false

0000778164

0000778164

2024-08-06

2024-08-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

ALTO INGREDIENTS, INC.

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

000-21467 |

|

41-2170618 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1300 South Second Street

Pekin, Illinois |

|

61554 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (916) 403-2123

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ | Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, $0.001 par

value |

|

ALTO |

|

The

Nasdaq Stock Market LLC

(Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 6, 2024, Alto Ingredients,

Inc. issued a press release announcing certain results of operations for the three and six months ended June 30, 2024. A copy of the press

release is furnished (not filed) as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished in

this Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed “filed” for the purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that section. The information in this Item 2.02 of this Current Report on Form 8-K is not incorporated by reference into any filings

of Alto Ingredients, Inc. made under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date

of this Current Report on Form 8-K, regardless of any general incorporation language in the filing unless specifically stated so therein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: August 6, 2024 |

ALTO INGREDIENTS, INC. |

| |

|

| |

By: |

/S/

ROBERT R. OLANDER |

| |

|

Robert R. Olander, |

| |

|

Chief Financial Officer |

-2-

Exhibit

99.1

Alto

Ingredients, Inc. Reports Second Quarter 2024 Results

Pekin,

IL, August 6, 2024 – Alto Ingredients, Inc. (NASDAQ: ALTO), a producer and distributor of renewable fuel, essential ingredients

and specialty alcohols, reported its financial results for the quarter ended June 30, 2024.

Bryon

McGregor, President and CEO of Alto Ingredients, said, “Our Pekin Campus has been producing alcohol and serving customers for over

150 years throughout many market cycles. We continue to strengthen our facilities by reinvesting our cash flow from operations and excess

liquidity in capital upgrades as well as repairs and maintenance. Most notably, our recent biennial outage at our Pekin wet mill

improved capacity utilization, while reducing our fixed costs per unit at the mill. Even with over $5 million of expenses related to

these planned facility outages, our Pekin Campus delivered over $10 million of gross profit in the second quarter of 2024, up from over

$4 million in the first quarter of 2024.

“Our

Pekin Campus is fully operational and taking advantage of the favorable summer driving season economics. In July, average crush margins

more than doubled compared to the second quarter. At Magic Valley, we resumed operations in early July and are encouraged by the initial

results. We expect to increase production rates in the coming weeks as we complete the system upgrades.

“If

current margins hold and we continue to hit our production targets, we expect to deliver positive Adjusted EBITDA for the third quarter.

We are excited to see our initiatives come to fruition, bolstering our ability to continue serving our customers for many years to come,”

McGregor concluded.

Financial

Results for the Three Months Ended June 30, 2024 Compared to 2023

| ● | Net

sales were $236.5 million, compared to $317.3 million. |

| ● | Cost

of goods sold was $228.9 million, compared to $300.1 million. |

| ● | Gross

profit was $7.6 million, including $2.9 million in realized losses on derivatives and $5.4

million in costs related to the planned Pekin Campus outages, compared to a gross profit

of $17.2 million, including $5.5 million in realized gains on derivatives. |

| ● | Selling,

general and administrative expenses were $9.0 million, compared to $7.9 million. |

| ● | Net

loss available to common stockholders was $3.4 million, or $0.05 per share, compared to net

income available to common stockholders $7.2 million, or $0.10 per share. |

| ● | Adjusted

EBITDA was negative $5.9 million, including $2.9 million in realized losses on derivatives

and $5.4 million in costs related to planned Pekin Campus outages, compared to positive $14.0

million, including $5.5 million in realized gains on derivatives. |

Cash

and cash equivalents were $27.1 million at June 30, 2024, compared to $30.0 million at December 31, 2023. At June 30, 2024, the company’s

borrowing availability was $95.0 million including $30.0 million under the company’s operating line of credit and $65.0 million

under its term loan facility, subject to certain conditions.

