Array Technologies (NASDAQ: ARRY) (“Array” or the “Company”), a

leading provider of tracker solutions and services for

utility-scale solar energy projects, today announced financial

results for its second quarter ended June 30, 2024.

“We finished the second quarter with strong

performance and execution and are pleased with the continued demand

we’re seeing in our high-probability pipeline. Our orderbook

remains healthy at over $2 billion and we’re encouraged by our

customers’ interest in our portfolio of products and services and

the longer-term tailwinds supporting utility-scale solar as one of

the lowest cost options to satisfy rapidly growing energy needs,”

said Chief Executive Officer, Kevin Hostetler. “In the second

quarter we achieved revenue of $256 million, which was slightly

ahead of the expectations signaled on our last earnings call.

Adjusted gross margin continued to be strong at 35.0%, which

included incremental 45X benefits through June 30, 2024 that were

not previously factored in our guidance. Excluding these

incremental benefits, our second quarter adjusted gross margin

result was within the low-thirties guidance range previously

provided for the full-year. As we move through the remainder of the

year, we will continue to report gross margins inclusive of both

torque tube and structural fastener benefits derived from 45X, and

there is still more work being done around the maximization of

those credits and the eligibility of additional parts that may

qualify.”

Mr. Hostetler continued, “While we’re seeing

positive long-term momentum in the market, our customers continue

to report struggles with short-term dynamics causing project

delays, which has caused us to reduce our revenue outlook for the

year. Notably, the recent AD/CVD petitions and the interpretation

of the new IRA domestic content elective safe harbor table are new

factors that have created some uncertainty in the U.S. market and

changed timelines for some customers’ projects. Internationally,

we’ve also witnessed a rapid devaluation of the Brazilian real

which has caused developers to delay projects in Brazil as they

work through renegotiating power purchase agreements. Within this

challenging environment, we continue to focus on setting Array up

for success to support growth in 2025 and beyond, and remain

confident in our operational execution, continued innovation

through new product launches like SkyLink, and enhanced customer

and industry engagement.”

Executed Contracts and Awarded

Orders

Total executed contracts and awarded orders at

June 30, 2024 were $2.0 billion. New bookings for the quarter were

$429 million, but the total orderbook was also impacted by

adjustments related to items such as commodity price updates,

project scope changes, and F/X impacts.

Full Year 2024

Guidance

For the year ending December 31, 2024, the

Company expects:

- Revenue to be in the range of $900

million to $1,000 million

- Adjusted EBITDA(2) to be in the

range of $185 million to $210 million

- Adjusted net income per share(2) to

be in the range of $0.64 to $0.74

We now expect volume to be down, due to the

changes in expected customer project timing, with declining ASP

when compared to 2023. For the third quarter specifically, we

expect revenue between $220 to $235 million. Finally, we expect

adjusted gross margin to increase to low-to-mid-thirties percent of

sales for the year from our previous guidance of low-thirties

percent of sales, driven by the realization of torque tube and

structural fastener 45X benefits.

Conference Call Information

Array management will host a conference call

today at 5:00 p.m. Eastern Time to discuss the Company’s financial

results. The conference call can be accessed live over the phone by

dialing (877)-869-3847 (domestic) or (201)-689-8261

(international). A telephonic replay will be available

approximately three hours after the call by dialing (877)-660-6853,

or for international callers, (201)-612-7415. The passcode for the

live call and the replay is 13747649. The replay will be available

until 11:59 p.m. (ET) on August 22, 2024.

Interested investors and other parties can

listen to a webcast of the live conference call by logging onto the

Investor Relations section of the Company's website at

http://ir.arraytechinc.com. The online replay will be

available for 30 days on the same website immediately following the

call.

To learn more about Array Technologies, please

visit the Company's website at http://ir.arraytechinc.com.

About Array Technologies,

Inc.

Array Technologies (NASDAQ: ARRY) is a leading

American company and global provider of utility-scale solar tracker

technology. Engineered to withstand the harshest conditions on the

planet, Array’s high-quality solar trackers and sophisticated

software maximize energy production, accelerating the adoption of

cost-effective and sustainable energy. Founded and headquartered in

the United States, Array relies on its diversified global supply

chain and customer-centric approach to deliver, commission and

support solar energy developments around the world, lighting the

way to a brighter, smarter future for clean energy. For more news

and information on Array, please visit arraytechinc.com.

