Consolidated Water Co. Ltd. (NASDAQ Global Select Market: CWCO), a

leading designer, builder and operator of advanced water supply and

treatment plants, reported results for the full year ended December

31, 2023. All comparisons are to the same prior year period unless

otherwise noted. The company will hold a conference call at 11:00

a.m. Eastern time tomorrow to discuss the results (see dial-in

information below).

2023 Financial Highlights

- Total revenue up 92% to $180.2

million.

- Retail revenue up 16% to $30.2

million.

- Bulk revenue increased 5% to $34.6

million.

- Services revenue increased 240% to

$98.0 million, with recurring services revenue generated from

operations and maintenance contracts up 37% to $19.4 million.

- Manufacturing revenue increased 177%

to $17.5 million.

- Net income from continuing

operations attributable to company stockholders was $30.7 million

or $1.93 per diluted share, as compared to $8.2 million or $0.54

per diluted share in 2022.

- Cash and cash equivalents totaled

$42.6 million and working capital was $88.8 million as of December

31, 2023.

2023 Operational Highlights

- Recognized $64.0 million in revenue

on the construction of a $81 million water treatment plant in

Goodyear, Arizona, being completed by our subsidiary, PERC Water

Corporation (PERC). The project was certified substantially

complete in January 2024 and the remaining work on the plant will

be completed by June 2024.

- Volume of retail water sold

increased 15%, primarily due to the greater return of tourist

activity in Grand Cayman.

- Began construction of a new 2.6

million gallon per day Red Gate desalination plant in Grand Cayman,

and recognized total design and construction revenue of $8.2

million in 2023.

- Began piloting, design and

permitting for a $204 million project to design, construct, operate

and maintain a seawater desalination plant in Hawaii announced in

June 2023.

- Acquired remaining 39% interest of

PERC to become the 100% owner of the company’s subsidiary that

designs, constructs, operates and manages water infrastructure

facilities in the Southwestern U.S.

- Acquired Ramey Environmental

Compliance (REC) in the fourth quarter, creating a new channel for

PERC to expand its presence in water-stressed regions in

Colorado.

Dividend Increase

In August 2023, the company increased its quarterly dividend by

11.8% to $0.095 per share beginning in the fourth quarter of

2023.

Management Commentary

“In 2023, our strong revenue and earnings growth made it the

best-performing year ever for Consolidated Water,” stated company

CEO, Rick McTaggart. “This is a fitting achievement in the year

that we celebrated our 50th year in business.

“In fact, revenue was up across all four of our business

segments, with total gross profit doubling to $61.9 million and

gross margin up 211 basis points to 34.4%. We believe this margin

expansion was primarily the result of our focus on quality projects

and cost control.

“Over the past year, we have seen tourism recover and water use

increase for our Cayman Islands retail and bulk water segments. We

also recognized revenue from the design and construction of the 2.6

million gallon per day Red Gate seawater desalination plant we are

building for the Water Authority of the Cayman Islands. This

contributed significantly to the year-over-year increase in our

services segment.

“Our operating results in 2023 benefited from an extraordinary

level of design and construction revenue from the Arizona and

Cayman projects, both of which are winding down this quarter. Other

segments in our business, however, also generated increased

revenues, which we expect to continue through 2024. Based on our

schedule for the Hawaii project, we expect to complete piloting,

design and permitting, and commence construction of that plant in

the third quarter of 2025, at which time we will begin to recognize

the majority of the $150 million in design-build revenue from that

important project over the two-year construction period.

“The sustained robust operational performance and revenue

expansion of our PERC subsidiary has continued to bolster our top

and bottom lines. Given its strong operational footprint in the

Southwestern U.S., a region grappling with critical water scarcity

exacerbated by unprecedented drought conditions, PERC is poised for

further expansion and advancement in this fundamental segment of

our business.

“In our U.S. desalination business, we commenced work in the

fourth quarter on site investigations, engineering, permitting and

public outreach for our contract to design, construct, operate and

maintain a 1.7 MGD seawater desalination plant in Oahu, Hawaii.