Financial

Results for the Six Months Ended June 30, 2024 Compared to 2023

| ● | Net

sales were $477.1 million, compared to $631.2 million. |

| ● | Net

loss available to common stockholders was $15.5 million, or $0.21 per share, compared to

$6.2 million, or $0.08 per share. |

| ● | Adjusted

EBITDA was negative $13.0 million, including $2.7 million in realized losses on derivatives

and $5.4 million in costs related to the biennial outage, compared to positive $3.6 million,

including $2.2 million in realized losses on derivatives. |

Second

Quarter 2024 Results Conference Call

Management

will host a conference call at 2:00 p.m. Pacific Time / 5:00 p.m. Eastern Time on Tuesday, August 6, 2024, and will deliver prepared

remarks via webcast followed by a question-and-answer session.

The

webcast for the conference call can be accessed from Alto Ingredients’ website at www.altoingredients.com. Alternatively, to receive

a number and unique PIN by email, register here. To dial directly up to twenty minutes prior to the scheduled call time, please dial (833) 630-0017 domestically and (412) 317-1806 internationally. The webcast will be archived for replay on the Alto Ingredients website

for one year. In addition, a telephonic replay will be available at 8:00 p.m. Eastern Time on Tuesday, August 6, 2024, through 8:00 p.m.

Eastern Time on Tuesday, August 13, 2024. To access the replay, please dial (877) 344-7529. International callers should dial 00-1 412-317-0088.

The pass code will be 3306041.

Use

of Non-GAAP Measures

Management

believes that certain financial measures not in accordance with generally accepted accounting principles ("GAAP") are useful

measures of operations. The company defines Adjusted EBITDA as unaudited consolidated net income (loss) before interest expense, interest

income, provision for income taxes, asset impairments, loss on extinguishment of debt, unrealized derivative gains and losses, acquisition-related

expense and depreciation and amortization expense. A table is provided at the end of this release that provides a reconciliation of Adjusted

EBITDA to its most directly comparable GAAP measure, net income (loss). Management provides this non-GAAP measure so that investors will

have the same financial information that management uses, which may assist investors in properly assessing the company's performance

on a period-over-period basis. Adjusted EBITDA is not a measure of financial performance under GAAP and should not be considered as an

alternative to net income (loss) or any other measure of performance under GAAP, or to cash flows from operating, investing or financing

activities as an indicator of cash flows or as a measure of liquidity. Adjusted EBITDA has limitations as an analytical tool, and you

should not consider this measure in isolation or as a substitute for analysis of the company's results as reported under GAAP.

About

Alto Ingredients, Inc.

Alto

Ingredients, Inc. (NASDAQ: ALTO) produces and distributes renewable fuel, essential ingredients and specialty alcohols. Leveraging the

unique qualities of its facilities, the company serves customers in a wide range of consumer and commercial products in the Health, Home

& Beauty; Food & Beverage; Industry & Agriculture; Essential Ingredients; and Renewable Fuels markets. For more information,

please visit www.altoingredients.com.

Safe

Harbor Statement under the Private Securities Litigation Reform Act of 1995

Statements

and information contained in this communication that refer to or include Alto Ingredients’ estimated or anticipated future results

or other non-historical expressions of fact are forward-looking statements that reflect Alto Ingredients’ current perspective of

existing trends and information as of the date of the communication. Forward-looking statements generally will be accompanied by words

such as “anticipate,” “believe,” “plan,” “could,” “should,” “estimate,”

“expect,” “forecast,” “outlook,” “guidance,” “intend,” “may,”

“might,” “will,” “possible,” “potential,” “predict,” “project,”

or other similar words, phrases or expressions. Such forward-looking statements include, but are not limited to, statements concerning

Alto Ingredients’ projected outlook, future performance, margin improvements and crush spreads; Alto Ingredients’ repair

and maintenance programs, plant improvements and other capital projects, and their financing, costs, timing and effects; and Alto Ingredients’

other plans, objectives, expectations and intentions. It is important to note that Alto Ingredients’ plans, objectives, expectations

and intentions are not predictions of actual performance. Actual results may differ materially from Alto Ingredients’ current expectations

depending upon a number of factors affecting Alto Ingredients’ business and plans. These factors include, among others adverse

economic and market conditions, including for renewable fuels, specialty alcohols and essential ingredients; export conditions and international