Investor Relations Contact:

Array Technologies, Inc.Investor Relations

505-437-0010investors@arraytechinc.com

Forward-Looking

Statements This press release contains

forward-looking statements that are based on our management’s

beliefs and assumptions and on information currently available to

our management. Forward-looking statements include information

concerning our projected future results of operations, project

timing, sales volume, and industry and regulatory environment.

Forward-looking statements include statements that are not

historical facts and can be identified by terms such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,”

“may,” “plan,” “potential,” “predict,” “project,” "seek," “should,”

“will,” “would” or similar expressions and the negatives of those

terms.

Array’s actual results and the timing of events

could materially differ from those anticipated in such

forward-looking statements as a result of certain risks,

uncertainties and other factors, including without limitation:

changes in growth or rate of growth in demand for solar energy

projects; competitive pressures within our industry; a loss of one

or more of our significant customers, their inability to perform

under their contracts, or their default in payment; a drop in the

price of electricity derived from the utility grid or from

alternative energy sources; a failure to maintain effective

internal controls over financial reporting; a further increase in

interest rates, or a reduction in the availability of tax equity or

project debt capital in the global financial markets, which could

make it difficult for customers to finance the cost of a solar

energy system; electric utility industry policies and regulations,

and any subsequent changes, may present technical, regulatory and

economic barriers to the purchase and use of solar energy systems,

which may significantly reduce demand for our products or harm our

ability to compete; the interruption of the flow of materials from

international vendors, which could disrupt our supply chain,

including as a result of the imposition of additional duties,

tariffs and other charges or restrictions on imports and exports;

geopolitical, macroeconomic and other market conditions unrelated

to our operating performance including the military conflict in

Ukraine and Russia, the Israel-Hamas war, attacks on shipping in

the Red Sea and rising inflation and interest rates; changes in the

global trade environment, including the imposition of import

tariffs or other import restrictions; our ability to convert our

orders in backlog into revenue; fluctuations in our

results of operations across fiscal periods, which could make our

future performance difficult to predict and could cause our results

of operations for a particular period to fall below expectations;

the reduction, elimination or expiration, or our failure to

optimize the benefits of government incentives for, or regulations

mandating the use of, renewable energy and solar energy,

particularly in relation to our competitors; failure

to, or incurrence of significant costs in order to,

obtain, maintain, protect, defend or enforce, our intellectual

property and other proprietary right; significant changes in the

cost of raw materials; defects or performance problems in our

products, which could result in loss of customers, reputational

damage and decreased revenue; delays, disruptions or quality

control problems in our product development operations; our ability

to obtain key personnel or failure to attract additional qualified

personnel; additional business, financial, regulatory and

competitive risks due to our continued planned expansion into new

markets; cybersecurity or other data incidents, including

unauthorized disclosure of personal or sensitive data or theft of

confidential information; failure to implement and maintain

effective internal controls over financial reporting; risks related

to actual or threatened public health epidemics, pandemics,

outbreaks or crises, such as the COVID-19 pandemic, which could

have a material and adverse effect on our business, results of

operations and financial condition; changes to tax laws and

regulations that are applied adversely to us or our customers,

which could materially adversely affect our business, financial

condition, results of operations and prospects, including our

ability to optimize those changes brought about by the passage of

the Inflation Reduction Act; and the other risks and uncertainties

described in more detail in the Company’s most recent Annual Report

on Form 10-K and other documents on file with the SEC, each of

which can be found on our website, www.arraytechinc.com.

Except as required by law, we assume no

obligation to update these forward-looking statements, or to update

the reasons actual results could differ materially from those

anticipated in these forward-looking statements, even if new

information becomes available in the future.

Non-GAAP

Financial InformationThis press

release includes certain financial measures that are not presented

in accordance with U.S. generally accepted accounting principles

(“GAAP”), including Adjusted gross profit, Adjusted EBITDA,

Adjusted net income, Adjusted net income per share, and Free cash

flow. We define Adjusted gross profit as gross profit plus (i)

developed technology amortization and (ii) other costs if

applicable. We define Adjusted EBITDA as net income (loss) plus (i)

other (income) expense, (ii) foreign currency transaction (gain)

loss, (iii) preferred dividends and accretion, (iv) interest

expense, (v) income tax (benefit) expense, (vi) depreciation

expense, (vii) amortization of intangibles, (viii) amortization of

developed technology, (ix) equity-based compensation, (x) change in

fair value of contingent consideration, (xi) certain legal

expenses, (xii) certain acquisition related costs if applicable,

and (xiii) other costs. We define Adjusted net income as net income

plus (i) amortization of intangibles, (ii) amortization of

developed technology, (iii) amortization of debt discount and

issuance costs (iv) preferred accretion, (v) equity-based

compensation, (vi) change in fair value of derivative assets, (vii)

