Cal-Maine Foods, Inc. (NASDAQ: CALM) (“Cal-Maine Foods” or the

“Company”), the largest producer and distributor of fresh shell

eggs in the United States, today reported results for the first

quarter of fiscal 2025 (thirteen weeks) ended August 31, 2024.

First Quarter Fiscal 2025 Highlights

- Quarterly net sales of $785.9 million

- Quarterly net income of $150.0 million, or $3.06 per diluted

share

- Quarterly record for total dozens sold and specialty dozens

sold

- Cash dividend of approximately $50.0 million, or $1.02 per

share, pursuant to the Company’s established dividend policy

Overview

Sherman Miller, president and chief executive officer of

Cal-Maine Foods, stated, “Our financial and operating results for

the first quarter mark a strong start to fiscal 2025 for Cal-Maine

Foods. These results reflect favorable demand for shell eggs during

most of the quarter and significantly higher market prices compared

with the first quarter last year. At the same time, the national

egg supply has declined due to the recent outbreaks of highly

pathogenic avian influenza (“HPAI”). As of September 1, 2024, the

total U.S. hen population fell approximately 4.5% below the

five-year average to 307.6 million layers. We have worked hard to

increase our production and purchase more eggs from outside

suppliers, and our team did an outstanding job bringing more eggs

to the market despite this low-supply environment. Our higher

volumes and sales were supported by the additional production

capacity from recent acquisitions as well as consistent organic

growth. Our operations ran well as we continued to extend our

market reach and supply the demands of our valued customers.

“We believe that today’s consumers are looking for affordable

and nutritious protein options and that our shell eggs and egg

products meet that need. In addition, our ability to offer a

diverse product mix has been a distinct competitive advantage for

Cal-Maine Foods. We strive to meet evolving consumer demand and

provide choices that include conventional, cage-free, organic,

brown, free-range, pasture-raised and nutritionally enhanced eggs.

We have also expanded our product portfolio to include value-added

egg products through our previous investment in Meadowcreek Foods,

LLC for hard-cooked eggs and our recent strategic investment in

Crepini Foods LLC (“Crepini”), a new venture offering egg products

and prepared foods. We have a unique opportunity to leverage the

established Crepini brand of quality products, including egg wraps,

protein pancakes, crepes and wrap-ups, and extend our market reach

to major retailers across the country. We believe there are

significant opportunities to use our scale and offer additional

choices through value-added egg products to our established

customer base.

“Subsequent to the end of the first quarter of fiscal 2025,

Hurricane Helene made landfall in the southeastern United States,

including areas where Cal-Maine Foods has operations and contract

farmers. We are still evaluating the impact of the storm on our

people, birds, facilities and operations; however, at this time, we

believe that all of our employees and contractors are safe and that

any loss of company-owned production assets is minimal and not

likely to be material. We are extremely proud of our operating

teams in the affected areas as they executed our contingency plans

for these severe weather events. As always, our top priority is the

safety of our employees and the welfare of the birds under our

care. We continue to do all we can to serve our valued customers

and expect any service disruption to be minimal. We are deeply

saddened by the destruction in the affected communities and are

grateful for the heroic work of first responders who are dealing

with the aftermath of the storm as conditions allow,” added

Miller.

Sales Performance & Operating Highlights

Max Bowman, vice president and chief financial officer of

Cal-Maine Foods, added, “For the first quarter of fiscal 2025, our

net sales were $785.9 million compared with $459.3 million for the

same period last year. The higher sales were primarily driven by an

increase in the net average selling price of shell eggs as well as

an increase in total dozens sold.

“For the first fiscal quarter, we sold 310.0 million dozens

shell eggs compared with 273.1 million dozens for the first quarter

of fiscal 2024. Sales of conventional eggs totaled 200.0 million

dozens, compared with 181.5 million dozens for the prior-year

period, an increase of 10.2%. Specialty egg volumes were 20.1%

higher with 110.0 million dozens sold for the first quarter of

fiscal 2025 compared with 91.6 million dozens sold for the first

quarter of fiscal 2024.

“Net income attributable to Cal-Maine Foods for the first

quarter of fiscal 2025 was $150.0 million, or $3.06 per diluted

share, compared with $926,000, or $0.02 per diluted share, for the

first quarter of fiscal 2024.

“Overall, our first quarter farm production costs per dozen were

11.7% lower compared to the prior-year period, primarily due to

more favorable commodity pricing for key feed ingredients. For the

first quarter of fiscal 2025, feed costs per dozen were down 17.3%

compared with the first quarter of fiscal 2024. Our egg purchases

and other (including change in inventory) costs increased

significantly quarter-over-quarter, primarily due to higher shell

egg prices as well as an increase in dozens purchased due to the

loss of production caused by the HPAI outbreaks at our facilities,

described below.

