Solid Second Quarter Revenue Growth

Continued Progress to Optimize Capital

Structure and Enhance Share Liquidity

Expansive Strategic Approach Targeting

Therapeutic Wellness and Men’s Health Categories

Biote (NASDAQ: BTMD), a leading solutions provider in preventive

health care through the delivery of personalized hormone therapy,

today announced financial results for the second quarter ended June

30, 2023.

Second Quarter 2023 Financial

Highlights

(All financial result comparisons made are against the prior

year period)

- Revenue of $49.3 million, a 19.1% increase

- Gross profit margin of 67.9%, a 60-basis point increase

- Net loss of $(13.1) million and GAAP loss per share of $(0.25),

compared to a net loss of $(21.3) million and GAAP loss per share

of $(0.34)

- Adjusted EBITDA of $14.5 million, a 10.6% increase

“Biote continued to broaden awareness of the benefits of hormone

replacement therapy while delivering solid financial performance in

our second quarter,” said Terry Weber, Biote’s Chief Executive

Officer. “Revenue grew more than 19% over the prior-year period,

and we achieved an Adjusted EBITDA margin of 29.5% even as we

invested in strengthening our capabilities. During the quarter, we

continued to optimize our capital structure by completing a warrant

exchange offer and consent solicitation. In addition, another

secondary offering of our Class A common stock was completed during

the quarter, further enhancing the liquidity of our publicly traded

shares without diluting current holders.”

Ms. Weber continued, “Recently we formalized our commitment to

men’s hormone health with the launch of our new Men’s Health

division. We are excited about the long-term opportunity in this

large and growing addressable market, as more men seek safe and

effective treatments regardless of age.

“To more effectively address the growing opportunities in

today’s dynamic preventative health market, we continue to expand

our strategic approach, encompassing a broader range of hormone and

wellness therapies. For example, we are currently trialing an

expanded suite of requested products from our top providers in

response to growing patient demand for wellness products that are

complementary to our existing therapies. Ultimately, we aim to

become a leading platform provider of evidence-based therapeutic

wellness solutions.”

2023 Second Quarter Financial Review

(All financial result comparisons made are against the prior

year period unless otherwise noted)

Revenue for the second quarter of 2023 was $49.3 million, an

increase of 19.1% from $41.4 million for the second quarter of

2022. The increase was driven by procedure revenue growth of 9.8%

and dietary supplement revenue growth of 52.8%. Second quarter

dietary supplement revenue benefited from a successful seasonal

promotion for Biote practitioners, as well as a continued positive

response to our new direct-to-patient distribution channel.

Gross profit margin for the second quarter of 2023 was 67.9%

compared to 67.3% for the second quarter of 2022. The increase in

gross profit margin reflected continued effective cost

management.

Operating income for the second quarter of 2023 was $7.7

million, compared to a loss of $(85.6) million for the second

quarter of 2022. Operating income in the second quarter of 2023

reflected growth in revenue and improved gross profit, partially

offset by increased personnel and other expenses to build our

infrastructure. Operating loss in the second quarter of 2022 was

mainly due to transaction-related expenses of $18.8 million and

share-based compensation of $79.3 million at time of going

public.

Net loss for the second quarter of 2023 was $(13.1) million, or

$(0.25) per share, compared to net loss of $(21.3) million, or

$(0.34) per share, for the second quarter of 2022. Net loss for the

second quarter of 2023 primarily reflected a net change in the fair

value adjustments to warrant and earnout liabilities of $18.2

million. Net loss for the second quarter of 2022 was impacted by

several transaction-related items.

Adjusted EBITDA for the second quarter of 2023 was $14.5

million, with an Adjusted EBITDA Margin of 29.5%, compared to

Adjusted EBITDA of $13.1 million, with an Adjusted EBITDA Margin of

31.8%, for the second quarter of 2022. The increase in Adjusted

EBITDA was driven by the growth in revenue and improved gross

profit, partially offset by increased operating expenses to support

the Company’s growth and expansion.1

2023 Financial Outlook

“Biote continues to drive profitable growth as we strengthen our

capabilities, broaden our suite of product offerings and focus on

therapeutic wellness solutions. Due to temporary inefficiencies

resulting from the realignment and expansion of our sales

geographies and evolving market dynamics, we anticipate a more

moderate pace of growth in the second half of 2023 as compared to

our prior forecast. As a result, we now forecast 2023 revenue and

Adjusted EBITDA will likely be toward the lower end of our guidance

range,” concluded Ms. Weber.

