Ascendis Pharma A/S (Nasdaq: ASND) today announced the pricing of

its underwritten public offering of 2,000,000 American Depositary

Shares (“ADSs”), each of which represents one ordinary share of

Ascendis, at a price to the public of $150.00 per ADS. All of the

ADSs are being offered by Ascendis. The offering is expected to

close on or about September 23, 2024, subject to the satisfaction

of customary closing conditions. In addition, Ascendis has granted

the underwriters a 30-day option to purchase up to an additional

300,000 ADSs at the public offering price, less the underwriting

commissions.

Ascendis estimates the net proceeds from the offering will be

approximately $281.3 million (assuming no exercise of the

underwriters’ option to purchase additional ADSs), after deducting

the underwriting commissions and estimated offering expenses.

Ascendis intends to use the net proceeds of the offering to support

the commercial preparations, launch and commercial activities,

clinical development and regulatory approvals for its products and

product candidates, and for working capital and general corporate

purposes.

J.P. Morgan, Morgan Stanley, Evercore ISI and

Goldman Sachs & Co. LLC are acting as joint book-running

managers for the offering. BofA Securities, Wells Fargo Securities

and Citigroup are acting as lead managers for the offering and

Oppenheimer & Co. is acting as co-manager for the offering.

A shelf registration statement relating to these securities was

filed with the U.S. Securities and Exchange Commission (“SEC”) on

September 18, 2024, and automatically became effective upon filing.

This offering is being made solely by means of a prospectus. A copy

of the final prospectus supplement and the accompanying prospectus

relating to this offering, when available, may be obtained by

contacting J.P. Morgan Securities LLC, Attention: Broadridge

Financial Solutions, 1155 Long Island Avenue, Edgewood,

NY 11717, or by email

at prospectus-eq_fi@jpmchase.com; Morgan Stanley &

Co. LLC, Attention: Prospectus Department, 180 Varick Street,

2nd Floor, New York, NY 10014, or by email

at prospectus@morganstanley.com; Evercore Group L.L.C.,

Attention: Equity Capital Markets, 55 East 52nd Street,

35th Floor, New York, NY 10055, or by telephone at (888)

474-0200, or by email at ecm.prospectus@evercore.com; or

Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200

West Street, New York, NY 10282, by telephone at (866) 471-2526, or

by email at Prospectus-ny@ny.email.gs.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such an offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such state or jurisdiction.

About Ascendis Pharma A/S

Ascendis Pharma is applying its innovative TransCon technology

platform to build a leading, fully integrated biopharma company

focused on making a meaningful difference in patients’ lives.

Guided by its core values of Patients, Science, and Passion,

Ascendis uses its TransCon technologies to create new and

potentially best-in-class therapies. Ascendis is headquartered in

Copenhagen, Denmark and has additional facilities in Europe and the

United States.

Forward-Looking Statements

This press release contains forward-looking statements that

involve substantial risks and uncertainties. All statements, other

than statements of historical facts, included in this press release

regarding Ascendis’ future operations, plans and objectives of

management are forward-looking statements. Examples of such

statements include, but are not limited to, statements relating to

(i) the satisfaction of customary closing conditions related to the

offering, (ii) the expected closing of the offering, (iii)

Ascendis’ expectations regarding the anticipated closing date, (iv)

Ascendis’ intended use of the net proceeds from the offering, (v)

Ascendis’ ability to apply its TransCon technology platform to

build a leading, fully integrated biopharma company and (vi)

Ascendis’ expectations regarding its ability to utilize its

TransCon technologies to create new and potentially best-in-class

therapies. Ascendis may not actually achieve the plans, carry out

the intentions or meet the expectations or projections disclosed in

the forward-looking statements and you should not place undue

reliance on these forward-looking statements. Actual results or

events could differ materially from the plans, intentions,

expectations and projections disclosed in the forward-looking

statements. Various important factors could cause actual results or

events to differ materially from the forward-looking statements

that Ascendis makes, including the following: dependence on third

party manufacturers, distributors and service providers for

Ascendis’ products and product candidates; unforeseen safety or

efficacy results in Ascendis’ development programs or on-market

products; unforeseen expenses related to commercialization of any

approved Ascendis products; unforeseen expenses related to

Ascendis’ development programs; unforeseen selling, general and

administrative expenses, other research and development expenses

and Ascendis’ business generally; delays in the development of its

programs related to manufacturing, regulatory requirements, speed

of patient recruitment or other unforeseen delays; Ascendis’

ability to obtain additional funding, if needed, to support its

business activities; the impact of international economic,

political, legal, compliance, social and business factors. For a

further description of the risks and uncertainties that could cause

actual results to differ from those expressed in these

forward-looking statements, as well as risks relating to Ascendis’

business in general, see Ascendis’ Annual Report on Form 20-F filed

with the SEC on February 7, 2024 and Ascendis’ other future reports

filed with, or submitted to, the SEC. Forward-looking statements do

not reflect the potential impact of any future in-licensing,

collaborations, acquisitions, mergers, dispositions, joint

ventures, or investments that Ascendis may enter into or make.

Ascendis does not assume any obligation to update any

forward-looking statements, except as required by law.

Ascendis, Ascendis Pharma and the Ascendis Pharma logo are

trademarks owned by the Ascendis Pharma group. © September 2024

Ascendis Pharma A/S.

|

Investor Contacts:Tim Lee Ascendis

Pharma(650)

374-6343 tle@ascendispharma.comir@ascendispharma.com |

Media Contact:Melinda BakerAscendis Pharma(650)

709-8875media@ascendispharma.com |

| |

|

| Patti Bank ICR Westwicke

(415) 513-1284 patti.bank@westwicke.com |

|

| |

|

Source: Ascendis Pharma A/S

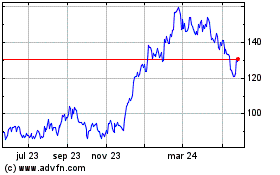

Ascendis Pharma AS (NASDAQ:ASND)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

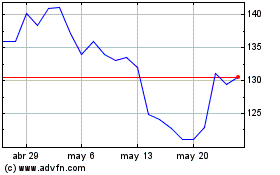

Ascendis Pharma AS (NASDAQ:ASND)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024