demand for the company’s products; fluctuations in the price of and demand for oil and gasoline; raw material costs, including

production input costs, such as corn and natural gas; adverse impacts of inflation and supply chain constraints; and the cost, ability

to fund, timing and effects of, including the financial and other results deriving from, Alto Ingredients’ repair and maintenance

programs, plant improvements and other capital projects, including carbon capture and storage (CCS), and other business initiatives and

strategies. These factors also include, among others, the inherent uncertainty associated with financial and other projections and large-scale

capital projects; the anticipated size of the markets and continued demand for Alto Ingredients’ products; the impact of competitive

products and pricing; the risks and uncertainties normally incident to the alcohol production, marketing and distribution industries;

changes in generally accepted accounting principles; successful compliance with governmental regulations applicable to Alto Ingredients’

facilities, products and/or businesses; changes in laws, regulations and governmental policies, including with respect to the Inflation

Reduction Act’s tax and other benefits Alto Ingredients expects to derive from CCS; the loss of key senior management or staff;

and other events, factors and risks previously and from time to time disclosed in Alto Ingredients’ filings with the Securities

and Exchange Commission including, specifically, those factors set forth in the “Risk Factors” section contained in Alto

Ingredients’ Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on May 8, 2024.

Company

IR and Media Contact:

Michael

Kramer, Alto Ingredients, Inc., 916-403-2755, Investorrelations@altoingredients.com

IR

Agency Contact:

Kirsten

Chapman, LHA Investor Relations, 415-433-3777, Investorrelations@altoingredients.com

ALTO

INGREDIENTS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited,

in thousands, except per share data)

| | |

Three

Months Ended

June 30, | | |

Six

Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Net

sales | |

$ | 236,468 | | |

$ | 317,297 | | |

$ | 477,097 | | |

$ | 631,188 | |

| Cost

of goods sold | |

| 228,915 | | |

| 300,116 | | |

| 471,944 | | |

| 617,171 | |

| Gross

profit | |

| 7,553 | | |

| 17,181 | | |

| 5,153 | | |

| 14,017 | |

| Selling,

general and administrative expenses | |

| 8,961 | | |

| 7,911 | | |

| 16,893 | | |

| 15,793 | |

| Asset

impairments | |

| — | | |

| — | | |

| — | | |

| 574 | |

| Income

(loss) from operations | |

| (1,408 | ) | |

| 9,270 | | |

| (11,740 | ) | |

| (2,350 | ) |

| Interest

expense, net | |

| (1,669 | ) | |

| (1,734 | ) | |

| (3,303 | ) | |

| (3,299 | ) |

| Other

income (expense), net | |

| (29 | ) | |

| 59 | | |

| 212 | | |

| 78 | |

| Income

(loss) before provision for income taxes | |

| (3,106 | ) | |

| 7,595 | | |

| (14,831 | ) | |

| (5,571 | ) |

| Provision

for income taxes | |

| — | | |

| — | | |

| — | | |

| — | |

| Net

income (loss) | |

$ | (3,106 | ) | |

$ | 7,595 | | |

$ | (14,831 | ) | |

$ | (5,571 | ) |

| Preferred

stock dividends | |

$ | (316 | ) | |

$ | (315 | ) | |

$ | (631 | ) | |

$ | (627 | ) |

| Net

income allocated to participating securities | |

| — | | |

| (96 | ) | |

| — | | |

| — | |

| Net

income (loss) available to common stockholders | |

$ | (3,422 | ) | |

$ | 7,184 | | |

$ | (15,462 | ) | |

$ | (6,198 | ) |

| Net

income (loss) per share, basic | |

$ | (0.05 | ) | |

$ | 0.10 | | |

$ | (0.21 | ) | |

$ | (0.08 | ) |

| Net

income (loss) per share, diluted | |

$ | (0.05 | ) | |

$ | 0.10 | | |

$ | (0.21 | ) | |

$ | (0.08 | ) |

| Weighted-average

shares outstanding, basic | |

| 73,486 | | |

| 73,394 | | |

| 73,126 | | |

| 73,603 | |

| Weighted-average

shares outstanding, diluted | |

| 73,486 | | |

| 74,103 | | |

| 73,126 | | |

| 73,603 | |

ALTO

INGREDIENTS, INC.

