Augmedix (Nasdaq: AUGX), a healthcare technology company that

delivers industry-leading ambient medical documentation and data

solutions, reported today financial results for the three and nine

months ended September 30, 2023.

“The third quarter marked another period of

strong progress for Augmedix as we continue to be a leader in the

large and rapidly growing ambient medical documentation market,”

commented Manny Krakaris, Chief Executive Officer at Augmedix.

“Growing adoption of Augmedix Live and Augmedix Notes drove 50%

revenue growth and net revenue retention of 157%, while expanding

gross margins by 390 basis points to 49.5%. With strong revenue

growth and improving profitability, we are on track to achieve our

financial goals and are increasing our revenue guidance for 2023

accordingly.”

Continued Mr. Krakaris, “We are delivering

strong financial results while expanding our product portfolio and

building out the foundations of our data and platform strategies.

We recently launched early access to Augmedix Go, our fully

automated scalable AI medical documentation solution, and we

continue to collaborate closely with HCA Healthcare to launch

Augmedix Go for the emergency room setting. We have also forged

strategic relationships with three innovative digital health

companies as part of our open network and platform strategy. These

vendor partners will be able to use our delivery platform through

application programming interfaces (APIs) so that they and our

health system partners can efficiently benefit and generate

incremental ROI from our structured data and bi-directional

communication channel to the point of care.”

“It is clearer than ever that there is a

tremendous opportunity in front of Augmedix,” concluded Mr.

Krakaris. “As healthcare systems lean into our ambient medical

documentation technology to reduce the burden on clinicians and

enhance operating efficiency, they are increasingly looking to

leverage our structured data for insights and our bi-directional

communication channel to deliver vital information that can

effectuate change at the point of care. We are confident that

addressing these expanded upstream and downstream requirements will

create greater value for our customers and ultimately, our

shareholders.”

Third Quarter 2023 Financial and

Business Highlights All comparisons, unless

otherwise noted, are to the three months ended September 30,

2022.

- Total revenue was $11.8 million, an increase of 50% compared to

$7.9 million.

- Dollar-based Net Revenue Retention was 157% for Health

Enterprise customers compared to 130% in the third quarter of 2022

and 148% in the second quarter of 2023.

- Average Clinicians in Service grew 47%.

- GAAP Gross Margin increased 390 basis points to 49.5% compared

to 45.7%.

- GAAP Operating Expenses were $10.2 million, compared to $9.0

million in the third quarter of 2022 and $10.0 million in the

second quarter of 2023.

- GAAP Net Loss narrowed to $4.4 million compared to $5.5

million.

- EBITDA losses declined to $3.7 million compared to $5.0

million. Adjusted EBITDA losses declined to $3.1 million compared

to $4.5 million, which excludes stock-based compensation in both

periods. Adjusted EBITDA losses again declined sequentially from

$3.6 million in the second quarter of 2023.

- Cash, cash equivalents, and restricted cash were $22.3 million

as of September 30, 2023, compared to $22.0 million as of December

31, 2022.

- The interest only period on our $20 million term loan with SVB

was lengthened from January 2024 to July 2024 as we exceeded the

financial requirements for extension during the third quarter.

- Launched the early access release of Augmedix Go for the

clinical setting, a clinician-controlled mobile app that uses

generative AI to create a fully automated draft medical note

instantaneously.

- Established strategic collaborations with three innovative

digital health companies – Myndshft, Ellipsis Health, and The

Sullivan Group – to enhance healthcare enterprise efficiency and

patient outcomes.

- Hosted the initial AI Advisory Council meeting with

distinguished academics, governance experts, and customers to

provide strategic guidance on Augmedix’s product roadmap on the

development and use of AI.

- Enhanced collaboration with HCA Healthcare and Google Cloud to

bring generative AI to hospitals.

- Achieved certified status by HITRUST for information security,

which validates Augmedix’s commitment to safeguarding sensitive

patient information data.

Non-GAAP operating expenses, EBITDA and Adjusted

EBITDA are a Non-GAAP financial measure. Please see “Non-GAAP

Financial Measures” below and the Reconciliation of the GAAP to

Non-GAAP Financial Measures table below.

2023 Revenue Guidance

Augmedix now expects approximately $44.5 million

of revenue in 2023.

