate actions. The concentrated voting power of these stockholders could have the effect of delaying or preventing a significant corporate transaction, including an acquisition, divestiture, or merger. This influence over our affairs could, under some circumstances, be adverse to the interests of the other stockholders.

The market price of our common stock could be negatively affected by sales of substantial amounts of our common stock in the public markets, or the perception in the public markets that these sales may occur.

Sales of a substantial number of shares of our common stock in the public market could occur at any time. These sales, or the perception in the market that the holders of a large number of shares intend to sell shares, could reduce the market price of our common stock.

As of June 30, 2024, we had 98,985,370 shares of common stock outstanding. Of our issued and outstanding shares, all of the shares of common stock sold in our initial public offering are, and all of the shares of common stock to be sold in this offering will be, freely transferable, except for any shares held by our “affiliates,” as that term is defined in Rule 144 under the Securities Act.

Following the consummation of this offering, we, our executive officers and directors, and the selling stockholders will be subject to a 60-day lock-up period provided under lock-up agreements executed in connection with this offering. See the section titled “Underwriting.” All of these shares will, however, be able to be resold after the expiration of the lock-up period, as well as pursuant to customary exceptions thereto or upon the waiver of the lock-up agreement by the underwriter.

In addition, as of June 30, 2024, we had options and RSUs outstanding that, if fully exercised or settled, would result in the issuance of 10,207,649 shares of common stock. We have filed a registration statement on Form S-8 to register shares reserved for future issuance under our equity compensation plans. Subject to the satisfaction of applicable vesting requirements, the shares issued upon exercise of outstanding stock options or settlement of outstanding RSUs will be available for immediate resale in the United States in the open market.

Sales of significant amounts of stock in the public market or the perception that such sales may occur, could adversely affect prevailing market prices of our common stock or make it more difficult for you to sell your shares of common stock at a time and price that you deem appropriate. The market price of our common stock could decline if the holders of currently restricted shares sell them or are perceived by the market as intending to sell them.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, and the documents incorporated by reference herein and therein contain forward-looking statements. We intend such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). All statements other than statements of historical facts contained or incorporated by reference in this prospectus supplement may be forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipates,” “expects,” “suggests,” “plans,” “believes,” “intends,” “estimates,” “targets,” “projects,” “seeks,” “should,” “can,” “could,” “would,” “may,” “will,” “forecasts” “strategy,” “future,” “likely” or the negative of these terms or other similar expressions. Forward-looking statements contained or incorporated by reference in this prospectus supplement include, but are not limited to, statements regarding our future results of operations and financial position, industry and business trends, equity compensation, business strategy, plans, market growth and our objectives for future operations.

You should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference herein and therein, and the documents that we have filed as exhibits to this prospectus supplement and the accompanying prospectus, with the understanding that our actual future results, performance and achievements may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. These forward-looking statements speak only as of the date of this prospectus supplement or the date of the accompanying prospectus, as applicable. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained in this prospectus supplement or the accompanying prospectus, whether as a result of any new information, future events or otherwise.

Some of the key factors that could cause actual results to differ from our expectations include, but are not limited to, the following:

•managing our rapid growth;

•attracting new clients and retaining and broadening our existing clients’ use of our solutions;

•maintaining, protecting and enhancing our brand;

•predicting the long-term rate of client subscription renewals or adoption of our solutions;

•the unpredictable and time-consuming nature of our sales cycles;

•integration with and reliance on third-party software, content and services;

•integrating our solutions with other systems used by our clients;

•satisfying our clients and meeting their digital banking needs;

•our dependence on the data centers operated by third parties and third-party internet hosting providers;

•defects, errors or performance problems associated with our solutions;

•retaining our management team and key employees and recruiting and retaining new employees;

•managing the increased complexity of our clients’ integration and functionality requirements;

•shifts in the number of account holders and registered users of our solutions, their use of our solutions and our clients’ implementation and client support needs;

•acquiring or investing in other companies or pursuing business partnerships;

•natural or man-made disasters;

•cybersecurity breaches or other compromises of our security measures or those of third parties upon which we rely;

•privacy and data security concerns, laws, regulations and standards and our processing and use of the personal information of end users;

•intense competition in the markets we serve;

•reliance on the financial services industry as the source of our revenue in the event of any downturn, consolidation or decrease in technological spend in such industry;

•evolving technological requirements and changes and additions to our solution offerings;

•the political, economic and competitive conditions in the markets and jurisdictions where we operate;

•regulations and laws applicable to us, our clients and our solutions;