change in fair value of contingent consideration, (viii) certain

legal expenses, (ix) certain acquisition related costs if

applicable, (x) other costs, and (xi) income tax (benefit) expense

of adjustments. We define Free cash flow as Cash provided by (used

in) operating activities less purchase of property, plant and

equipment. A detailed reconciliation between GAAP results and

results excluding special items (“non-GAAP”) is included within

this presentation. We calculate net income (loss) per

share as net income (loss) to common shareholders divided by the

basic and diluted weighted average number of shares outstanding for

the applicable period and we define Adjusted net income per share

as Adjusted net income (as detailed above) divided by the basic and

diluted weighted average number of shares outstanding for the

applicable period.

We believe that these non-GAAP financial

measures are provided to enhance the reader’s understanding of our

past financial performance and our prospects for the future. Our

management team uses these non-GAAP financial measures in assessing

the Company’s performance, as well as in planning and forecasting

future periods. The non-GAAP financial information is presented for

supplemental informational purposes only and should not be

considered a substitute for financial information presented in

accordance with GAAP, and may be different from similarly titled

non-GAAP measures used by other companies.

Among other limitations, Adjusted gross profit,

Adjusted EBITDA and Adjusted net income do not reflect our cash

expenditures, or future requirements, for capital expenditures or

contractual commitments; do not reflect the impact of certain cash

charges resulting from matters we consider not to be indicative of

our ongoing operations; do not reflect income tax expense or

benefit; and other companies in our industry may calculate Adjusted

gross profit, Adjusted EBITDA and Adjusted net income differently

than we do, which limits their usefulness as comparative measures.

Because of these limitations, Adjusted gross profit, Adjusted

EBITDA and adjusted net income should not be considered in

isolation or as substitutes for performance measures calculated in

accordance with GAAP. We compensate for these limitations by

relying primarily on our GAAP results and using Adjusted gross

profit, Adjusted EBITDA and Adjusted net income on a supplemental

basis. You should review the reconciliation of gross profit to

Adjusted gross profit and net income (loss) to Adjusted EBITDA and

Adjusted net income below and not rely on any single financial

measure to evaluate our business.

(1) A reconciliation of the most comparable GAAP measure to its

Non-GAAP measure is included below.

(2) A reconciliation of projected Adjusted gross

margin, Adjusted EBITDA and Adjusted net income per share, which

are forward-looking measures that are not prepared in accordance

with GAAP, to the most directly comparable GAAP financial measures,

is not provided because we are unable to provide such

reconciliation without unreasonable effort. The inability to

provide a quantitative reconciliation is due to the uncertainty and

inherent difficulty predicting the occurrence, the financial impact

and the periods in which the components of the applicable GAAP

measures and non-GAAP adjustments may be recognized. The GAAP

measures may include the impact of such items as non-cash

share-based compensation, revaluation of the fair-value of our

contingent consideration, and the tax effect of such items, in

addition to other items we have historically excluded from Adjusted

EBITDA and Adjusted net income per share. We expect to continue to

exclude these items in future disclosures of these non-GAAP

measures and may also exclude other similar items that may arise in

the future (collectively, “non-GAAP adjustments”). The decisions

and events that typically lead to the recognition of non-GAAP

adjustments are inherently unpredictable as to if or when they may

occur. As such, for our 2024 outlook, we have not included

estimates for these items and are unable to address the probable

significance of the unavailable information, which could be

material to future results.