Conference Call

Augmedix will host a conference call at 1:30

p.m. PT / 4:30 p.m. ET on Monday, November 6, 2023, to discuss its

third quarter 2023 financial results. The conference call can be

accessed by dialing +1-877-407-3982 for U.S. participants or

+1-201-493-6780 for international participants and referencing

conference ID #13741543. Interested parties may access a live and

archived webcast of the event on the “Investor Relations” section

of the Company’s website at: ir.augmedix.com.

Definition of Key Metrics

Dollar-Based Net Revenue Retention: We define a

"Health Enterprise" as a company or network of doctors that has at

least 50 clinicians currently employed or affiliated that could

utilize our services. Dollar-based net revenue retention is

determined as the revenue from Health Enterprises as of twelve

months prior to such period end as compared to revenue from these

same Health Enterprises as of the current period end, or current

period revenue. Current period revenue includes any expansion or

new products and is net of contraction or churn over the trailing

twelve months but excludes revenue from new Health Enterprises in

the current period. We believe growth in dollar-based net revenue

retention is a key indicator of the performance of our business as

it demonstrates our ability to increase revenue across our existing

customer base through expansion of users and products, as well as

our ability to retain existing customers.

Clinicians in Service: We define a clinician in

service as an individual doctor, nurse practitioner or other

healthcare professional using our services. We average the

month-end number of clinicians in service for all months in the

measurement period and the number of clinicians in service at the

end of the month immediately preceding the measurement

period. We believe growth in the number of clinicians in

service is an indicator of the performance of our business as it

demonstrates our ability to penetrate the market and grow our

business.

About Augmedix

Augmedix (Nasdaq: AUGX) delivers

industry-leading, ambient medical documentation and data solutions

to healthcare systems, physician practices, hospitals, and

telemedicine practitioners.

Augmedix is on a mission to help clinicians and

patients form a human connection by seamlessly integrating our

technology at the point of care. Augmedix’s proprietary platform

digitizes natural clinician-patient conversations, which are

converted into comprehensive medical notes and structured data in

real time. The company’s platform uses automatic speech

recognition, and natural language processing, including large

language models, to generate accurate and timely medical notes that

are transferred into the EHR.

Augmedix’s products relieve clinicians of

administrative burden, in turn, reducing burnout, increasing

clinician efficiency and improving patient access. Through

Augmedix’s proprietary platform and bi-directional communication

channel, Augmedix is ideally suited to serve as the vehicle for

change at the point of care.

Augmedix is headquartered in San Francisco, CA,

with offices around the world. To learn more, visit

www.augmedix.com.

Contact Information

Investors:Matt Chesler, CFAFNK IR(646)

809-2183augx@fnkir.cominvestors@augmedix.com

Media:Kaila GrafemanAugmedixpr@augmedix.com

Non-GAAP Financial Measures

To supplement our consolidated financial

statements, which are prepared and presented in accordance with

GAAP, we use the following non-GAAP financial measures: Non-GAAP

gross profit, Non-GAAP gross margin, Non-GAAP Operating Expenses,

EBITDA, and adjusted EBITDA. The presentation of this financial

information is not intended to be considered in isolation or as a

substitute for, or superior to, the financial information prepared

and presented in accordance with GAAP.

We use these non-GAAP financial measures for

financial and operational decision-making and as a means to

evaluate period-to-period comparisons. We believe that these

non-GAAP financial measures provide meaningful supplemental

information regarding our performance by excluding certain items

that may not be indicative of our recurring core business operating

results. We believe that both management and investors benefit from

referring to these non-GAAP financial measures in assessing our

performance and when planning, forecasting, and analyzing future

periods. These non-GAAP financial measures also facilitate

management's internal comparisons to our historical performance and

liquidity as well as comparisons to our competitors' operating

results. We believe these non-GAAP financial measures are useful to

investors both because (1) they allow for greater transparency with

respect to key metrics used by management in its financial and

operational decision-making and (2) they are used by our

institutional investors and the analyst community to help them

analyze the health of our business.

There are a number of limitations related to the

use of non-GAAP financial measures. We compensate for these

limitations by providing specific information regarding the GAAP

amounts excluded from these non-GAAP financial measures and

evaluating these non-GAAP financial measures together with their

relevant financial measures in accordance with GAAP.

