0001875444false00018754442024-03-062024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 29, 2024

___________________________________

Arhaus, Inc.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | 001-41009 (Commission File Number) | 87-1729256 (I.R.S. Employer Identification Number) |

51 E. Hines Hill Road, Boston Heights, Ohio

(Address of Principal Executive Offices)

44236

(Zip Code)

(440) 439-7700

(Registrant's telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

Class A common stock, $0.001 par value per share | ARHS | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 4.02 - Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review

On February 29, 2024, the Audit Committee (the "Audit Committee") of the Board of Directors of Arhaus, Inc. (the “Company”), after discussion with management, concluded that the Company's previously issued unaudited condensed consolidated financial statements included in the Company’s Quarterly Report on Form 10-Q for the period ended September 30, 2023 (the “Q3 Form 10-Q” and such period, the “Affected Period”), filed with the U.S. Securities and Exchange Commission (the “SEC”) on November 2, 2023, should no longer be relied upon due to the errors described below and should be restated.

In preparation of the December 31, 2023 consolidated financial statements, the Company identified an error within the unaudited condensed consolidated balance sheet as of September 30, 2023 related to certain leasehold and landlord improvements prior to showroom completion being incorrectly included in prepaid and other current assets rather than property, furniture and equipment, net. The error resulted in inaccurate cash flows ascribed to operating and investing activities in the unaudited condensed consolidated statement of cash flows for the nine months ended September 30, 2023.

As such, the Company will restate its financial statements for the Affected Period and revise the December 31, 2022 comparative balance sheet included therein in an amendment to the Q3 Form 10-Q (the “Q3 Form 10-Q/A”) to be filed as soon as practicable. Additionally the Company will make the corresponding revisions for impacted annual and applicable interim periods in the years ended December 31, 2023, 2022 and 2021 in the Company’s 2023 Form 10-K.

In connection with the restatement of the Company’s unaudited condensed consolidated financial statements for the Affected Period, the Company determined it is appropriate to correct for certain other previously identified immaterial errors.

The errors caused the below specific line items previously presented in the unaudited condensed consolidated balance sheet to (decrease) or increase by the following amounts (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 |

Condensed Consolidated Balance Sheet | | As Reported | | Adjustment | | As Restated |

| Prepaid and other current assets | | $ | 63,140 | | | $ | (26,441) | | | $ | 36,699 | |

| Total current assets | | $ | 574,457 | | | $ | (26,441) | | | $ | 548,016 | |

| | | | | | |

Operating right-of-use assets(1) | | $ | 314,378 | | | $ | (4,806) | | | $ | 309,572 | |

| Property, furniture and equipment, net | | 156,632 | | | 26,441 | | | 183,073 | |

| Total assets | | $ | 1,115,574 | | | $ | (4,806) | | | $ | 1,110,768 | |

| | | | | | |

Current portion of operating lease liabilities(1) | | $ | 42,472 | | | $ | 94 | | | $ | 42,566 | |

| Total current liabilities | | $ | 386,163 | | | $ | 94 | | | $ | 386,257 | |

| | | | | | |

Operating lease liabilities, long-term(1) | | $ | 360,708 | | | $ | (4,900) | | | $ | 355,808 | |

| Total liabilities | | $ | 807,086 | | | $ | (4,806) | | | $ | 802,280 | |

| Total liabilities and stockholders' equity | | $ | 1,115,574 | | | $ | (4,806) | | | $ | 1,110,768 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

(1) These identified adjustments are to correct immaterial errors.

The errors caused the below specific line items previously presented in the unaudited condensed consolidated statement of cash flows to increase or (decrease) by the following amounts (in thousands):

| | | | | | | | | | | | | | | | | | | | |

| | Nine months ended |

| | September 30, 2023 |

Condensed Consolidated Statement of Cash Flows | | As Reported | | Adjustment | | As Restated |

| Cash flows from operating activities | | | | | | |

| Changes in prepaid and other assets | | $ | (28,952) | | | $ | 20,504 | | | $ | (8,448) | |

| Changes in accounts payable | | (4,093) | | | (6,048) | | | (10,141) | |

| Net cash provided by operating activities | | $ | 131,368 | | | $ | 14,456 | | | $ | 145,824 | |

| | | | | | |

| Cash flows from investing activities | | | | | | |

| Purchases of property, furniture and equipment | | $ | (42,306) | | | $ | (14,456) | | | $ | (56,762) | |

| Net cash used in investing activities | | $ | (41,973) | | | $ | (14,456) | | | $ | (56,429) | |

| | | | | | |

| Supplemental disclosure of cash flow information | | | | | | |

| Noncash operating activities: | | | | | | |

| Lease incentives | | $ | 7,313 | | | $ | (7,313) | | | $ | — | |

| Noncash investing activities: | | | | | | |

| Purchase of property, furniture and equipment in accounts payable | | $ | 2,756 | | | $ | 6,048 | | | $ | 8,804 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