This project includes a two-year development phase, two-year

construction phase and 20-year operating phase, with two potential

5-year operating phase extensions at the client’s option.

“We see opportunities to grow our US-based O&M business as

well as our design-build business by building upon our successes

this past year. Bidding activity for O&M contracts and

design-build projects— particularly in California where PERC’s

presence is strong—has been robust and we hope to obtain some of

this new work.

“Our strong 2023 results certainly set the bar higher in terms

of our future growth outlook. However, we remain optimistic about

our growth prospects. Our exceptional operational performance over

the past several years has reaffirmed our belief that our highly

efficient and aesthetically pleasing treatment plant designs,

world-class operating and maintenance capabilities, and our

innovative project delivery models are superior to our

competitors.”

2023 Financial Summary

Revenue totaled $180.2 million, up 92% compared to $94.1 million

in 2022. The increase was primarily driven by increases of $4.2

million in the retail segment, $1.6 million in the bulk segment,

$69.1 million in the services segment and $11.2 million in the

manufacturing segment.

Retail revenue increased primarily due to a 15% increase in the

volume of water sold. The volume of water sold in the Cayman Water

license area increased by 14% and the remaining 1% increase in the

volume of water sold was due to sales by Cayman Water directly to

the Water Authority Cayman in the first quarter of 2023. Retail

revenue also increased as the result of higher energy costs that

increased the energy pass-through component of the company’s retail

water rates.

The increase in bulk segment revenue was due to an increase of

6% in the volume of water sold by CW-Bahamas and higher energy

costs, which increased the energy pass-through component of the

company’s bulk water rates.

The increase in services segment revenue was primarily due to

plant construction revenue increasing 566% to $77.3 million. The

company recognized approximately $64.0 million in revenue for the

construction of the water treatment plant in Goodyear, Arizona, and

recognized $8.2 million in revenue for the design and construction

of the Red Gate plant in Grand Cayman, Cayman Islands.

Revenue generated under operations and maintenance contracts

totaled $19.4 million in the full year of 2023, up 37% from $14.2

million in 2022.

The increase in manufacturing segment revenue was due to higher

project activity.

Gross profit for the full year of 2023 was $61.9 million or

34.4% of total revenue, up 104% from $30.4 million or 32.3% of

total revenue in 2022.

Net income from continuing operations attributable to

stockholders for the full year of 2023 was $30.7 million or $1.93

per diluted share, compared to net income of $8.2 million or $0.54

per diluted share in 2022.

Net income attributable to Consolidated Water stockholders for

the full year of 2023, which includes the results of discontinued

operations, was $29.6 million or $1.86 per diluted share, up from

net income of $5.9 million or $0.38 per diluted share in 2022.

Cash and cash equivalents totaled $42.6 million as of December

31, 2023, with working capital of $88.8 million, debt of $0.4

million, and stockholders’ equity totaling $186.8 million.

Full Year Segment Results

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31, 2023 |

| |

|

Retail |

|

Bulk |

|

Services |

|

Manufacturing |

|

Total |

|

Revenue |

|

$ |

30,158,051 |

|

|

$ |

34,595,058 |

|

$ |

97,966,650 |

|

$ |

17,491,474 |

|

$ |

180,211,233 |

|

| Cost of revenue |

|

|

13,891,229 |

|

|

|

24,128,132 |

|

|

66,797,762 |

|

|

13,467,005 |

|

|

118,284,128 |

|

| Gross profit |

|

|

16,266,822 |

|

|

|

10,466,926 |

|

|

31,168,888 |

|

|

4,024,469 |

|

|

61,927,105 |

|

| General and administrative

expenses |

|

|

16,905,010 |

|

|

|

1,737,264 |

|

|

4,271,808 |

|

|

1,838,284 |

|

|

24,752,366 |

|

| Gain (loss) on asset

dispositions and impairments, net |

|

|

(22,065 |

) |

|

|

12,720 |

|

|

— |

|

|

2,233 |

|

|

(7,112 |

) |

| Income (loss) from

operations |

|

$ |

(660,253 |

) |

|

$ |

8,742,382 |

|

$ |

26,897,080 |

|

$ |

2,188,418 |

|

|

37,167,627 |

|

| Other income, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

828,313 |

|

| Income before income

taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37,995,940 |

|

| Provision for income

taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,750,014 |

|

| Net income from continuing

operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31,245,926 |

|

| Income from continuing

operations attributable to non-controlling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