For more information on the non-GAAP financial

measures, please see the Reconciliation of GAAP to non-GAAP

Financial Measures table in this press release. This accompanying

table includes details on the GAAP financial measures that are most

directly comparable to Non-GAAP financial measures and the related

reconciliations between these financial measures.

Forward-Looking Statements

This press release contains "forward-looking

statements" that involve a number of risks and uncertainties. Words

such as "believes," "may," "will," "estimates," "potential,"

"continues," "anticipates," "intends," "expects," "could," "would,"

"projects," "plans," "targets," “excited,” “optimistic,” and

variations of such words and similar expressions are intended to

identify forward-looking statements. Such forward-looking

statements include, without limitation, statements regarding the

Company’s expectations regarding revenues for the full fiscal year

2023 and the achievement of its financial goals; the ability of the

Company’s vendor and health system partners to efficiently benefit

from, and generate incremental ROI through the use of, the

Company’s structured data and bi-directional communication channel

to the point of care; the tremendous opportunity in front of

Augmedix; healthcare systems leaning into the Company’s ambient

medical documentation technology to reduce the burden on clinicians

and enhance operating efficiency; the increase in healthcare

systems looking to leverage the Company’s structured data for

insights and the Company’s bi-directional communication channel to

deliver vital information that can effectuate change at the point

of care; and the Company’s confidence that addressing these

expanded upstream and downstream requirements will lead to greater

value for its customers and ultimately its shareholders. Our actual

results could differ materially from those stated or implied in

forward-looking statements due to a number of factors, including

but not limited to, risks detailed in our most recent Form 10-K

filed with the Securities and Exchange Commission on April 17, 2023

as well as other documents that may be filed by us from time to

time with the Securities and Exchange Commission. In particular,

the following factors, among others, could cause results to differ

materially from those expressed or implied by such forward-looking

statements: our expectations regarding changes in regulatory

requirements; our ability to interoperate with the electronic

health record systems of our customers; our reliance on vendors;

our ability to attract and retain key personnel; the competition to

attract and retain remote documentation specialists; anticipated

trends, growth rates, and challenges in our business and in the

markets in which we operate; our ability to further penetrate our

existing customer base; our ability to protect and enforce our

intellectual property protection and the scope and duration of such

protection; developments and projections relating to our

competitors and our industry, including competing dictation

software providers, third-party, non-real time medical note

generators and real time medical note documentation services; and

the impact of current and future laws and regulations. Past

performance is not necessarily indicative of future results. The

forward-looking statements included in this press release represent

our views as of the date of this press release. We anticipate that

subsequent events and developments will cause our views to change.

We undertake no intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. These forward-looking statements should

not be relied upon as representing our views as of any date

subsequent to the date of this press release.

AUGMEDIX, INC.Condensed

Consolidated Statements of Operations(Unaudited,

in thousands except EPS and Average Clinicians in

Service)

| |

Three Months Ended |

| |

September 30, |

| |

(unaudited) |

|

|

|

2023 |

|

|

2022 |

|

| Revenue |

$ |

11,767 |

|

$ |

7,864 |

|

| Cost of revenue |

|

5,937 |

|

|

4,274 |

|

|

Gross profit |

|

5,830 |

|

|

3,590 |

|

| Operating

Expenses |

|

|

|

General and administrative |

|

4,568 |

|

|

4,136 |

|

|

Sales and marketing |

|

2,729 |

|

|

2,304 |

|

|

Research and development |

|

2,936 |

|

|

2,608 |

|

|

Total operating expenses |

|

10,233 |

|

|

9,048 |

|

| Loss from

operations |

|

(4,403 |

) |

|

(5,458 |

) |

| |

|

|

|

Other income (expense), net |

|

(4 |

) |

|

(32 |

) |

| Net loss |

$ |

(4,407 |

) |

$ |

(5,490 |

) |

| |

|

|

| Weighted average common stock

outstanding |

|

45,521 |

|

|

37,427 |

|

| |

|

|

| Earnings Per Share |

$ |

(0.10 |

) |

$ |

(0.15 |

) |

| |

|

|

| Average Clinicians in Service

(CIS) |

|

1,650 |

|

|

1,121 |

|

| |

AUGMEDIX,

INC. Condensed Consolidated Balance

Sheet (Unaudited, in

thousands)

