false

0001768224

0001768224

2024-05-08

2024-05-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d)

of the Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): May 8, 2024

ARCTURUS THERAPEUTICS

HOLDINGS INC.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-38942 |

|

32-0595345 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

10628 Science Center

Drive, Suite 250

San Diego, California 92121

(Address of principal

executive offices)

Registrant’s

telephone number, including area code: (858) 900-2660

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common stock, par value $0.001 per share |

|

ARCT |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Conditions.

On May 8, 2024, Arcturus Therapeutics Holdings

Inc. (the “Company” or “Arcturus”) issued a press release, a copy of which is furnished herewith as Exhibit 99.1,

announcing the Company’s financial results for the quarter ended March 31, 2023 and providing a corporate update (the “Press

Release”).

The information contained in Item 2.02 of

this Current Report on Form 8-K, including the Press Release, shall not be deemed “filed” for the purposes of Section 18 of

the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section or Sections 11 and 12(a)(2) of

the Securities Act of 1933, as amended. In addition, this information shall not be deemed incorporated by reference into any of the Company’s

filings with the Securities and Exchange Commission (the “SEC”), except as shall be expressly set forth by specific reference

in any such filing.

Cautionary Note Regarding Forward-Looking

Statements

This Current Report on Form 8-K and the press

release contain forward-looking statements that involve substantial risks and uncertainties for purposes of the safe harbor provided by

the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact included in this press

release, are forward-looking statements, including those regarding strategy, future operations, the likelihood of success and continued

advancement of the Company’s pipeline (including ARCT-032 and ARCT-810) and partnered programs (including the COVID-19 and flu programs

partnered with CSL Seqirus), the likelihood of delivery of doses of Kostaive (including timing and volume thereof), the anticipated commercialization

of Kostaive and the timing thereof, the likelihood and timing of a European Marketing Authorization application approval decision for

Kostaive, the monetization of Arcturus’ interests in ARCALIS JV in Japan, that preclinical or clinical data will be predictive of

future clinical results, the likelihood and timing of clinical study updates (including for ARCT-2138 (LUNAR-FLU), ARCT-032 (LUNAR-CF)),

the qualification for commercial milestones under the CSL collaboration, the continuation and expected recruitment in the Phase 3 pivotal

study of ARCT-2303 candidate vaccine containing the Omicron XBB.1.5 variant, the ongoing recruitment in the ARCT-2138 (LUNAR-FLU) Phase

1 study, the likelihood or timing of collection of accounts receivables including expected future milestone and other payments from CSL,

its current cash position and expected cash burn and runway, and the impact of general business and economic conditions. Arcturus may

not actually achieve the plans, carry out the intentions or meet the expectations or projections disclosed in any forward-looking statements

such as the foregoing and you should not place undue reliance on such forward-looking statements. These statements are only current predictions

or expectations, and are subject to known and unknown risks, uncertainties, and other factors that may cause our or our industry’s

actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking

statements, including those discussed under the heading "Risk Factors" in Arcturus’ most recent Annual Report on Form

10-K, and in subsequent filings with, or submissions to, the SEC, which are available on the SEC’s website at www.sec.gov. Except

as otherwise required by law, Arcturus disclaims any intention or obligation to update or revise any forward-looking statements, which

speak only as of the date they were made, whether as a result of new information, future events or circumstances or otherwise.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Arcturus Therapeutics Holdings Inc. |

| Date: May 8, 2024 |

|

| |

|

|

| |

By: |

/s/ Joseph E. Payne |

| |

Name: |

Joseph E. Payne |

| |

Title: |

Chief Executive Officer |

Arcturus

Therapeutics Announces First Quarter 2024 Financial Update and Pipeline Progress

Commercial manufacture of Kostaive® on track

for delivery of initial 4 million doses in Q3

Kostaive® European Marketing Authorization

Application approval decision expected Q3

Multiple Kostaive® Phase 3 trials further

demonstrate breadth and durability of STARR® vaccine platform

ARCT-2138 (LUNAR-FLU) Phase 1 topline immunogenicity

and safety data, anticipated in Q3

ARCT-810 (LUNAR-OTC) Phase 2 and ARCT-032 (LUNAR-CF)

Phase 1b interim data and update to be provided on July 1st

JP Morgan engaged to monetize investment in

ARCALIS JV in Japan

Investor conference call at 4:30 p.m. ET today

SAN DIEGO--(BUSINESS WIRE)--May. 8, 2024-- Arcturus

Therapeutics Holdings Inc. (the “Company”, “Arcturus”, Nasdaq: ARCT), a global messenger RNA medicines company

focused on the development of infectious disease vaccines and opportunities within liver and respiratory rare diseases, today announced

its financial results for the first quarter ended March 31, 2024, and provided corporate updates.