“Current indications for corn supply project an overall better

stocks-to-use ratio, implying more favorable prices in the near

term. However, as we continue to face uncertain external forces

including weather patterns and global supply chain disruptions,

price volatility could remain,” said Bowman.

13 Weeks Ended

August 31, 2024

September 2, 2023

Dozen Eggs Sold (000)

309,979

273,126

Conventional Dozen Eggs Sold (000)

199,989

181,530

Specialty Dozen Eggs Sold (000)

109,990

91,596

Dozen Eggs Produced (000)

266,839

250,365

% Specialty Sales (dozen)

35.5

%

33.5

%

% Specialty Sales (dollars)

34.2

%

47.7

%

Net Average Selling Price (per dozen)

$

2.392

$

1.589

Net Average Selling Price Conventional

Eggs (per dozen)

$

2.424

$

1.241

Net Average Selling Price Specialty Eggs

(per dozen)

$

2.335

$

2.278

Feed Cost (per dozen)

$

0.494

$

0.597

HPAI & Table Egg Supply Outlook

Outbreaks of HPAI have continued to occur in U.S. poultry

flocks. From the resurgence beginning in November 2023 until the

last reported case in commercial layer hens in July 2024,

approximately 33.1 million commercial laying hens and pullets have

been depopulated.

During the third and fourth quarters of fiscal 2024, Cal-Maine

Foods experienced HPAI outbreaks within Company facilities located

in Kansas and Texas, resulting in total depopulation of

approximately 3.1 million laying hens and 577,000 pullets. Both

locations have been cleared by the USDA to resume operations.

Repopulation began during first fiscal quarter 2025 and is expected

to be completed before calendar year end.

The Company remains dedicated to robust biosecurity programs

across its locations; however, no farm is immune from HPAI. HPAI is

currently widespread in the wild bird population worldwide. The

extent of possible future outbreaks, with heightened risk during

the migration seasons, and more recent HPAI events, which have been

directly linked to dairy cattle operations, cannot be predicted.

According to the U.S. Centers for Disease Control and Prevention,

the human health risk to the U.S. public from the HPAI virus is

considered to be low. Also, according to the USDA, HPAI cannot be

transmitted through safely handled and properly cooked eggs. There

is no known risk related to HPAI associated with eggs that are

currently in the market and no eggs have been recalled.

Looking Ahead

Miller added, “We are proud of our ability to consistently

execute our growth strategy in a dynamic environment with favorable

results. We commend our dedicated managers and employees whose

shared commitment to operational excellence and responsible and

sustainable production have distinguished Cal-Maine Foods in the

marketplace. As the largest producer and distributor of fresh shell

eggs in the U.S., we are mindful of our critical role in supporting

the nation’s food supply with a differentiated product mix. As

such, we continue to expand our capacity, including cage-free and

other specialty egg production, through investments in innovative,

scale-driven products and facilities. We have also identified

opportunities to enhance our product portfolio through strategic

acquisitions and joint ventures. We are fortunate to have a strong

balance sheet and a disciplined capital allocation strategy that

supports our growth objectives. Above all, we are focused on

meeting the needs of our valued customers with quality products and

outstanding support and service. We look forward to the

opportunities ahead for Cal-Maine Foods.”

Dividend Payment

For the fourth quarter of fiscal 2024, Cal-Maine Foods will pay

a cash dividend of approximately $1.02 per share to holders of its

Common Stock and Class A Common Stock. Pursuant to Cal-Maine Foods’

variable dividend policy, for each quarter in which the Company

reports net income, the Company pays a cash dividend to

shareholders in an amount equal to one-third of such quarterly

income. Following a quarter for which the Company does not report

net income, the Company will not pay a dividend with respect to

that quarter or for a subsequent profitable quarter until the

Company is profitable on a cumulative basis computed from the date

of the most recent quarter for which a dividend was paid. The

amount paid per share will vary based on the number of outstanding

shares on the record date. The dividend is payable on November 14,

2024, to holders of record on October 30, 2024.

About Cal-Maine Foods

Cal-Maine Foods, Inc. is primarily engaged in the production,

grading, packaging, marketing and distribution of fresh shell eggs,

including conventional, cage-free, organic, brown, free-range,

pasture-raised and nutritionally enhanced eggs. The Company, which

is headquartered in Ridgeland, Mississippi, is the largest producer

and distributor of fresh shell eggs in the nation and sells most of

its shell eggs throughout the majority of the United States.