_____________________________

1 Please see the “Reconciliations of

Adjusted EBITDA” table below for a reconciliation of Adjusted

EBITDA to the most directly comparable GAAP measure, net income,

and additional information about Adjusted EBITDA.

($ in millions)

2023

Guidance Range

Revenue

$190-$200

Adjusted EBITDA

$56-$60

Conference Call:

Terry Weber, Chief Executive Officer, and the Company’s

management will host a conference call to review these results and

provide a business update beginning at 8:30 a.m. ET on Friday,

August 11, 2023. To access the conference call by telephone, please

dial (844) 481-2820 (U.S toll-free) or (412) 317-0679

(International). To access a live webcast of the call, interested

parties may use the following link: Biote Q2 2023 Earnings Webcast.

A replay of the webcast will be available on the Events page of the

Biote Investor Relations website, at ir.biote.com, shortly after

the event concludes.

Discussion of Non-GAAP Financial Measures

To provide investors with additional information regarding our

financial results, Biote has disclosed Adjusted EBITDA, a non-GAAP

financial measure that it calculates as net income before interest,

taxes and depreciation and amortization, further adjusted to

exclude stock-based compensation, transaction-related expenses,

fair value adjustments to certain equity instruments classified as

liabilities and other non-operating costs. Below we have provided a

reconciliation of net income (the most directly comparable GAAP

financial measure) to Adjusted EBITDA.

We present Adjusted EBITDA because it is a key measure used by

our management to evaluate our operating performance, generate

future operating plans and determine payments under compensation

programs. Accordingly, we believe that Adjusted EBITDA provides

useful information to investors and others in understanding and

evaluating our operating results in the same manner as our

management.

Adjusted EBITDA has limitations as an analytical tool, and you

should not consider it in isolation or as a substitute for analysis

of our results as reported under GAAP. Some of these limitations

are as follows:

- Although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized may have to be replaced

in the future, and Adjusted EBITDA does not reflect cash capital

expenditure requirements for such replacements of our assets;

- Adjusted EBITDA does not reflect changes in, or cash

requirements for, our working capital needs; and

- Adjusted EBITDA does not reflect tax payments that may

represent a reduction in cash available to us.

In addition, Adjusted EBITDA is subject to inherent limitations

as it reflects the exercise of judgment by Biote’s management about

which expenses are excluded or included. A reconciliation is

provided in the financial statement tables included below in this

press release for each non-GAAP financial measure to the most

directly comparable financial measure stated in accordance with

GAAP. Because of these limitations, you should consider Adjusted

EBITDA alongside other financial performance measures, including

net income and our other GAAP results.

About Biote

Biote is transforming healthy aging through innovative,

personalized hormone optimization therapies delivered by

Biote-certified medical providers. Biote trains practitioners how

to identify and treat early indicators of hormone-related aging

conditions, an underserved $7 billion global market, providing

affordable symptom relief for patients and driving clinic success

for practitioners.

Forward-Looking Statements

Except for historical information contained herein, this press

release contains certain forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

Some of the forward-looking statements can be identified by the use

of forward-looking words. Statements that are not historical in

nature, including the words “may,” “can,” “should,” “will,”

“estimate,” “plan,” “project,” “forecast,” “intend,” “expect,”

“hope,” “anticipate,” “believe,” “seek,” “target,” “continue,”

“could,” “might,” “ongoing,” “potential,” “predict,” “would” and

other similar expressions, are intended to identify forward-looking

statements. Forward-looking statements are predictions, projections

and other statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks

and uncertainties. Many factors could cause actual results or

developments to differ materially from those expressed or implied

by such forward-looking statements, including but not limited to:

the success of our dietary supplements to attain significant market

acceptance among clinics, practitioners and their patients; our

customers’ reliance on certain third parties to support the

manufacturing of bio-identical hormones for prescribers; our and

our customers’ sensitivity to regulatory, economic, environmental

and competitive conditions in certain geographic regions; our

ability to increase the use by practitioners and clinics of the

Biote Method at the rate that we anticipate or at all; our ability

to grow our business; the significant competition we face in our

industry; our limited operating history; our ability to protect our

intellectual property; the heavy regulatory oversight in our

industry; changes in applicable laws or regulations; the inability

to profitably expand in existing markets and into new markets; the

possibility that we may be adversely impacted by other economic,

business and/or competitive factors, including recent bank

failures; and future exchange and interest rates. The foregoing

list of factors is not exhaustive. You should carefully consider

the foregoing factors and the other risks and uncertainties

described in the “Risk Factors” section of Biote’s Quarterly Report

on Form 10-Q for the quarter ended June 30, 2023, filed with the

SEC on August 11, 2023. These filings identify and address other

important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the

forward-looking statements. Forward-looking statements speak only

as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and Biote assumes no

obligation and does not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise. Biote does not give any assurance that

it will achieve its expectations.

