UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Cyanotech Corporation

(Name of Issuer)

Common Stock, $0.02 par value per share

(Title of Class of Securities)

232437301

(CUSIP Number)

Mark Finser, Ginungagap Foundation

1621 Juanita Lane

Tiburon, California

94920

(415) 699-9990

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

August 24, 2023

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of sections 240.13d-1(e),

240.13d-1(f) or 140.13d-1(g), check the following box. [ ]

Note: Schedules filed in paper format shall include a

signed original and five copies of the schedule, including all exhibits. See section 240.13d-7 for other parties to whom copies are to

be sent.

* The remainder of this cover page shall be filled out for a

reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter the disclosures provided in a prior cover page.

The information required in the remainder of this cover page

shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

Potential persons who are to respond to the collection of

information contained in this form are not required to respond unless the form displays a currently valid OMB control number.

Explanatory Footnote: This Amendment No. 1 is being made to correct

formatting inaccuracies in the original filing.

| 1. | Names of Reporting Persons.

Ginungapap Foundation |

| 2. | Check the Appropriate Box if a Member of a Group (See Instructions)

(a)

(b) X |

| 4. | Source of Funds (See Instructions) 00 |

| 5. | Check if Disclosure of Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e) ____ |

| 6. | Citizenship or Place of Organization Delaware |

|

Number of

Shares

Beneficially

Owned by

Each Reporting

Person With |

7. Sole Voting Power 424,621

|

|

8. Shared Voting Power 0

|

| 9. Sole Dispositive Power 424,621 |

| 10. Shared Dispositive Power 0 |

| 11. | Aggregate Amount Beneficially Owned by Each Reporting Person 424,621 |

| 12. | Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See

Instructions) ______ |

| 13. | Percent of Class Represented by Amount in Row (11) 6.6% |

| 14. | Type of Reporting Person (See Instructions) 00 |

| Item 1. | Security and Issuer |

This statement on Schedule 13D (this “Schedule

13-D) relates to the common stock (the “Common Stock”) of Cyanotech Corporation (the “Issuer”), the principal

executive offices of which are located at 73-4460 Queen Kaahumanu Hwy. #102m Kailua Kona, HI 96740.

Item 2. Identity and Background

This Schedule 13D is filed as the Reporting Person on behalf of

Ginungagap Foundation, a Delaware corporation (“Ginungagap”), recognized as a tax-exempt organization under Internal Revenue

Code Section 501(c)(3). The address of the principal office of Ginungagap is 1621 Juanita Lane, Tiburon, alifornia 94920. Ginungagap is

a supporting organization for, and supports the programmatic purposes and missions of, Rudolf Steiner Foundation, Inc., dba RSF Social

Finance.

Neither the Reporting Person nor, to the best knowledge of the Reporting

Person, any of the persons listed in Schedule A has, during the last five years, been convicted in any criminal proceeding (excluding

traffic violations or similar misdemeanors) or been party to a civil proceeding of a judicial or administrative body of competent jurisdiction

resulting in his, her or its being subject to a judgment, decree or final order enjoining future violations of, or prohibiting or mandating

activities subject to, federal or state securities laws or finding any violation with respect to such laws.

Item 3. Source of Funds

On August 24, 2023, 424,621 shares

of the Common stock was donated to Ginungagap by Skywords Family Foundation, Inc. (“Skywords”) pursuant to a Grant Award,

dated as of August 24, 2023.

| Item 4. | Purpose of Transaction |

The Reporting

Person was granted 424,621 shares of Common Stock to assist the Reporting Person to fulfill its charitable mission. Michael A. Davis (“Davis”)

serves as the President of Ginungagap and is a member of its Board of Directors. Davis also serves on the Board of Directors of the Issuer

and as its Chairman. Davis has recused himself from all matters relating to the Common Stock owned by Ginungagap, including, without limitation,

decisions to vote or dispose of the Common Stock.

Except as

set forth herein, the Reporting Person has no plans or proposals relating

to any matters specified in

paragraphs (a) through (j)) of ltem 4 of Schedule 13D. Depending on market conditions, an evaluation of the business and

the prospects of the Issuer and other

factors, the Reporting Person may, in its sole

discretion, purchase additional shares of Common Stock, or other securities

convertible into or exchangeable for shares of Common Stock,

or dispose of shares of

Common Stock from time to time in the open

market, in privately negotiated transactions or otherwise, subject to

market conditions and other factors.

| Item 5. | Interest in Securities of the Issuer |

Percentage interests in shares

of Common Stock reported in this Schedule 13D are based on 6,467,503 shares of Common Stock outstanding at August 25, 2023 based

on information provided by the Issuer.