The Company’s management has previously concluded and disclosed that the Company's disclosure controls and procedures were not effective due to the existence of material weaknesses in the Company's internal control over financial reporting ("ICFR"). The Company has evaluated the impact of the errors described above on its ICFR and concluded the existing material weaknesses resulted in these errors.

The Company’s management and the Audit Committee have discussed the matters disclosed in this Current Report on Form 8-K with PricewaterhouseCoopers LLP, the Company’s independent registered public accounting firm.

Forward-Looking Statements

Certain statements contained herein are not based on historical fact and are “forward-looking statements” within the meaning of applicable securities laws. Forward-looking statements can generally be identified by the use of forward-looking terminology, including, but not limited to, “may,” “could,” “seek,” “guidance,” “predict,” “potential,” “likely,” “believe,” “will,” “expect,” “anticipate,” “estimate,” “plan,” “intend,” “forecast,” or variations of these terms and similar expressions, or the negative of these terms or similar expressions. Past performance is not a guarantee of future results or returns and no representation or warranty is made regarding future performance. Such forward-looking statements involve known and unknown risks, uncertainties and other important factors beyond our control that could cause our actual results, performance or achievements to be materially different from the expected results, performance or achievements expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: our ability to manage and maintain the growth rate of our business; our ability to obtain quality merchandise in sufficient quantities; disruption in our receiving and distribution system, including delays in the integration of our distribution centers and the possibility that we may not realize the anticipated benefits of multiple distribution centers; the possibility of cyberattacks and our ability to maintain adequate cybersecurity systems and procedures; loss, corruption and misappropriation of data and information relating to clients and employees; changes in and compliance with applicable data privacy rules and regulations; risks as a result of constraints in our supply chain; a failure of our vendors to meet our quality standards; declines in general economic conditions that affect consumer confidence and consumer spending that could adversely affect our revenue; our ability to anticipate changes in consumer preferences; risks related to maintaining and increasing showroom traffic and sales; our ability to compete in our market; our ability to adequately protect our intellectual property; compliance with applicable governmental regulations; effectively managing our eCommerce business and digital marketing efforts; our reliance on third-party transportation carriers and risks associated with increased freight and transportation costs; and compliance with SEC rules and regulations as a public reporting company. These factors should not be construed as exhaustive. Further information on potential factors that could affect the financial results of the Company and its forward-looking statements is included in

the Company’s filings with the Securities and Exchange Commission. The Company assumes no obligation to update any forward-looking statement, except as may be required by law. These forward-looking statements speak only as of the date of this filing. All forward-looking statements are qualified in their entirety by this cautionary statement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized on this 6th day of March, 2024.

| | | | | |

| ARHAUS, INC. |

| |

By: | /s/ Dawn Phillipson |

Name: | Dawn Phillipson |

Title: | Chief Financial Officer |

Cover

|

Mar. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 29, 2024

|

| Entity Registrant Name |

Arhaus, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-41009

|

| Entity Address, Address Line One |

51 E. Hines Hill Road

|

| Entity Address, City or Town |

Boston Heights

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

44236

|

| City Area Code |

440

|

| Local Phone Number |

439-7700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.001 par value per share

|

| Trading Symbol |

ARHS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001875444

|

| Amendment Flag |

false

|

| Entity Tax Identification Number |

87-1729256

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

51 E. Hines Hill Road

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

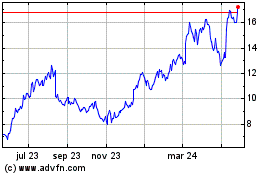

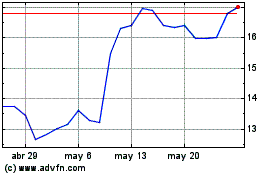

Arhaus (NASDAQ:ARHS)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Arhaus (NASDAQ:ARHS)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024