Financial Tables

Biote Corp.

Consolidated Balance Sheets

(In Thousands)

(Unaudited)

June 30, December 31,

2023

2022

Assets Current assets: Cash and cash equivalents

$

68,480

$

79,231

Short-term investment

20,000

—

Accounts receivable, net

8,336

6,948

Inventory, net

7,396

11,183

Other current assets

7,898

3,816

Total current assets

112,110

101,178

Property and equipment, net

1,062

1,504

Capitalized software, net

5,733

5,073

Operating lease right-of-use assets

1,915

2,052

Deferred tax asset

18,232

1,838

Total assets

$

139,052

$

111,645

Liabilities and Stockholders’ Deficit Current

liabilities: Accounts payable

$

7,468

$

4,112

Accrued expenses

5,426

6,274

Term loan, current

6,250

6,250

Deferred revenue, current

2,310

1,965

Operating lease liabilities, current

280

165

Total current liabilities

21,734

18,766

Term loan, net of current portion

109,352

112,086

Deferred revenue, net of current portion

1,071

926

Operating lease liabilities, net of current portion

1,781

1,927

TRA liability

14,432

—

Warrant liability

—

4,104

Earnout liability

63,920

32,110

Total liabilities

212,290

169,919

Commitments and contingencies (See Note 18) Stockholders’ Deficit

Preferred stock, $0.0001 par value, 10,000,000 shares authorized;

no shares issued or outstanding as of June 30, 2023 and December

31, 2022

—

—

Class A common stock, $0.0001 par value, 600,000,000 shares

authorized; 29,310,636 and 11,242,887 shares issued, 27,723,136 and

9,655,387 shares outstanding as of June 30, 2023 and December 31,

2022, respectively

3

1

Class B common stock, $0.0001 par value, 8,000,000 shares

authorized; no shares issued or outstanding as of June 30, 2023 and

December 31, 2022

—

—

Class V voting stock, $0.0001 par value, 100,000,000 shares

authorized; 44,819,066 and 58,565,824 shares issued, 34,819,066 and

48,565,824 shares outstanding as of June 30, 2023 and December 31,

2022, respectively

3

5

Additional paid-in capital

—

—

Accumulated deficit

(46,393

)

(44,460

)

Accumulated other comprehensive loss

(18

)

(5

)

biote Corp.’s stockholders’ deficit

(46,405

)

(44,459

)

Noncontrolling interest

(26,833

)

(13,815

)

Total stockholders’ deficit

(73,238

)

(58,274

)

Total liabilities and stockholders’ deficit

$

139,052

$

111,645

Biote Corp.

Consolidated Statements of

Operations

(In Thousands, except per share

values)

(Unaudited)

Three Months Ended June 30, Six Months Ended June

30,

2023

2022

2023

2022

Revenue: Product revenue

$

48,652

$

40,789

$

92,807

$

77,547

Service revenue

605

570

1,293

955

Total revenue

49,257

41,359

94,100

78,502

Cost of revenue (excluding depreciation and amortization included

in selling, general and administrative, below) Cost of products

14,992

12,984

28,019

24,641

Cost of services

836

553

1,686

1,173

Cost of revenue

15,828

13,537

29,705

25,814

Selling, general and administrative

25,760

113,425

48,845

128,528

Income (loss) from operations

7,669

(85,603

)

15,550

(75,840

)

Other income (expense), net: Interest expense

(2,547

)

(794

)

(4,973

)

(1,153

)

Gain (loss) from change in fair value of warrant liability

(11,793

)

3,399

(13,411

)

3,399

Gain (loss) from change in fair value of earnout liability

(6,400

)

61,680

(31,810

)

61,680

Loss from extinguishment of debt

—

(445

)

—

(445

)

Other income

898

88

1,671

98

Total other income (expense), net

(19,842

)

63,928

(48,523

)

63,579

Loss before provision for income taxes

(12,173

)

(21,675

)

(32,973

)

(12,261

)

Income tax expense (benefit)

922

(346

)

1,552

(282

)

Net loss

(13,095

)

(21,329

)

(34,525

)

(11,979

)

Less: Net loss attributable to noncontrolling interest

(7,952

)

(18,723

)

(22,577

)

(9,373

)

Net loss attributable to biote Corp. stockholders

(5,143

)

(2,606

)

(11,948

)

(2,606

)

Other comprehensive income (loss): Foreign currency

translation adjustments

—

(5

)

—

1

Other comprehensive income (loss)

—

(5

)

—

1

Comprehensive loss

$

(13,095

)

$

(21,334

)

$

(34,525

)

$

(11,978

)

Net loss per common share Basic

$

(0.25

)

$

(0.34

)

$

(0.62

)

$

(0.34

)

Diluted

$

(0.25

)

$

(0.34

)

$

(0.62

)

$

(0.34

)

Weighted average common shares outstanding Basic

20,704,866

7,574,271

19,153,574

7,574,271

Diluted

20,704,866

7,574,271

19,153,574

7,574,271

Biote Corp.