(a) and

(b):

Items

7-13 of the cover pages of this Schedule 13D are incorporated herein by reference.

(c):Except as set forth

in Item 3, the Reporting Person has not engaged in any transactions in the Issuer's shares of Common Stock during the past sixty days.

(d) Not

applicable

(e) Not

applicable

| Item 6. | Contracts, Arrangement, Understandings or Relationships with Respect to Securities of the Issuer |

The responses set forth in Items 2, 3, and

4 are incorporated herein by reference in their entirety.

Skywords is party to the Grant Award with Ginungagap,

pursuant to which Skywords granted 424,621 shares of the Common Stock to Ginungagap.

Davis is party to the Recusal, dated as of

August 24, 2023, pursuant to which Davis has recused himself from all matters relating to the Common Stock owned by Ginungagap.

The foregoing description of the Grant Award

and the Recusal does not purport to be complete and is qualified in its entirety by reference to the full text of such agreements, which

are included as Exhibits A and B hereto and incorporated herein by reference.

Except as otherwise described in this Schedule

13D, there are no contracts, arrangements, understandings or relationships between the Reporting Person and any other person with respect

to any securities of the Issuer.

| Item 7. | Material to Be Filed as Exhibits |

Exhibit A Grant Award, dated as of August

24, 2023, by and among Skywords and Ginungagap.

Exhibit B Recusal, dated as of August

24, 2023, by Davis and acknowledged on behalf of Ginungagap.

SIGNATURES

After reasonable inquiry and to the best of my knowledge, I certify that

the information set forth in this statement is true, complete and correct.

Dated: August 30, 2023

|

/s/ Mark Finser

Mark Finser

Secretary and Treasurer

|

SCHEDULE A

The name and present principal occupation of each director and executive

officer of Ginungagap is set forth below. Unless otherwise notes the business address of each person listed below is c/o Ginungagap Foundation,

1621 Juanita Lane, Tiburon, California 94920

DIRECTORS AND EXECUTIVE OFFICERS OF GINUNGAGAP

| Name and Business Address |

Present Principal Occupation |

Citizenship |

| Michael A. Davis |

President and Director of Ginungagap, also Chairman of the Board of Directors of the Issuer |

United States |

| Mark Finser |

Secretary and Treasurer of Ginungagap |

United States |

| Beth Weisburn |

Director |

United States |

| Reid Shaw |

Director |

United States |

EXHIBIT A

GRANT AWARD, DATED AUGUST 24, 2023.

Skywords Family Foundation

Grant Award

Date of Agreement: August

24, 2023

Parties to Agreement: Skywords

Family Foundation Inc., a Delaware nonprofit non-stock corporation (“Skywords”), and Ginungagap Foundation, a Delaware nonprofit

non-stock corporation (“Grantee”)

| Grantor: | Skywords Family Foundation, Inc. |

Purpose of Grant: To

assist Grantee to fulfill its stated charitable mission, including through providing grants or otherwise supporting the activities of

Grantee

Total Amount

of Grant: 424,621 shares of common stock (the “Granted Shares”) of Cyanotech Corporation, a Nevada corporation (“Cyanotech”),

with a value at the date of grant of $346,066 (based on the average of the high and low price of the Cyanotech common stock on the date

of transfer)

Award Date: The

grant of the Granted Shares will be made on August 24, 2023 which is a date that is at least 2 trading days after neither Skywords nor

Michael A. Davis (“Davis”) is subject to any “blackout period” or trading restrictions, if any, established by

Cyanotech applicable to either Skywords or Davis with respect to Cyanotech’s common stock

This grant is awarded by Skywords, subject

to the following terms and conditions:

| 1. | Grantee confirms that it is an organization that is currently recognized

by the Internal Revenue Service (the “IRS”) as a public charity under Sections 501(c)(3) and 509(a)(3) of the Internal Revenue

Code (the “Code”), and Grantee will inform Skywords immediately of any change in, or IRS proposed or actual revocation (whether

or not appealed) of, its tax status described above. |

| 2. | This grant may be used only for Grantee’s charitable activities. While

Skywords understands that Grantee may participate in the public policy process, consistent with its tax-exempt status, Grantee may not

use any proceeds from the Granted Shares to influence the outcome of any public election or to carry on any voter registration drive.