CONSOLIDATED BALANCE SHEETS

(unaudited, in thousands, except par value)

| |

June

30,

2024 | | |

December

31,

2023 | |

| ASSETS | |

| | |

| |

| Current

Assets: | |

| | |

| |

| Cash

and cash equivalents | |

$ | 27,124 | | |

$ | 30,014 | |

| Restricted

cash | |

| 1,287 | | |

| 15,466 | |

| Accounts

receivable, net | |

| 64,081 | | |

| 58,729 | |

| Inventories | |

| 49,434 | | |

| 52,611 | |

| Derivative

instruments | |

| 5,606 | | |

| 2,412 | |

| Other

current assets | |

| 6,126 | | |

| 9,538 | |

| Total

current assets | |

| 153,658 | | |

| 168,770 | |

| Property

and equipment, net | |

| 244,893 | | |

| 248,748 | |

| Other

Assets: | |

| | | |

| | |

| Right

of use operating lease assets, net | |

| 20,404 | | |

| 22,597 | |

| Intangible

assets, net | |

| 8,204 | | |

| 8,498 | |

| Other

assets | |

| 5,339 | | |

| 5,628 | |

| Total

other assets | |

| 33,947 | | |

| 36,723 | |

| Total

Assets | |

$ | 432,498 | | |

$ | 454,241 | |

ALTO

INGREDIENTS, INC.

CONSOLIDATED BALANCE SHEETS (CONTINUED)

(unaudited, in thousands, except par value)

| |

June

30,

2024 | | |

December

31,

2023 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | |

| |

| Current Liabilities: | |

| | |

| |

| Accounts

payable | |

$ | 20,132 | | |

$ | 20,752 | |

| Accrued liabilities | |

| 16,504 | | |

| 20,205 | |

| Current portion –

operating leases | |

| 4,481 | | |

| 4,333 | |

| Derivative instruments | |

| 2,764 | | |

| 13,849 | |

| Other

current liabilities | |

| 5,886 | | |

| 6,149 | |

| Total current liabilities | |

| 49,767 | | |

| 65,288 | |

| | |

| | | |

| | |

| Long-term debt, net | |

| 90,960 | | |

| 82,097 | |

| Operating leases, net of current portion | |

| 16,828 | | |

| 19,029 | |

| Other liabilities | |

| 9,120 | | |

| 8,270 | |

| Total

Liabilities | |

| 166,675 | | |

| 174,684 | |

| | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Preferred stock,

$0.001 par value; 10,000 shares authorized; Series A: no shares issued and outstanding as of June 30, 2024 and December 31, 2023

Series B: 927 shares issued and outstanding as of June 30, 2024 and December 31, 2023 | |

| 1 | | |

| 1 | |

| Common stock, $0.001

par value; 300,000 shares authorized; 76,645 and 75,703 shares issued and outstanding as of June 30, 2024 and December 31, 2023,

respectively | |

| 77 | | |

| 76 | |

| Non-voting common

stock, $0.001 par value; 3,553 shares authorized; 1 share issued and outstanding as of June 30, 2024 and December 31, 2023 | |