Forward Looking Statements

Statements contained in this press release that are not

historical facts are forward-looking statements as that term is

defined in the Private Securities Litigation Reform Act of 1995.

The forward-looking statements are based on management’s current

intent, belief, expectations, estimates and projections regarding

our company and our industry. These statements are not guarantees

of future performance and involve risks, uncertainties, assumptions

and other factors that are difficult to predict and may be beyond

our control. The factors that could cause actual results to differ

materially from those projected in the forward-looking statements

include, among others, (i) the risk factors set forth in the

Company’s SEC filings (including its Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K),

(ii) the risks and hazards inherent in the shell egg business

(including disease, pests, weather conditions and potential for

recall), including but not limited to the current outbreak of

highly pathogenic avian influenza affecting poultry in the U.S.,

Canada and other countries that was first detected in commercial

flocks in the U.S. in February 2022 and that first impacted our

flocks in December 2023, (iii) changes in the demand for and market

prices of shell eggs and feed costs, (iv) our ability to predict

and meet demand for cage-free and other specialty eggs, (v) risks,

changes or obligations that could result from our recent or future

acquisitions of new flocks or businesses and risks or changes that

may cause conditions to completing a pending acquisition not to be

met, (vi) risks relating to changes in inflation and interest

rates, (vii) our ability to retain existing customers, acquire new

customers and grow our product mix, (viii) adverse results in

pending litigation matters, and (ix) global instability, including

as a result of the war in Ukraine, the conflicts in Israel and

surrounding areas and attacks on shipping in the Red Sea. SEC

filings may be obtained from the SEC or the Company’s website,

www.calmainefoods.com. Readers are cautioned not to place undue

reliance on forward-looking statements because, while we believe

the assumptions on which the forward-looking statements are based

are reasonable, there can be no assurance that these

forward-looking statements will prove to be accurate. Further, the

forward-looking statements included herein are only made as of the

respective dates thereof, or if no date is stated, as of the date

hereof. Except as otherwise required by law, we disclaim any intent

or obligation to publicly update these forward-looking statements,

whether as a result of new information, future events or

otherwise.

CAL-MAINE FOODS, INC. AND

SUBSIDIARIES

FINANCIAL HIGHLIGHTS

(Unaudited)

(In thousands, except per share

amounts)

SUMMARY STATEMENTS OF

INCOME

13 Weeks Ended

August 31, 2024

September 2, 2023

Net sales

$

785,871

$

459,344

Cost of sales

538,653

413,911

Gross profit

247,218

45,433

Selling, general and administrative

61,932

52,246

Loss on involuntary conversions

146

-

Gain on disposal of fixed assets

(1,817

)

(56

)

Operating income (loss)

186,957

(6,757

)

Other income, net

10,996

7,490

Income before income taxes

197,953

733

Income tax expense

48,363

322

Net income

149,590

411

Less: Loss attributable to noncontrolling

interest

(386

)

(515

)

Net income attributable to Cal-Maine

Foods, Inc.

$

149,976

$

926

Net income per common share:

Basic

$

3.08

$

0.02

Diluted

$

3.06

$

0.02

Weighted average shares outstanding:

Basic

48,761

48,690

Diluted

48,932

48,840

CAL-MAINE FOODS, INC. AND

SUBSIDIARIES

FINANCIAL HIGHLIGHTS

(Unaudited)

(In thousands)

SUMMARY BALANCE SHEETS

August 31, 2024

June 3, 2023

ASSETS

Cash and short-term investments

$

753,590

$

812,377

Receivables, net

282,551

162,442

Inventories, net

293,182

261,782

Prepaid expenses and other current

assets

14,156

5,238

Current assets

1,343,479

1,241,839

Property, plant and equipment, net

960,070

857,234

Other noncurrent assets

86,459

85,688

Total assets

$

2,390,008

$

2,184,761

LIABILITIES AND STOCKHOLDERS' EQUITY

Accounts payable and accrued expenses

$

275,444

$

189,983

Dividends payable

49,971

37,760

Current liabilities

325,415

227,743

Deferred income taxes and other

liabilities

165,530

159,975

Stockholders' equity

1,899,063

1,797,043

Total liabilities and stockholders'

equity

$

2,390,008

$

2,184,761

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241001974301/en/

Sherman Miller, President and CEO Max P. Bowman, Vice President

and CFO (601) 948-6813

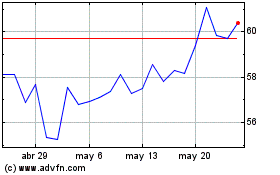

Cal Maine Foods (NASDAQ:CALM)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Cal Maine Foods (NASDAQ:CALM)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024