•protecting our intellectual property rights and defending ourselves against claims that we are misappropriating the intellectual property rights of others;

•using open-source software in our solutions or risks resulting in the disclosure our proprietary source code to our clients;

•complying with license or technology agreements with third parties and our ability to enter into additional license or technology agreements on reasonable terms;

•litigation or threats of litigation;

•the fluctuation of our quarterly and annual results of operations relative to our expectations and guidance;

•the way we recognize revenue, which has the effect of delaying changes in the subscriptions for our solutions from being reflected in our operating results;

•our limited operating history, our history of operating losses and our ability to use our net operating loss carryforwards;

•our ability to raise sufficient capital and the resulting dilution and the terms of that certain Amended and Restated Credit Agreement, dated as of April 29, 2022, with Silicon Valley Bank, Comerica Bank and Canadian Imperial Bank of Commerce, as amended by the first amendment thereto entered into on June 27, 2023 and the second amendment thereto entered into on July 1, 2024;

•our status as an emerging growth company;

•future sales of shares of our common stock, our lack of an intention to pay dividends and significant influence of our principal stockholders; and

•anti-takeover and exclusive forum provisions in our governing documents.

Although we have attempted to identify important risk factors, there may be other risk factors not presently known to us or that we presently believe are not material that could cause actual results and developments to differ materially from those made in or suggested by the forward-looking statements contained in this prospectus supplement or the accompanying prospectus. If any of these risks materialize, or if any of the above assumptions underlying forward-looking statements prove incorrect, actual results and developments may differ materially from those made in or suggested by the forward-looking statements contained in this prospectus supplement or the accompanying prospectus. For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are incorporated by reference herein. Any forward-looking statement speaks only as of the date on which we make it. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all

of them. We undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

USE OF PROCEEDS

The selling stockholders will receive all of the net proceeds from the sale of shares of common stock in this offering. We are not selling any shares of common stock in this offering, and we will not receive any of the proceeds from any sale of shares in this offering. We will, however, bear the costs associated with the sale of shares by the selling stockholders, other than any underwriting discounts and commissions and additional legal counsel costs beyond one firm, which will be borne by the selling stockholders. See the section titled “Underwriting.”

DIVIDEND POLICY

We have never declared or paid, and do not anticipate declaring or paying, any cash dividends on our common stock. Any future determination as to the declaration and payment of dividends, will be at the discretion of our board of directors, subject to applicable laws, and will depend on then existing conditions, including our financial condition, operating results, contractual restrictions, capital requirements, business prospects, and other factors that our board of directors may deem relevant.

PRINCIPAL AND SELLING STOCKHOLDERS

The following table and footnotes set forth information with respect to the beneficial ownership of our common stock by the selling stockholders as of June 30, 2024, subject to certain assumptions set forth in the footnotes and as adjusted to reflect the sale of shares of common stock by the selling stockholders as set forth on the cover page of this prospectus supplement. Percentage of beneficial ownership before this offering is based on 98,985,370 shares of common stock outstanding as of June 30, 2024.

Beneficial ownership is based on information furnished by the selling stockholders. The beneficial ownership of the common stock set forth in the following table is determined in accordance with the SEC rules, and the information is not necessarily indicative of beneficial ownership for any other purpose. In general, under the SEC rules, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise has or shares voting power or investment power with respect to such security. A person is also deemed to be a beneficial owner of a security if that person has the right to acquire beneficial ownership of such security within 60 days. To our knowledge, except as otherwise indicated, and subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock beneficially owned by that person.

Unless the context otherwise requires, as used in this prospectus supplement, the “selling stockholders” include the selling stockholders named in the table below and any of its pledgees, donees, assignees, transferees, successors and others who may hold any of the interest of the selling stockholders named in the table below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Shares beneficially owned prior to this offering | | Shares being offered | | Shares beneficially owned after this offering |

Name of Selling Stockholder | | Number | | Percentage | | Number | | Number | | Percentage |

General Atlantic(1) | | 17,214,863 | | 17.4 | % | | 1,666,667 | | | 15,548,196 | | 15.7 | % |

S3 Ventures Fund III, L.P. (2) | | 18,532,824 | | 18.7 | % | | 1,583,334 | | | 16,949,490 | | 17.1 | % |

Brian R. Smith(2)(3) | | 19,393,853 | | 19.6 | % | | 1,666,667 | (4) | | 17,727,186 | | 17.9 | % |

George B. Kaiser(5) | | 12,608,061 | | 12.7 | % | | 1,666,666 | (6) | | 10,941,395 | | 11.1 | % |