|

Array Technologies, Inc. and Subsidiaries |

|

Consolidated Balance Sheets (unaudited) |

|

(in thousands, except per share and share amounts) |

| |

|

|

|

| |

June 30, 2024 |

|

December 31, 2023 |

|

ASSETS |

| Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

282,320 |

|

|

$ |

249,080 |

|

|

Accounts receivable, net of allowance of $4,911 and $3,824,

respectively |

|

309,719 |

|

|

|

332,152 |

|

|

Inventories |

|

165,639 |

|

|

|

161,964 |

|

|

Prepaid expenses and other |

|

91,259 |

|

|

|

89,085 |

|

|

Total current assets |

|

848,937 |

|

|

|

832,281 |

|

| |

|

|

|

| Property, plant and equipment,

net |

|

26,677 |

|

|

|

27,893 |

|

| Goodwill |

|

402,501 |

|

|

|

435,591 |

|

| Other intangible assets,

net |

|

307,591 |

|

|

|

354,389 |

|

| Deferred income tax

assets |

|

13,369 |

|

|

|

15,870 |

|

| Other assets |

|

52,447 |

|

|

|

40,717 |

|

|

Total assets |

$ |

1,651,522 |

|

|

$ |

1,706,741 |

|

| |

|

|

|

|

LIABILITIES, REDEEMABLE PERPETUAL PREFERRED STOCK AND

STOCKHOLDERS' EQUITY |

| Current liabilities |

|

|

|

|

Accounts payable |

$ |

112,489 |

|

|

$ |

119,498 |

|

|

Accrued expenses and other |

|

57,265 |

|

|

|

70,211 |

|

|

Accrued warranty reserve |

|

1,639 |

|

|

|

2,790 |

|

|

Income tax payable |

|

3,368 |

|

|

|

5,754 |

|

|

Deferred revenue |

|

90,982 |

|

|

|

66,488 |

|

|

Current portion of contingent consideration |

|

1,918 |

|

|

|

1,427 |

|

|

Current portion of debt |

|

29,221 |

|

|

|

21,472 |

|

|

Other current liabilities |

|

40,697 |

|

|

|

48,051 |

|

|

Total current liabilities |

|

337,579 |

|

|

|

335,691 |

|

| |

|

|

|

| Deferred income tax

liabilities |

|

54,512 |

|

|

|

66,858 |

|

| Contingent consideration, net

of current portion |

|

6,786 |

|

|

|

8,936 |

|

| Other long-term

liabilities |

|

18,613 |

|

|

|

20,428 |

|

| Long-term warranty |

|

4,035 |

|

|

|

3,372 |

|

| Long-term debt, net of current

portion |

|

651,522 |

|

|

|

660,948 |

|

|

Total liabilities |

|

1,073,047 |

|

|

|

1,096,233 |

|

| |

|

|

|

| Commitments and contingencies

(Note 11) |

|

|

|

| |

|

|

|

| Series A Redeemable Perpetual

Preferred Stock of $0.001 par value; 500,000 authorized; 446,541

and 432,759 shares issued as of June 30, 2024 and December 31,

2023, respectively; liquidation preference of $493.1 million at

both dates |

|

378,512 |

|

|

|

351,260 |

|

| |

|

|

|

| Stockholders’ equity |

|

|

|

|

Preferred stock of $0.001 par value - 4,500,000 shares authorized;