“Arcturus continues to make encouraging

progress in both our vaccine and therapeutics pipeline,” said Joseph Payne, President & CEO of Arcturus. “In collaboration

with our global vaccine partner CSL and their partner Meiji Seika Pharma, we are excited to begin the commercialization of Kostaive this

year.”

Mr. Payne continued, “We also look forward

to providing meaningful clinical study data updates July 1st, for each of our flagship mRNA therapeutic programs, ARCT-810

(OTC deficiency) and ARCT-032 (CF).”

“I am pleased to announce that we have engaged

JP Morgan to monetize our stake in ARCALIS, our JV manufacturing operation in Japan,” stated Andrew Sassine, Chief Financial Officer

of Arcturus Therapeutics. “Additionally, I am pleased to announce we will begin to qualify for commercial milestones under our CSL

collaboration upon commencement of Kostaive revenues in Japan this year. Finally, our cash runway remains strong for at least three years

into the first quarter of fiscal year 2027.”

Recent Corporate Highlights

| · | In March, Meiji Seika Pharma announced plans to supply Japan with 4 million doses of Kostaive for fall/winter

season of 2024. To support this effort, Arcturus along with CDMO partners are on track to deliver the initial 4 million commercial doses

of Kostaive in Q3. |

| · | In March, the Company, along with partners CSL and Meiji, announced

that the Company’s bivalent COVID-19 Vaccine candidate, ARCT-2301 (Wuhan strain and Omicron BA.4/5), met the primary endpoint (non-inferiority)

in a Phase 3 clinical study in Japan. The study enrolled 930 healthy adults and individuals with comorbidities, who previously received

three to five doses of mRNA COVID-19 vaccines, including the last booster at least three months prior to recruitment. |

| o | Both the geometric mean titer (GMT) ratio and seroresponse rate (SRR) difference of neutralizing antibodies

against SARS-CoV-2 (Omicron BA.4/5) and Wuhan strains met pre-specified non-inferiority and superiority criteria versus a licensed mRNA

vaccine comparator. There were no causally-associated serious adverse events with ARCT-2301. |

| · | In March, Arcturus and CSL initiated a Phase 3 pivotal study with the ARCT-2303 candidate vaccine containing

the Omicron XBB.1.5 variant. |

| o | The purpose of this study is to generate additional immunogenicity and safety data to support product

licensure in the U.S. |

| o | The study will also assess the co-administration of ARCT-2303 with the age-appropriate seasonal influenza

vaccines. |

| o | Approximately 1,680 young and older adults are planned to be recruited in the southern hemisphere. |

| · | The Company has filed a Marketing Authorization Application (MAA) for Kostaive to the European Medicines

Agency (EMA), with the European Commission (EC) expected to provide an approval decision in Q3. |

| · | ARCT-2138 (LUNAR-FLU, Quadrivalent Seasonal Influenza), is progressing well through Arcturus’ partner

CSL. As of May 1, 2024, 84 healthy young adults were recruited in a Phase 1 dose-finding and immunogenicity study and received one of

four dose levels of the study vaccine or a licensed influenza vaccine. The recruitment of older adults is ongoing. |

| · | In April, the Company presented Phase 1 single ascending dose (SAD) studies for ARCT-810, an mRNA therapeutic

candidate for ornithine transcarbamylase (OTC) deficiency, at the Society for Inherited Metabolic Diseases (SIMD) annual conference. |

| o | ARCT-810-01 was a Phase 1 SAD study that enrolled 30 healthy adults, randomized 2:1 to receive ARCT-810

(0.1, 0.2, 0.3 or 0.4 mg/kg) or placebo as an intravenous infusion. ARCT-810-02 is a recently completed Phase 1b SAD study that enrolled