| — | | |

| — | |

| Additional paid-in capital | |

| 1,042,639 | | |

| 1,040,912 | |

| Accumulated other comprehensive

income | |

| 2,481 | | |

| 2,481 | |

| Accumulated

deficit | |

| (779,375 | ) | |

| (763,913 | ) |

| Total

Stockholders’ Equity | |

| 265,823 | | |

| 279,557 | |

| Total

Liabilities and Stockholders’ Equity | |

$ | 432,498 | | |

$ | 454,241 | |

Reconciliation

of Adjusted EBITDA to Net Income

| | |

Three

Months Ended

June 30, | | |

Six

Months Ended

June 30, | |

| (in

thousands) (unaudited) | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net

income (loss) | |

$ | (3,106 | ) | |

$ | 7,595 | | |

$ | (14,831 | ) | |

$ | (5,571 | ) |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Interest

expense | |

| 1,669 | | |

| 1,734 | | |

| 3,303 | | |

| 3,299 | |

| Interest

income | |

| (150 | ) | |

| (190 | ) | |

| (325 | ) | |

| (411 | ) |

| Unrealized

derivative (gains) losses | |

| (11,089 | ) | |

| (1,474 | ) | |

| (14,279 | ) | |

| (7,400 | ) |

| Acquisition-related

expense | |

| 675 | | |

| 700 | | |

| 1,350 | | |

| 1,400 | |

| Asset

impairments | |

| — | | |

| — | | |

| — | | |

| 574 | |

| Depreciation

and amortization expense | |

| 6,074 | | |

| 5,680 | | |

| 11,802 | | |

| 11,735 | |

| Total

adjustments | |

| (2,821 | ) | |

| 6,450 | | |

| 1,851 | | |

| 9,197 | |

| Adjusted

EBITDA | |

$ | (5,927 | ) | |

$ | 14,045 | | |

$ | (12,980 | ) | |

$ | 3,626 | |

Sales

and Operating Metrics (unaudited)

| | |

Three

Months Ended

June 30, | | |

Six

Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Alcohol Sales (gallons in millions) | |

| | |

| | |

| | |

| |

| Pekin

Campus renewable fuel gallons sold | |

| 30.7 | | |

| 34.7 | | |

| 62.5 | | |

| 70.0 | |

| Western

production renewable fuel gallons sold | |

| 9.0 | | |

| 16.5 | | |

| 20.2 | | |

| 24.4 | |

| Third

party renewable fuel gallons sold | |

| 34.4 | | |

| 26.6 | | |

| 64.1 | | |

| 60.5 | |

| Total

renewable fuel gallons sold | |

| 74.1 | | |

| 77.8 | | |

| 146.8 | | |

| 154.9 | |

| Specialty

alcohol gallons sold | |

| 21.0 | | |

| 16.6 | | |

| 47.3 | | |

| 38.0 | |

| Total

gallons sold | |

| 95.1 | | |

| 94.4 | | |

| 194.1 | | |

| 192.9 | |

| | |

| | | |

| | | |

| | | |

| | |

| Sales

Price per Gallon | |

| | | |

| | | |

| | | |

| | |

| Pekin

Campus | |

$ | 1.98 | | |

$ | 2.54 | | |

$ | 1.94 | | |

$ | 2.46 | |

| Western

production | |

$ | 1.94 | | |

$ | 2.69 | | |

$ | 1.86 | | |

$ | 2.67 | |

| Marketing

and distribution | |

$ | 2.04 | | |

$ | 2.73 | | |

$ | 1.94 | | |

$ | 2.60 | |

| Total | |

$ | 2.00 | | |

$ | 2.63 | | |

$ | 1.93 | | |

$ | 2.52 | |

| | |

| | | |

| | | |

| | | |

| | |

| Alcohol

Production (gallons in millions) | |

| | | |

| | | |

| | | |

| | |

| Pekin

Campus | |

| 50.0 | | |

| 53.0 | | |

| 103.6 | | |

| 106.3 | |

| Western

production | |

| 8.6 | | |

| 17.5 | | |

| 18.3 | | |

| 24.8 | |

| Total | |

| 58.6 | | |

| 70.5 | | |

| 121.9 | | |

| 131.1 | |

| | |

| | | |

| | | |

| | | |

| | |

| Corn

Cost per Bushel | |

| | | |

| | | |

| | | |

| | |

| Pekin

Campus | |

$ | 4.50 | | |

$ | 7.06 | | |

$ | 4.62 | | |

$ | 6.83 | |

| Western

production | |

$ | 5.78 | | |

$ | 8.14 | | |

$ | 5.84 | | |

$ | 8.42 | |

| Total | |

$ | 4.68 | | |

$ | 7.32 | | |

$ | 4.81 | | |

$ | 7.19 | |

Sales

and Operating Metrics (unaudited)