none issued at respective dates |

|

— |

|

|

|

— |

|

| Common stock of $0.001 par

value - 1,000,000,000 shares authorized; 151,875,097 and

151,242,120 shares issued at respective dates |

|

151 |

|

|

|

151 |

|

|

Additional paid-in capital |

|

320,379 |

|

|

|

344,517 |

|

|

Accumulated deficit |

|

(102,367 |

) |

|

|

(130,230 |

) |

|

Accumulated other comprehensive income |

|

(18,200 |

) |

|

|

44,810 |

|

|

Total stockholders’ equity |

|

199,963 |

|

|

|

259,248 |

|

|

Total liabilities, redeemable perpetual preferred stock and

stockholders’ equity |

$ |

1,651,522 |

|

|

$ |

1,706,741 |

|

|

|

|

|

|

|

|

|

|

|

Array Technologies, Inc. and Subsidiaries |

|

Consolidated Statements of Operations

(unaudited) |

|

(in thousands, except per share amounts) |

| |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue |

$ |

255,766 |

|

|

$ |

507,725 |

|

|

$ |

409,169 |

|

|

$ |

884,498 |

|

| Cost of revenue |

|

|

|

|

|

|

|

|

Cost of product and service revenue |

|

166,173 |

|

|

|

357,683 |

|

|

|

260,847 |

|

|

|

633,277 |

|

|

Amortization of developed technology |

|

3,640 |

|

|

|

3,640 |

|

|

|

7,279 |

|

|

|

7,279 |

|

|

Total cost of revenue |

|

169,813 |

|

|

|

361,323 |

|

|

|

268,126 |

|

|

|

640,556 |

|

| Gross profit |

|

85,953 |

|

|

|

146,402 |

|

|

|

141,043 |

|

|

|

243,942 |

|

| |

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

General and administrative |

|

36,971 |

|

|

|

40,250 |

|

|

|

74,755 |

|

|

|

78,392 |

|

|

Change in fair value of contingent consideration |

|

503 |

|

|

|

705 |

|

|

|

(232 |

) |

|

|

2,043 |

|

|

Depreciation and amortization |

|

8,877 |

|

|

|

9,206 |

|

|

|

18,504 |

|

|

|

19,808 |

|

|

Total operating expenses |

|

46,351 |

|

|

|

50,161 |

|

|

|

93,027 |

|

|

|

100,243 |

|

| |

|

|

|

|

|

|

|

| Income from operations |

|

39,602 |

|

|

|

96,241 |

|

|

|

48,016 |

|

|

|

143,699 |

|

| |

|

|

|

|

|

|

|

|

Other (loss) income, net |

|

(1,793 |

) |

|

|

125 |

|

|

|

(980 |

) |

|

|

319 |

|

|

Interest income |

|

4,782 |

|

|

|

1,468 |

|

|

|

8,462 |

|

|

|

2,699 |

|

|

Foreign currency (loss) gain, net |

|

(468 |

) |

|

|

260 |

|

|

|

(967 |

) |

|

|

66 |

|

|

Interest expense |

|

(8,614 |

) |

|

|

(11,577 |

) |

|

|

(17,554 |

) |

|

|

(22,308 |

) |

|

Total other expense, net |

|

(6,093 |

) |

|

|

(9,724 |

) |

|

|

(11,039 |

) |

|

|

(19,224 |

) |

| |

|

|

|

|

|

|

|

| Income before income tax

expense |

|

33,509 |

|

|

|

86,517 |

|

|

|

36,977 |

|

|

|

124,475 |

|

| Income tax expense |

|

7,810 |

|

|

|

21,352 |

|

|

|

9,114 |

|

|

|

29,675 |

|

| Net income |

|

25,699 |

|

|

|

65,165 |

|

|

|

27,863 |

|

|

|

94,800 |

|

| Preferred dividends and

accretion |

|

13,749 |

|

|

|

12,784 |

|

|

|

27,251 |

|

|

|

25,268 |

|

| Net income to common

shareholders |

$ |

11,950 |

|

|

$ |

52,381 |

|

|

$ |

612 |

|

|

$ |

69,532 |

|

| |

|

|

|

|

|

|

|

| Income per common share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.08 |