573,791 |

|

| Net income from continuing

operations attributable to Consolidated Water Co. Ltd.

stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30,672,135 |

|

| Loss from discontinued

operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,086,744 |

) |

| Net income attributable to

Consolidated Water Co. Ltd. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

29,585,391 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31, 2022 |

| |

|

Retail |

|

Bulk |

|

Services |

|

Manufacturing |

|

Total |

|

Revenue |

|

$ |

25,954,013 |

|

|

$ |

32,991,066 |

|

$ |

28,835,428 |

|

$ |

6,324,465 |

|

|

$ |

94,104,972 |

|

| Cost of revenue |

|

|

12,548,763 |

|

|

|

23,032,212 |

|

|

22,973,634 |

|

|

5,195,240 |

|

|

|

63,749,849 |

|

| Gross profit |

|

|

13,405,250 |

|

|

|

9,958,854 |

|

|

5,861,794 |

|

|

1,129,225 |

|

|

|

30,355,123 |

|

| General and administrative

expenses |

|

|

14,552,866 |

|

|

|

1,570,732 |

|

|

3,461,294 |

|

|

1,485,342 |

|

|

|

21,070,234 |

|

| Gain (loss) on asset dispositions

and impairments, net |

|

|

(39,397 |

) |

|

|

5,607 |

|

|

23,717 |

|

|

(2,631 |

) |

|

|

(12,704 |

) |

| Income (loss) from

operations |

|

$ |

(1,187,013 |

) |

|

$ |

8,393,729 |

|

$ |

2,424,217 |

|

$ |

(358,748 |

) |

|

|

9,272,185 |

|

| Other income, net |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

464,810 |

|

| Income before income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,736,995 |

|

| Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

396,739 |

|

| Net income from continuing

operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9,340,256 |

|

| Income from continuing operations

attributable to non-controlling interests |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,112,913 |

|

| Net income from continuing

operations attributable to Consolidated Water Co. Ltd.

stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8,227,343 |

|

| Loss from discontinued

operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2,371,049 |

) |

| Net income attributable to

Consolidated Water Co. Ltd. stockholders |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

5,856,294 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue earned by major geographic region was:

| |

|

Year ended December 31, |

| |

|

2023 |

|

2022 |

|

Cayman Islands |

|

$ |

41,728,340 |

|

$ |

30,375,985 |

| The Bahamas |

|

|

31,221,633 |

|

|

29,943,615 |

| United States |

|

|

106,768,621 |

|

|

33,338,466 |

| Revenue earned from management

services agreement with OC-BVI |

|

|

492,639 |

|

|

446,906 |

| |

|

$ |

180,211,233 |

|

$ |

94,104,972 |

| |

|

|

|

|

|

|

Annual General Meeting of Shareholders

The company has set May 28, 2024 as the date of its Annual

General Meeting of Shareholders to be held at 3:00 p.m. Cayman

Islands time (4:00 p.m. EDT) at the Grand Cayman Marriott Resort,

Seven Mile Beach, Grand Cayman, Cayman Islands. Holders of record

of the company’s stock as of March 28, 2024 will be entitled to

vote at the meeting.Conference Call

Consolidated Water management will host a conference call

tomorrow to discuss these results, which will include a

question-and-answer period.