16 adults with mild OTC deficiency, randomized 3:1 to receive single doses of ARCT-810 (0.2, 0.3, 0.4, or 0.5 mg/kg) or placebo as an

intravenous infusion. |

| o | The results showed that ARCT-810 was generally well tolerated with

no serious or severe adverse events in both studies. |

| o | The results from ARCT-810-01 and ARCT-810-02 studies facilitated the initiation of a Phase 2 multiple

ascending dose study of ARCT-810 (ARCT-810-03) in OTC deficiency adolescents and adults which is ongoing in the UK and EU. Subjects are

randomized to receive 6 doses of ARCT-810 or placebo (randomized 3:1) administered every 14 days. |

| o | The Company will share a progress update on the Phase 2 study on July 1, 2024. |

| · | Arcturus is advancing ARCT-032, an inhaled mRNA therapeutic for cystic fibrosis. The Company remains on

track to share Phase 1b interim data on July 1, 2024. Each CF patient in this trial receives two inhaled administrations of ARCT-032. |

Financial Results for the

three months ended March 31, 2024

Revenues in conjunction

with strategic alliances and collaborations:

Arcturus’ primary sources

of revenues were from license fees, consulting and related technology transfer fees, reservation fees and collaborative payments received

from research and development arrangements with pharmaceutical and biotechnology partners. For the three months ended March 31, 2024,

revenues were $38.0 million compared with $80.3 million for the three months ended March 31, 2023. The decrease

was primarily attributable to the CSL agreement as $78.2 million total revenue was recognized during the first quarter of 2023 upon the

achievement of a conditional payment and multiple milestones, compared to $32.4 million total revenue related to CSL during the first

quarter of 2024, resulting in a decrease of $45.8 million. The total decrease was primarily offset by an increase in revenue of $4.9 million

related to the agreement with BARDA.

Operating expenses:

Total

operating expenses for the three months ended March 31, 2024, were $68.4 million compared with $65.5 million for

the three months ended March 31, 2023.

Research and development

expenses:

Research

and development expenses consist primarily of external manufacturing costs, in-vivo research studies and clinical trials performed by

contract research organizations, clinical and regulatory consultants, personnel-related expenses, facility-related expenses and laboratory

supplies related to conducting research and development activities. Research and development expenses were $53.6 million for

the three months ended March 31, 2024, compared with $51.8 million in the comparable period last year. The increase in

research and development expenses were primarily driven by the CSL and BARDA programs as well as Arcturus’ internal OTC and Cystic

Fibrosis programs. Additionally, investments increased in early stage and discovery technologies, including the initiation of preclinical

research related to its Lyme Disease and Gonorrhea vaccine discovery programs.

General and Administrative

Expenses:

General

and administrative expenses primarily consist of salaries and related benefits for executive, administrative, legal and accounting functions

and professional service fees for legal and accounting services as well as other general and administrative expenses. General and administrative

expenses were $14.9 million for the three months ended March 31, 2024, compared with $13.8 million in the comparable period

last year. The increase in expenses resulted primarily from increased personnel expenses due to increased salaries, increased travel and

consulting expenses as well as escalated rent expense associated with facilities.

Net Loss:

For the

three months ended March 31, 2024, Arcturus reported a net loss of approximately $26.8 million, or ($1.00) per diluted share,

compared with a net income of $50.8 million, or $1.87 per diluted share in the three months ended March 31, 2023.

Cash Position and Balance

Sheet:

Cash,

cash equivalents and restricted cash were $345.3 million as of March 31, 2024, and $348.9 million on December

31, 2023. Arcturus achieved a total of approximately $420.1 million in upfront payments and milestones from CSL as of March 31, 2024,

and expects to continue to receive future milestone payments from CSL supporting the ongoing development of the COVID and flu programs

and three additional vaccine programs by CSL. The expected cash runway extends at least three years based on the current pipeline and

programs through the first quarter of fiscal year 2027.

Earnings Call: Wednesday,

May 8, 2024 @ 4:30 pm ET

| · | Domestic: 1-888-886-7786 |

| · | International: 1-416-764-8658 |

About Arcturus Therapeutics

Founded in 2013 and based in San Diego, California,

Arcturus Therapeutics Holdings Inc. (Nasdaq: ARCT) is a global mRNA medicines and vaccines company with enabling technologies: (i) LUNAR®

lipid-mediated delivery, (ii) STARR® mRNA Technology (sa-mRNA) and (iii) mRNA drug substance along with drug product manufacturing

expertise. Arcturus developed the first self-amplifying messenger RNA (sa-mRNA) COVID vaccine (Kostaive®) in the world to be approved.