__________________

(1)Consists of (a) 17,186,985 shares held by General Atlantic (AL), L.P (“GA AL”) and (b) 27,878 shares held by Raphael Osnoss (a member of our board of directors), who is an employee of General Atlantic Service Company, L.P. (“GASC”), solely for the benefit of GASC. The following investment funds share beneficial ownership of the common shares held of record by GA AL: General Atlantic Partners 100, L.P. (“GAP 100”), General Atlantic Partners (Bermuda) EU, L.P. (“GAP Bermuda EU”), General Atlantic Partners (Lux) SCSp (“GAP Lux”), GAP Coinvestments III, LLC (“GAPCO III”), GAP Coinvestments IV, LLC (“GAPCO IV”), GAP Coinvestments V, LLC (“GAPCO V”) and GAP Coinvestments CDA, L.P. (“GAPCO CDA”). GAP 100, GAP Bermuda EU, GAP Lux are collectively referred to as the “GA Funds.” GAPCO III, GAPCO IV, GAPCO V and GAPCO CDA are collectively referred to as the “Sponsor Coinvestment Funds.” The general partner of GA AL is General Atlantic (SPV) GP, LLC (“GA SPV”). The general partner of GAP Lux is General Atlantic GenrPar (Lux) SCSp (“GA GenPar Lux”), and the general partner of GA GenPar Lux is General Atlantic (Lux) S.à r.l. (“GA Lux”). The general partner of GAP Bermuda EU and the sole shareholder of GA Lux is General Atlantic GenPar (Bermuda), L.P. (“GenPar Bermuda”). General Atlantic, L.P. (“GA LP”), which is controlled by the Partnership Committee of GASC MGP, LLC (the “GA Partnership Committee”), is the managing member of GAPCO III, GAPCO IV, and GAPCO V, the general partner of GAPCO CDA, and is the sole member of GA SPV. GAP (Bermuda) LP. (“GAP Bermuda”), which is also controlled by the Partnership Committee, is the general partner of GenPar Bermuda. The general partner of GAP 100 is GA GenPar, and the general partner of GA GenPar is GA LP. GA LP, GA SPV, GA AL, GA GenPar, GA GenPar Lux, GA Lux, GenPar Bermuda, GAP (Bermuda), the GA Funds and the Sponsor Coinvestment Funds are a “group” within the meaning of Rule 13d-5 of the Exchange Act, as amended. The address of GAP Bermuda EU, GenPar Bermuda, and GAP (Bermuda) is Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda. The address of GAP Lux, GA GenPar Lux and GA Lux is Luxembourg is 412F, Route d’Esch, L-1471 Luxembourg. The address of GAP 100, GA SPV, GA AL, GA GenPar, GA LP, and each of the Sponsor Coinvestment Funds is c/o General Atlantic Service Company, L.P., 55 East 52nd Street, 33rd Floor, New York, NY 10055. There are five members of the GA Partnership Committee. Each of the members of the GA Partnership Committee disclaims ownership of the shares except to the extent that he has a pecuniary interest therein. The Partnership Committee is formerly the Management Committee, with composition effective pending applicable regulatory approvals.

(2)S3 Ventures GPLP III, L.P. (“S3 GPLP III”) is the general partner of S3 Ventures Fund III, L.P. (“S3 Fund III”). S3 Ventures III, L.L.C. (“S3 III LLC”) is the General Partner of S3 GPLP III. Brian R. Smith (a member of our board of directors) is the Managing Director of S3 III LLC. Each of S3 GPLP III, S3 III LLC and Mr. Smith may be deemed to have beneficial ownership of the shares held by S3 Fund III. Mr. Smith disclaims beneficial ownership of the shares held by S3 Fund III except to the extent of his pecuniary interest therein. The business address for each of S3 Fund III, S3 GPLP III, S3 III LLC and Brian R. Smith is 6300 Bridge Point Parkway, Building 1, Suite 405, Austin, TX 78730.

(3)In addition to the shares of common stock held of record by S3 Fund III, Mr. Smith may also be deemed to beneficially own 821,793 shares of common stock held directly and 39,236 shares of common stock underlying restricted stock units that are vested or will vest within 60 days.

(4)Includes 1,583,334 shares of common stock being offered by S3 Fund III.

(5)George B. Kaiser directly owns 10,086,450 shares of our common stock. Mr. Kaiser also may be deemed to be the beneficial owner of 2,521,611 shares of our common stock owned of record by ARG Private Equity II, LLC (“APE II”). The business address for Mr. Kaiser and the principal business address of APE II is 6733 South Yale Avenue, Tulsa, Oklahoma 74136.