|

|

$ |

0.34 |

|

|

$ |

— |

|

|

$ |

0.47 |

|

|

Diluted |

$ |

0.08 |

|

|

$ |

0.34 |

|

|

$ |

— |

|

|

$ |

0.46 |

|

| Weighted average number of

common shares outstanding |

|

|

|

|

|

|

|

|

Basic |

|

151,797 |

|

|

|

150,919 |

|

|

|

151,574 |

|

|

|

150,763 |

|

|

Diluted |

|

152,207 |

|

|

|

152,129 |

|

|

|

152,170 |

|

|

|

151,970 |

|

| |

|

|

|

|

|

|

|

|

Array Technologies, Inc. and Subsidiaries |

|

Consolidated Statements of Cash Flows

(unaudited) |

|

(in thousands) |

|

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Operating

activities |

|

|

|

|

|

|

|

| Net income |

$ |

25,699 |

|

|

$ |

65,165 |

|

|

$ |

27,863 |

|

|

$ |

94,800 |

|

| Adjustments to net

income: |

|

|

|

|

|

|

|

|

Provision for bad debts |

|

800 |

|

|

|

(374 |

) |

|

|

1,696 |

|

|

|

(141 |

) |

|

Deferred tax benefit |

|

(3,488 |

) |

|

|

(4,798 |

) |

|

|

(3,501 |

) |

|

|

(1,796 |

) |

|

Depreciation and amortization |

|

9,331 |

|

|

|

9,519 |

|

|

|

19,456 |

|

|

|

20,413 |

|

|

Amortization of developed technology |

|

3,640 |

|

|

|

3,640 |

|

|

|

7,279 |

|

|

|

7,279 |

|

|

Amortization of debt discount and issuance costs |

|

1,548 |

|

|

|

2,172 |

|

|

|

3,101 |

|

|

|

4,998 |

|

|

Equity-based compensation |

|

910 |

|

|

|

4,945 |

|

|

|

4,836 |

|

|

|

8,311 |

|

|

Change in fair value of contingent consideration |

|

503 |

|

|

|

705 |

|

|

|

(232 |

) |

|

|

2,043 |

|

|

Warranty provision |

|

1,077 |

|

|

|

43 |

|

|

|

(61 |

) |

|

|

479 |

|

|

Write-down of inventories |

|

627 |

|

|

|

1,611 |

|

|

|

1,227 |

|

|

|

3,458 |

|

|

Changes in operating assets and liabilities, net of business

acquisition: |

|

— |

|

|

|

|

|

|

|

|

Accounts receivable |

|

(97,369 |

) |

|

|

(87,277 |

) |

|

|

(1,379 |

) |

|

|

(81,039 |

) |

|

Inventories |

|

4,335 |

|

|

|

46,156 |

|

|

|

(7,207 |

) |

|

|

22,844 |

|

|

Income tax receivables |

|

(1,315 |

) |

|

|

2,851 |

|

|

|

(1,313 |

) |

|

|

3,220 |

|

|

Prepaid expenses and other |

|

(1,234 |

) |

|

|

3,655 |

|

|

|

(3,453 |

) |

|

|

(3,292 |

) |

|

Accounts payable |

|

20,959 |

|

|

|

387 |

|

|

|

(2,932 |

) |

|

|

30,542 |

|

|

Accrued expenses and other |

|

35,397 |

|

|

|

3,197 |

|

|

|

(15,172 |

) |

|

|

7,097 |

|

|

Income tax payable |

|

(3,619 |

) |

|

|

4,886 |

|

|

|

(2,684 |

) |

|

|

9,838 |

|

|

Lease liabilities |

|

(663 |

) |

|

|

590 |

|

|

|

(3,135 |

) |

|

|

1,414 |

|

|

Deferred revenue |

|

6,820 |

|

|

|

(36,533 |

) |

|

|

27,070 |

|

|

|

(64,112 |

) |

|

Net cash provided by operating activities |

|

3,958 |

|

|

|

20,540 |

|

|

|

51,459 |

|

|

|

66,356 |

|

| Investing

activities |

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

(2,131 |

) |

|

|

(5,541 |

) |

|

|

(4,527 |

) |

|

|

(9,424 |

) |

|

Retirement/disposal of property, plant and equipment |

|

29 |

|

|

|

— |

|

|

|

39 |

|

|

|

— |

|

|

Net cash used in investing activities |

|

(2,102 |

) |

|

|

(5,541 |

) |

|

|

(4,488 |

) |

|

|

(9,424 |

) |

| Financing

activities |

|

|

|

|

|

|

|

|

Series A equity issuance costs |

|

— |

|

|

|

(758 |

) |

|

|

— |

|

|

|

(1,508 |

) |

|

Tax withholding related to vesting of equity-based

compensation |

|

— |

|

|

|

— |

|

|

|

(580 |

) |

|

|

— |

|

|

Proceeds from issuance of other debt |

|

10,401 |

|

|

|

17,332 |

|

|

|

12,684 |

|

|

|

23,801 |

|

|

Principal payments on other debt |

|

(8,890 |

) |

|

|

(21,051 |

) |

|

|

(12,671 |

) |

|

|

(38,257 |

) |

|

Principal payments on term loan facility |

|

(1,080 |

) |

|

|

(11,075 |

) |

|

|

(2,150 |

) |

|

|

(22,150 |

) |

|

Contingent consideration payments |

|

— |

|

|

|

— |

|

|

|

(1,427 |

) |

|

|

(1,200 |

) |

|

Net cash (provided by) used in financing activities |

|

431 |

|

|

|

(15,552 |

) |

|

|

(4,144 |

) |

|

|

(39,314 |

) |

| Effect of exchange rate

changes on cash and cash equivalent balances |

|

(7,586 |

) |

|

|

8,763 |

|

|

|

(9,587 |

) |

|

|

4,447 |

|

| Net change in cash and cash

equivalents |

|

(5,299 |

) |

|

|

8,210 |

|

|

|

33,240 |

|

|

|

22,065 |

|

| Cash and cash equivalents,

beginning of |

|

287,620 |

|

|

|

147,756 |

|

|

|

249,080 |

|

|

|

133,901 |

|

| Cash and cash equivalents, end

of period |

$ |

282,321 |

|

|

$ |

155,966 |

|

|

$ |

282,320 |

|

|

$ |

155,966 |

|

| |

|

|

|

|

|

|

|

| Supplemental cash flow

information |

|

|

|

|

|

|

|

|

Cash paid for interest |

$ |

6,519 |

|

|

$ |

7,900 |

|

|

$ |

17,819 |

|

|

$ |

15,880 |

|

|

Cash paid for income taxes (net of refunds) |

$ |

16,599 |

|

|

$ |

15,962 |

|

|

$ |

17,001 |

|

|

$ |

18,484 |

|

|

|

|

|

|

|

|

|

|

| Non-cash investing and

financing |

|

|

|

|

|

|

|

|

Dividends accrued on Series A |

$ |

6,945 |

|

|

$ |

6,521 |

|

|

$ |

13,782 |

|

|

$ |

12,871 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Array Technologies,

Inc.Adjusted Gross Profit, Adjusted EBITDA,

Adjusted Net Income, and Free Cash Flow Reconciliation

(unaudited)(in thousands, except per share amounts)

