- Net rental income up +4.0% like-for-like versus first

quarter 2023

- Excellent commercial momentum: 210 leases signed in the

first quarter (+19%), positive reversion (+3.4%)

- Financial occupancy at 95.9% (versus 96,0% at end-March

2023)

- Retailer sales up +2.0% and footfall up +0.9% versus first

quarter 2023

- Launch of solar energy project in Spain

- Confirmation of guidance: Recurring earnings per share of at

least €1.63 in 2024 (growth of at least 2% versus 2023)

- Closing of the acquisition of Galimmo expected this

summer

- Dividend of €1.20 per share, in cash, for 2023 (versus €1.17

for 2022)

Regulatory News:

Marie Cheval, Chair and Chief Executive Officer of Carmila

(Paris:CARM) commented: « First quarter results once again show

the appeal of Carmila centres for retailers and their customers. In

2024 Carmila continues to roll out its growth strategy, with the

acquisition of Galimmo, the pivot of the merchandising mix and

transformation projects, notably including new investments in solar

energy in Spain. »

First quarter 2024

First quarter 2023

Change

Like-for-like change

Gross Rental Income (€m)

97.5

95.9

+1.7%

Net Rental Income (€m)

87.4

86.4

+1.1%

+4.0%

France

58.1

57.8

+0.4%

Spain

23.3

23.0

+1.5%

Italy

6.0

5.6

+7.2%

Net rental income up +4.0% versus the first quarter of

2023

In the first three months of 2024, net rental income is up +4.0%

on a like-for-like basis, driven by the indexation of rents to

inflation.

As published, following the sale of three assets in France and

four assets in Spain, net rental income is up +1.1% versus the

first quarter of 2023.

The collection rate for the first quarter 2024 was 95%, up 1

point versus the first quarter of 2023 at the same date.

Excellent commercial momentum

Leasing activity in the first quarter of 2024 has been very

strong, with 210 new leases signed (+19% in terms of number of

leases versus the same period in 2023).

Notable new business signed since the

beginning of the year includes:

- Innovative and sector-leading names such as

Adopt’, Rituals, Le Comptoir de Mathilde, Normal, Mango, Tramas+

and Jeff de Bruges ;

- A leisure complex at Rennes Cesson of more

than 7000m², including a karting track (Speed Park) and an new

adventure concept (Fort Boyard);

- Healthcare retailers such as Optic 2000 and

Soloptical, as well as a new pharmacy.

Reversion was +3.4% on average for the leases signed in the

first quarter, demonstrating the strength of demand from retailers

for space in Carmila centres.

Financial occupancy stood at 95.9% at end March 2024, at a

similar level to end March 2023 (96.0%), and reflecting the typical

seasonality after the end of year holiday period.

Revenues of the specialty leasing and temporary retail activity

(pop-up stores and sales events) were up +15% versus the first

quarter of 2023, driven by the success of new concepts, such as the

sale of undelivered parcels, and the development of “second hand”

in clothing and accessories.

Retailer sales up +2.0% and footfall up +0.9% versus first

quarter 2023

In the first quarter of 2024, retailer sales were up +2.0% on

average vs. the first quarter of 2023 (+1.7% in France, +3.2% in

Spain and +0.3% in Italy). Footfall is also up (+0.9% on average

versus the first quarter of 2023, of which +0.8% in France, +1.1%

in Spain and +1.9% in Italy), supported by the appeal of Carrefour

hypermarkets.

Launch of solar energy project in Spain

In Q1 2024, Carmila launched the first phase of a project to

install solar panels on six centres in Spain.

This first investment will enable Carmila to reduce consumption

by its centres from the electricity grid in favour of “green”

autogeneration. The project will result in annual energy savings of

3 044MWh and will reduce the carbon footprint of the group by the

equivalent of 16 538 tonnes of CO2.

The initiative is part of Carmila’s ambitious CSR roadmap, which

includes a target to reach net zero on Scopes 1 and 2 by 2030.

Confirmation of earnings guidance

As announced on February 13, with the publication of 2023 annual

results, recurring earnings per share are expected to be at least

€1.63 in 2024, corresponding to growth of at least +2% versus

2023.

This expected growth in recurring earnings per share assumes

organic growth in rental income, driven by indexation, at a similar

level to 2023, as well as the partial contribution of recurring

earnings of Galimmo, following the closing of the acquisition

expected this summer.

The full annual accretion to recurring earnings (+3-5% pro

forma) from the Galimmo acquisition is expected in 2025.

Dividend of €1.20 per share, in cash, for 2023

As also announced on 13 February, the Annual meeting of Carmila

shareholders, which will take place on 24 April 2024, will vote on

a proposed dividend of €1.20 per share for 2023, to be paid in cash

(versus €1.17 for the prior year).

This dividend represents a payout of 75% of recurring earnings.

As a reminder, the dividend policy of Carmila for 2022 to 2026 is a

minimum of 1 euro per share, in cash, and a target payout ratio of

75% of recurring earnings.

The ex-dividend date will be 29 April 2024 and dividends will be

paid from 2 May 2024.

INVESTOR AGENDA

24 April 2024: Annual General Meeting 24 July 2024

(after market close): First-half 2024 results 25 July

2024: First-half 2024 results presentation 17 October 2024

(after market close): Third-quarter 2024 financial

information

ABOUT CARMILA

As the third-largest listed owner of commercial property in

Europe, Carmila was founded by Carrefour and large institutional

investors in order to enhance the value of shopping centres

adjoining Carrefour hypermarkets in France, Spain and Italy. At 31

December 2023, its portfolio was valued at €5.9 billion and is made

up of 201 shopping centres, with leading positions in their

catchment areas.

Carmila is listed on Euronext-Paris Compartment A under the

symbol CARM. It benefits from the tax regime for French real estate

investment trusts (“SIIC”). Carmila has been a member of the SBF

120 since 20 June 2022.

Important notice

Some of the statements contained in this document are not

historical facts but rather statements of future expectations,

estimates and other forward-looking statements based on

management’s beliefs. These statements reflect such views and

assumptions prevailing as of the date of the statements and involve

known and unknown risks and uncertainties that could cause future

results, performance or events to differ materially from those

expressed or implied in such statements. Please refer to the most

recent Universal Registration Document filed in French by Carmila

with the Autorité des marchés financiers for additional information

in relation to such factors, risks and uncertainties. Carmila has

no intention and is under no obligation to update or review the

forward-looking statements referred to above. Consequently, Carmila

accepts no liability for any consequences arising from the use of

any of the above statements.

This press release is available in the

“Financial Press Releases” section of Carmila’s Finance webpage:

https://www.carmila.com/en/finance/financial-press-releases

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240417504906/en/

INVESTOR AND ANALYST CONTACT Jonathan Kirk – Head of Investor

Relations jonathan_kirk@carmila.com

+33 6 31 71 83 98

PRESS CONTACT Elodie Arcayna – Corporate Social Responsibility

and Communications Director elodie_arcayna@carmila.com +33 7 86 54 40 10

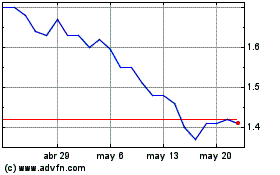

Carisma Therapeutics (NASDAQ:CARM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Carisma Therapeutics (NASDAQ:CARM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024