(6)In addition to the shares that Mr. Kaiser is selling directly as a selling shareholder, Mr. Kaiser, as the indirect holder of a 96.3% limited partner interest in S3 Fund III, may also be deemed to be the indirect seller of up to 96.3% of the 18,532,824 shares being sold in this offering by S3 Fund III.

MATERIAL U.S. FEDERAL INCOME TAX CONSEQUENCES TO NON-U.S. HOLDERS

The following discussion is a summary of the material U.S. federal income tax consequences to Non-U.S. Holders (as defined below) of the purchase, ownership and disposition of our common stock sold pursuant to this offering, but does not purport to be a complete analysis of all potential tax effects. The effects of other U.S. federal tax laws, such as estate and gift tax laws, and any applicable state, local or non-U.S. tax laws are not discussed. This discussion is based on the U.S. Internal Revenue Code of 1986, as amended (the “Code”), Treasury Regulations promulgated thereunder, judicial decisions, and published rulings and administrative pronouncements of the U.S. Internal Revenue Service (the “IRS”), in each case in effect as of the date hereof. These authorities may change or be subject to differing interpretations. Any such change or differing interpretation may be applied retroactively in a manner that could adversely affect a Non-U.S. Holder. We have not sought and will not seek any rulings from the IRS regarding the matters discussed below. There can be no assurance the IRS or a court will not take a contrary position to that discussed below regarding the tax consequences of the purchase, ownership and disposition of our common stock.

This discussion is limited to Non-U.S. Holders that hold our common stock as a “capital asset” within the meaning of Section 1221 of the Code (generally, property held for investment). This discussion does not address all U.S. federal income tax consequences relevant to a Non-U.S. Holder’s particular circumstances, including the impact of the Medicare contribution tax on net investment income and the alternative minimum tax. In addition, it does not address consequences relevant to Non-U.S. Holders subject to special rules, including, without limitation:

•U.S. expatriates and former citizens or long-term residents of the United States;

•persons holding our common stock as part of a hedge, straddle or other risk reduction strategy or as part of a conversion transaction or other integrated investment;

•banks, insurance companies, and other financial institutions;

•brokers, dealers or traders in securities;

•“controlled foreign corporations,” “passive foreign investment companies,” and corporations that accumulate earnings to avoid U.S. federal income tax;

•partnerships or other entities or arrangements treated as partnerships for U.S. federal income tax purposes (and investors therein);

•tax-exempt organizations or governmental organizations;

•persons deemed to sell our common stock under the constructive sale provisions of the Code;

•persons who hold or receive our common stock pursuant to the exercise of any employee stock option or otherwise as compensation;

•tax-qualified retirement plans; and

•“qualified foreign pension funds” as defined in Section 897(l)(2) of the Code and entities all of the interests of which are held by qualified foreign pension funds.

If an entity treated as a partnership for U.S. federal income tax purposes holds our common stock, the tax treatment of a partner in the partnership will depend on the status of the partner, the activities of the partnership and certain determinations made at the partner level. Accordingly, entities treated as partnerships holding our common stock and the partners in such partnerships should consult their tax advisors regarding the U.S. federal income tax consequences to them.

THIS DISCUSSION IS NOT TAX ADVICE. INVESTORS SHOULD CONSULT THEIR TAX ADVISORS WITH RESPECT TO THE APPLICATION OF THE U.S. FEDERAL INCOME TAX LAWS TO THEIR PARTICULAR SITUATIONS AS WELL AS ANY TAX CONSEQUENCES OF THE PURCHASE, OWNERSHIP AND DISPOSITION OF OUR COMMON STOCK ARISING UNDER THE

U.S. FEDERAL ESTATE OR GIFT TAX LAWS OR UNDER THE LAWS OF ANY STATE, LOCAL OR NON-U.S. TAXING JURISDICTION OR UNDER ANY APPLICABLE TAX TREATY.

Definition of a Non-U.S. Holder

For purposes of this discussion, a “Non-U.S. Holder” is any beneficial owner of our common stock that is neither a “U.S. person” nor an entity treated as a partnership for U.S. federal income tax purposes. A U.S. person is any person that, for U.S. federal income tax purposes, is or is treated as any of the following:

(a)an individual who is a citizen or resident of the United States;

(b)a corporation created or organized under the laws of the United States, any state thereof or the District of Columbia;

(c)an estate, the income of which is subject to U.S. federal income tax regardless of its source; or

(d)a trust that (1) is subject to the primary supervision of a U.S. court and all substantial decisions of which are subject to the control of one or more “United States persons” (within the meaning of Section 7701(a)(30) of the Code), or (2) has a valid election in effect to be treated as a United States person for U.S. federal income tax purposes.

