C3is Inc. Announces Pricing of $7.0 Million Upsized Underwritten Public Offering

19 Enero 2024 - 7:55AM

C3is Inc. (Nasdaq: CISS) (the “Company”), a ship-owning company

providing dry bulk and crude oil tanker seaborne transportation

services, today announced the pricing of a firm commitment

underwritten public offering with gross proceeds to the Company

expected to be approximately $7.0 million, before deducting

underwriting discounts and other estimated expenses payable by the

Company. The offering was upsized from $6.0 Million. The offering

consists of 28,000,000 Common Units or Pre-funded Units, each

consisting of one share of common stock (“Common Share”) or

Pre-Funded Warrant, one half of a Class B-1 Warrant to purchase one

Common Share at an exercise price of $0.375 per share (or 150% of

the price of each Common Unit sold in the offering) or pursuant to

an alternative cashless exercise option, which warrant will expire

on the five-year anniversary of the original issuance date (the

"Class B-1 Warrants") and one Class B-2 Warrant to purchase one

Common Share at an exercise price of $0.425 per share (or 170% of

the price of each Common Unit sold in the offering) which warrant

will expire on the five-year anniversary of the original issuance

date (the "Class B-2 Warrants" and together with the Class B-1

Warrants, the "Warrants"). The purchase price of each Common Unit

is $0.25, and the purchase price of each Pre-Funded Unit is $0.24

(which is equal to the public offering price per Common Unit minus

$0.01). The Pre-Funded Warrants will be immediately exercisable and

may be exercised at any time until all of the Pre-Funded Warrants

are exercised in full.

The Company intends to use the net proceeds from this offering

for capital expenditures, including for payment towards the $38.7

million remaining purchase price for the Aframax tanker we acquired

in July 2023, or acquisitions of additional vessels which we have

not yet identified, which may include vessels in seaborne

transportation sectors other than the drybulk and tanker sectors in

which we currently operate, working capital, or for other general

corporate purposes, or a combination thereof.

The closing of the offering is expected to occur on January 23,

2024, subject to customary closing conditions.

In addition, the Company has granted Aegis Capital Corp. a

45-day option to purchase up to 15% of the number of Common Shares

and/or Pre-Funded Warrants sold in the offering, and/or additional

Warrants representing up to 15% of the Warrants sold in the

offering solely to cover over-allotments, if any.

Aegis Capital Corp. is acting as the sole book-running

manager for the offering. Goodwin Procter LLP is serving as U.S.

counsel to the Company for the offering. Sichenzia Ross Ference

Carmel LLP is serving as counsel to the sole book-running manager,

Aegis Capital Corp., for the offering.

The offering is being made pursuant to an effective registration

statement on Form F-1 (No. 333- 276430) previously filed with the

U.S. Securities and Exchange Commission (the "SEC") and declared

effective by the SEC on January 18, 2024 and the Company’s

registration statement on Form F-1MEF (File No. 333-276597) filed

with the SEC on January 19, 2024 that became effective upon filing.

A preliminary prospectus (the "Preliminary Prospectus") describing

the terms of the proposed offering was filed with the SEC and is

available on the SEC's website located at www.sec.gov. A final

prospectus (the "Final Prospectus") relating to and describing the

terms of the offering will be filed with the SEC and will be

available on the SEC's website located at www.sec.gov. Electronic

copies of the Preliminary Prospectus and Final Prospectus, when

available, may be obtained by contacting Aegis Capital Corp.,

Attention: Syndicate Department, 1345 Avenue of the Americas, 27th

floor, New York, NY 10105, by email at syndicate@aegiscap.com, or

by telephone at (212) 813-1010.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

ABOUT C3IS INC.

C3is Inc. is a ship-owning company providing dry bulk and crude

oil seaborne transportation services. The Company owns three

vessels, two handysize dry bulk carriers with a total capacity of

64,000 deadweight tons (dwt) and an Aframax oil tanker with a cargo

carrying capacity of approximately 115,800 dwt, resulting with a

fleet total capacity of 179,800 dwt. C3is Inc.’s shares of Common

Stock are listed on the Nasdaq Capital Market and trade under the

symbol “CISS.”

Forward-Looking Statements

Matters discussed in this release may constitute forward-looking

statements. Forward-looking statements reflect our current views

with respect to future events and financial performance and may

include statements concerning the closing of the offering, plans,

objectives, goals, strategies, future events or performance, or

impact or duration of the COVID-19 pandemic and underlying

assumptions and other statements, which are other than statements

of historical facts. The forward-looking statements in this release

are based upon various assumptions, many of which are based, in

turn, upon further assumptions, including without limitation,

management’s examination of historical operating trends, data

contained in our records and other data available from third

parties. Although C3IS INC. believes that these assumptions were

reasonable when made, because these assumptions are inherently

subject to significant uncertainties and contingencies which are

difficult or impossible to predict and are beyond our control, C3IS

INC. cannot assure you that it will achieve or accomplish these

expectations, beliefs or projections. Important factors that, in

our view, could cause actual results to differ materially from

those discussed in the forward-looking statements include risks

discussed in our filings with the SEC and the following: the

ability to close the offering and the anticipated use of proceeds

from the offering, the impact of the COVID-19 pandemic and efforts

throughout the world to contain its spread, the strength of world

economies and currencies, general market conditions, including

changes in charter hire rates and vessel values, charter

counterparty performance, changes in demand that may affect

attitudes of time charterers to scheduled and unscheduled

dry-dockings, shipyard performance, changes in C3IS INC’s operating

expenses, including bunker prices, dry-docking and insurance costs,

ability to obtain financing and comply with covenants in our

financing arrangements, or actions taken by regulatory authorities,

potential liability from pending or future litigation, domestic and

international political conditions, the conflict in Ukraine and

related sanctions, potential disruption of shipping routes due to

accidents and political events or acts by terrorists.

Company Contact:

Nina Pyndiah

Chief Financial Officer

C3is INC.

00-30-210-6250-001

E-mail: info@c3is.pro

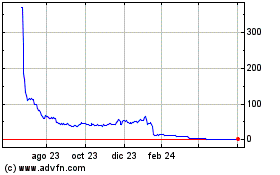

C3is (NASDAQ:CISS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

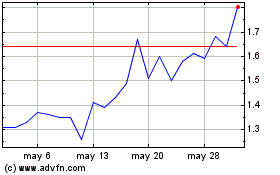

C3is (NASDAQ:CISS)

Gráfica de Acción Histórica

De May 2023 a May 2024