Altamira Therapeutics Announces Divestiture of Inner Ear Development Assets

21 Octubre 2022 - 7:47AM

- Definitive agreement to sell 90%

stake in Company’s Zilentin subsidiary with option to acquire all

of Altamira’s remaining inner ear development assets in Q4

2022

- Company to receive immediate cash

payment of $2 million, $25 million second upfront payment upon

option exercise, and potential milestone payments of up to $55

million and future royalties

- Buyer is a European family office

seeking to continue and expand Altamira’s projects in hearing loss,

tinnitus, and vertigo

- Transaction represents important

first step in Altamira’s strategy to focus solely on RNA

delivery

- Company actively working towards

divestiture of BentrioTM before year-end

Altamira Therapeutics Ltd. (NASDAQ:CYTO), a company dedicated to

developing therapeutics that address important unmet medical needs,

today announced that it has entered into an agreement regarding the

sale of certain of its legacy assets comprised of its inner ear

therapeutics research and development programs and a license to use

its RNA delivery technology in certain inner ear applications to a

European family office (the “Buyer”), in a multi-step process.

This divestiture is in line with the Company’s previously stated

intention to divest or spin off its legacy assets in order to focus

on its patented platform for RNA delivery; it was unanimously

approved by Altamira’s Board of Directors as being in the best

interest of shareholders.

In a first step, the Buyer has agreed to acquire 90% of the

share capital of Altamira’s subsidiary Zilentin Ltd., Zug

(Switzerland) for immediate cash consideration of $1 million.

Zilentin has been active in the research for novel, second

generation tinnitus treatments in collaboration with leading

academic partners (project AM-102). At the closing of such initial

acquisition (expected on or about October 28, 2022), Zilentin will

purchase from Altamira, for immediate cash consideration of another

$1 million, an option that entitles Zilentin to acquire Altamira’s

remaining legacy assets in inner ear therapeutics, including AM-101

(tinnitus), AM-111 (hearing loss) and AM-125 (vertigo), for an

upfront payment of $25 million in cash upon exercise.

The option may be exercised for 30 days; during this period,

Altamira will take certain preparatory steps for the transfer of

its four additional inner ear related subsidiaries and their staff

to Zilentin. Beyond the 30 days, Zilentin will have a right of

first refusal to acquire these companies until December 31, 2022

with the $25 million option-exercise payment increasing by $1

million per month. The option period is designed to allow Buyer and

Altamira to work out the details surrounding the transaction

structure and the organizational separation.

Upon Zilentin acquiring the full portfolio of Altamira’s inner

ear development assets, Altamira will be entitled to receive

milestone payments of up to $55 million as well as royalties. The

milestones relate to certain development or regulatory milestones,

including:

- the opening of an IND, a successful

Phase 3 and regulatory approval for AM-125 in vertigo ($25

million)

- the regulatory approval of AM-101 in

acute inner ear tinnitus ($10 million)

- the regulatory approval of AM-111 in

acute inner ear hearing loss ($10 million)

- the grant of a license for

Altamira’s RNA delivery technology to Zilentin for certain targets

in inner ear disorders ($10 million upfront plus a mid-single digit

percentage in royalties on future revenues generated from the sale

of drug products making use of the technology)

Within six months, it is planned that Altamira’s CEO, Thomas

Meyer, will become the CEO of the Zilentin Group while also

continuing to serve as the principal executive of Altamira together

with the current RNA leadership team.

“We are excited to take this important first step in the

execution of our strategy of becoming a ‘pure play’ RNA delivery

technology company,” commented Thomas Meyer, Altamira Therapeutics’

founder, Chairman and CEO. “While there is a high unmet need and

great potential for innovative treatments in inner ear disorders,

we consider the future development of our programs in this

therapeutic area to be better placed with a different type of

owner. We are glad to hand them over to a long-term oriented family

office that has a strong entrepreneurial spirit and is passionate

about developing effective and safe treatments for common health

problems like tinnitus, hearing loss and vertigo.”