The following table reconciles Gross profit to

Adjusted gross profit:

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Revenue |

255,766 |

|

|

507,725 |

|

|

409,169 |

|

|

884,498 |

|

| Cost of revenue |

169,813 |

|

|

361,323 |

|

|

268,126 |

|

|

640,556 |

|

| Gross profit |

85,953 |

|

|

146,402 |

|

|

141,043 |

|

|

243,942 |

|

| Amortization of developed

technology |

3,640 |

|

|

3,640 |

|

|

7,279 |

|

|

7,279 |

|

| Adjusted gross

profit |

89,593 |

|

|

150,042 |

|

|

148,322 |

|

|

251,221 |

|

| Adjusted gross margin |

35.0 |

% |

|

29.6 |

% |

|

36.2 |

% |

|

28.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

The following table reconciles Net income to

Adjusted EBITDA:

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income |

$ |

25,699 |

|

|

$ |

65,165 |

|

|

$ |

27,863 |

|

|

$ |

94,800 |

|

| Preferred dividends and

accretion |

|

13,749 |

|

|

|

12,784 |

|

|

|

27,251 |

|

|

|

25,268 |

|

| Net income to common

shareholders |

$ |

11,950 |

|

|

$ |

52,381 |

|

|

$ |

612 |

|

|

$ |

69,532 |

|

| Other expense, net |

|

(2,989 |

) |

|

|

(1,593 |

) |

|

|

(7,482 |

) |

|

|

(3,018 |

) |

| Foreign currency loss (gain),

net |

|

468 |

|

|

|

(260 |

) |

|

|

967 |

|

|

|

(66 |

) |

| Preferred dividends and

accretion |

|

13,749 |

|

|

|

12,784 |

|

|

|

27,251 |

|

|

|

25,268 |

|

| Interest expense |

|

8,614 |

|

|

|

11,577 |

|

|

|

17,554 |

|

|

|

22,308 |

|

| Income tax expense |

|

7,810 |

|

|

|

21,352 |

|

|

|

9,114 |

|

|

|

29,675 |

|

| Depreciation expense |

|

1,155 |

|

|

|

576 |

|

|

|

2,038 |

|

|

|

1,188 |

|

| Amortization of

intangibles |

|

8,141 |

|

|

|

8,942 |

|

|

|

17,395 |

|

|

|

19,224 |

|

| Amortization of developed

technology |

|

3,640 |

|

|

|

3,640 |

|

|

|

7,279 |

|

|

|

7,279 |

|

| Equity-based compensation |

|

808 |

|

|

|

5,240 |

|

|

|

4,828 |

|

|

|

8,580 |

|

| Change in fair value of

contingent consideration |

|

503 |

|

|

|

705 |

|

|

|

(232 |

) |

|

|

2,043 |

|

| Certain legal expenses

(a) |

|

1,533 |

|

|

|

248 |

|

|

|

2,263 |

|

|

|

552 |

|

| Other costs (b) |

|

— |

|

|

|

— |

|

|

|

42 |

|

|

|

— |

|

| Adjusted

EBITDA |

$ |

55,382 |

|

|

$ |

115,592 |

|

|

$ |

81,629 |

|

|

$ |

182,565 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Represents

certain legal fees and other related costs associated with (i)

Actions filed against the company and certain officers and

directors alleging violations of the Securities Exchange Acts of

1934 and 1933, which litigation was dismissed with prejudice by the

Court on May 19, 2023 and subsequently appealed. The appeal has

been fully briefed, argued, and the Company is awaiting a decision,

and (ii) other litigation. We consider these costs not

representative of legal costs that we will incur from time to time

in the ordinary course of our business.

(b) For the six

months ended June 30, 2024, other costs represent costs related to

Capped-Call accounting treatment evaluation.