| | |

Three

Months Ended

June 30, | | |

Six

Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Average Market Metrics | |

| | |

| | |

| | |

| |

| PLATTS Ethanol

price per gallon | |

$ | 1.79 | | |

$ | 2.45 | | |

$ | 1.67 | | |

$ | 2.33 | |

| CME Corn

cost per bushel | |

$ | 4.43 | | |

$ | 6.25 | | |

$ | 4.39 | | |

$ | 6.42 | |

| Board

corn crush per gallons (1) | |

$ | 0.21 | | |

$ | 0.22 | | |

$ | 0.10 | | |

$ | 0.03 | |

| | |

| | | |

| | | |

| | | |

| | |

| Essential

Ingredients Sold (thousand tons) | |

| | | |

| | | |

| | | |

| | |

| Pekin

Campus: | |

| | | |

| | | |

| | | |

| | |

| Distillers

grains | |

| 79.7 | | |

| 76.4 | | |

| 167.4 | | |

| 167.2 | |

| CO2 | |

| 43.3 | | |

| 47.8 | | |

| 82.4 | | |

| 90.1 | |

| Corn

wet feed | |

| 24.8 | | |

| 15.0 | | |

| 50.4 | | |

| 41.7 | |

| Corn

dry feed | |

| 19.8 | | |

| 23.7 | | |

| 38.7 | | |

| 45.2 | |

| Corn

oil and germ | |

| 17.5 | | |

| 18.5 | | |

| 35.3 | | |

| 37.8 | |

| Syrup

and other | |

| 11.1 | | |

| 8.8 | | |

| 20.6 | | |

| 19.3 | |

| Corn

meal | |

| 8.0 | | |

| 10.2 | | |

| 16.3 | | |

| 19.6 | |

| Yeast | |

| 5.8 | | |

| 6.9 | | |

| 11.5 | | |

| 13.3 | |

| Total

Pekin Campus essential ingredients sold | |

| 210.0 | | |

| 207.3 | | |

| 422.6 | | |

| 434.2 | |

| | |

| | | |

| | | |

| | | |

| | |

| Western

production: | |

| | | |

| | | |

| | | |

| | |

| Distillers

grains | |

| 61.8 | | |

| 109.1 | | |

| 133.6 | | |

| 163.1 | |

| CO2 | |

| 15.1 | | |

| 13.2 | | |

| 28.4 | | |

| 26.8 | |

| Syrup

and other | |

| 2.0 | | |

| 32.9 | | |

| 16.2 | | |

| 36.4 | |

| Corn

oil | |

| 0.9 | | |

| 1.6 | | |

| 2.4 | | |

| 2.9 | |

| Total

Western production essential ingredients sold | |

| 79.8 | | |

| 156.8 | | |

| 180.6 | | |

| 229.2 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total

Essential Ingredients Sold | |

| 289.8 | | |

| 364.1 | | |

| 603.2 | | |

| 663.4 | |

| | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Essential

ingredients return % (2) | |

| | | |

| | | |

| | | |

| | |

| Pekin

Campus return | |

| 48.8 | % | |

| 41.3 | % | |

| 50.0 | % | |

| 43.8 | % |

| Western

production return | |

| 35.1 | % | |

| 30.3 | % | |

| 37.4 | % | |

| 33.2 | % |

| Consolidated

total return | |

| 45.6 | % | |

| 38.3 | % | |

| 47.8 | % | |

| 41.7 | % |

| (1) | Assumes corn

conversion of 2.80 gallons of alcohol per bushel of corn. |

| (2) | Essential ingredients

revenues as a percentage of total corn costs consumed. |

Segment

Financials (unaudited, in thousands)