Date: Thursday, March 28, 2024Time: 11:00 a.m. Eastern time

(8:00 a.m. Pacific time)Toll-free dial-in number:

1-844-875-6913International dial-in number:

1-412-317-6709Conference ID: 6785971

Please call the conference telephone number five minutes prior

to the start time. An operator will register your name and

organization. If you require any assistance connecting with the

call, please contact CMA at 1-949-432-7566.

A replay of the call will be available after 1:00 p.m. Eastern

time on the same day through April 4, 2024, as well as available

for replay via the Investors section of the Consolidated Water

website at www.cwco.com.

Toll-free replay number: 1-877-344-7529International replay

number: 1-412-317-0088Replay ID: 6785971

About Consolidated Water Co. Ltd.

Consolidated Water Co. Ltd. develops and operates advanced water

supply and treatment plants and water distribution systems. The

company designs, constructs and operates seawater desalination

facilities in the Cayman Islands, The Bahamas and the British

Virgin Islands, and designs, constructs and operates water

treatment and reuse facilities in the United States. The company

recently entered the U.S. desalination market with a contract to

design, constructs, operate and maintain a seawater desalination

plant in Hawaii.The company also manufactures and services a wide

range of products and provides design, engineering, management,

operating and other services applicable to commercial and municipal

water production, supply and treatment, and industrial water and

wastewater treatment. For more information, visit cwco.com.

Cautionary Note Regarding Forward-Looking

Statements

This press release includes statements that may constitute

"forward-looking" statements, usually containing the words

"believe", "estimate", "project", "intend", "expect", "should",

"will" or similar expressions. These statements are made pursuant

to the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements inherently involve

risks and uncertainties that could cause actual results to differ

materially from the forward-looking statements. Factors that would

cause or contribute to such differences include, but are not

limited to (i) continued acceptance of the company's products and

services in the marketplace; (ii) changes in its relationships with

the governments of the jurisdictions in which it operates; (iii)

the outcome of its negotiations with the Cayman government

regarding a new retail license agreement; (iv) the collection of

its delinquent accounts receivable in the Bahamas; and (v) various

other risks, as detailed in the company's periodic report filings

with the Securities and Exchange Commission (“SEC”). For more

information about risks and uncertainties associated with the

company’s business, please refer to the “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” and

“Risk Factors” sections of the company’s SEC filings, including,

but not limited to, its annual report on Form 10-K and quarterly

reports on Form 10-Q, copies of which may be obtained by contacting

the company’s Secretary at the company’s executive offices or at

the “Investors – SEC Filings” page of the company’s website at

http://ir.cwco.com/docs. Except as otherwise required by law, the

company undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise.Company Contact:David