Apart from divesting its inner ear therapeutics portfolio,

Altamira is also actively working towards the divestiture of its

other legacy asset, the Bentrio nasal spray, in the OTC consumer

health sector. Based on the progress achieved to date in a

structured divestiture process, the Company remains confident to

meet its objective of completing a Bentrio transaction before

year-end.

About Altamira TherapeuticsAltamira

Therapeutics (NASDAQ:CYTO) is dedicated to developing therapeutics

that address important unmet medical needs. The Company is

currently active in three areas: the development of RNA

therapeutics for extrahepatic therapeutic targets (OligoPhore™ /

SemaPhore™ platforms; preclinical), nasal sprays for protection

against airborne allergens and, where approved, viruses (Bentrio™;

commercial) or for the treatment of vertigo (AM-125; post Phase 2),

and the development of therapeutics for intratympanic treatment of

tinnitus or hearing loss (Keyzilen® and Sonsuvi®; Phase 3). Founded

in 2003, it is headquartered in Hamilton, Bermuda, with its main

operations in Basel, Switzerland. For more information,

visit: https://altamiratherapeutics.com/

Forward-Looking StatementsThis press release

may contain statements that constitute "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934. Forward-looking

statements are statements other than historical facts and may

include statements that address future operating, financial or

business performance or Altamira Therapeutics' strategies or

expectations. In some cases, you can identify these statements by

forward-looking words such as "may", "might", "will", "should",

"expects", "plans", "anticipates", "believes", "estimates",

"predicts", "projects", "potential", "outlook" or "continue", or

the negative of these terms or other comparable terminology.

Forward-looking statements are based on management's current

expectations and beliefs and involve significant risks and

uncertainties that could cause actual results, developments and

business decisions to differ materially from those contemplated by

these statements. These risks and uncertainties include, but are

not limited to, the closing of the initial sale of 90% of Zilentin,

the exercise by Zilentin of its option to purchase additional

legacy assets, the achievement by Altamira of the milestones set

forth in the option agreement, Altamira’s ability to complete a

divestiture transaction of Bentrio, the approval and timing of

commercialization of AM-301, Altamira Therapeutics' need for and

ability to raise substantial additional funding to continue the

development of its product candidates, the timing and conduct of

clinical trials of Altamira Therapeutics' product candidates, the

clinical utility of Altamira Therapeutics' product candidates, the

timing or likelihood of regulatory filings and approvals, Altamira

Therapeutics' intellectual property position and Altamira

Therapeutics' financial position, including the impact of any

future acquisitions, dispositions, partnerships, license

transactions or changes to Altamira Therapeutics' capital

structure, including future securities offerings. These risks and

uncertainties also include, but are not limited to, those described

under the caption "Risk Factors" in Altamira Therapeutics' Annual

Report on Form 20-F for the year ended December 31, 2021, and in

Altamira Therapeutics' other filings with the SEC, which are

available free of charge on the Securities Exchange Commission's

website at: www.sec.gov . Should one or more of these

risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated. All forward-looking statements and all

subsequent written and oral forward-looking statements attributable

to Altamira Therapeutics or to persons acting on behalf of Altamira

Therapeutics are expressly qualified in their entirety by reference

to these risks and uncertainties. You should not place undue

reliance on forward-looking statements. Forward-looking statements

speak only as of the date they are made, and Altamira Therapeutics

does not undertake any obligation to update them in light of new

information, future developments or otherwise, except as may be

required under applicable law.

CONTACTInvestors@altamiratherapeutics.com800-460-0183

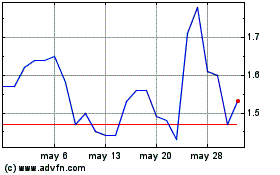

Altamira Therapeutics (NASDAQ:CYTO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Altamira Therapeutics (NASDAQ:CYTO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025