Distributions

As described in the section entitled “Dividend Policy,” we have never declared or paid, and do not anticipate declaring or paying, any cash dividends on our common stock. However, if we do make distributions of cash or property on our common stock, such distributions will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. Amounts not treated as dividends for U.S. federal income tax purposes will constitute a return of capital and first be applied against and reduce a Non-U.S. Holder’s adjusted tax basis in its common stock, but not below zero. Any excess will be treated as capital gain and will be treated as described below under “-Sale or Other Taxable Disposition.”

Subject to the discussion below regarding effectively connected income, dividends paid to a Non-U.S. Holder will be subject to U.S. federal withholding tax at a rate of 30% of the gross amount of the dividends (or such lower rate specified by an applicable income tax treaty, provided the Non-U.S. Holder furnishes a valid IRS Form W-8BEN or W-8BEN-E (or other applicable documentation) certifying qualification for the lower treaty rate). A Non-U.S. Holder that does not timely furnish the required documentation, but that qualifies for a reduced treaty rate, may obtain a refund of any excess amounts withheld by timely filing an appropriate claim for refund with the IRS. Non-U.S. Holders should consult their tax advisors regarding their entitlement to benefits under any applicable tax treaties.

If dividends paid to a Non-U.S. Holder are effectively connected with the Non-U.S. Holder’s conduct of a trade or business within the United States (and, if required by an applicable income tax treaty, the Non-U.S. Holder maintains a permanent establishment in the United States to which such dividends are attributable), the Non-U.S. Holder will be exempt from the U.S. federal withholding tax described above. To claim the exemption, the Non-U.S. Holder must furnish to the applicable withholding agent a valid IRS Form W-8ECI, certifying that the dividends are effectively connected with the Non-U.S. Holder’s conduct of a trade or business within the United States.

Any such effectively connected dividends will be subject to U.S. federal income tax on a net income basis at the regular rates applicable to U.S. persons. A Non-U.S. Holder that is a corporation also may be subject to a branch profits tax at a rate of 30% (or such lower rate specified by an applicable income tax treaty) on such effectively connected dividends, as adjusted for certain items. Non-U.S. Holders should consult their tax advisors regarding any applicable tax treaties that may provide for different rules.

Sale or Other Taxable Disposition

A Non-U.S. Holder will not be subject to U.S. federal income tax on any gain realized upon the sale or other taxable disposition of our common stock unless:

•the gain is effectively connected with the Non-U.S. Holder’s conduct of a trade or business within the United States (and, if required by an applicable income tax treaty, the Non-U.S. Holder maintains a permanent establishment in the United States to which such gain is attributable);

•the Non-U.S. Holder is a nonresident alien individual present in the United States for 183 days or more during the taxable year of the disposition and certain other requirements are met; or

•our common stock constitutes a U.S. real property interest (“USRPI”), by reason of our status as a U.S. real property holding corporation (“USRPHC”), for U.S. federal income tax purposes.

Gain described in the first bullet point above generally will be subject to U.S. federal income tax on a net income basis at the regular rates applicable to U.S. persons. A Non-U.S. Holder that is a corporation also may be subject to a branch profits tax at a rate of 30% (or such lower rate specified by an applicable income tax treaty) on such effectively connected gain, as adjusted for certain items.

A Non-U.S. Holder described in the second bullet point above will be subject to U.S. federal income tax at a rate of 30% (or such lower rate specified by an applicable income tax treaty) on gain realized upon the sale or other taxable disposition of our common stock, which gain may be offset by certain U.S. source capital losses of the Non-U.S. Holder (even though the individual is not considered a resident of the United States), provided the Non-U.S. Holder has timely filed U.S. federal income tax returns with respect to such losses.

With respect to the third bullet point above, we believe we currently are not, and do not anticipate becoming, a USRPHC. Because the determination of whether we are a USRPHC depends, however, on the fair market value of our USRPIs relative to the fair market value of our non-U.S. real property interests and our other business assets, there can be no assurance we currently are not a USRPHC or will not become one in the future. Even if we are or were to become a USRPHC, gain arising from the sale or other taxable disposition of our common stock by a Non-U.S. Holder will not be subject to U.S. federal income tax if our common stock is “regularly traded,” as defined by applicable Treasury Regulations, on an established securities market, and such Non-U.S. Holder owned, actually and constructively, 5% or less of our common stock throughout the shorter of the five-year period ending on the date of the sale or other taxable disposition or the Non-U.S. Holder’s holding period.