| | |

Three

Months Ended

June 30, | | |

Six

Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Net

Sales | |

| | |

| | |

| | |

| |

| Pekin Campus, recorded as gross: | |

| | |

| | |

| | |

| |

| Alcohol

sales | |

$ | 100,687 | | |

$ | 127,694 | | |

$ | 209,035 | | |

$ | 260,075 | |

| Essential ingredient

sales | |

| 39,371 | | |

| 53,954 | | |

| 86,080 | | |

| 117,585 | |

| Intersegment

sales | |

| 286 | | |

| 444 | | |

| 606 | | |

| 757 | |

| Total Pekin Campus sales | |

| 140,344 | | |

| 182,092 | | |

| 295,721 | | |

| 378,417 | |

| | |

| | | |

| | | |

| | | |

| | |

| Marketing and distribution: | |

| | | |

| | | |

| | | |

| | |

| Alcohol sales, gross | |

$ | 70,157 | | |

$ | 72,589 | | |

$ | 124,587 | | |

$ | 156,936 | |

| Alcohol sales, net | |

| 64 | | |

| 104 | | |

| 98 | | |

| 218 | |

| Intersegment

sales | |

| 2,388 | | |

| 2,499 | | |

| 5,140 | | |

| 5,342 | |

| Total marketing and distribution

sales | |

| 72,609 | | |

| 75,192 | | |

| 129,825 | | |

| 162,496 | |

| | |

| | | |

| | | |

| | | |

| | |

| Western production, recorded as gross: | |

| | | |

| | | |

| | | |

| | |

| Alcohol sales | |

$ | 17,456 | | |

$ | 44,384 | | |

$ | 37,690 | | |

$ | 65,316 | |

| Essential ingredient

sales | |

| 5,950 | | |

| 14,421 | | |

| 13,776 | | |

| 22,773 | |

| Intersegment

sales | |

| — | | |

| 62 | | |

| (130 | ) | |

| 62 | |

| Total Western production

sales | |

| 23,406 | | |

| 58,867 | | |

| 51,336 | | |

| 88,151 | |

| | |

| | | |

| | | |

| | | |

| | |

| Corporate and other | |

| 2,783 | | |

| 4,151 | | |

| 5,831 | | |

| 8,285 | |

| Intersegment eliminations | |

| (2,674 | ) | |

| (3,005 | ) | |

| (5,616 | ) | |

| (6,161 | ) |

| Net sales as reported | |

$ | 236,468 | | |

$ | 317,297 | | |

$ | 477,097 | | |

$ | 631,188 | |

| Cost

of goods sold: | |

| | | |

| | | |

| | | |

| | |

| Pekin Campus | |

$ | 130,200 | | |

$ | 168,419 | | |

$ | 281,311 | | |

$ | 366,596 | |

| Marketing and distribution | |

| 69,437 | | |

| 71,746 | | |

| 123,123 | | |

| 154,871 | |

| Western production | |

| 27,167 | | |

| 57,834 | | |

| 63,683 | | |

| 91,815 | |

| Corporate and other | |

| 2,943 | | |

| 3,414 | | |

| 5,738 | | |

| 5,786 | |

| Intersegment eliminations | |

| (832 | ) | |

| (1,297 | ) | |

| (1,911 | ) | |

| (1,897 | ) |

| Cost of goods sold as

reported | |

$ | 228,915 | | |

$ | 300,116 | | |

$ | 471,944 | | |

$ | 617,171 | |

| Gross

profit (loss): | |

| | | |

| | | |

| | | |

| | |

| Pekin Campus | |

$ | 10,144 | | |

$ | 13,673 | | |

$ | 14,410 | | |

$ | 11,821 | |

| Marketing and distribution | |

| 3,172 | | |

| 3,446 | | |

| 6,702 | | |

| 7,625 | |

| Western production | |

| (3,761 | ) | |

| 1,033 | | |

| (12,347 | ) | |

| (3,664 | ) |

| Corporate and other | |

| (160 | ) | |

| 737 | | |

| 93 | | |

| 2,499 | |

| Intersegment eliminations | |

| (1,842 | ) | |

| (1,708 | ) | |

| (3,705 | ) | |

| (4,264 | ) |

| Gross profit (loss) as

reported | |

$ | 7,553 | | |

$ | 17,181 | | |

$ | 5,153 | | |

$ | 14,017 | |

####

9

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

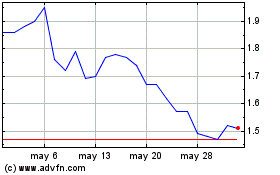

Alto Ingredients (NASDAQ:ALTO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Alto Ingredients (NASDAQ:ALTO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024