Arcturus has an ongoing global collaboration for innovative mRNA vaccines with CSL Seqirus, and a joint venture in Japan, ARCALIS, focused

on the manufacture of mRNA vaccines and therapeutics. Arcturus’ pipeline includes RNA therapeutic candidates to potentially treat

ornithine transcarbamylase deficiency and cystic fibrosis, along with its partnered mRNA vaccine programs for SARS-CoV-2 (COVID-19) and

influenza. Arcturus’ versatile RNA therapeutics platforms can be applied toward multiple types of nucleic acid medicines including

messenger RNA, small interfering RNA, circular RNA, antisense RNA, self-amplifying RNA, DNA, and gene editing therapeutics. Arcturus’

technologies are covered by its extensive patent portfolio (over 400 patents and patent applications in the U.S., Europe, Japan, China,

and other countries). For more information, visit www.ArcturusRx.com. In addition, please connect with us on Twitter and LinkedIn.

Forward Looking Statements

This press release contains forward-looking statements

that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform

Act of 1995. Any statements, other than statements of historical fact included in this press release, are forward-looking statements,

including those regarding strategy, future operations, the likelihood of success and continued advancement of the Company’s pipeline

(including ARCT-032 and ARCT-810) and partnered programs (including the COVID-19 and flu programs partnered with CSL Seqirus), the likelihood

of delivery of doses of Kostaive (including timing and volume thereof), the anticipated commercialization of Kostaive and the timing thereof,

the likelihood and timing of a European Marketing Authorization application approval decision for Kostaive, the monetization of Arcturus’

interests in ARCALIS JV in Japan, that preclinical or clinical data will be predictive of future clinical results, the likelihood and

timing of clinical study updates (including for ARCT-2138 (LUNAR-FLU), ARCT-032 (LUNAR-CF)), the qualification for commercial milestones

under the CSL collaboration, the continuation and expected recruitment in the Phase 3 pivotal study of ARCT-2303 candidate vaccine containing

the Omicron XBB.1.5 variant, the ongoing recruitment in the ARCT-2138 (LUNAR-FLU) Phase 1 study, the likelihood or timing of collection

of accounts receivables including expected future milestone and other payments from CSL, its current cash position and expected cash burn

and runway, and the impact of general business and economic conditions. Arcturus may not actually achieve the plans, carry out the intentions

or meet the expectations or projections disclosed in any forward-looking statements such as the foregoing and you should not place undue

reliance on such forward-looking statements. These statements are only current predictions or expectations, and are subject to known and

unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance

or achievements to be materially different from those anticipated by the forward-looking statements, including those discussed under the

heading "Risk Factors" in Arcturus’ most recent Annual Report on Form 10-K, and in subsequent filings with, or submissions

to, the SEC, which are available on the SEC’s website at www.sec.gov. Except as otherwise required by law, Arcturus disclaims any

intention or obligation to update or revise any forward-looking statements, which speak only as of the date they were made, whether as

a result of new information, future events or circumstances or otherwise.

Trademark Acknowledgements

The Arcturus logo and other trademarks of Arcturus appearing in this

announcement, including LUNAR® and STARR®, are the property of Arcturus. All other trademarks, services marks, and trade names

in this announcement are the property of their respective owners.

ARCTURUS THERAPEUTICS HOLDINGS INC. AND ITS

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| | |

March 31,

2024 | |

December 31,

2023 |

| (in thousands, except par value information) | |

| (unaudited) | | |

| | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 288,396 | | |

$ | 292,005 | |

| Restricted cash | |

| 55,000 | | |

| 55,000 | |

| Accounts receivable | |

| 27,057 | | |

| 32,064 | |

| Prepaid expenses and other current assets | |

| 5,335 | | |

| 7,521 | |

| Total current assets | |

| 375,788 | | |

| 386,590 | |

| Property and equipment, net | |

| 11,763 | | |

| 12,427 | |

| Operating lease right-of-use asset, net | |

| 29,413 | | |

| 28,500 | |

| Non-current restricted cash | |

| 1,885 | | |

| 1,885 | |

| Total assets | |

$ | 418,849 | | |

$ | 429,402 | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 9,144 | | |

$ | 5,279 | |

| Accrued liabilities | |

| 34,770 | | |

| 31,881 | |

| Deferred revenue | |

| 71,516 | | |

| 44,829 | |

| Total current liabilities | |

| 115,430 | | |

| 81,989 | |

| Deferred revenue, net of current portion | |

| 11,795 | | |

| 42,496 | |

| Operating lease liability, net of current portion | |

| 27,652 | | |

| 25,907 | |

| Other non-current liabilities | |

| — | | |

| 497 | |

| Total liabilities | |

| 154,877 | | |

| 150,889 | |

| Stockholders’ equity | |

| | | |

| | |

Common stock, $0.001 par value; 60,000 shares authorized; issued and

outstanding shares were 26,917 at March 31, 2024 and 26,828 at December 31, 2023 | |