Consolidated Statements of Cash

Flows

(In Thousands)

(Unaudited)

Six Months Ended June 30,

2023

2022

Operating Activities Net loss

$

(34,525

)

$

(11,979

)

Adjustments to reconcile net loss to net cash provided by (used in)

operating activities: Depreciation and amortization

1,068

1,064

Bad debt expense

766

60

Amortization of debt issuance costs

391

188

Provision for obsolete inventory

(155

)

20

Non-cash lease expense

137

116

Shares issued in settlement of litigation

1,199

—

Non-cash sponsor share transfers

—

7,216

Share-based compensation expense

4,817

79,270

(Gain) loss from change in fair value of warrant liability

13,411

(3,399

)

(Gain) loss from change in fair value of earnout liability

31,810

(61,680

)

Loss from extinguishment of debt

—

445

Deferred income taxes

236

(598

)

Changes in operating assets and liabilities: Accounts receivable

(2,154

)

(1,652

)

Inventory

3,942

(217

)

Other current assets

(4,082

)

(5,407

)

Accounts payable

3,295

3,839

Deferred revenue

490

201

Accrued expenses

(848

)

(28,965

)

Operating lease liabilities

(31

)

(123

)

Net cash provided by (used in) operating activities

19,767

(21,601

)

Investing Activities Purchases of short-term investments

(20,000

)

—

Purchases of property and equipment

(67

)

(328

)

Purchases of capitalized software

(1,158

)

(812

)

Net cash used in investing activities

(21,225

)

(1,140

)

Financing Activities Proceeds from the business combination

—

12,282

Principal repayments on term loan

(3,125

)

(1,250

)

Borrowings on term loan

—

125,000

Extinguishment of Bank of America term loan

—

(36,250

)

Debt issuance costs

—

(4,036

)

Proceeds from exercise of stock options

420

—

Distributions

(6,588

)

(8,707

)

Capitalized transaction costs

—

(8,341

)

Net cash provided by (used in) financing activities

(9,293

)

78,698

Effect of exchange rate changes on cash and cash equivalents

—

2

Net increase (decrease) in cash and cash equivalents

(10,751

)

55,959

Cash and cash equivalents at beginning of period

79,231

26,766

Cash and cash equivalents at end of period

$

68,480

$

82,725

Supplemental Disclosure of Cash Flow Information Cash paid for

interest

$

4,581

$

982

Cash paid for income taxes

4,472

171

Non-cash investing and financing activities Capital expenditures

and capitalized software included in accounts payable

$

61

$

126

Biote Corp.

Reconciliation of Adjusted EBITDA

to Net (Loss) Income

(In Thousands)

(Unaudited)

Three Months Ended Six Months Ended June

30, June 30,

2023

2022

2023

2022

Net loss

$

(13,095

)

$

(21,329

)

$

(34,525

)

$

(11,979

)

Interest expense

2,547

794

4,973

1,153

Income tax expense (benefit)

922

(346

)

1,552

(282

)

Depreciation and amortization

530

563

1,068

1,064

Loss from extinguishment of debt

—

445

—

445

Other non-operating items

(898

)

(89

)

(1,671

)

(98

)

Share-based compensation expense

2,647

79,270

`

4,817

79,270

Transaction-related expenses

—

18,769

—

19,477

Litigation and other

3,692

150

6,210

841

(Gain) loss from change in fair value of warrant liability

11,793

(3,399

)

13,411

(3,399

)

(Gain) loss from change in fair value of earnout liability

6,400

(61,680

)

31,810

(61,680

)

Adjusted EBITDA

$

14,538

$

13,148

$

27,645

$

24,812

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230810999398/en/

Investor Relations:

Eric Prouty AdvisIRy Partners eric.prouty@advisiry.com

Media: Press@biote.com

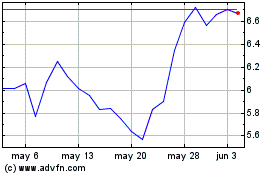

Biote (NASDAQ:BTMD)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

Biote (NASDAQ:BTMD)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025