| |

September 30, |

December 31, |

| |

2023 |

2022 |

|

Assets |

|

|

Cash, cash equivalents, and restricted cash |

$ |

22,286 |

$ |

21,988 |

| Accounts receivables,

net |

|

9,446 |

|

6,354 |

| Other assets |

|

9,101 |

|

5,299 |

| Total assets |

|

40,833 |

|

33,641 |

| |

|

|

| Liabilities &

Stockholders’ Equity |

|

|

| Liabilities |

|

|

| Accounts payable |

$ |

1,816 |

$ |

1,563 |

| Deferred revenue |

|

7,993 |

|

7,254 |

| Loan payable |

|

20,108 |

|

15,134 |

| Other liabilities |

|

10,182 |

|

8,224 |

| Total liabilities |

$ |

40,099 |

$ |

32,175 |

| Stockholders’

equity |

$ |

734 |

$ |

1,466 |

| Total liabilities &

stockholders’ equity |

$ |

40,833 |

$ |

33,641 |

| |

AUGMEDIX,

INC. Condensed Consolidated Statement of Cash

Flows (Unaudited, in

thousands)

|

|

Nine Months Ended |

|

|

September 30, |

|

|

2023 |

2022 |

|

Cash flows from operating activities |

$ |

(14,468 |

) |

$ |

(12,387 |

) |

| Cash flows from investing

activities |

|

(1,912 |

) |

|

(816 |

) |

| Cash flows from financing

activities |

|

16,989 |

|

|

(1,244 |

) |

| Effect of exchange rate

changes on cash and restricted cash |

|

(311 |

) |

|

(143 |

) |

| Net decrease in

cash |

$ |

298 |

|

$ |

(14,590 |

) |

| Cash, restricted cash, and

cash equivalents at the beginning of the period |

$ |

21,988 |

|

$ |

41,587 |

|

| Cash, restricted cash, and

cash equivalents at the end of the period |

$ |

22,286 |

|

$ |

26,997 |

|

| |

AUGMEDIX,

INC. Reconciliation of GAAP to Non-GAAP

Financial Measures (Unaudited, in

thousands)

| |

Three Months Ended |

| |

September 30, |

| |

(unaudited) |

| Stock Based

Compensation Expense |

2023 |

2022 |

|

Cost of revenue |

$ |

33 |

|

$ |

22 |

|

| General and

administrative |

|

425 |

|

|

320 |

|

| Sales and marketing |

|

57 |

|

|

50 |

|

| Research and

development |

|

122 |

|

|

85 |

|

| Total stock-based

compensation expense |

$ |

637 |

|

$ |

477 |

|

| |

|

|

| Net

loss |

$ |

(4,407 |

) |

$ |

(5,490 |

) |

| Interest |

|

355 |

|

|

257 |

|

| Tax |

|

84 |

|

|

19 |

|

| Depreciation |

|

252 |

|

|

217 |

|

|

EBITDA |

$ |

(3,716 |

) |

$ |

(4,997 |

) |

| Add: Stock-based

compensation |

|

637 |

|

|

477 |

|

| Adjusted

EBITDA |

$ |

(3,079 |

) |

$ |

(4,520 |

) |

| |

|

|

| GAAP Cost of

revenue |

$ |

5,937 |

|

$ |

4,274 |

|

| Less: Stock-based

compensation |

|

33 |

|

|

22 |

|

| Non-GAAP cost of

revenue |

$ |

5,904 |

|

$ |

4,252 |

|

| |

|

|

| Non-GAAP Gross

Profit |

$ |

5,863 |

|

$ |

3,612 |

|

| Non-GAAP Gross

Margin |

|

49.8 |

% |

|

45.9 |

% |

| |

|

|

| GAAP Operating

expenses |

$ |

10,233 |

|

$ |

9,048 |

|

| Less: Stock-based

compensation |

|

604 |

|

|

455 |

|

| Non-GAAP operating

expenses |

$ |

9,629 |

|

$ |

8,593 |

|

| |

|

|

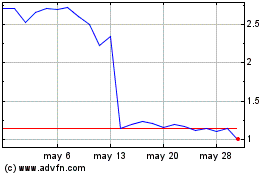

Augmedix (NASDAQ:AUGX)

Gráfica de Acción Histórica

De Oct 2024 a Oct 2024

Augmedix (NASDAQ:AUGX)

Gráfica de Acción Histórica

De Oct 2023 a Oct 2024