Non-U.S. Holders should consult their tax advisors regarding any applicable tax treaties that may provide for different rules.

Information Reporting and Backup Withholding

Payments of dividends on our common stock will not be subject to backup withholding, provided the Non-U.S. Holder certifies its non-U.S. status, such as by furnishing a valid IRS Form W-8BEN, W-8BEN-E or W-8ECI, or otherwise establishes an exemption. However, information returns are required to be filed with the IRS in connection with any distributions on our common stock paid to the Non-U.S. Holder, regardless of whether such distributions constitute dividends or whether any tax was actually withheld. In addition, proceeds of the sale or other taxable disposition of our common stock within the United States or conducted through certain U.S.-related brokers generally will not be subject to backup withholding or information reporting if the applicable withholding agent receives the certification described above or the Non-U.S. Holder otherwise establishes an exemption. Proceeds of a disposition of our common stock conducted through a non-U.S. office of a non-U.S. broker that does not have certain enumerated relationships with the United States generally will not be subject to backup withholding or information reporting.

Copies of information returns that are filed with the IRS may also be made available under the provisions of an applicable treaty or agreement to the tax authorities of the country in which the Non-U.S. Holder resides or is established.

Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules may be allowed as a refund or a credit against a Non-U.S. Holder’s U.S. federal income tax liability, provided the required information is timely furnished to the IRS.

Additional Withholding Tax on Payments Made to Foreign Accounts

Withholding taxes may be imposed under Sections 1471 to 1474 of the Code (such Sections commonly referred to as the Foreign Account Tax Compliance Act (“FATCA”)) on certain types of payments made to non-U.S. financial institutions and certain other non-U.S. entities. Specifically, a 30% withholding tax may be imposed on dividends on, and, subject to the proposed Treasury Regulations discussed below, gross proceeds from the sale or other disposition of, our common stock paid to a “foreign financial institution” or a “non-financial foreign entity” (each as defined in the Code), unless (1) the foreign financial institution undertakes certain diligence and reporting obligations, (2) the non-financial foreign entity either certifies it does not have any “substantial United States owners” (as defined in the Code) or furnishes identifying information regarding each substantial United States owner, or (3) the foreign financial institution or non-financial foreign entity otherwise qualifies for an exemption from these rules. If the payee is a foreign financial institution and is subject to the diligence and reporting requirements in (1) above, it must enter into an agreement with the U.S. Department of the Treasury requiring, among other things, that it undertake to identify accounts held by certain “specified United States persons” or “United States owned foreign entities” (each as defined in the Code), annually report certain information about such accounts, and withhold 30% on certain payments to non-compliant foreign financial institutions and certain other account holders. Foreign financial institutions located in jurisdictions that have an intergovernmental agreement with the United States governing FATCA may be subject to different rules.

Under applicable Treasury Regulations and administrative guidance, withholding under FATCA generally applies to payments of dividends on our common stock. While withholding under FATCA would have applied also to payments of gross proceeds from the sale or other disposition of our common stock beginning on January 1, 2019, proposed Treasury Regulations eliminate FATCA withholding on payments of gross proceeds entirely. Taxpayers generally may rely on these proposed Treasury Regulations until final Treasury Regulations are issued.

Prospective investors should consult their tax advisors regarding the potential application of withholding under FATCA to their investment in our common stock.

UNDERWRITING

The selling stockholders are offering the shares of common stock described in this prospectus supplement through J.P. Morgan Securities LLC, which is acting as sole underwriter of the offering. We and the selling stockholders have entered into an underwriting agreement with the underwriter. Subject to the terms and conditions of the underwriting agreement, the selling stockholders have agreed to sell to the underwriter, and the underwriter has agreed to purchase, at the public offering price less underwriting discounts and commissions, the number of shares of common stock listed next to its name in the following table:

| | | | | | | | |

| Name | | Number of Shares |

| J.P. Morgan Securities LLC | | 5,000,000 |

| Total | | 5,000,000 |

The underwriter is committed to purchase all the shares of common stock offered by the selling stockholders if it purchases any shares. The underwriting agreement also provides that if the underwriter defaults, the offering may be terminated.

The underwriter may offer the shares of common stock purchased from the selling stockholders from time to time for sale in one or more transactions on the Nasdaq Global Select Market, in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at the time of sale, at prices related to prevailing market prices or at negotiated prices, subject to receipt and acceptance by it and subject to its right to reject any order in whole or in part. The underwriter may effect such transactions by selling shares of common stock to or through dealers, and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriter and/or purchasers of common stock for whom it may act as agent or to whom it may sell as principal. Sales of any shares made outside of the United States may be made by affiliates of the underwriter. In connection with the sale of the common stock offered hereby, the difference between the price at which the underwriter purchases the shares of common stock and the price at which the underwriter sells such shares may be deemed underwriting compensation in the form of underwriting discounts.