This grant must be used for the purpose as identified above, and may not be expended for any other purposes without Skywords’ prior

written approval. |

| 3. | Grantee acknowledges that 300,000 of the 424,621 Granted Shares are restricted

stock and Grantee will not be able to sell, transfer or otherwise dispose of any of the Granted Shares

|

| 4. | unless such sale, transfer or other disposition is consummated in compliance

with the safe harbor provided by Rule 144 promulgated under the Securities Act of 1933 Act, as amended (the “1933 Act”) or

other available exemption under the 1933 Act, and Grantee, upon written request by Cyanotech, provides a written representation letter

to Cyanotech containing the necessary information to permit Cyanotech’s counsel to issue a written legal opinion that such sale,

transfer or other disposition is consummated in compliance with the safe harbor provided by Rule 144 promulgated under the 1933 Act or

other available exemption under the 1933 Act. |

| 5. | This Grant Award shall be governed by and construed in accordance with the

laws of the State of California applicable to contracts entered into between California residents and wholly to be performed in California.

This grant award constitutes the entire agreement between the parties. This grant award may not be modified or amended, and no provision

waived, without the prior written consent of the party against whom enforcement of the amendment or waiver is sought. If any provision

contained in this agreement is determined to be void, illegal or unenforceable, in whole or in part, then the other provisions contained

herein shall remain in full force and effect as if the provision that was determined to be void, illegal, or unenforceable had not been

contained herein. This agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which

together shall constitute one and the same instrument. It is further understood and agreed that a copy of this signed agreement, including

an electronic copy in pdf, shall be as binding as the signed original of the agreement. |

On behalf of Skywords, I agree to make the

grant of Granted Shares to Grantee pursuant to the foregoing terms and conditions.

Signature: /s/

Michael A. Davis

| Title: | President, Skywords Family Foundation Inc. |

Dated as of: August

24, 2023

On behalf of Grantee, I understand and agree

to the foregoing terms and conditions of Skywords’ grant.

Signature: /s/

Mark Finser

| Title: | Secretary Treasurer, Ginungagap Foundation |

Dated as of: August 24, 2023

EXHIBIT B

Ginungagap Foundation

Recusal by Michael A. Davis

I, Michael A. Davis, in my capacity as President and a director of Ginungagap

Foundation, a Delaware nonprofit non-stock corporation (the “Foundation”), hereby recuse myself from participating in all

matters relating to all shares of stock of Cyanotech Corporation, a Nevada corporation, owned by the Foundation, or any portion thereof

(the “Cyanotech Shares”).

I acknowledge that I shall have no right to exercise any power, direction,

or action with respect to the Cyanotech Shares, including, without limitation, voting, exchanging, selling, and disposing of the Cyanotech

Shares. All powers, directions, or actions with respect to the Cyanotech Shares shall be exercised, determined, and taken by the other

directors and/or officers of the Foundation.

Given my role as the Chairman of the Board of Cyanotech Corporation, this

Recusal is intended to preclude any self-dealing transaction or any appearance of self-dealing involving the Foundation in conformance

with California Corporations Code Section 5233.

| Signature: | /s/ Michael A. Davis |

| Title: | President and Director, Ginungagap Foundation |

Dated as of: August

24, 2023

Acknowledgement of Recusal

On behalf of Ginungagap Foundation, a Delaware nonprofit non-stock

corporation (the “Foundation”), each of the undersigned directors of the Foundation acknowledge receipt of a signed copy of

the foregoing Recusal by Michael A. Davis, as President and a director of the Foundation, with respect to all powers, directions, or actions

with respect to all shares of stock of Cyanotech Corporation, a Nevada corporation, owned by the Foundation, or any portion thereof.

Signature: /s/

Beth Weisburn

| Title: | Director, Ginungagap Foundation |

Dated as of: August

24, 2023

Signature: /s/

Reid Shaw

| Title: | Director, Ginungagap Foundation |

Dated as of: August

24, 2023

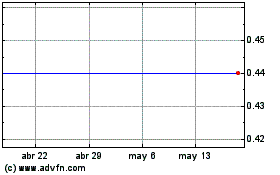

Cyanotech (NASDAQ:CYAN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Cyanotech (NASDAQ:CYAN)

Gráfica de Acción Histórica

De May 2023 a May 2024