Form 8-K - Current report

17 Octubre 2024 - 8:12AM

Edgar (US Regulatory)

false 0001658551 0001658551 2024-10-17 2024-10-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 17, 2024

AMYLYX PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-41199 |

|

46-4600503 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 43 Thorndike St., |

|

|

| Cambridge, MA |

|

02141 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (617) 682-0917

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

|

AMLX |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

On October 17, 2024, Amylyx Pharmaceuticals, Inc. (the “Company”) announced positive topline data from the Phase 2 open-label HELIOS clinical trial of AMX0035 (sodium phenylbutyrate [PB] and taurursodiol [TURSO, also known as ursodoxicoltaurine]) in 12 adults living with Wolfram syndrome. Wolfram syndrome is a rare, progressive, monogenic disease impacting approximately 3,000 people in the U.S. HELIOS showed improvement in pancreatic function, as measured by C-peptide response after 24 weeks of treatment with AMX0035, the study’s primary efficacy endpoint, in contrast to the expected decrease in pancreatic function with disease progression. Similar overall improvements or stabilization were observed across all secondary endpoints, including hemoglobin A1c (HbA1c), time in target glucose range assessed by continuous glucose monitoring, and visual acuity. Patient- and physician-reported global impressions of change showed disease stability or improvement in all participants, meeting prespecified responder criteria. In addition, longer-term data for all participants who completed Week 36 (n=10) and Week 48 (n=6) assessments showed sustained improvement over time.

The analysis performed includes Week 24 data for all 12 participants and data for all participants who completed their Week 36 (n=10) and Week 48 (n=6) assessments as of the data cutoff.

HELIOS showed improvements in its primary endpoint of C-peptide response with a change from baseline to Week 24 at 120 minutes of +3.8 minutes*ng/mL (min*ng/mL) [standard error (SE): 19.3] in the Intent to Treat group (N=12) and +20.2 min*ng/mL [SE: 11.2] in the Per Protocol group (N=11). In addition, as outlined in the table below, participants receiving AMX0035 had improved glycemic control, as measured by markers of glucose metabolism; improved visual acuity in some participants, as measured by the Snellen chart; and improvement or stabilization of the disease, as measured by the Clinician Reported Global Impression of Change (CGIC) and Patient Reported Global Impression of Change (PGIC).

|

|

|

|

|

|

|

|

|

| |

|

Week 24 ITT

(N=12) |

|

Week 24 Per

Protocol† (N=11) |

|

Week 36

(n=10) |

|

Week 48

(n=6) |

| C-Peptide Response (min*ng/mL) mean change in AUC from baseline over 120 minutes†† |

|

+3.8

(SE: 19.3) |

|

+20.2

(SE: 11.2) |

|

+30.7

(SE: 9.7) |

|

+36.7

(SE: 19.6) |

|

|

|

|

|

| Hemoglobin A1c (%) change from baseline |

|

-0.09

(SE: 0.14) |

|

-0.16

(SE: 0.13) |

|

-0.35

(SE: 0.18) |

|

-0.30

(SE: 0.31) |

|

|

|

|

|

| Absolute Time in Target Glucose Range (%) change from baseline |

|

+5.2

(SE: 3.6) |

|

+5.7

(SE: 3.9) |

|

+12.3

(SE: 4.0) |

|

+5.8

(SE: 8.9) |

|

|

|

|

|

| Mean Exogenous Insulin Dose (units/kg/2 weeks) change from baseline |

|

-0.01 |

|

-0.01 |

|

0.01 |

|

0.02 |

|

|

|

|

|

| Visual Acuity (LogMAR) change from baseline |

|

-0.04

(SE: 0.06) |

|

-0.04

(SE: 0.06) |

|

Not Collected at this

Time Point |

|

-0.11

(SE: 0.12) |

|

|

|

|

|

| Clinician Report Global Impression of Change (CGIC) % meeting responder criteria††† |

|

100% |

|

100% |

|

100% |

|

100% |

|

|

|

|

|

| Patient Reported Global Impression of Change (PGIC) % meeting responder criteria††† |

|

100% |

|

100% |

|

100% |

|

100% |

| † |

Upon genetic review, one participant did not meet the inclusion/exclusion criteria for HELIOS. This participant was found to have an autosomal recessive mutation confirmed to be pathogenic on just one of the two alleles and variant of uncertain significance on the other allele. This participant was within normal range for C-peptide, glycemic measures, and vision suggesting lack of typical Wolfram syndrome phenotype. Data presented with and without this participant who reached Week 24 (Intent to Treat and Per Protocol, respectively). |

| †† |

In non-diabetic individuals, C-peptide peaks after a meal at approximately ~30 minutes; in Wolfram syndrome, peak is slower but generally was at or before 120 minutes in HELIOS. Area under the curve (AUC) over 120 minutes after meal challenge reflects beta cell response to a meal. Amylyx is currently planning to focus on 120-minute AUC as the C-peptide measure for future studies. |

| ††† |

HELIOS defines a “responder” on both the CGIC and PGIC as no change or improvement given the progressive nature of Wolfram syndrome. |

The safety profile of AMX0035 in HELIOS was consistent with prior safety data. AMX0035 was generally well-tolerated. All adverse events (AEs) were mild or moderate, and there were no serious AEs related to AMX0035 treatment. The most common AE was diarrhea.

Participants in HELIOS receive AMX0035 for up to 96 weeks followed by a four-week safety follow-up. Primary and secondary outcomes are assessed at Week 24 and at longer-term time points.

The U.S. Food and Drug Administration (“FDA”) and the European Commission granted Orphan Drug Designation to AMX0035 for the treatment of Wolfram syndrome in November 2020 and August 2024, respectively. Amylyx plans to meet with the FDA and other stakeholders to inform a Phase 3 program and expects to provide an update in 2025.

Forward-Looking Statements

Statements contained in this Current Report on Form 8-K regarding matters that are not historical facts are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Such statements include, but are not limited to, Amylyx’ expectations regarding: the potential clinical benefit for AMX0035 to help people living with Wolfram syndrome; and interactions with regulatory authorities. Any forward-looking statements in this Current Report on Form 8-K are based on management’s current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. Risks that contribute to the uncertain nature of the forward-looking statements include the risks and uncertainties set forth in Amylyx’ United States Securities and Exchange Commission (SEC) filings, including Amylyx’ Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, and subsequent filings with the SEC. All forward-looking statements contained in this Current Report on Form 8-K speak only as of the date on which they were made. Amylyx undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AMYLYX PHARMACEUTICALS, INC. |

|

|

|

|

| Date: October 17, 2024 |

|

|

|

By: |

|

/s/ James M. Frates |

|

|

|

|

|

|

James M. Frates |

|

|

|

|

|

|

Chief Financial Officer |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

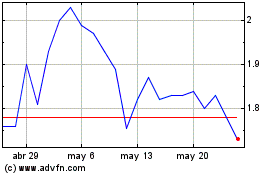

Amylyx Pharmaceuticals (NASDAQ:AMLX)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Amylyx Pharmaceuticals (NASDAQ:AMLX)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024