W. SasnettExecutive Vice President and CFOTel (954) 509-8200Email

ContactInvestor Relations Contact:Ron Both or

Grant StudeCMA Investor RelationsTel (949) 432-7566Email

ContactMedia Contact:Tim RandallCMA Media

RelationsTel (949) 432-7572Email Contact

CONSOLIDATED WATER

CO. LTD.CONSOLIDATED BALANCE

SHEETS

|

|

|

|

|

|

|

|

| |

|

December 31, |

| |

|

2023 |

|

2022 |

| ASSETS |

|

|

|

|

|

|

| Current

assets |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

42,621,898 |

|

$ |

50,711,751 |

|

Accounts receivable, net |

|

|

38,226,891 |

|

|

27,046,182 |

|

Inventory |

|

|

6,044,642 |

|

|

5,727,842 |

|

Prepaid expenses and other current assets |

|

|

4,056,370 |

|

|

5,643,279 |

|

Contract assets |

|

|

21,553,057 |

|

|

2,913,722 |

|

Current assets of discontinued operations |

|

|

211,517 |

|

|

531,480 |

| Total current

assets |

|

|

112,714,375 |

|

|

92,574,256 |

| Property, plant and equipment,

net |

|

|

55,882,521 |

|

|

52,529,545 |

| Construction in progress |

|

|

495,471 |

|

|

3,705,681 |

| Inventory, noncurrent |

|

|

5,045,771 |

|

|

4,550,987 |

| Investment in OC-BVI |

|

|

1,412,158 |

|

|

1,545,430 |

| Goodwill |

|

|

12,861,404 |

|

|

10,425,013 |

| Intangible assets, net |

|

|

3,353,185 |

|

|

2,818,888 |

| Operating lease right-of-use

assets |

|

|

2,135,446 |

|

|

2,058,384 |

| Other assets |

|

|

3,407,973 |

|

|

1,669,377 |

| Long-term assets of

discontinued operations |

|

|

21,129,288 |

|

|

21,129,288 |

| Total

assets |

|

$ |

218,437,592 |

|

$ |

193,006,849 |

| |

|

|

|

|

|

|

| LIABILITIES AND

EQUITY |

|

|

|

|

|

|

| Current

liabilities |

|

|

|

|

|

|

|

Accounts payable, accrued expenses and other current

liabilities |

|

$ |

11,604,369 |

|

$ |

8,438,315 |

|

Accounts payable - related parties |

|

|

— |

|

|

403,839 |

|

Accrued compensation |

|

|

3,160,030 |

|

|

2,267,583 |

|

Dividends payable |

|

|

1,572,655 |

|

|

1,375,403 |

|

Current maturities of operating leases |

|

|

456,865 |

|

|

546,851 |

|

Current portion of long-term debt |

|

|

192,034 |

|

|

114,964 |

|

Contract liabilities |

|

|

6,237,011 |

|

|

8,803,921 |

|

Deferred revenue |

|

|

317,017 |

|

|

315,825 |

|

Current liabilities of discontinued operations |

|

|

364,665 |

|

|

389,884 |

| Total current

liabilities |

|

|

23,904,646 |

|

|

22,656,585 |

| Long-term debt,

noncurrent |

|

|

191,190 |

|

|

216,117 |

| Deferred tax liabilities |

|

|

530,780 |

|

|

560,306 |

| Noncurrent operating

leases |

|

|

1,827,302 |

|

|

1,590,542 |

| Other liabilities |

|

|

153,000 |

|

|

219,110 |

| Long-term liabilities of

discontinued operations |

|

|

— |

|

|

— |

| Total

liabilities |

|

|

26,606,918 |

|

|

25,242,660 |

| Commitments and

contingencies |

|

|

|

|

|

|

| Equity |

|

|

|

|

|

|

| Consolidated Water Co. Ltd.

stockholders' equity |

|

|

|

|

|

|

|

Redeemable preferred stock, $0.60 par value. Authorized 200,000

shares; issued and outstanding 44,297 and 34,383 shares,

respectively |

|

|

26,578 |

|

|

20,630 |

|

Class A common stock, $0.60 par value. Authorized 24,655,000

shares; issued and outstanding 15,771,545 and 15,322,875 shares,

respectively |

|

|

9,462,927 |

|

|

9,193,725 |

|

Class B common stock, $0.60 par value. Authorized 145,000 shares;

none issued |

|

|

— |

|

|

— |

|

Additional paid-in capital |

|

|

92,188,887 |

|

|

89,205,159 |

|

Retained earnings |

|

|

85,148,820 |

|

|

61,247,699 |

| Total Consolidated Water Co.