The following table reconciles Net income to Adjusted net

income:

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income |

$ |

25,699 |

|

|

$ |

65,165 |

|

|

$ |

27,863 |

|

|

$ |

94,800 |

|

| Preferred dividends and

accretion |

|

13,749 |

|

|

|

12,784 |

|

|

|

27,251 |

|

|

|

25,268 |

|

| Net income to common

shareholders |

$ |

11,950 |

|

|

$ |

52,381 |

|

|

$ |

612 |

|

|

$ |

69,532 |

|

| Amortization of intangibles |

|

8,141 |

|

|

|

8,942 |

|

|

|

17,395 |

|

|

|

19,224 |

|

| Amortization of developed

technology |

|

3,640 |

|

|

|

3,640 |

|

|

|

7,279 |

|

|

|

7,279 |

|

| Amortization of debt discount and

issuance costs |

|

1,549 |

|

|

|

2,172 |

|

|

|

3,101 |

|

|

|

4,998 |

|

| Preferred accretion |

|

6,805 |

|

|

|

6,263 |

|

|

|

13,470 |

|

|

|

12,398 |

|

| Equity based compensation |

|

808 |

|

|

|

5,240 |

|

|

|

4,828 |

|

|

|

8,580 |

|

| Change in fair value of

contingent consideration |

|

503 |

|

|

|

705 |

|

|

|

(232 |

) |

|

|

2,043 |

|

| Certain legal expenses(a) |

|

1,533 |

|

|

|

248 |

|

|

|

2,263 |

|

|

|

552 |

|

| Other costs(b) |

|

— |

|

|

|

— |

|

|

|

42 |

|

|

|

— |

|

| Income tax expense of

adjustments(c) |

|

(4,285 |

) |

|

|

(5,301 |

) |

|

|

(9,137 |

) |

|

|

(10,752 |

) |

| Adjusted net

income |

$ |

30,644 |

|

|

$ |

74,290 |

|

|

$ |

39,621 |

|

|

$ |

113,854 |

|

| |

|

|

|

|

|

|

|

| Income per common share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.08 |

|

|

$ |

0.34 |

|

|

$ |

— |

|

|

$ |

0.47 |

|

|

Diluted |

$ |

0.08 |

|

|

$ |

0.34 |

|

|

$ |

— |

|

|

$ |

0.46 |

|

| Weighted average number of

common shares outstanding |

|

|

|

|

|

|

|

|

Basic |

|

151,797 |

|

|

|

150,919 |

|

|

|

151,574 |

|

|

|

150,763 |

|

|

Diluted |

|

152,207 |

|

|

|

152,129 |

|

|

|

152,170 |

|

|

|

151,970 |

|

| Adjusted net income per common

share |

|

|

|

|

|

|

|

|

Basic |

$ |

0.20 |

|

|

$ |

0.49 |

|

|

$ |

0.26 |

|

|

$ |

0.76 |

|

|

Diluted |

$ |

0.20 |

|

|

$ |

0.49 |

|

|

$ |

0.26 |

|

|

$ |

0.75 |

|

| Weighted average number of common

shares outstanding |

|

|

|

|

|

|

|

|

Basic |

|

151,797 |

|

|

|

150,919 |

|

|

|

151,574 |

|

|

|

150,763 |

|

|

Diluted |

|

152,207 |

|

|

|

152,129 |

|

|

|

152,170 |

|

|

|

151,970 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Represents

certain legal fees and other related costs associated with (i)

Actions filed against the company and certain officers and

directors alleging violations of the Securities Exchange Acts of

1934 and 1933, which litigation was dismissed with prejudice by the

Court on May 19, 2023 and subsequently appealed. The appeal has

been fully briefed, argued, and the Company is awaiting a decision,

and (ii) other litigation. We consider these costs not

representative of legal costs that we will incur from time to time

in the ordinary course of our business.

(b) For the six

months ended June 30, 2024, other costs represent costs related to

Capped-Call accounting treatment evaluation.

(c) Represents the

estimated tax impact of all Adjusted Net Income add-backs,

excluding those which represent permanent differences between book

versus tax.

The following table reconciles new cash provided

by operating activities to Free cash flow:

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

| Net cash provided by operating

activities |

3,958 |

|

|

20,540 |

|

|

51,459 |

|

|

66,356 |

|

| Purchase of property, plant

and equipment |

(2,131 |

) |

|

(5,541 |

) |

|

(4,527 |

) |

|

(9,424 |

) |

| Free cash

flow |

1,827 |

|

|

14,999 |

|

|

46,932 |

|

|

56,932 |

|

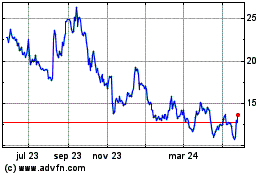

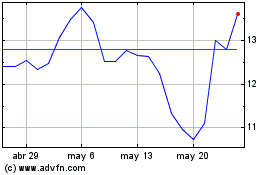

Array Technologies (NASDAQ:ARRY)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Array Technologies (NASDAQ:ARRY)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024