The underwriter is purchasing the shares of common stock from the selling stockholders at $ per share, resulting in proceeds, before expenses, to the selling stockholders of approximately $ (or approximately $ if the underwriter’s option to purchase an additional shares of common stock is exercised in full, as described below). We estimate that the total expenses of this offering, including registration, filing and listing fees, printing fees and legal and accounting expenses, but excluding the underwriting discounts and commissions, will be approximately $750,000.

The underwriter has an option to buy up to 750,000 additional shares of common stock from the selling stockholders. The underwriter has 30 days from the date of this prospectus supplement to exercise this option to purchase additional shares. If any additional shares of common stock are purchased with this option to purchase additional shares, the underwriter will offer the additional shares on the same terms as those on which the shares are being offered.

A prospectus in electronic format may be made available on the websites maintained by the underwriter, or selling group members, if any, participating in the offering. The underwriter may agree to allocate a number of shares to the underwriter and selling group members for sale to their online brokerage account holders. Internet distributions will be allocated to the underwriter and selling group members that may make Internet distributions on the same basis as other allocations.

We and our executive officers, directors and the selling stockholders have agreed with the underwriter, subject to certain exceptions, not to dispose of or hedge any shares of their common stock or securities convertible into or exchangeable for shares of common stock during the period from the date of this prospectus supplement continuing through the date 60 days after the date of this prospectus supplement (the “lock-up period”).

The restrictions contained in the lock-up agreements described above will not apply, subject in certain cases and various conditions, to certain transactions, including:

•the sale of shares of common stock by the selling stockholders to the underwriter in this offering;

•transfers of shares acquired in open market transactions after this offering;

•transfers as a bona fide gift or gifts or for bona fide estate planning purposes, provided that the donee or donees thereof agree to be bound in writing by the lock-up agreement and any such transfer does not involve a disposition for value;

•transfers to any trust for the direct or indirect benefit of the transferor or the immediate family of the transferor, provided that the trustee of the trust agrees to be bound in writing by the lock-up agreement; and any such transfer does not involve a disposition for value;

•transfers in connection with the exercise or settlement of options, restricted stock units, warrants or other rights to acquire shares of common stock or any security convertible into or exercisable for shares of common stock in accordance with their terms outstanding as of the date of this prospectus supplement, provided that any such shares issued upon exercise or settlement of such option, restricted stock unit, warrant or other right shall be subject to the lock-up agreement;

•transfers to us in connection with the exercise or settlement of options, restricted stock units, warrants or other rights to acquire shares of common stock or any security convertible into or exercisable for shares of common stock in accordance with their terms (including the settlement of restricted stock units and including, in each case, by way of net exercise and/or to cover withholding tax obligations in connection with such exercise), provided that any such shares issued upon exercise or settlement of such option, restricted stock unit, warrant or other right shall be subject to the lock-up agreement;

•transfers by will or intestacy, provided that the legatee, heir or other transferee agrees to be bound in writing by the lock-up agreement and any such transfer does not involve a disposition for value;

•transfers to any immediate family member, provided that such family member agrees to be bound in writing by the lock-up agreement and any such transfer does not involve a disposition for value;

•transfers to a partnership, limited liability company or other entity of which the transferor and the immediate family members of the transferor are the legal and beneficial owners of all of the outstanding equity securities or similar interests, provided that such entity agrees to be bound in writing by the lock-up agreement and any such transfer does not involve a disposition for value;

•transfers pursuant to a court order or settlement agreement related to the distribution of assets in connection with the dissolution of a marriage or civil union provided that the distributee agrees to be bound in writing by the lock-up agreement;

•transfers to us pursuant to agreements under which we have the option to repurchase or a right of first refusal with respect to transfers of such shares upon termination of service;

•pursuant to a bona fide third-party merger, consolidation, tender offer or other similar transaction involving a change of control of the Company that is approved by our board of directors and made to all holders of our capital stock;

•if the transferor is a corporation, partnership, limited liability company, trust or other business entity, transfers (i) to another corporation, partnership, limited liability company, trust or other business entity that is an affiliate of the transferor, or to any investment fund or other entity controlled or managed by the transferor or its affiliates, (ii) as part of a distribution to the stockholders, partners, members, beneficiaries or other equityholders of the transferor, or (iii) in the case where the transferor is a trust, to any beneficiary of the transferor or the estate of any such beneficiary, provided in each case that the transferee agrees to be bound by the lock-up agreement, and such transfer does not involve a disposition for value;