Ltd. stockholders' equity |

|

|

186,827,212 |

|

|

159,667,213 |

| Non-controlling interests |

|

|

5,003,462 |

|

|

8,096,976 |

| Total

equity |

|

|

191,830,674 |

|

|

167,764,189 |

| Total liabilities and

equity |

|

$ |

218,437,592 |

|

$ |

193,006,849 |

| |

|

|

|

|

|

|

CONSOLIDATED WATER

CO. LTD.CONSOLIDATED STATEMENTS OF

INCOME

| |

|

|

|

|

|

|

| |

|

Year Ended December 31, |

| |

|

2023 |

|

|

2022 |

|

|

Revenue |

|

$ |

180,211,233 |

|

|

$ |

94,104,972 |

|

| Cost of

revenue (including related party expense of $0 and

$2,694,810 in 2023 and 2022) |

|

|

118,284,128 |

|

|

|

63,749,849 |

|

| Gross

profit |

|

|

61,927,105 |

|

|

|

30,355,123 |

|

| General and administrative

expenses (including related party expense of $0 and $96,924 in 2023

and 2022) |

|

|

24,752,366 |

|

|

|

21,070,234 |

|

| Loss on asset dispositions and

impairments, net |

|

|

(7,112 |

) |

|

|

(12,704 |

) |

| Income from

operations |

|

|

37,167,627 |

|

|

|

9,272,185 |

|

| |

|

|

|

|

|

|

| Other income

(expense): |

|

|

|

|

|

|

|

Interest income |

|

|

696,408 |

|

|

|

447,186 |

|

|

Interest expense |

|

|

(145,284 |

) |

|

|

(46,545 |

) |

|

Profit-sharing income from OC-BVI |

|

|

46,575 |

|

|

|

26,325 |

|

|

Equity in the earnings of OC-BVI |

|

|

123,153 |

|

|

|

75,900 |

|

|

Loss on put/call options |

|

|

— |

|

|

|

(128,000 |

) |

|

Other |

|

|

107,461 |

|

|

|

89,944 |

|

| Other income,

net |

|

|

828,313 |

|

|

|

464,810 |

|

| Income before income

taxes |

|

|

37,995,940 |

|

|

|

9,736,995 |

|

| Provision for income

taxes |

|

|

6,750,014 |

|

|

|

396,739 |

|

| Net income from

continuing operations |

|

|

31,245,926 |

|

|

|

9,340,256 |

|

| Income from continuing

operations attributable to non-controlling interests |

|

|

573,791 |

|

|

|

1,112,913 |

|

| Net income from

continuing operations attributable to Consolidated Water Co. Ltd.

stockholders |

|

|

30,672,135 |

|

|

|

8,227,343 |

|

| Loss from discontinued

operations |

|

|

(1,086,744 |

) |

|

|

(2,371,049 |

) |

| Net income

attributable to Consolidated Water Co. Ltd.

stockholders |

|

$ |

29,585,391 |

|

|

$ |

5,856,294 |

|

| |

|

|

|

|

|

|

| Basic earnings (loss)

per common share attributable to Consolidated Water Co. Ltd. common

stockholders |

|

|

|

|

|

|

| Continuing

operations |

|

$ |

1.95 |

|

|

$ |

0.54 |

|

| Discontinued

operations |

|

|

(0.07 |

) |

|

|

(0.16 |

) |

| Basic earnings per

share |

|

$ |

1.88 |

|

|

$ |

0.38 |

|

| |

|

|

|

|

|

|

| Diluted earnings

(loss) per common share attributable to Consolidated Water Co. Ltd.

common stockholders |

|

|

|

|

|

|

| Continuing

operations |

|

$ |

1.93 |

|

|

$ |

0.54 |

|

| Discontinued

operations |

|

|

(0.07 |

) |

|

|

(0.16 |

) |

| Diluted earnings per

share |

|

$ |

1.86 |

|

|

$ |

0.38 |

|

| |

|

|

|

|

|

|

| Dividends declared per

common and redeemable preferred shares |

|

$ |

0.36 |

|

|

$ |

0.34 |

|

| |

|

|

|

|

|

|

| Weighted average

number of common shares used in the determination of: |

|

|

|

|

|

|

|

Basic earnings per share |

|

|

15,739,056 |

|

|

|

15,290,509 |

|

|

Diluted earnings per share |

|

|

15,865,897 |

|

|

|

15,401,653 |

|

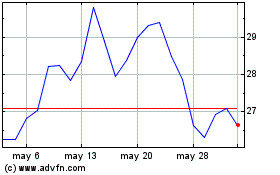

Consolidated Water (NASDAQ:CWCO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Consolidated Water (NASDAQ:CWCO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024