| 27 | | |

| 27 | |

| Additional paid-in capital | |

| 658,628 | | |

| 646,352 | |

| Accumulated deficit | |

| (394,683 | ) | |

| (367,866 | ) |

| Total stockholders’ equity | |

| 263,972 | | |

| 278,513 | |

| Total liabilities and stockholders’ equity | |

$ | 418,849 | | |

$ | 429,402 | |

ARCTURUS THERAPEUTICS HOLDINGS INC. AND ITS

SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE (LOSS) INCOME

Unaudited

| | |

Three Months Ended |

| | |

March 31, | |

December, |

| (in thousands, except per share data) | |

2024 | |

2023 | |

2023 |

| Revenue: | |

| |

| |

|

| Collaboration revenue | |

$ | 32,598 | | |

$ | 79,729 | | |

$ | 25,078 | |

| Grant revenue | |

| 5,414 | | |

| 556 | | |

| 5,777 | |

| Total revenue | |

| 38,012 | | |

| 80,285 | | |

| 30,855 | |

| Operating expenses: | |

| | | |

| | | |

| | |

| Research and development, net | |

| 53,573 | | |

| 51,768 | | |

| 36,620 | |

| General and administrative | |

| 14,851 | | |

| 13,762 | | |

| 12,507 | |

| Total operating expenses | |

| 68,424 | | |

| 65,530 | | |

| 49,127 | |

| (Loss) income from operations | |

| (30,412 | ) | |

| 14,755 | | |

| (18,272 | ) |

| Loss from foreign currency | |

| (53 | ) | |

| (328 | ) | |

| (54 | ) |

| Gain on debt extinguishment | |

| — | | |

| 33,953 | | |

| — | |

| Finance income, net | |

| 4,016 | | |

| 2,477 | | |

| 6,881 | |

| Net (loss) income before income taxes | |

| (26,449 | ) | |

| 50,857 | | |

| (11,445 | ) |

| Provision for income taxes | |

| 368 | | |

| 103 | | |

| 262 | |

| Net (loss) income | |

$ | (26,817 | ) | |

$ | 50,754 | | |

$ | (11,707 | ) |

| (Loss) earnings per share | |

| | | |

| | | |

| | |

| Basic | |

$ | (1.00 | ) | |

$ | 1.91 | | |

$ | (0.44 | ) |

| Diluted | |

$ | (1.00 | ) | |

$ | 1.87 | | |

$ | (0.44 | ) |

| Weighted-average shares used in calculation of (loss) earnings per share: | |

| | | |

| | | |

| | |

| Basic | |

| 26,879 | | |

| 26,555 | | |

| 26,628 | |

| Diluted | |

| 26,879 | | |

| 27,149 | | |

| 26,628 | |

| Comprehensive (loss) income: | |

| | | |

| | | |

| | |

| Net (loss) income | |

$ | (26,817 | ) | |

$ | 50,754 | | |

$ | (11,707 | ) |

| Comprehensive (loss) income | |

$ | (26,817 | ) | |

$ | 50,754 | | |

$ | (11,707 | ) |

IR and Media Contacts

Arcturus Therapeutics

Neda Safarzadeh

VP, Head of IR/PR/Marketing

(858) 900-2682

IR@ArcturusRx.com

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

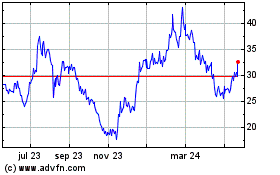

Arcturus Therapeutics (NASDAQ:ARCT)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

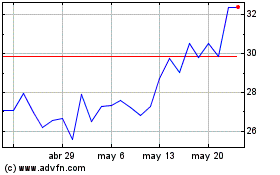

Arcturus Therapeutics (NASDAQ:ARCT)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024