•the establishment of a trading plan pursuant to Rule 10b5-1 of the Exchange Act, provided that such plan does not provide for the transfer of shares of common stock during the lock-up period;

•transfers of shares pursuant to a trading plan pursuant to Rule 10b5-1 established prior to the lock-up period; and

•transfers of shares pursuant to a trading plan pursuant to Rule 10b5-1 of the Exchange Act established prior to the lock-up period and where information about the number of shares of common stock that may be sold pursuant to such plan during the lock-up period has been provided to the underwriter; and

sales of shares of common stock by executive officers during the lock-up period in an aggregate amount for all executive officers not to exceed 500,000 shares of common stock.

J.P. Morgan Securities LLC, in its sole discretion, may release the securities subject to any of the lock-up agreements with the underwriter described above, in whole or in part at any time.

We and the selling stockholders have agreed to indemnify the underwriter against certain liabilities, including liabilities under the Securities Act.

Our common stock is listed on the Nasdaq Global Select Market under the symbol “ALKT.”

In connection with this offering, the underwriter may engage in stabilizing transactions, which involves making bids for, purchasing and selling shares of common stock in the open market for the purpose of preventing or retarding a decline in the market price of the common stock while this offering is in progress. These stabilizing transactions may include making short sales of common stock, which involves the sale by the underwriter of a greater number of shares of common stock than it is required to purchase in this offering, and purchasing shares of common stock on the open market to cover positions created by short sales. Short sales may be “covered” shorts, which are short positions in an amount not greater than the underwriter’s option to purchase additional shares referred to above, or may be “naked” shorts, which are short positions in excess of that amount. The underwriter may close out any covered short position either by exercising its option to purchase additional shares, in whole or in part, or by purchasing shares in the open market. In making this determination, the underwriter will consider, among other things, the price of shares available for purchase in the open market compared to the price at which the underwriter may purchase shares through the option to purchase additional shares. A naked short position is more likely to be created if the underwriter is concerned that there may be downward pressure on the price of the common stock in the open market that could adversely affect investors who purchase in this offering. To the extent that the underwriter creates a naked short position, it will purchase shares in the open market to cover the position.

The underwriter has advised us that, pursuant to Regulation M of the Securities Act, it may also engage in other activities that stabilize, maintain or otherwise affect the price of the common stock, including the imposition of penalty bids. This means that if the underwriter purchases common stock in the open market in stabilizing transactions or to cover short sales, the underwriter may repay the underwriting discount received by it.

These activities may have the effect of raising or maintaining the market price of the common stock or preventing or retarding a decline in the market price of the common stock, and, as a result, the price of the common stock may be higher than the price that otherwise might exist in the open market. If the underwriter commences these activities, it may discontinue them at any time. The underwriter may carry out these transactions on the Nasdaq Global Select Market, in the over‑the‑counter market or otherwise.

The underwriter and its affiliates have provided in the past to us and our affiliates and may provide from time to time in the future certain commercial banking, financial advisory, investment banking and other services for us and such affiliates in the ordinary course of their business, for which they have received and may continue to receive customary fees and commissions. In addition, from time to time, the underwriter and its affiliates may effect transactions for their own account or the account of customers, and hold on behalf of themselves or their customers, long or short positions in our debt or equity securities or loans, and may do so in the future.

Selling Restrictions

Other than in the United States, no action has been taken by us or the underwriter that would permit a public offering of the securities offered by this prospectus supplement and the accompanying prospectus in any jurisdiction where action for that purpose is required. The securities offered by this prospectus supplement and the accompanying prospectus may not be offered or sold, directly or indirectly, nor may this prospectus supplement, the accompanying prospectus or any other offering material or advertisements in connection with the offer and sale of any such securities, or any documents incorporated by reference herein, be distributed or published in any jurisdiction, except under circumstances that will result in compliance with the applicable rules and regulations of that jurisdiction. Persons into whose possession this prospectus supplement or the accompanying prospectus comes are advised to inform themselves about and to observe any restrictions relating to the offering and the distribution of this prospectus supplement. This prospectus supplement and the accompanying prospectus, including any documents incorporated by reference herein, does not constitute an offer to sell or a solicitation of an offer to buy any securities offered by this prospectus supplement and the accompanying prospectus in any jurisdiction in which such an offer or a solicitation is unlawful.

Notice to Prospective Investors in Canada